The title of this post is a reference to a story by Edgar Allen Poe, which I would strongly recommend and, not wishing to give much away in the way of spoilers, is about a very exclusive party given by a Prince Prospero that ended extremely badly for all participants. It seems an appropriate title today,

As I suspected Trump did go ahead with the April 2nd ‘Liberation Day’ tariffs and seems determined to persist with these for several months at least. In practice this is the largest peacetime tax hike on US citizens in history and it seems unlikely that this experiment will go well. Before I look at the markets today I’d like to put these tariffs into some factual and historical context.

Firstly these tariffs are not reciprocal, as they are not based on any actual tariffs or non-trade barriers that these would be reciprocating against. The number for each country or trading bloc (EU) on the charts that Trump showed was calculated by taking the trade deficit with that country (or EU) and dividing it by the exports of that country (or EU) to the US. This has since been confirmed by the White House.

The example I have seen is Indonesia, with $28bn exports to the US and a US trade deficit of $17.9%. The calculation delivers a ‘tariff’ rate of 64%, and the same calculation delivers Trump’s numbers for South Korea, EU etc etc. Not real tariffs or non-trade barriers, but using this method did save doing a lot of research and analysis involving some potentially tricky math.

There was an operating minimum of 10% assigned to countries with whom the US has a trade surplus, hence the 10% rate and tariff against the UK for instance, and this hilariously also delivered 10% rate assessments and tariffs against the Heard and McDonald Islands, inhabited only by penguins, and the British Ocean Territory, inhabited only by those assigned to the US base there at Diego Garcia.

In terms of the history of big tariff hikes by the US I yield to Rand Paul, who delivered an excellent speech in the Senate on this yesterday that is well worth watching:

Rand Paul Delivers Epic Speech Against Trump's Tariffs On 'Liberation Day'

In terms of the history Senator Paul mentioned three previous Presidents that raised tariffs a lot. The first was John Quincy Adams in 1828 & he was the second of the ten presidents that failed to be re-elected. The tariffs were very unpopular. He was representing the Democratic Republicans who split into the Democrats and the National Republicans during his term in office, with the Democrats taking the 1832 election. The National Republicans were then absorbed into the Whigs, who then fell apart and were absorbed into the relatively new Republicans in the 1850s.

The second was Trump’s hero William McKinley who as a congressman introduced the short lived McKinley Tariff Act in 1890, which probably wasn’t the only reason for the landslide victory by the Democrats later in that year in which Republicans lost over 100 of their 170 seats in the House of Representatives. As President from 1896 he oversaw the Dingley Tariff Act in 1897 which raised average tariff rates to 47%. That didn’t lead to an economic crisis, he was re-elected in 1900, and he was assassinated for unrelated reasons in 1901.

The third was Herbert Hoover who was the seventh of the ten presidents that failed to be re-elected. Hoover was president when the Smoot-Hawley Act was passed in 1930. That raised overall weighted-average tariffs to 20%, sparking a general trade war in the world, reducing US trade with the rest of the world by 67% over the 1930s and deepening the Great Depression. That was a political disaster for Republicans in both Houses of Congress, with both houses turning back briefly to Republicans in 1947-9 and 1953-5, but otherwise with the Republicans losing control of both houses until 1983 for the Senate and 1995 for the House of Representatives.

The tariffs announced yesterday raise average weighted tariffs to 29%, the highest in well over a century. That is unlikely to spark a general trade war here, as most other countries remember the lessons of the 1930s, but is likely to lead to retaliatory tariffs against the US and a sharp reduction in US trade with the rest of the world. I have suggested to a couple of friends in recent weeks that this round of tariffs might seriously damage Republicans for a generation, and looking at what happened after 1930 that may be right. It is also unlikely to be good for prices, the US economy, or the markets. On the plus side a contracting economy tends to depress inflation.

On to the markets, where of the four topping patterns on US indices that I looked at in my post on 19th February, QQQ had already made target, SPX made target this morning, and DIA and IWM are getting closer.

As for the bear flags on these four indices that I called likely highs for in my post on on 26th March, those have now all made their targets at the retest of the March lows with the DIA finally retesting that low this morning. Let’s have a look at the obvious remaining downside targets on all four of these in detail.

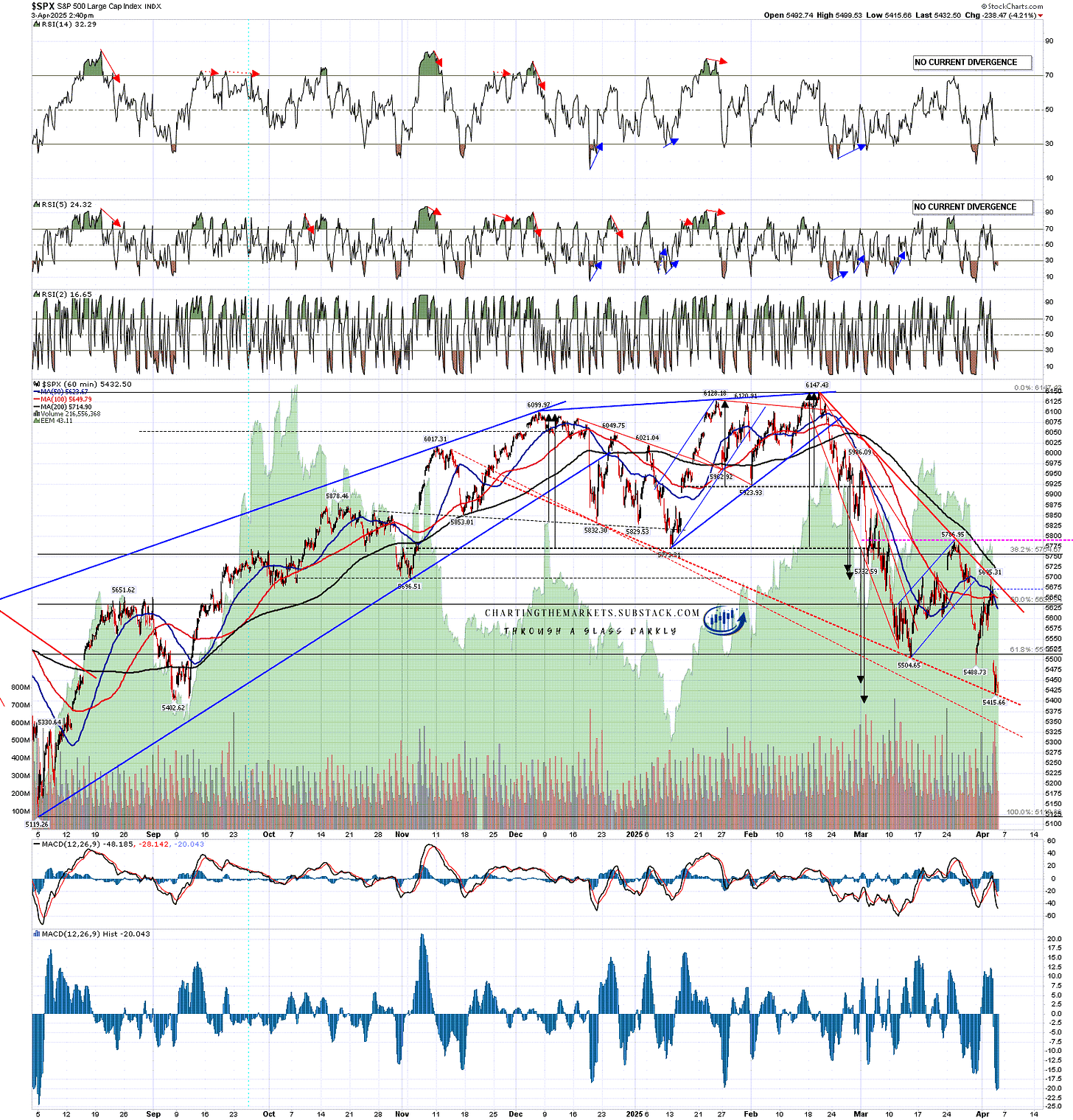

This morning SPX went lower and reached the higher double top target in the 5440 area. The lower target is in the 5390 area and likely will also be reached soon but at the time of writing SPX has reached and is trying to hold the higher probability possible support trendline that I posted last week. I’m watching that with interest.

If SPX goes lower then the very obvious target area below is the 5100 level I was looking at in my post on Tuesday. If reached, I have pencilled in a possible rally from there back into the 5600-5700 area before a possible move much lower.

SPX 60min chart:

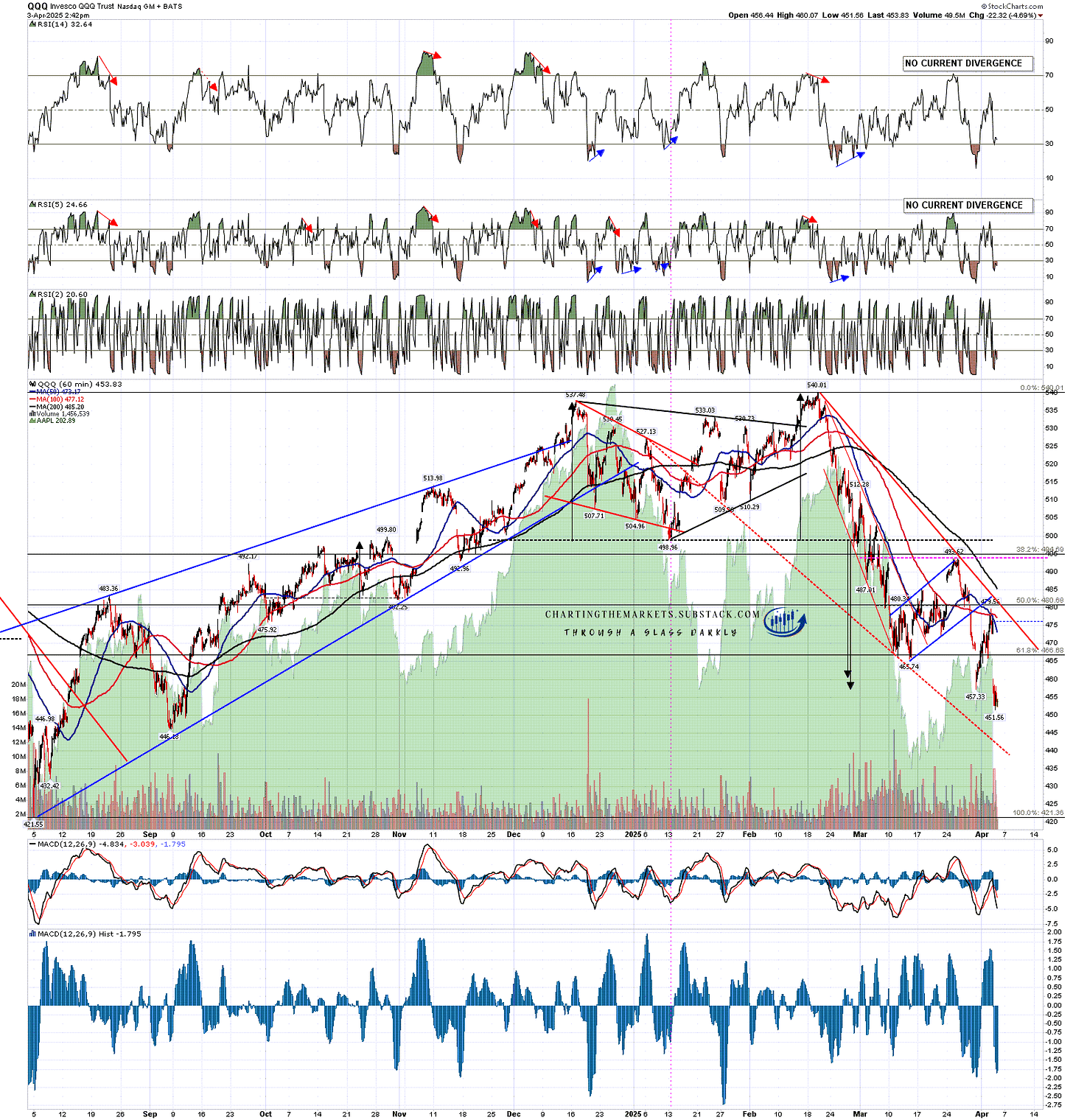

QQQ reached the initial double top target in late March after the bear flag also made target. I have a possible high quality support trendline currently in the 442 area and, if QQQ goes lower then the obvious next big target areas that I was looking at in my post yesterday are the possible H&S necklines in the 430 and 420 areas. If support is found there I’d be looking for a possible right shoulder rally there before a possible move much lower.

QQQ 60min chart:

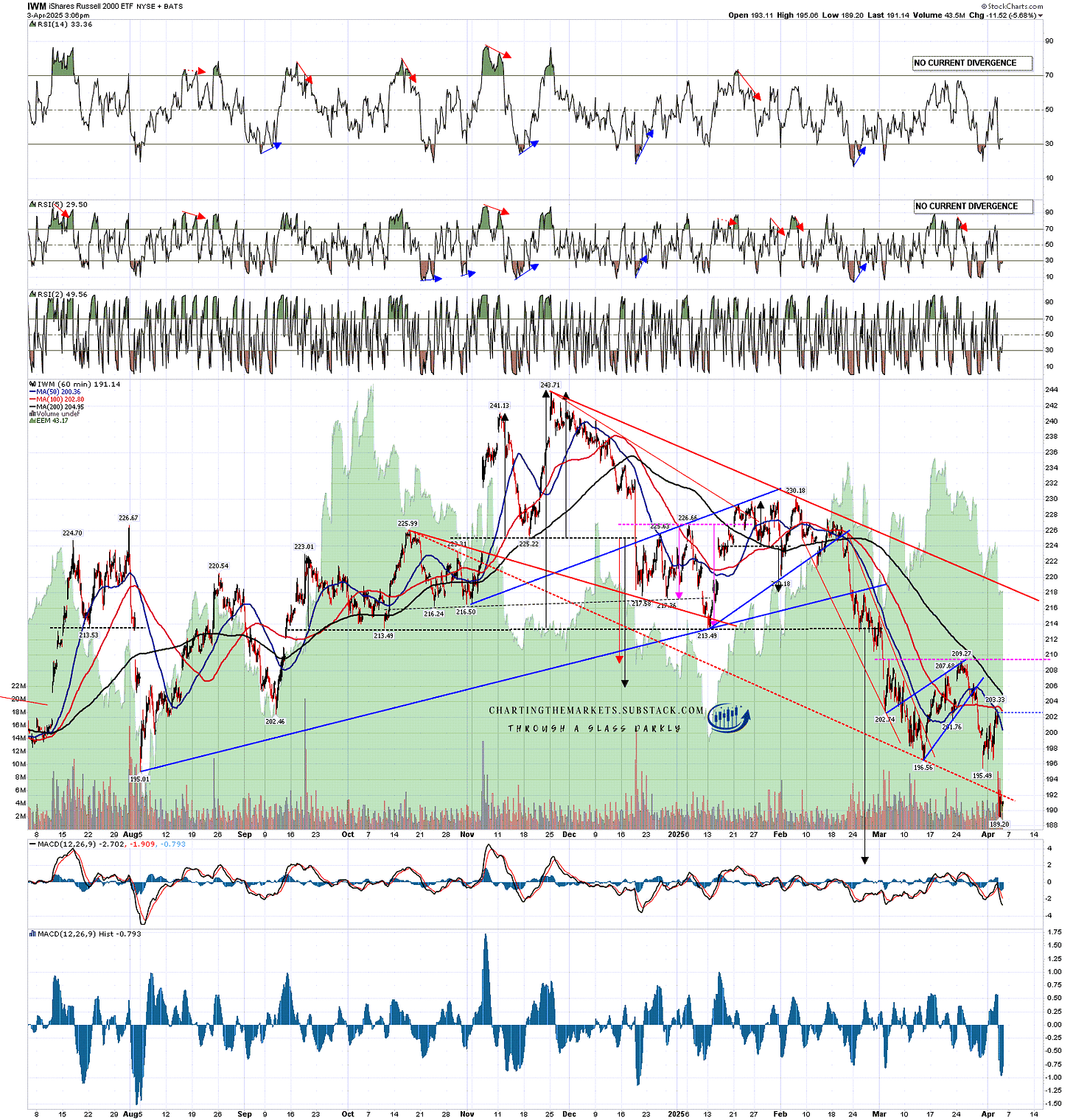

IWM reached the bear flag target at the retest of the prior March low at the end of March, and is getting close to the H&S target in the 183 area. I drew in a possible high quality support trendline that might hold in a post last week but that broke hard this morning. There is no obvious next support level anywhere close below. The two really big levels on IWM are the big 193-5 area that is breaking so far today, and the even larger level below in the 156-8 area.

IWM 60min chart:

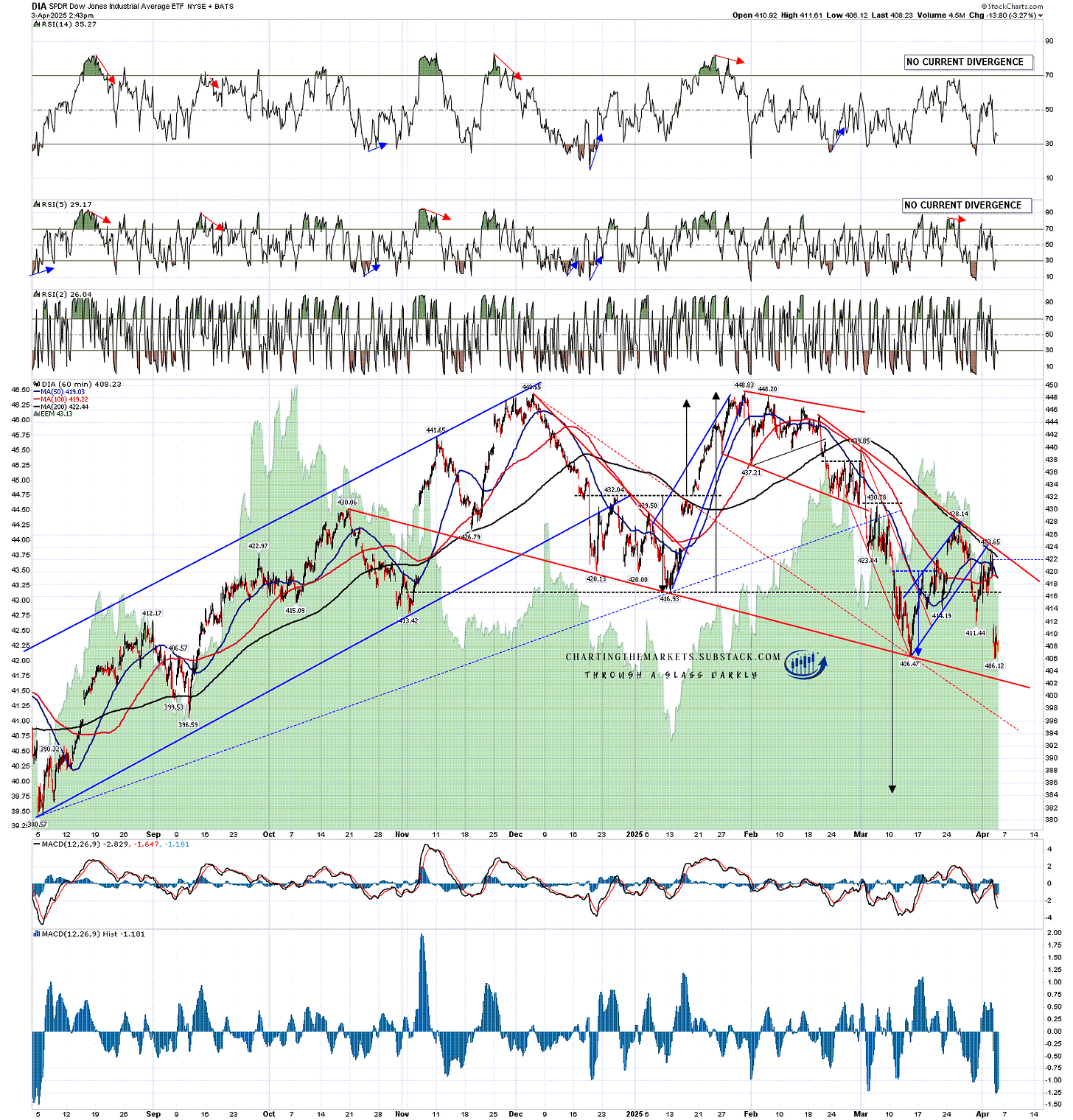

DIA finally reached the bear flag target today and the double top target is still significantly lower in the 383 area. That target is very close to the higher of the two possible H&S necklines in the 380 then 370 areas, and that is the big support area that I am looking for next.

Depending on the relative speeds of their declines, it is currently very credible that SPX, QQQ and DIA might reach at the same time their big support areas respectively in the 5100 area, the 520-30 area and the 370-80 area. Those areas are all big support areas and possible H&S necklines that may set up large topping patterns that could then later deliver a move much lower on these indices.

DIA 60min chart:

I don’t like to assume anything, mainly taking my view on prices just from market action, but I really like these downside scenarios and the economic backdrop looks very favorable for a deep bear market developing over the coming months. I’ll be watching this develop very carefully and would note that if I am right, there will still be strong rallies on the way as these moves very rarely happen over a very short timeframe or in anything resembling a straight line. My working assumption is that such a deep bear market would play out over the next six months to a year, and might take as long as eighteen months.

As I have been since the start of 2025 I’m still leaning on the bigger picture towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities, not least because both of the last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch. I could of course however be mistaken. UPDATE 11th March 2025 - I am wondering if this may be a bear market that dominates the whole of 2025.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.