On Friday morning I was looking at an interesting bull setup across the Crypto instruments that I look at every day. You can see that here if you’re interested in my Crypto channel on YouYube.

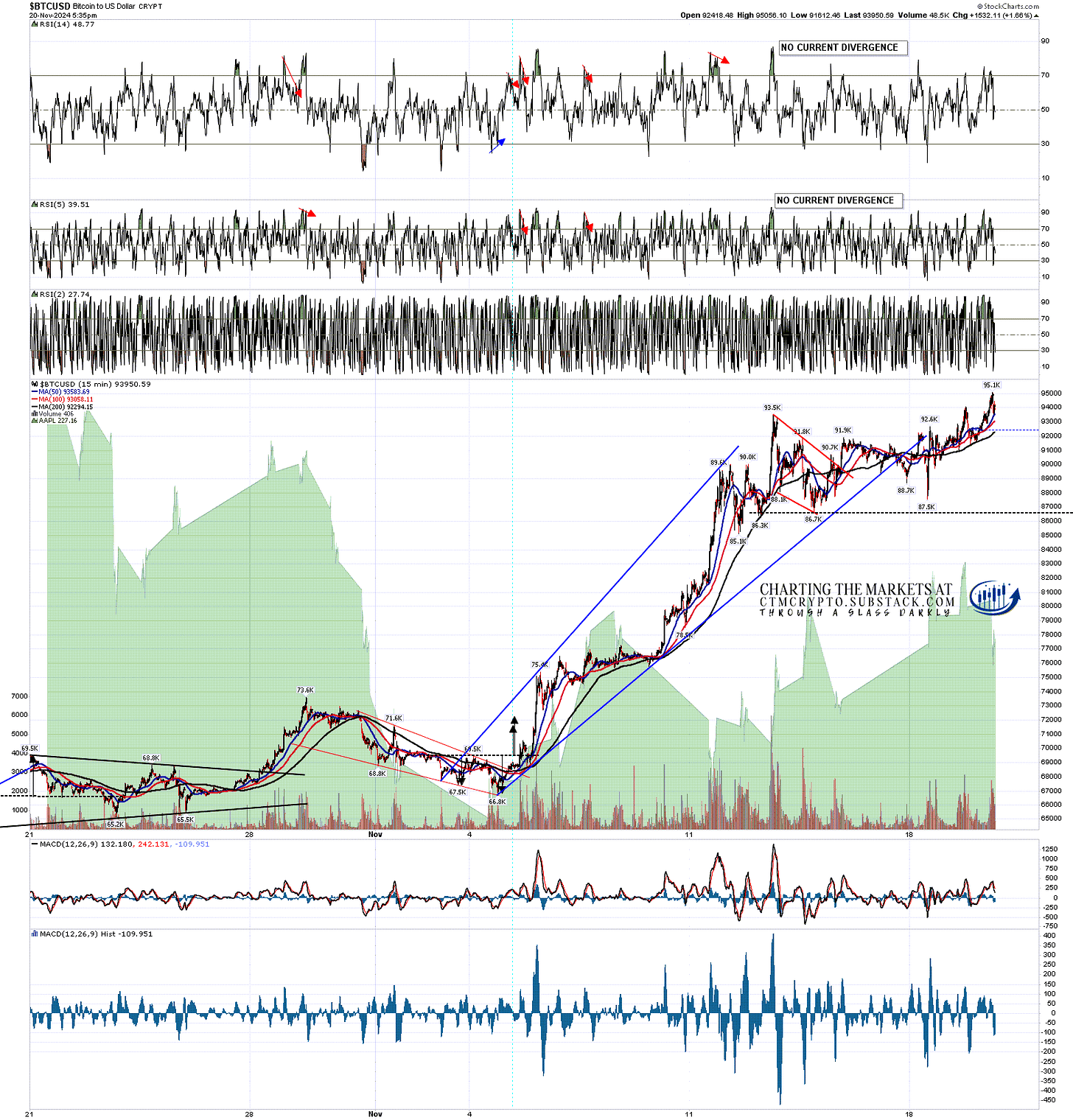

On Bitcoin (BTCUSD) a small but bullish leaning falling wedge was starting to break up, and I was saying that I was expecting that to deliver a retest of the all time high in due course. That has delivered now.

BTCUSD 15min chart:

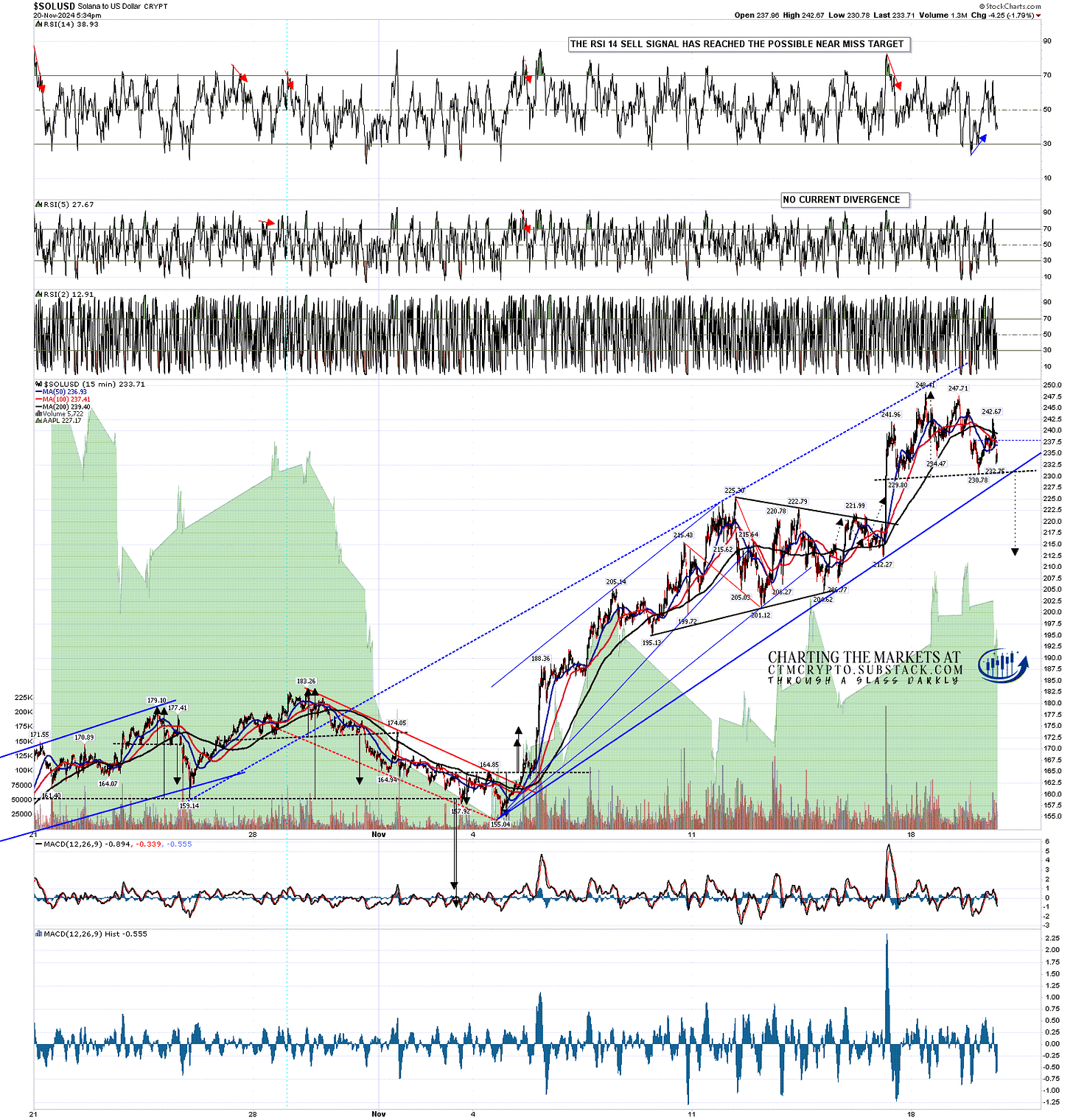

On Solana (SOLUSD) the part formed triangle on Friday morning more or less followed the ideal path arrows I drew on then and broke up into a new high. Since then a possible H&S pattern has formed that I was talking about in my video this morning, and since then that has almost completed forming, and we are waiting to see whether that will break down towards a target in the 212-4 area.

As with all H&S patterns, a break down followed by a rejection back above the right shoulder high at 242.67 would then likely deliver a retest of the current 2024 high at 248.41.

SOLUSD 15min chart:

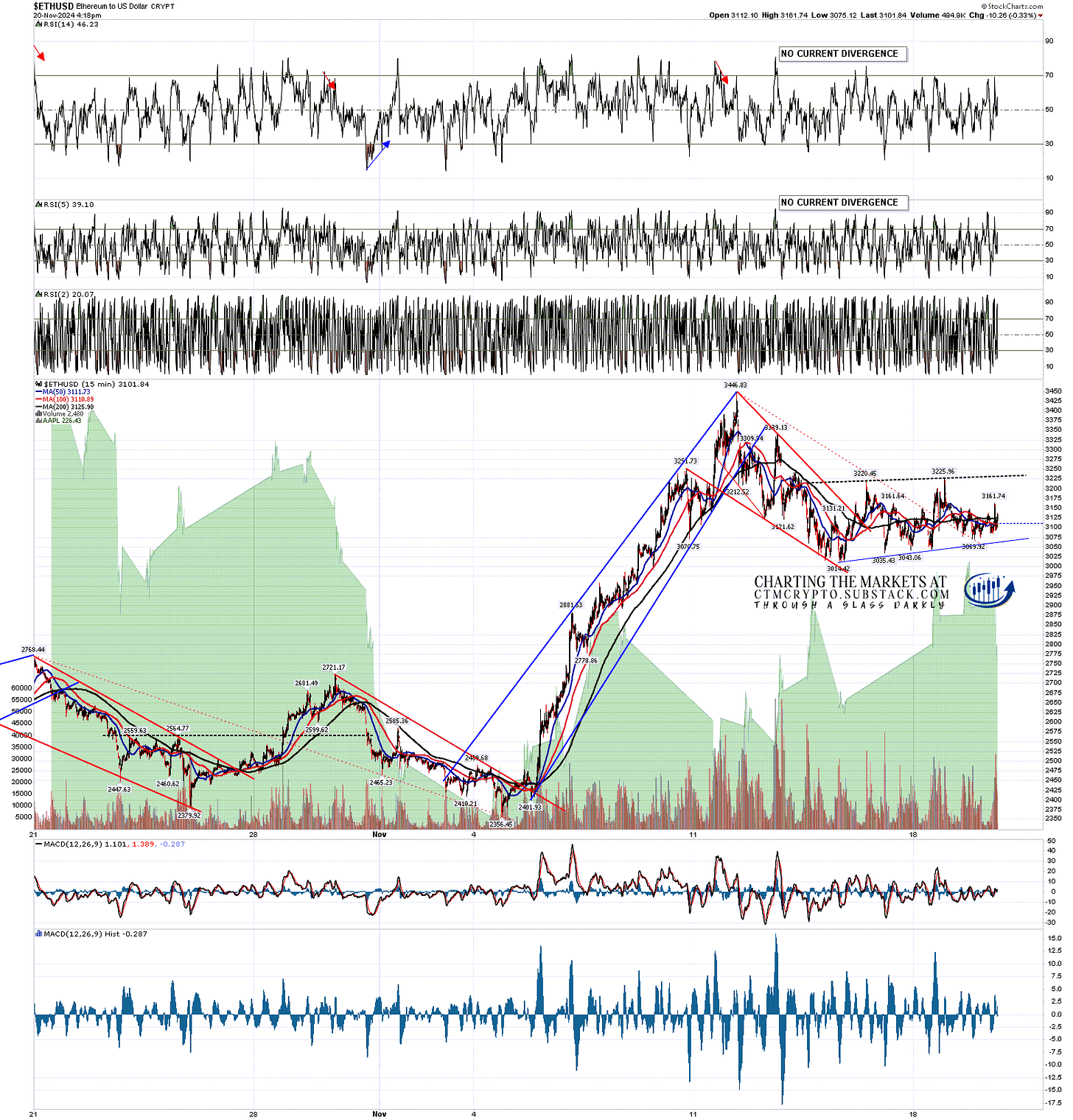

On Ethereum (ETHUSD) we have the minority report I mentioned in the title today. The bull flag falling wedge I was looking at on Friday broke up, then formed the likely bear flag shown on the chart below, and that is breaking down towards a retest of 3014.42. If seen that could deliver a possible double bottom for a retest of the November high at 3446.83, or a break down further that would likely still be, in my view, a larger bull flag forming.

ETHUSD 15min chart:

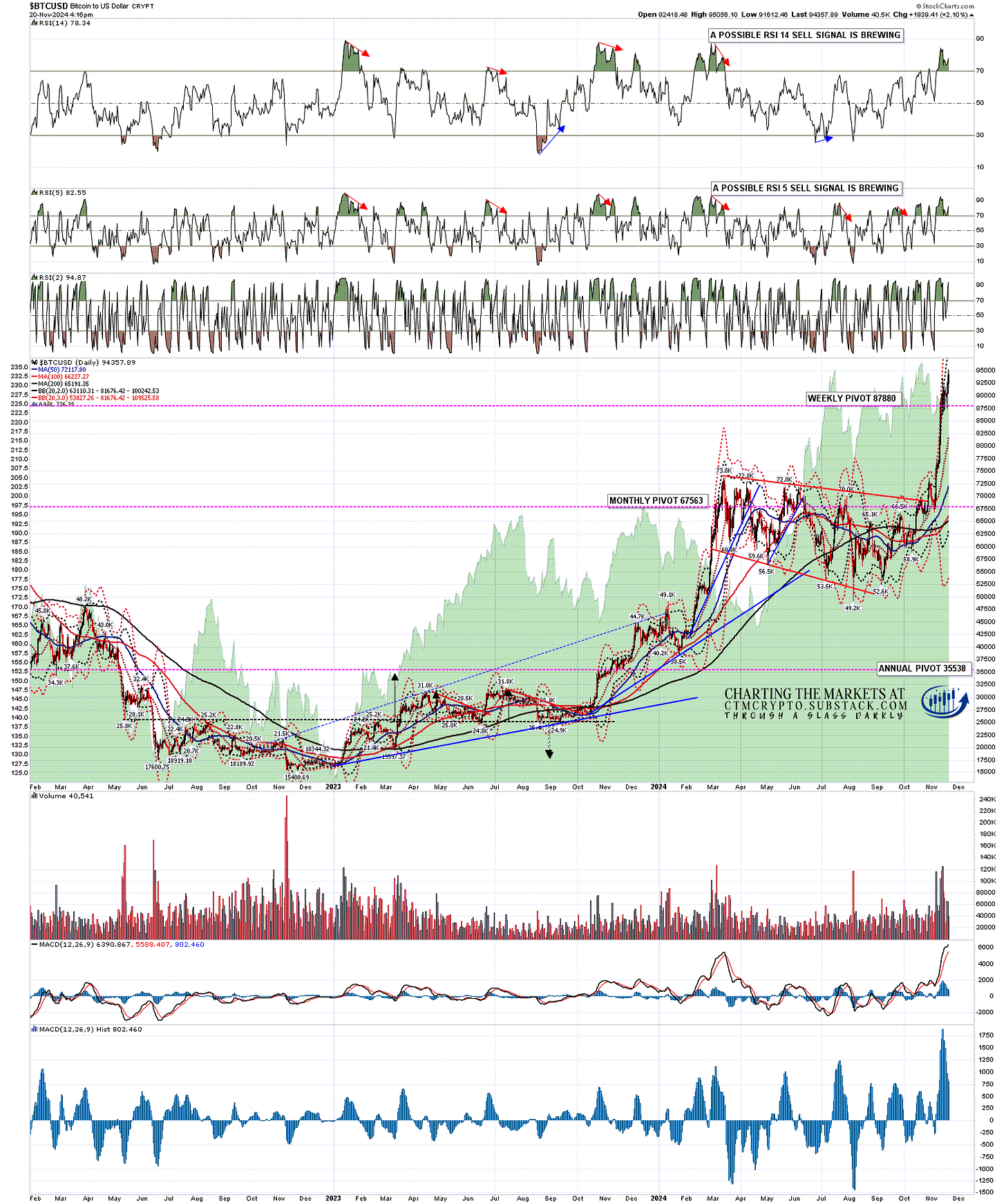

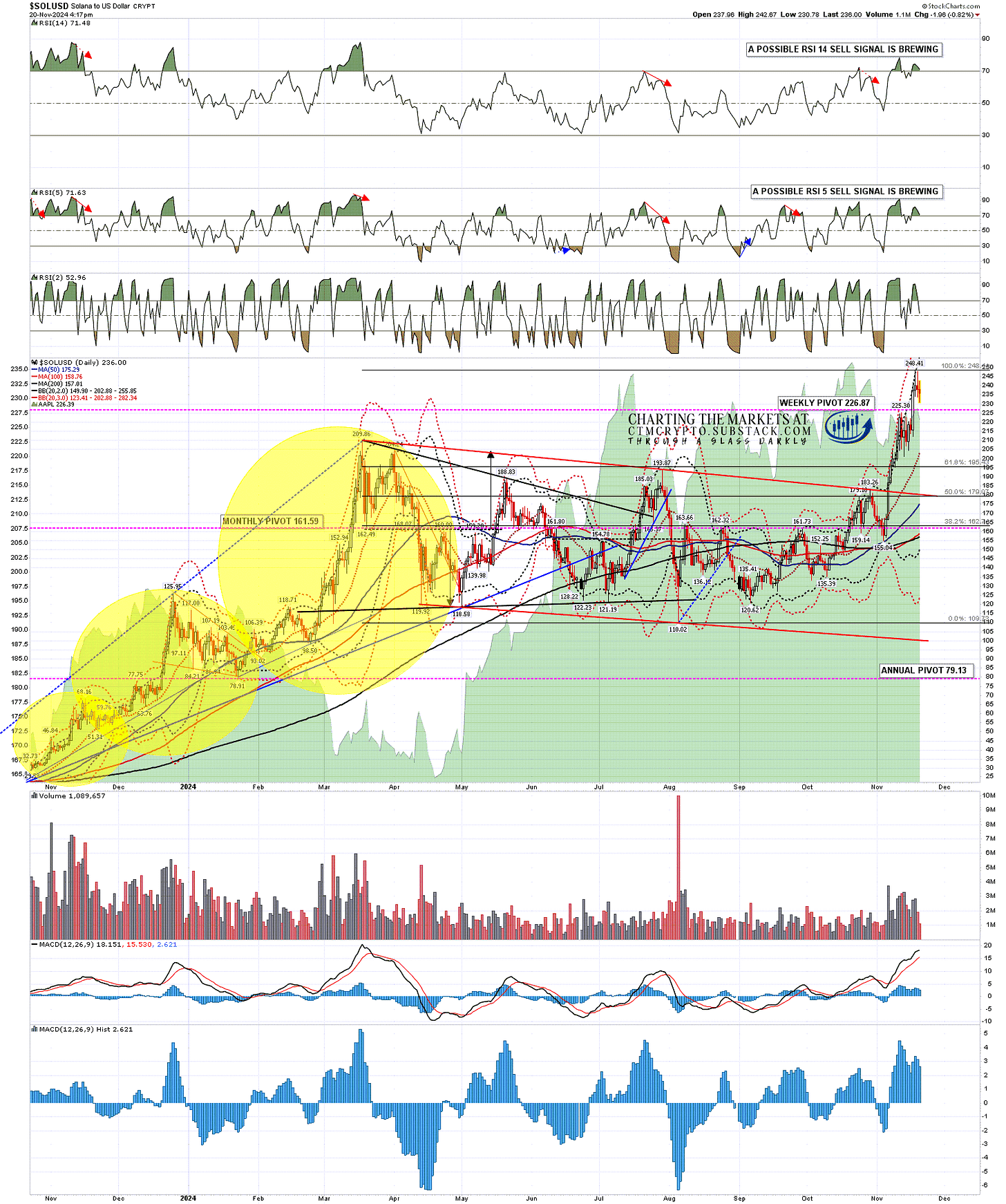

I was mentioning also on Friday morning that is we were to see high retests on Bitcoin and Solana, then good quality possible daily RSI 14 and RSI 5 sell signals would start brewing. Those are just potentials of course, but are telling us that a strong retracement may be close. You can see those have started brewing on the chart below.

BTCUSD daily chart

Solana also has both possible daily RSI 14 and RSI 5 sell signals below on the daily chart.

SOLUSD daily chart:

Every so often I see some really comical TA howlers online from forecasters who are somewhat longer on enthusiasm and volume than they are on knowledge or experience, as some of these are worth sharing as good learning opportunities.

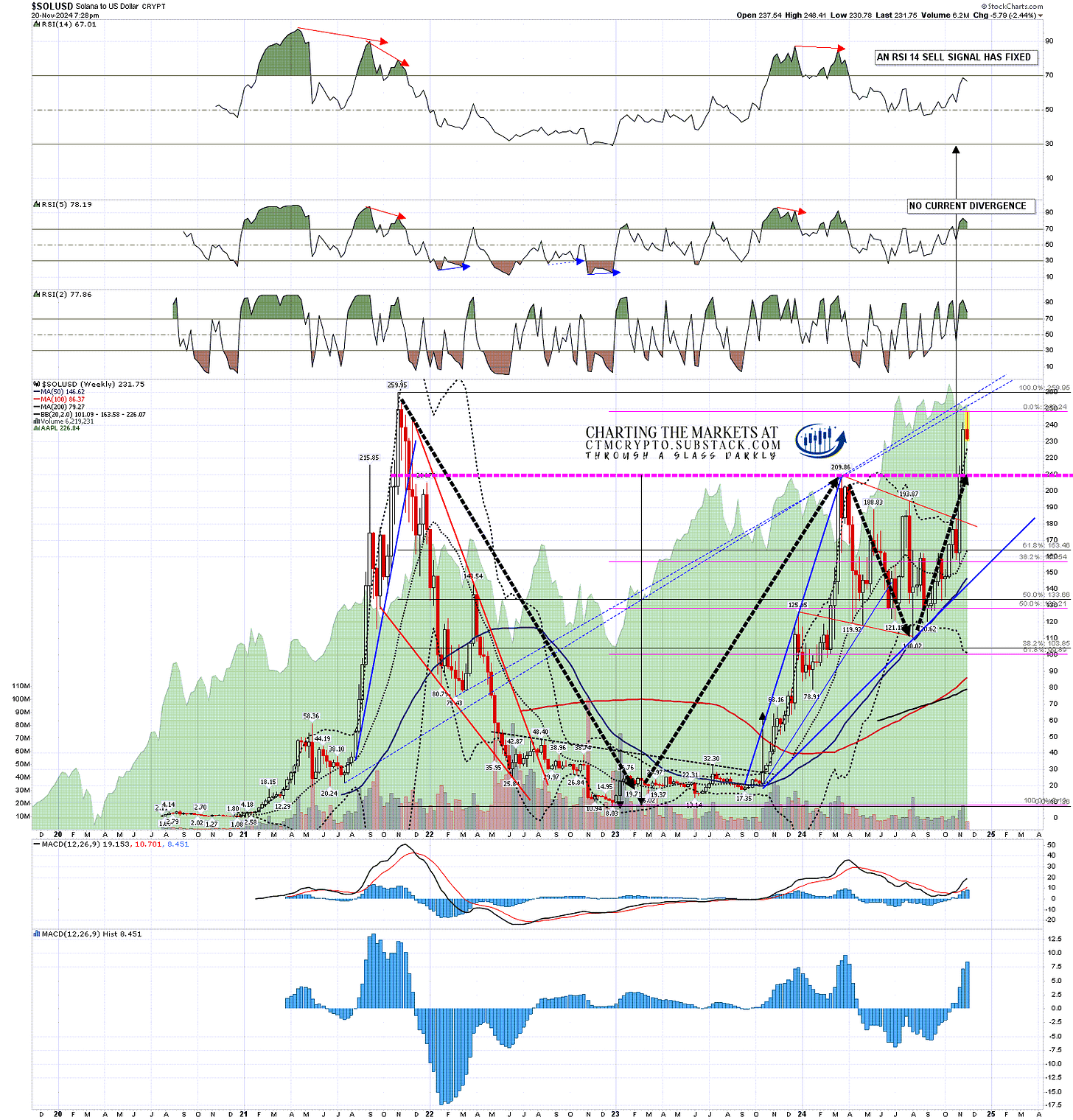

A few days ago a well known Crypto forecaster who shall remain nameless, but who has more than 100k followers on X, posted this on the Solana weekly chart as a cup with handle pattern and a friend of mine asked me this morning whether he was right.

You can see below that it is a nice looking pattern, though overall I think these patterns are a mediocre kind of bull flag, but I told my friend that in my view it didn’t qualify.

The reasoning is that if this is a cup with handle pattern then it has now broken up with a target in the $410 area. If Solana reaches that target, as I think it may well do anyway, then no doubt this forecaster will consider himself a charting genius.

However, the cup with handle is either a reversal or a continuation pattern, and what kind of bullish continuation pattern starts with a move that wipes out 97% of the instrument’s value? None. A 97% decline (259.95 to 8.03) is not a bullish continuation pattern forming, it is a really brutal bear market. As a reversal pattern it also fails, as a reversal pattern should never be so large that is dominates the trend that it is supposed to be reversing. The further over the 50% high to low level a reversal pattern grows, the less likely it is to be one. This one is slightly over 80% of the preceding trend, and by then there is no way this can be a reversal pattern.

What’s the takeaway here? Context is important.

SOLUSD weekly chart:

As a matter of fact my finger in the air working estimates for the next bull market highs on Bitcoin and Solana are in the $150k to $200k area for Bitcoin and $300 to $500 area on Solana, so that forecaster may well be right, but only because Solana was headed there anyway.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment