In my last post on Crypto I was looking at the overall setup on Crypto and the short term H&S patterns on Bitcoin (BTCUSD) and Solana (SOLUSD). Those short term setups are played out now (more details below) and we have been seeing strong rallies across the board which could be the start of a larger break up.

This is a match with what I am seeing on equities, which may be starting a general break up here though, as with Crypto, more needs to be done to the upside to deliver that break up.

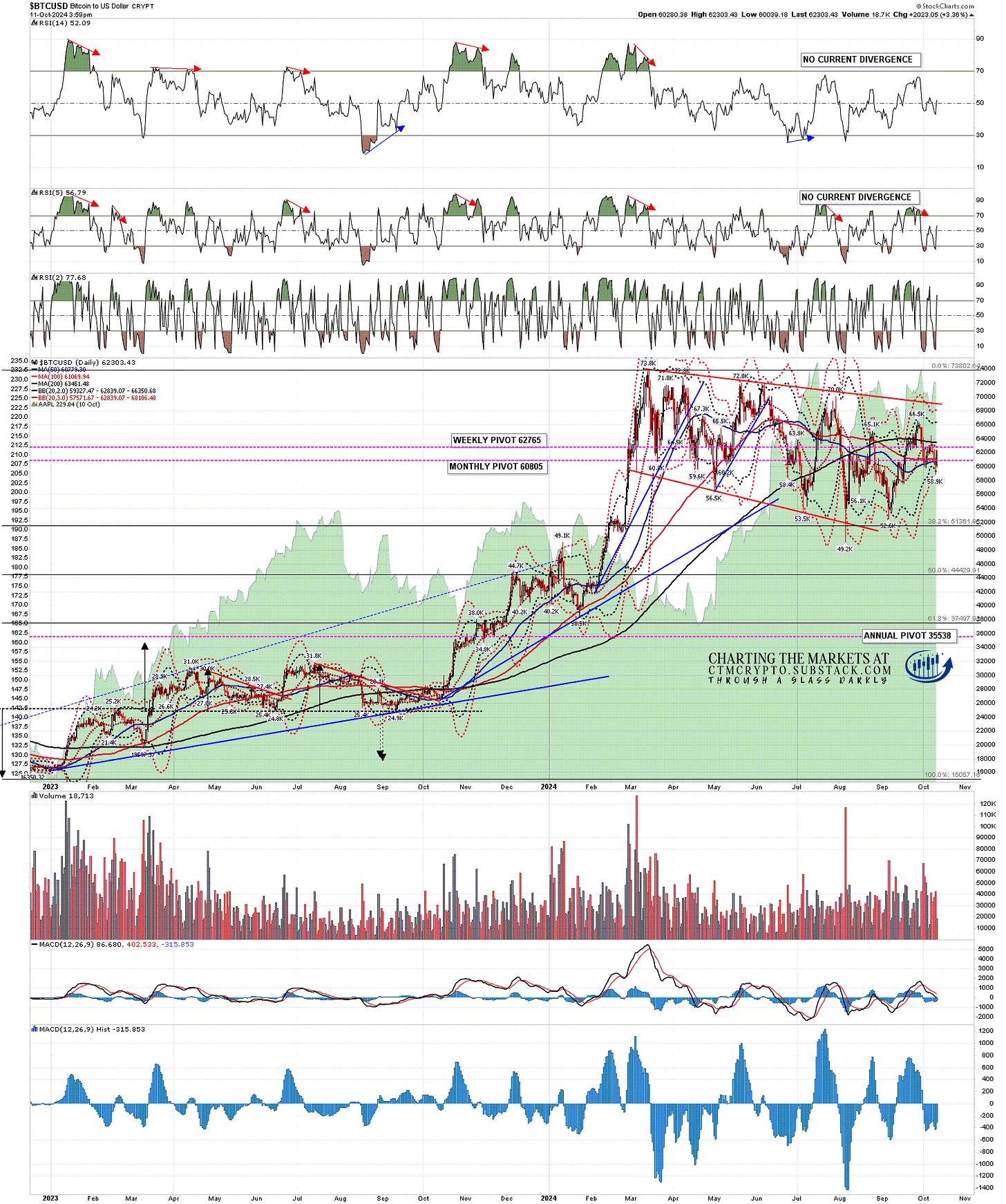

Equities have been looking stronger than Crypto recently, so the first big step on the road on crypto is to see breaks and conversions to support of the daily middle bands. On Bitcoin the daily middle band is currently at 62,839, supported by the 200dma, currently at 63,451. A decent break over both that doesn’t reject back under the daily middle band the day or two after would be unambiguously bullish.

BTCUSD daily chart:

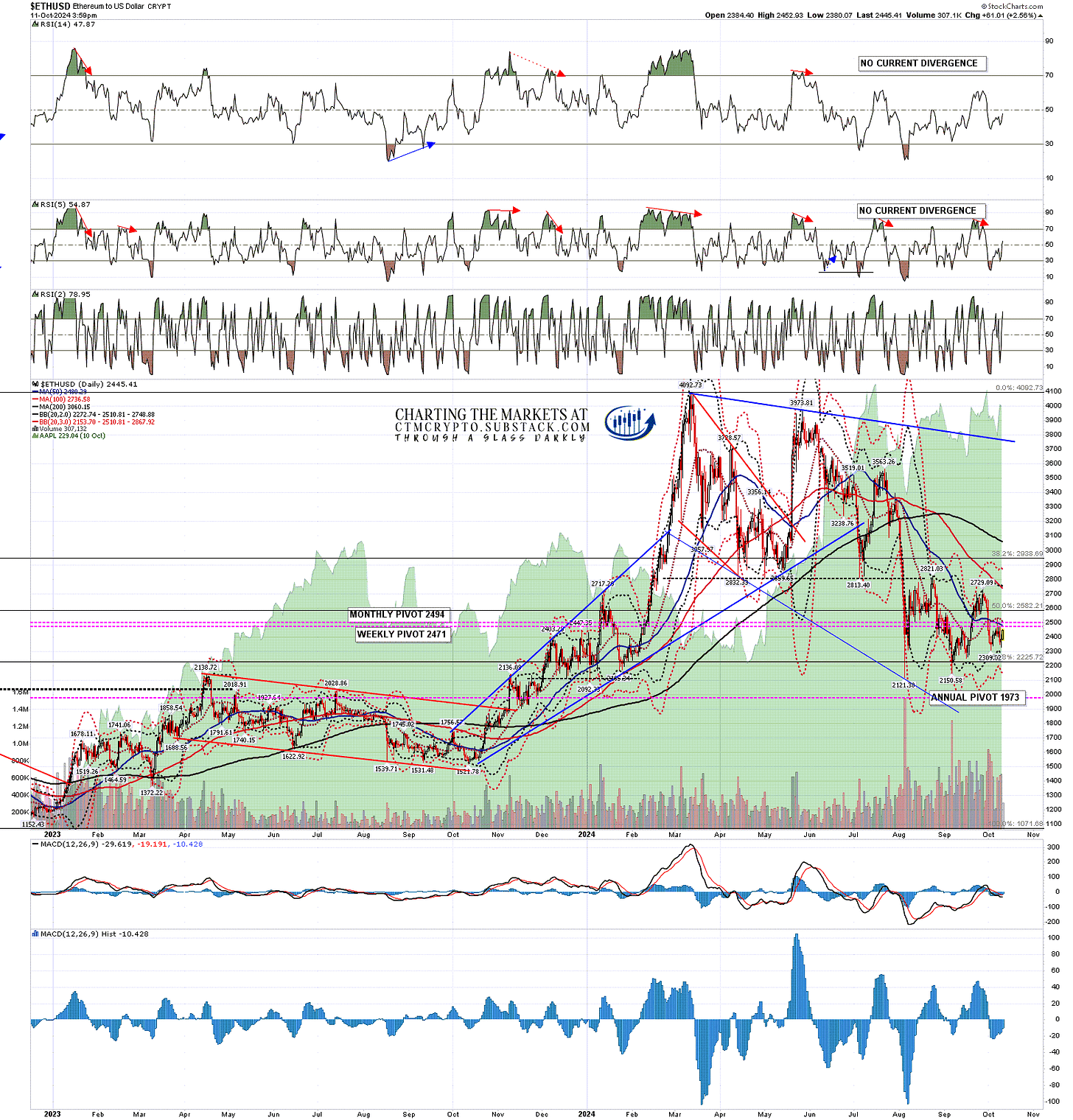

On Ethereum (ETHUSD) the daily middle band is currently at 2511, slightly over the 50dma, currently at 2480. A decent break over both that doesn’t reject back under the daily middle band the day or two after would be unambiguously bullish.

ETHUSD daily chart:

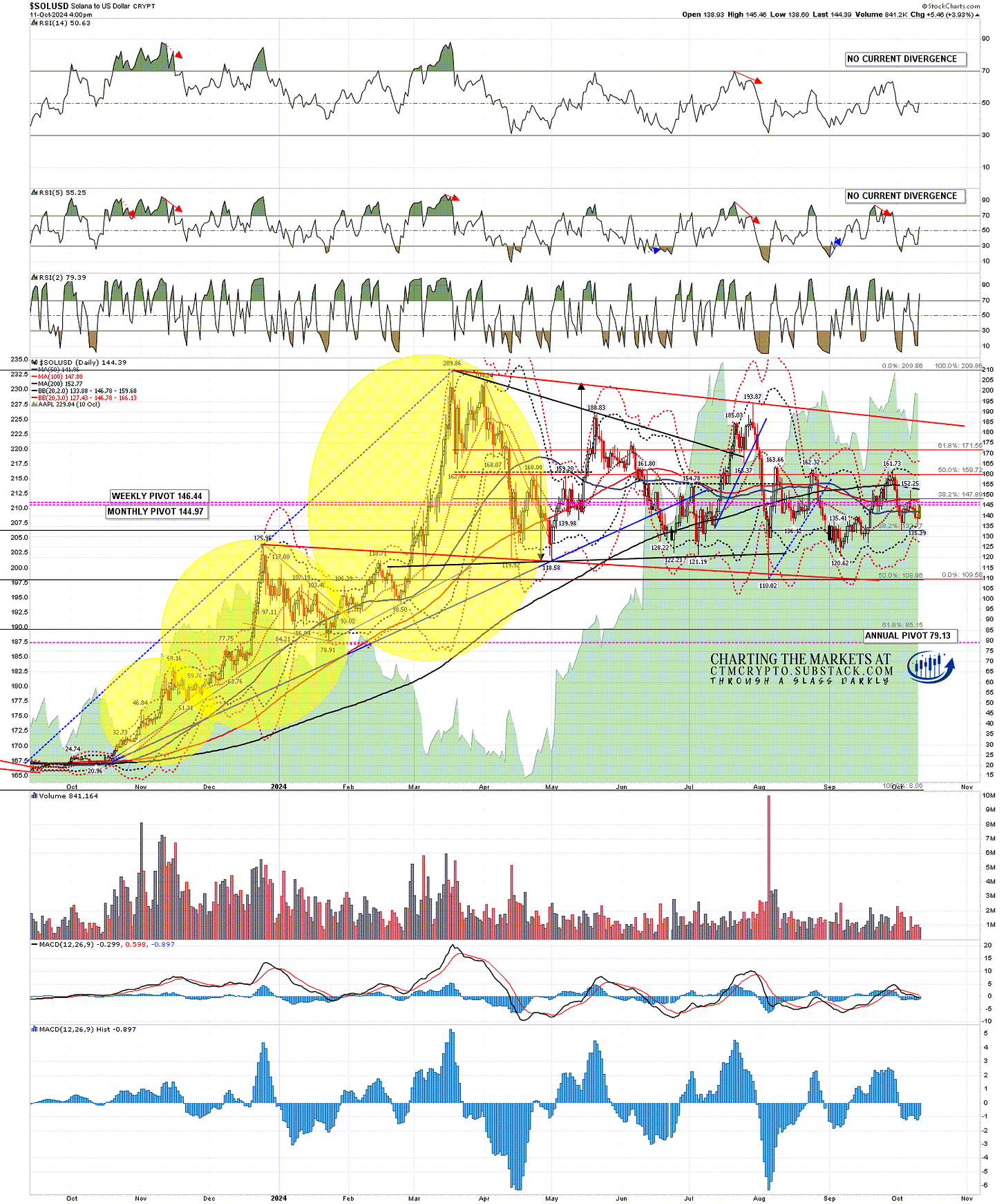

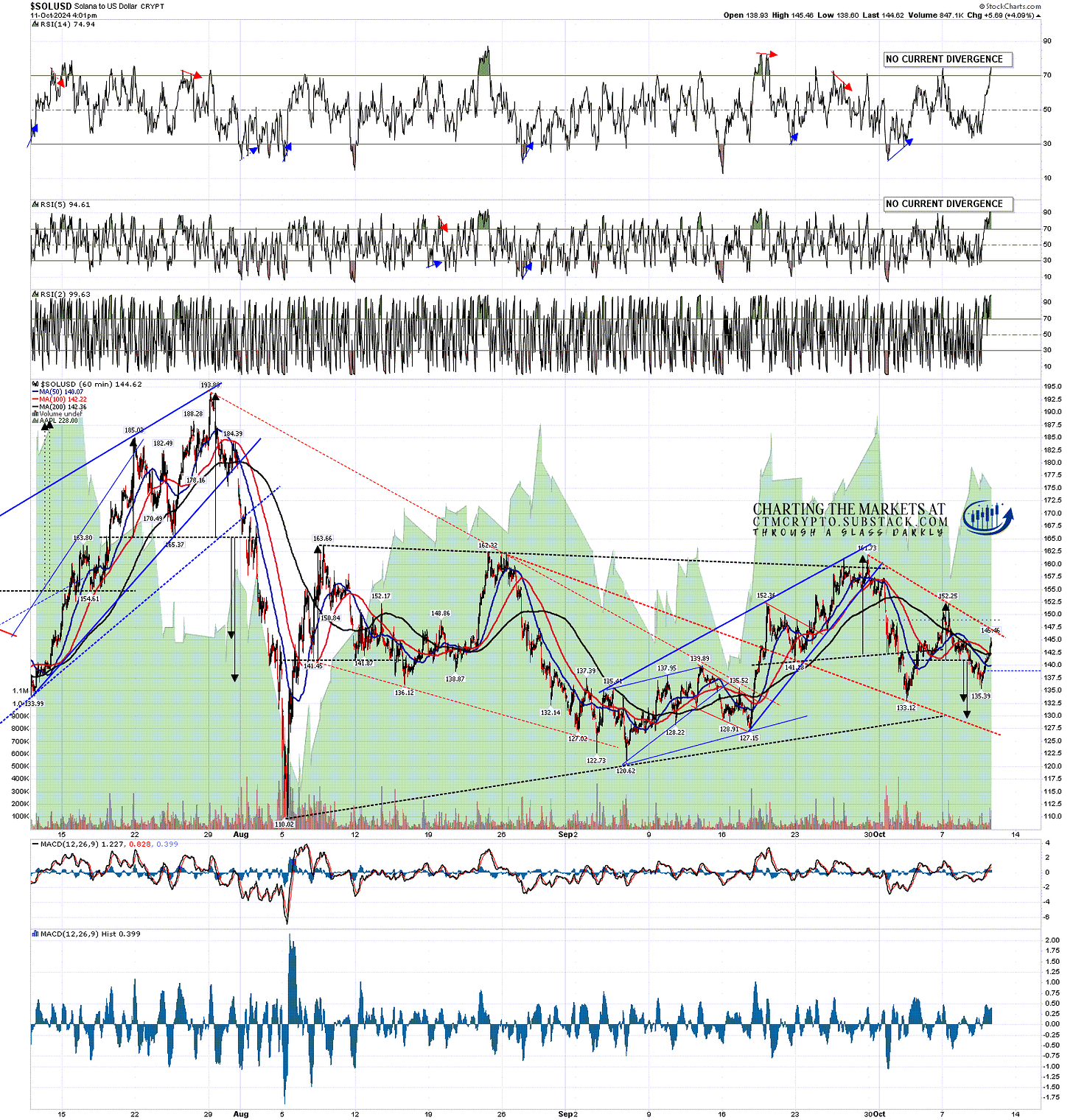

On Solana the daily middle band is currently at 146.79. A decent break above that doesn’t reject back under the daily middle band the day or two after would be unambiguously bullish.

SOLUSD daily chart:

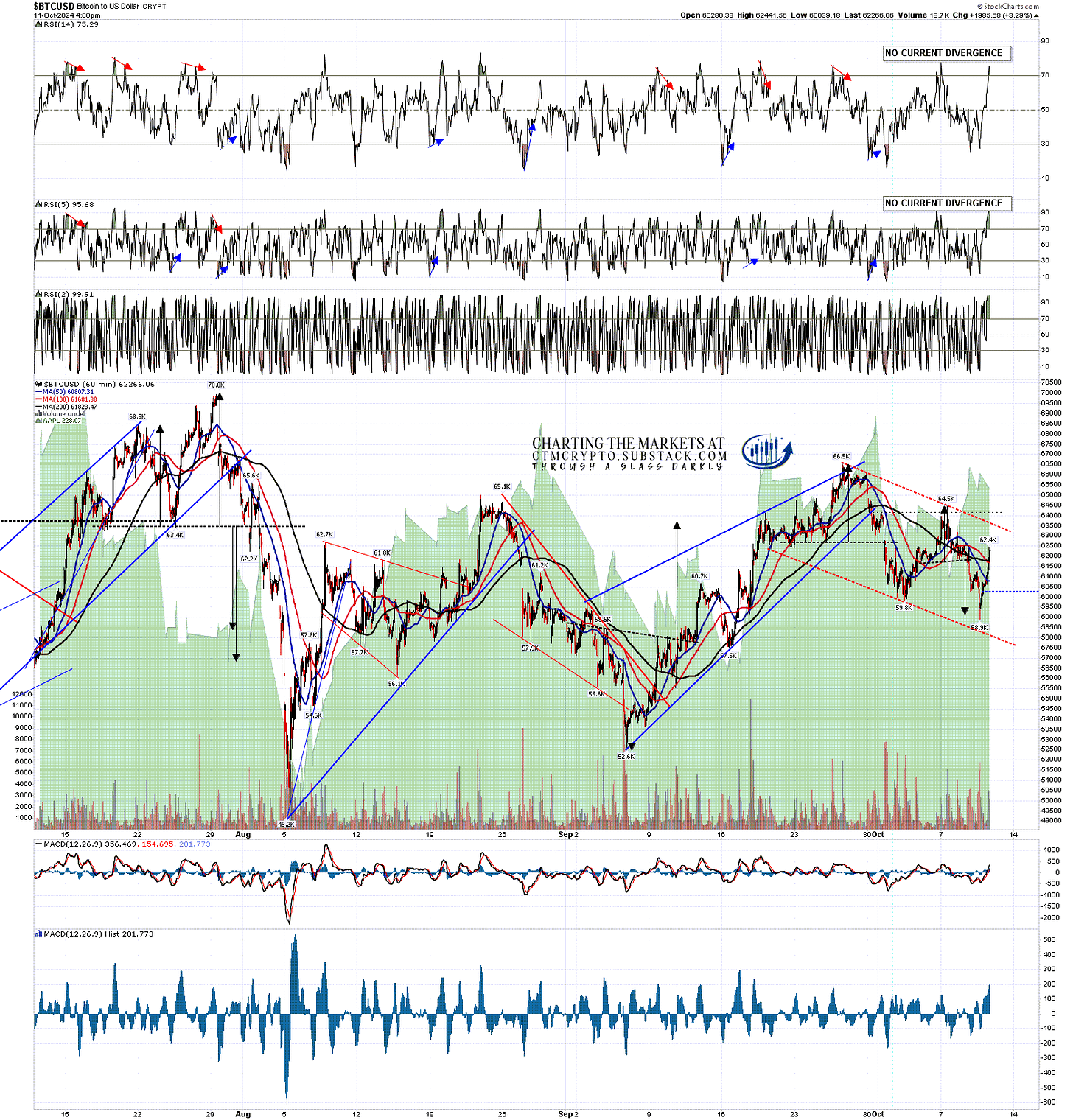

In terms of those short term H&S patterns Bitcoin made the H&S target but didn’t quite make it to the ideal bull flag support trendline now in the 58,200 area. That trendline could be unfinished business below, but would stop being a possible target on a break over possible bull flag resistance currently in the 63,600 area.

BTCUSD 60min chart:

Solana didn’t make either H&S target, but the rally from the low has taken it back over the H&S right shoulder high, so that H&S has failed with a target back at a retest of the last short term high at 152.25. Slightly less short term declining resistance from the 161.73 high is now in the 147 area and is a decent match with the daily middle band.

SOLUSD 60min chart:

Equities are at a big inflection point here and Crypto will likely follow whichever way that breaks. If equities break into another modest leg down next week then we might see that on Crypto too, though I’d be leaning long on both afterwards. In terms of a decline next week, I am wondering whether Israel might retaliate against Iran over the weekend. Israel has been very close mouthed about what form that retaliation might take but they have been very clear that they are planning one. We’ll see.

In terms of the overall Crypto market Peter Brandt made a comment last night that was thought-provoking & you can see that here. I would note that there are only a couple of data points to base this observation on, but I do agree that continued sideways action would be a concern. I’m expecting Crypto to impress into Xmas and, if it doesn’t, then his observation is definitely something to bear in mind.

Everyone have a great weekend. :-)

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment