The conflict in Iran is only a few days old, and as yet it is hard to see how it will develop, and there seems little agreement as to whether it counts as a war. Both Trump and Hegseth have referred to it repeatedly as a war, but as only Congress has the constitutional authority to declare war in the US, there have also been numerous explanations from administration officials and the Speaker of the House as to why it is not actually a war. I think President Trump described it as a ‘Special Military Operation’ at one point yesterday and for a number of reasons perhaps that is the best way to describe it.

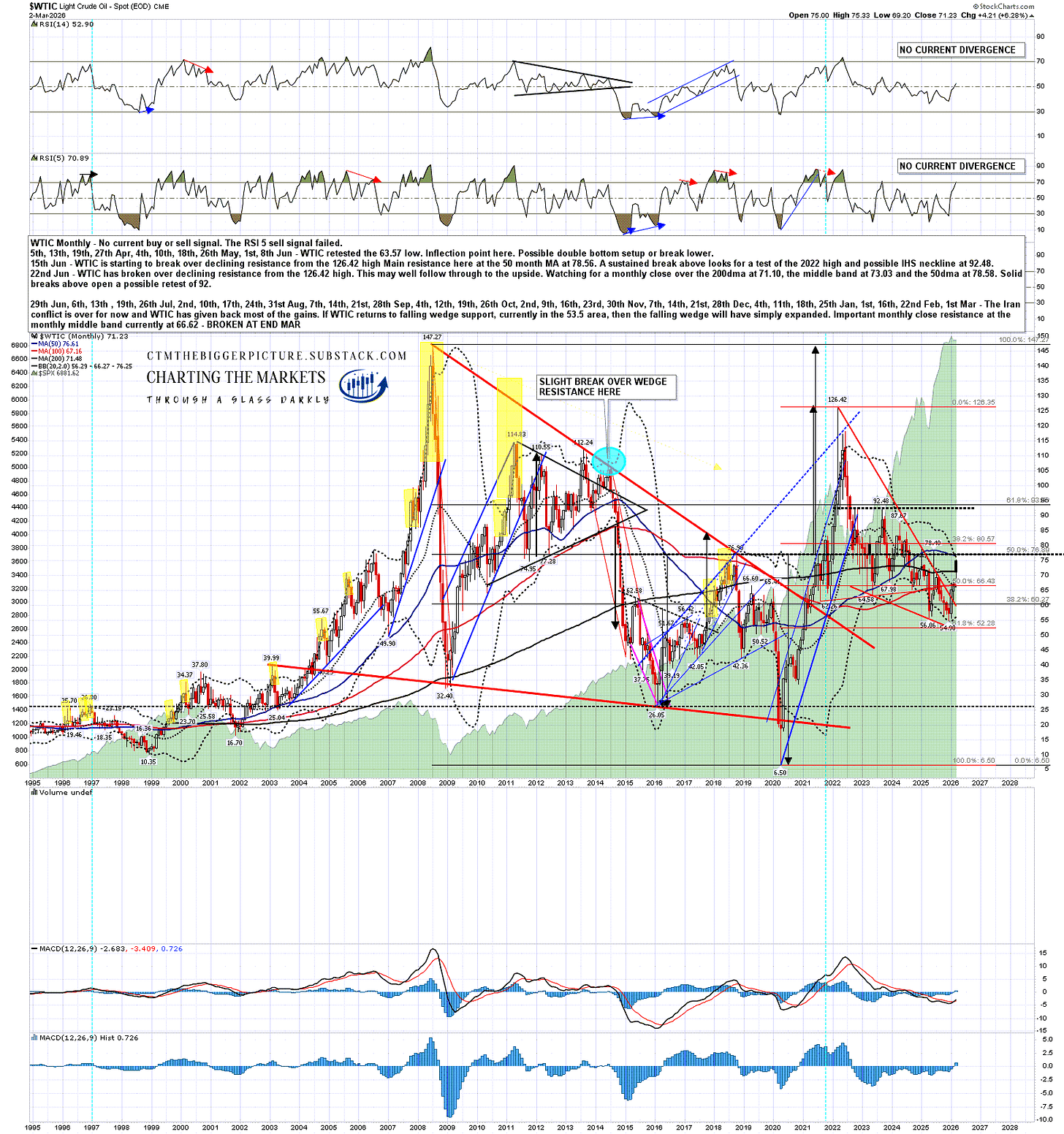

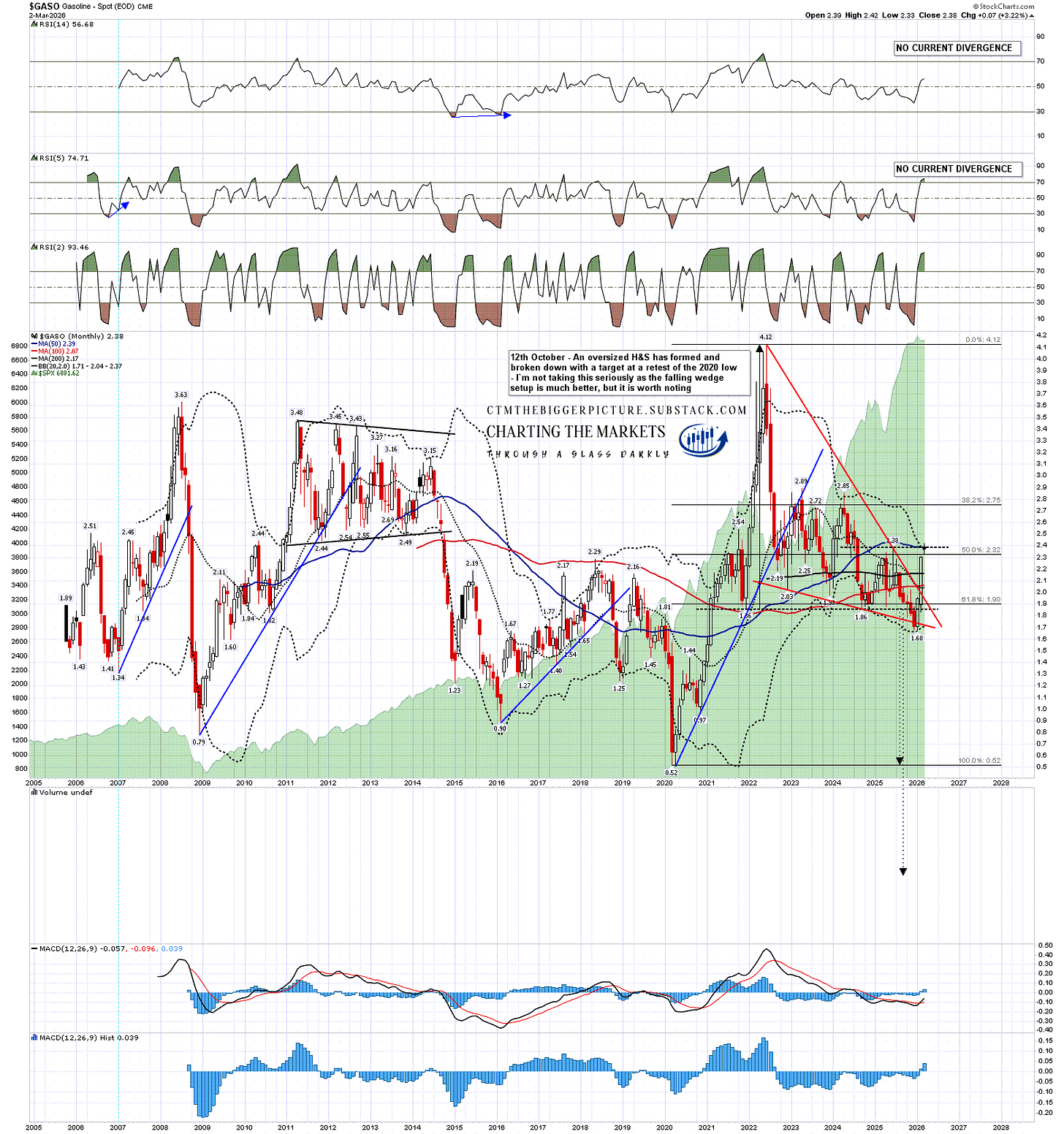

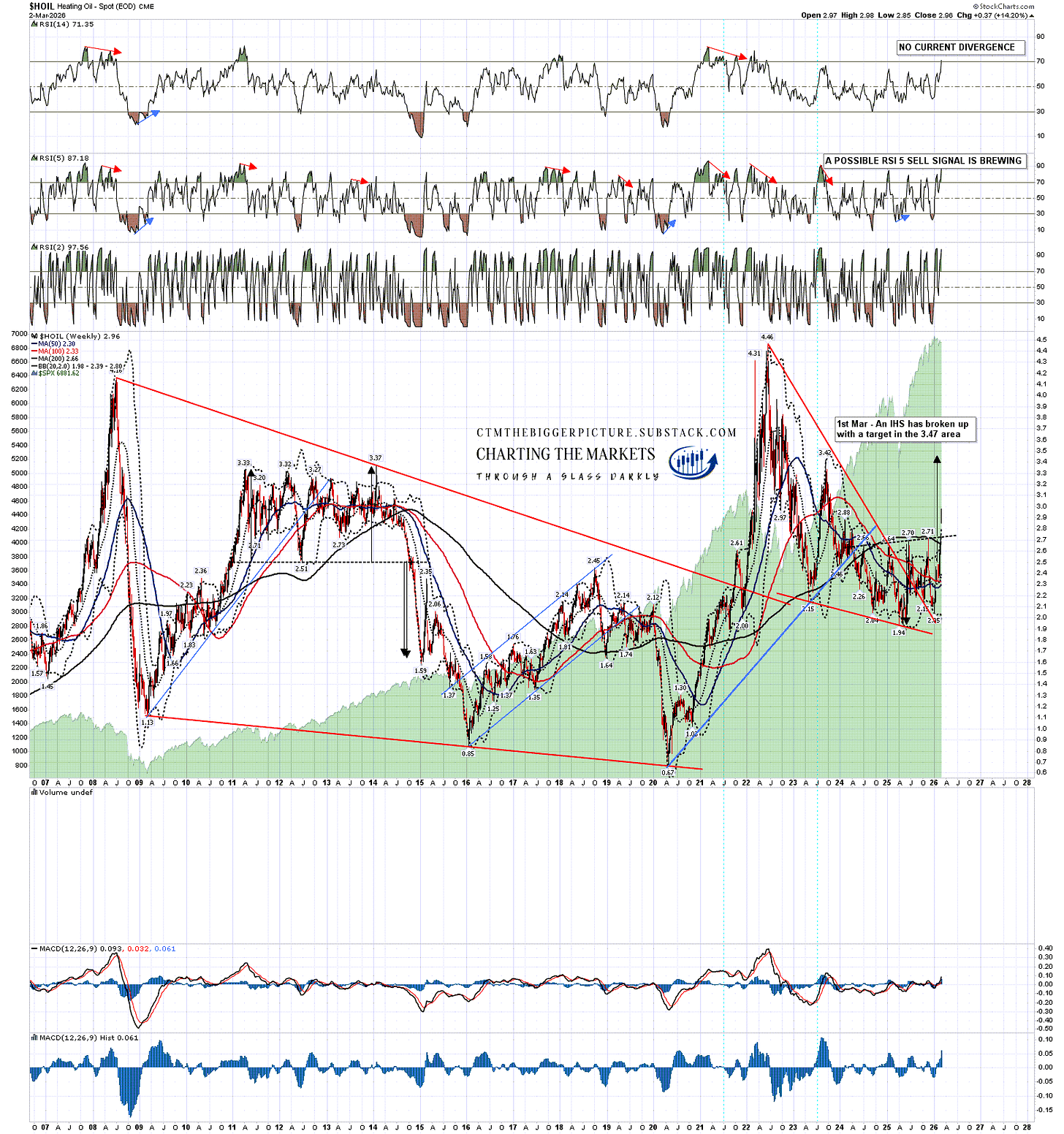

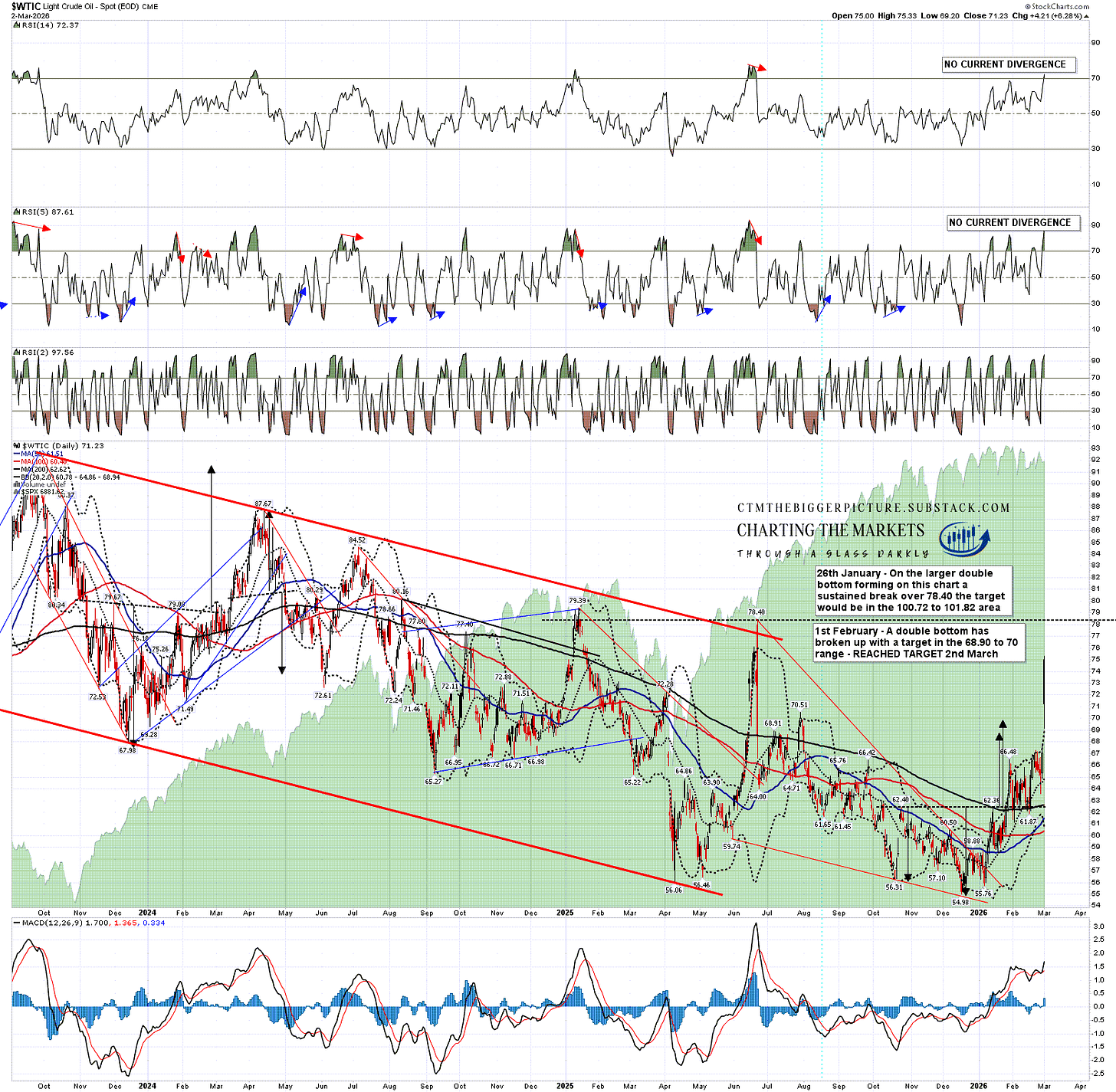

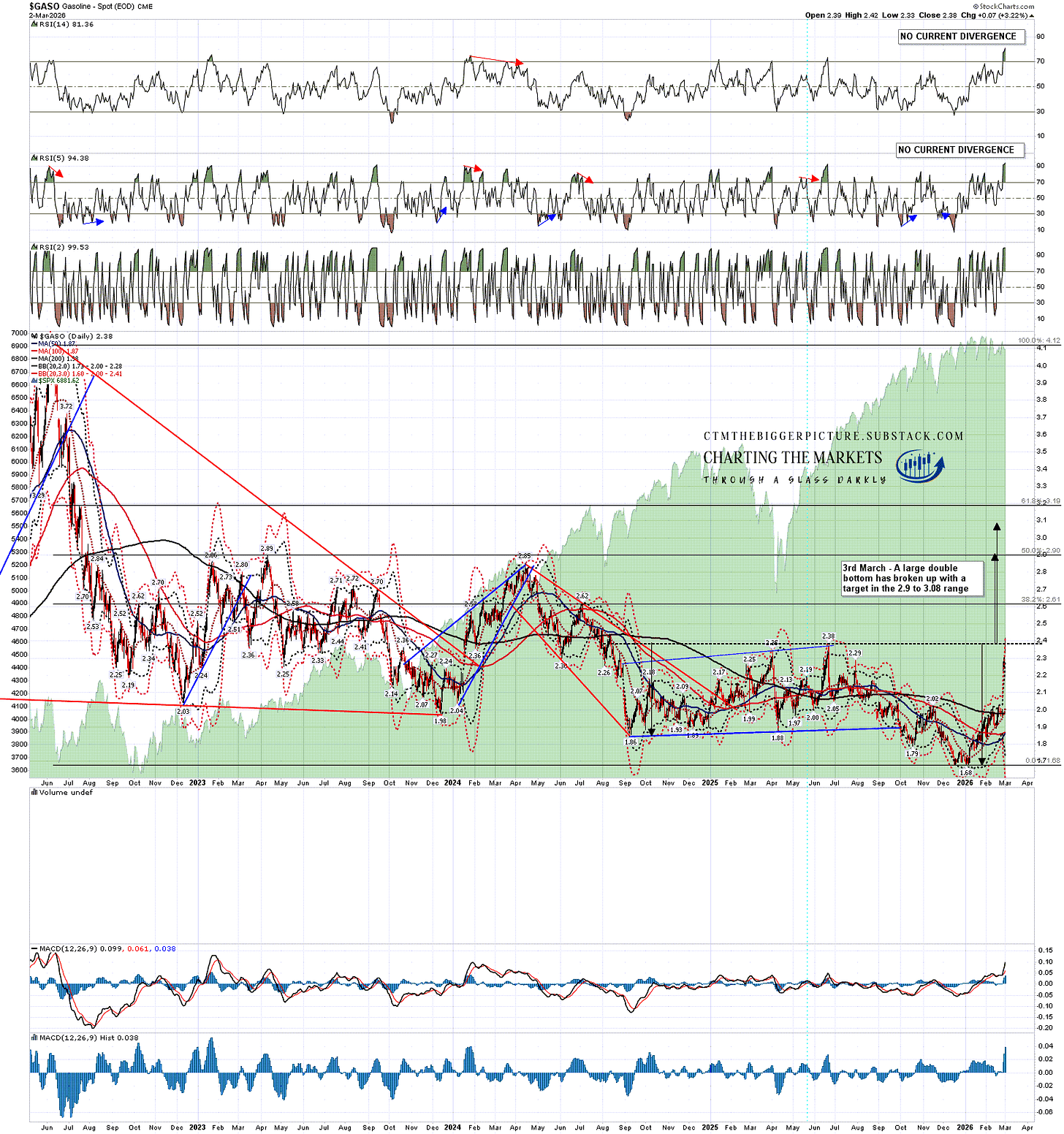

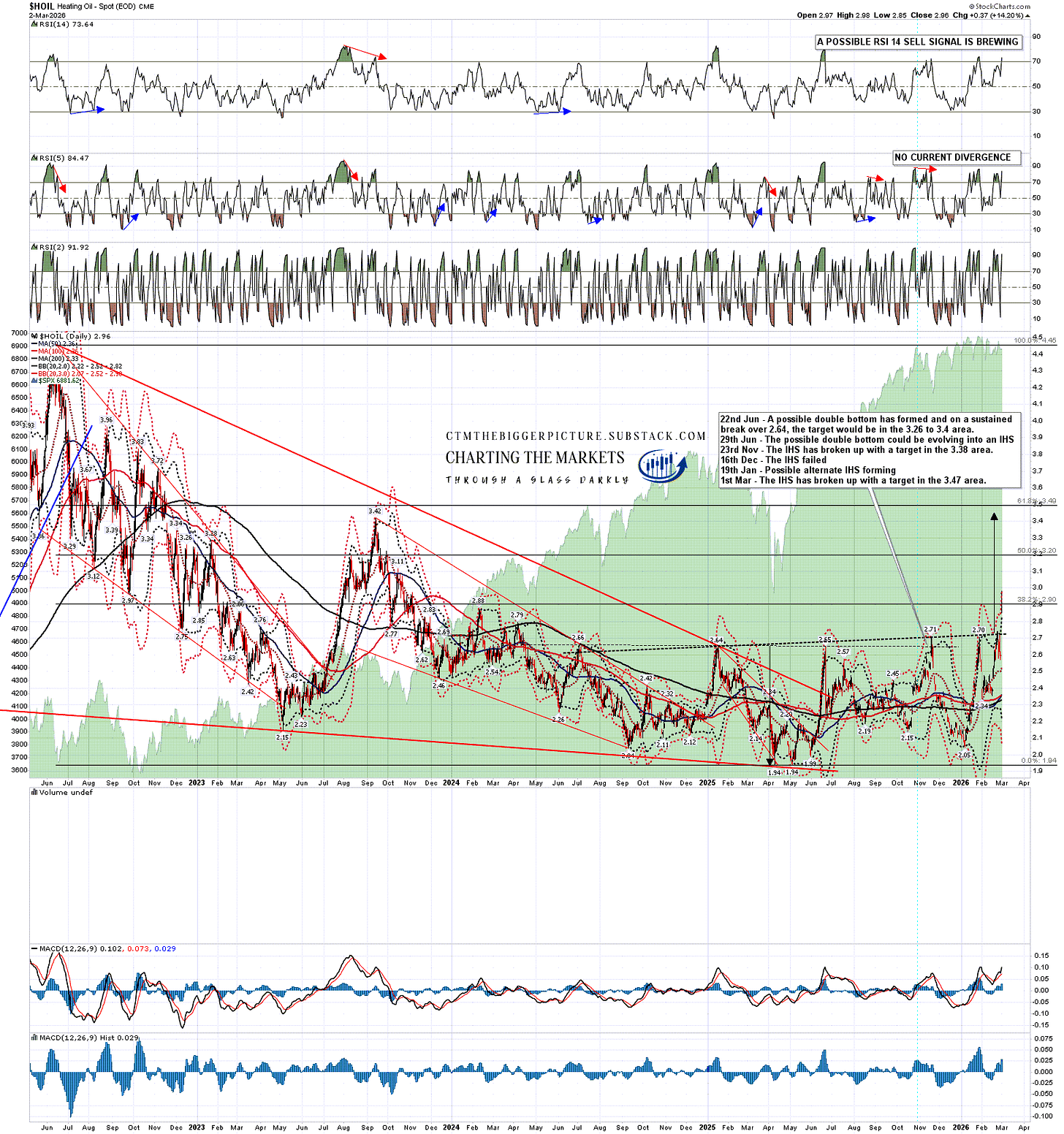

I wrote a post on Tuesday looking at the possible major disruption in oil markets that could happen if Iran can close the Strait of Hormuz to commercial traffic and the US is trying to prevent that, but we’ll have to see how that goes.

The key question here is what happens next in Iran. Obviously the aerial bombardment has been going well, but the US does not have full control of Iranian airspace. If it did there would not be Iranian missiles and drones exploding across the Middle East.

In the background of course is the fact that since the Russians invaded Ukraine in 2022 in their own ‘Special Military Operation’, the face of modern warfare has changed dramatically, with drones emerging as likely the biggest revolution in the way war is waged since the inception of modern air warfare in the 1930s.

The US, while undeniably very strong militarily, is just getting started in drone warfare and only two nations, Ukraine and Russia, have much experience in waging this kind of warfare. It is worth noting though that Russia’s Shaheed drone was designed in and initially imported from Iran, so the only other nation with any significant claim to experience in this kind of warfare is Iran. At minimum they are certainly very capable of building large quantities of cheap and deadly military drones.

Iran is not so far showing any inclination to surrender, and it seems possible at the time of writing that this campaign by Israel ands the US may actually unite much of the Iranian population behind the regime. If this ‘Special Military Operation’ continues over months, and possibly years, then we have yet to see how well Iran can leverage their expertise in making cheap and effective drones into closing the Strait of Hormuz and causing chaos across the Middle East.

I would also note though that in effect the modern drone is a kamikaze plane that does not require a human pilot to be in the flying bomb. Kamikaze planes in WW2 sank several dozen US warships and killed thousands of US naval personnel. In the Black Sea since 2022 Ukraine has devastated the Russian fleet with just drones, to the extent that Russia has withdrawn the remnants of that fleet to a safe distance where it is no longer supporting the Russian invasion. Sinking the Iranian Navy may not give the US control of the Strait of Hormuz, and potentially may lead to cheap Iranian drones sinking very expensive and fully crewed US warships. We’ll see.

If all does not go well then I have already written that post on Tuesday about how closure of the Strait of Hormuz could potentially send oil markets to new all time highs, showing the setups that might deliver that which have already started to play out.

On equity markets the effect has so far been muted, and markets seem to be waiting to see how this develops. If all goes well then there may be no significant fallout on equity markets, but today I’ll be looking at the setup here in the event that all does not go well.

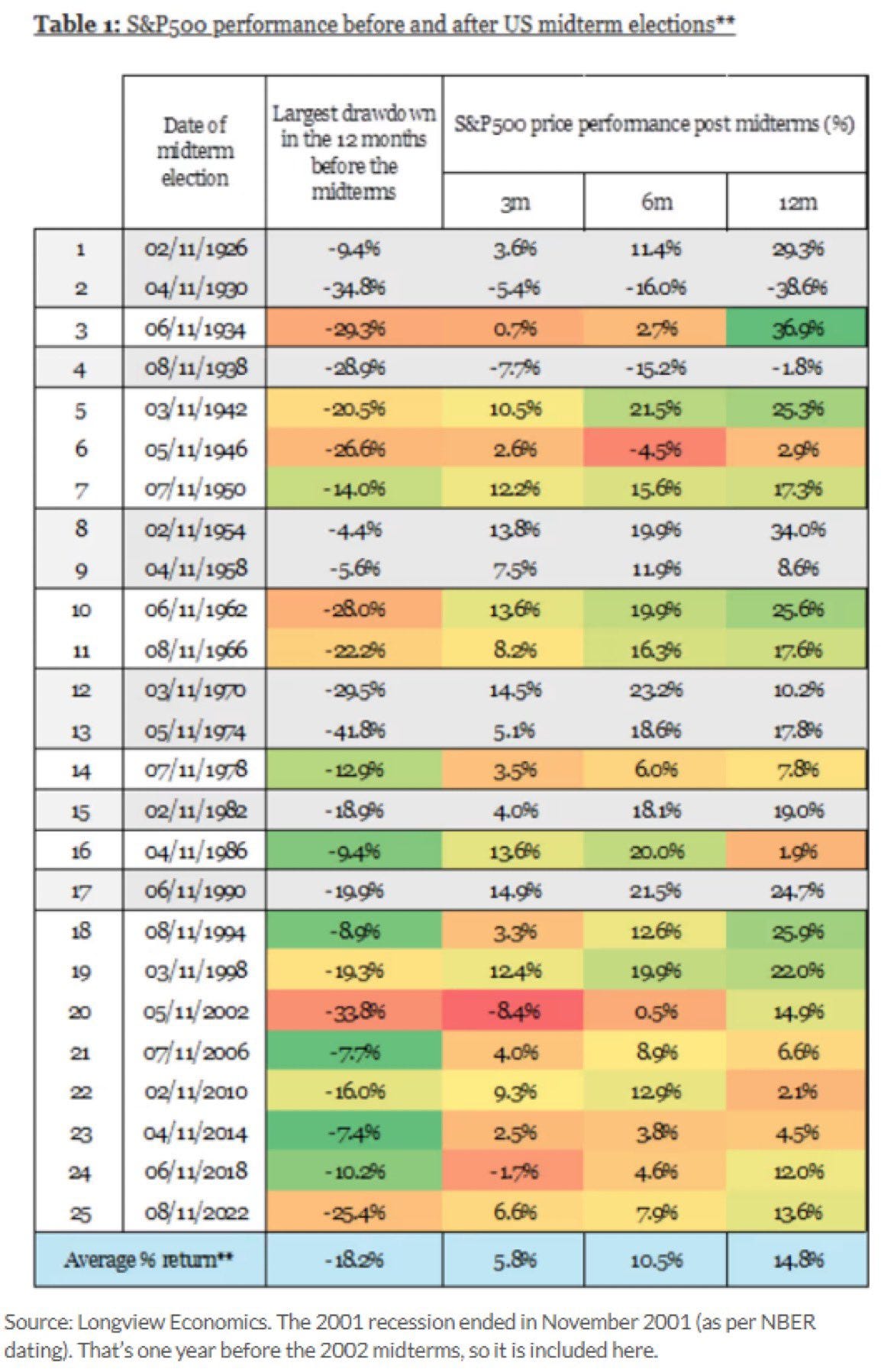

To start with I’d note that there is considerable history of large drawdowns on equity markets in US midterm years. I posted the chart below earlier this week as my ‘Chart of the Day’ on my premarket post and it shows the intra-year drawdowns in midterm years over the last century. I noted then that of the 25 midterm years listed, 11 had drawdowns over 20% and 14 had drawdowns over 18%:

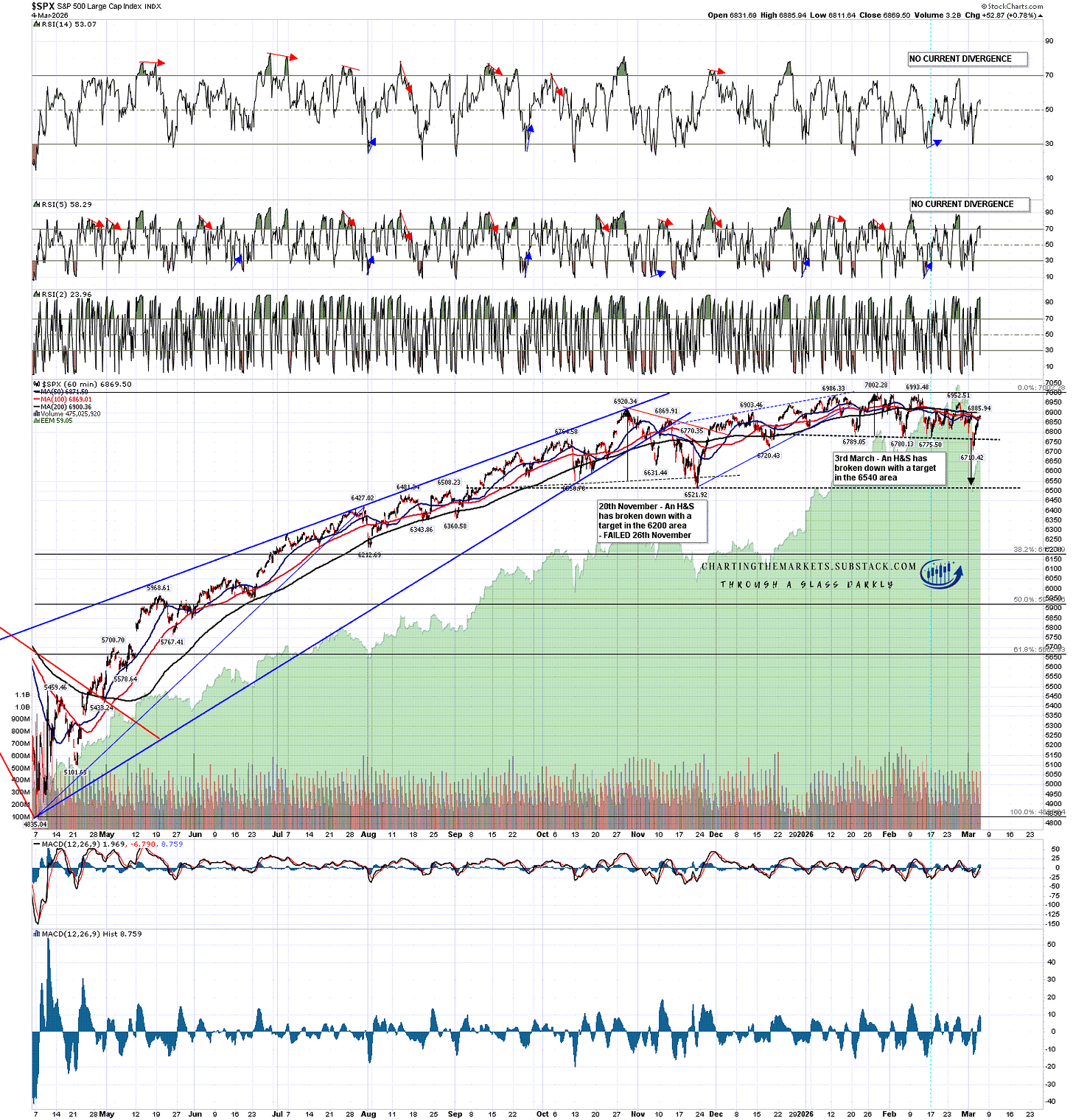

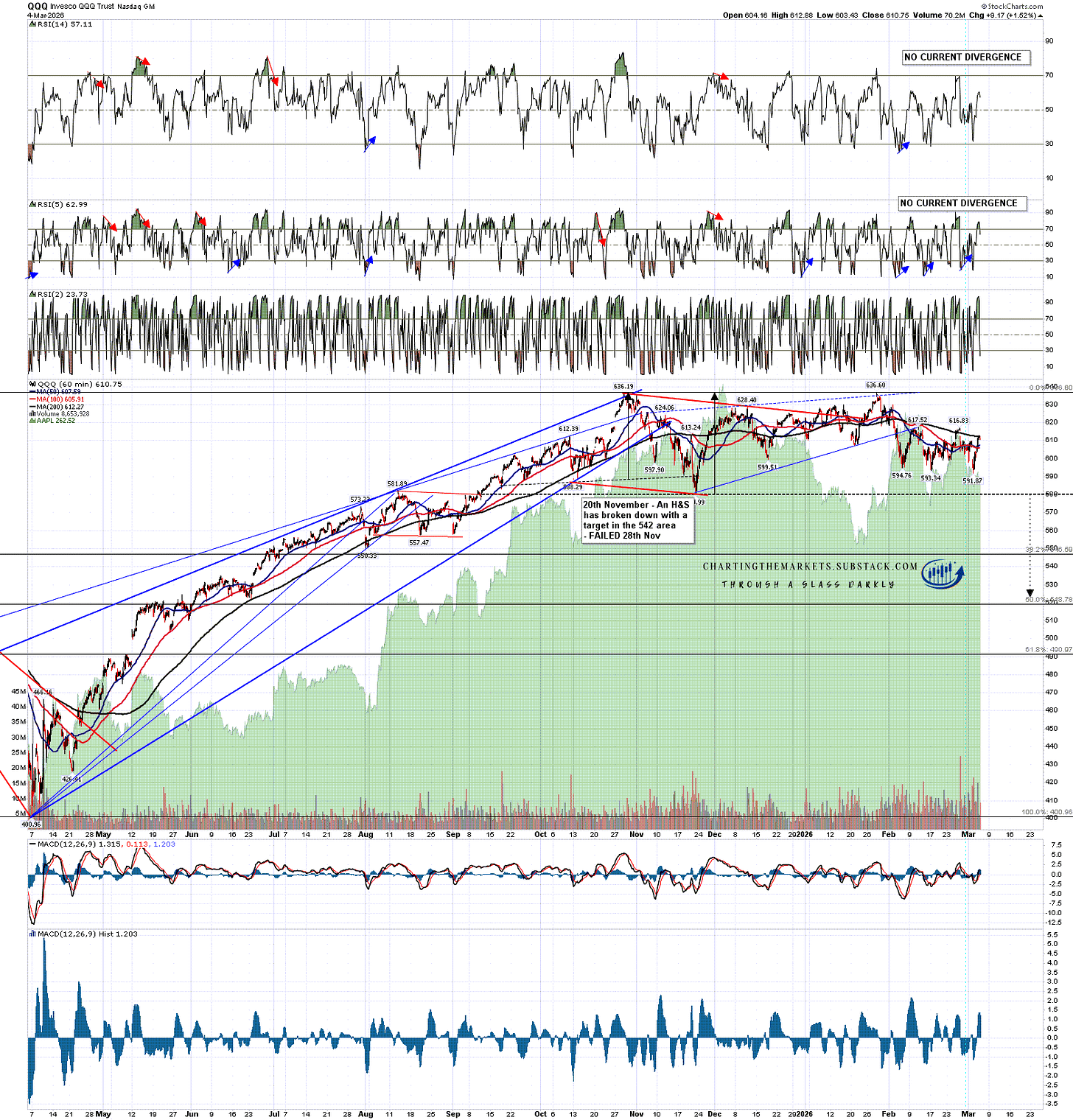

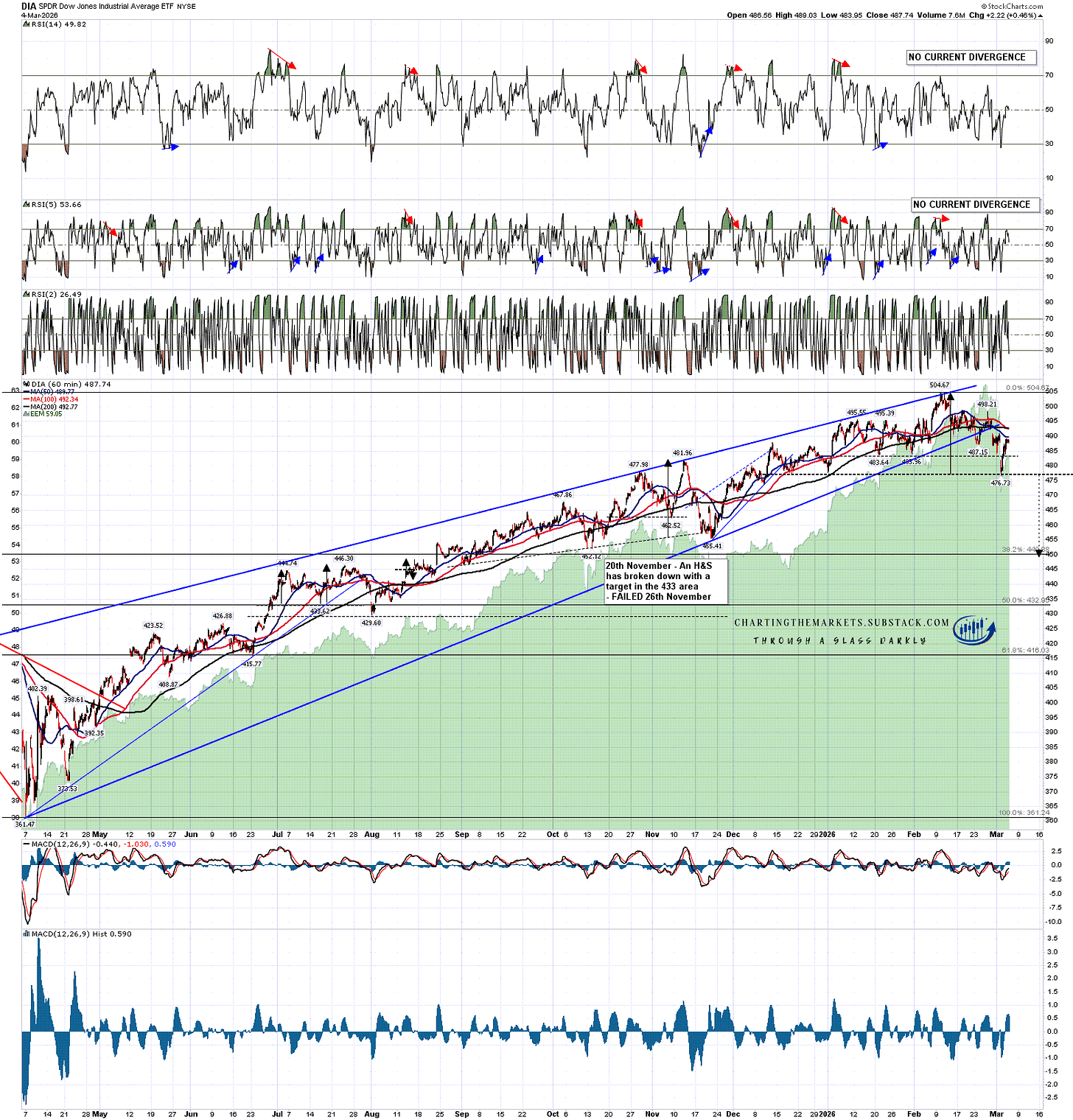

In terms of topping setups on equities here, there are some decent ones formed from the patterns that developed from the April 2025 lows.

On SPX the rising wedge from April peaked in October and broke down in November. Since then SPX has essentially traded sideways and I’ve been watching a possible H&S that has been forming and broke down at the start of this week with a target in the 6540 area. That target is close to a possible larger H&S neckline, or asymmetric double top support, in the 6522 area This is a possible overall setup for a strong decline that could target the 6040 - 6120 area:

On QQQ the rising wedge from April peaked in October and broke down in November. Since then QQQ has essentially traded sideways and I’ve been watching a possible double top that has been forming since that October high. I would note that while this is a lovely double top on QQQ it is less nice on NDX as the second high there was just shy of a new all time high. If this double top was to break down under 580 the target would be in the 523 - 4 area, close to a 50% retracement of the move up from the April low:

On DIA the rising wedge from April peaked in October and broke down in November before a return to wedge resistance in February that expanded the original wedge. A possible H&S is forming that on a sustained break below the low this week at 476.73 would look for a target in the 450 area:

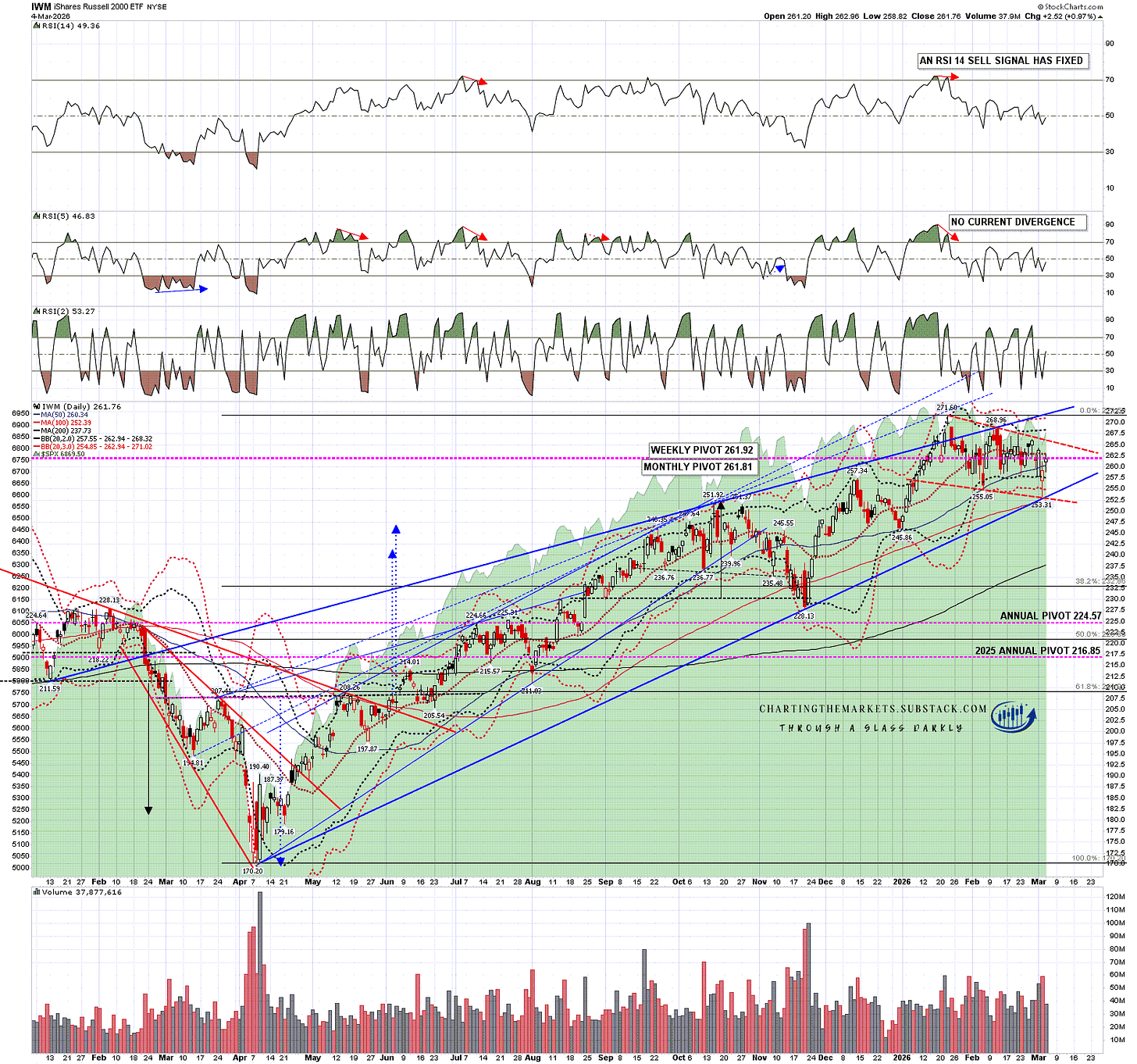

On IWM the rising wedge from April peaked and broke down in October before a return and overthrow of wedge resistance in January that expanded the original wedge. That expanded wedge hasn’t broken down yet, there is no obvious topping pattern formed, and the obvious pattern established from the January high so far is a bull flag in the form of a falling wedge.

There are two obvious options for forming a topping pattern on IWM. The first is that the bull flag delivers a retest of the all time high and establishes a double top setup. The second is that the bull flag breaks down, as happens perhaps 30% of the time, towards a target in the 235 area. By definition though, bull flags lean strongly bullish until demonstrated otherwise. I would note that a daily RSI 14 sell signal fixed at the last all time high, and hasn’t reached target yet, though daily RSI 5 sell signals are both more common and more reliable:

It may be that the Iran war/conflict/operation/whatever all goes well and there is no serious blowback on equities as a result, but the history of US wars in the Middle East and elsewhere since 1946 suggests that there is at least a significant probability that it develops into an asymmetric quagmire. We’ll see how that goes, but in the event that all does not go well, these are the patterns that I am watching.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST, but only for paying subscribers. Other places to find me are my page on the platform previously known as twitter, and my YouTube channel.