(First published a day ago on Substack and www.slopeofhope.com)

In my last post on Monday I was looking at the big inflection point that has formed over recent week on US equity indices, which were then testing key support. I was liking the positive divergence forming on the index futures and those turned into hourly buy signals and played out during the day delivering significant rallies.

This was encouraging for bulls as, first and foremost, the US indices didn’t break down hard into the bear scenario looking considerably lower and, secondly, that a path has been forming that could take US indices back into the high retests that I was talking about as the obvious targets for the bull scenario.

One of my favorite lines from the Matrix, a film with many well-crafted and memorable lines, is where Morpheus says that there is a difference between knowing the path, and walking the path. That is an important distinction for TA where a path often becomes obvious to the analyst but then it is prices that then need to actually follow that path to get to the destination, and reaching that destination is always a matter of relative probabilities rather than certainties, to the surprise of many a novice trader or aspiring amateur analyst.

I have said many times in past years that, as I see it, the key job of the analyst is to identify the higher probability paths that prices might take, and the higher probability inflection points where price may take another path. There is never any certainty and any setup, however well formed and compelling, can fail. The current setup is a good example of that, so this post is using that setup as a teaching moment to show how price works in uptrends and downtrends.

Now in this instance there are two obvious significant inflection points on the way to retests of the all time highs on all of SPX, QQQ and DIA. The first is the follow-through from the initial rally, taking the US indices to main resistance, which the case of SPX is the daily middle band. The second is the break and conversion of those main resistance levels to support, opening the path to the retests of the all time highs. At either of these we could see a hard fail back to the lows tested yesterday and once again be knocking on the door to the downside. That door is not necessarily going to then open, but as a friend remarked to me many years ago, the more often such doors are knocked upon, the more likely they are to open.

In my premarket video yesterday morning I was noting that the hourly buy signals that fixed yesterday had now all played out, and was looking at the options for another leg up. I was examining IHS patterns forming on the futures charts, and have since then been watching those on the RTH index charts today. If we are going to see the all time highs on SPX, QQQ and maybe DIA retested, then these are a promising start.

The obvious IHS patterns forming on the chart are, in order of descending quality, on SPX, QQQ and DIA.

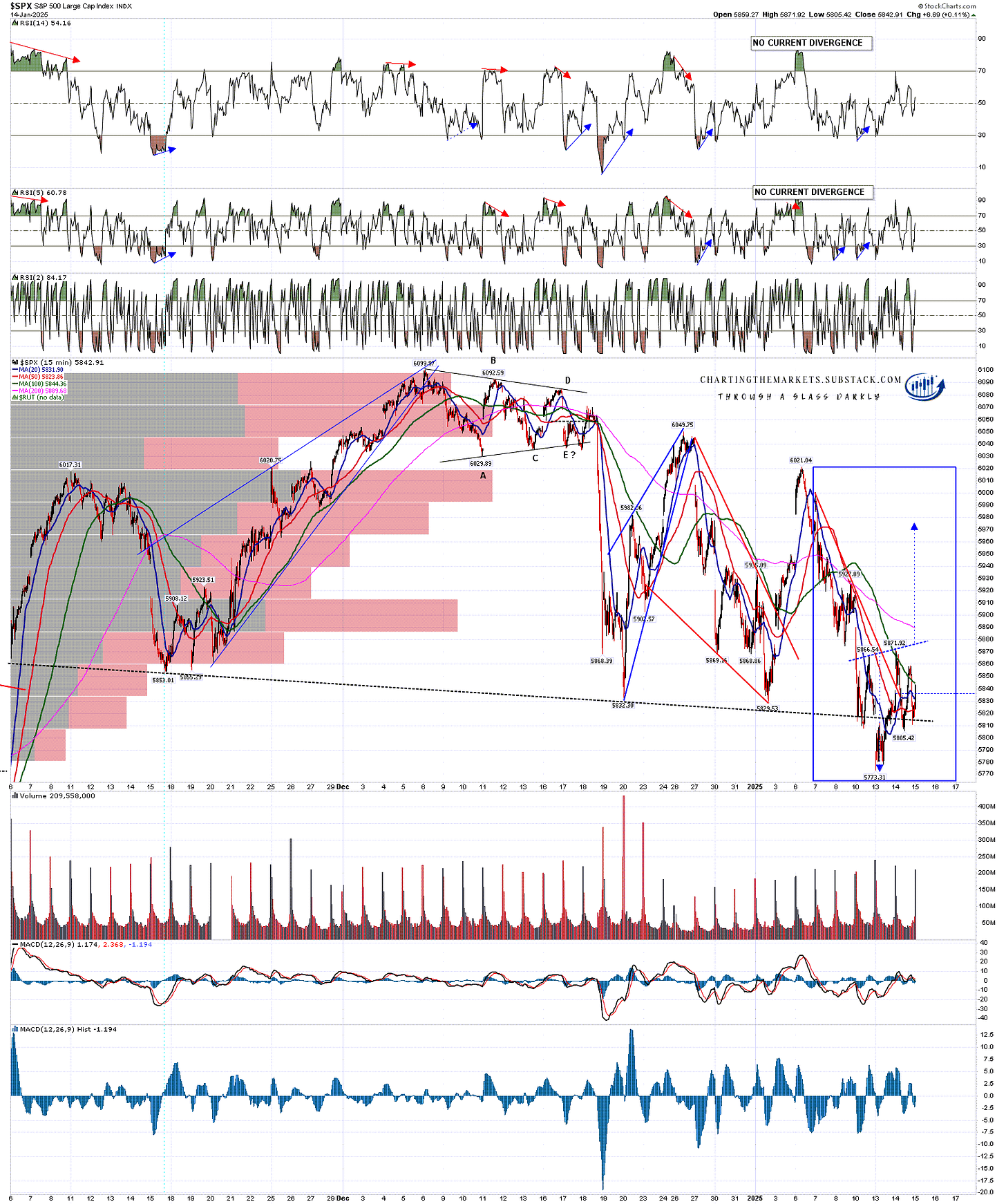

SPX has been forming a good quality IHS at this candidate low which I am particularly happy to see as when an H&S pattern fails, as the much larger H&S will need to if the all time high is to be retested, then you will often see an H&S formed facing in the opposite direction. This possible IHS is all within the blue box on the right of the chart.

On a break up from the IHS neckline in the 5877 area, and follow through after that of course, the IHS target would be in the 5975-80 area, and with the daily middle band currently at 5938 and declining, making that target would deliver a break up through that key resistance level. A conversion of that level to support and follow through would then open the all time high retest at 6099.97.

SPX 15min chart:

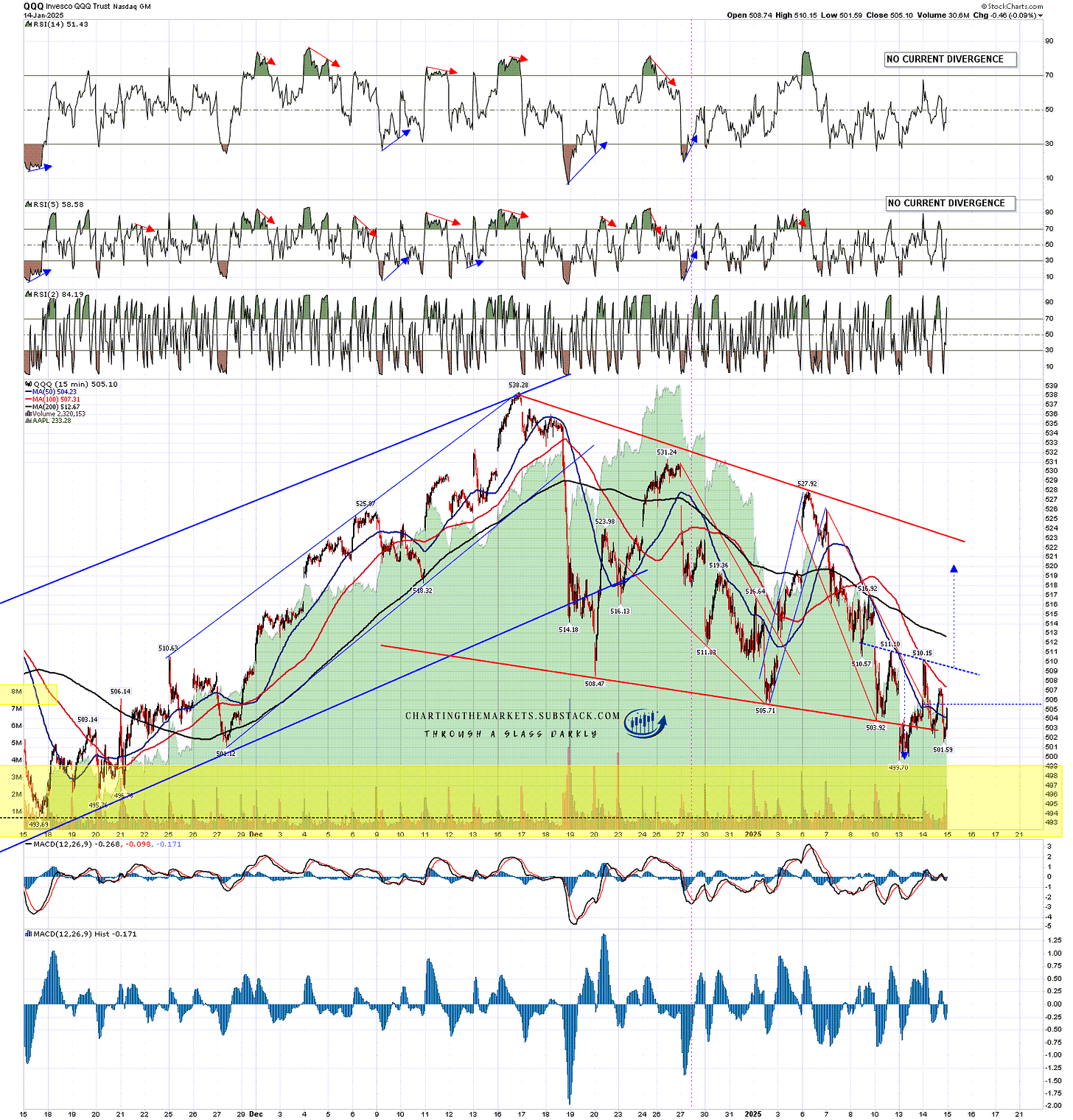

On the QQQ chart there was no large H&S that broke down, just an encouraging bull flag falling wedge that is 70% bullish. The low yesterday was a break below that flag wedge support which is a bullish underthrow signalling that a break higher is close, as long as price doesn’t invalidate that by following through to the downside and triggering the 30% downside scenario target I looked at yesterday.

On a break through this IHS neckline in the 509-10 area the IHS target would be in the 520 area, slightly short of flag wedge resistance, currently in the 523.5 area, but over the daily middle band, currently at 519. On this chart I see the flag resistance as the key level and location of the next inflection point, and a sustained break through that opens a retest of the all time high at 538.28 as the obvious next target.

QQQ 15min chart:

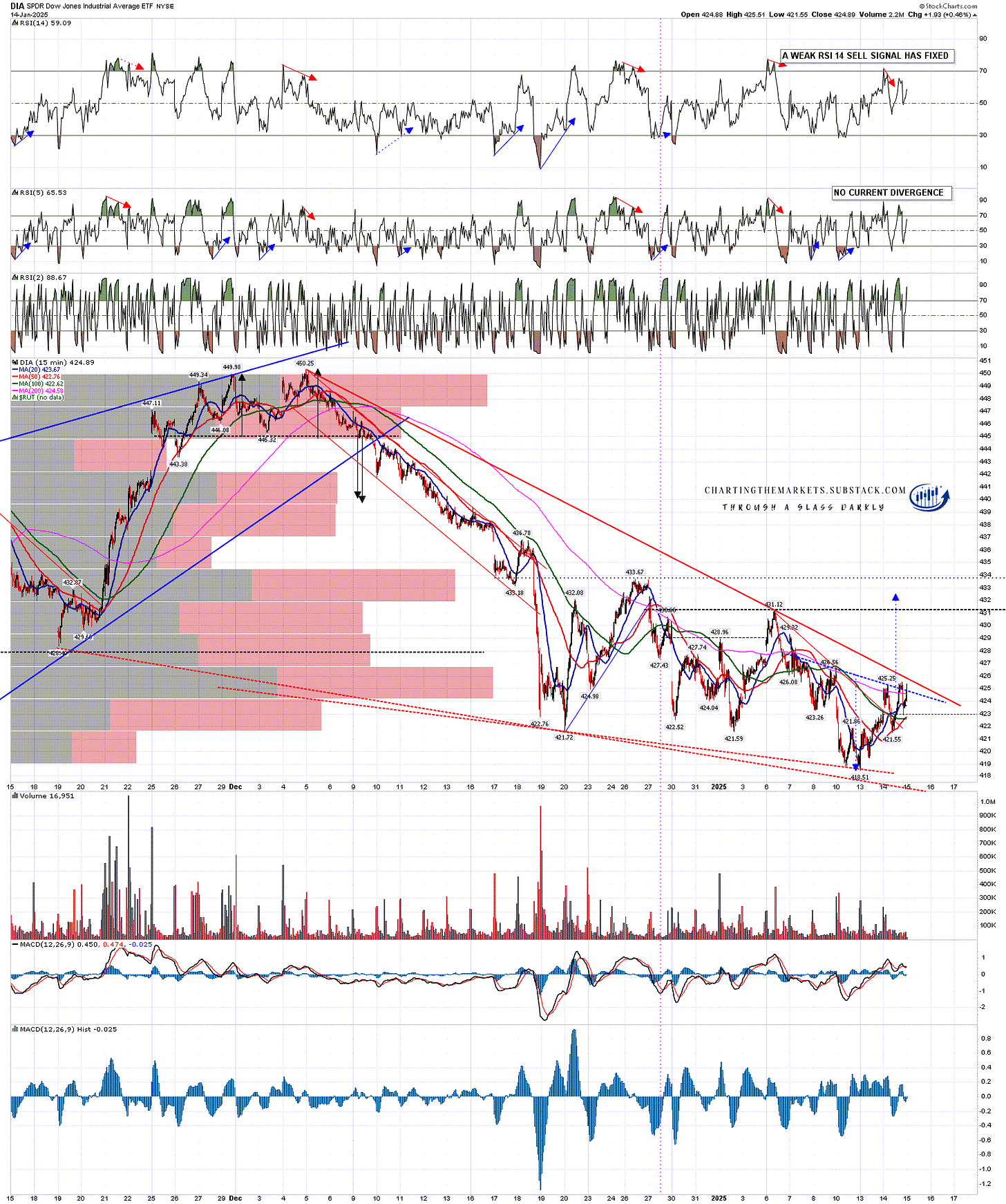

On DIA there is another bull flag falling wedge, not quite as nice as QQQ and with no bullish underthrow, but with flag resistance far closer. This is my lowest quality IHS mainly because the IHS neckline is so steep, but it is still decent and, unlike the others, it has already broken up. A follow though to the upside would take DIA through flag wedge resistance in the 425.8 area, just under the daily middle band currently in the 427.85 area, towards the IHS target at 433.5.

DIA came down longer and further than SPX and QQQ, and while there are still two obvious inflection points on this chart, the second is at a second bullish reversal pattern, the possible double bottom resistance or part formed IHS neckline at 431.12. A sustained break up through that would look for a target in the 441-5 range.

441-5 would put DIA within reach of the all time high at 450.25, with an ok quality bull flag target at that retest, but the larger overall distance to be travelled makes it more of a reach than on SPX or QQQ.

DIA 15min chart:

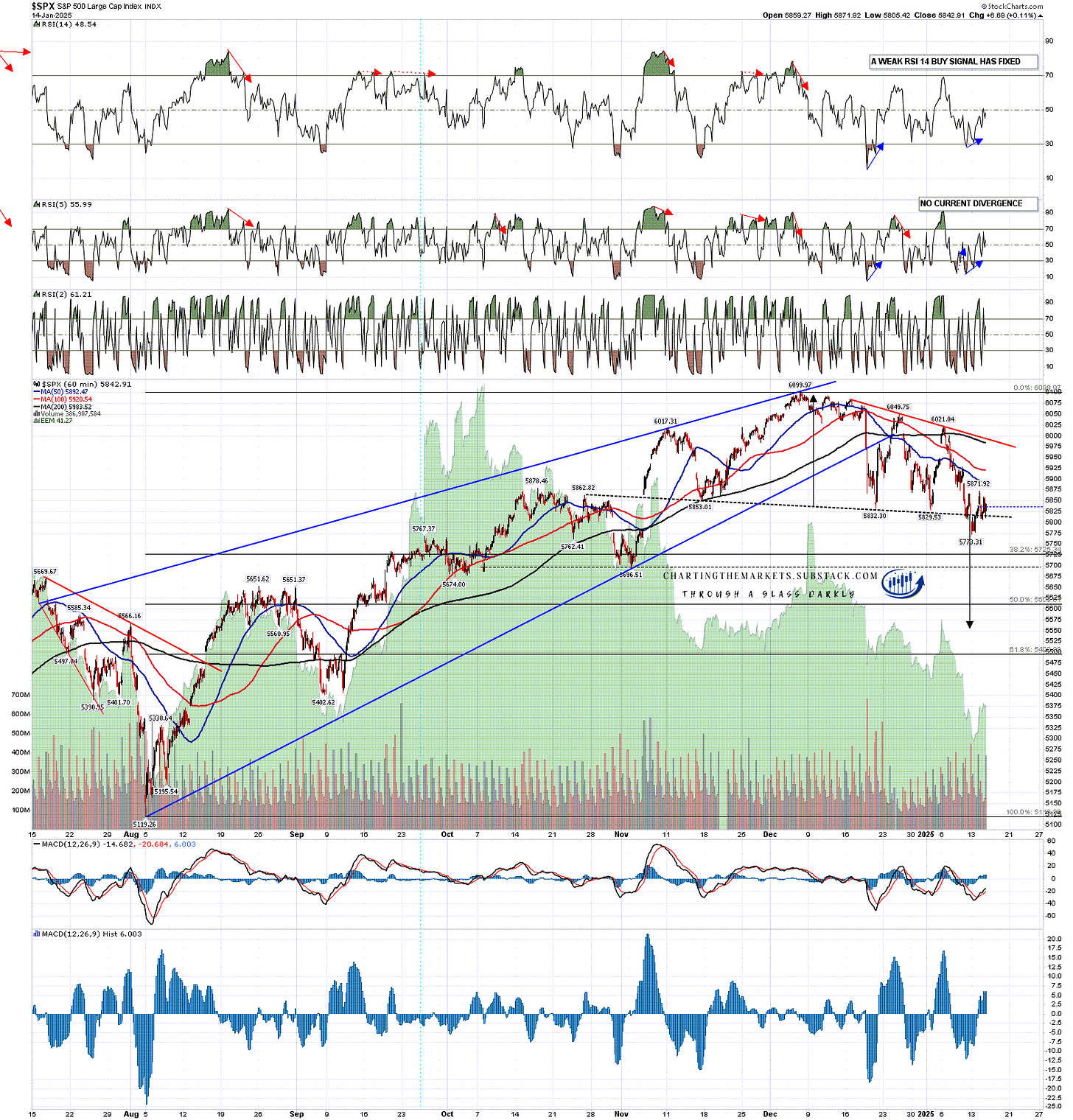

How are divergences looking? Well I was noting on Monday that there were possible hourly buy signals brewing on both RSI 14 and RSI 5. Both fixed, the RSI 5 buy signal made target yesterday and the weak RSI 14 buy signal is still part way there. Not a strong indication but encouraging. On QQQ there is a possible weak hourly RSI 14 buy signal brewing but not yet fixed. On DIA there is a possible weak daily RSI 14 buy signal brewing and on IWM there are both daily RSI 5 and (weak) RSI 14 buy signals fixed.

I would see this background as encouraging but thin, on a pattern setup that favors the bulls overall but not hugely so. This reversal is very vulnerable to a hard fail and is worth treating with caution.

SPX 60min chart:

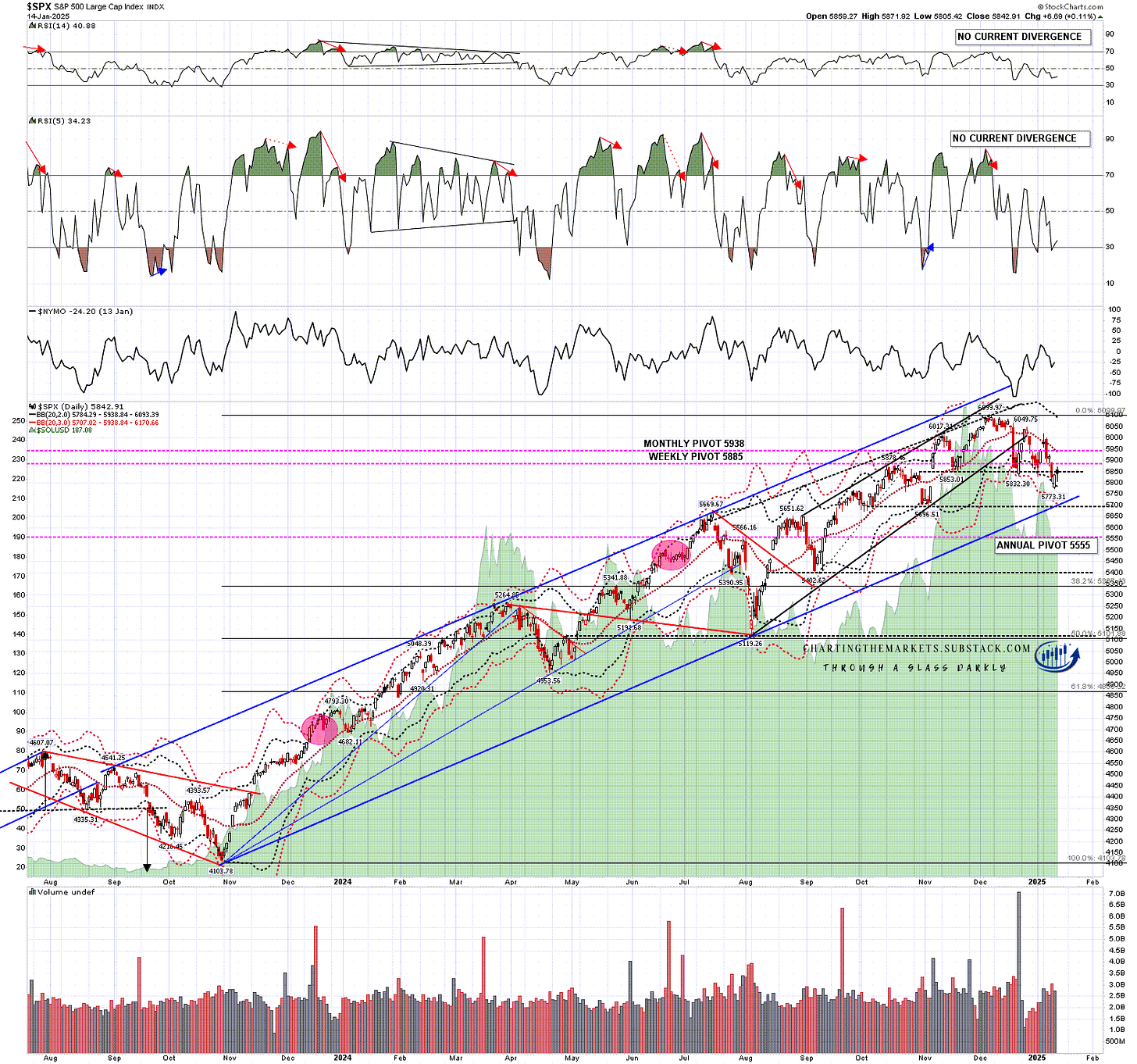

The resistance level I am watching with most interest in the SPX daily middle band. SPX has failed there on the last two rallies and it is this level that needs to be broken and converted to support to open the all time high retest.

SPX daily chart:

If we are going to see this setup fail back into a retest of Monday’s lows, I’d expect to see that tomorrow at the latest, but more likely today.

I’m leaning towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. Whichever way this breaks would be fine for that scenario. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities. The last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first.

I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment