Last week I was looking at the IHS patterns that had broken up on SPX and NDX with targets at retests of their respective all time highs. We've seen some retracement this week but overall nothing has changed and I am still looking for the same targets, though the retracement has given more form to the current moves and is giving some clues as to where these moves will find resistance.

Starting with ES, where after the grind up on Monday I posted a chart on the subscriber twitter feed at theartofchart.net showing the rising channel established on ES Dec from the September lows, and with a slight adjustment that channel has held into the end of the week with a test of the low before the open yesterday morning. Resistance on that channel is now in the 3600 area so the IHS target is within that range.

ES Dec 60min chart:

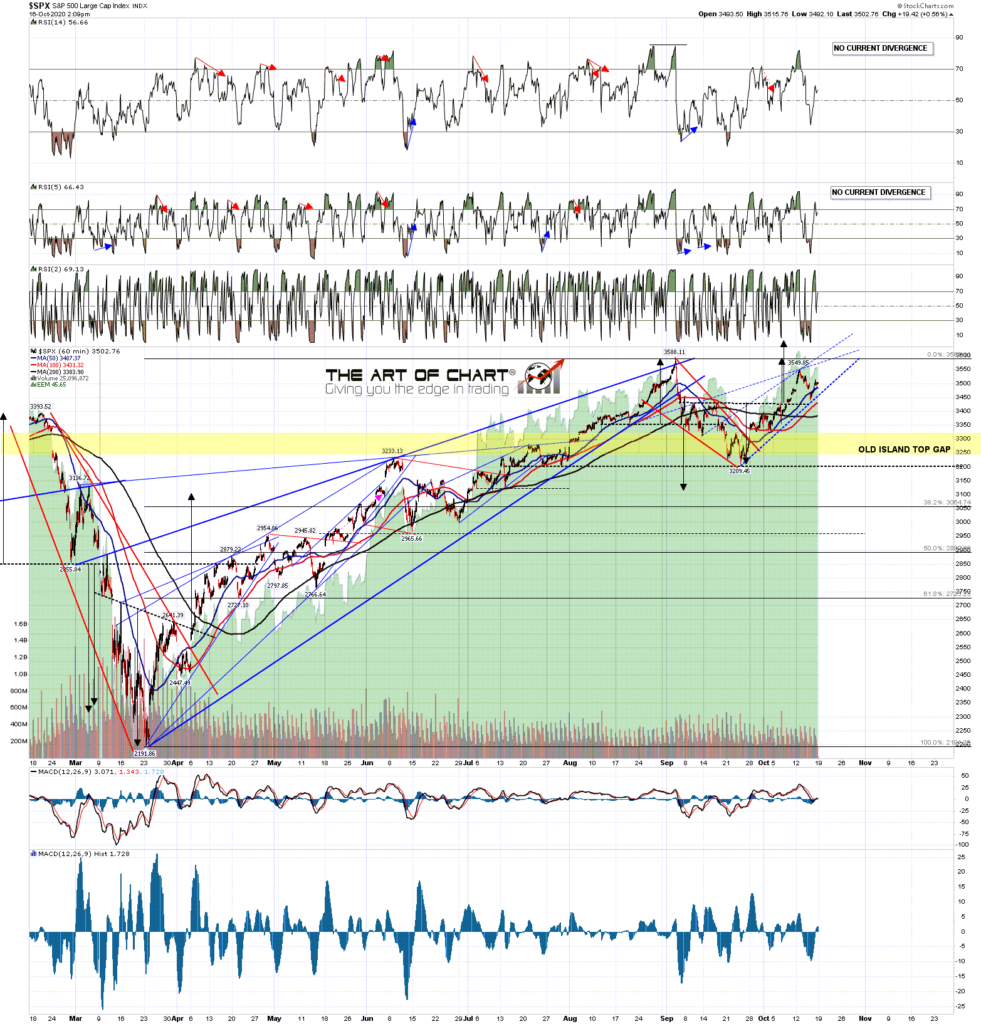

On the SPX daily chart this retracement has been deep enough that by the time the all time high is retested there should be a high quality possible daily RSI 5 sell signal brewing. The daily upper band is expanding into the all time high retest area.

SPX daily chart:

There isn't a corresponding rising channel on SPX but there are a couple of decent rising wedge resistance trendline options that I'll be watching. Either would be a good fit for the retest of the all time high depending on the time taken to deliver that.

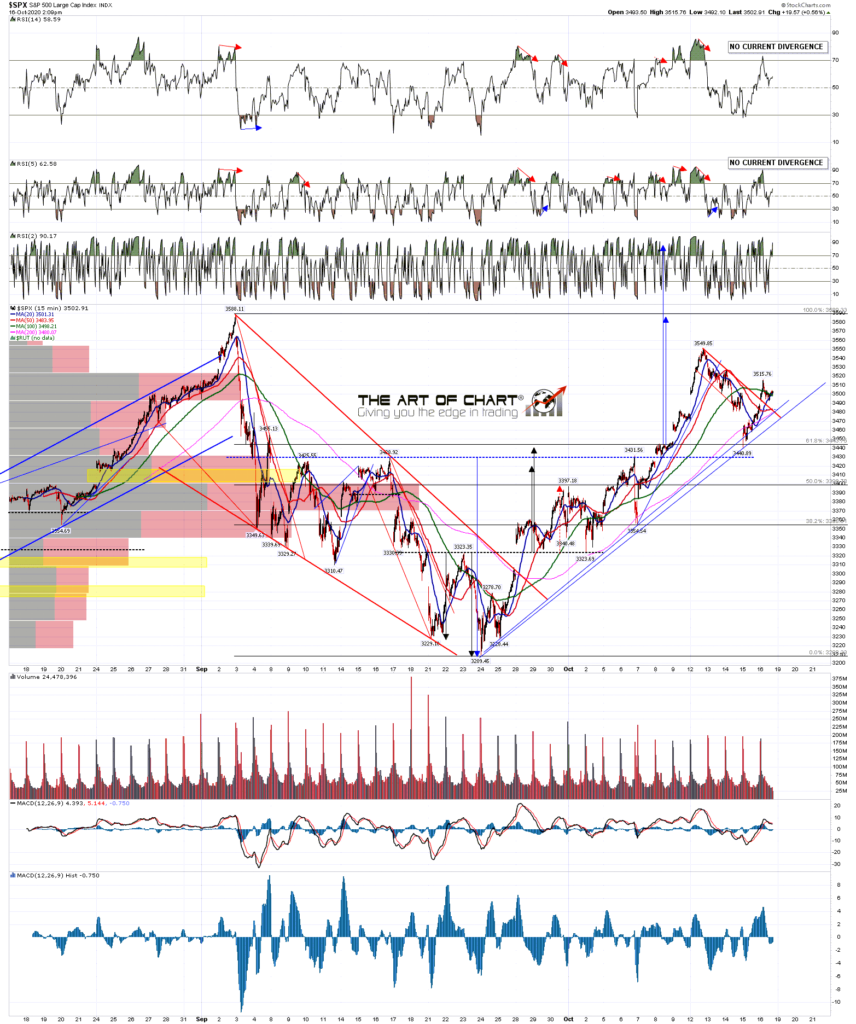

SPX 60min chart:

SPX broke back over declining resistance from the last high today so this retracement low is probably in, though a break below the ES rising channel support, currently at 3455 would open a possible lower retracement low. I'm not currently seeing any reason to expect that though, and this retracement low was close to the IHS neckline backtest that would often be seen with a pattern like this. I would note though that this backtest does increase the probability of hitting the extended IHS target, which is in the 3650 area, as the retracement started about halfway to that target.

SPX 15min chart:

On NDX a decent quality rising channel has been established, though NDX has been lagging since the retracement low so far and declining resistance has not yet been broken.

NDX 15min chart:

Two things to mention about next week. The first thing is something I was talking about on Wednesday morning in my usual premarket video for subscribers, and that is that there are four out of five trading days next week which historically close higher over 60% of the time. That makes next week one of the most historically bullish weeks of the year, and and ideal week to attempt a retest of the all time highs on SPX and NDX. I was saying on Wednesday morning that a couple more weak days into the end of the week could set that retest up very nicely and if we see an AM low on Monday that could run higher into the end of the week. I'll be watching for that.

The other thing is to mention that Stan and I did another trading commodities webinar at theartofchart.net yesterday looking at trades on oil, natural gas and gold. The recording is posted on our October Free Webinars page if you'd like to see that and I'd mention that in future, as these are mainly about designing options trades, we are expanding these to cover everything else we watch, so as other futures, sector ETFs and tech stocks. We are doing out next Big Five and Sectors webinar an hour after the close next Thursday, covering FAANG stocks The sector ETFs and if you'd like to attend you can register for that on the same page. Everyone have a great weekend :-)

No comments:

Post a Comment