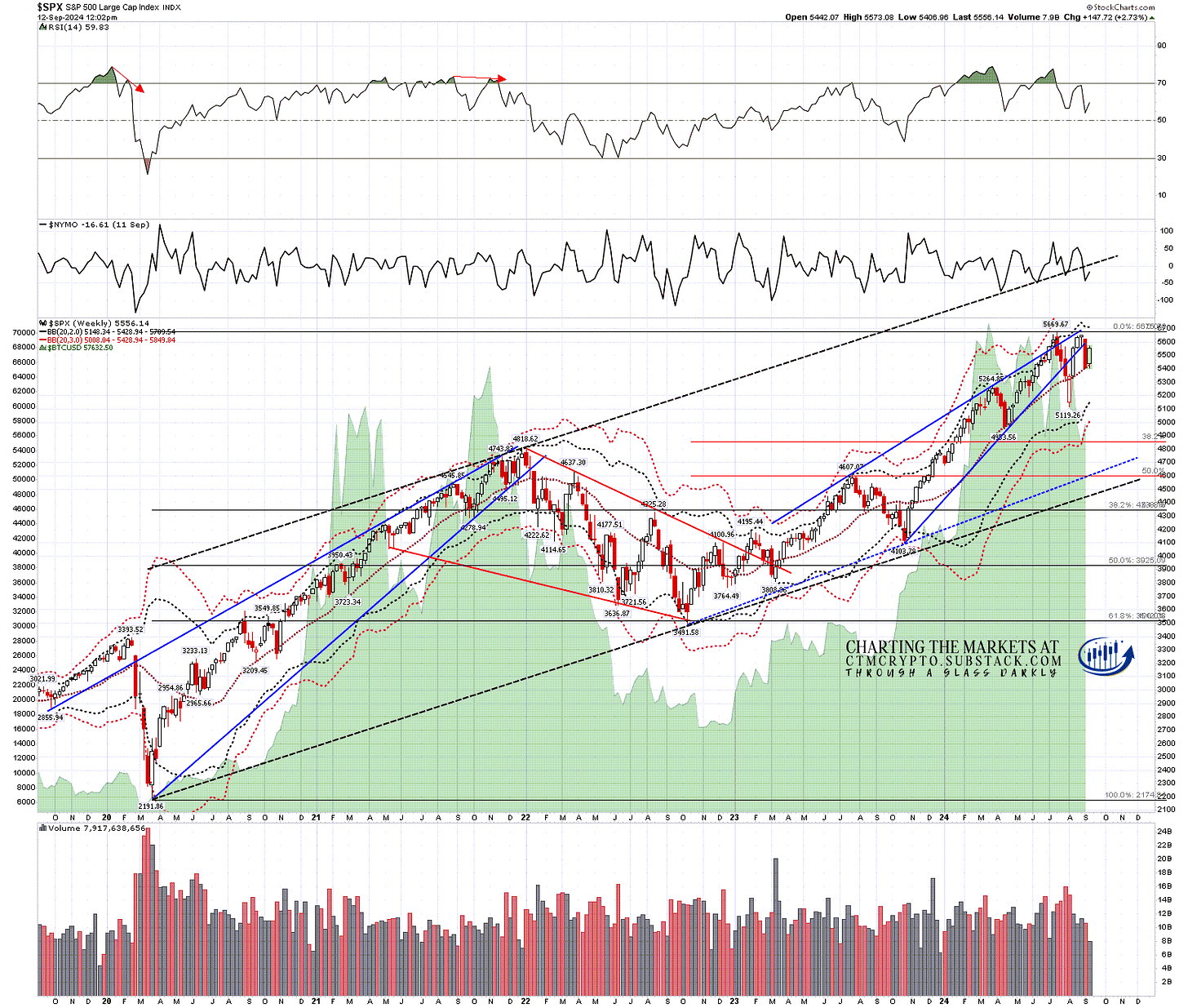

I’ve been having a good look at the longer term correlation between Crypto & equity indices and it is a strong one that has been impressively consistent over the last 8 years. The chart below just covers the last five years of SPX vs BTUSD (bitcoin) but you can see that the upswings and downswings tend to be correlated, and going back to 2016 the big highs on both are decently matched, with a strong tendency for Crypto to turn down before equities do.

I was asked a couple of weeks ago whether this might be happening again, with Crypto having topped a few months ago and SPX, NDX and Dow all looking as though a significant high might be close. I’ve looked at that and would say that it would be more typical for the two highs to be within a month of each other, though there is a possibly comparable period as BTCUSD was forming a bull flag for ten months or so in 2019-20 with the C wave down during the 2020 COVID crash.

This is a small sample though and when something has only happened once before, it is a bit early to be identifying a pattern. Maybe.

SPX vs BTCUSD weekly chart:

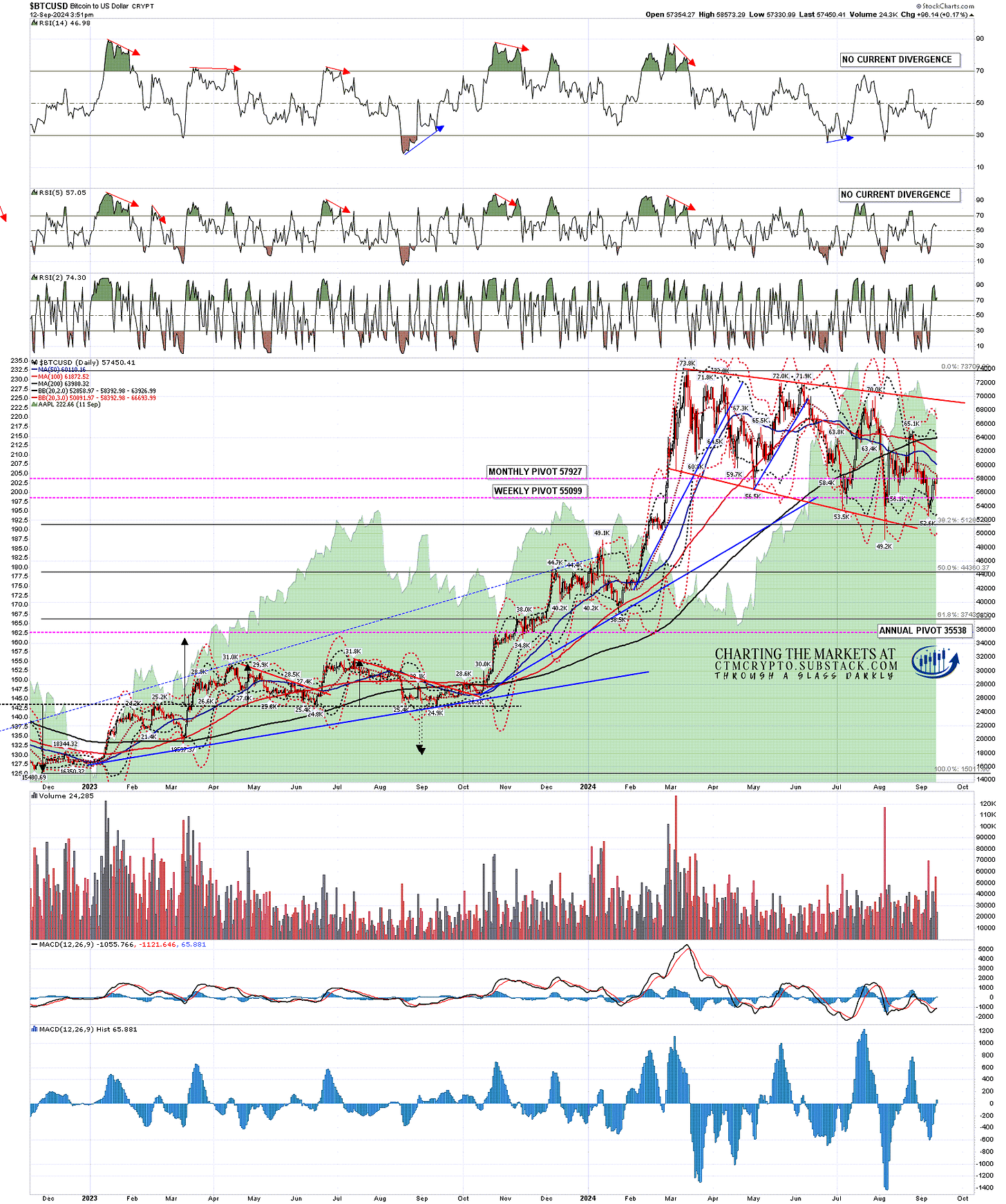

Could that happen here? Well yes. BTCUSD has been forming what is likely an overall bull flag since the new all time high was made in March 2024 and, if there is a larger decline on equity indices coming up soon, then there is a case that we will see some low retests then that would finish this bull flag setup.

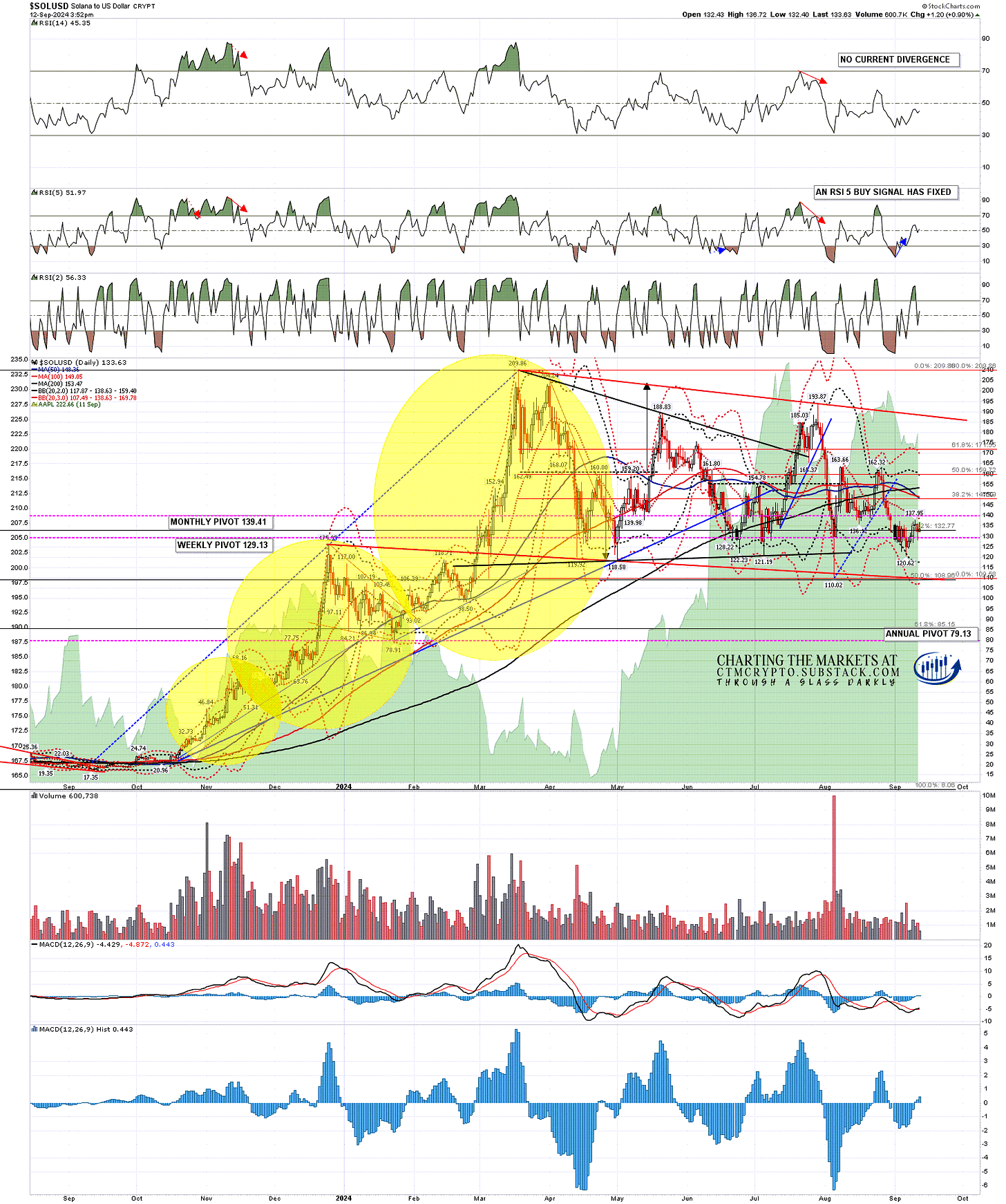

Is there a case for a lower low on BTCUSD? Maybe, though the case for that looks stronger on both ETHUSD (Ethereum) and SOLUSD (Solana).

BTCUSD daily chart:

If so though, I have a theory about how that might look on SPX, with SPX and likely Dow retesting their all time highs in the next couple of weeks, leading into a larger retracement into October and, given that we have seen a lot of significant lows in Octobers over the last few years, perhaps a strong October low to finish the sequence? I was looking at that scenario on my The Bigger Picture video last night, and if you’d like to see that video, you can see it here.

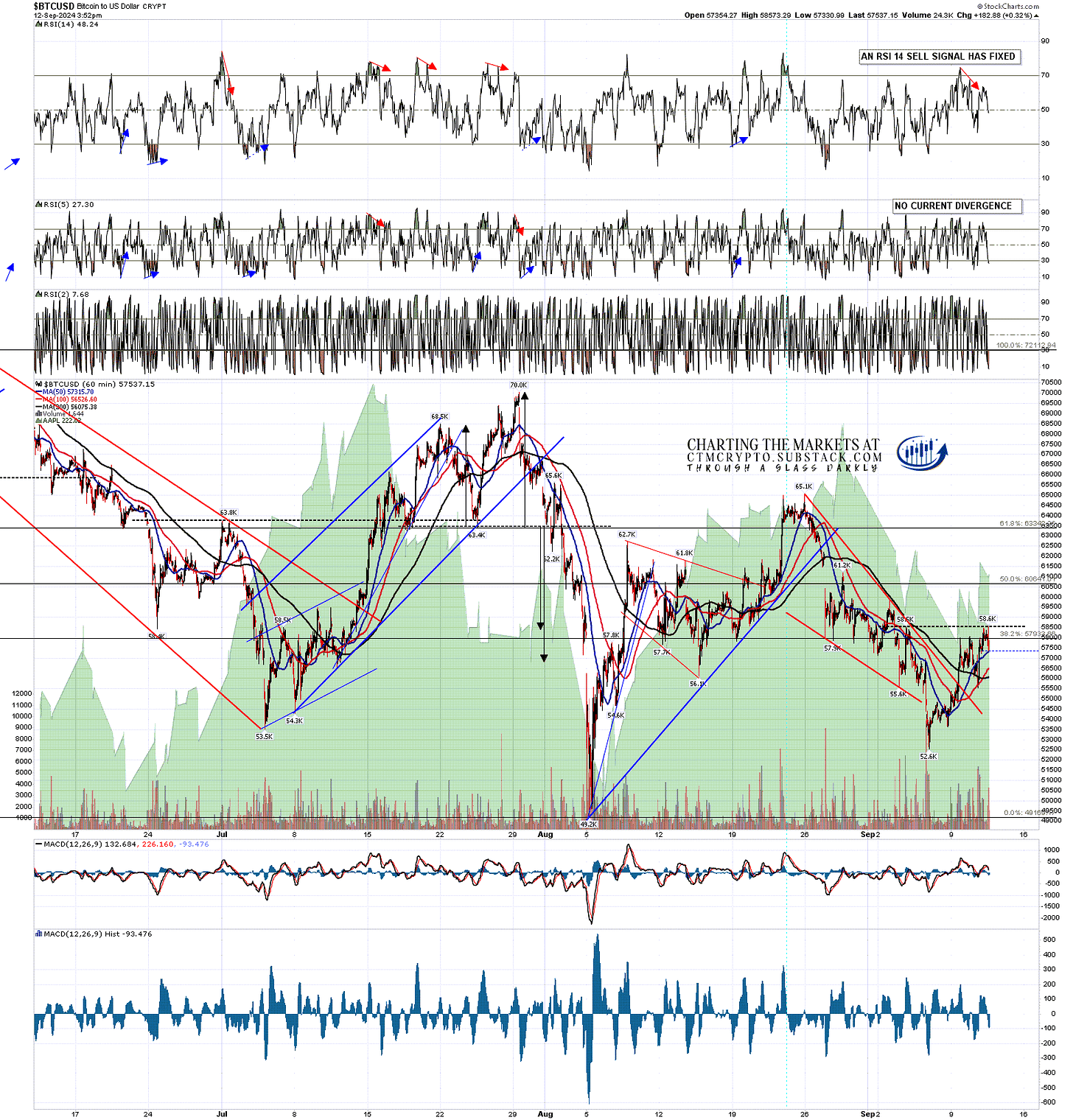

How might that look on Bitcoin? Well, there is a possible IHS forming on that at the moment, and while that’s not a big pattern, it might be a decent match with that scenario on SPX & Dow, with a subsequent decline into a new bull flag low, possibly close to the 50% retracement level in the 44,360 area, before a new leg up on Crypto begins. In terms of the IHS, a sustained break over 58.6k would look for the 64.4k area.

I was talking about this on my Crypto premarket video this morning, and if you’d like to see that video , you can see it here.

BTUSD 60min chart:

The obvious reads here on Ethereum and Solana since March are also bull flags forming on the daily chart. Here is the one on Solana.

SOLUSD daily chart:

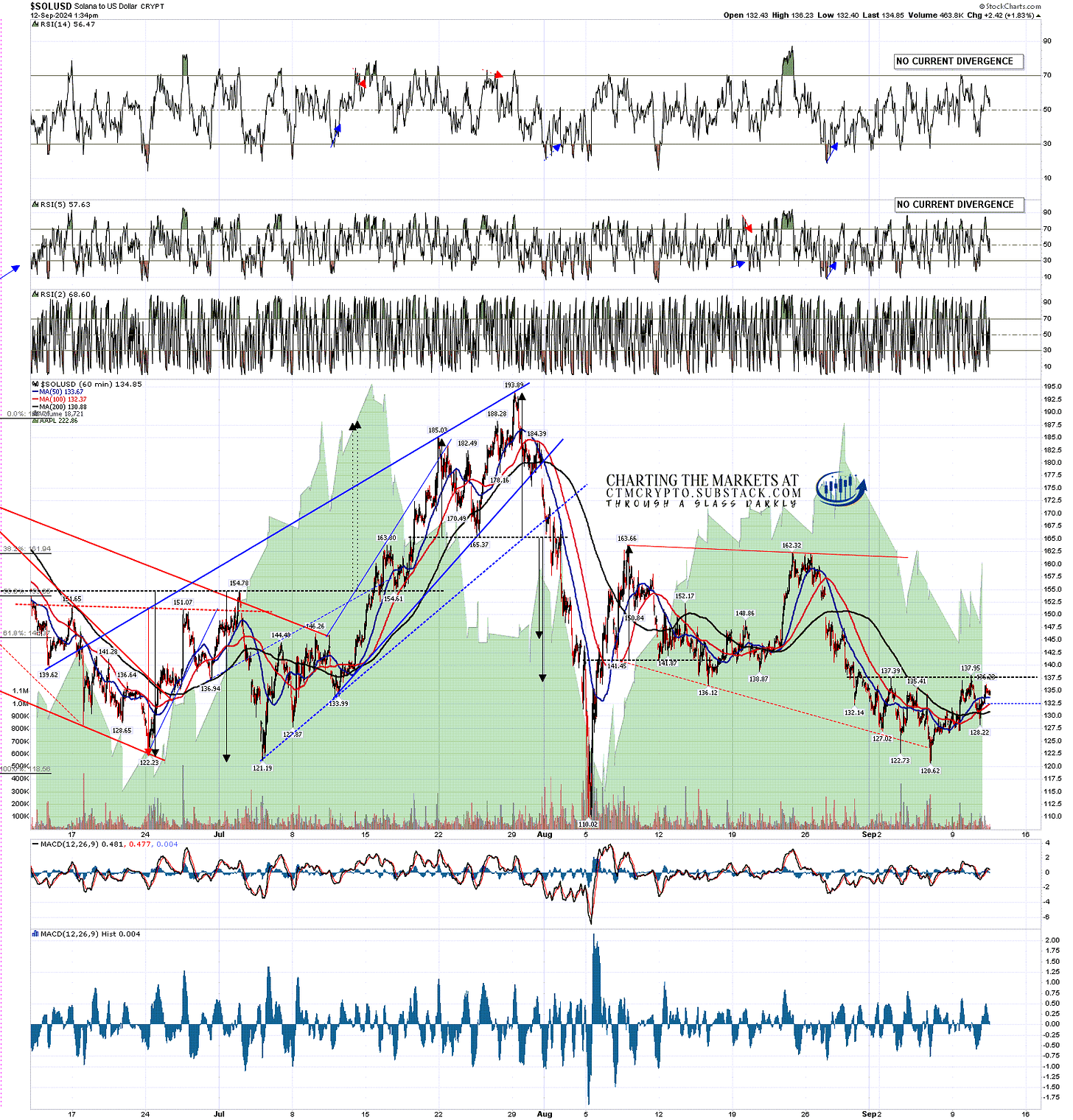

On the Solana hourly chart there is also a good quality possible IHS forming and, on a sustained break over 138, that would have a target in the 154/5 area. A decent rally, but there is still an obvious case for at least retesting the low at 110.02 to make the second low of a double bottom, so we might see that move after the IHS rally in sympathy with the decline on equity indices that may well happen then.

SOLUSD 60min chart:

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Cryptos for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

CTM Crypto Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

No comments:

Post a Comment