In my post on Wednesday last week I was looking at the bear flags formed on Bitcoin (BTCUSD), Solana (SOLUSD) and Ethereum (ETHUSD), and those have all since broken down, but in a way that looks as though we might see a rally shortly.

I was outlining a scenario for that rally to a friend a couple of days ago, but was thinking the setup would probably fall apart as equity indices fell hard, but with SPX down almost 10% since then the setup is still intact, so I’m going to look at that today.

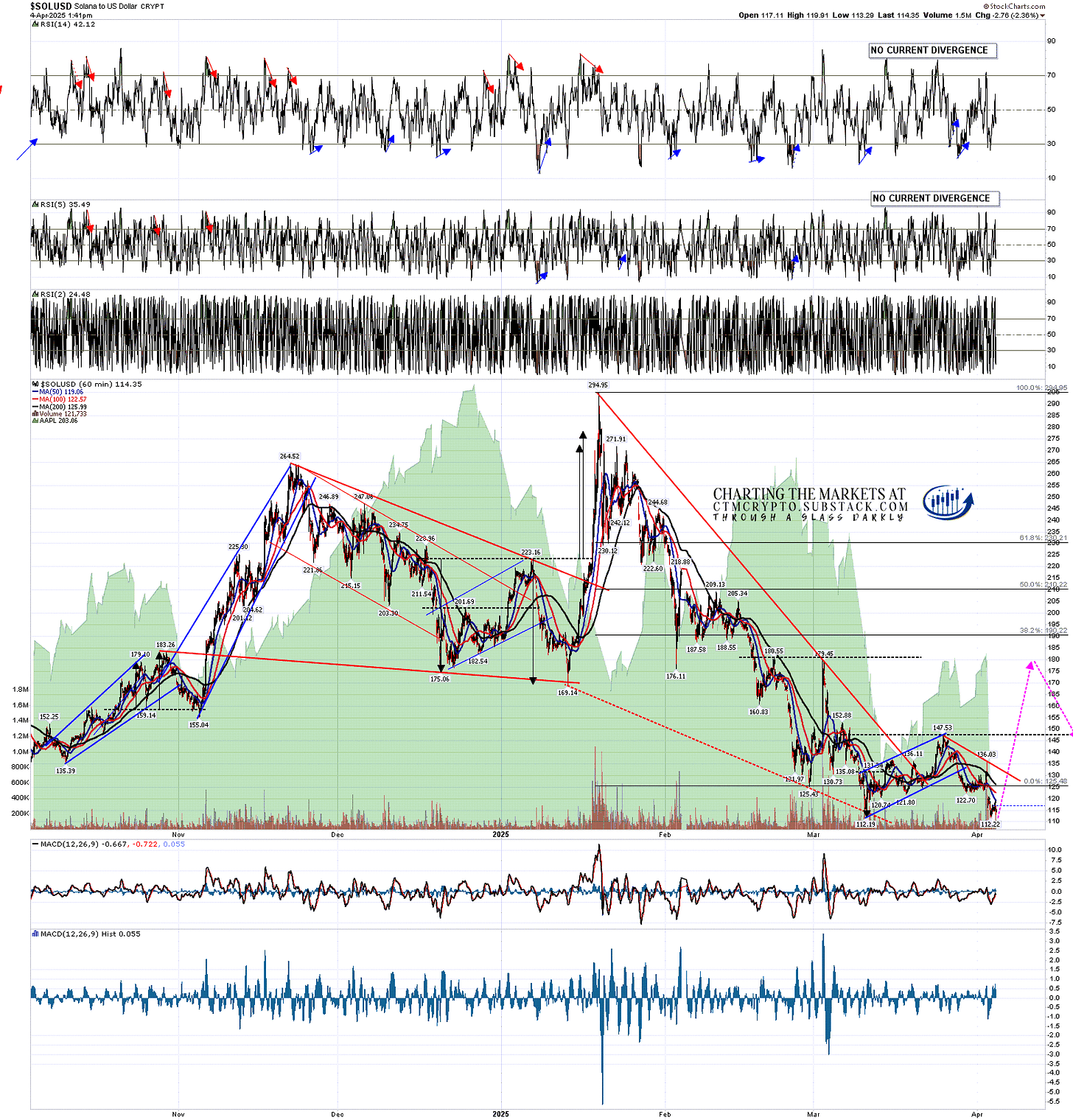

Solana hasn’t quite reached the flag target at the retest of 112.19 but the post flag low at 112.22, if it holds, is close enough for government work, and has held so far while SPX has fallen almost 300 handles.

If this support area holds that sets up a double bottom that could play out if SPX sees the strong bounce I’m thinking we might see there from big support and the possible H&S neckline in the 5100 area.

If so, a sustained break over 147.53 would look for a target in the 182/3 area, with significant resistance in that area, so we might well see a reversal back down there.

SOLUSD 60min chart:

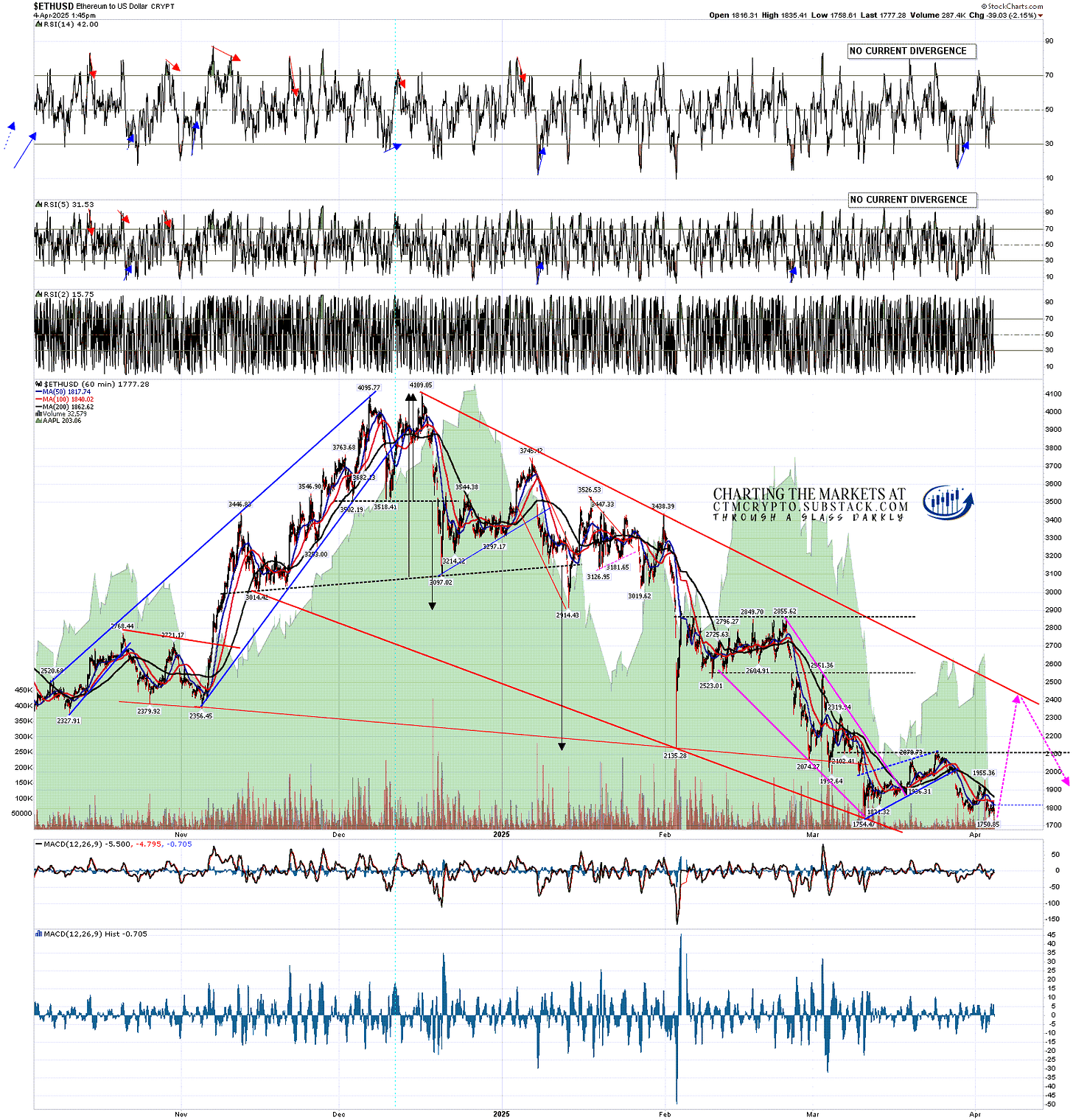

The setup on Ethereum is similar with the bear flag having played out and the March low at 1754.47 retested but the low area holding so far. Here a sustained break over 2070.73 would look for a double bottom target in the 2600 area with possible resistance on the way at declining resistance from the late 2024 high, currently in the 2490 area.

ETHUSD 60min chart:

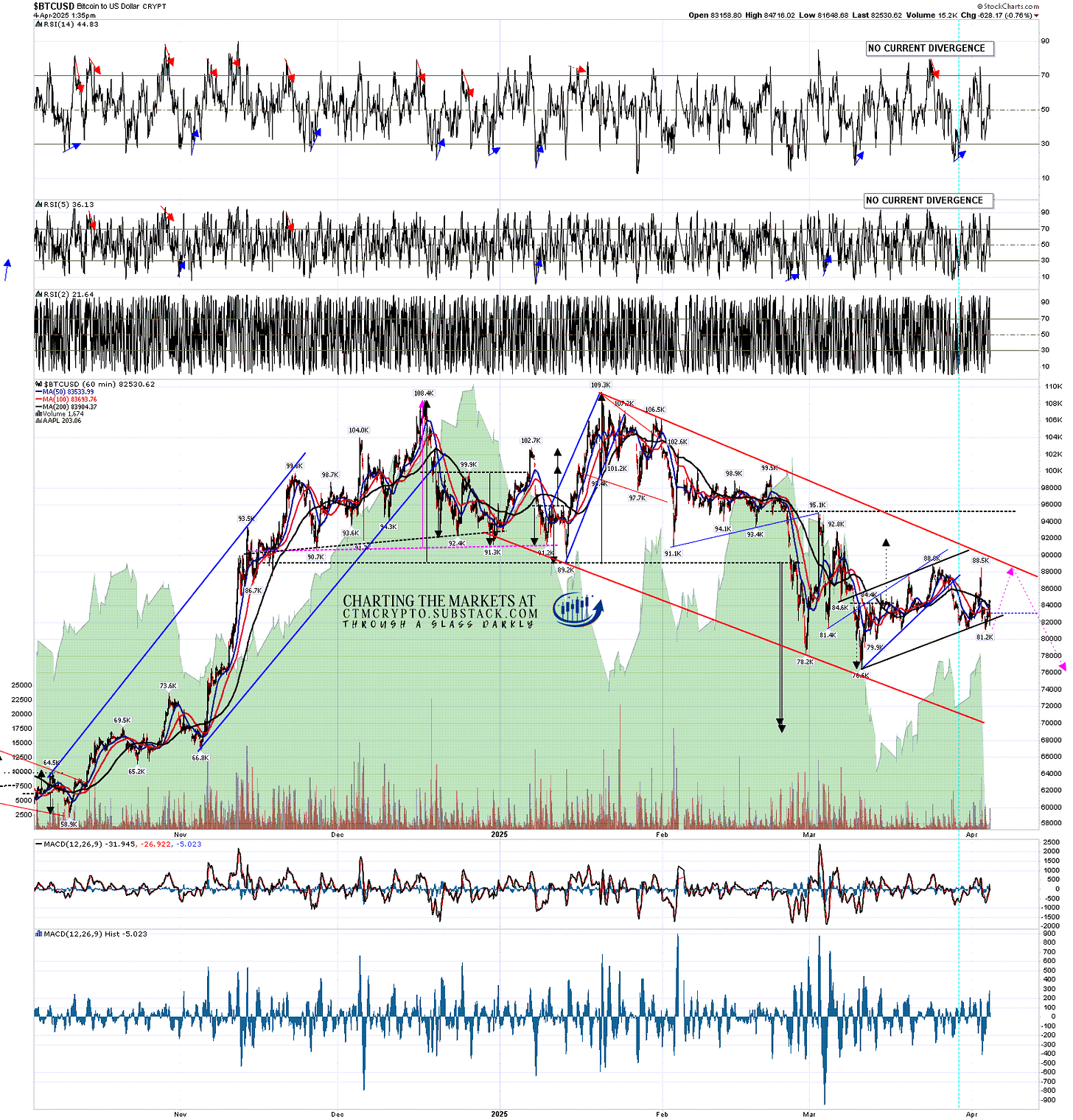

Bitcoin is holding up the best, as has been the case the last few months, and the initial bear flag wedge evolved into a larger bear flag channel which has now broken down too. I’m wondering about a possible rally into the retest of 88.8k to set up a double top to then take BTCUSD down to the bear flag target at 76.6k. That would also be a good match with a test of declining resistance from the all time high, currently in the 90k area.

BTCUSD 60min chart:

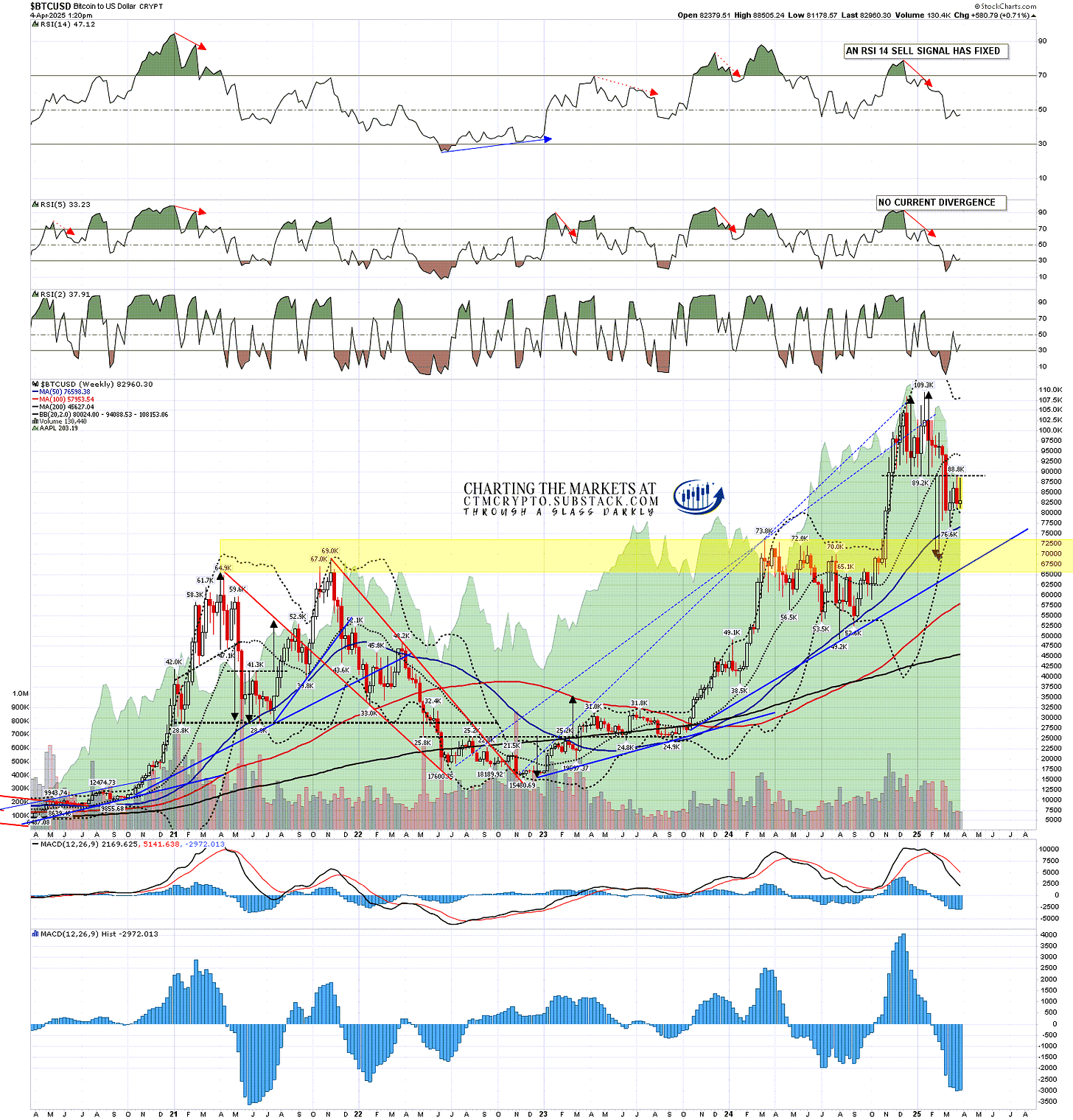

On the bigger picture there is still an open double top target on Bitcoin in the 69k to 70k area that I am still expecting to see hit after these possible rallies.

BTCUSD weekly chart:

Everyone have a great weekend. :-)

So far this year I have been and am still leaning towards seeing weakness in the first half of the year and renewed strength in the second half of 2025, with a very possible bull market high on Crypto pencilled in close to the end of the year. That scenario would be a good match with past Crypto bull markets. Is it possible that I am mistaken? Always, but we can only ever try to identify the higher probability paths in the future. Only time can show us the path that is actually taken. Still, I’m with Confucious who said ‘study the past, if you would divine the future’.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment