In my last post on Tuesday I was looking at the very promising rally setup on Crypto and was looking at the important daily middle band resistance that needed to be broken and converted to open the upside. So far, that has not been going well and while the rally setup hasn’t failed yet, it may well be failing.

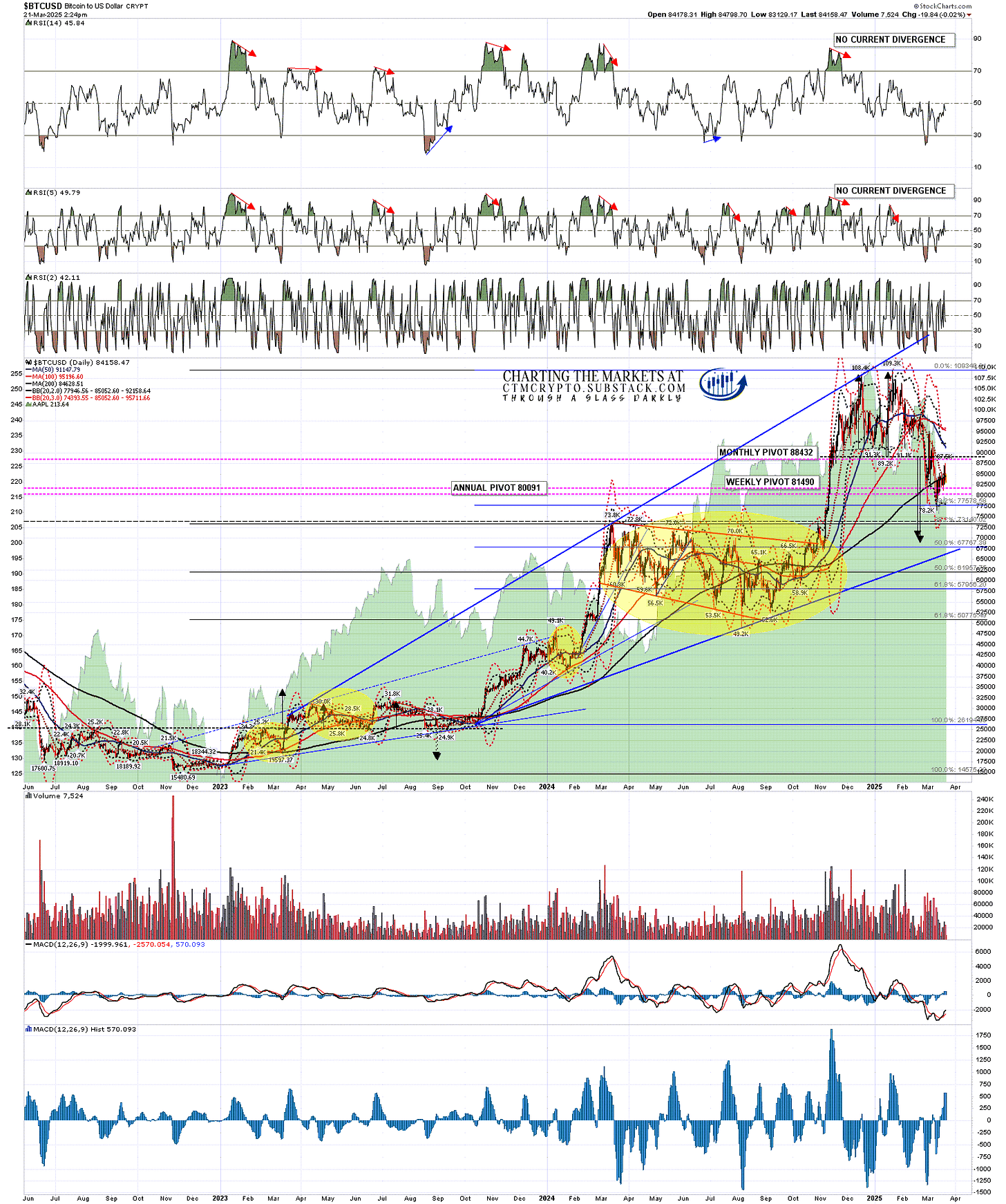

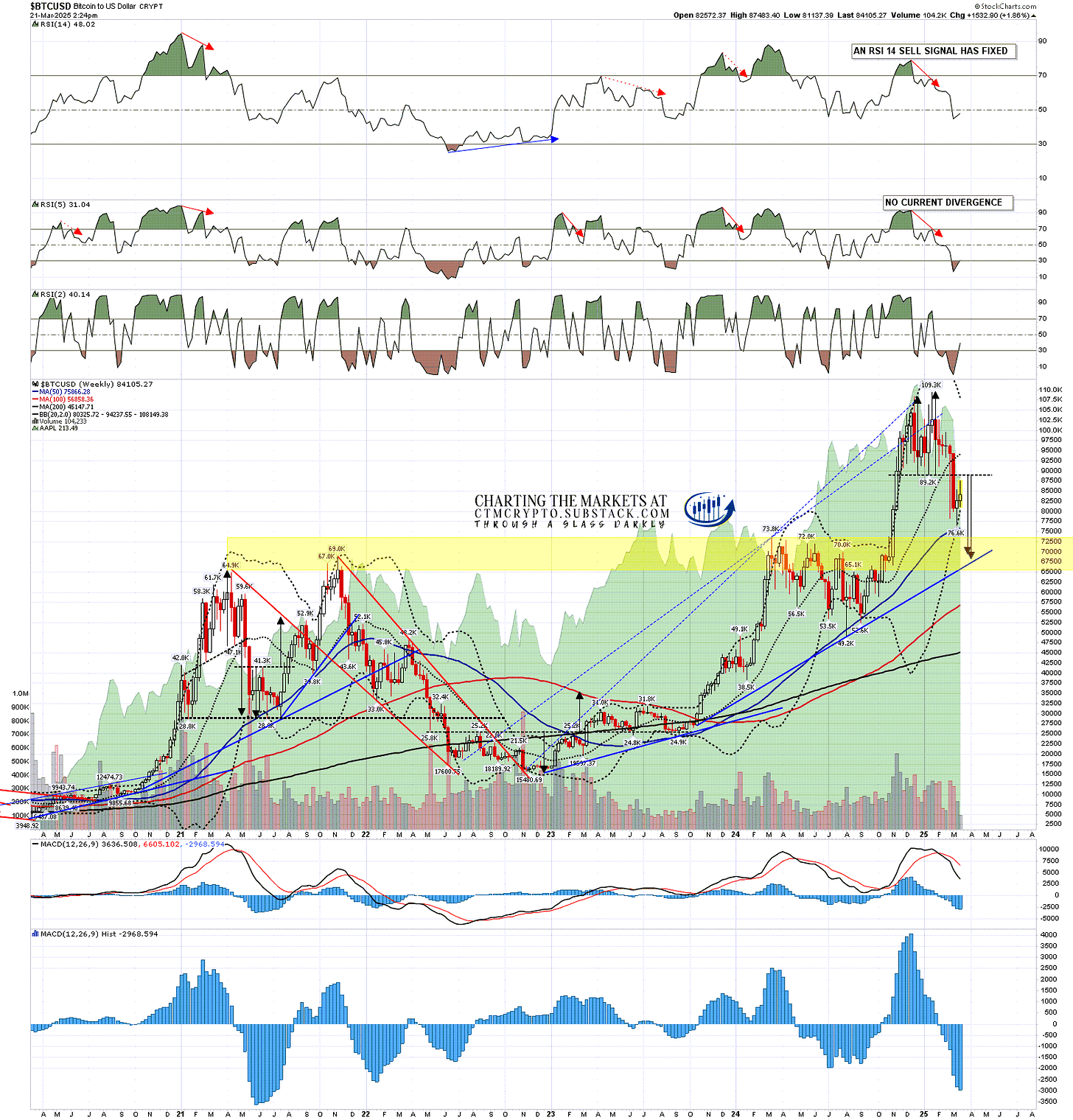

On the Bitcoin (BTCUSD) chart, there was a clear break back above the daily middle band on Wednesday, then a clear rejection back below yesterday. That was not promising, as more often than not this delivers a low retest.

BTCUSD daily chart:

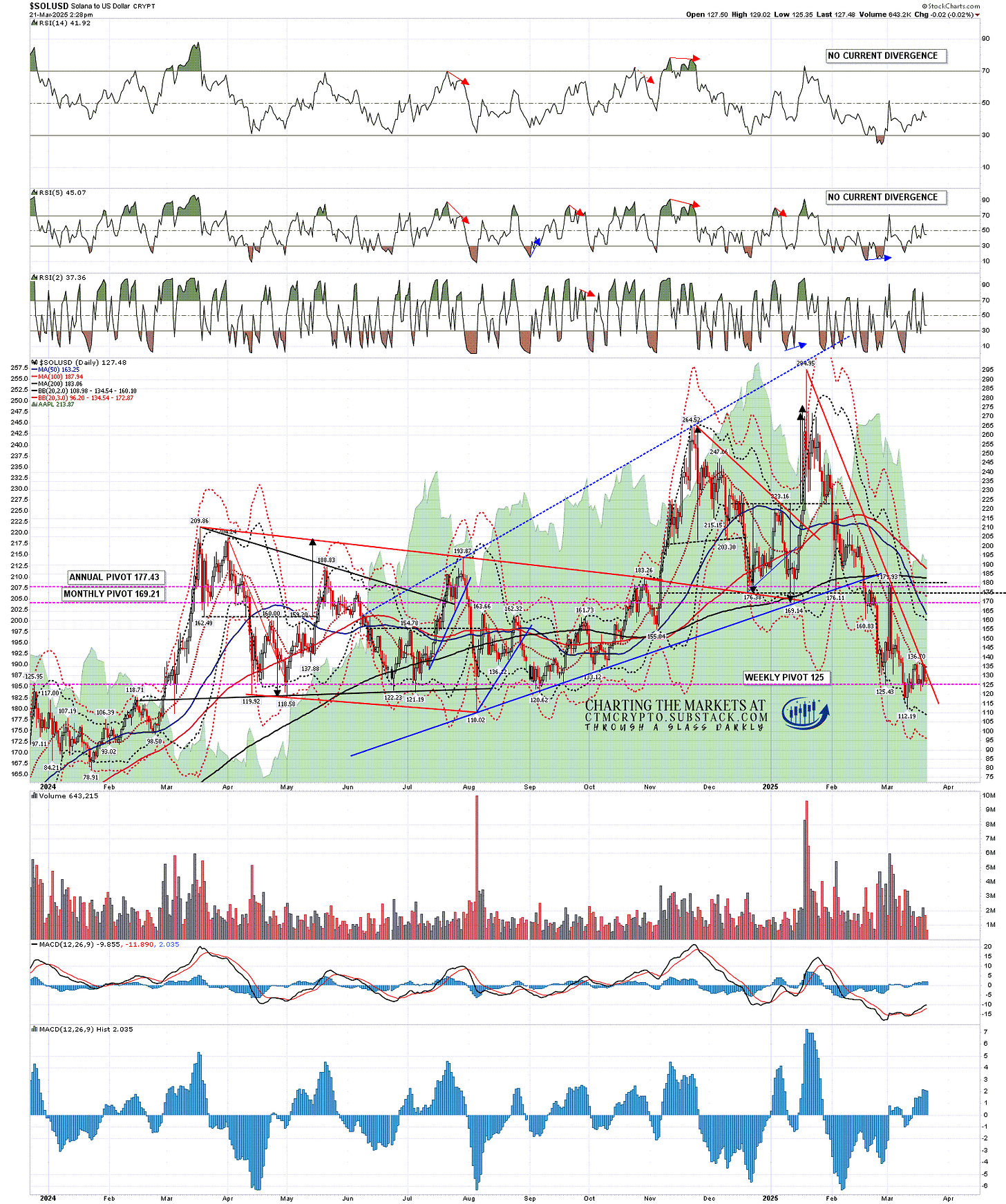

On Solana (SOLUSD) resistance at the daily middle band was tested on Wednesday and held again.

SOLUSD daily chart:

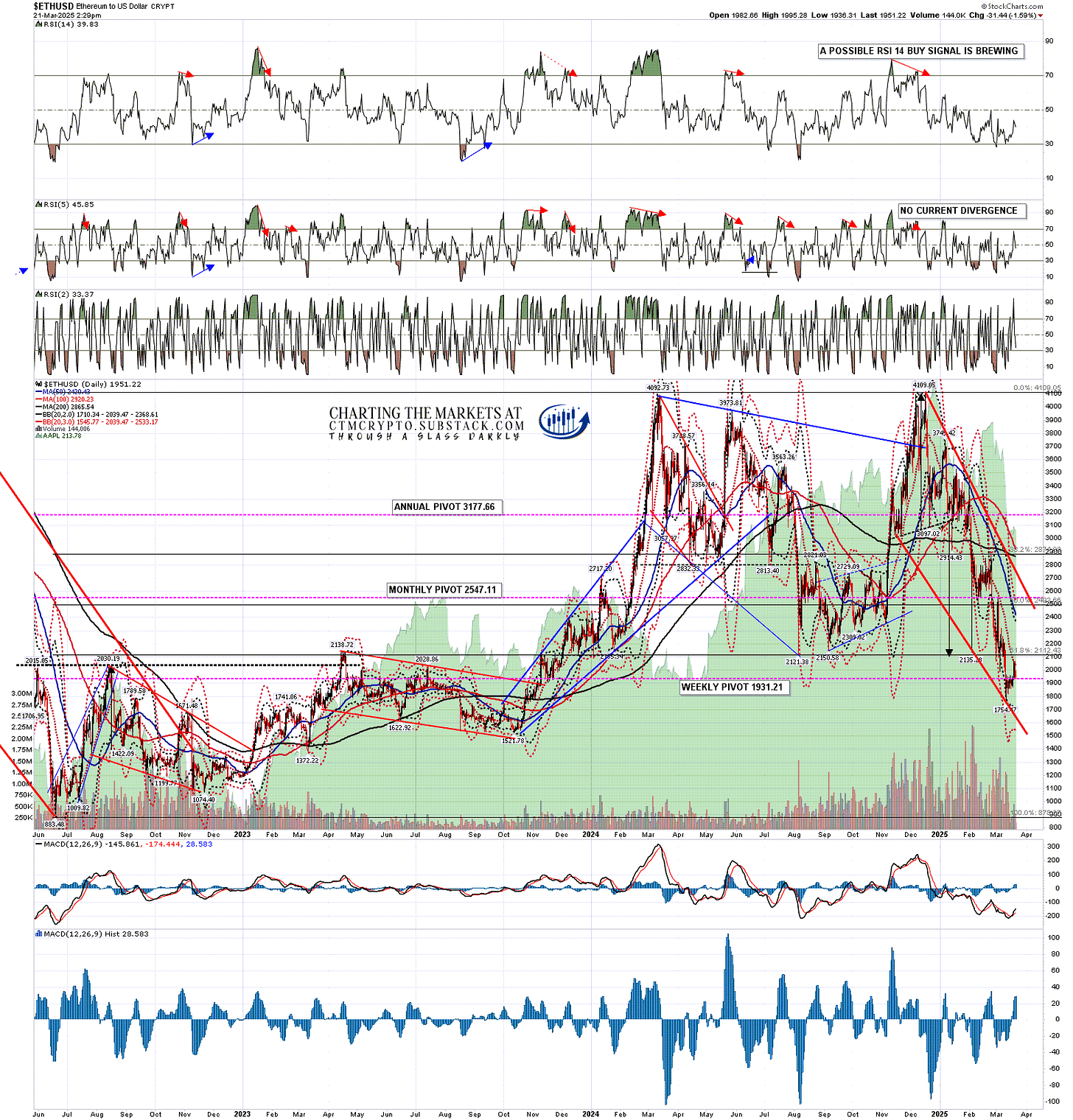

On Ethereum (ETHUSD) resistance at the daily middle band was tested on Wednesday and held again.

ETHUSD daily chart:

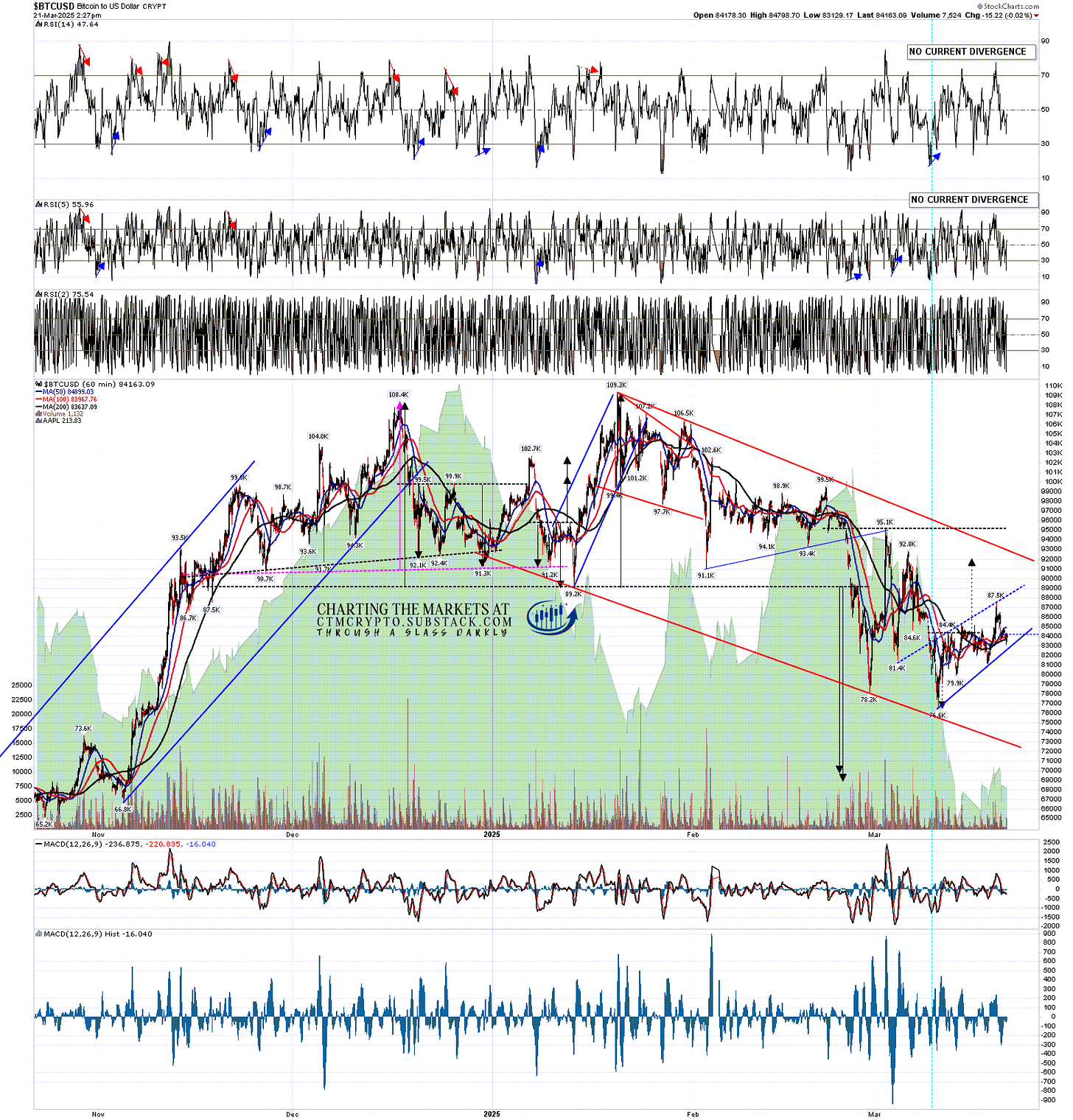

On the Bitcoin hourly chart the IHS that has broken up with a target in the 92000 area has not yet failed, but will fail with a target at a retest of the lows on a break below the right shoulder low at 79.9k. A high quality bear flag falling wedge has also been forming though that hasn’t broken down yet.

BTCUSD 60min chart:

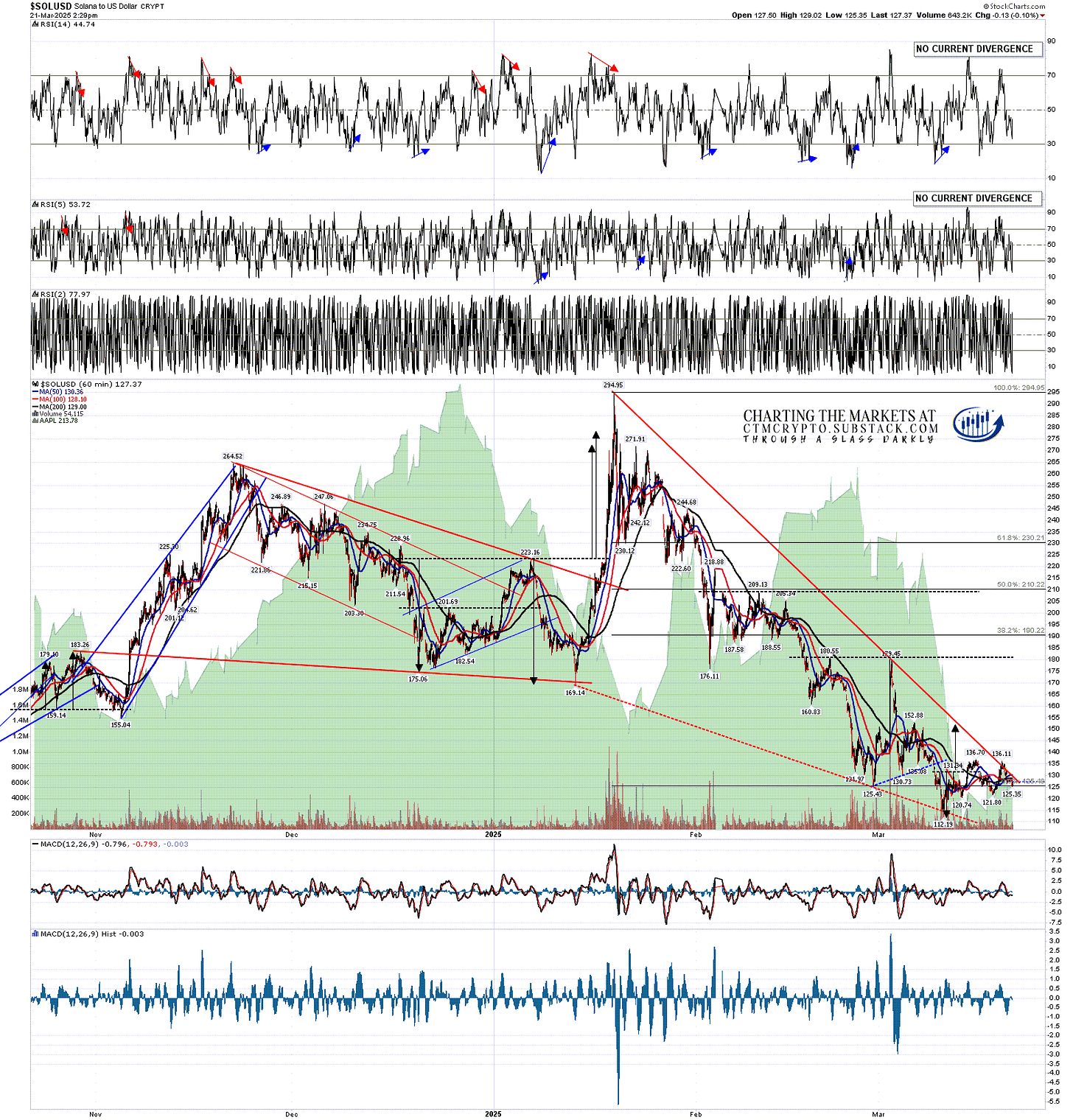

On the Solana hourly chart the IHS that has broken up with a target in the 152 area has not yet failed, but will fail with a target at a retest of the lows on a break below the right shoulder low at 120.74.

SOLUSD 60min chart:

So what happens if these two IHS patterns fail? Most likely a retest of the retracement lows on Bitcoin, at 78.2k, and Solana, at 112.19. They could hold those levels as the second lows of double bottoms but there is of course still an open double top target on the Bitcoin chart with a target in the 69k to 70k area, and we might well see continuation down to that target directly.

BTCUSD weekly chart:

On the bigger picture I still think that talk of the next bear market on Crypto having already started is premature. It’s possible but there’s no compelling evidence for that so far. I think Bitcoin likely has some more downside coming but I think Solana and Ethereum may already be starting to make their lows for this move.

Against that the setup on equities is looking ncreasingly in favor of at least a technical bear market decline of 20% this year and possibly a lot more than that. If so, that could drag Crypto down into a full bear market with it. We’ll see. Everyone have a great weekend :-)

So far this year I have been and am still leaning towards seeing weakness in the first half of the year and renewed strength in the second half of 2025, with a very possible bull market high on Crypto pencilled in close to the end of the year. That scenario would be a good match with past Crypto bull markets. Is it possible that I am mistaken? Always, but we can only ever try to identify the higher probability paths in the future. Only time can show us the path that is actually taken. Still, I’m with Confucious who said ‘study the past, if you would divine the future’.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment