In my last post on Thursday 24th July I was talking about the inflection point forming here on equities and the two important possible triggers this week. The first of those was the trade deal being negotiated with the EU and that seems to have been agreed over the weekend, at a general level of 15%. This follows a similar agreement with Japan and means that trade deals in that kind of area have been agreed now with most of the largest US trading partners except China, Canada and Mexico, currently at higher levels.

This could be establishing a new normal on trade so I wanted to take a moment to review where this may be leaving us.

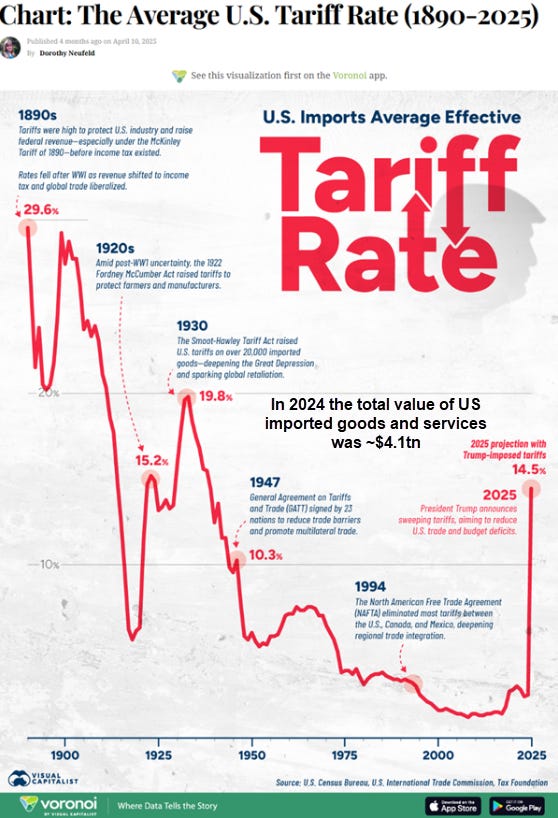

The chart below shows US tariff rates 1890-2025 and has tariff rates this year settling in the 14.5% area. Historically the closest equivalent is the increased tariffs imposed in the Fordney McCumber Act in 1922 that raised tariffs into the 15.2% area but didn’t greatly restrict trade in the 1920s, though it would be reasonable to expect that if these tariffs are sustained then imports into the US will decline in coming years, and exports from the US may well decline with them as foreign markets become somewhat more hostile to US exports in response:

In fiscal terms the impact of tariffs has been disregarded by the CBO as it is not based on any US legislation so far, but in 2024 the total value of US imported goods and services was about $4.1 trillion. An average 14.5% tariff level would yield about $595bn at the 2024 level of imports, so it would be reasonable to think that these tariffs should yield $500bn or more annually in tax revenue.

This does improve the fiscal situation in the US and while these tariffs are sustained, should likely significantly more than cancel out the negative fiscal impact of the ‘big beautiful bill’, without greatly improving the overall deficit and debt situation.

Tariffs are always paid by the importer of course so the tariffs will be paid by US importers and consumers, in effect a consumption tax, though the impact may be reduced somewhat by foreign companies eating some of the tariffs. This is the largest tax increase on US consumers in many years and will reduce their spending power, which will likely have a negative effect on economic growth.

In terms of inflation imported goods will be more expensive, though the impact on inflation will be moderated to an extent, perhaps a third, by foreign exporters and US importers also eating some of the tariffs at the expense of profits. The increase may also be a one-off increase that doesn’t feed through into future inflation though, while that increase is feeding through, the prospects for interest rate cuts will be reduced and the possibility of interest rate rises increased.

Overall though the impact, if tariffs settle down in this area, may be modest both for US debt (somewhat improved) and US growth (somewhat reduced). This reduces the probabilities for a major shock to the system for equity markets though US corporate profits will likely be reduced overall, something that we have already been seeing.

Moving onto the equity markets the daily close on Friday failed both of the fixed RSI 14 and RSI 5 sell signals on SPX. This is something often seen in a strongly trending markets and leans cautiously bullish.

SPX daily chart:

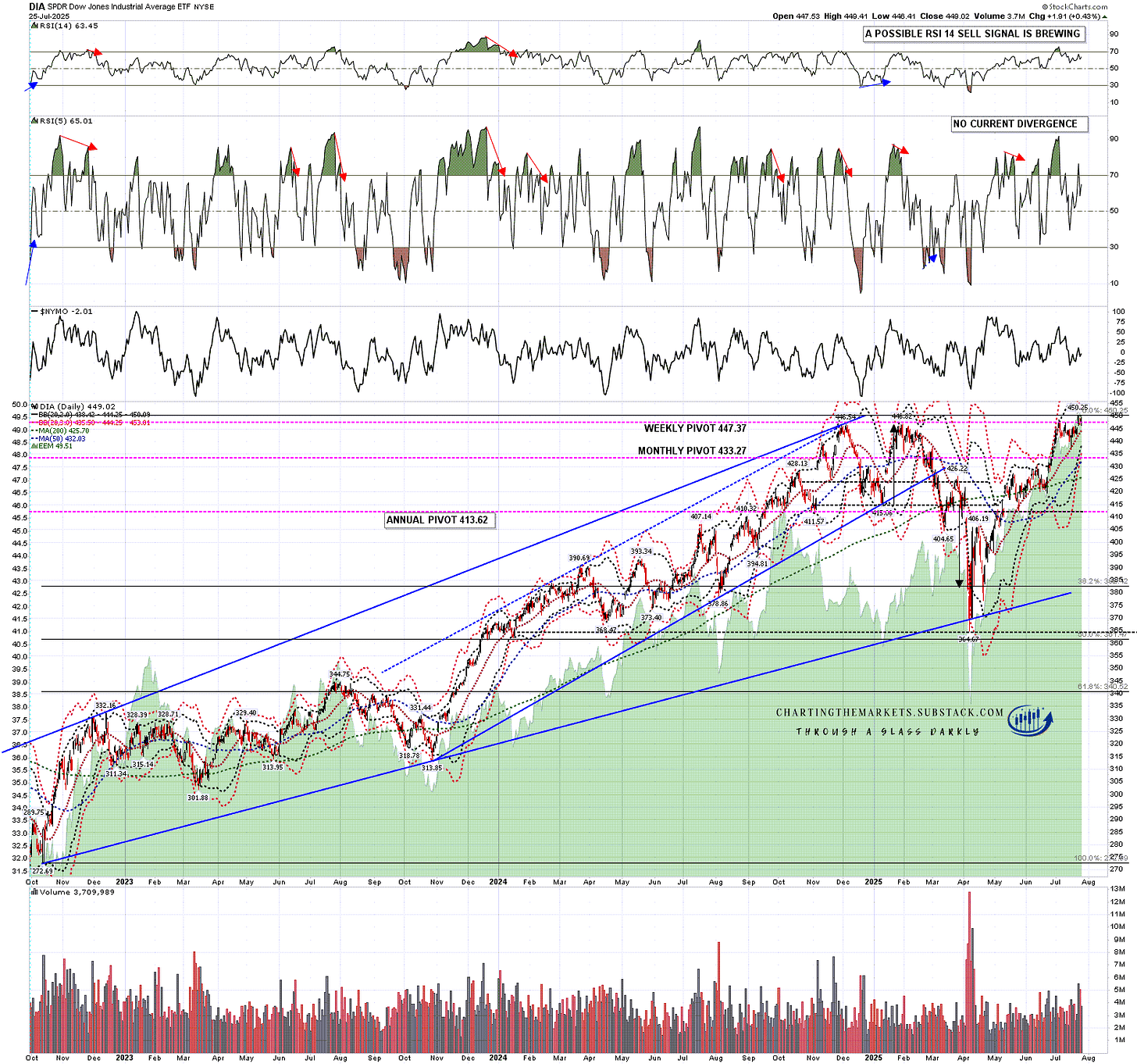

I would say though that while SPX and NDX may be trending higher here, both DIA and IWM have formed very decent looking possible double tops.

DIA daily chart:

The IWM chart is perhaps the most important here as a high quality IHS formed and broke up with a target at a retest of the all time high at 243.04. On a sustained break higher that would be the obvious target. On a hard fail here that broke the IHS right shoulder low at 199.10 however, the obvious next target would be a retest of the April low at 171.26.

IWM daily chart:

We still have an important legal ruling this week on the legality of Trump’s tariffs but whichever way that goes I wouldn’t expect much of a negative reaction on US markets. If they are ruled illegal that I think there are decent odds that the currently agreed tariffs could be resurrected in legislation implemented in the traditional way through Congress.

In my post on Tuesday 3rd June I was looking at a possible break up towards higher targets on SPX and NDX and if equities break up at this inflection point the obvious upside target on NDX would be the resistance trendline on the chart below, currently in the 24,500 area.

NDX weekly chart:

If equities break up at this inflection point the obvious upside target on SPX would be the resistance trendline on the chart below, currently in the 6500 area.

SPX weekly chart:

What would I like to see happen from here? Ideally I’d likely to see equities slowly grind up into the end of the year and form a larger high there. I’m thinking this trade deal with the EU might help deliver that. We’ll see.

I’ve been saying the following on all my posts so far this year:

As I have been since the start of 2025 I’m still leaning on the bigger picture towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities, not least because both of the last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch. I could of course however be mistaken. UPDATE 16th July 2025 - We may now be completing the initial strong decline and then the new all time highs I projected for this year, and making the more significant high I was projecting that process might deliver.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST, but only for paying subscribers. Other places to find me are my twitter, and my Youtube channel.

No comments:

Post a Comment