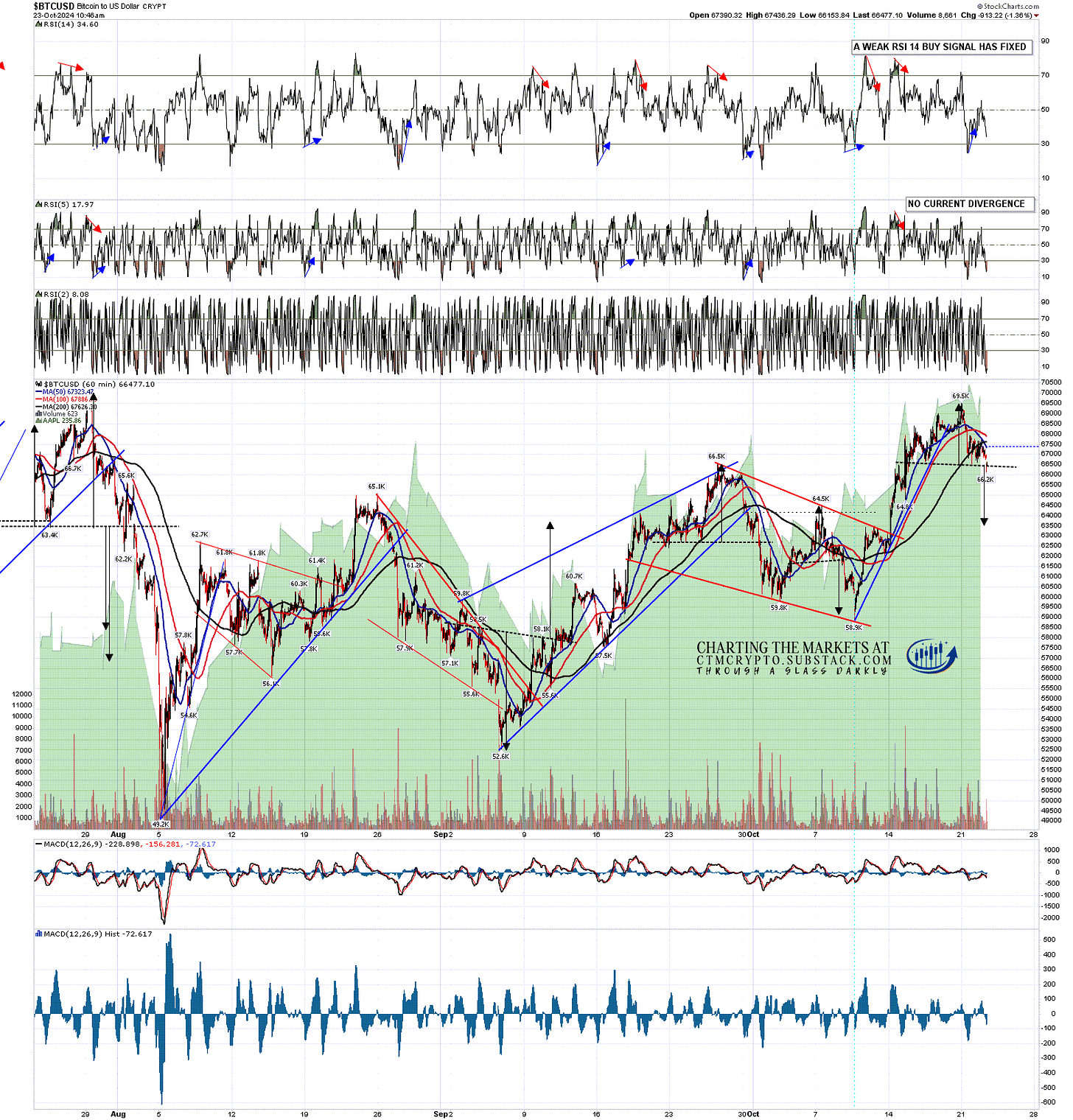

Bitcoin (BTCUSD) has been retracing for a couple of days now and I mentioned on the premarket video yesterday morning that a possible small H&S was forming that might deliver some more downside. Since then that H&S has finished forming and has broken down with a target in the 63,500 area.

Now there is always a chance of course that an H&S may reject back up to the high, and if we see that here, this H&S would fail with a target back at a retest of the last high at 69.5k on a break back over the right shoulder high at 67,801.

BTCUSD 60min chart:

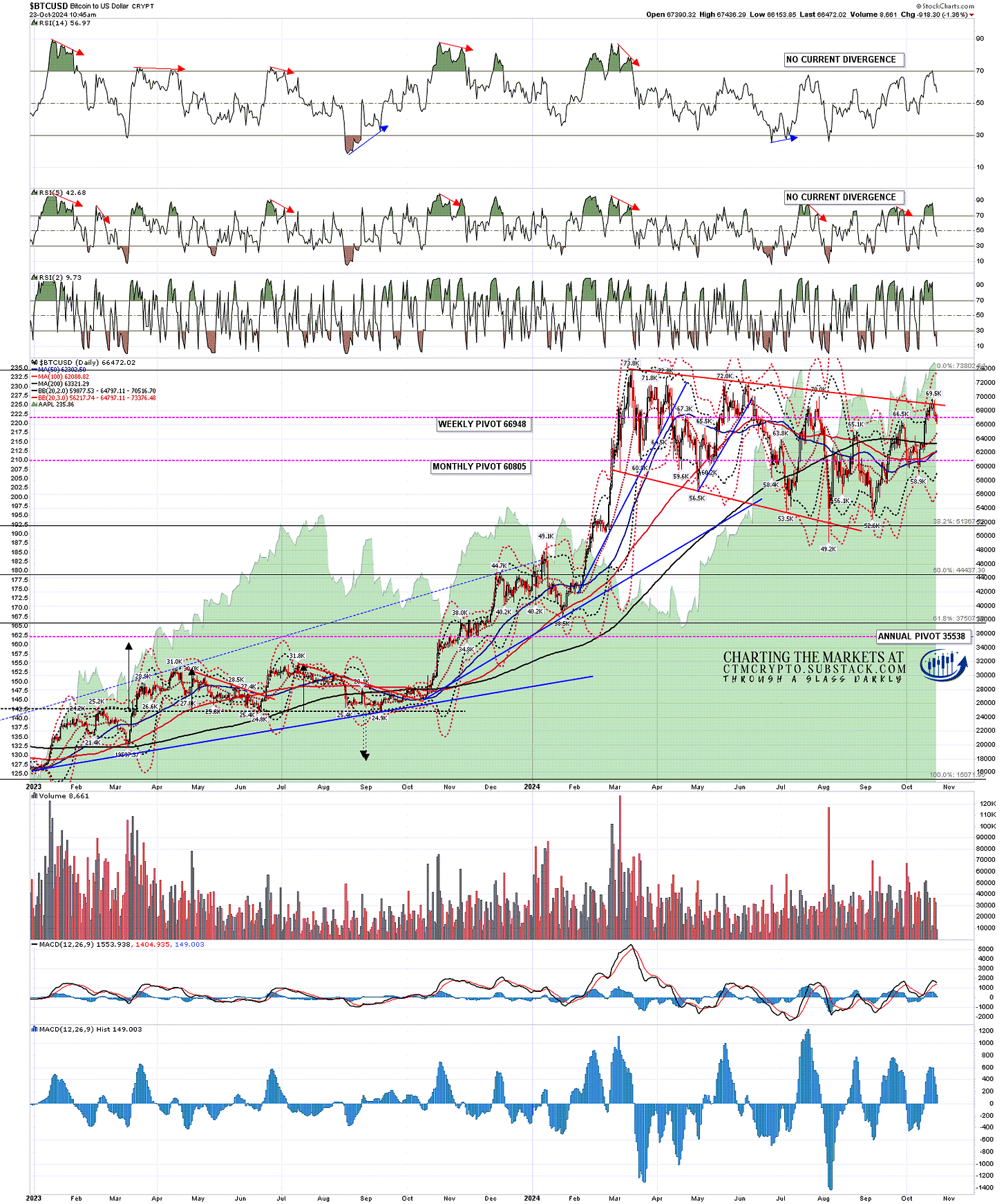

On the bigger picture BTCUSD has broken slightly over the main bull flag resistance trendline and after this retracement there is a good chance that will follow through to the upside into the bull flag target at a retest of the all time high at 73.8k.

If the small H&S plays out towards the target then I’ll be watching support at the daily middle band, currently at 64,797, and the 200dma, currently at 63,321. If seen, two daily closes below the daily middle band would be bearish and potentially open up lower targets.

BTCUSD daily chart:

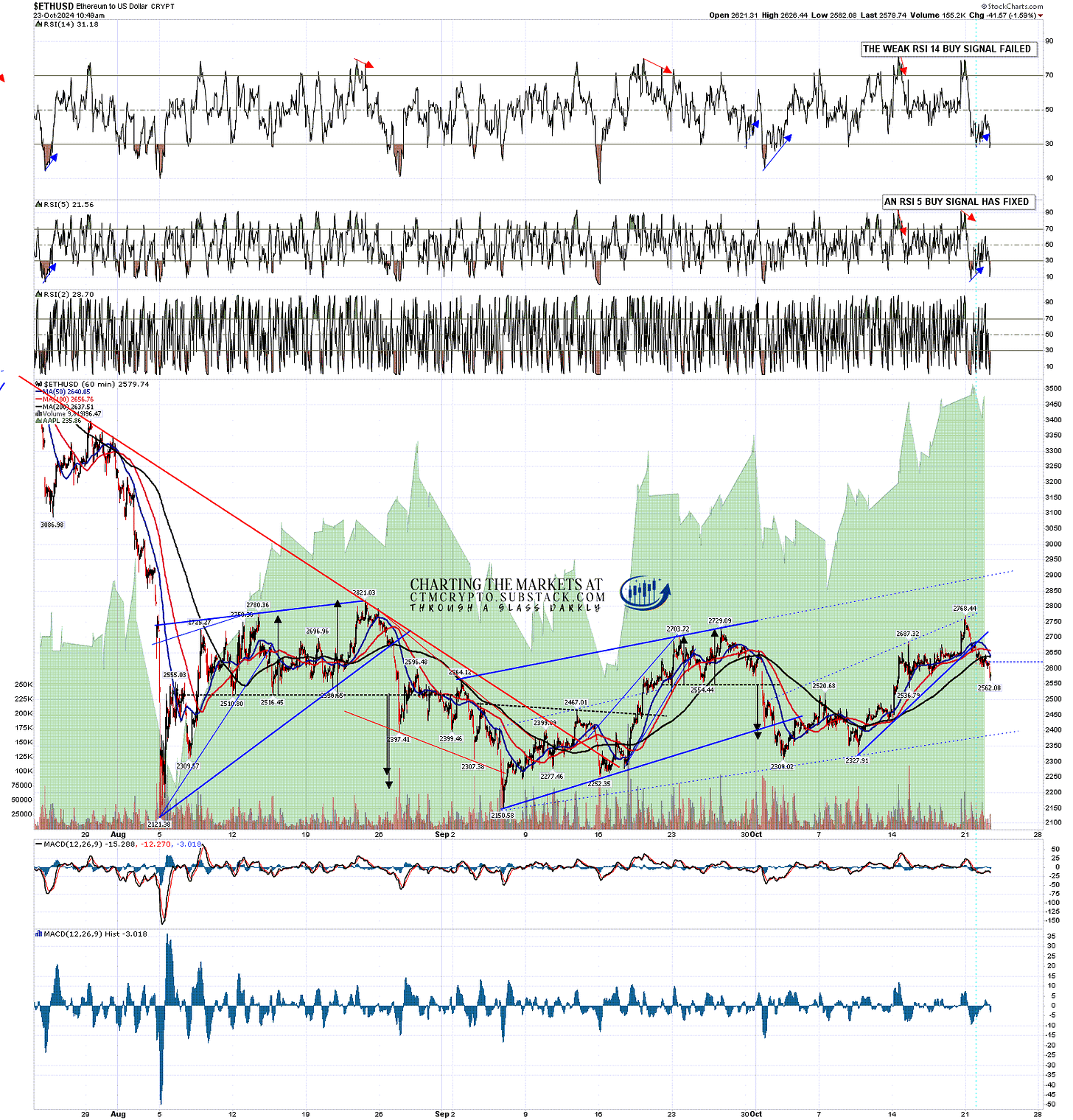

On the Ethereum (ETHUSD) hourly chart there were two buy signals that fixed yesterday, a weak RSI 14 buy signal that failed overnight, and a full RSI 5 buy signal that may fail too. The failed buy signal leans modestly bearish.

ETHUSD 60min chart:

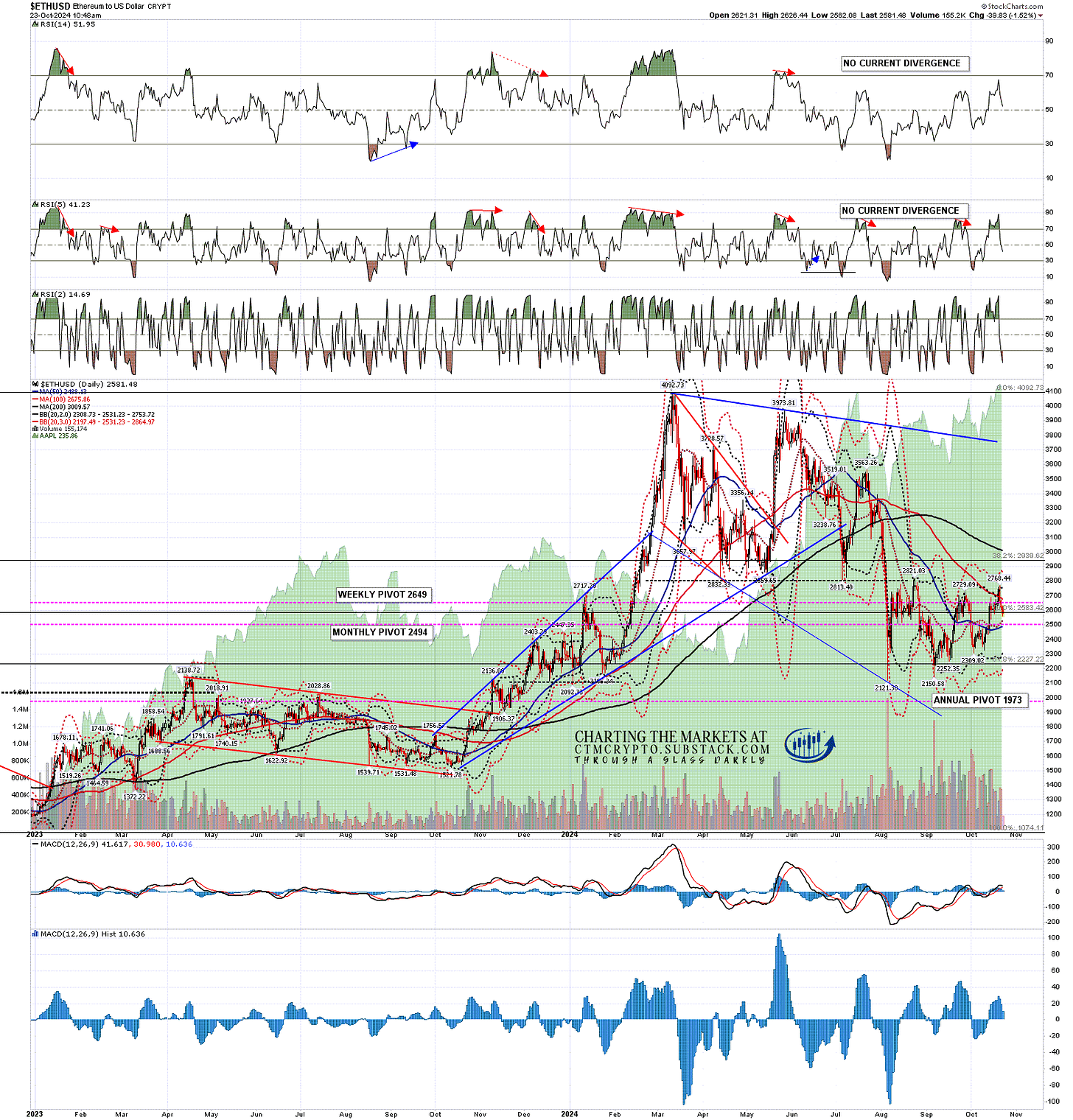

On the Ethereum daily chart there is very obvious double support below at the daily middle band, currently at 2531, supported by the 50dma, currently at 2488. A sustained break below these would also look bearish.

ETHUSD daily chart:

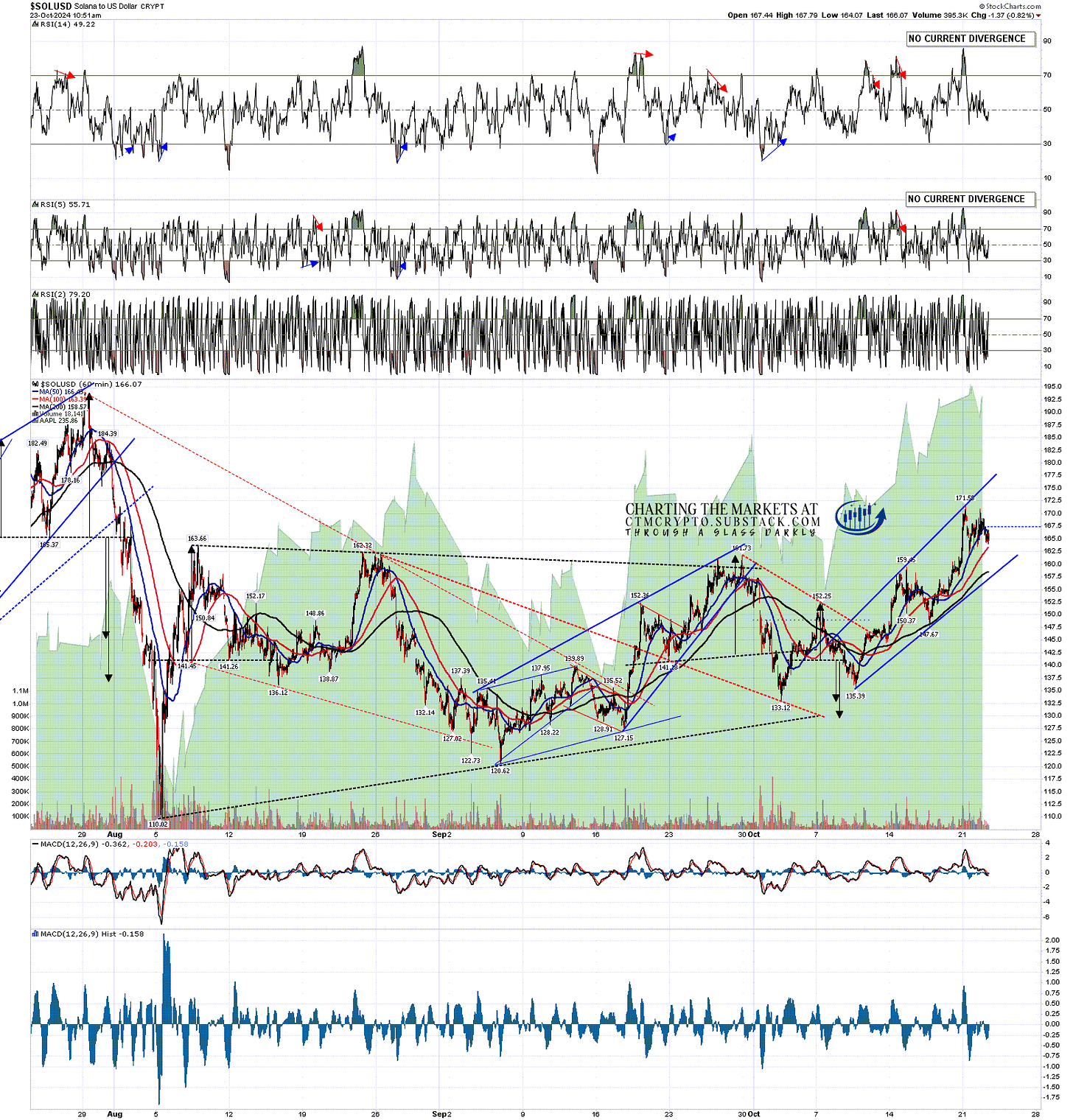

Solana (SOLUSD) has been holding up better than the other two, but there is a possible small rising megaphone forming and I am wondering about a possible test of that megaphone support trendline, currently in the 157.5 area.

SOLUSD 60min chart:

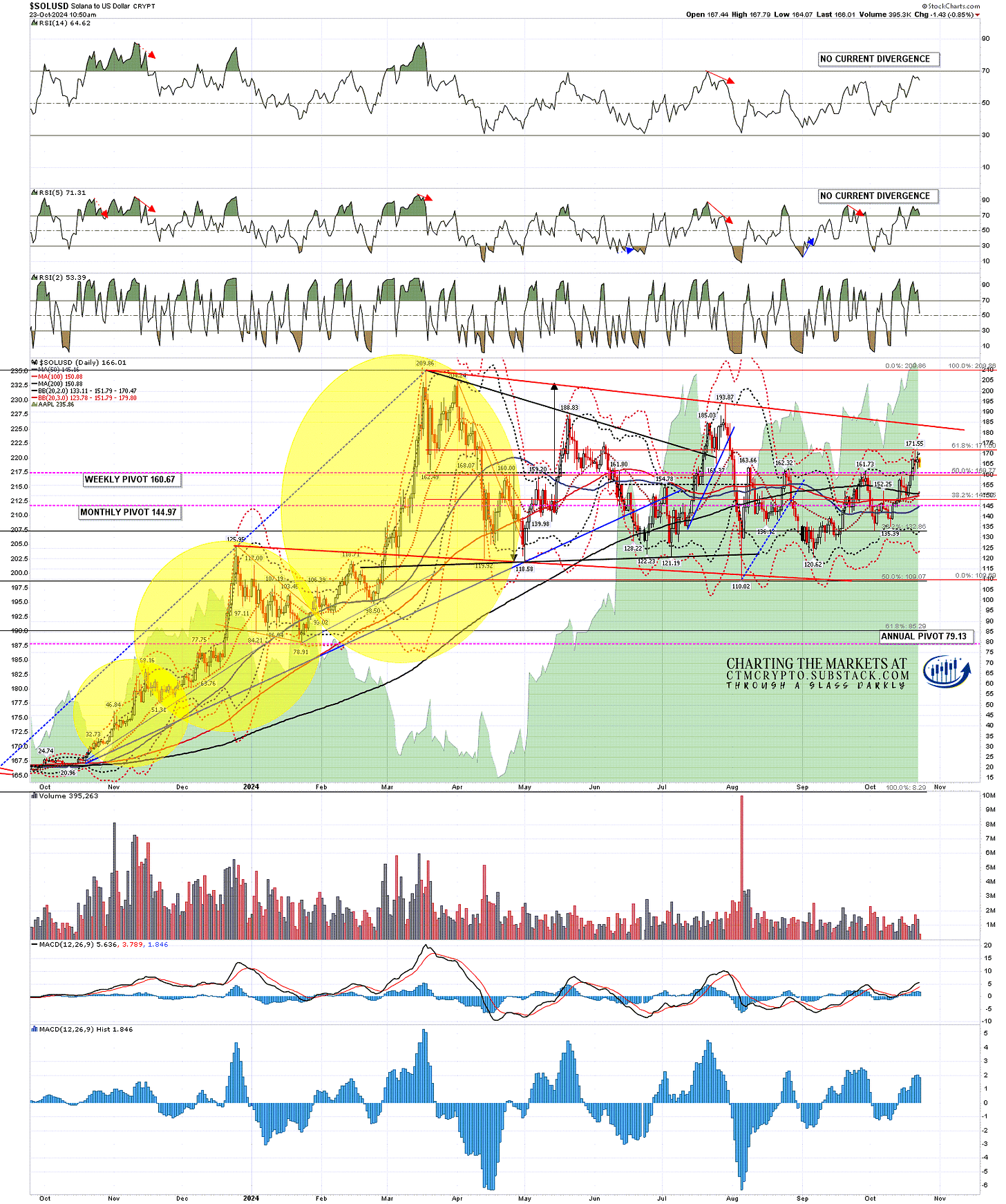

On the Solana daily chart the obvious support is at the daily middle band, currently at 151.79, and the 200dma at 150.88. Solana is currently a long way above both of these though and there’s no obvious reason to think that either will be tested.

SOLUSD daily chart:

I was only looking for a modest retracement on Crypto yesterday morning and that’s still the case. The Bitcoin H&S is a good quality pattern and may well make target, but unless we start seeing sustained breaks below the daily middle bands on Crypto then there’s no reason to think that this is anything other than a bullish consolidation.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment