A week ago I led with a chart looking at the strong correlation between SPX and BTCUSD (Bitcoin).I was talking about the big inflection point likely coming up on SPX, and SPX is in that inflection point now, at a stage where it could very much break either way, though the Fed gave bulls a big boost yesterday. Whichever way SPX breaks here, Crypto will likely follow to a significant degree.

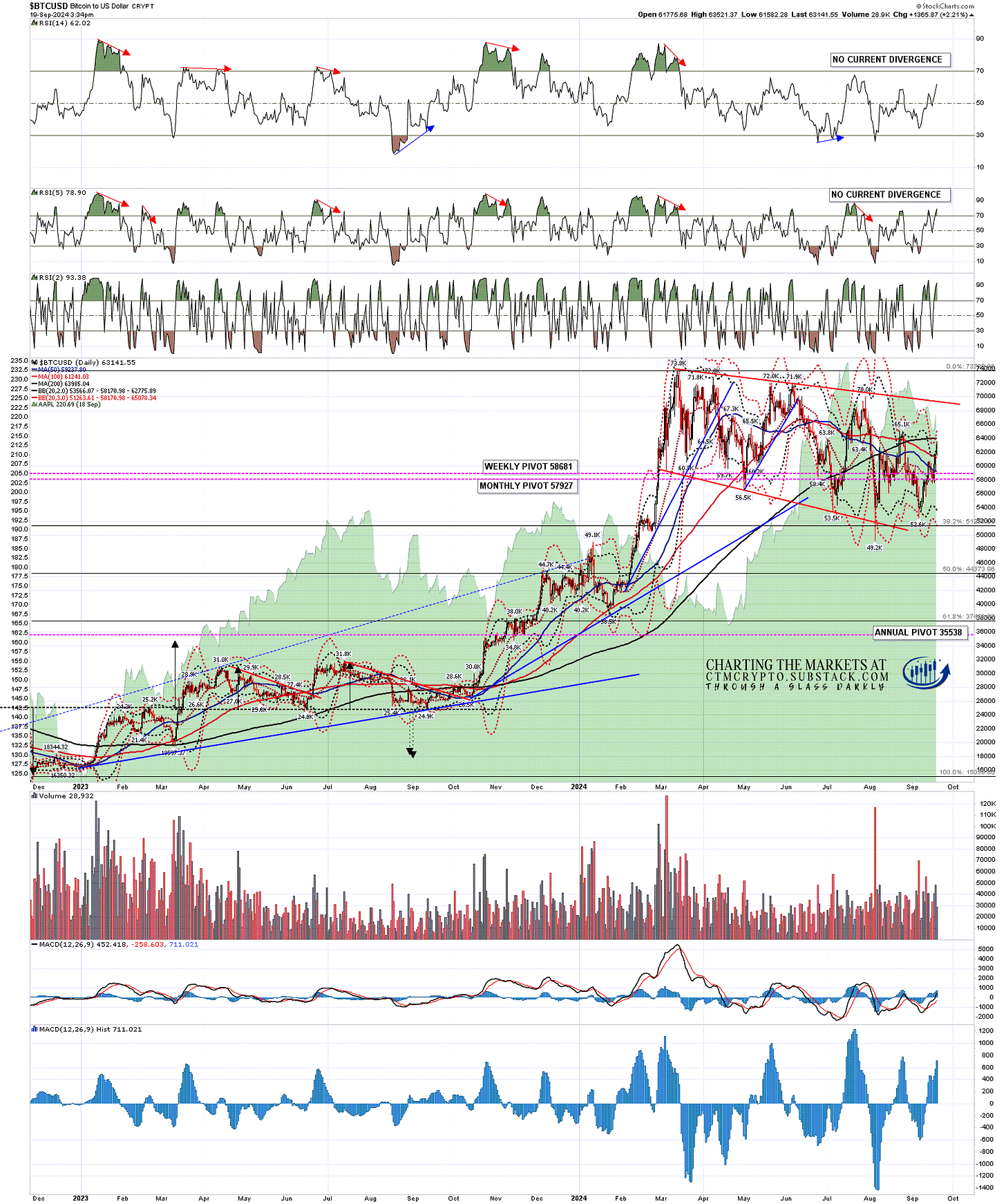

On the Bitcoin daily chart, the daily middle band was backtested and held as support. BTCUSD has also broken back over the 50dma, and is close to a test of the 200dma currently at 63985. Bitcoin is looking a bit stretched at the moment, over the daily upper band currently at 62775, but still well short of the daily 3sd upper band currently at 65078.

BTCUSD daily chart:

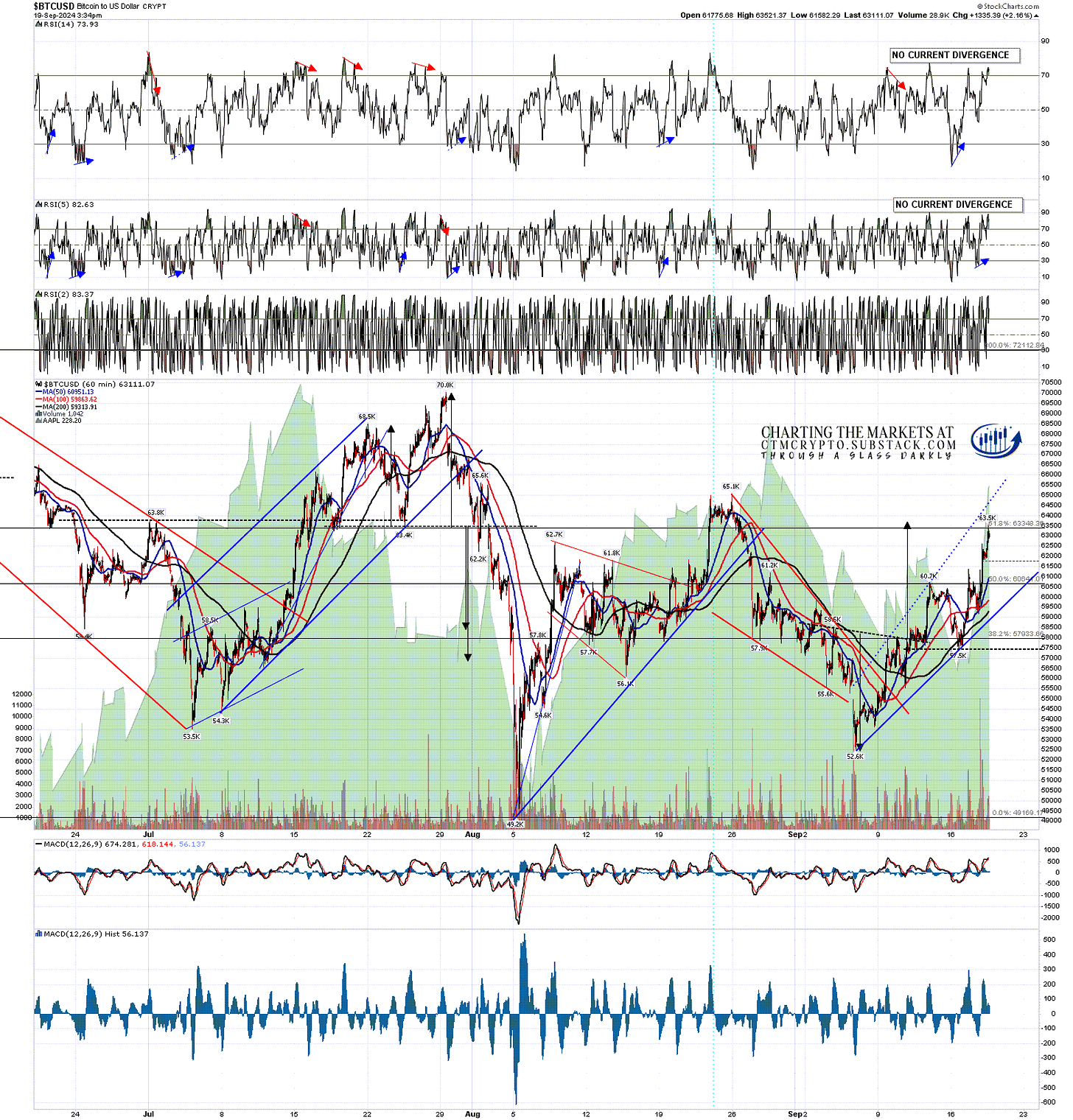

I was looking at the possible IHS forming on Bitcoin in my post a week ago and, in the meantime, that finished forming, broke up, and has almost reached the IHS target in the 63750 area. I have drawn in a possible rising megaphone resistance trendline currently in the 64600 area and the key short term target for bulls is a higher high over the August high at 65.1k.

BTCUSD 60min chart:

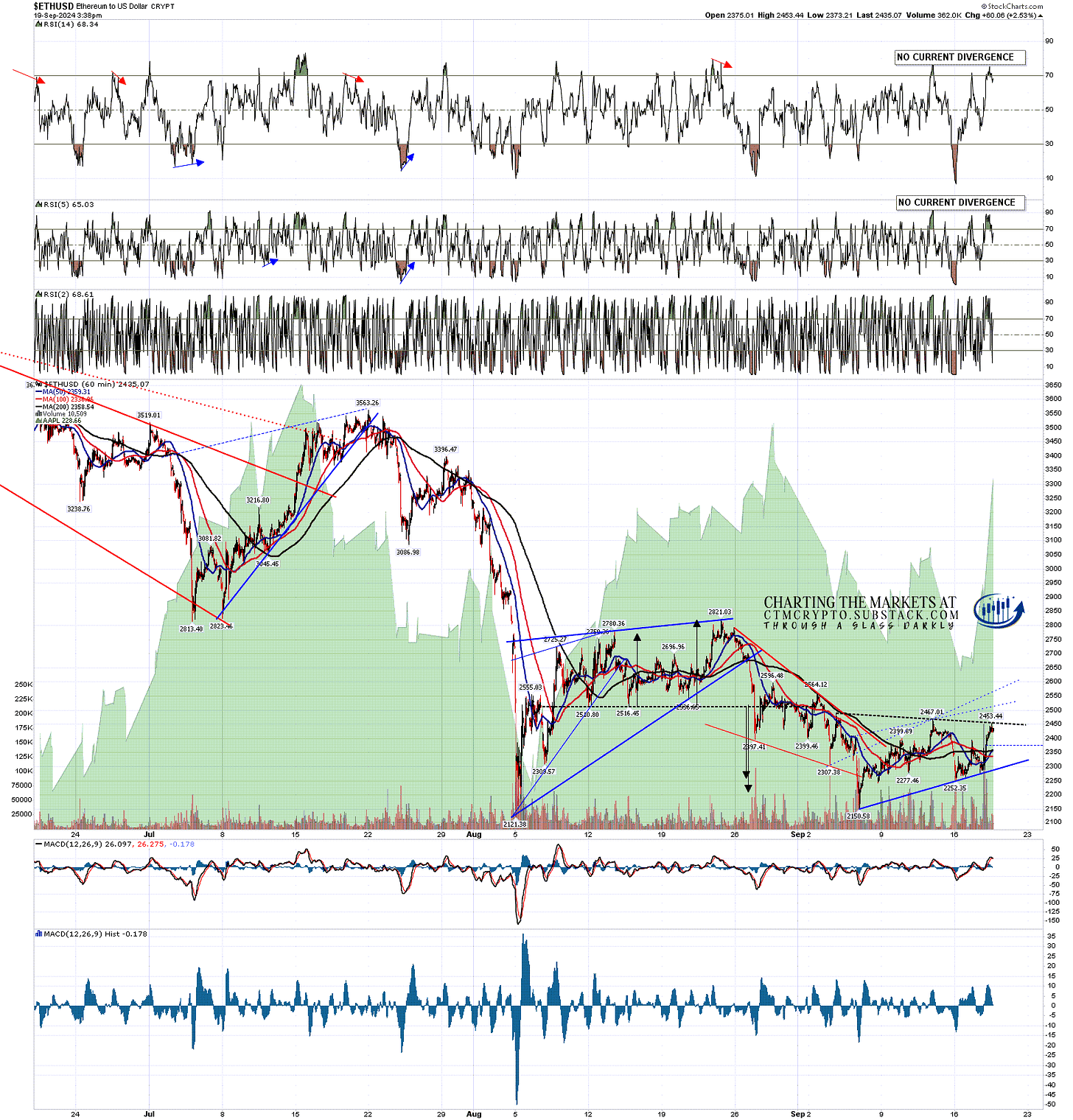

On ETHUSD (Ethereum) a bear flag may well be forming and I have drawn in the three obvious trendline resistance options on the chart below. The first is a triangle resistance trendline and is being tested at the time of writing.

ETHUSD 60min chart:

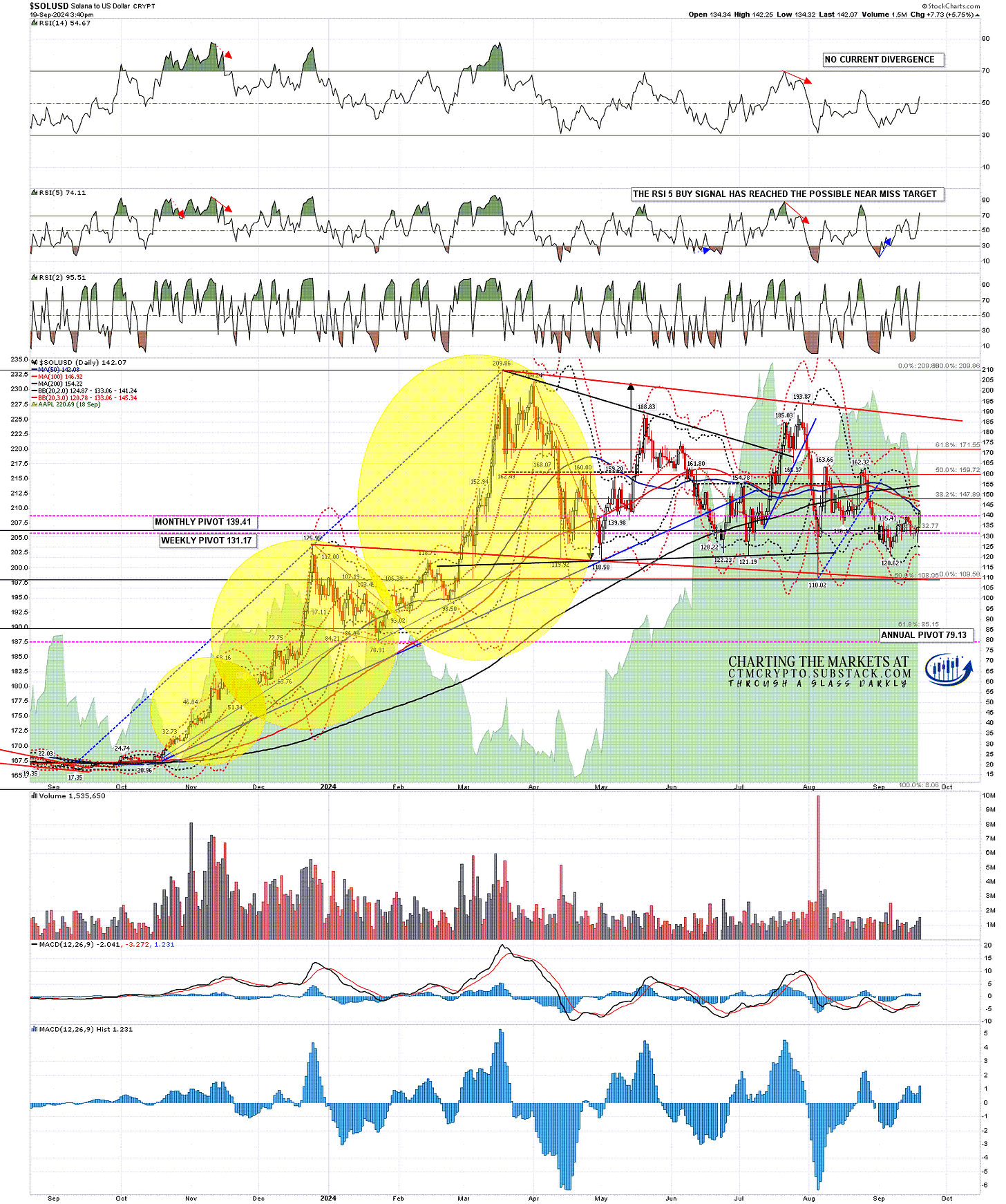

SOLUSD (Solana) has been the strongest today, breaking up from the daily middle band to the upper band and the test of the 50dma. Short term upside looks limited with the daily 3sd now at 145.35, so if we are going to see a break back up into a test of the 200dma, currently at 154.22, then it will likely be a couple of days before that is attempted.

SOLUSD daily chart:

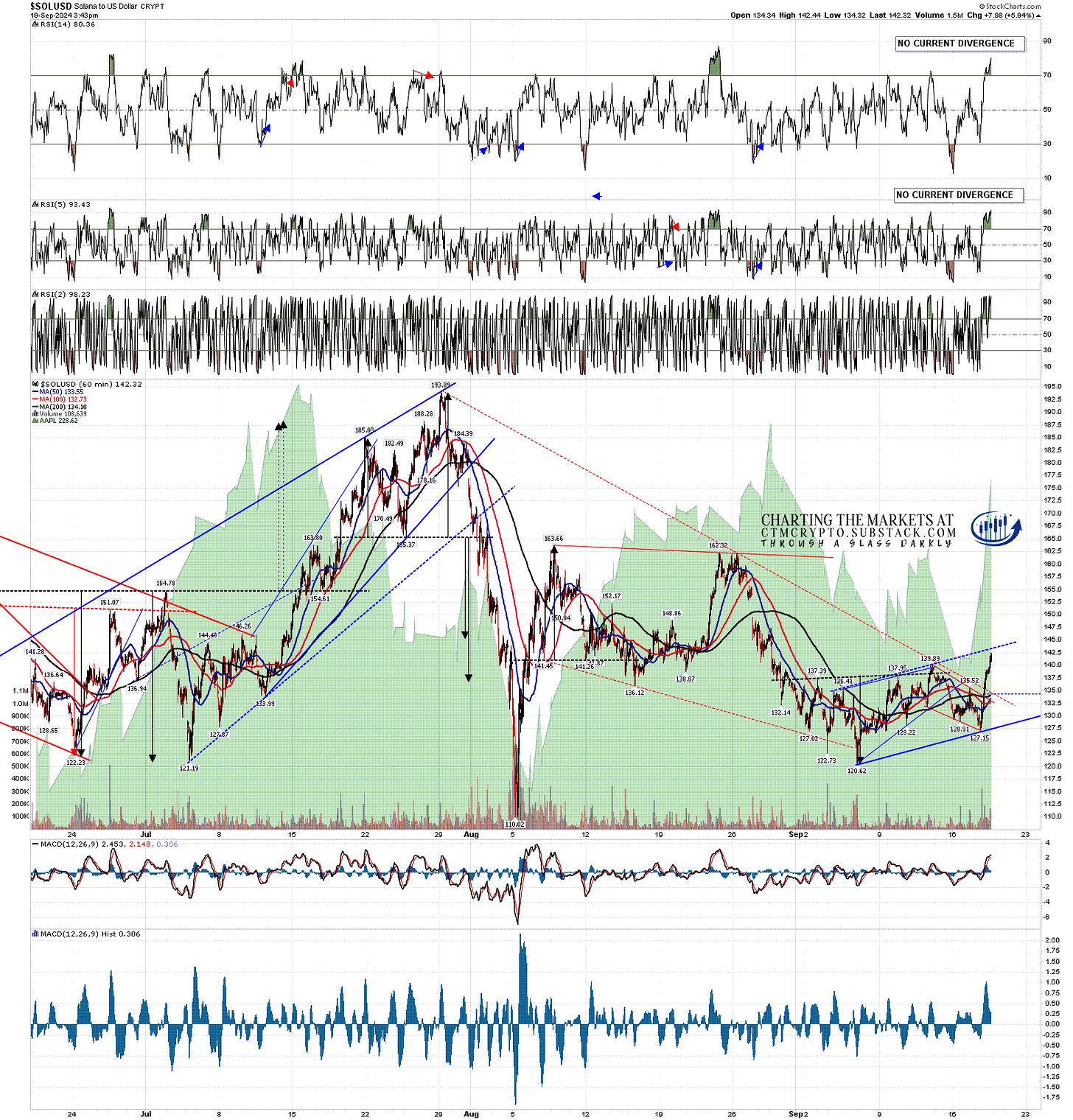

In the shorter term there is a high quality bear flag channel established on Solana, with flag resistance currently in the 143 area. I’m watching that level, and a break and conversion to support there would be bullish. A touch and fail there would be bearish.

SOLUSD 60min chart:

On the bigger picture, SPX and Crypto will likely either break up or fail hard together here. That decision is still being made. If it is a break down then the obvious downside targets on Ethereum and Solana are retests of the August lows at 2121.38 and 110.02 levels respectively to make possible second lows of large double bottoms before likely reversal higher. The target on Bitcoin is less clear as it has been the strongest of the three in recent months and a retest of the August low at 49.2k would both look harder, and would definitely not be the possible second low on a double bottom setup.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Cryptos for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment