Every so often I talk about the way chart patterns form and how they can evolve, and I have some very good illustrations of what I mean by that to show you today.

When rising wedges form in a trend and break down, sometimes they are just expanding as they rise and, when we saw breaks down the initial rising wedges from the April lows on SPX and QQQ a few weeks ago, I was talking about how if further levels above were reached then the wedges were just expanding and I would redraw the support trendlines as unbroken. That would create a new inflection point as those new patterns broke down.

What I am looking for in these cases are high quality resistance trendlines to form, either extensions of the initial wedge resistance trendlines or new trendlines, and I have three very high quality examples of the latter to show you today.

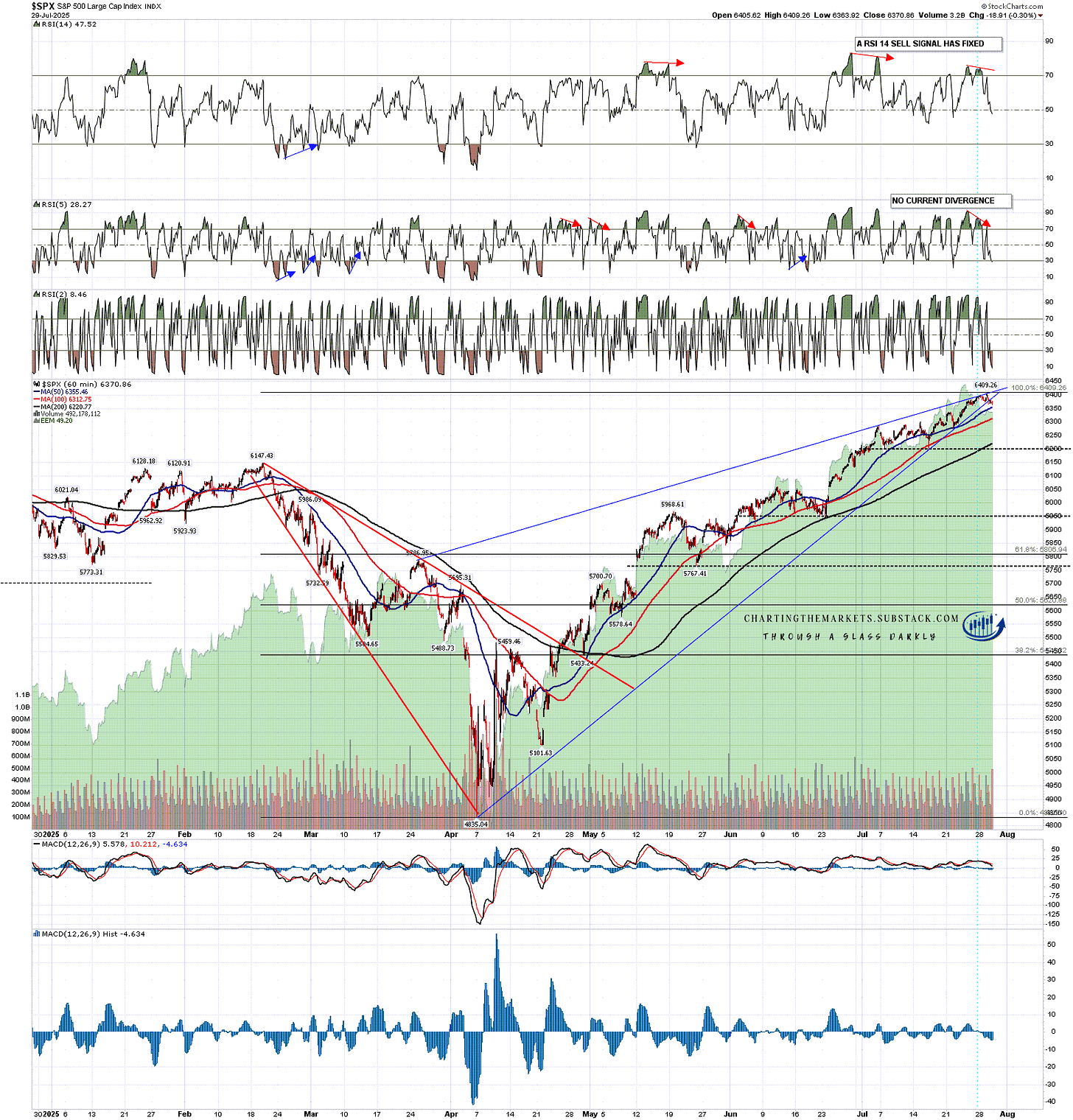

The first of those today is on SPX where there is a lovely three touch resistance trendline established at the last high coming from the late March rally high. This updated rising wedge has broken down this week.

SPX 60min chart:

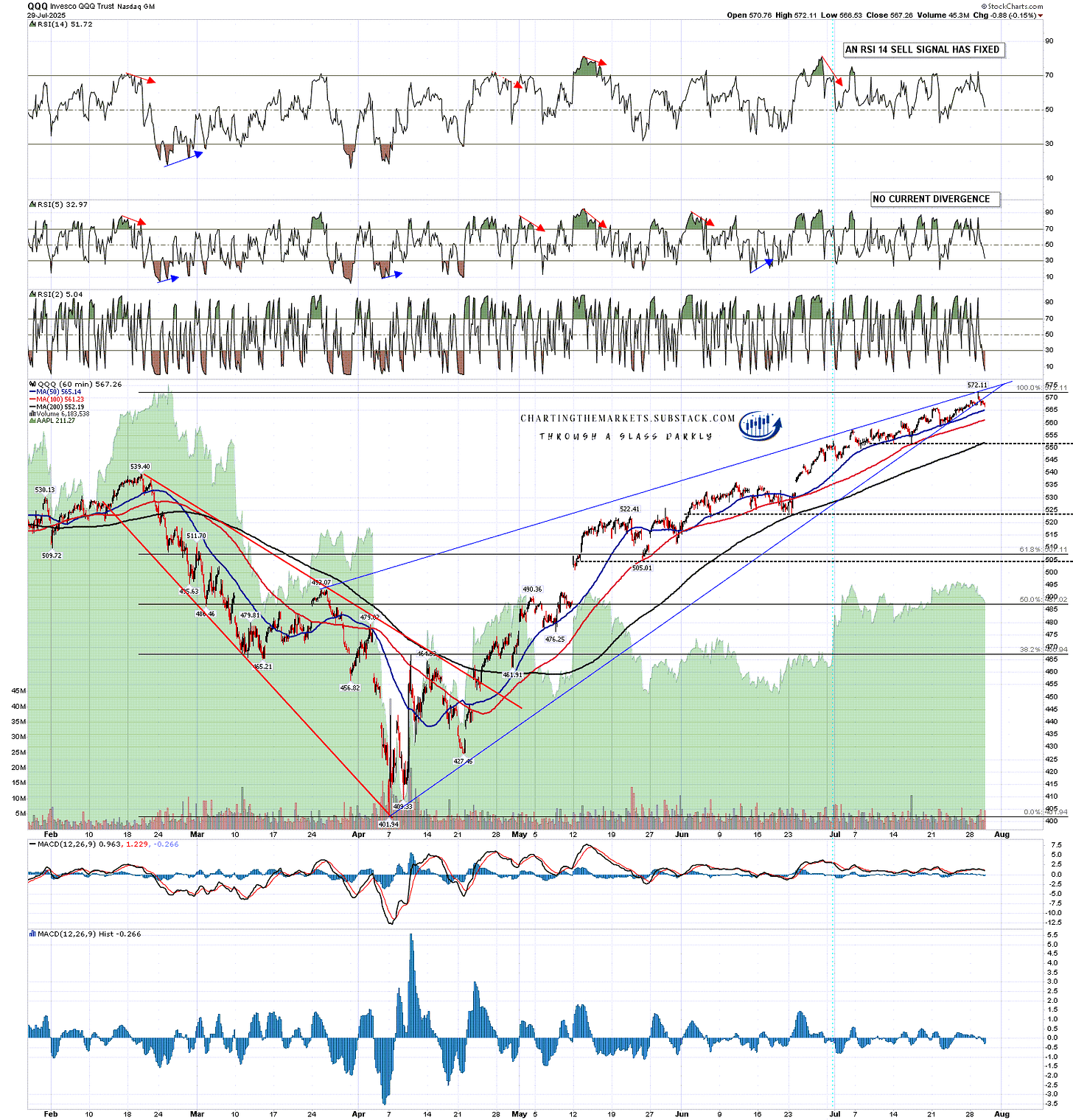

The second of those today is on QQQ where there is a lovely three touch resistance trendline established at the last high again coming from the late March rally high. This updated rising wedge has also broken down this week.

QQQ 60min chart:

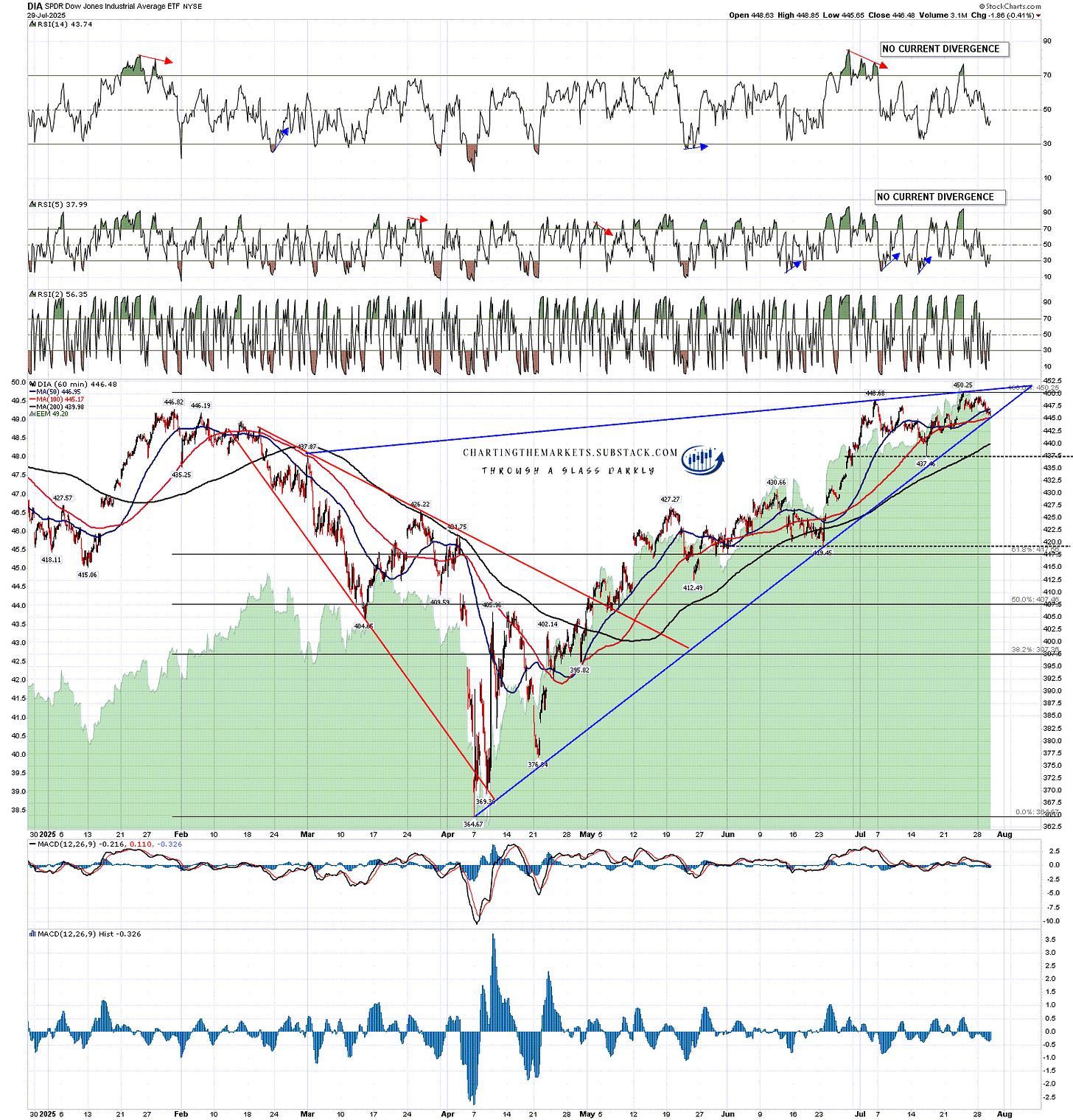

The third of those today is on DIA where there is a lovely three touch resistance trendline established at the last high coming from the late February rally high. This rising wedge has not yet broken down but delivered a third touch on wedge support at the low yesterday.

DIA 60min chart:

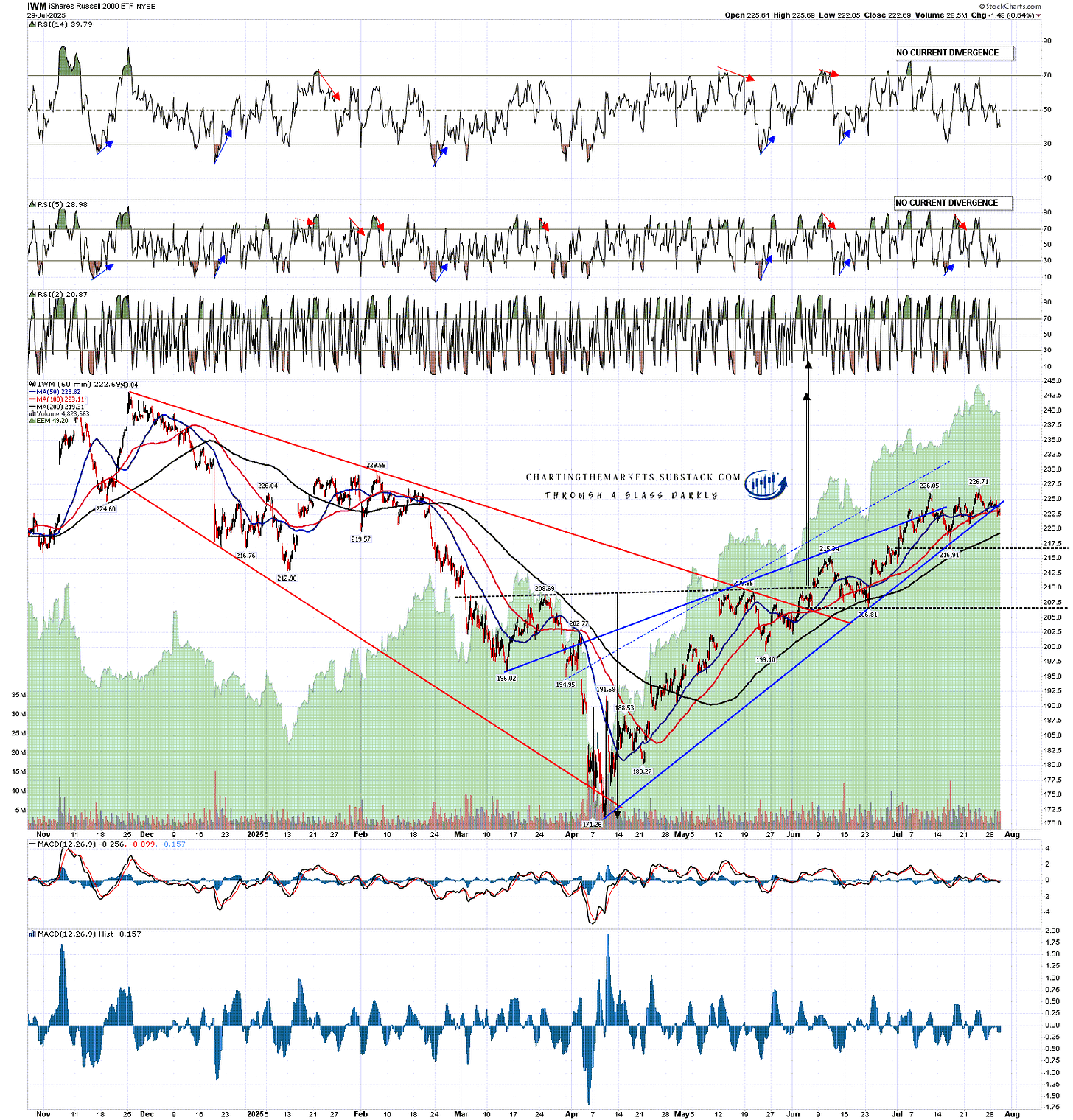

IWM has not done the same, but as is often the case, has been ploughing its own technical furrow. There the original rising wedge broke down slightly a few days ago and has retested the high setting up a high quality little double top.

IWM 60min chart:

What does this mean? It means that we are looking here at another inflection point where we are looking at a possible high forming for either a decent retracement or a full reversal of this trend from the April low. Subject to news I am leaning towards the retracement option.

In terms of indicators there are hourly RSI 14 sell signals fixed and still waiting to deliver on both SPX and QQQ and, on the daily charts, there is a fixed RSI 5 sell signal on QQQ, a fixed weak RSI 14 sell signal on IWM as well as a fixed full RSI 5 sell signal, and a possible RSI 14 sell signal is brewing on DIA. That is a lot of negative divergence.

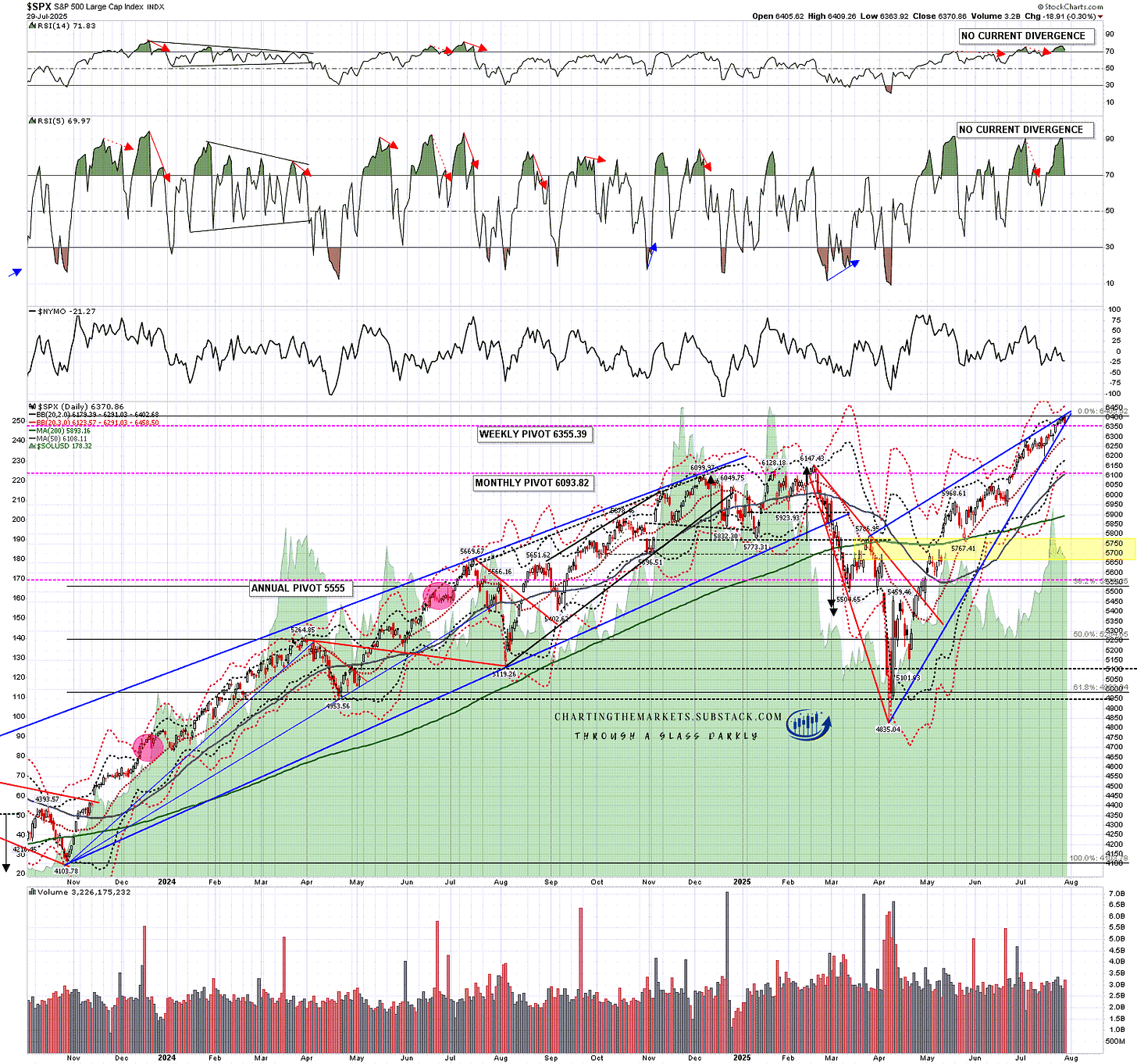

On SPX the sell signals were the same as on IWM until they both failed at the close last Friday. This regularly happens just before a reversal and that is possible here.

SPX daily chart:

I think that it is more likely here though that we see another high retest shortly on SPX and that sets up new daily negative divergence on SPX and ES. A very promising looking bull flag setup has formed on the ES 15min chart over the last couple of days supporting that view.

ES Sep 15min chart:

This is a really nice setup for at least a short term high forming here and this would be a good time to see a retracement. There is a bullish leaning day today but after that the next bullish leaning day historically is on 15th August. There is also a lot of economic data coming through this week with second quarter GDP and ADP private payrolls today, PCE inflation tomorrow and the July jobs report on Friday which, despite being the first trading day of August, leans significantly bearish historically.

I don’t often get the opportunity to post beautiful chart setup posts like this but they are generally very well worth paying attention to. The last one I posted was the topping patterns that had formed on all four of the indices above in my post on 19th February this year and I’d note that those all played out. This inflection point may not deliver anything as large, but it is potentially very significant. I’m watching this setup form closely.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST, but only for paying subscribers. Other places to find me are my twitter, and my Youtube channel.

No comments:

Post a Comment