Solana (SOLUSD) is the pattern leader on Crypto here, so I’ll start with that today.

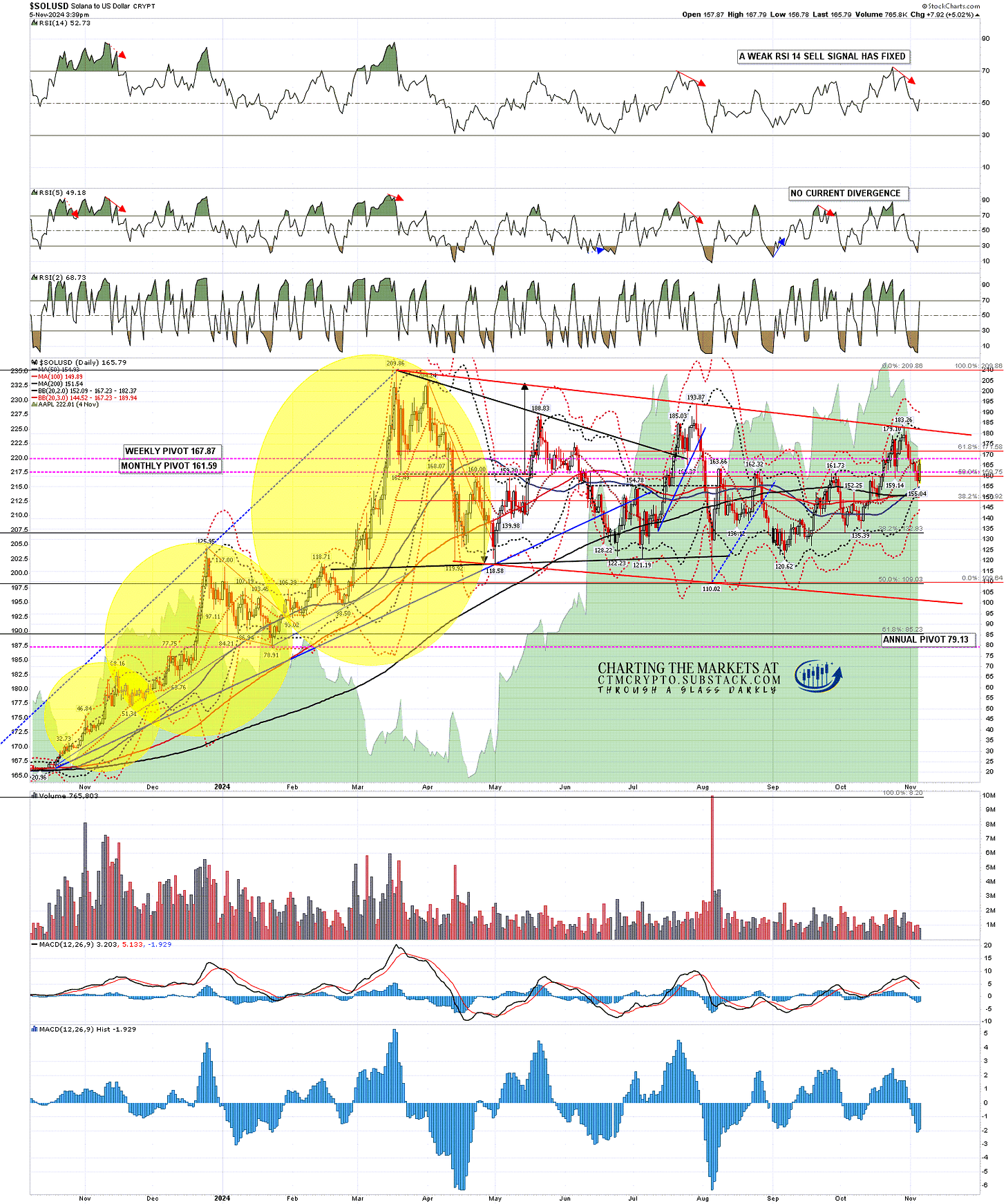

I was looking at the possible inflection point on Solana last week as it hit main bull flag resistance and reversed there, and so far that has been playing out in a way that is suggesting that we might see that possible big reversal that I was looking at.

SOLUSD daily chart:

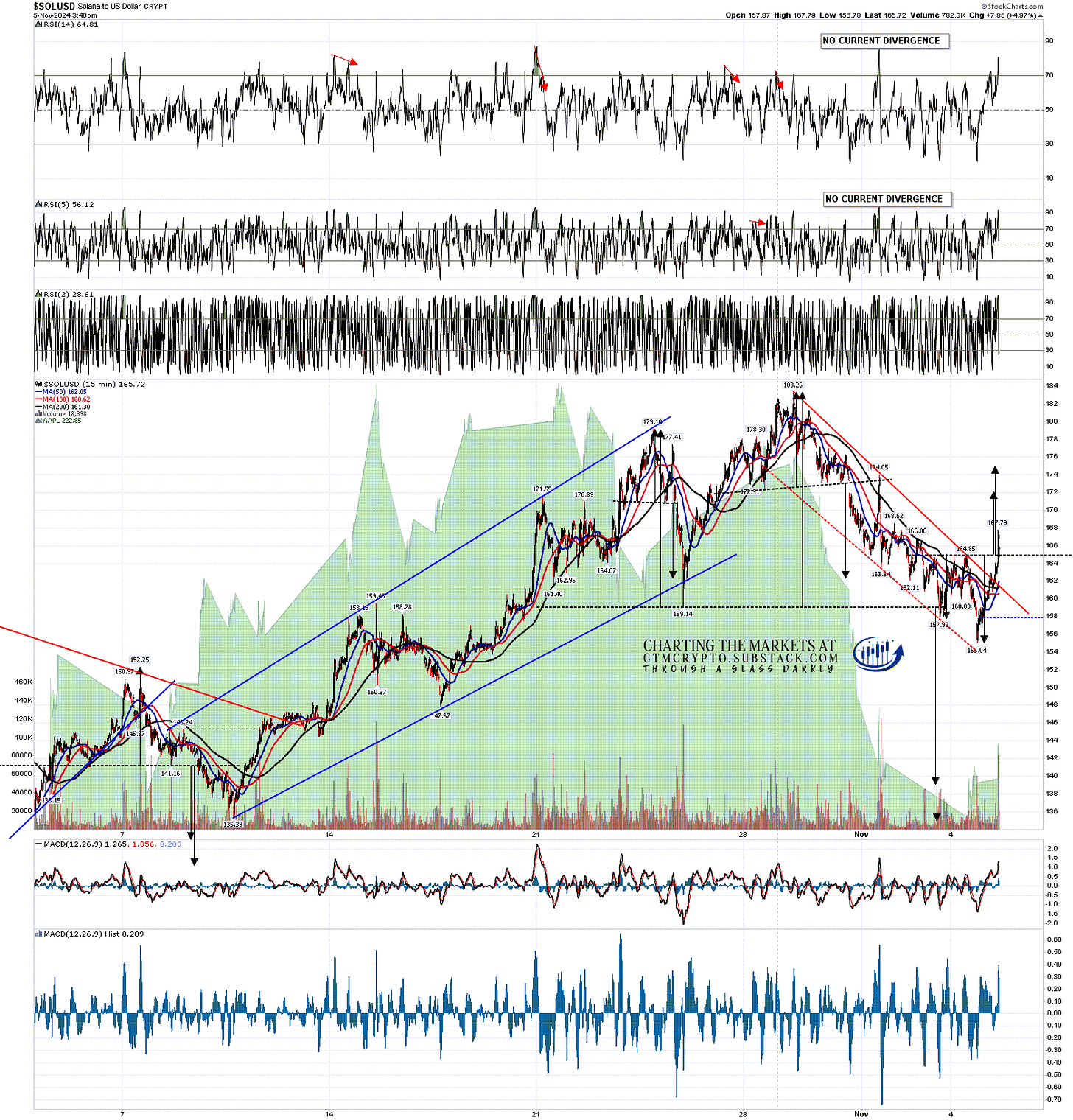

On the 15min chart Solana has broken the possible double top support I was looking at last week with a target in the 135-9 area, and that leaves us with a binary setup here where SOLUSD will likely either head down to that target or reject back up to retest the last high at 183.26.

In the short term I was looking in my premarket video this morning at the possible double bottom that formed yesterday on Solana that on a sustained break over double bottom resistance at 164.85 would look for the 172-5 area. As I write, that double bottom is breaking up and Solana is backtesting the daily middle band.

SOLUSD 15min chart:

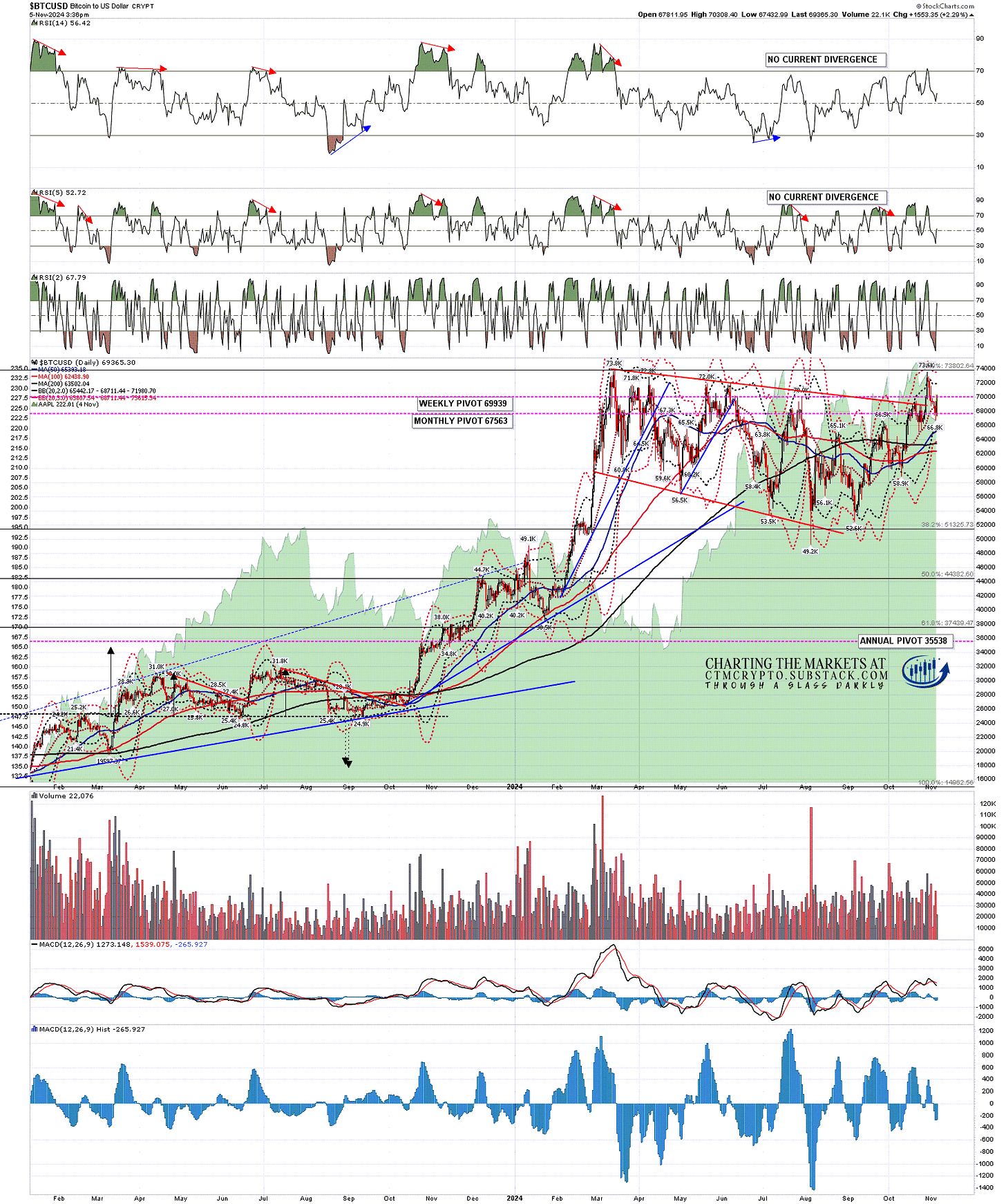

On Bitcoin (BTCUSD) we have seen a break back under the daily middle band, currently at 68,740, though not with great confidence, and an attempt to break back over that today that may be successful.

BTCUSD daily chart:

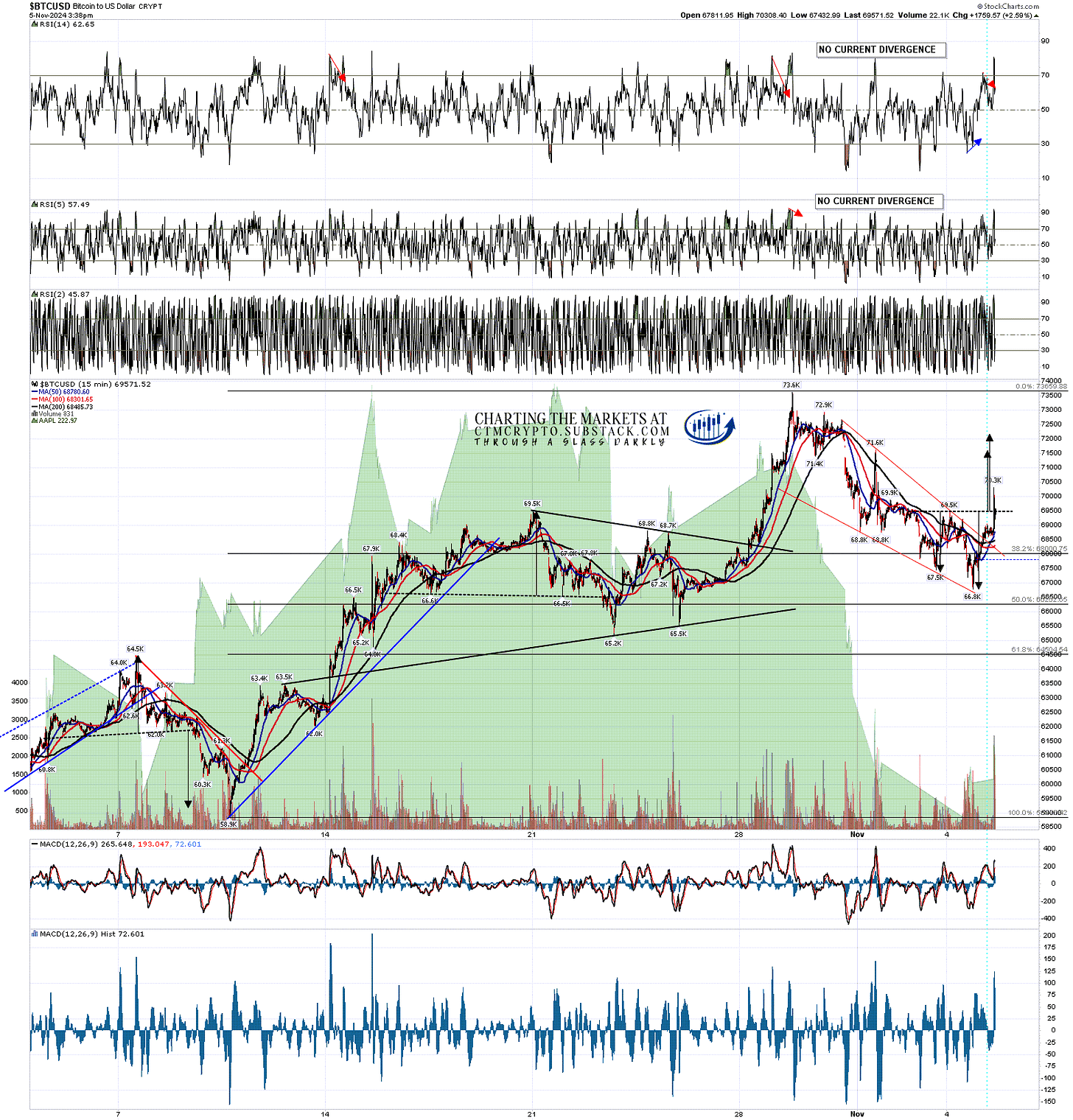

On the 15min chart Bitcoin formed a small falling wedge that has broken up and a small double bottom has formed that on a sustained break back up over double bottom resistance at 69.5k, the double bottom target would be in the 71.5k to 72.2k area. Again, as I write, that double bottom has broken up.

BTCUSD 15min chart:

Not much to add on Ethereum (ETHUSD) here other than to say the obvious resistance is at the 50dma, currently at 2529, and the daily middle band at 2554/5.

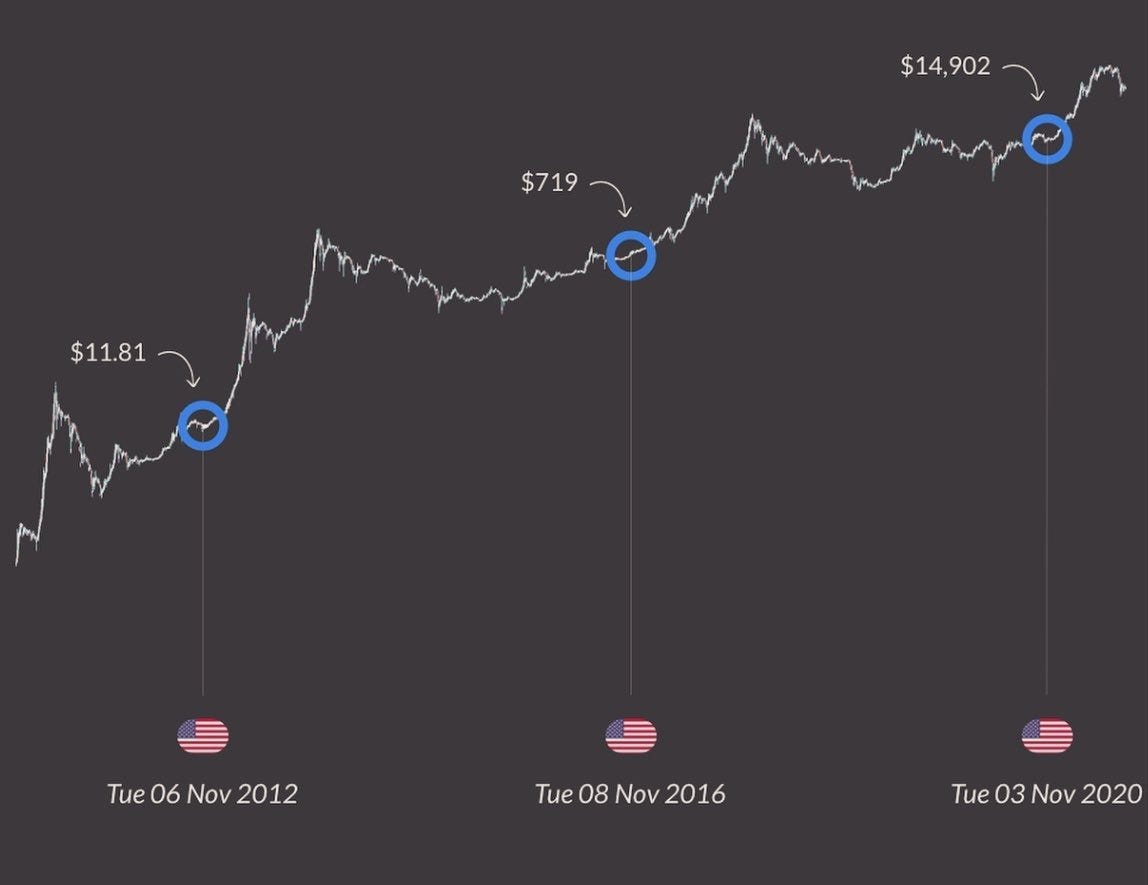

Instead of an Ethereum chart I’ll repost an interesting looking chart from Quinten Francois on twitter noting that the last three presidential election all set Bitcoin price floors that have never subsequently been broken. That’s not necessarily significant, but it is interesting.

BTCUSD vs Presidential Elections 2012-20:

So what’s the takeaway here? Well before the open this morning I was talking about the decent looking possible double bottoms on Bitcoin, Solana, SPX and DIA. Those have broken up on Bitcoin and Solana, and the ones on SPX and DIA are heading that way at speed at the moment. We could see a strong rally across the board today and, subject to the huge news week this week, that could take all of these back to last week’s highs.

I would add that a lot of people have been building up the presidential election as Trump good for Crypto & Harris bad for Crypto. I personally don’t think that Trump would be particularly great for Crypto or that Harris would be bad. I think that either would likely be good, but if there is a strong perception that a Harris win would be bad for Crypto, then we might have a short term sharp decline coming this week if she wins.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment