Back in my post on 11th April I called the likely start of a strong rally which we then saw of course.

Back in my post on 12th May I called for new all time highs on Bitcoin (BTCUSD) and laid out possible IHS scenarios on both Solana (SOLUSD) and Ethereum (ETHUSD), looking for ideal right shoulder lows on Solana in the 125.43 area and on Ethereum in the 2074.27 area. That hasn’t gone quite as I drew then but essentially both are still running that scenario.

In my last post on 23rd Jun I called the likely lows on those right shoulders made on Solana at 126.09 and on Ethereum at 2113.65, and was looking for that IHS scenario on both to start to play out.

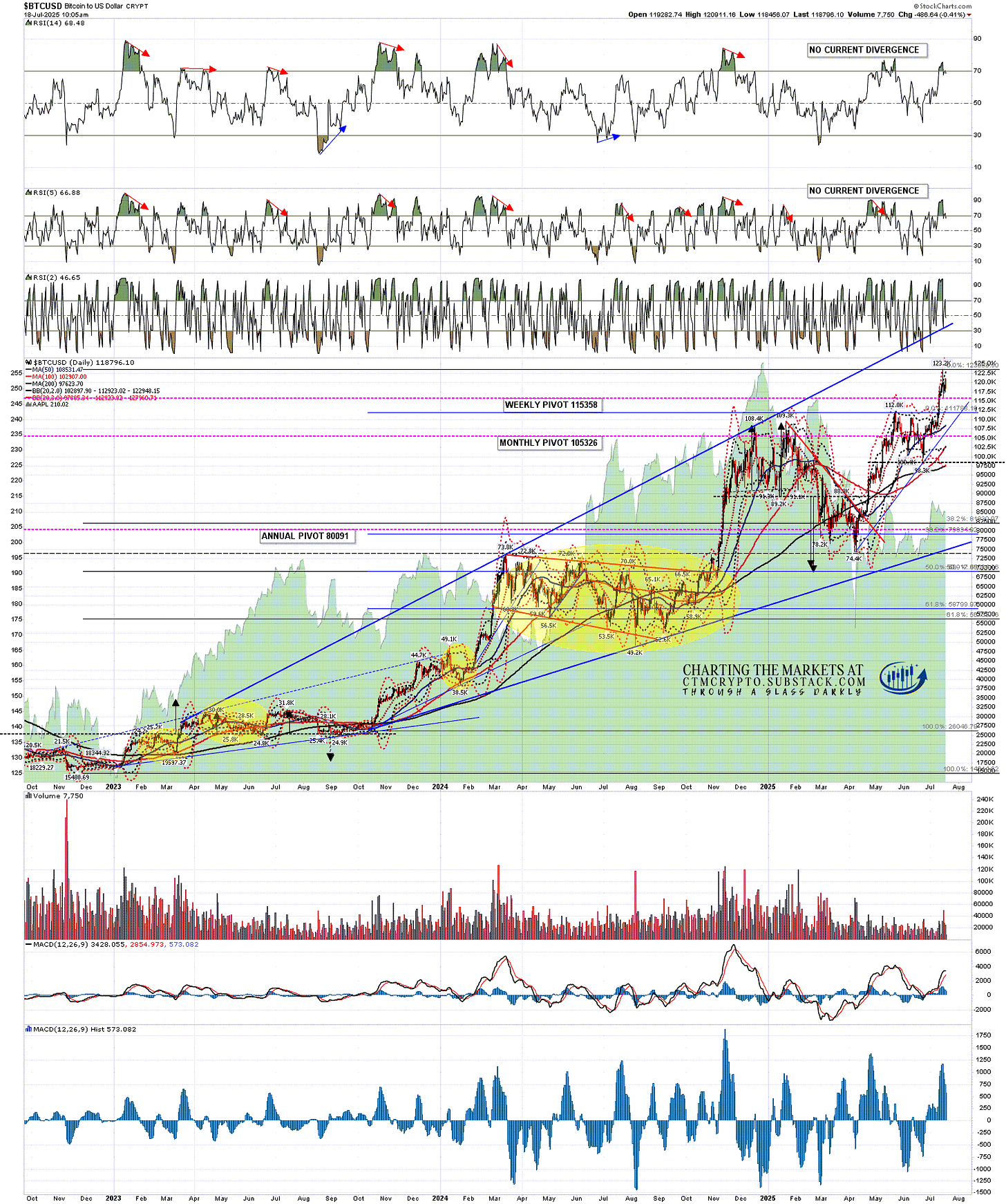

So where are we now? Well on Bitcoin we have seen all time highs as expected. On the daily chart there is no compelling upside target but I am wondering about the resistance trendline currently in the 135-40k area. That would be a compelling upside target if the last retracement had hit the corresponding rising support trendline but that was missed.

BTCUSD daily chart:

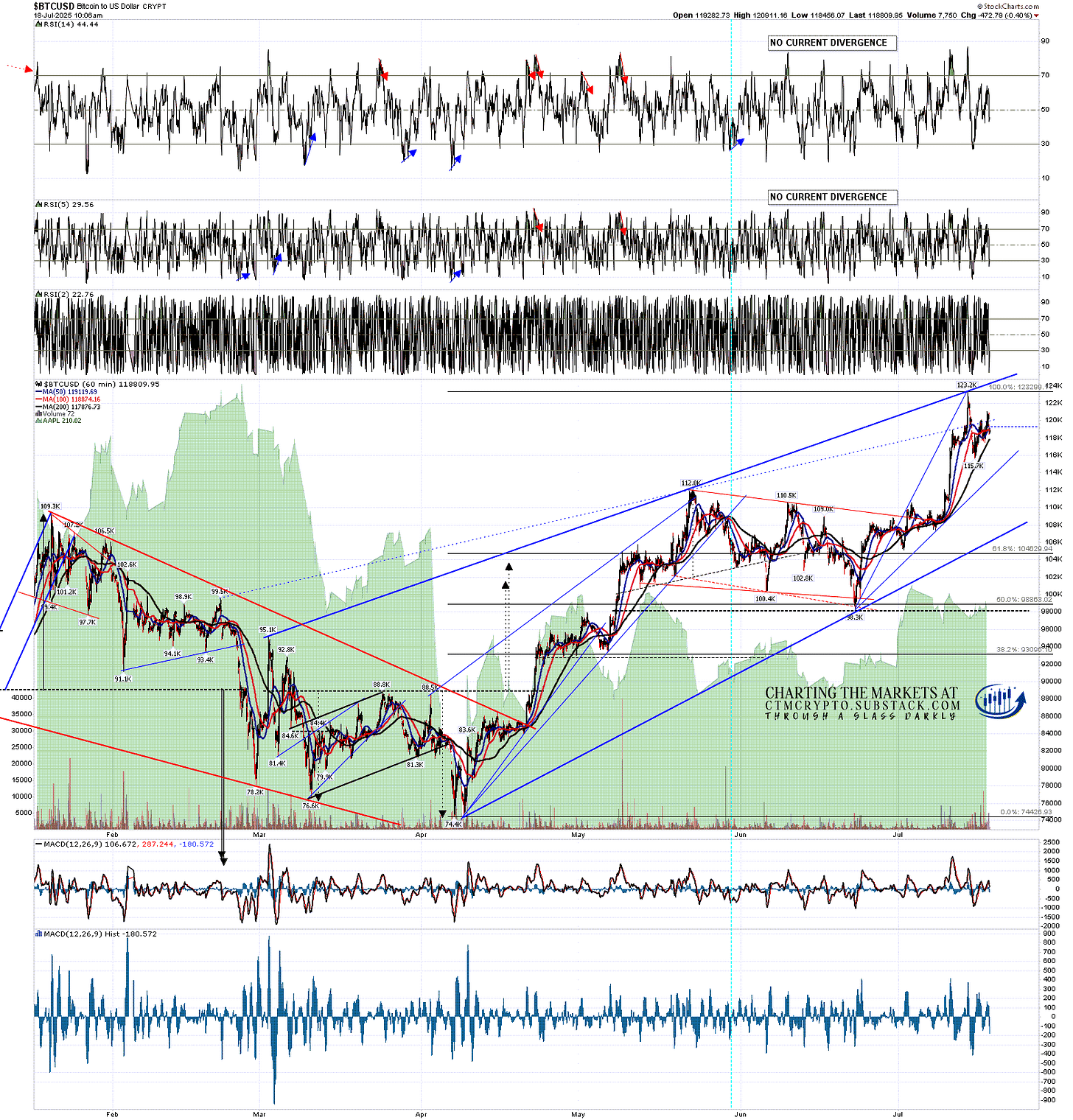

On the Bitcoin hourly chart a high quality rising wedge has formed from the April low so may be topping out for a retracement with the obvious target at wedge support, currently in the 106.5k area. If seen, a retest of the last ATH at 123.2k would likely set daily RSI 14 and RSI 5 sell signals brewing:

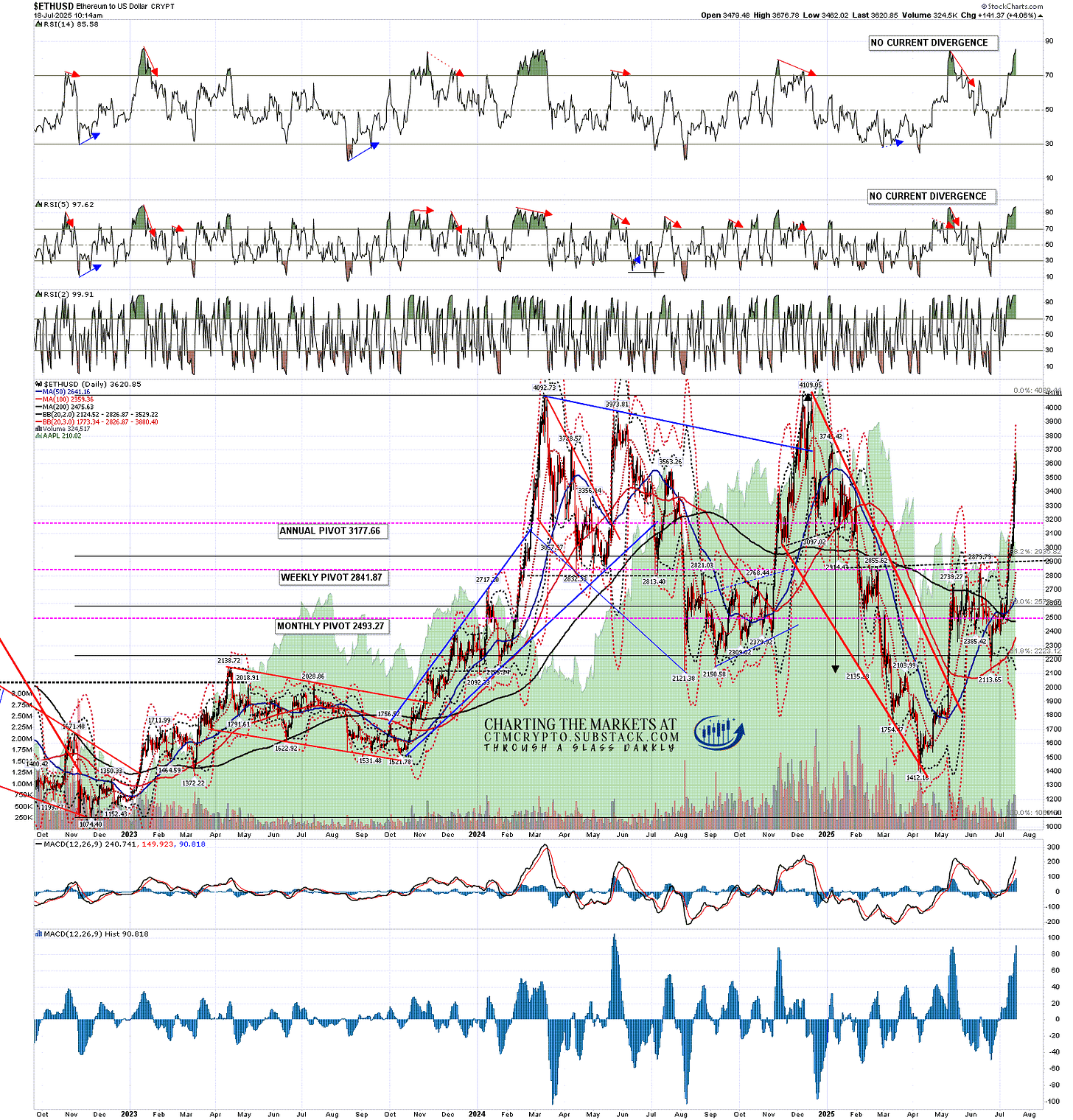

Ethereum needed to convert triple resistance at the 200dma, 50dma and daily middle band to support to open the upside and, after finally doing that in early July, has spiked up hard. The IHS broke up and Ethereum is now more than halfway to the target at a retest of the retest of the 4109.05 high.

ETHUSD daily chart:

On the Ethereum chart there is a possible trendline target currently in the 3760 area. That’s a decent match with the trendlines I have on Bitcoin and Solana so I am wondering whether that might be a short term resistance area. A possible hourly RSI 14 sell signal is brewing.

ETHUSD 60min chart:

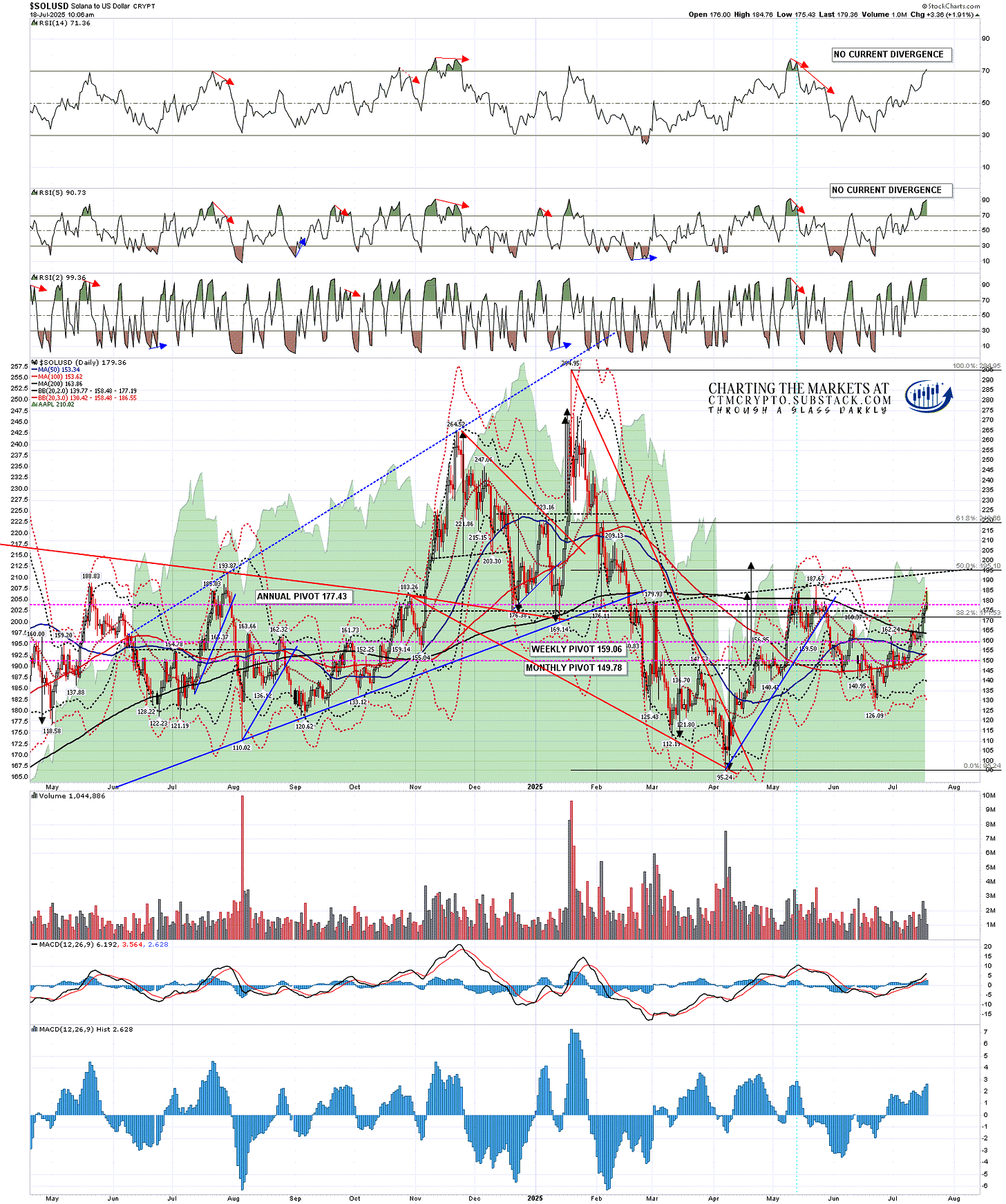

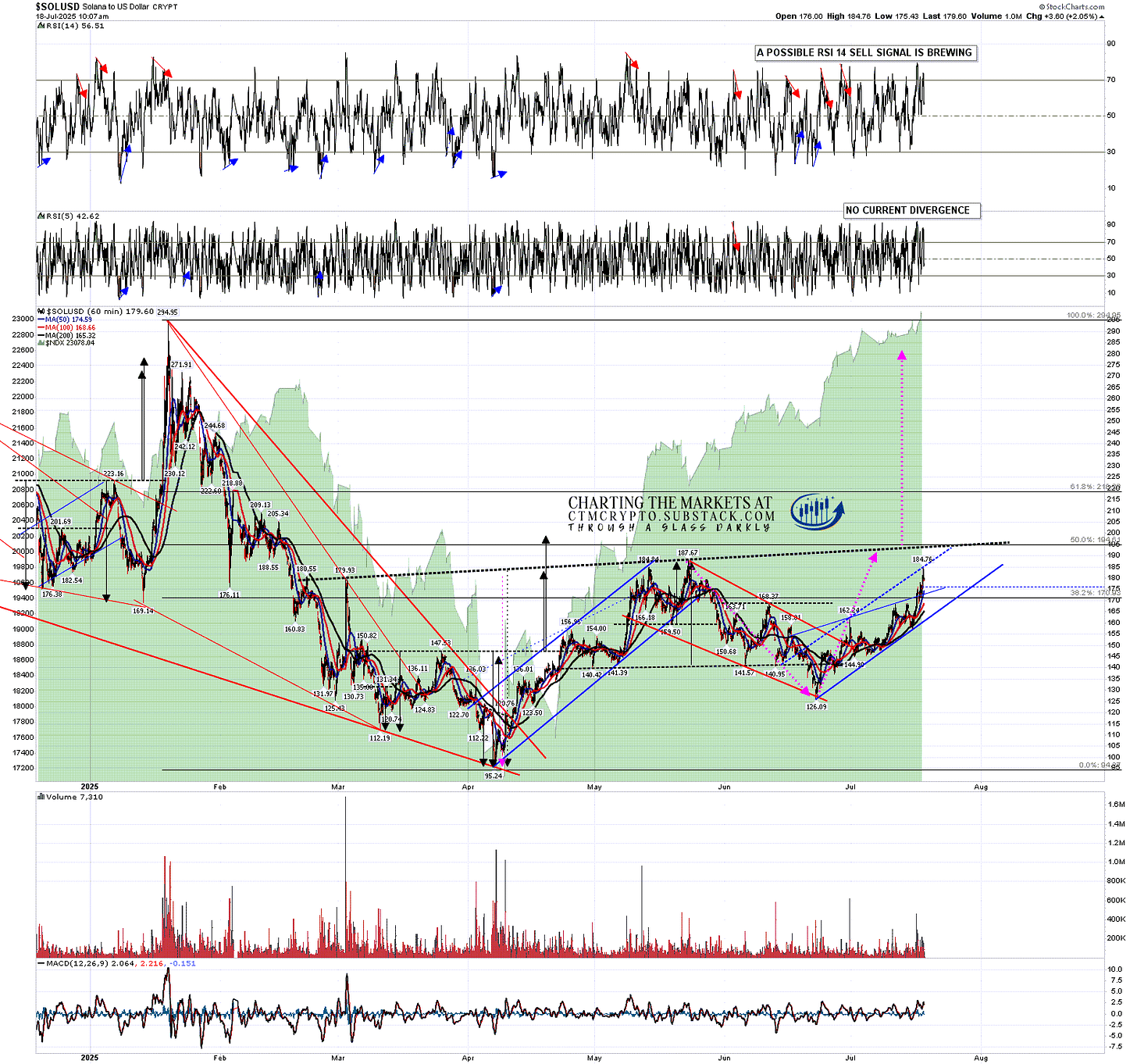

Solana has the lower quality IHS and the weakest move off the lows but finally broke and converted the key 200dma to support earlier this week and is close to a retest of the May high at 187.67.

SOLUSD daily chart:

I drew in a possible shorter term rising megaphone earlier this week and that trendline was hit overnight so I’m wondering about a possible short term high forming in this area. A possible hourly RSI 14 sell signal is brewing.

SOLUSD 60min chart:

I posted the following note at the end of my post on 13th Jan:

My preferred scenario here is that we see a bullish consolidation either now or soon on Crypto that takes a few months and sets up the next big leg up on Crypto into a possible bull market high in late 2025.

We saw the consolidation and the new bull market highs on Bitcoin so far but my concern is that we have seen very little evidence that Crypto can deliver a bullish move while equities are going down, and I am increasingly leaning towards equities topping out here and then very possibly being in a downtrend for the rest of the year. The IHS target on Ethereum here looks doable while equity indices are topping out, but I’m becoming skeptical about seeing the same on Solana. We’ll see.

I have a question for everyone reading. I’ve referenced some very nice calls this year on this post, but since I started doing daily videos on Crypto early last year I’ve got Crypto direction right most of the time and more than any other analyst anywhere that I’m aware of. I’m a very good analyst and all three of these instruments are very classical chartist friendly. I’m not much of a marketer though, and the free Crypto substack I set up last August still only has just over 150 readers.

My question is how I should increase my readership, as it appears that just putting out high quality work is not enough? I am also wondering whether I should get a side gig writing for a big Crypto exchange or website. On my published work I don’t think I’d have much trouble getting hired and that would expose my work to a much larger audience. Suggestions very welcome.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment