In my post on Monday 13th January I was looking at the four bull flag setups on SPX, QQQ, DIA and IWM, and the possibility that the bull flags would break up into retests of the all time highs across all four of those. SPX and DIA have made their new all time highs now, QQQ is getting close and I have some doubts about whether IWM will make it. I’ll review those today but first some historical stats.

The January Barometer is triggered when January closes down, and will often deliver a down year, but unless we see a truly impressive decline today that is now irrelevant for this year.

The second statistic I’ve been looking at today is the record of stock markets in the year after a presidential election. Of the last 21 of those going back to Roosevelt in 1941, eight delivered a down year, making this overall weakly bullish.

However this is really better viewed in two parts. For 1941 through 1981 there were seven down years and four up years, making this significantly bearish. After that though, looking at 1985 through 2021, there was only one red close (2001) making this in more recent years very significantly bullish. An interesting stat for this year.

More immediately though, today is the last trading day of January. The stats for the first trading day of the month are often bullish, and one of the most bullish of the year is the first trading day of February, where US equity indices close green over 80% of the time. Tuesday and Thursday also lean significantly bullish and Wednesday leans bearish. There is therefore a very strong possibility of a strong Monday and a bullish leaning weak overall. With that in mind let’s review the four indices against the bull flags I posted on Monday 13th January.

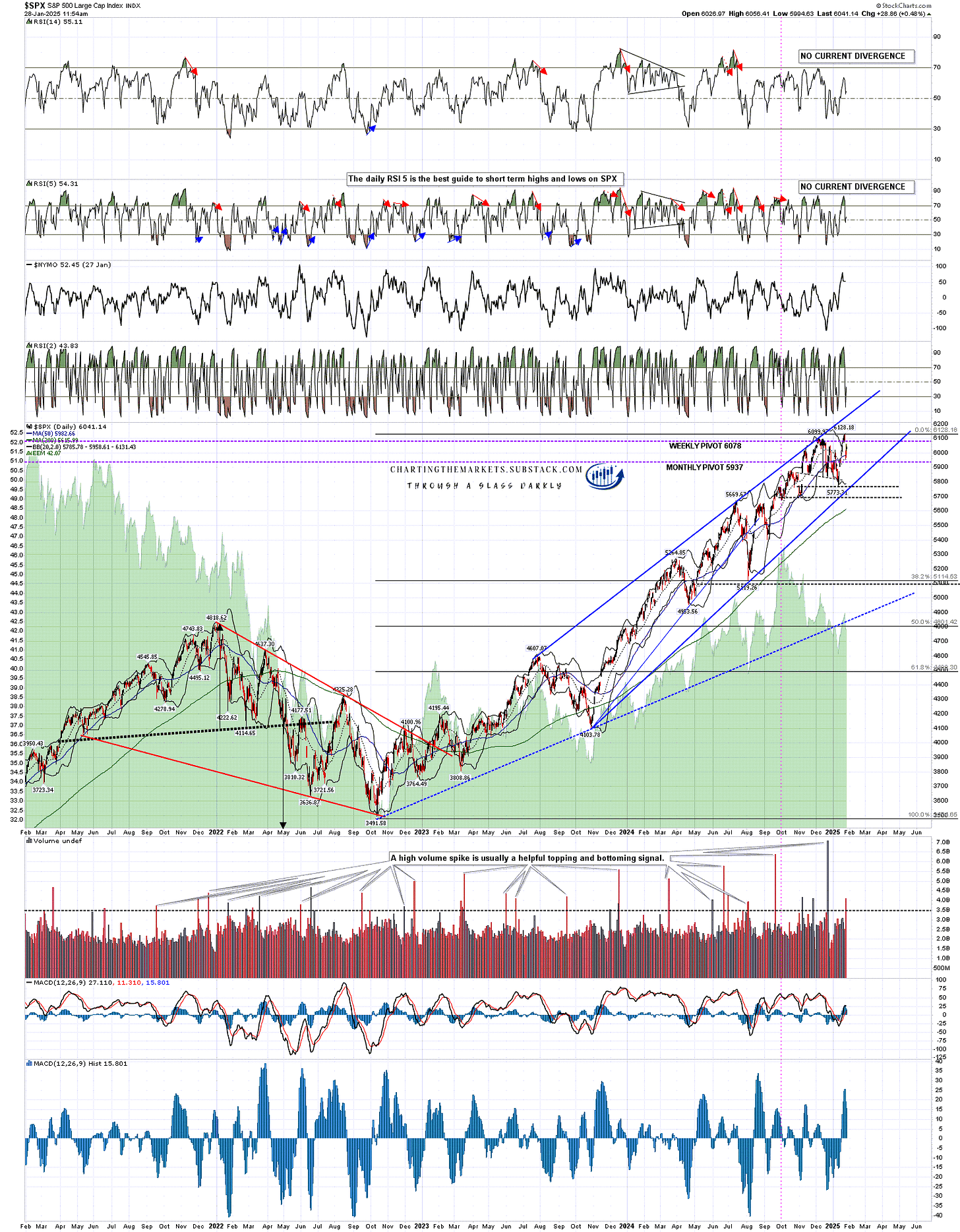

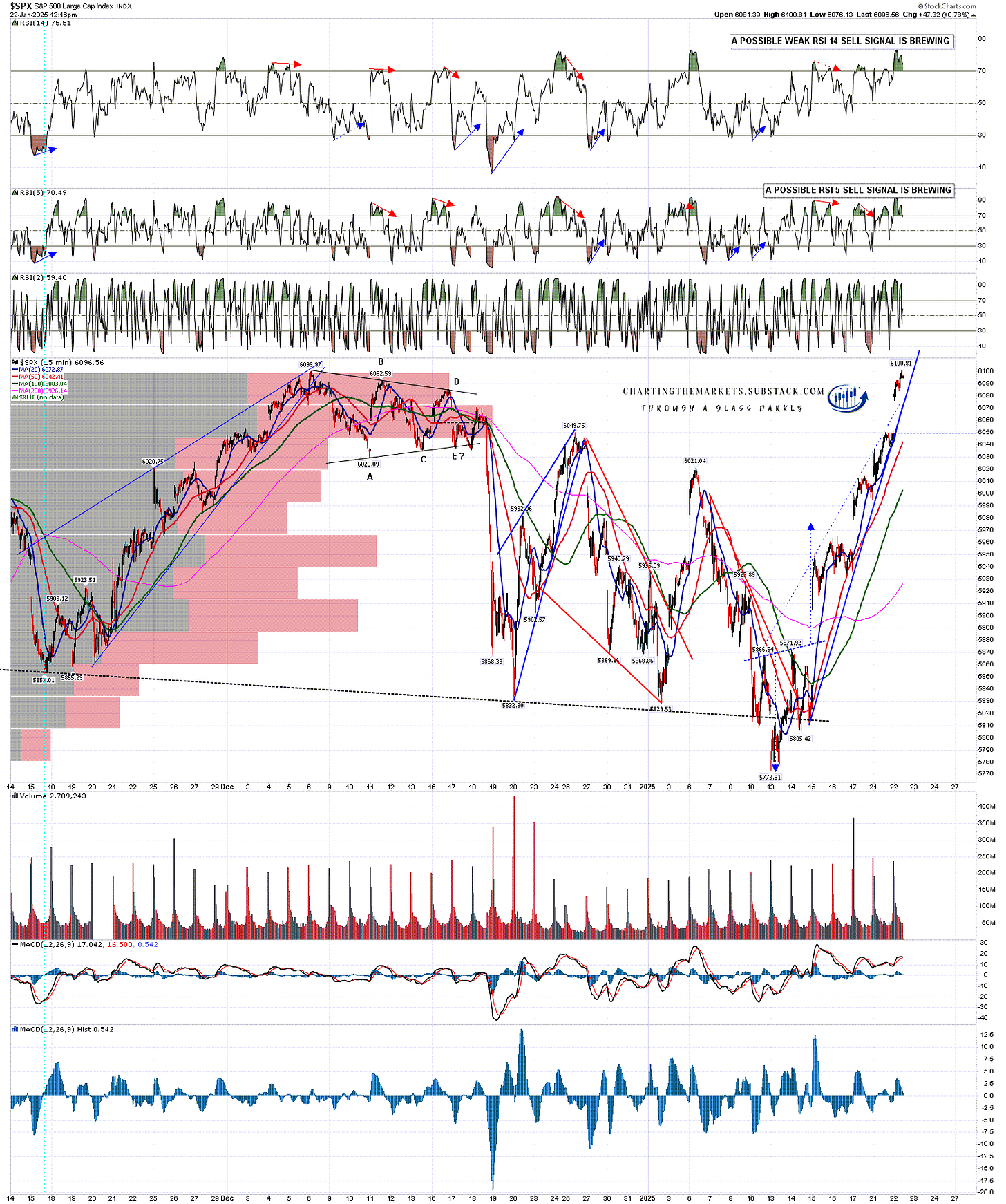

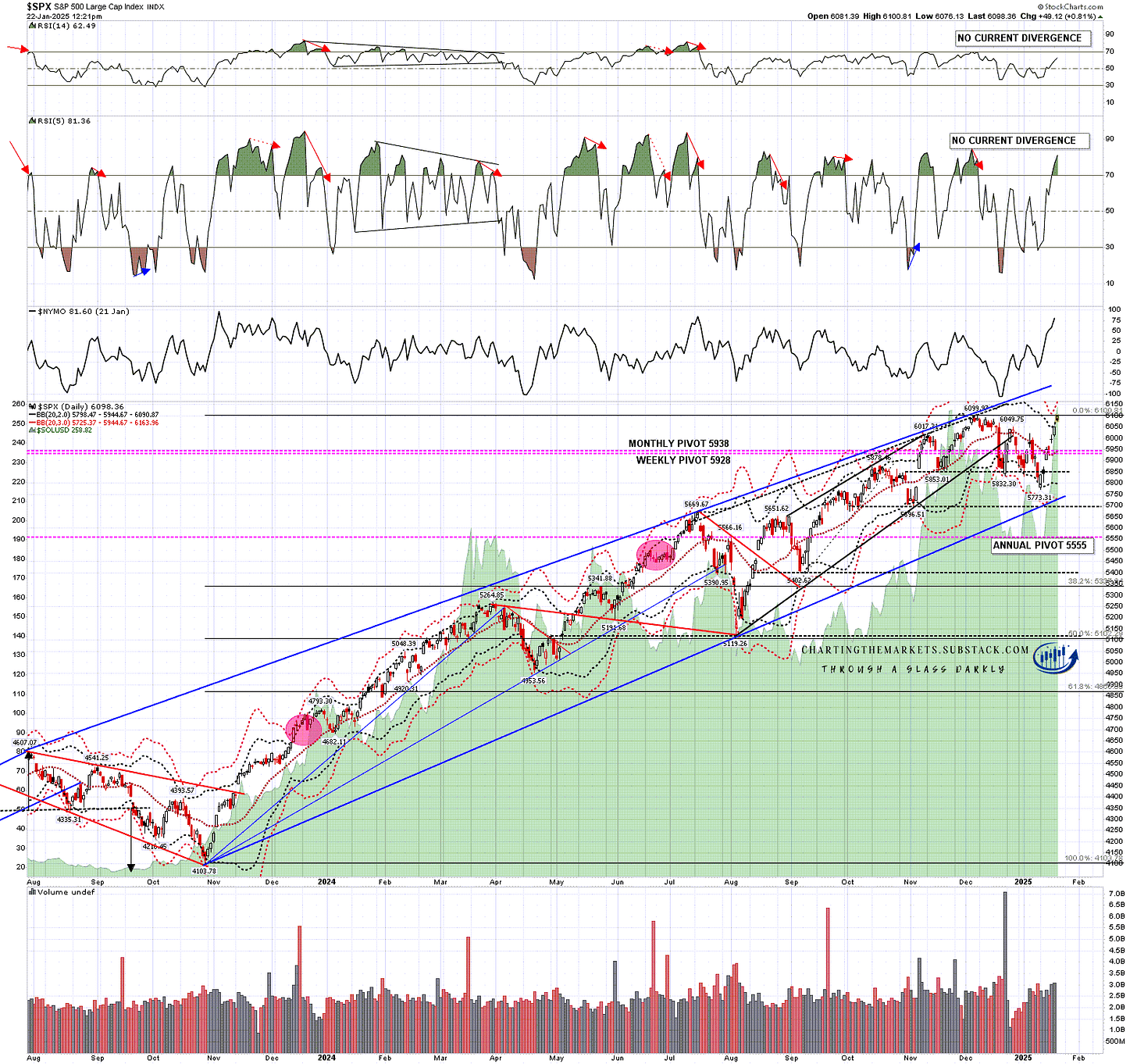

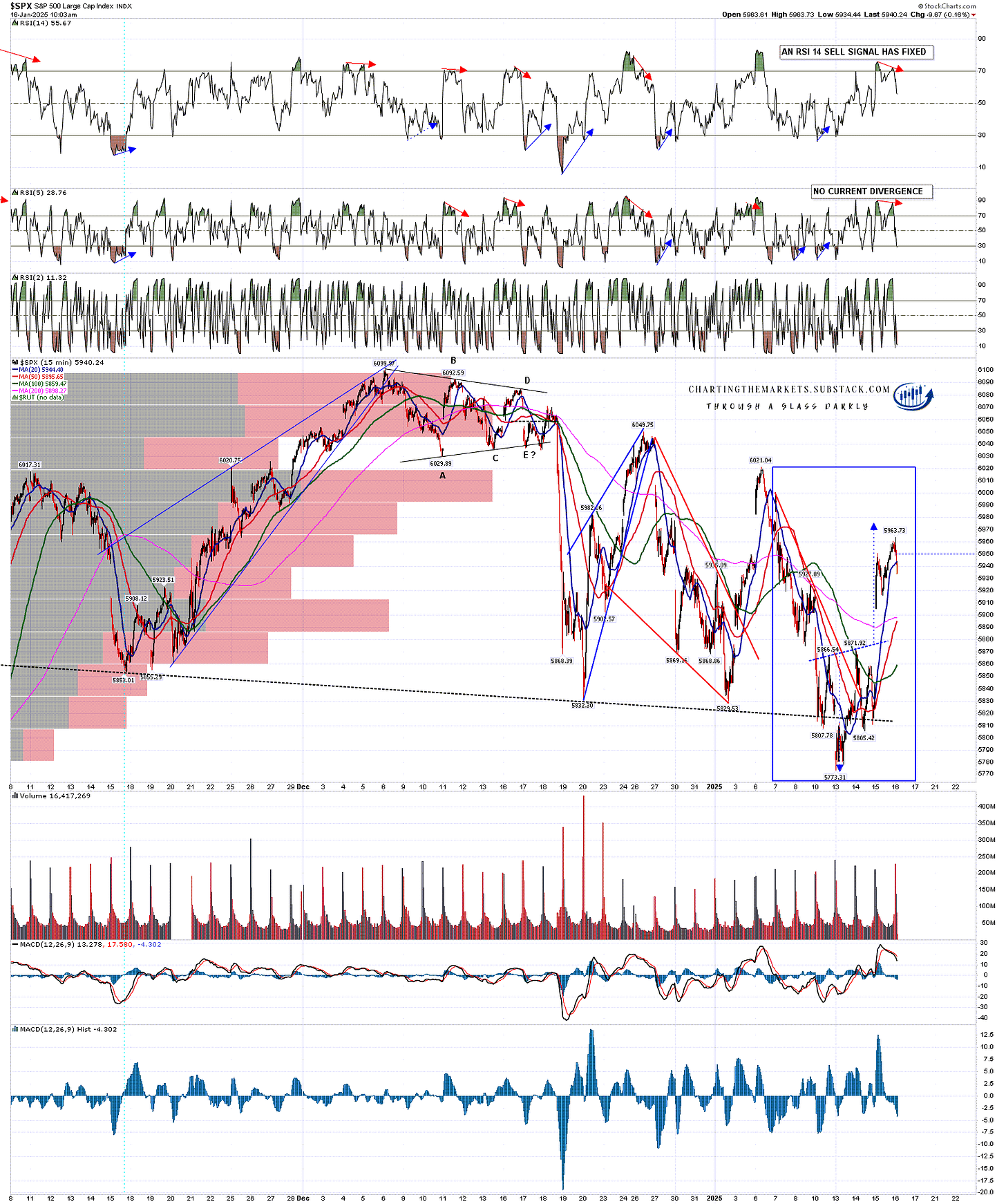

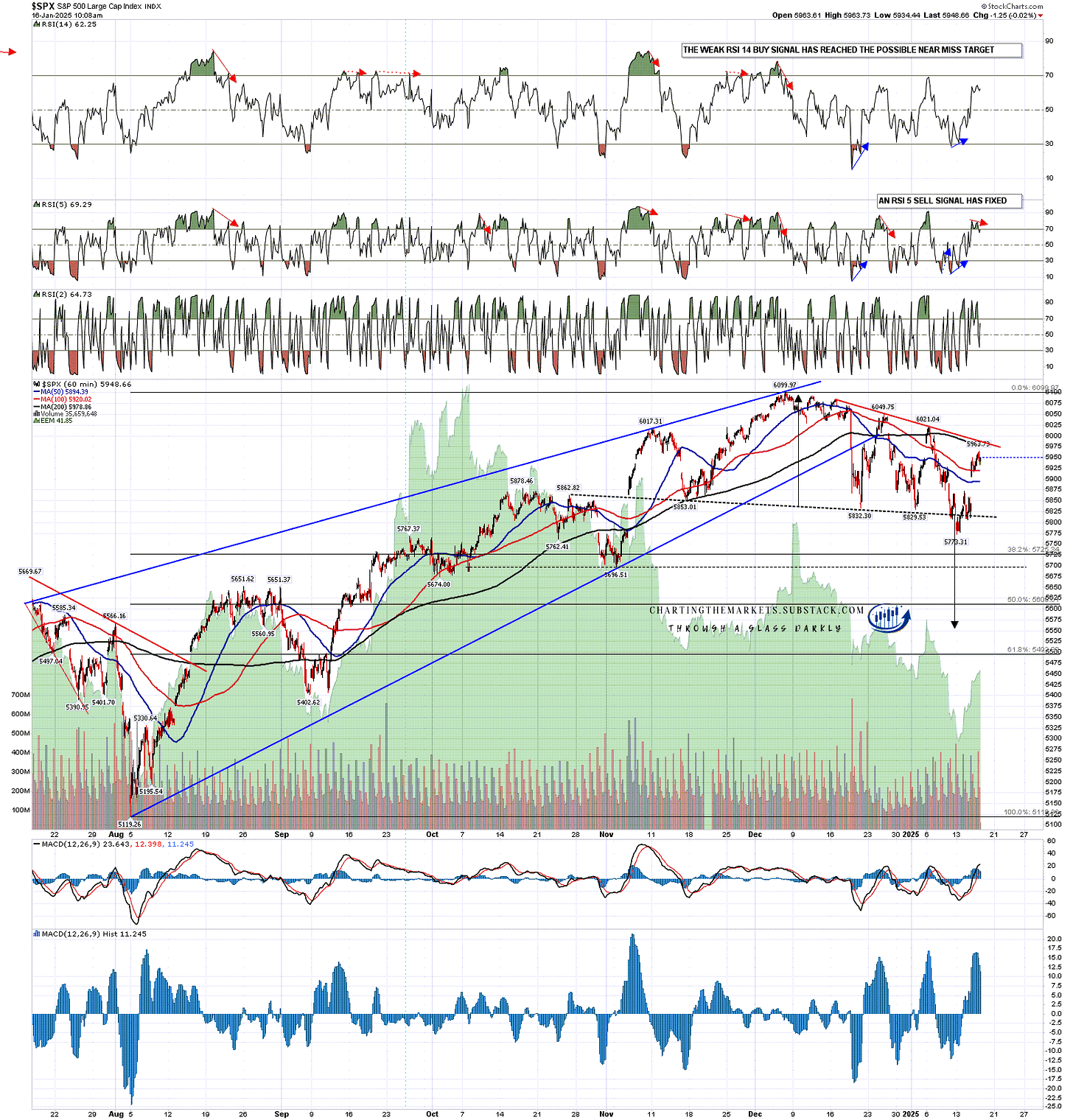

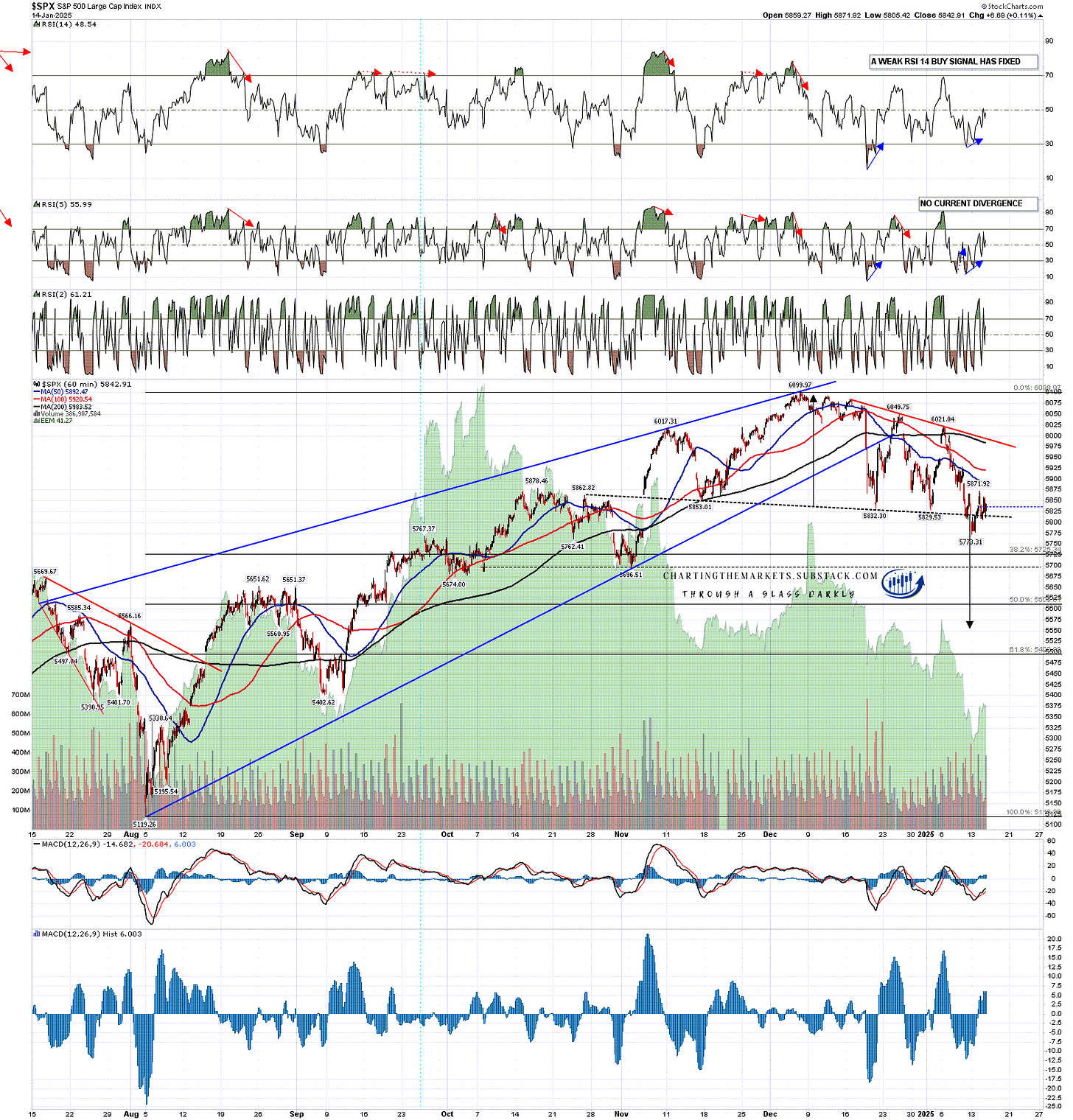

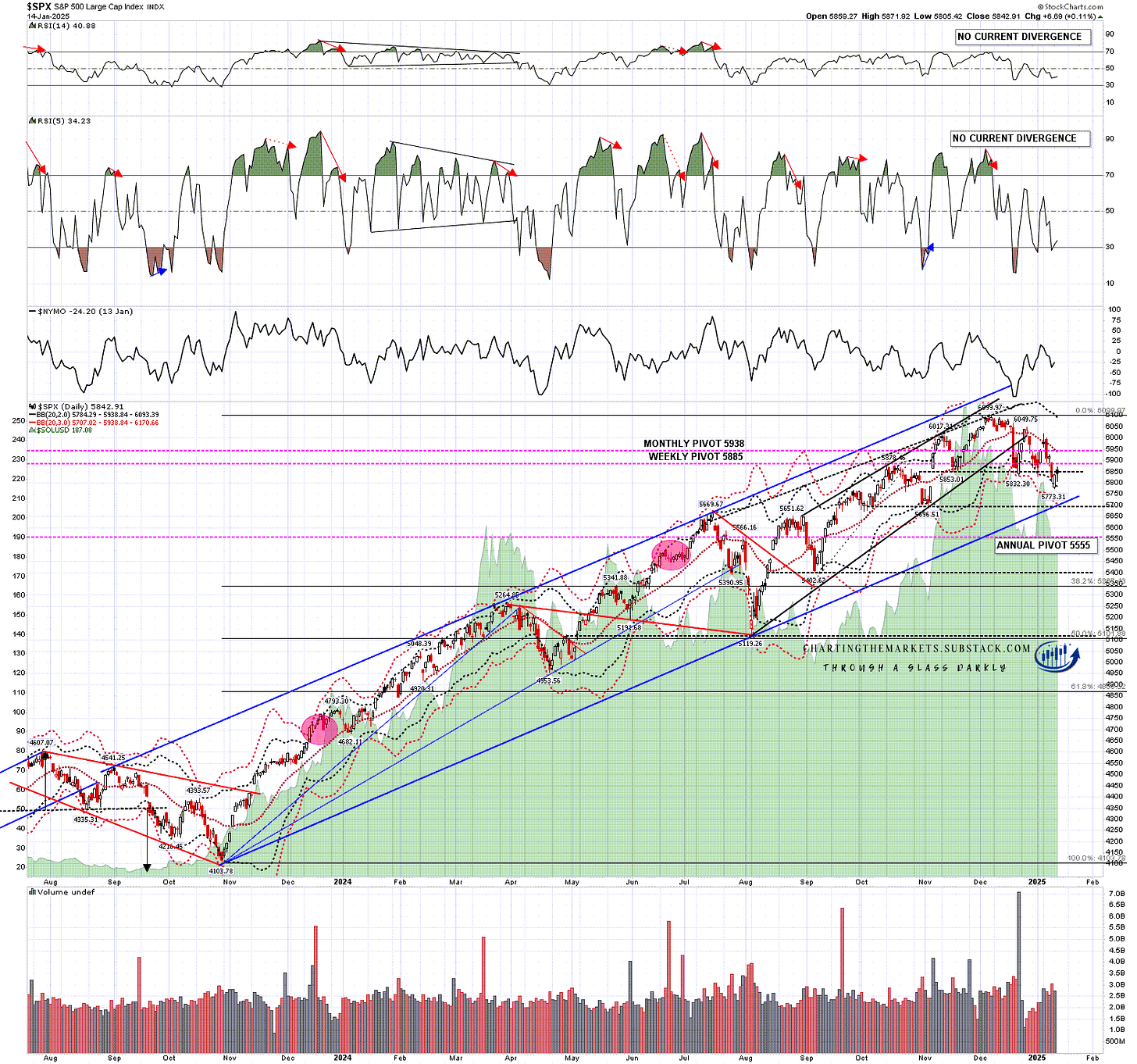

SPX made a new all time high the fastest and, as yet, hasn’t progressed much beyond it. This could be a double top setup , but I’m really expecting QQQ to made a new all time high before there is a serious risk of topping out.

Worth noting on the chart is the decent quality rising channel from the January low with channel resistance currently in the 6250 area, which is also where I currently have trendline resistance from the 2023 low.

SPX 60min chart:

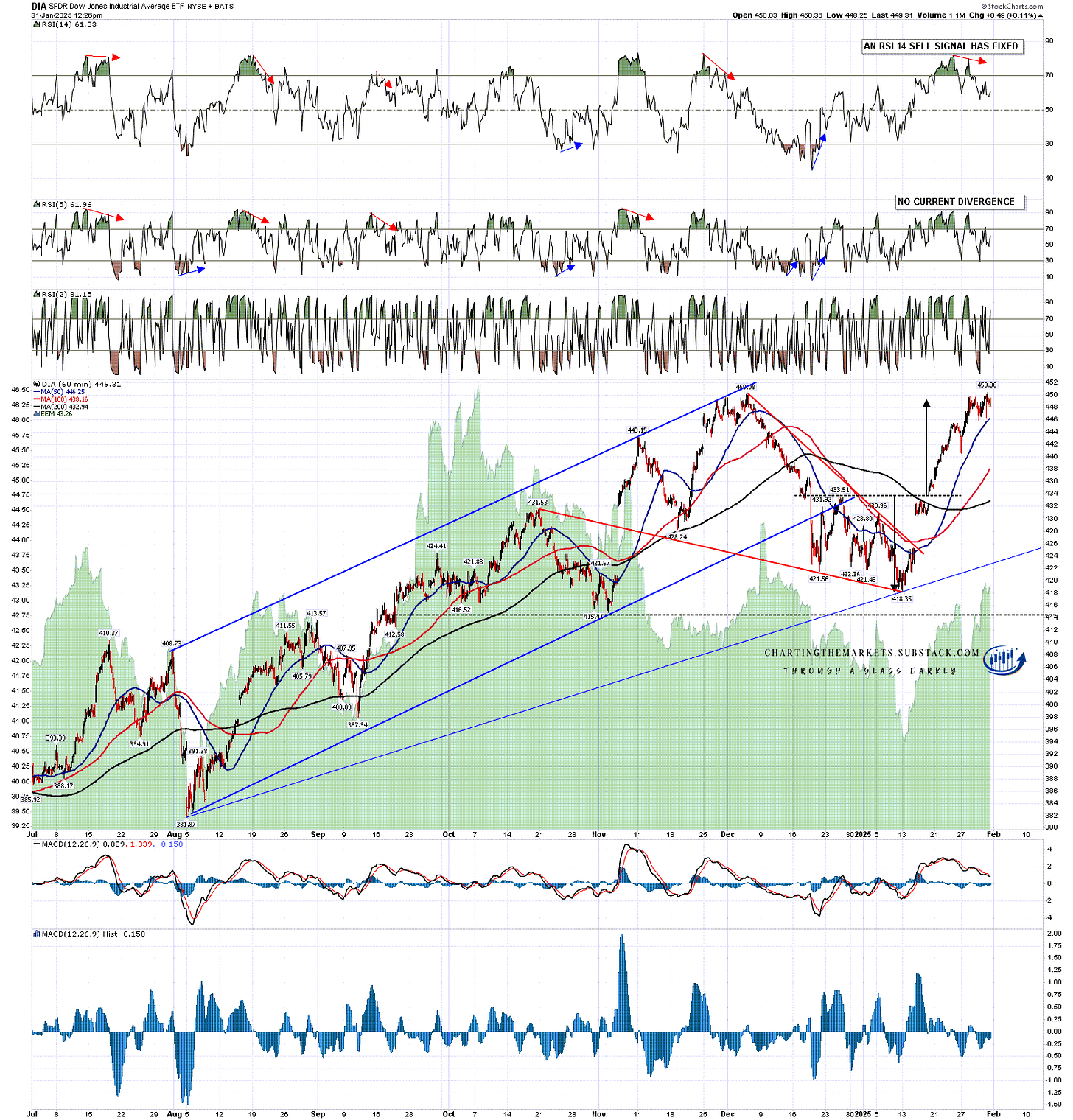

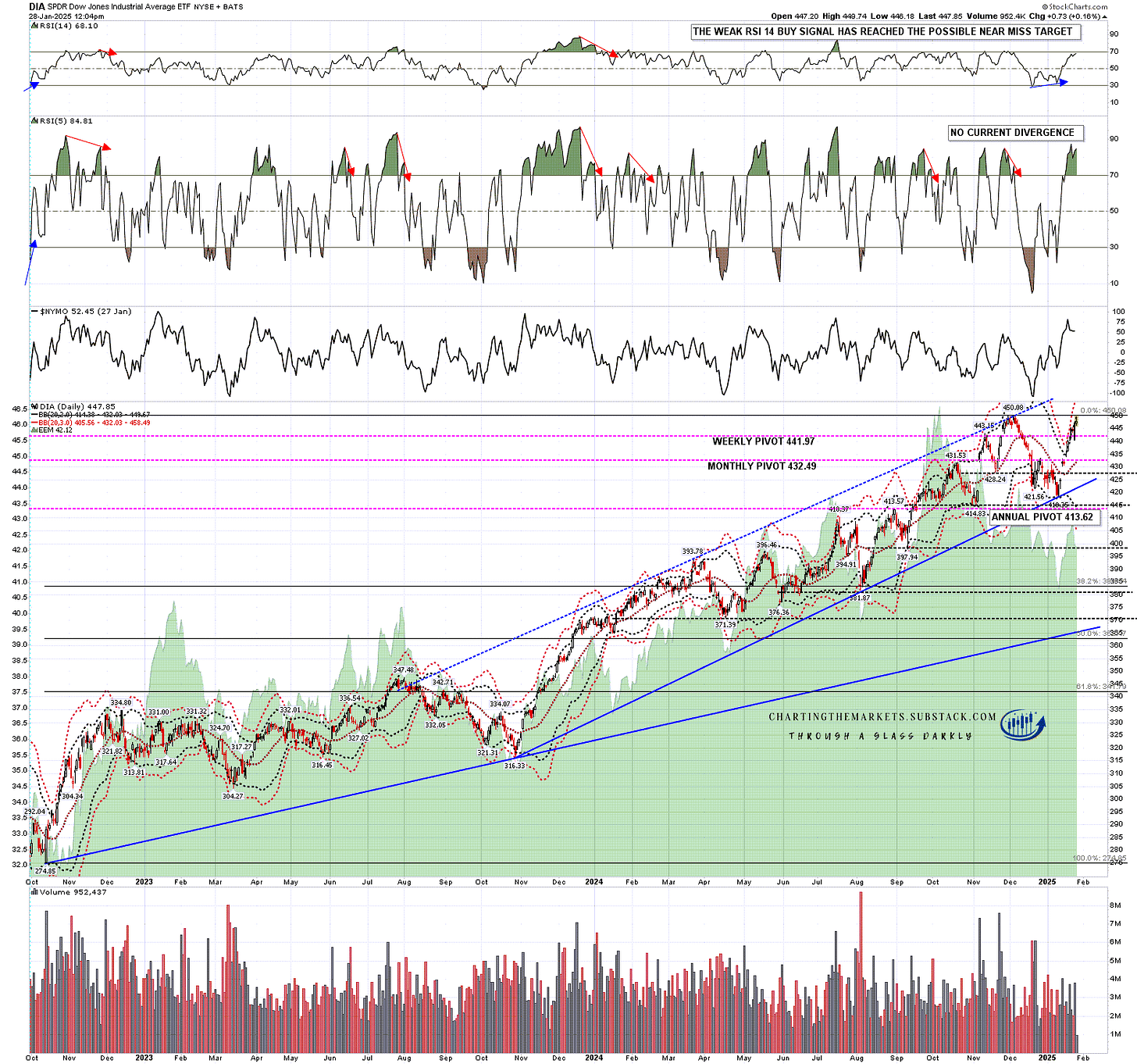

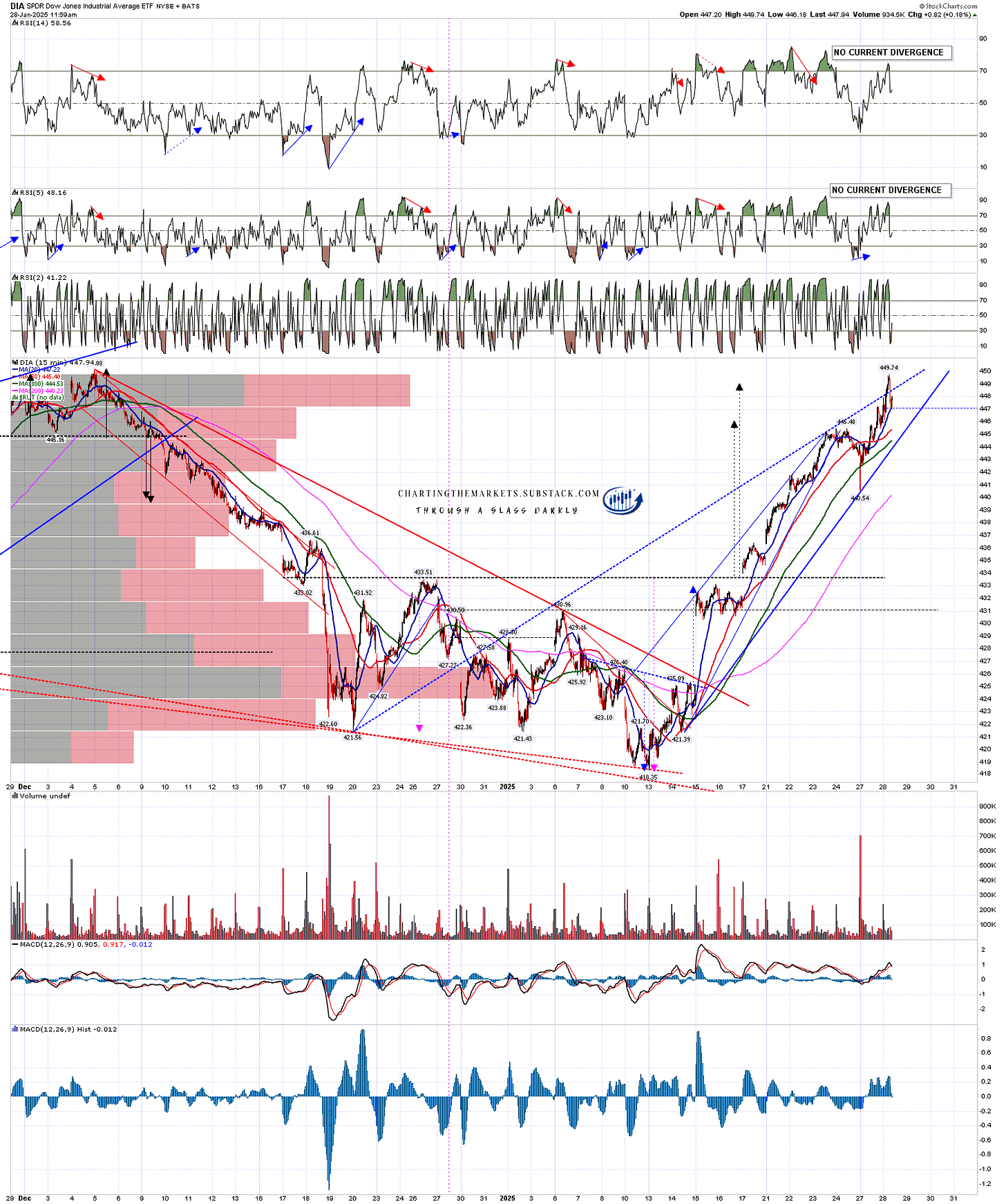

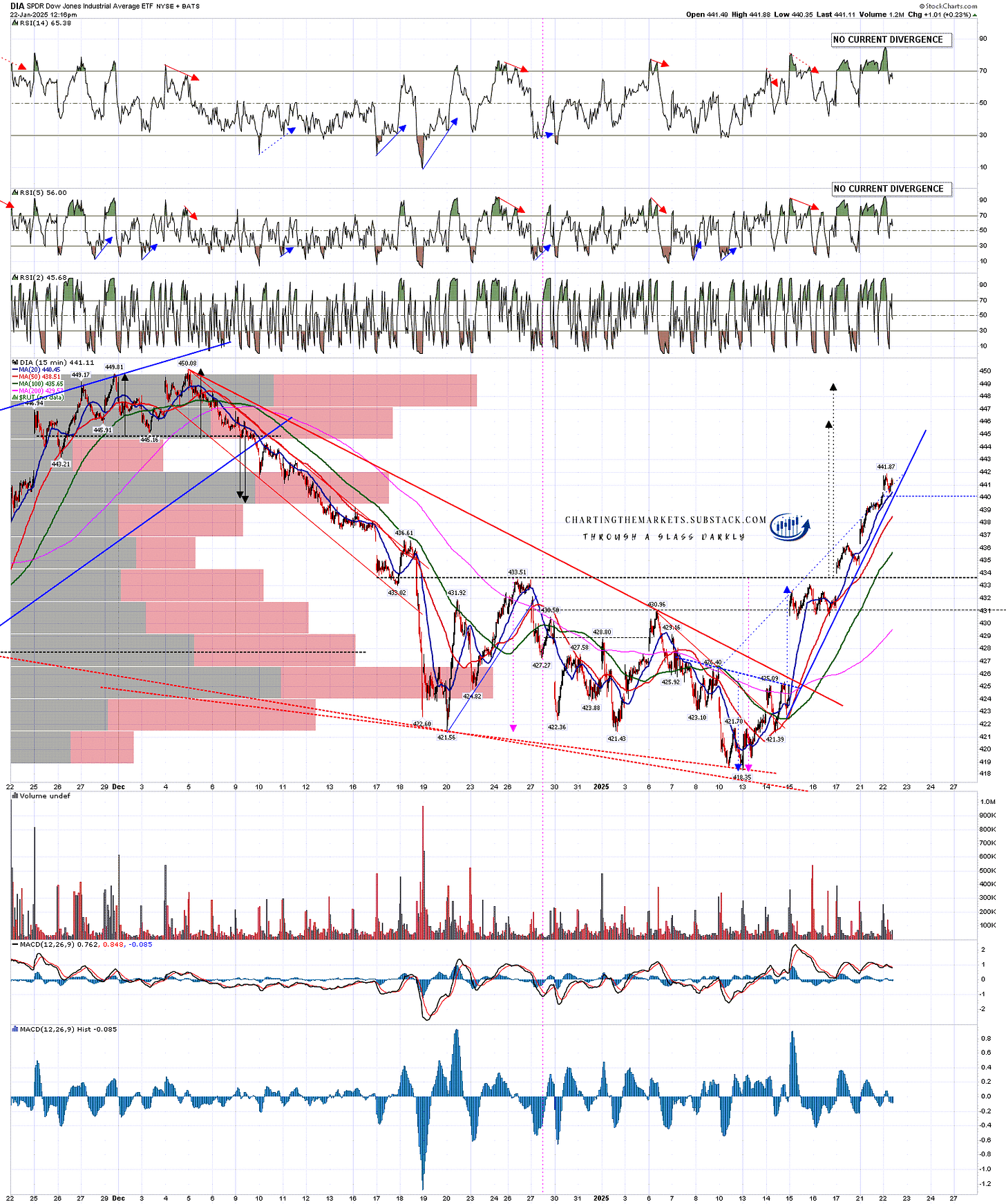

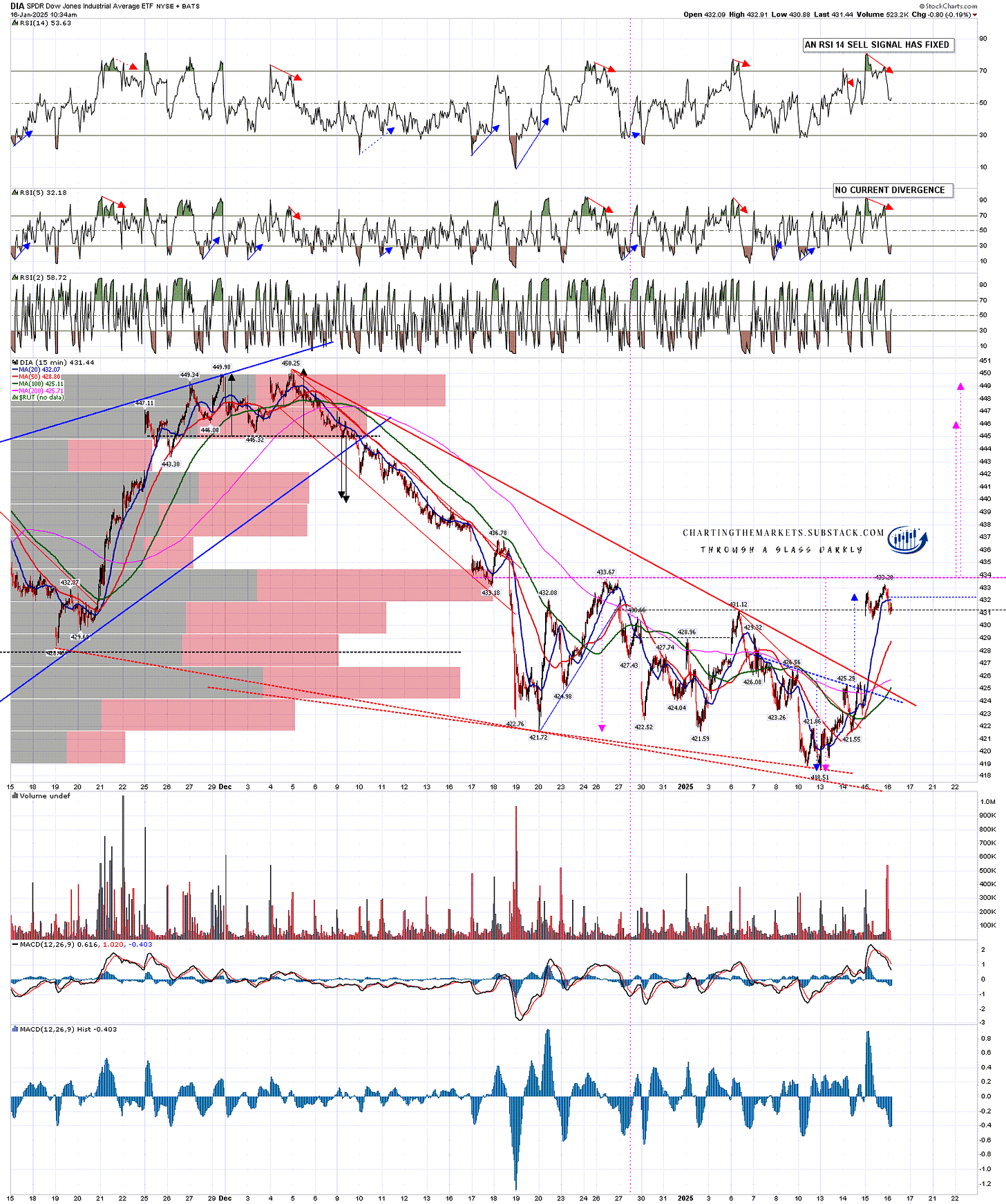

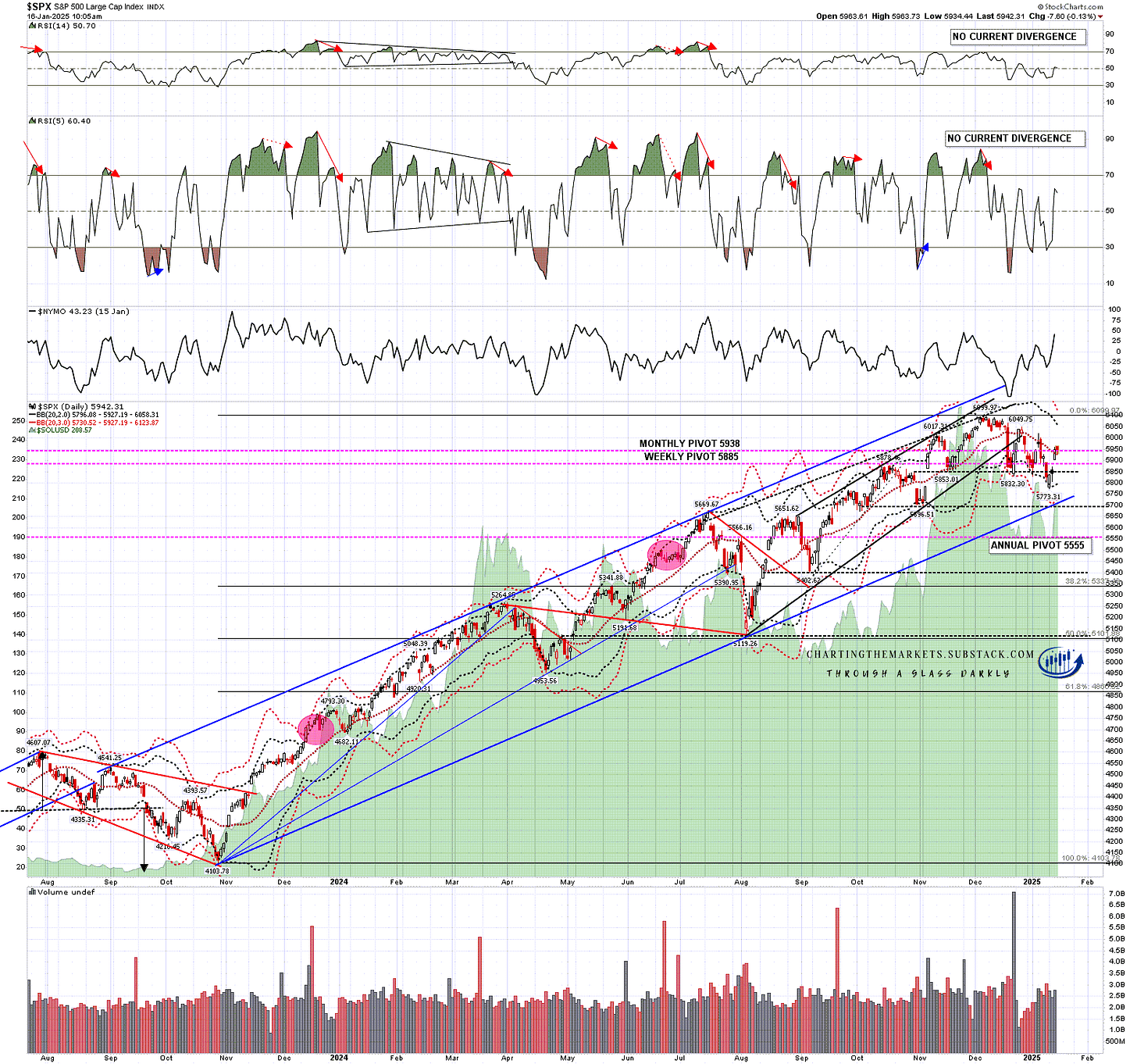

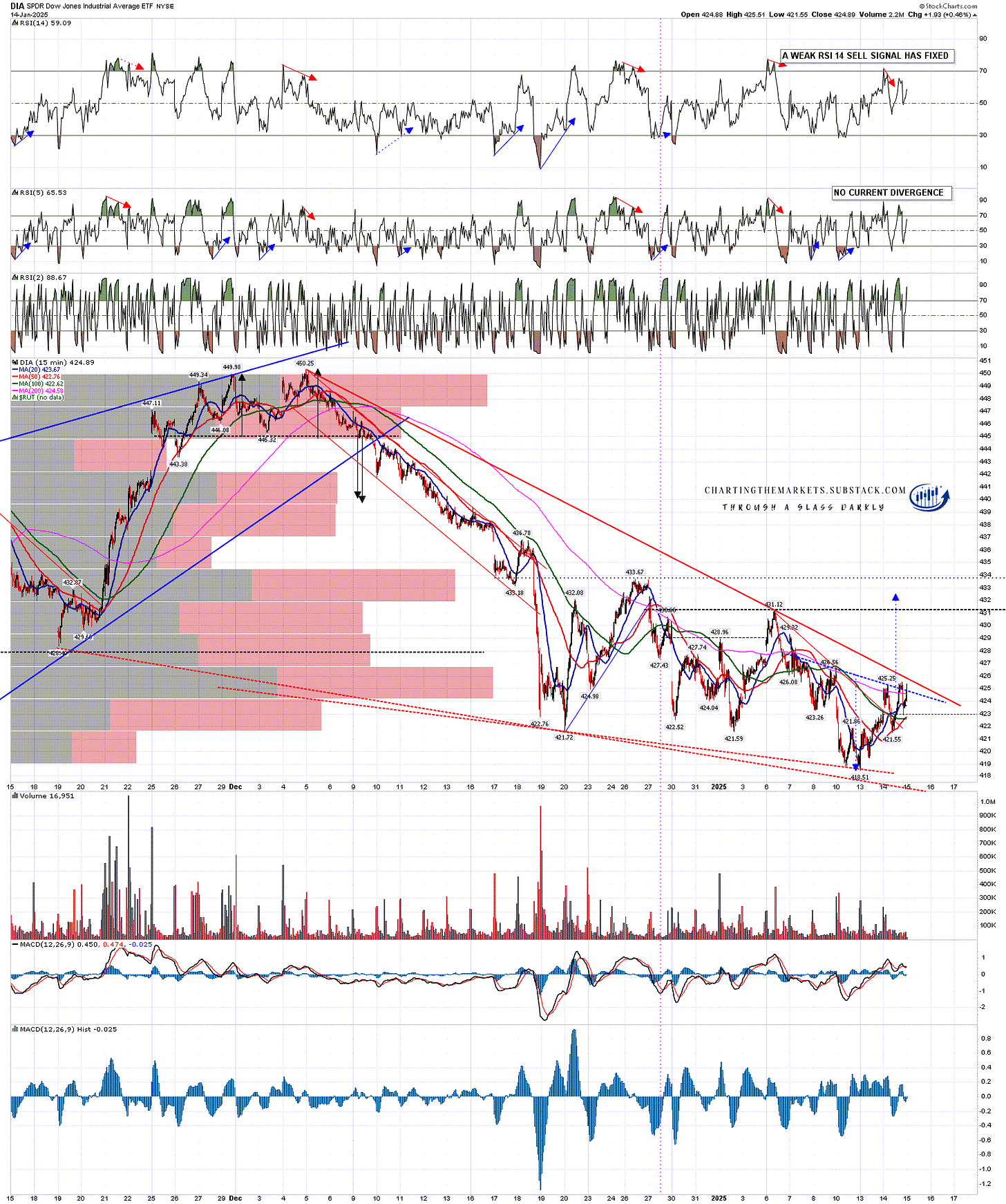

DIA has now made a new all time high this week and there is another possible double top setup formed here. No obvious support trendline has formed and held since the flag low, though we may get one after the low today.

Short term though it is worth noting that there is also a small double top set up on DIA that on a sustained break below 445.77 would look for a target in the 441-2 area.

DIA 60min chart:

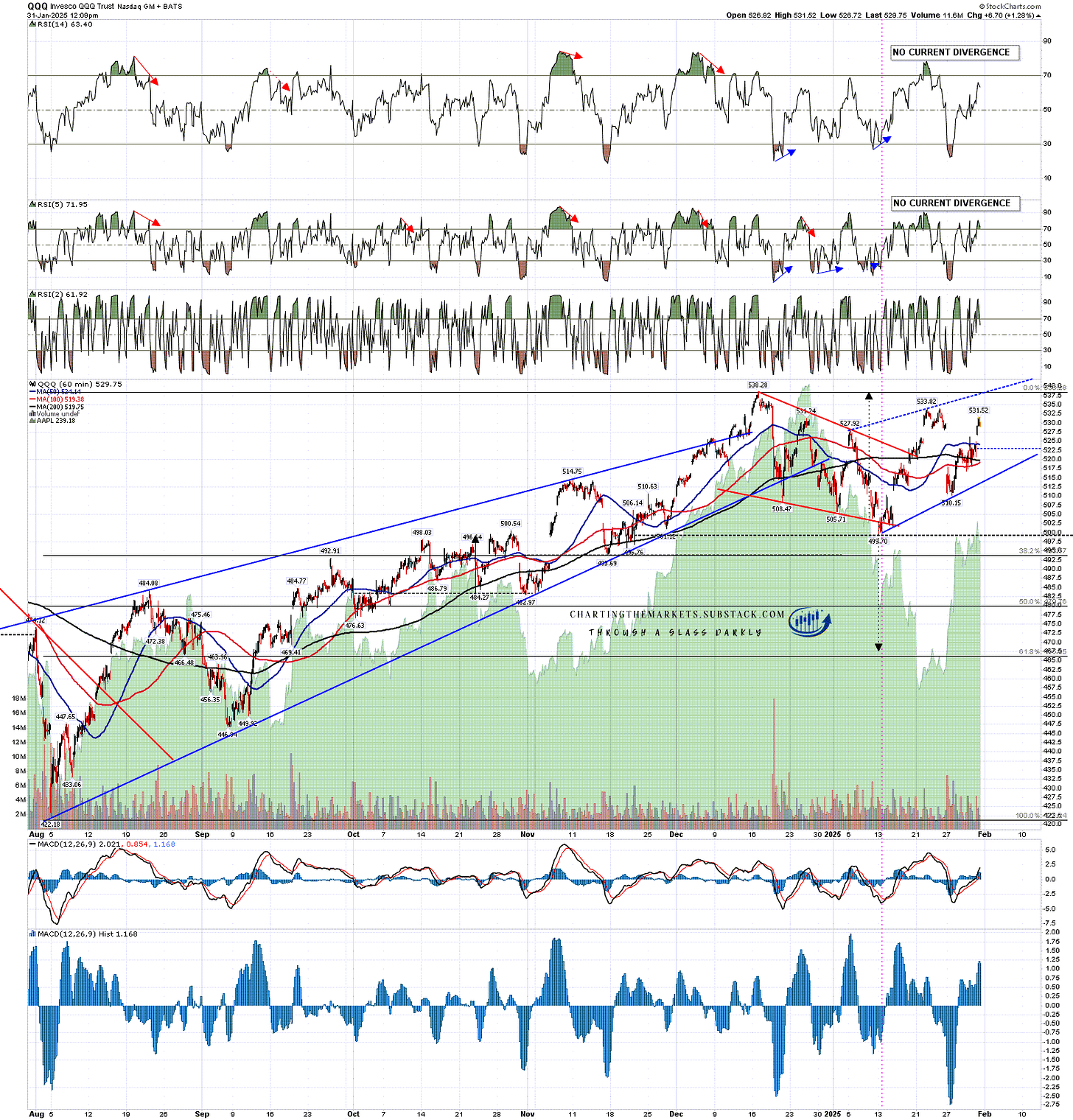

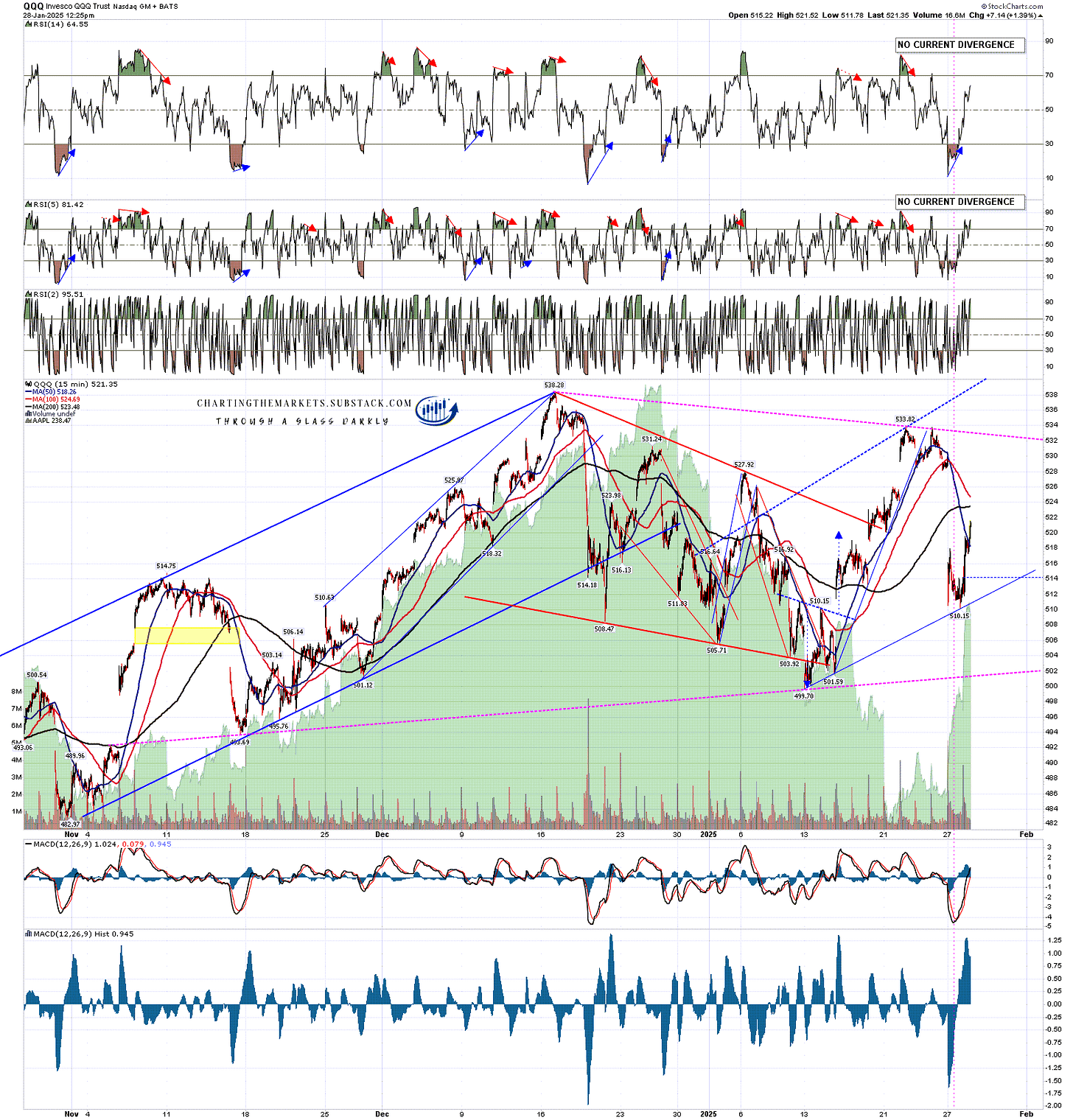

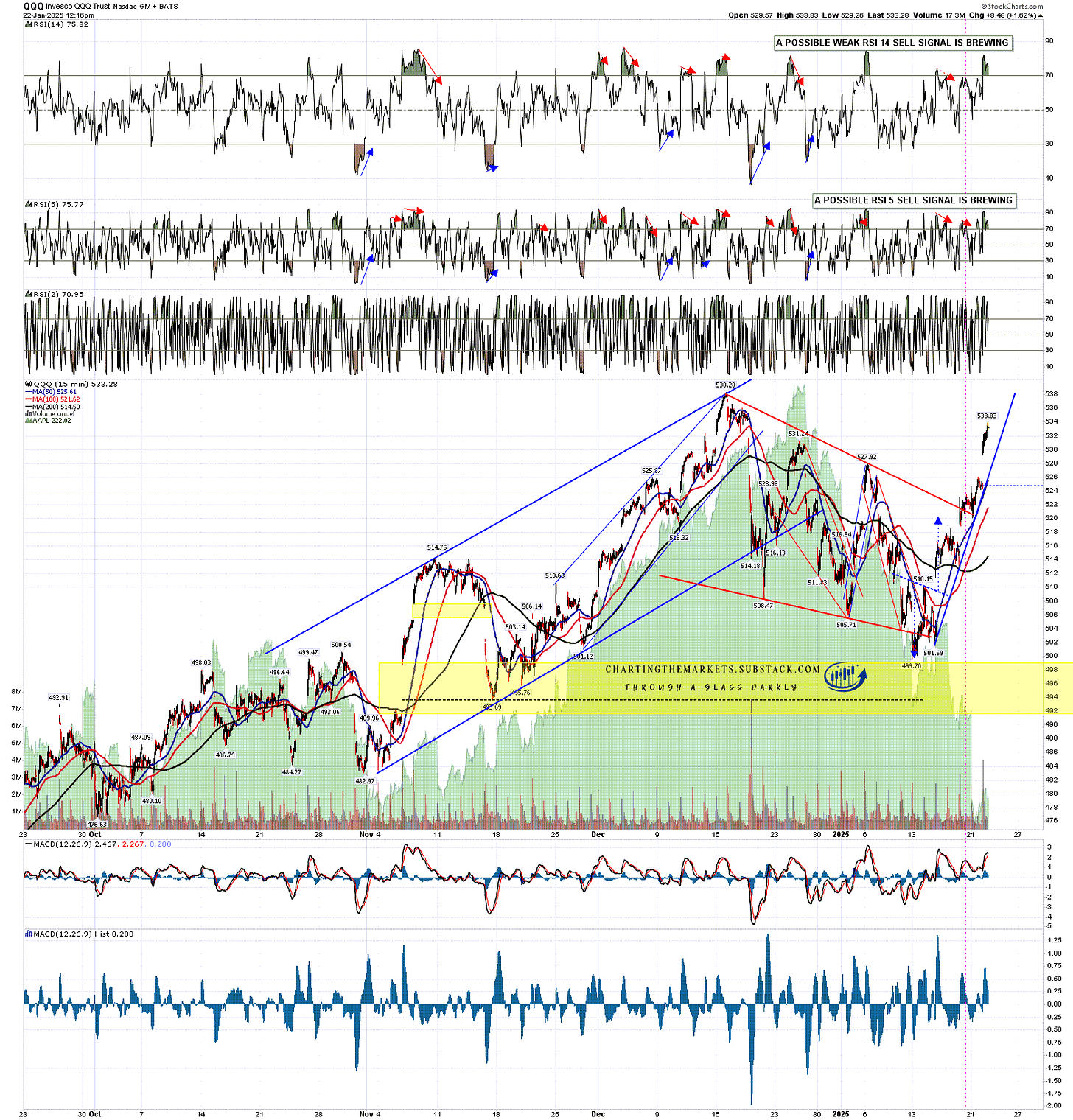

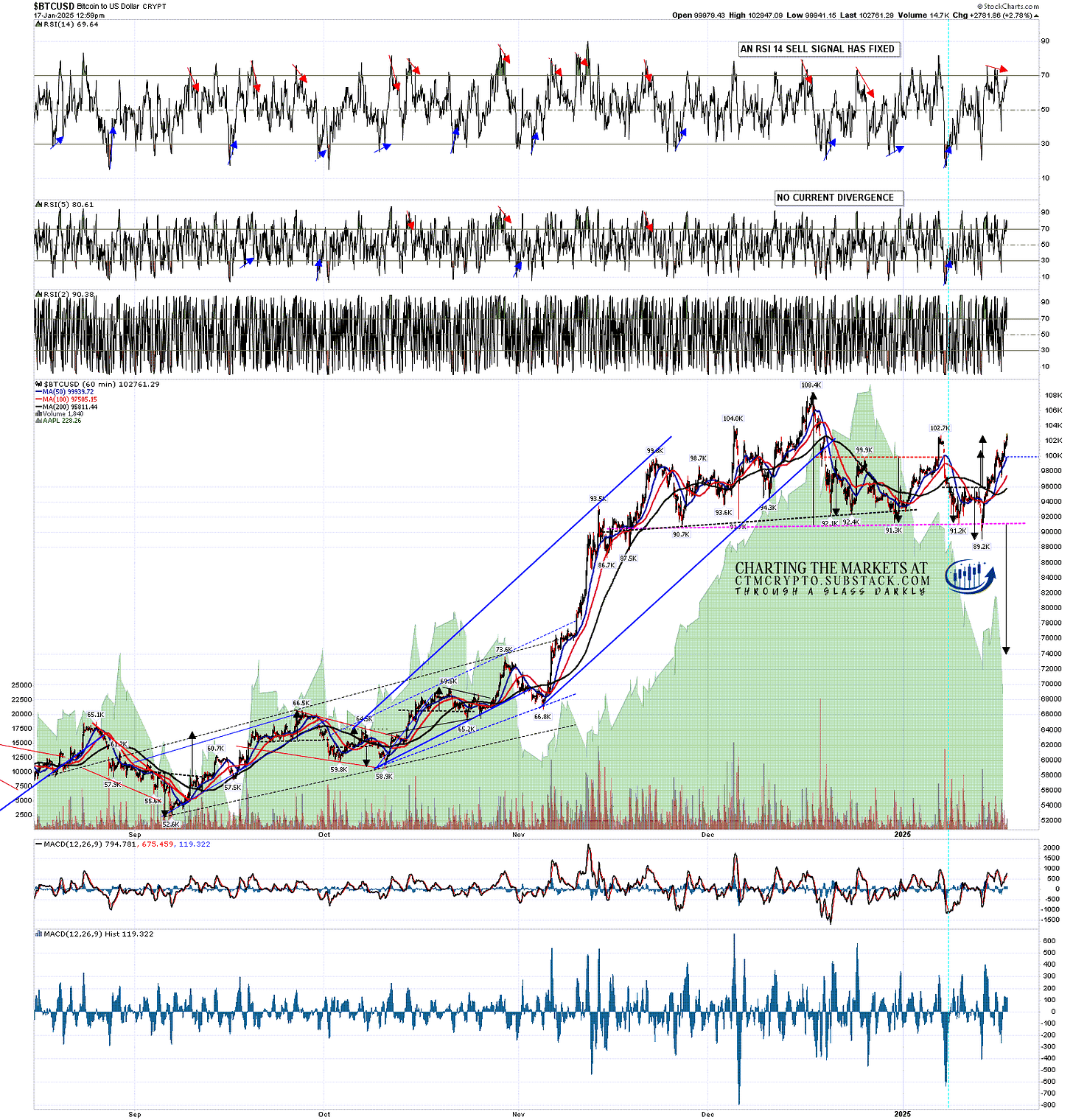

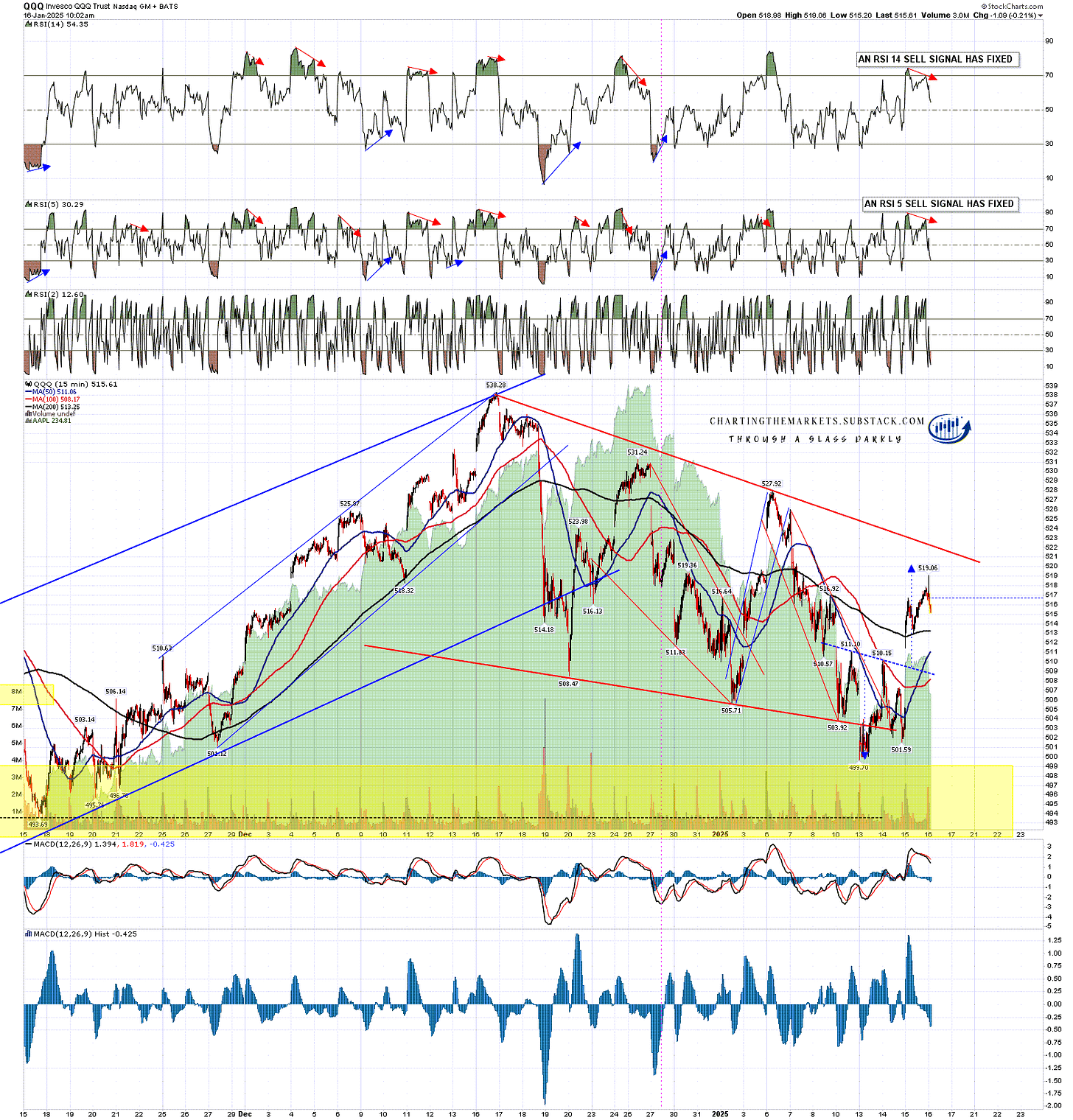

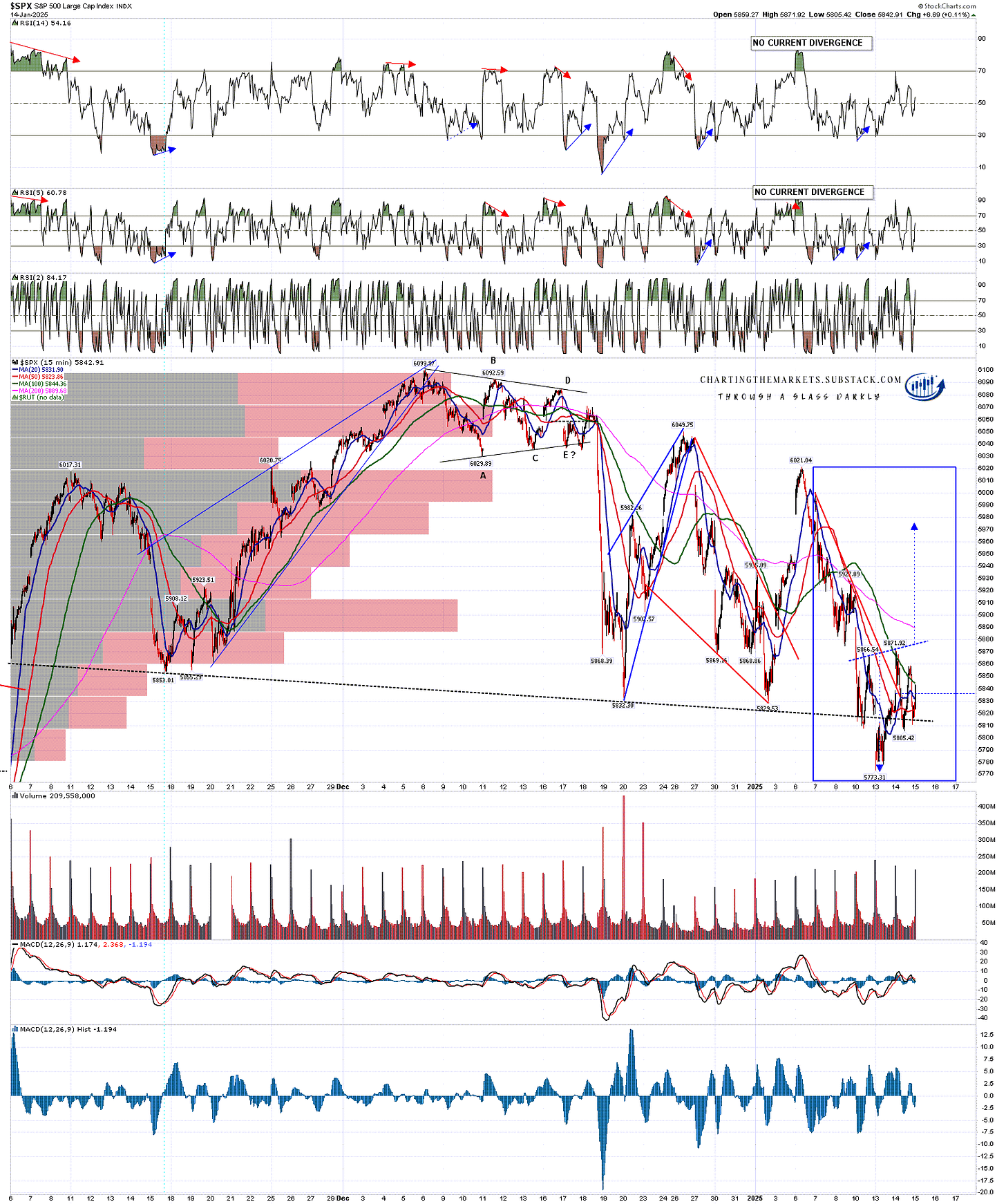

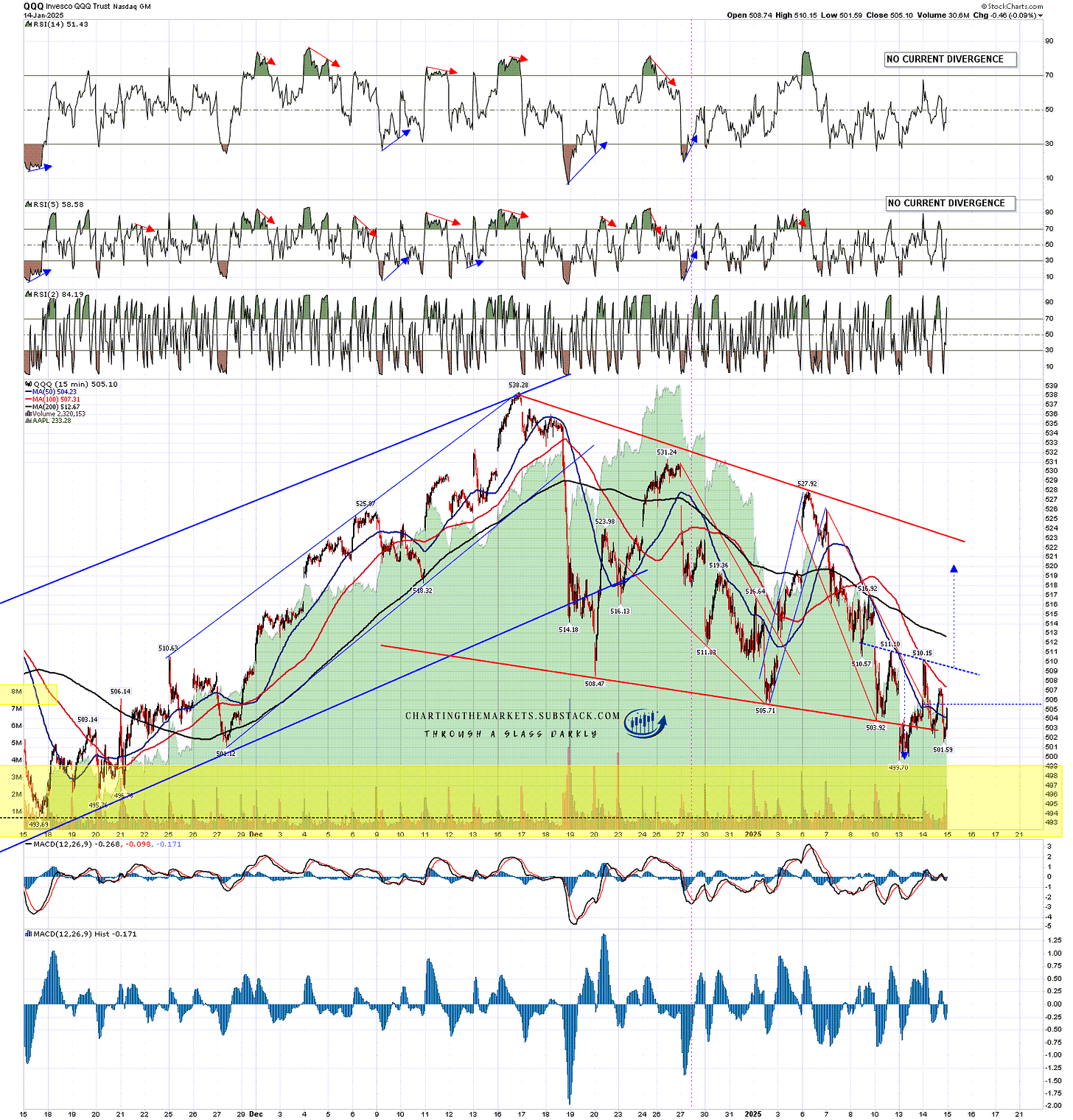

QQQ is getting close to target and I’m expecting it to make a new all time high, ideally in the next week or two.

QQQ 60min chart:

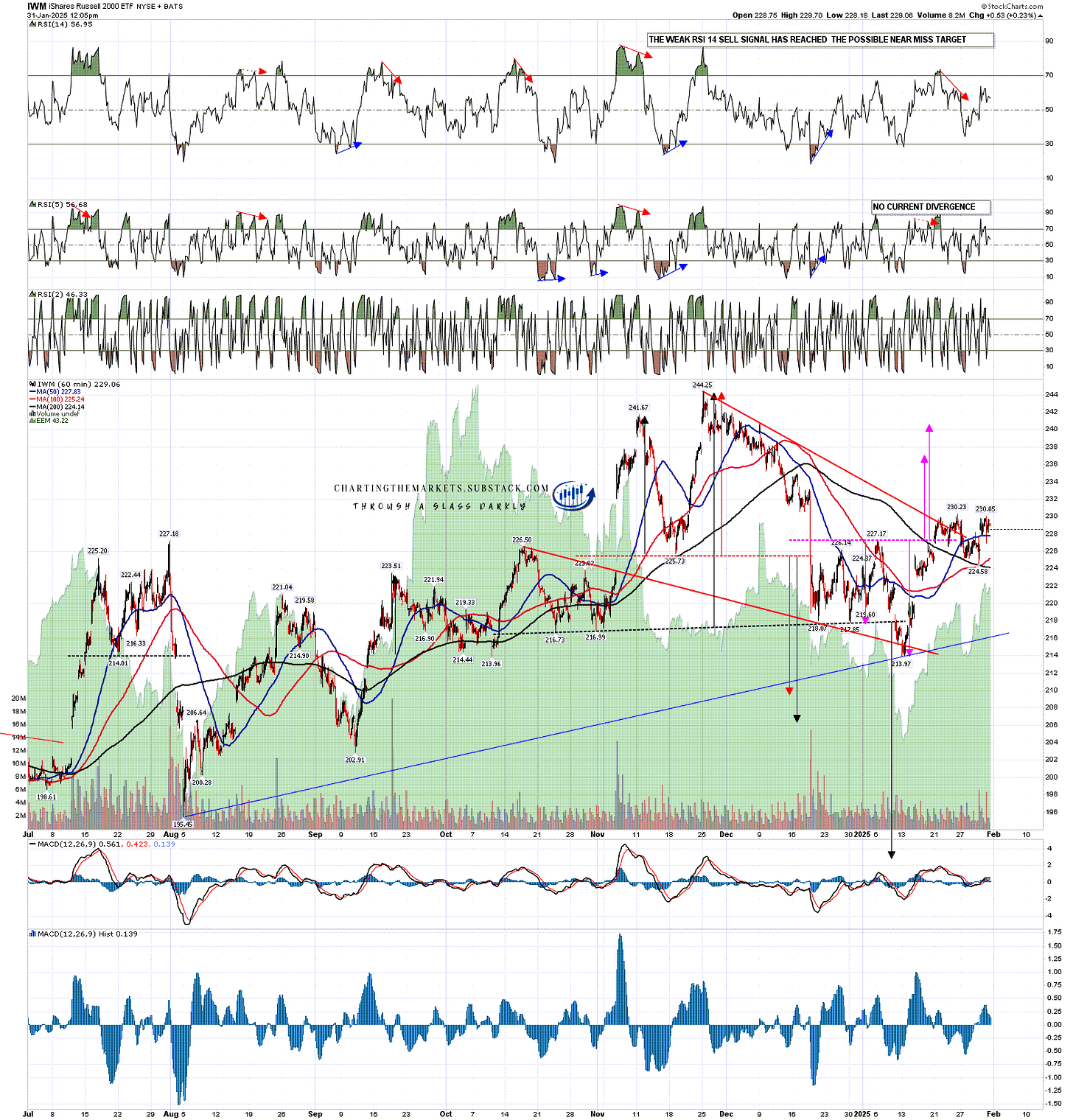

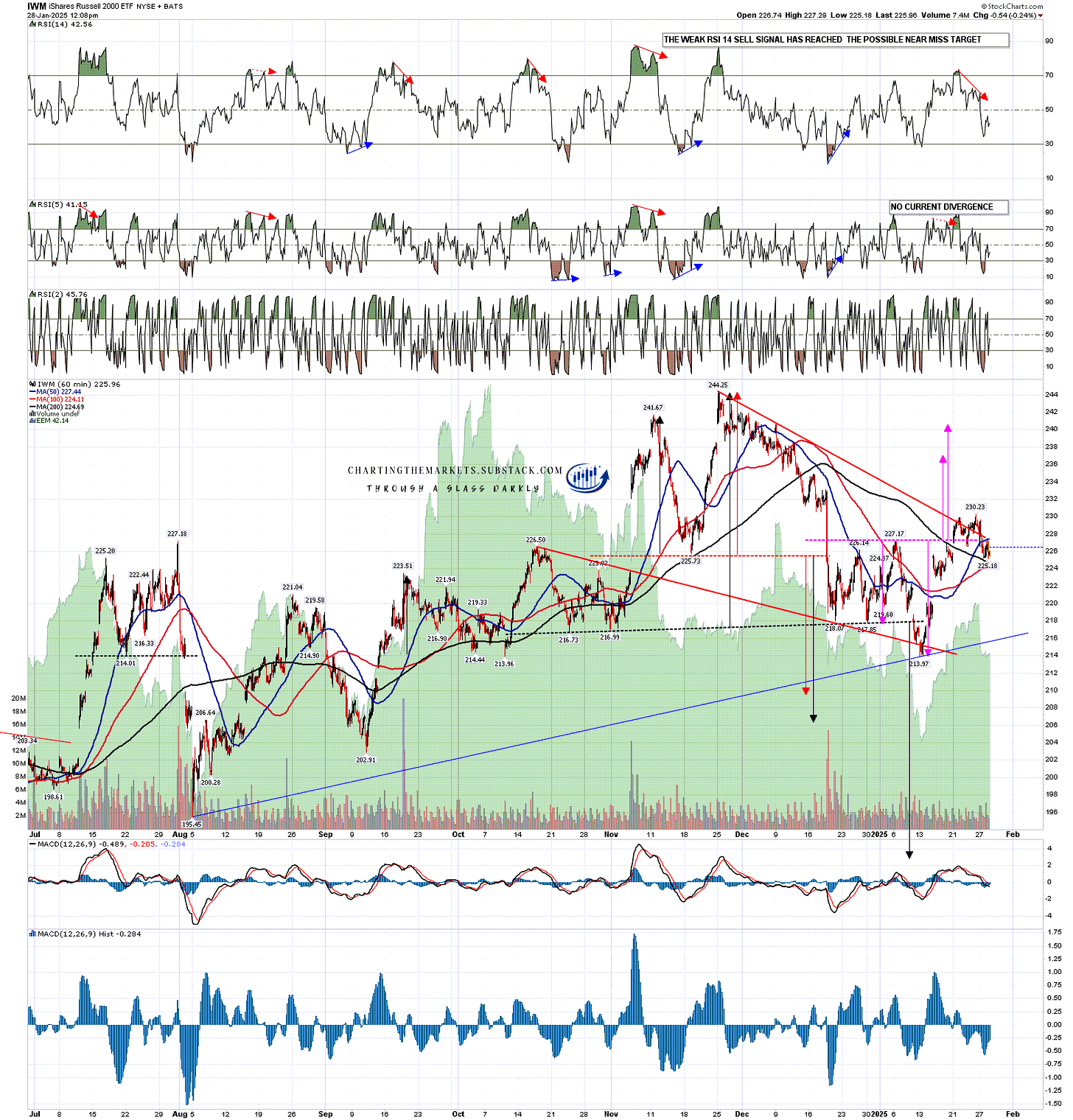

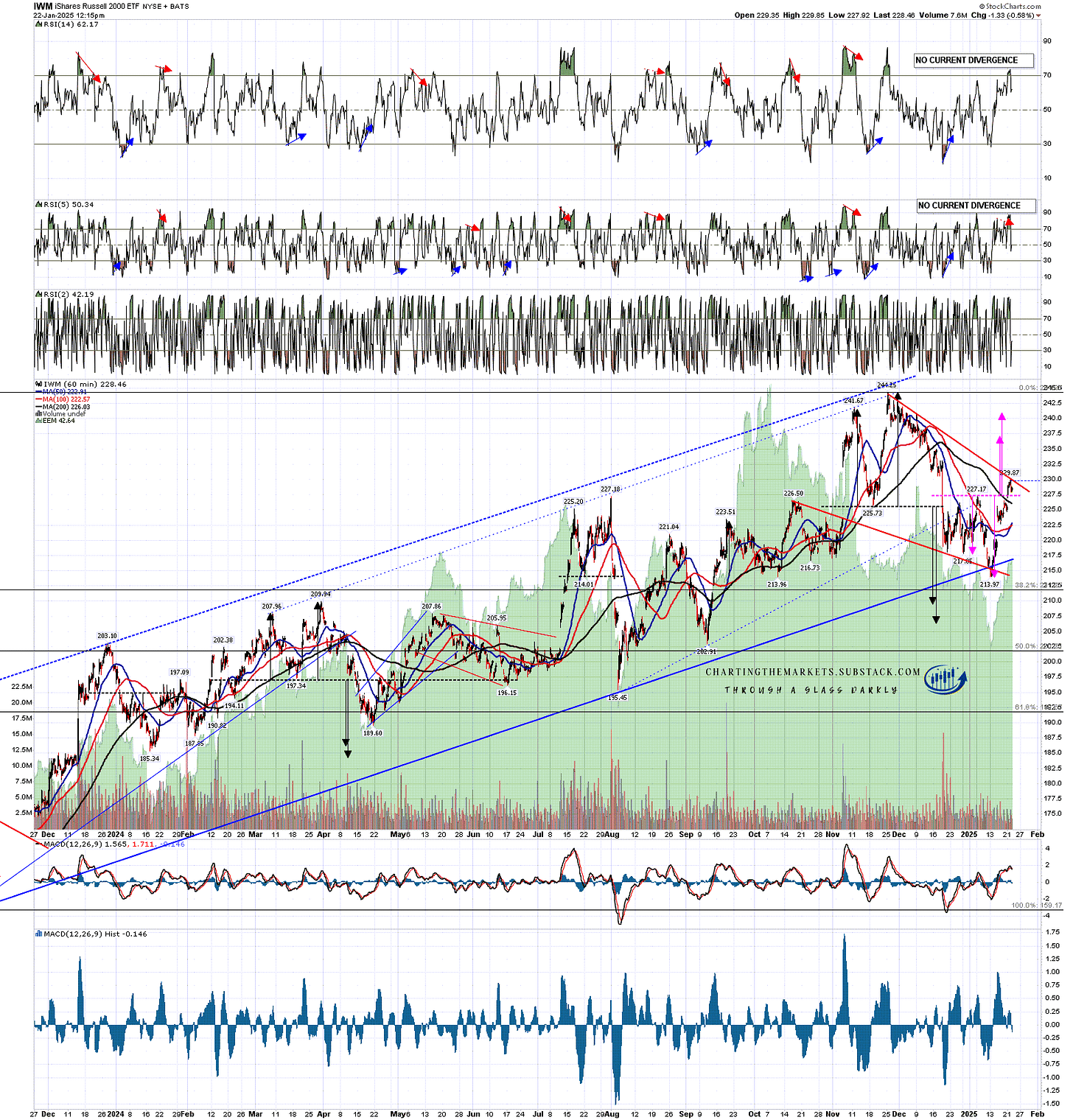

IWM has broken up from the bull flag, but very weakly so far. If we see the other three follow through decently to the upside then this has a shot at making a new all time high too, but it may fail before that.

IWM 60min chart:

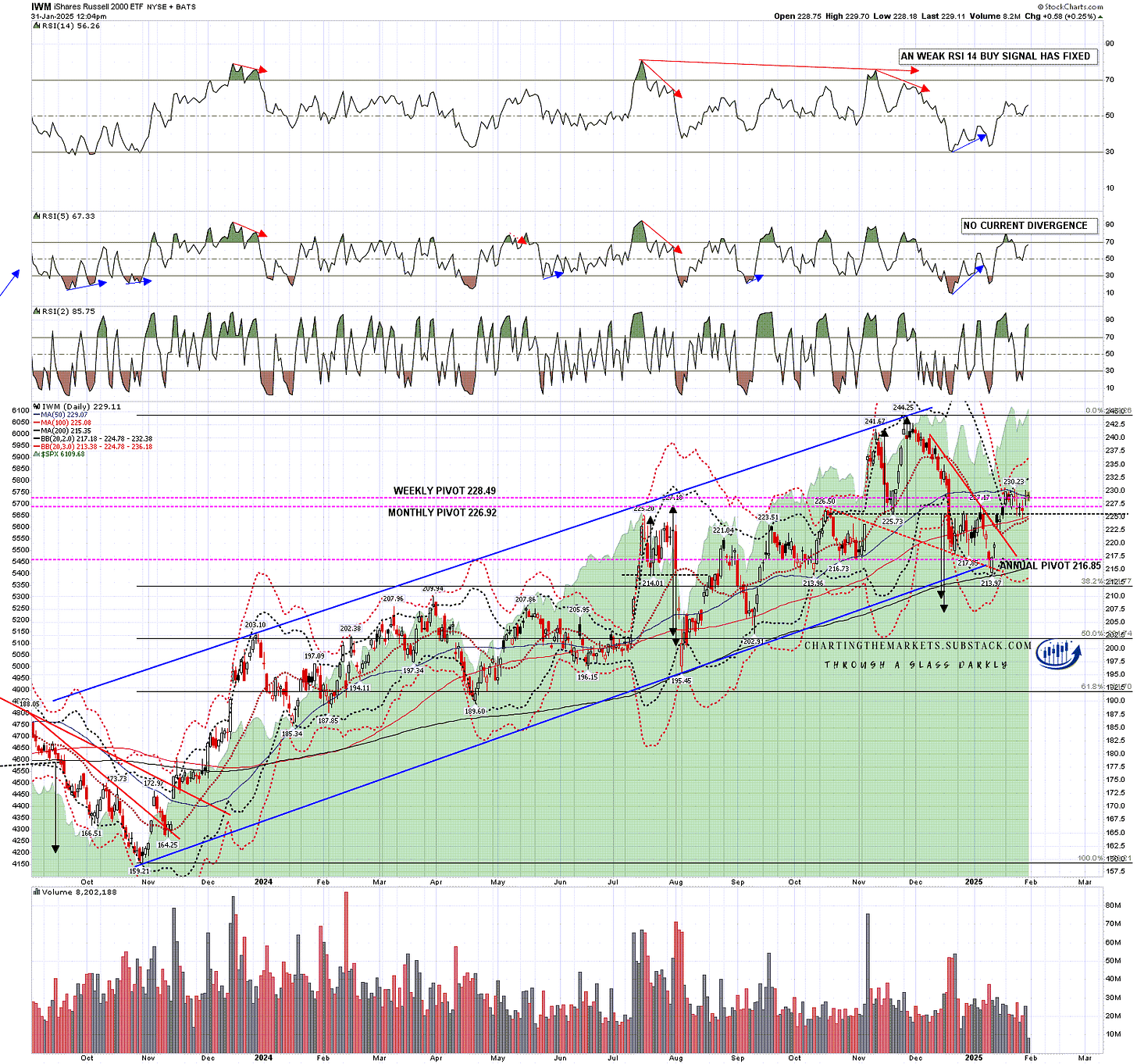

On the IWM daily chart I would note that there is still an open double top target in the 207 to 209.5 area unless IWM is rejecting back into the highs.

On the daily chart IWM recovered back over the daily middle band quickly but has been trying and failing to get back over the 50dma for nine days now, with the latest failure today. If IWM can break and convert that to support then a possible all time high retest has a shot. If not then IWM may just be marking time until another leg down.

IWM daily chart:

There is a possible topping setup forming here on SPX, DIA and QQQ too if it can get a little higher. This is another inflection point and I’m watching it carefully, though negative divergence is currently thin and there’s not much reason to expect a high now. We’ll see how this develops over the next few days.

In the short term though, Monday will lean very bullish and there will be a significant bullish lean to next week. That may deliver a new all time high on QQQ and a break up on IWM.

I’m still leaning towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities. The last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch. I could of course however be mistaken. Everyone have a great weekend. :-)

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.