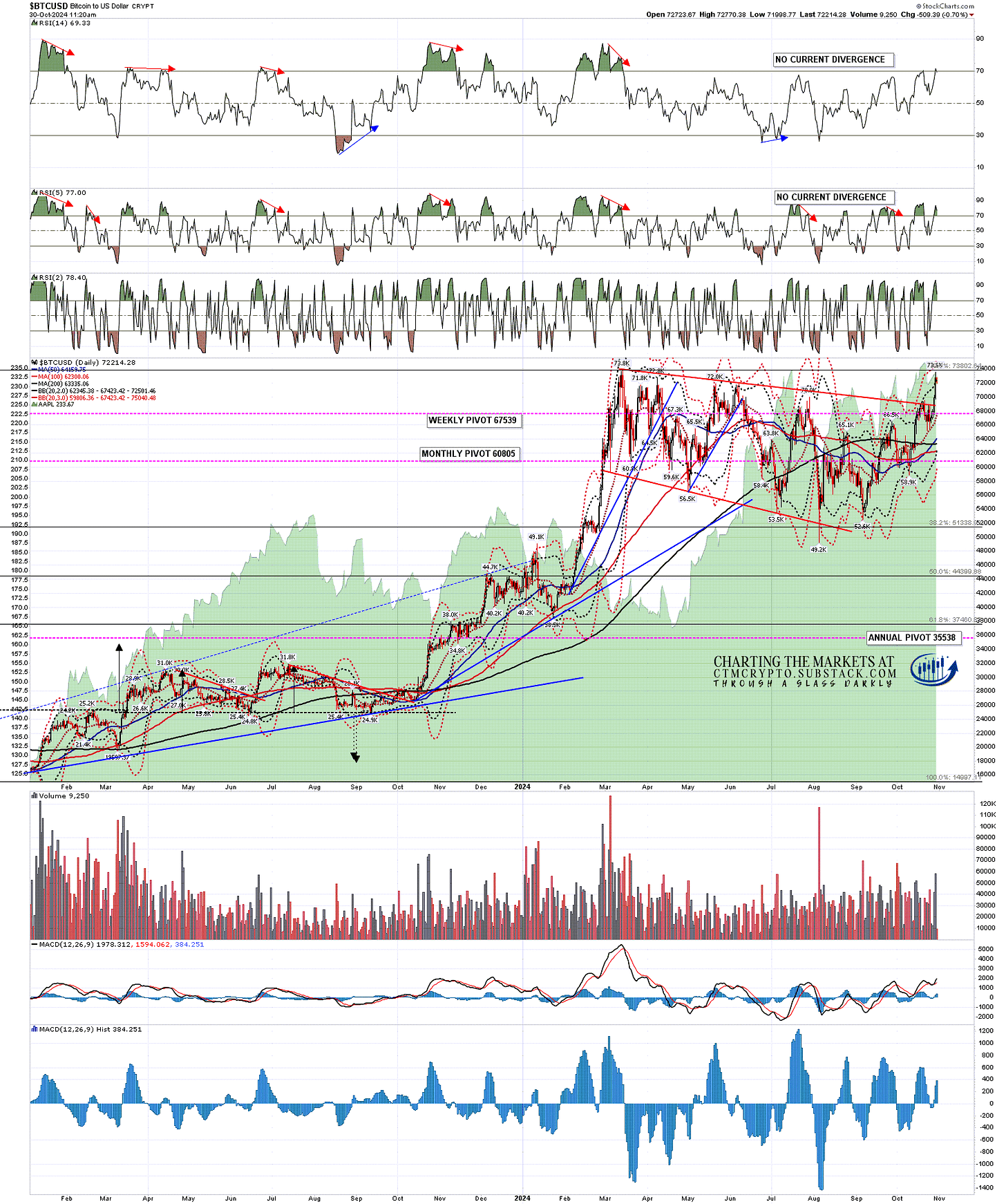

I’ve been looking at the overall bull flag setup on Bitcoin (BTCUSD) for months now, and that has finally broken up and almost delivered a full retest of the all time high at 73,802.641 yesterday, though it fell just short.

My lean is that Bitcoin makes a new all time high soon and continues higher, but there is an alternative scenario, and we could see a hard reversal here instead.

BTCUSD daily chart:

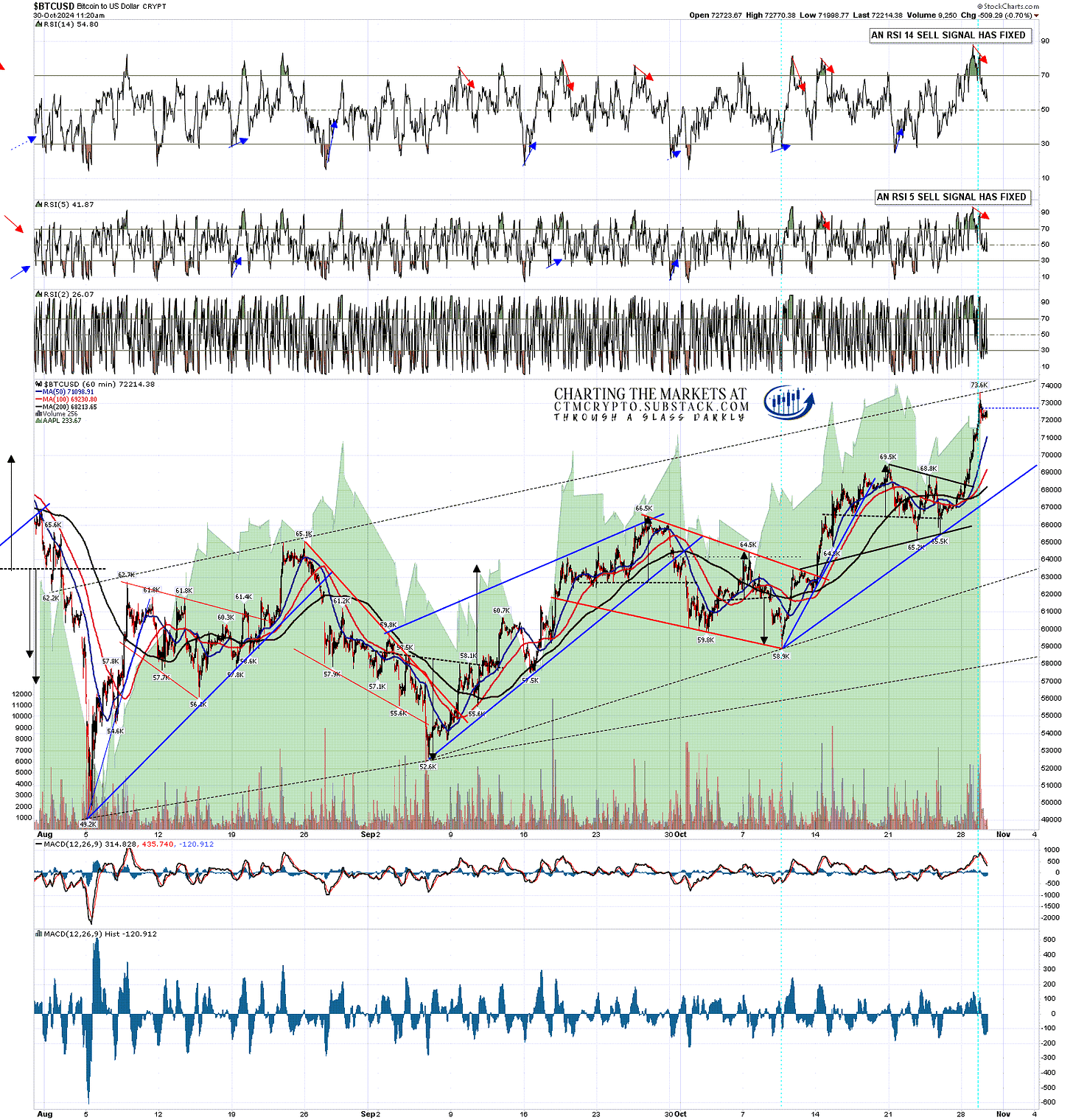

The high yesterday has established a possible three touch resistance trendline on negative hourly RSI 14 and RSI 5 divergence, and hourly sell signals were established on both overnight.

Those sell signals won’t deliver a big reversal but there is a potential setup for that here, and if we see a break below rising support from the 58.9k low, currently in the 67.2k area, then I’ll be taking a possible big reversal here seriously.

BTCUSD 60min chart:

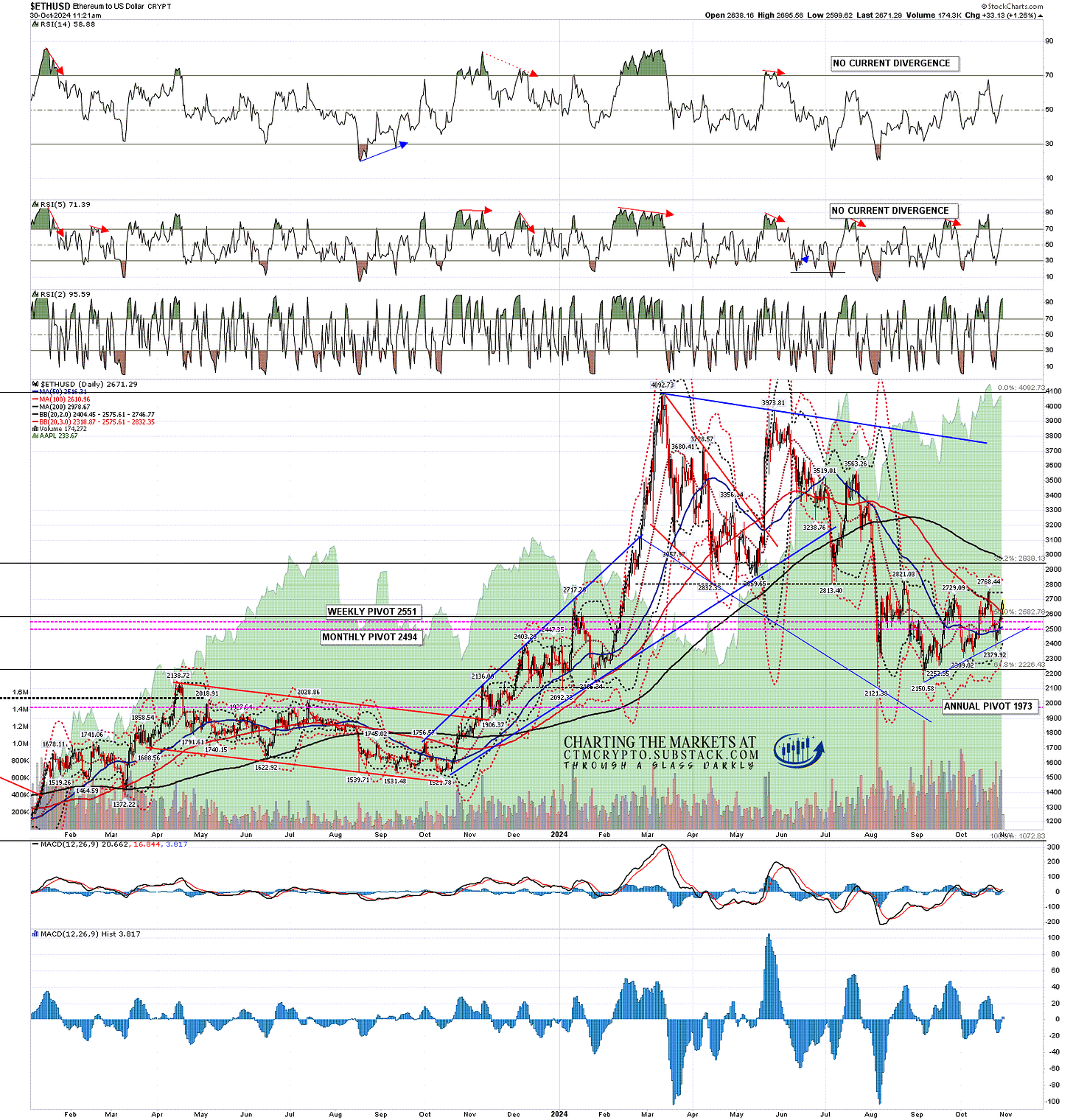

Nothing exciting to see on the Ethereum (ETHUSD) chart, but I will repeat my comment a few days ago that the action on Ethereum since the low in the summer could be a bear flag or triangle forming. If so Ethereum could be setting up for a retest of the August low at 2121.38.

ETHUSD daily chart:

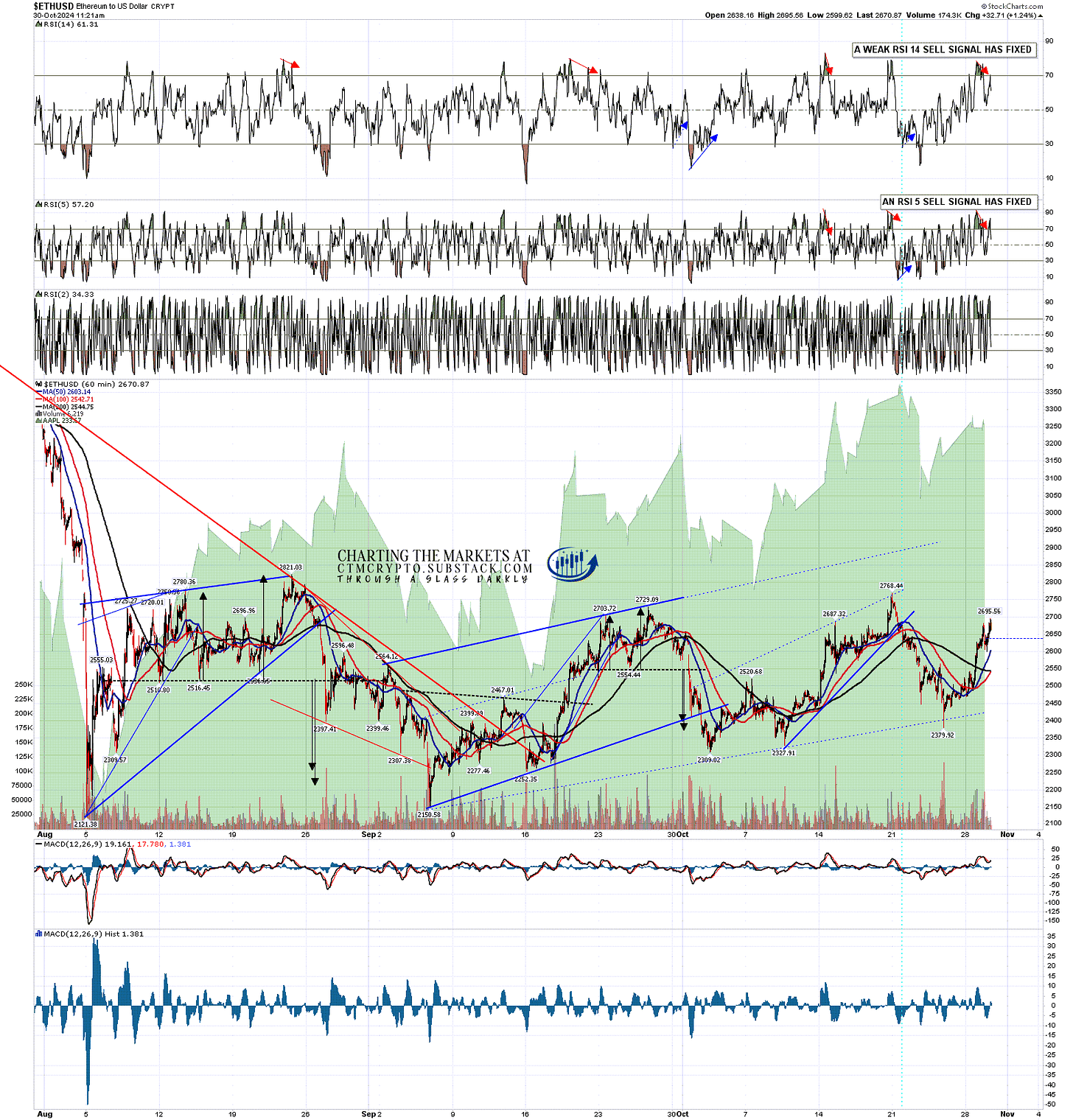

A weak RSI 14 hourly sell signal fixed on Ethereum yesterday and a full RSI 14 sell signal is now brewing. There is a potential small double top setup here that on a sustained break below double top support at 2599.62 would look for the 2503-16 area.

ETHUSD 60min chart:

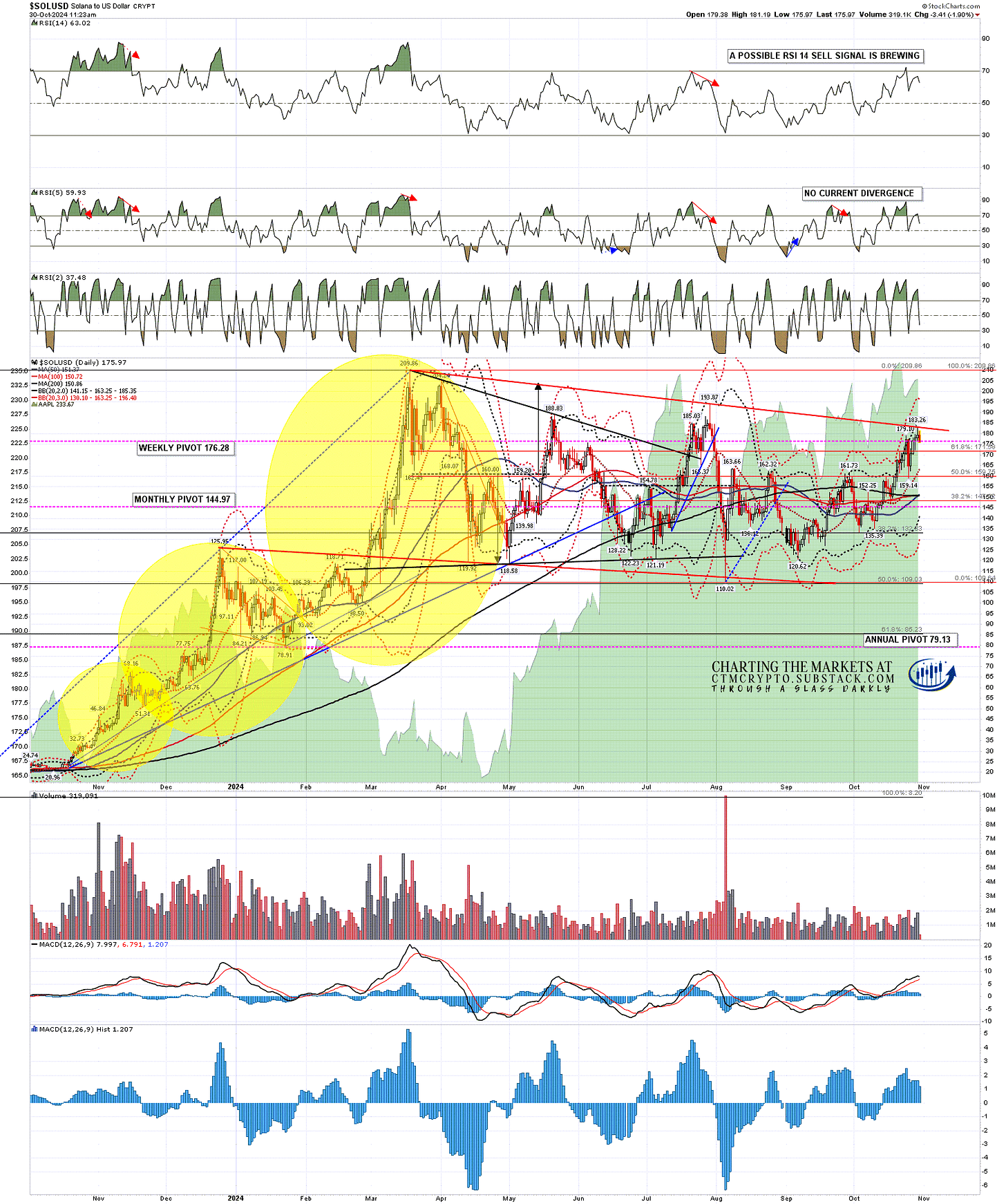

I’ve been looking for a test of the main bull flag resistance on Solana (SOLUSD), and we saw that at the high yesterday. As I mentioned on my last post was likely, that test has set a possible daily RSI 14 sell signal brewing.

SOLUSD daily chart:

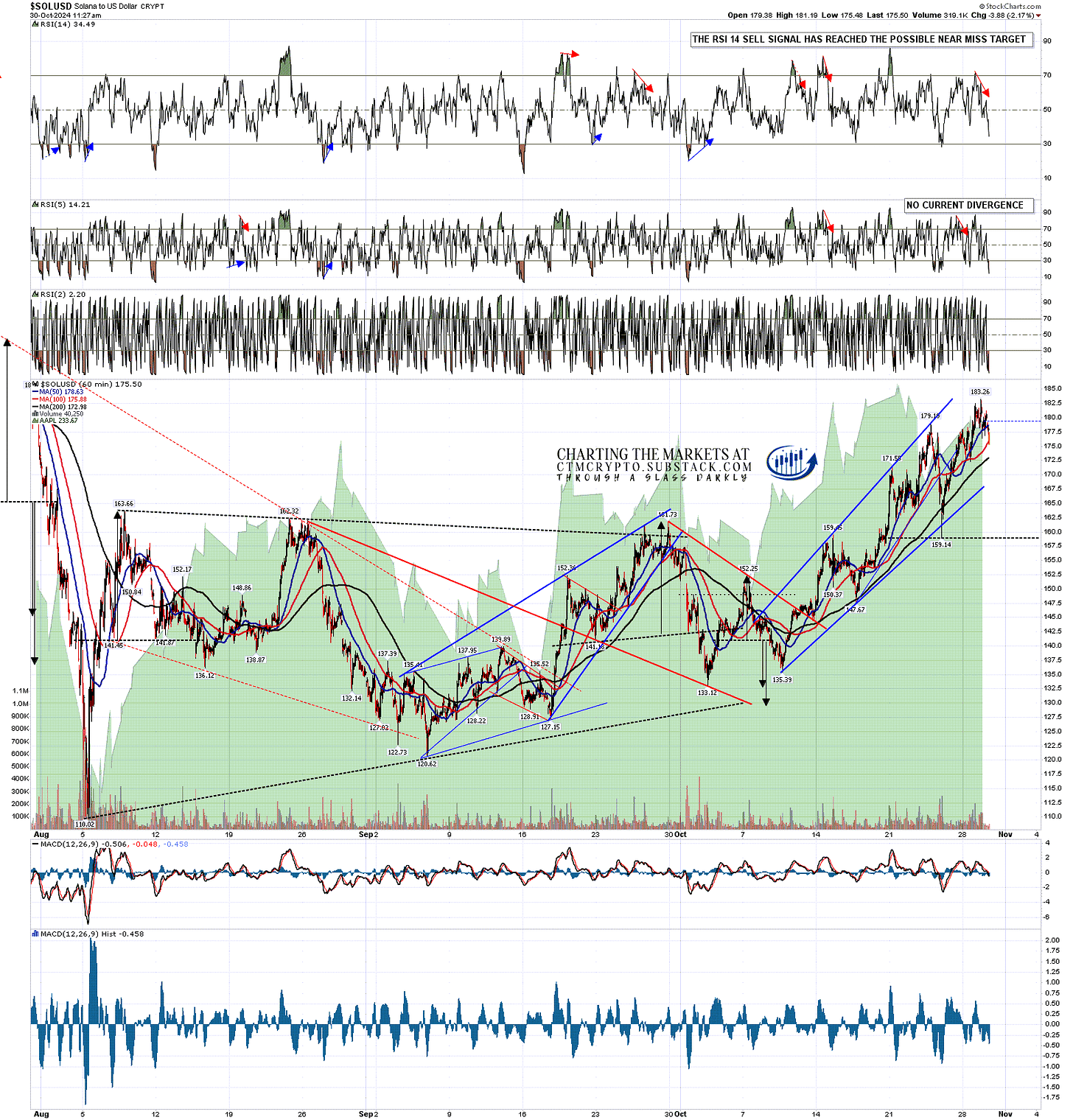

An hourly RSI 14 sell signal fixed on Solana after the high yesterday, and that has already reached the possible near miss target.

As I mentioned in my last post, there is a possible double top setup here on Solana, and on a sustained break below double top support at 159.14 the double top target would be in the 135 to 139 area.

SOLUSD 60min chart:

This isn’t a very strong reversal setup, but it’s not bad either. In that it resembles the reversal setups at the May high at 188.83, and the July high at 193.87, both of which I was watching at the time, and both of which delivered large reversals. That could happen again here so until we see Solana and Bitcoin make further new short term highs with confidence, I’ll be watching this with great interest.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment