I wanted to take an opportunity to take stock of where this rally is in relation to the possible all time high retests that I was talking about in my post on 14th June just before the 2022 low was made. I have done three main posts looking at this and a possible news background that might help deliver those high retests from the decent looking bull flags that have formed in 2022 on all four of the main US indices that I watch from those all time highs

These are those three posts which are worth another look as there is more in them than I will be reviewing in this post.

Through A Glass Darkly - 14th Jun

Blood In The Streets - 17th Jun

The Evolving Markets - 8th Jul

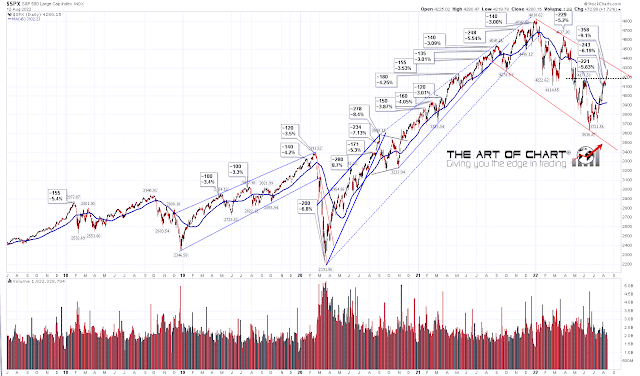

On the SPX daily chart I started looking for a possible move to test bull flag resistance on 28th May, three weeks or so before the low. SPX then delivered a bullish underthrow to make the 2022 low and reversed back up towards flag resistance, now in the 4340 area, just above the 200dma, now at 4330. A break and conversion of that resistance would fix a clear target back at a retest of the all time high.

Since then SPX has broken and converted the daily and weekly middle bands and yesterday at the high delivered an almost tick perfect test of the monthly middle band and 4257, just above the 50% retracement of the move down from the all time high. This is the last big resistance level before the test of SPX flag resistance and the 200dma.

In the meantime though, SPX is now really stretched against the 45dma (last chart on this post) and there is now clear daily negative divergence on SPX, NDX, IWM and Dow. History suggests that we are very close to a short term high and a minimum retracement back down to the 45dma, now at 3928.

SPX daily chart:

NDX has already broken up from the overall bull flag and has reached the higher possible IHS neckline that I was looking at. If we see a right shoulder retracement here then the ideal right shoulder low would be in the 12750 area. A possible daily RSI 5 sell signal is brewing.

NDX daily chart:

IWM has already broken up from the overall bull flag and has at least some IHS potential here, though nothing that leaps off the chart. A possible daily RSI 5 sell signal is brewing.

IWM daily chart:

Flag resistance on Dow is now in the 34000 area and is getting close. Dow is still only slightly above the original possible IHS neckline that I was looking at there but there is another also in the 34000 area. A possible daily RSI 5 sell signal is brewing.

INDU daily chart:

The SPX intraday high yesterday was an eye-watering 8.3% above the 45dma. The only other readings as high as this were the two big highs after the 2020 low at 8.7% then 8.4%. Both of those then delivered at least a retracement back to the 45dma, now at 3928.

SPX daily 45dma chart:

I haven't talked about bonds today, and a big rally there was the other linked move I was talking about at the lows and in early July. What we have seen though is some optimism on inflation from the recent numbers, which is what I was thinking might deliver a potential window for both all time high retests on equities and the rest of the rally on bonds that I was looking for in those earlier posts, and have only seen about half of so far.

Do the equity indices have to turn down here? No, but there is a lot of negative divergence here, 50% of the move down has now been retraced on SPX, and SPX is looking really stretched now against the 45dma. If SPX continues up regardless then the next big inflection point is in the 4340 area.

In terms of the historical stats I'd note that the first three days of next week all lean significantly bullish, at 61.9% bullish on Monday and Tuesday and 71.4% bullish on Wednesday.

If you're wondering where I get these daily historical stats from, I get those from the Stock Trader's Almanac 2022 by Jeffrey A Hirsch. I've been getting one at the start of every year for many years now and they are available from Amazon in the US and elsewhere.

If you're wondering about the title today a black swan is a market event that knocks almost everything out of every trajectory. These are rare but what are more common are market moves that make no sense, but are technically sound, and go ahead and happen despite making no sense. These don't happen a lot either but there have nonetheless been quite a number of them over the last twenty years. If we do see these all time high retests on equities against this economic backdrop this would be one of those moves and I was thinking I might start calling them grey swans.

My next post will likely be on Monday or Tuesday before the open. Everyone have a great weekend :-)