Happy New Year everyone and I hope you had a great holiday. :-)

Just a few comments on the overall picture going into this year before I get started on the shorter term picture. Alan Greenspan famously stated that it was hard to identify speculative bubbles and I disagree. It isn’t hard to identify speculative bubbles, what is hard is to identify is when they are going to burst.

Plainly there is a speculative bubble now in progress in Tech and AI. I was reading a comment this morning that NVDA’s market capitalisation is now higher than the combined market capitalisations of Europe’s largest twenty companies. The takeaway of the writer was that Europe is increasingly irrelevant. My takeaway was that European stocks currently look much better value than US Tech stocks.

As it happens world stocks excluding US were up about 29% in 2025 and US stocks were up about 16%. I suspect that US stocks will relatively underperform in 2026 as well. Berkshire Hathaway has now been a net seller of (mainly US) stocks for twelve consecutive quarters, and they are very smart & long term money.

Given that it is hard to predict when bubbles burst I’m not giving this bubble much immediate thought. As and when it bursts there will generally be plenty of warning signs, and the topping process tends to take a while, so I’ll be watching carefully and keeping you posted as the picture evolves. Until then I see nothing compelling to suggest that a major market decline is imminent and, until that changes, I won’t be talking about it much. As we see possible topping setups form I will be paying more attention to it.

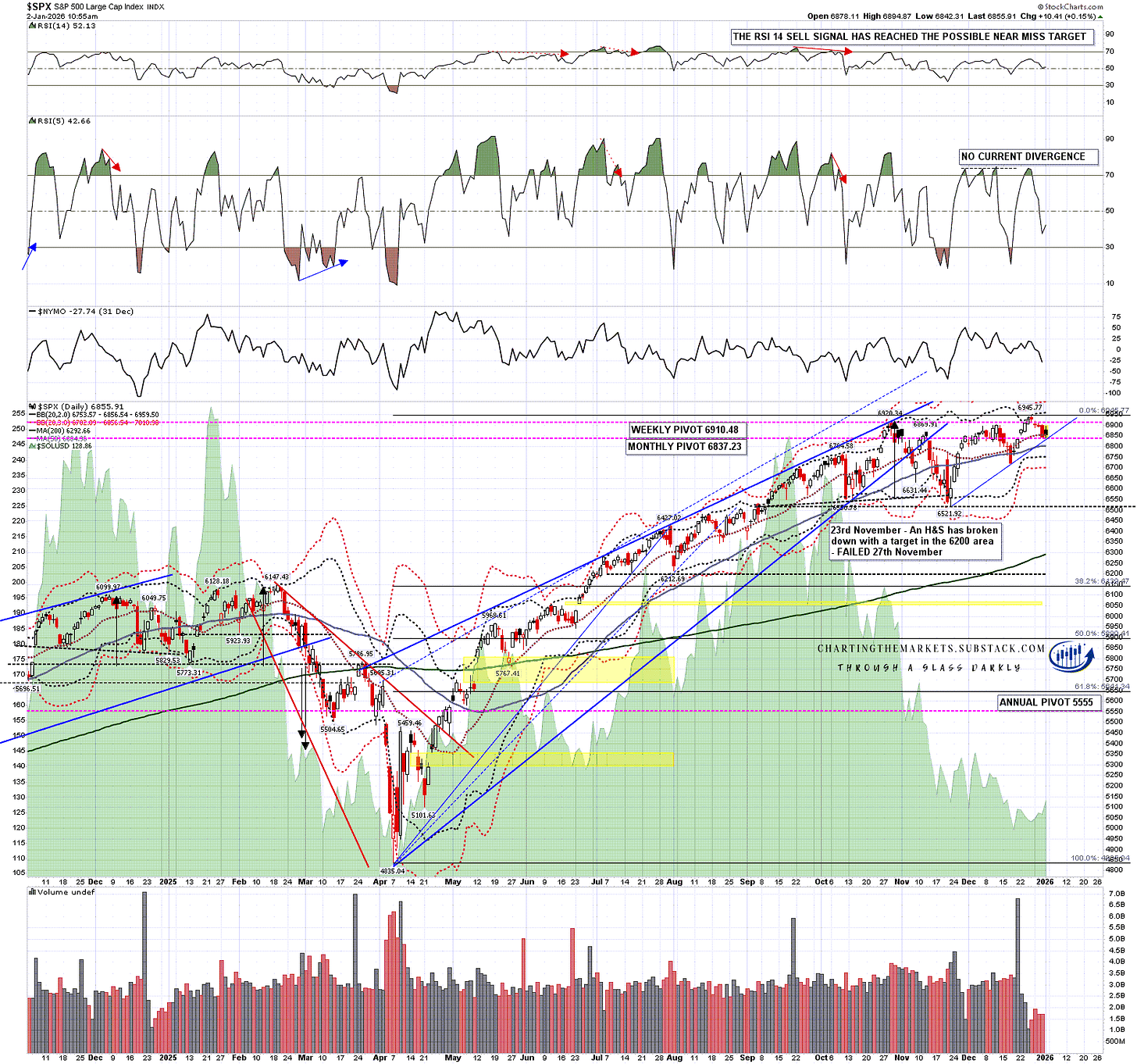

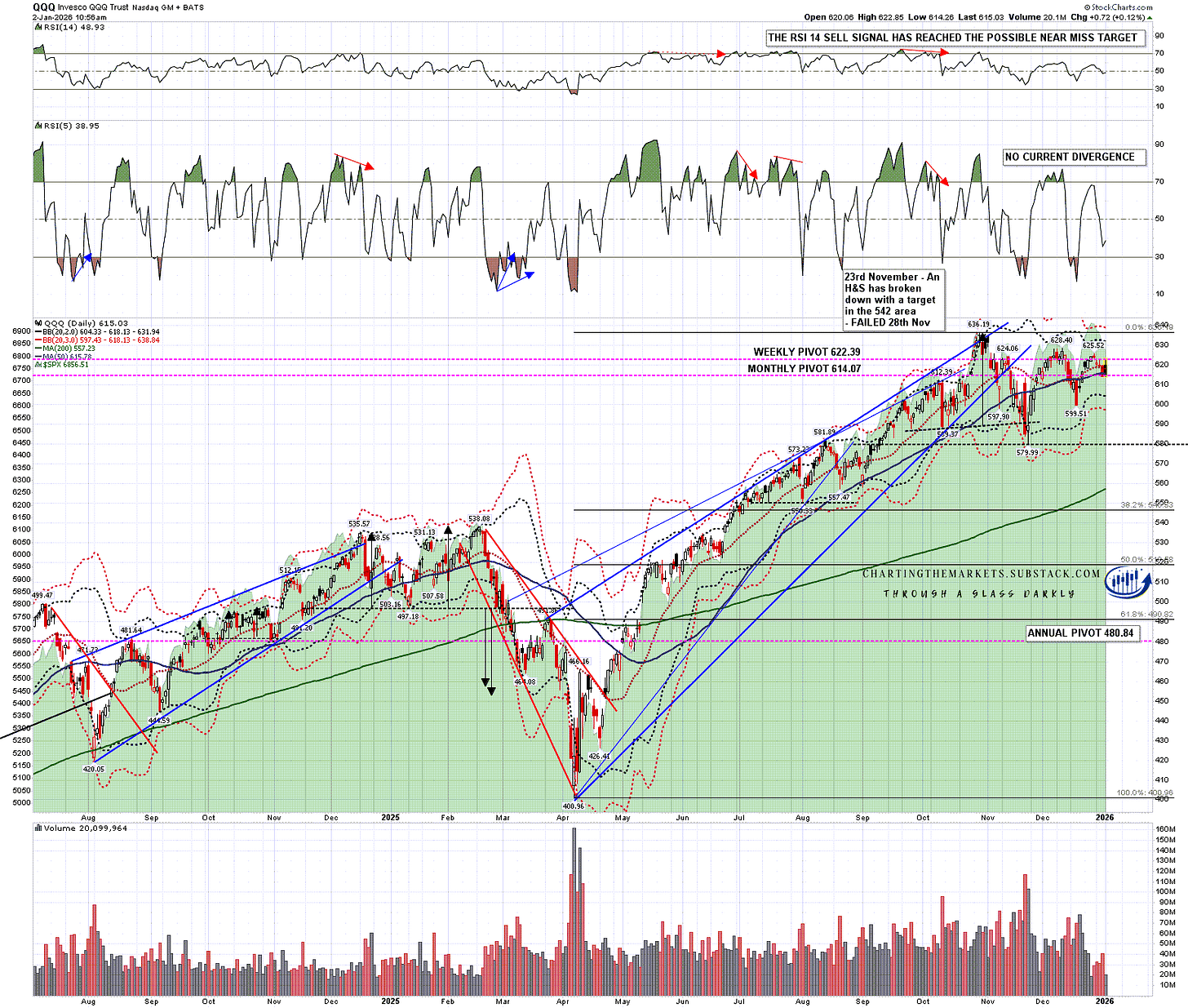

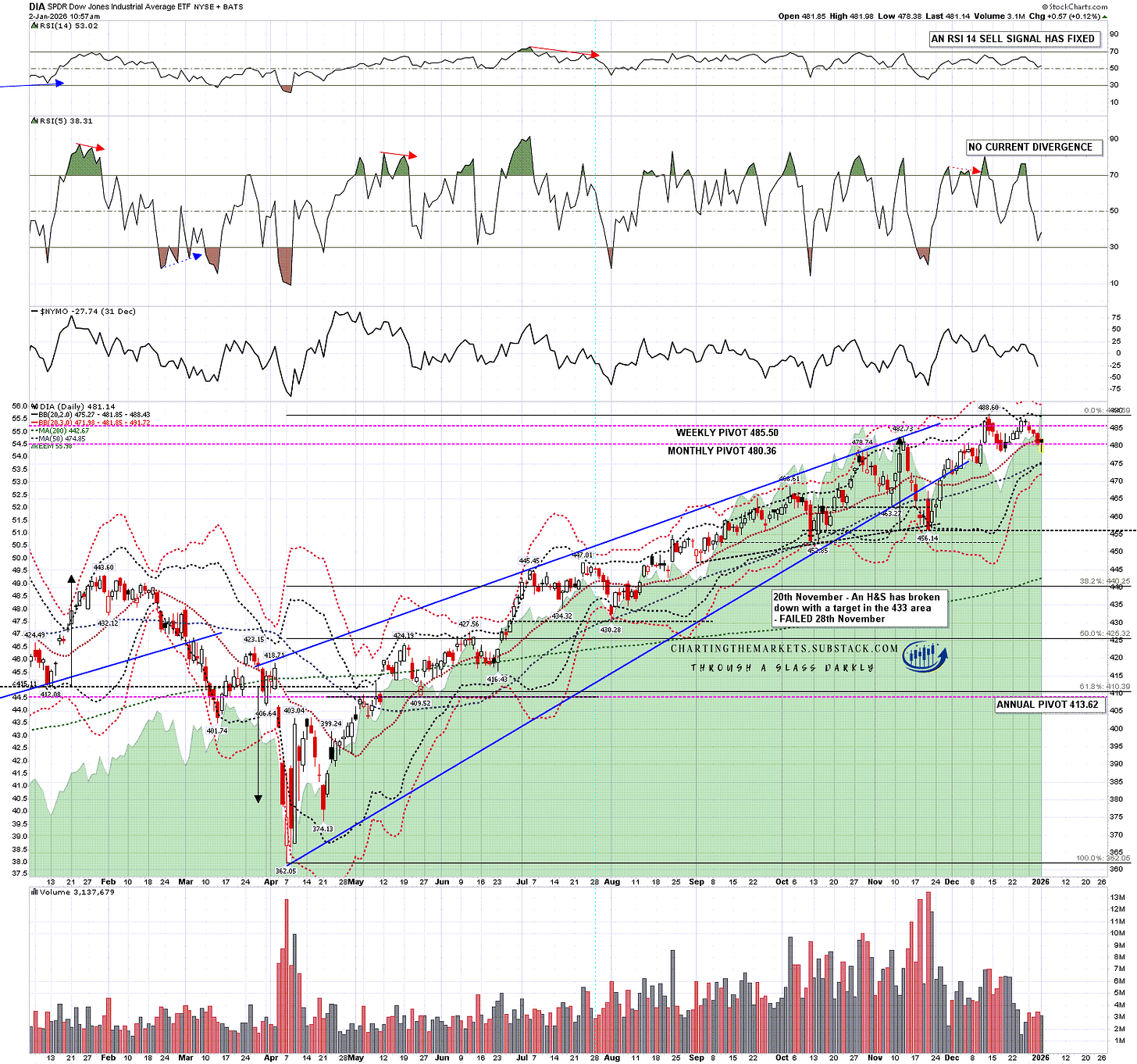

In my last post on Monday 19th December I was looking for a setup for possible new all time highs on SPX, QQQ, DIA and IWM in the Santa rally, and the results were a mixed bag.

SPX made the IHS target and a new all time high, but QQQ and DIA are still struggling towards their IHS and double bottom targets respectively and on IWM the IHS failed and IWM made a new low for December on Wednesday.

Wednesday was expected to close red but went further than I expected, delivering clear closes below the daily middle bands on SPX, QQQ and DIA, with IWM already having broken below at the end of last week.

On SPX the new all time high has of course set up a possible double top.

SPX daily chart:

On QQQ there was a clear close below the daily middle band on Friday and a close on the 50dma:

On DIA there was another clear close below the daily middle band on Wednesday.

DIA daily chart:

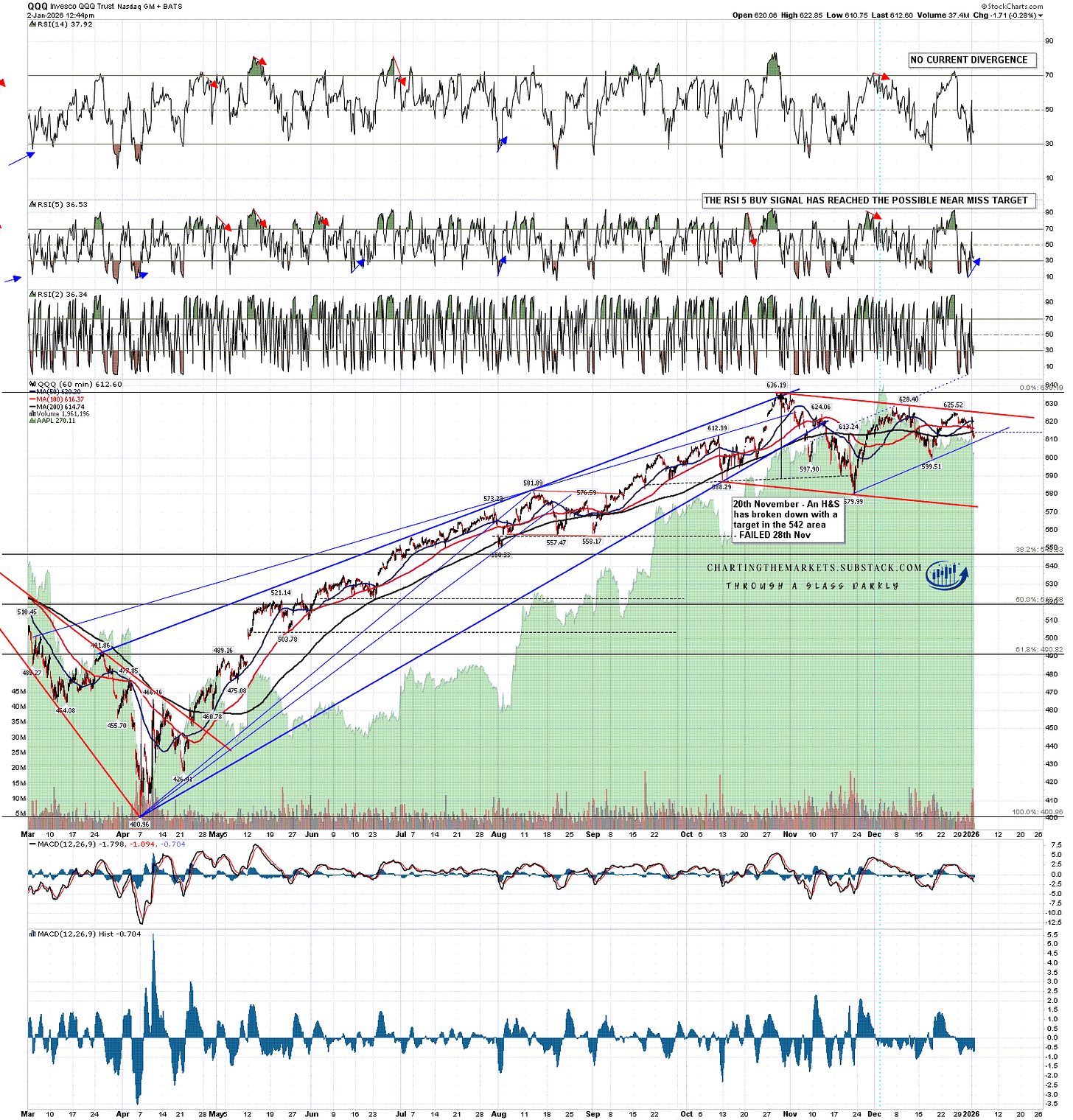

Now when you see a series of daily middle band breaks like this, one of two things will generally happen. Either there will be a swift rejection back above those daily middle bands, generally on the next trading day but sometimes on the day after, or the middle band converts to resistance and we see continuation lower.

Which will happen here? Well in my premarket video this morning I gave 75% odds that we would see rejection higher, mainly based on the pattern setup and positive divergence on the hourly charts.

Hourly RSI 5 buy signals have now fixed on all of SPX, QQQ, and DIA, and these tend to be good signals, though the signal on QQQ has already reached the possible near miss target.

The patterns look decent though. If the current low holds then there is a high quality descending triangle forming on DIA (not shown), and a decent quality triangle setup forming on QQQ.

I would note though that the triangle is forming within an overall bull flag channel and on a further break down the obvious target would be that channel support currently in the 572 area.

QQQ 60min chart:

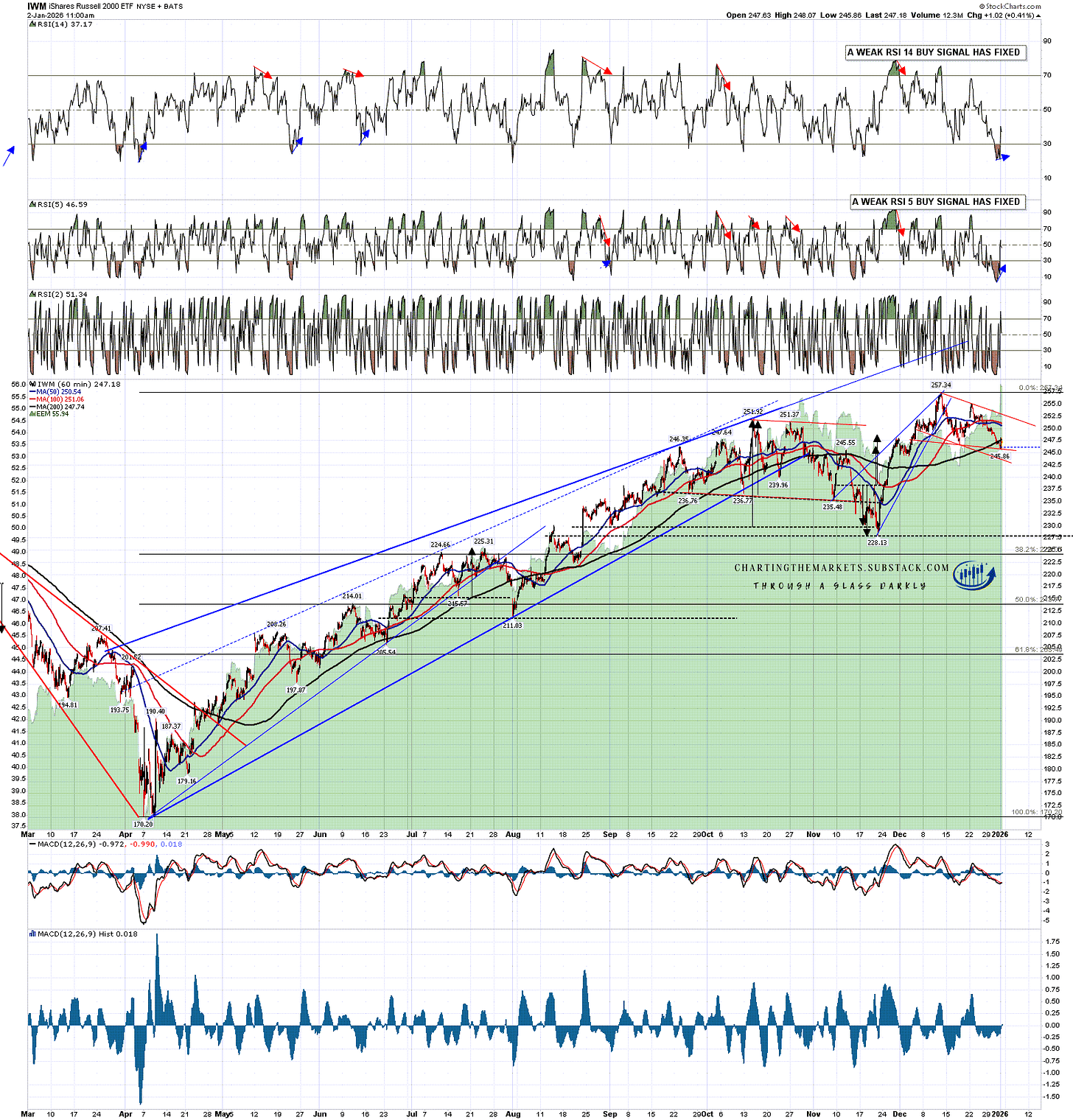

On IWM both RSI 14 and RSI 5 buy signals fixed this morning, and there is a high quality possible falling wedge bull flag forming. Another nice bullish setup at the time of writing.

IWM 60min chart:

Overall I still like the rejection back over the daily middle bands scenario better and am still thinking the odds of seeing that are 70% or better. If we see a further break down instead I’ll be looking at lower target options on Monday morning.

Regardless of that though I still think that new all time highs soon on at least DIA and QQQ look likely. SPX has already delivered a new all time high in the last few days and while I’d like to see a new all time high on IWM too, the new all time high there in mid-December might be enough for now.

I am also still thinking that after that unfinished business above is completed, we may see a larger retracement in stocks than anything we have seen since the April low.

Everyone have a great weekend :-)

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST, but only for paying subscribers. Other places to find me are my page on the platform previously known as twitter, and my YouTube channel.

No comments:

Post a Comment