On Thursday last week I wrote a post looking at the possible four larger bear flags that could form on SPX, NDX, Dow & IWM after the sharp decline on Wednesday afternoon. Of those four, there are three decent looking larger bear flags that have since formed, and this morning we are watching the inflection point where these flags may break down into retests of the retracement lows made on Monday last week.

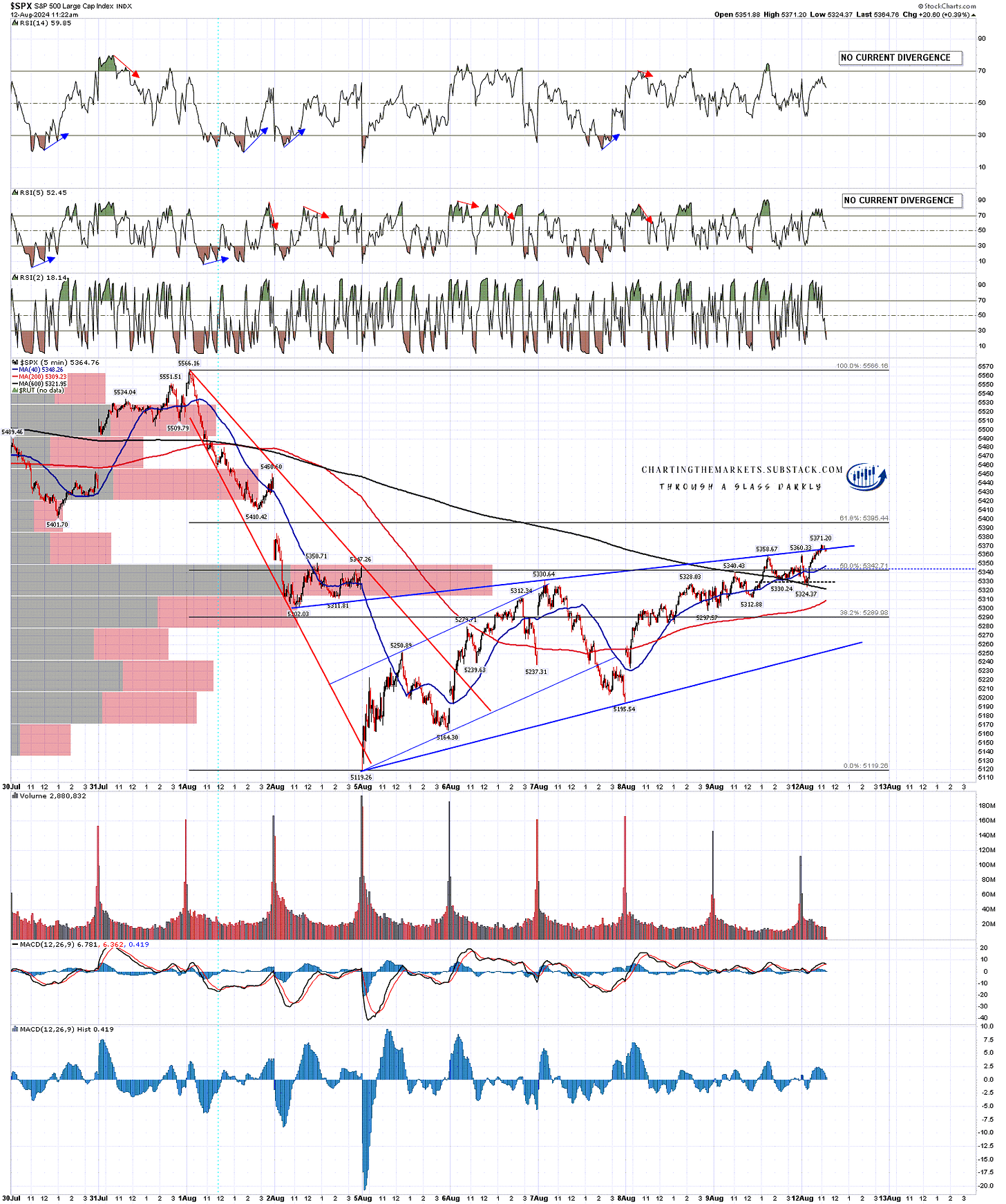

On SPX the obvious larger flag resistance trendline I drew on Thursday was hit perfectly on Friday and overthrown slightly today.

SPX 5min chart:

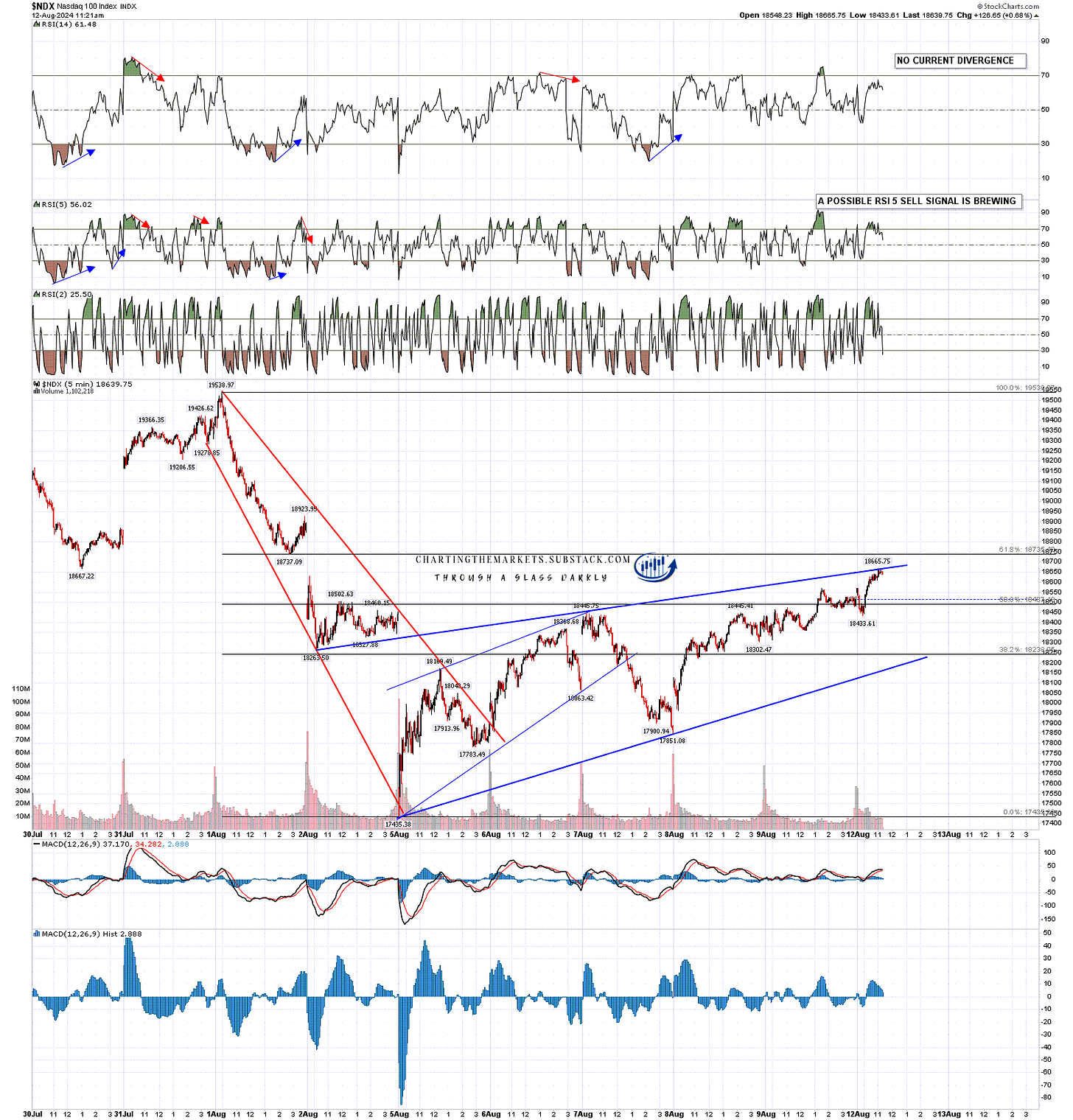

On NDX the possible larger bear flag resistance I drew on Thursday was hit perfectly this morning.

NDX 5min chart:

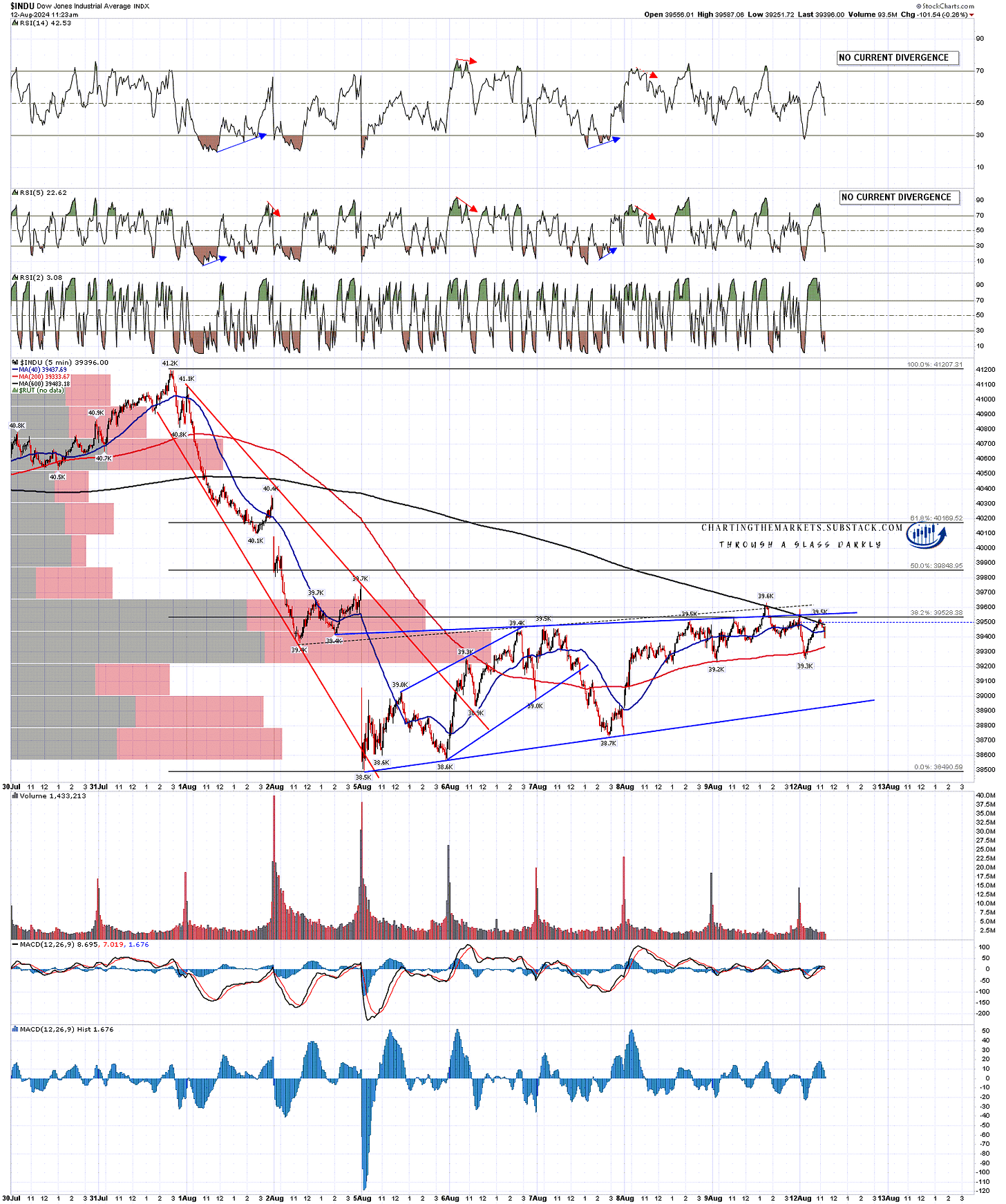

On Dow the trendline I drew on Thursday was hit, but an alternate to that trendline is a better fit, and that has been hit and overthrown.

INDU 5min chart:

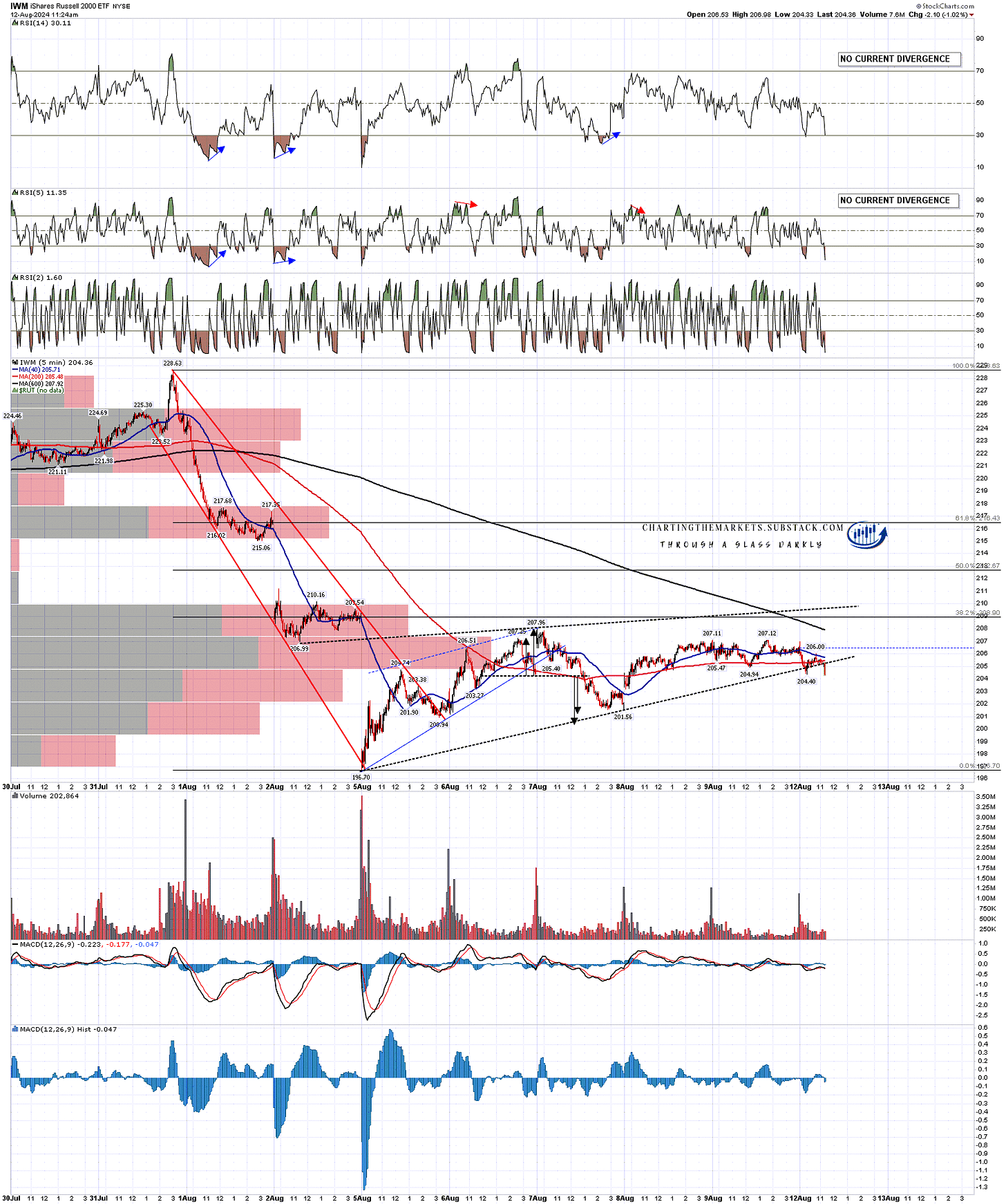

The one that didn’t hit was IWM, though that could be developing a triangle, and it still of course has a target at the lows from the original bear flag that broke down on Wednesday.

IWM 5min chart:

So there we have it, three out of the four larger bear flags that I proposed on Thursday morning have formed, and we will see now whether these break down into low retests. It is a decent setup and, as ever, the market will decide.

There are some supporting RSI sell signals on the futures charts, with weak 60min sell signals fixed on ES, NQ and YM. We’ll see how that goes.

ES Sep Daily:

I’ve been setting up my new base at Substack over the last few days and I have set up three substacks to cover different areas of my work. These are as follows:

Equity indices & futures with a premarket webinar every morning. Weekly & monthly pivots posted every weekend. My main base for writing posts: -

Crypto posts, charts & a premarket webinar every day. Weekly & monthly pivots posted every Monday: -

Bigger picture on equity indices, bonds, currency pairs & commodities. Two webinars a week, all the supporting charts on Sundays, and regular posts:

These are all the three I will be setting up for now. There will be plenty of free content across them & all are welcome.

No comments:

Post a Comment