Since then the wedge has broken up, retraced about 50% of the decline, and an IHS has formed with a target back at a retest of the last high.

At this stage there are only two main options. Firstly that the IHS breaks up, converts the neckline to support, and goes on to retest the last high, and secondly that SPX drops back through 4360, and likely then retests the last low at 4328.09, and then very possibly down further. It is very likely that we will see one of those two options happen next.

SPX 5min chart:

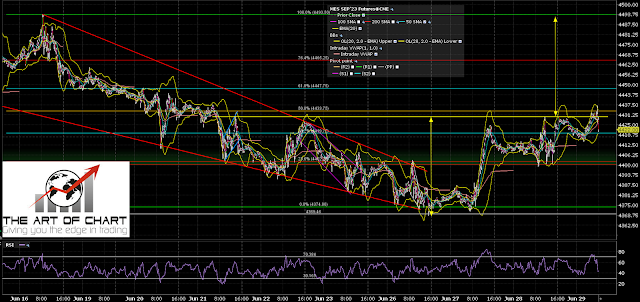

On the ES chart the setup is even cleaner. There is a near perfect quality IHS that has formed and broken up with a target at the retest of the last high. That has broken up slightly overnight and completed a close to exact 50% retracement of the move down from the last high. This is a near perfect setup to either retest the high or fail back into the lows.

A break below 4400 at this point fails the IHS and look for a retest of the current 3969 low. A conversion of 4430 sets up the high retest.

On the bear side I would note that a 60min sell signal fixed on ES yesterday.

ES Sep 5min chart:

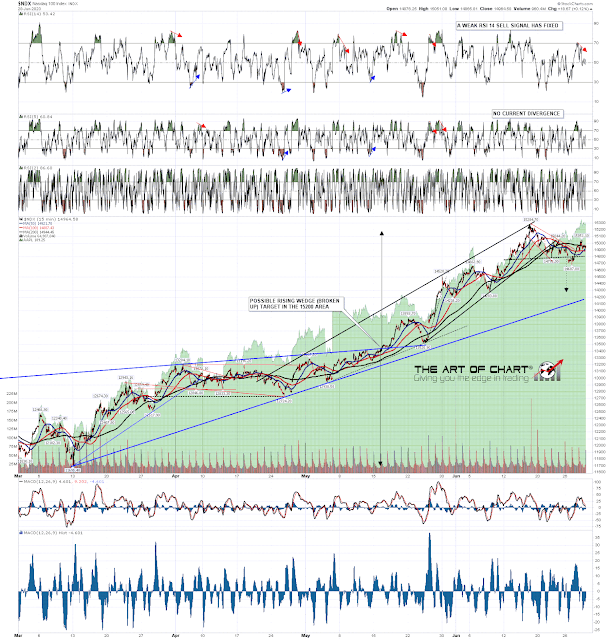

On the bull side the H&S on NDX that had broken down and I was looking at in my last post failed at the high yesterday. That failure has a target at a retest of the last high so that was a significant strike in favor of the bulls here.

NDX 15min chart:

So what are the odds here? Well the setup is ambiguous, but there is still a decent argument for a high retest, and today leans 61.9% bullish. Tomorrow leans neutral to mildly bullish and Monday leans 85.7% bullish on SPX. With Independence Day coming up this is a holiday period, which generally favors the bulls.

I'd give the odds here at 65% in favor of this resolving bullishly but beyond that this is all about the breaks today. If support at 3960 SPX and 4400 ES is broken then it is very likely this resolves down. If 4390 SPX and 4430 ES can be converted to support then it is very likely this resolves up. We will see.

We are running our July 4th sale with deep discounts on annual memberships at theartofchart.com. If you're interested you can see the page and offer here.

If you are enjoying my analysis and would like to see it every day at theartofchart.net, which I co-founded in 2015, you can register for a 30 day free trial here. It is included in the Daily Video Service, which in turn is included in the Triple Play Service.

No comments:

Post a Comment