Two weeks ago today I wrote a post looking at the case for a rally on US equity indices in the 12 trading day window into April 2nd, the planned day for US tariffs to be extended to most US trade partners. That rally delivered but wasn’t quite as strong as I hoped then, and I wrote another post a week ago in which I was looking at the bear flags forming on the US indices and talking about those moves topping out on Tuesday or Wednesday last week. On Wednesday morning I wrote a third post calling a likely high within those bear flag patterns and sketching out in arrows my preferred path from there.

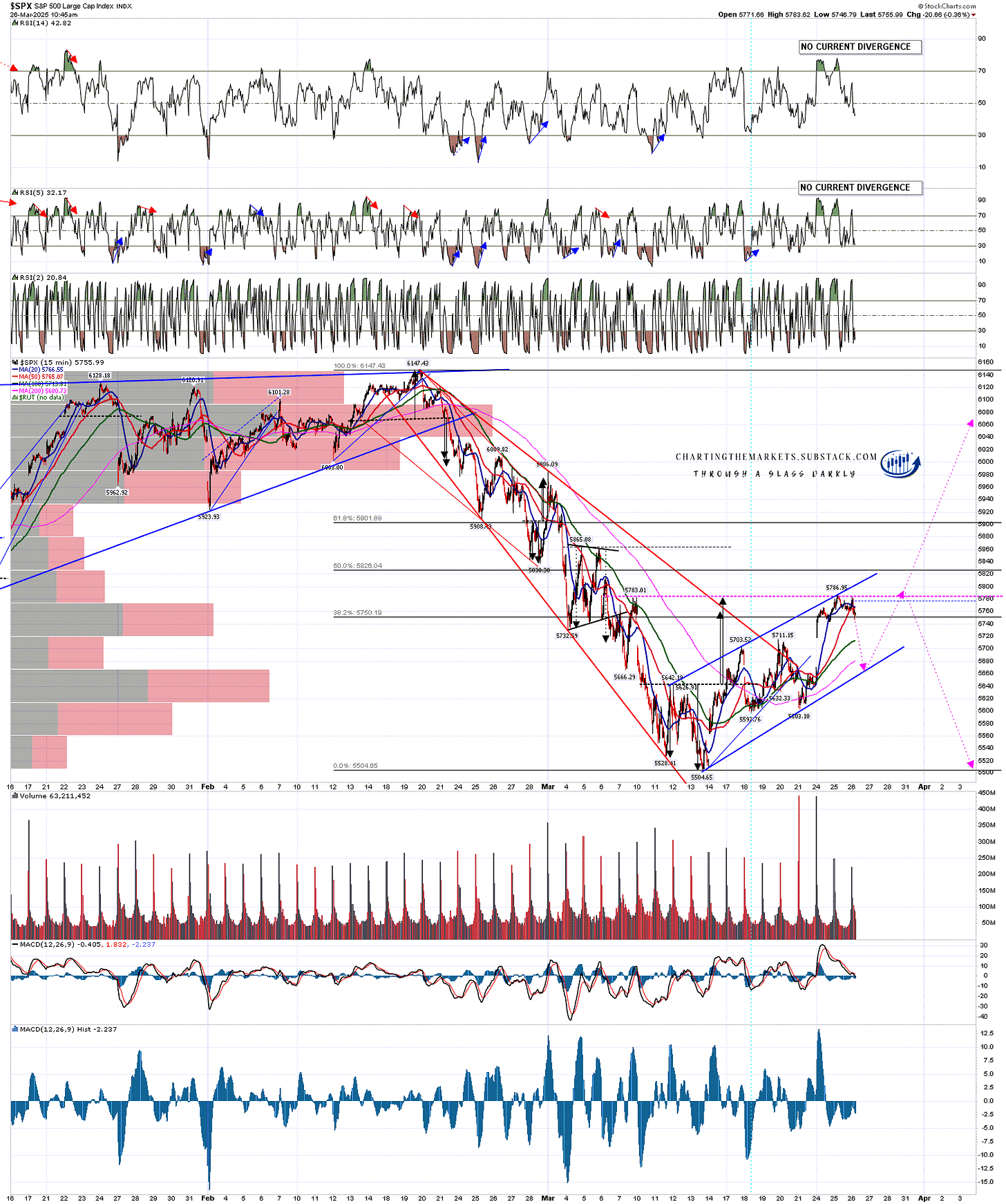

That path was looking good but my hoped for high retest failed on the bad inflation numbers on Friday and this morning the bear flag targets at the retests of the 2025 lows on SPX, QQQ and IWM were hit. The bear flag target at the retest of the 2025 low on DIA is still outstanding but likely gets hit after the current oversold rally on the US indices ends.

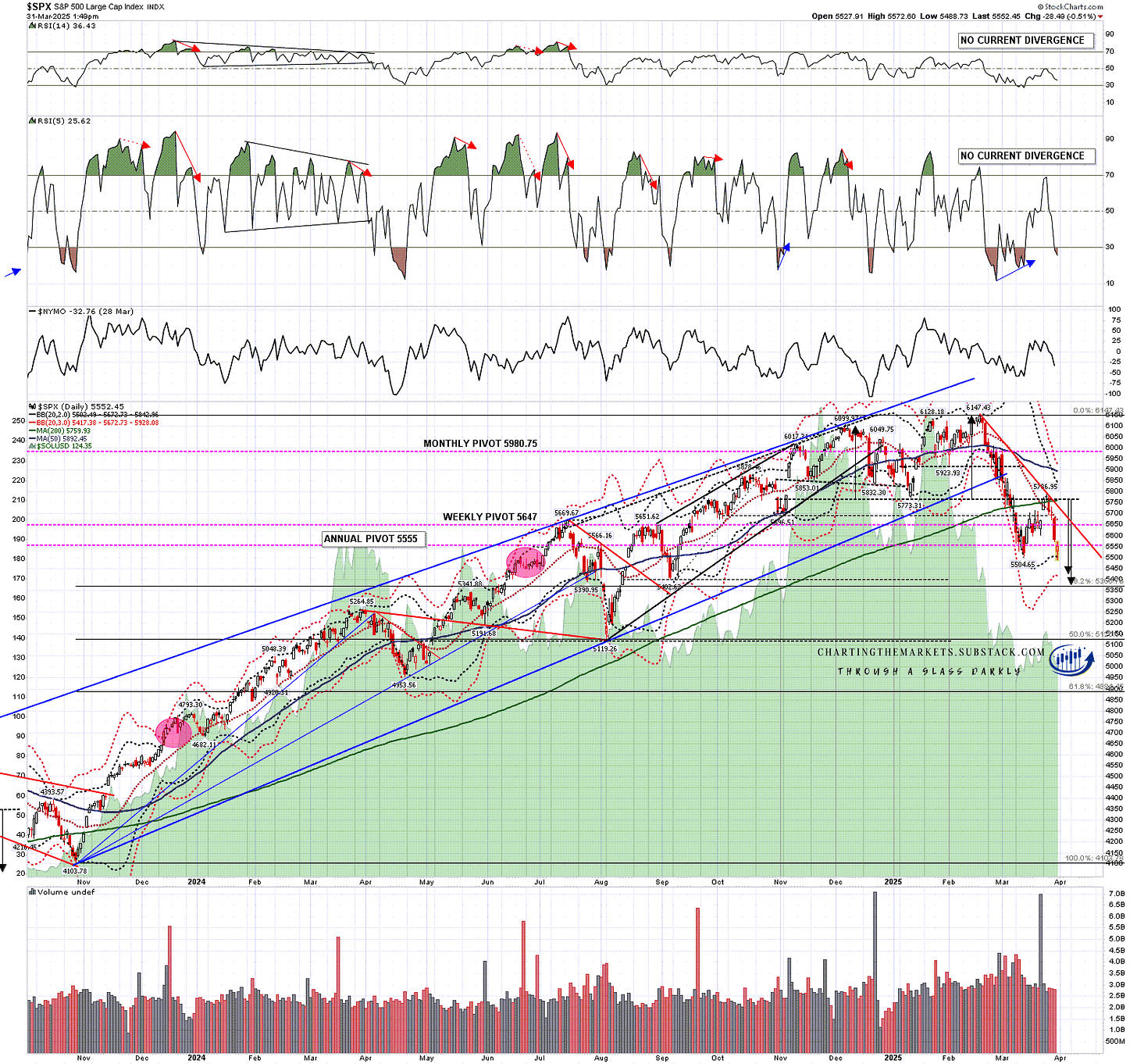

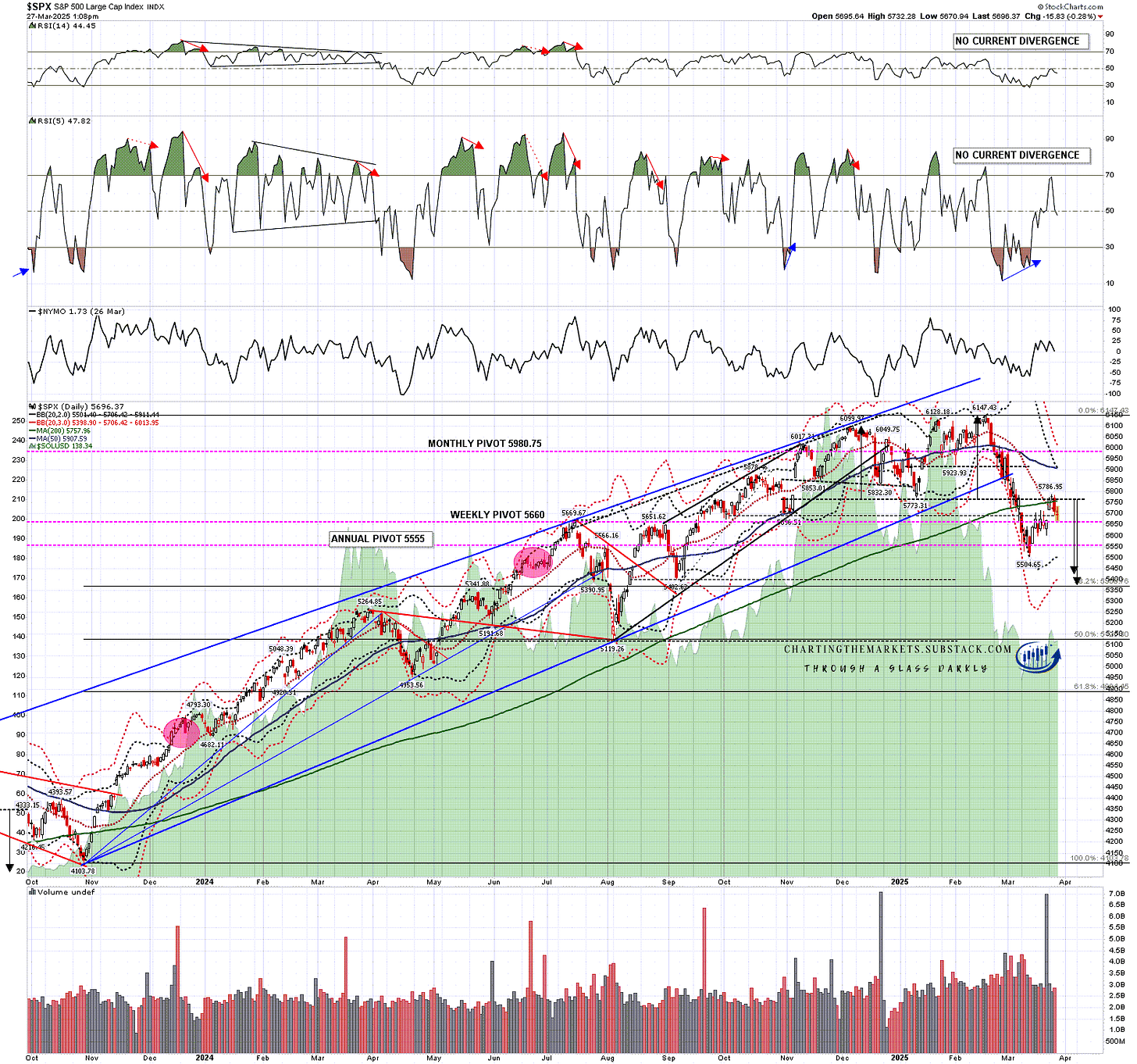

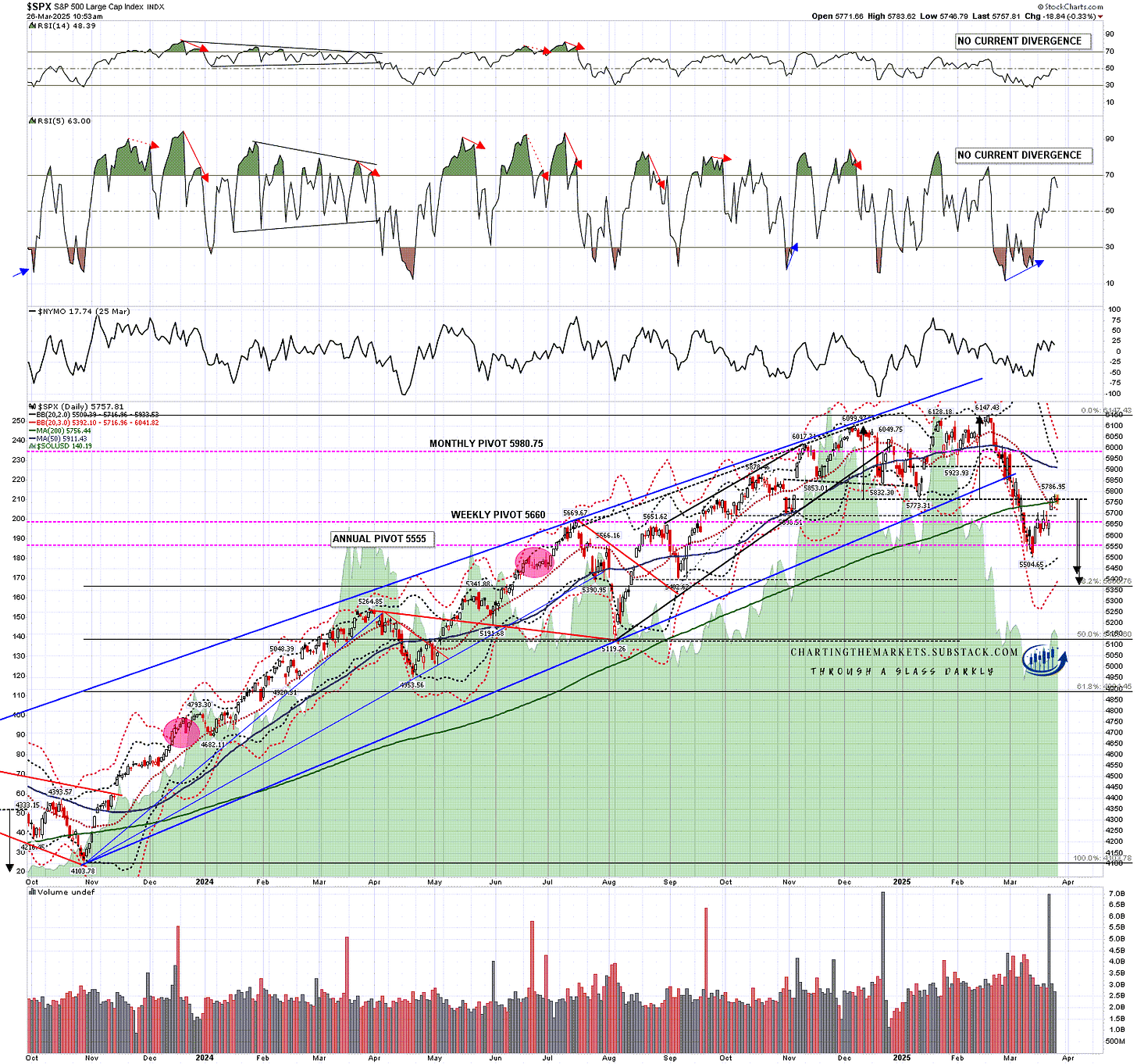

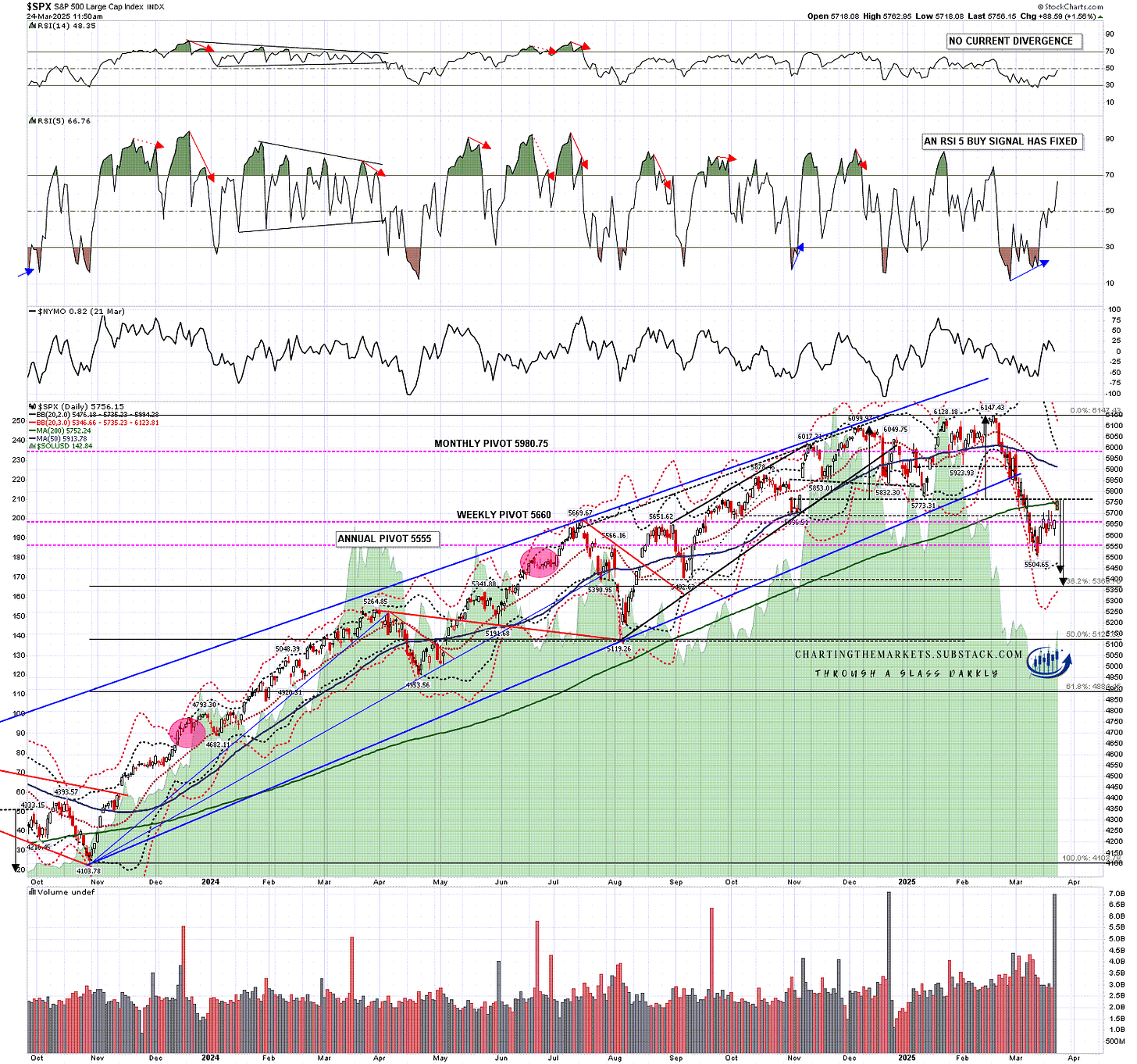

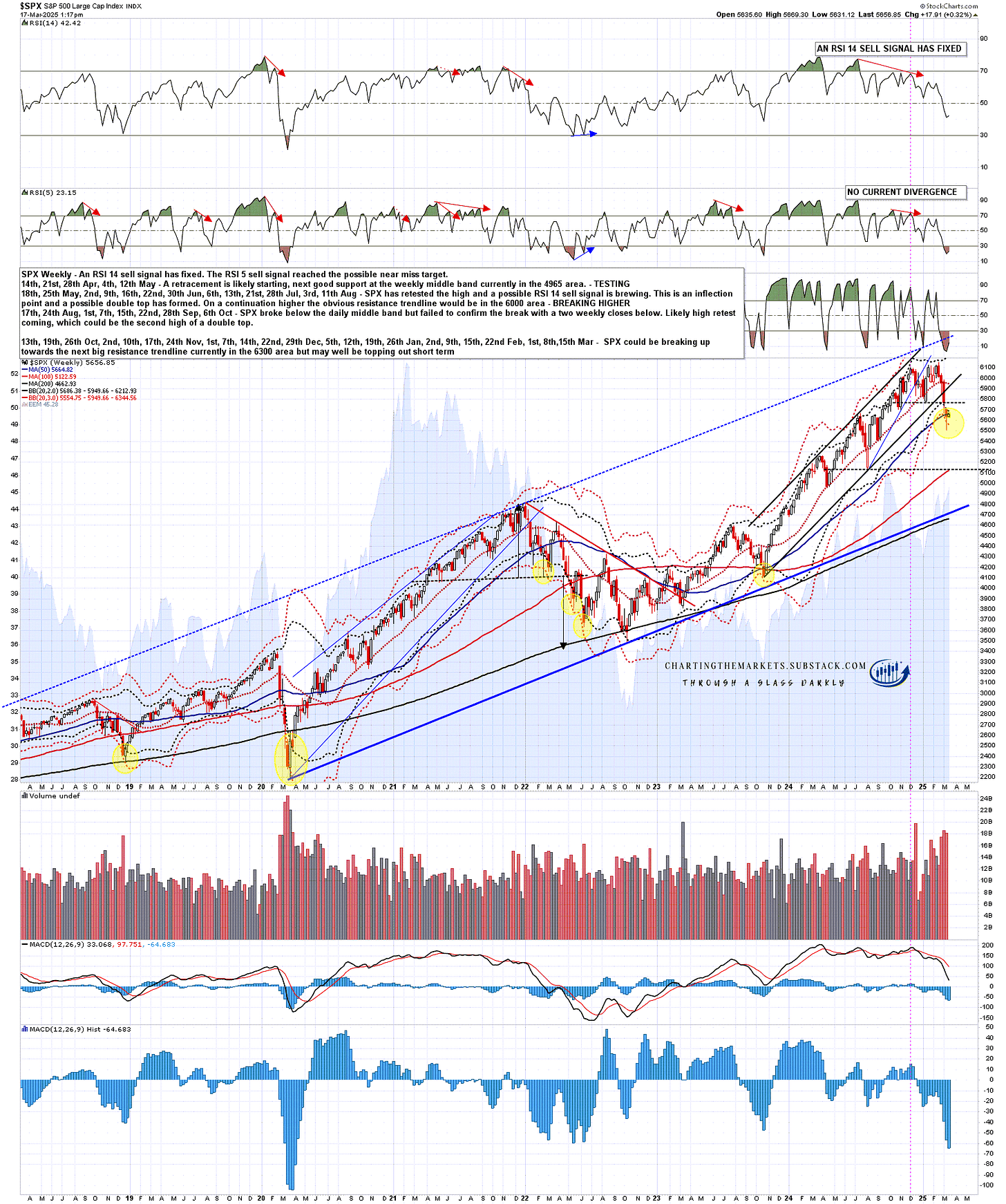

First the daily chart where the support at the daily middle bands on all of SPX, QQQ, IWM and DIA were broken very hard on Friday. I would note that the daily middle bands have been compressing over the last two weeks and that this setup where there has been a strong thrust down, followed by a bear flag that has broken down, has two main options.

The first option is the start of another leg down, and it is my working assumption that will happen next. If that leg was to be as long as the first leg then the target would be in the 5143 area. That is a very important area and may well be the next big target. I have the 50% retracement of the rising wedge from October 2023 in the 5125 area and a possible large H&S neckline at 5119.26.

The second option is to make a short term low here, and these low retests have set up possible double bottoms that I’ll be looking at. They may deliver if there is good news in the next couple of days and are worth considering as a possibility here.

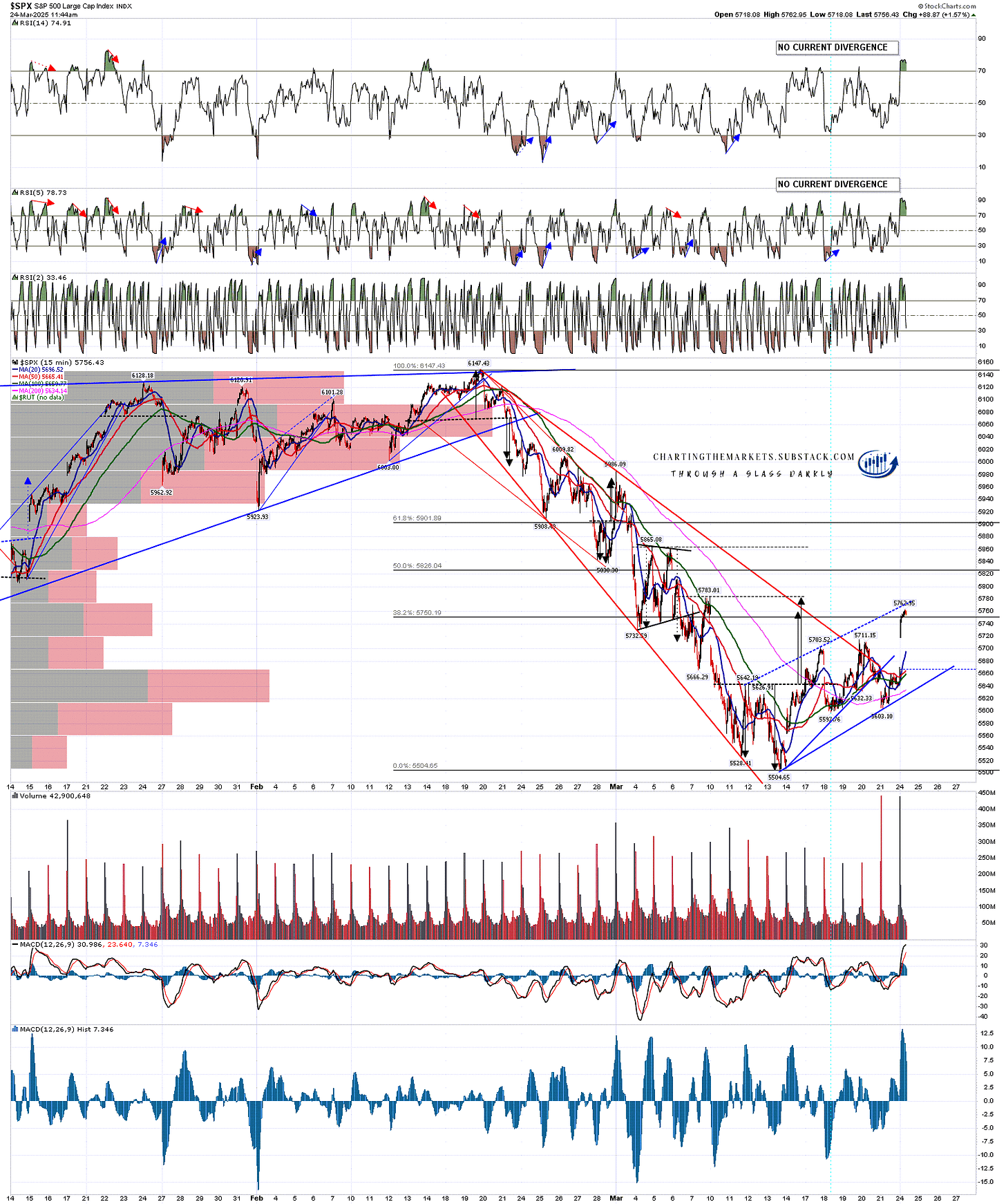

SPX daily chart:

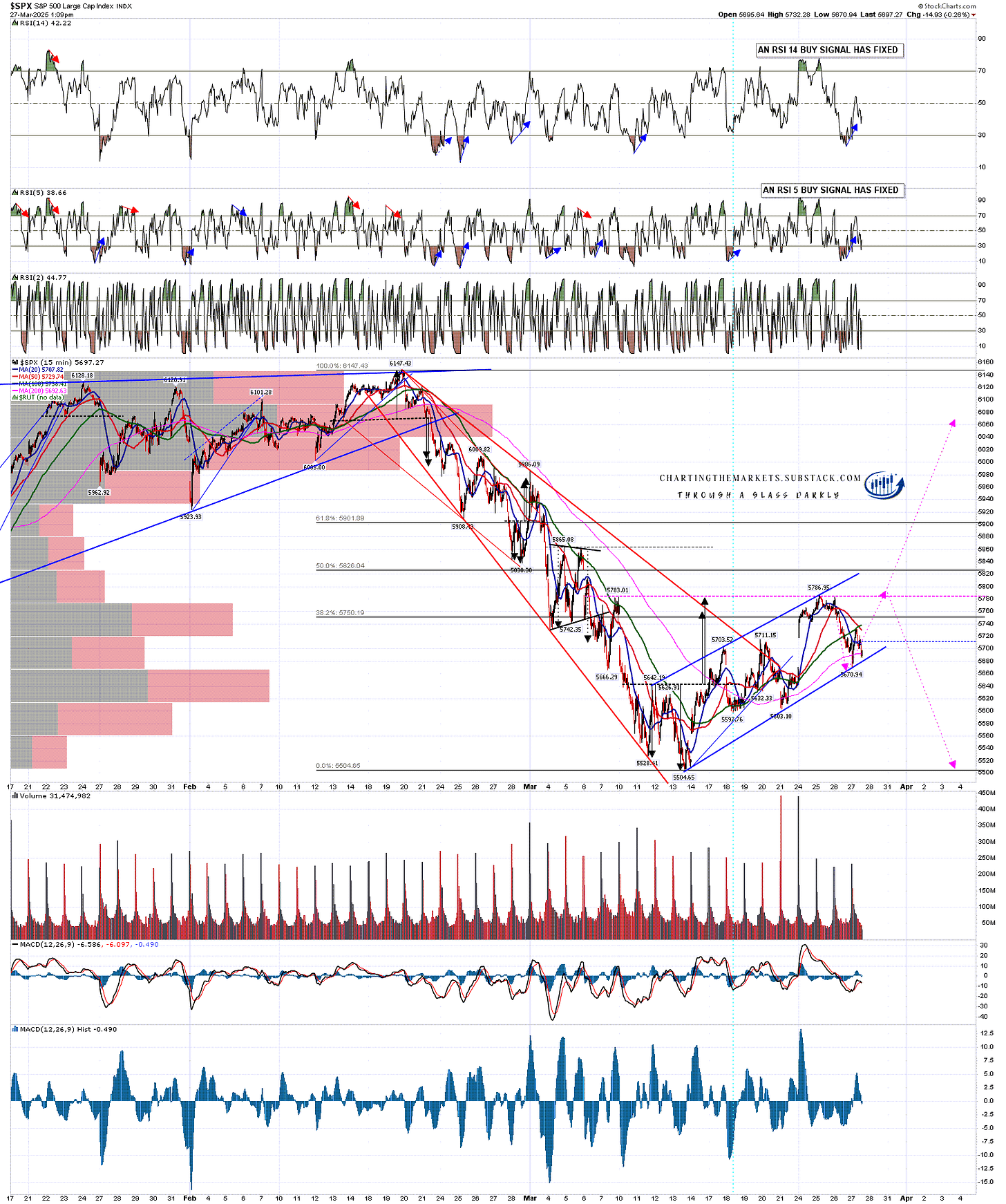

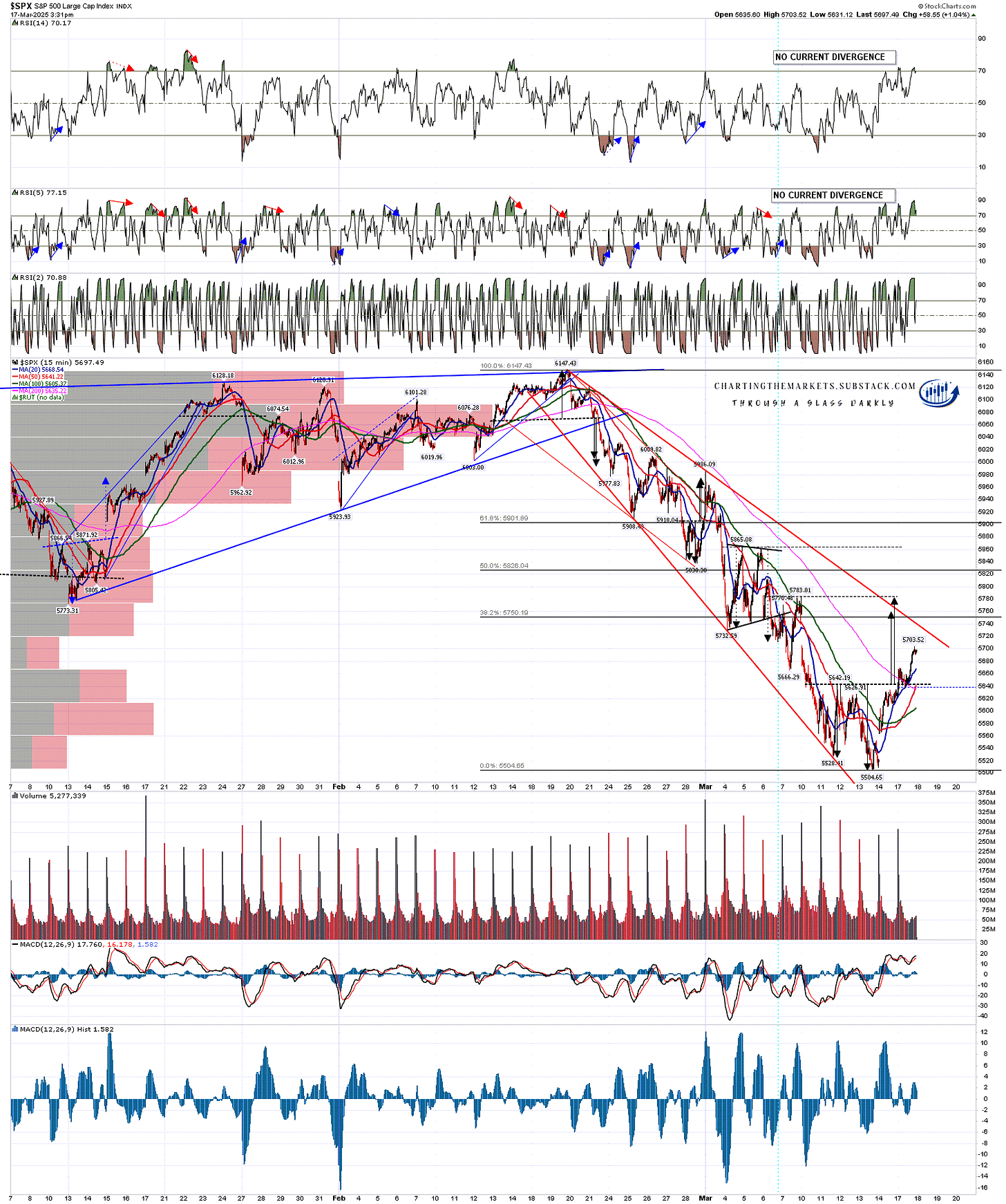

SPX has retested the 2025 low and has set up a high quality double bottom that on a sustained break back over double bottom resistance at 5786.95 would look for a target close to a retest of the all time high at 6147.43.

The open double top target is not far below in the 5440 to 5390 range, and I am watching two decent quality support trendlines that are potential support and that I have marked on the chart below. These are currently in the 5430 and 5360 areas and declining of course.

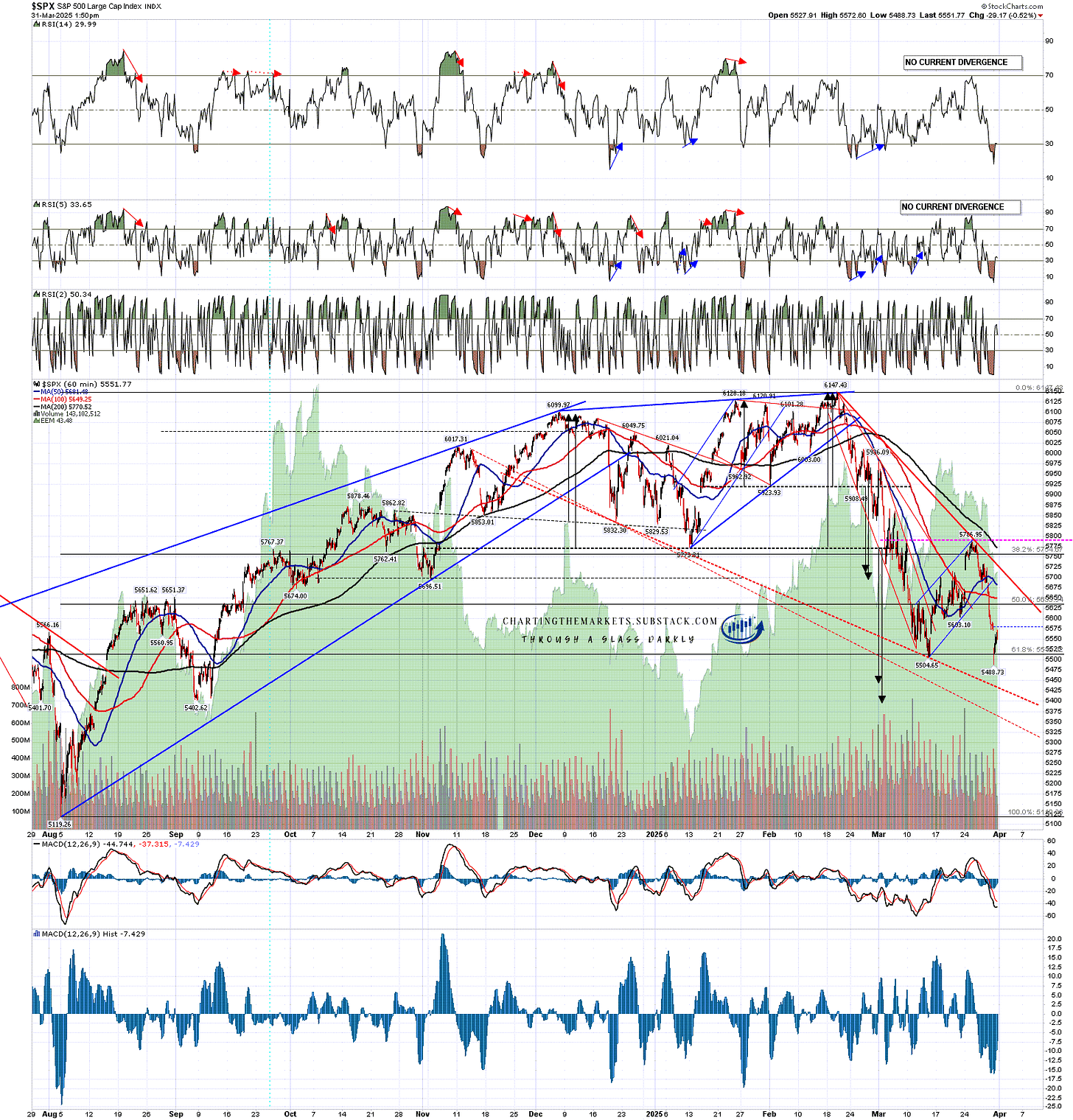

SPX 60min chart:

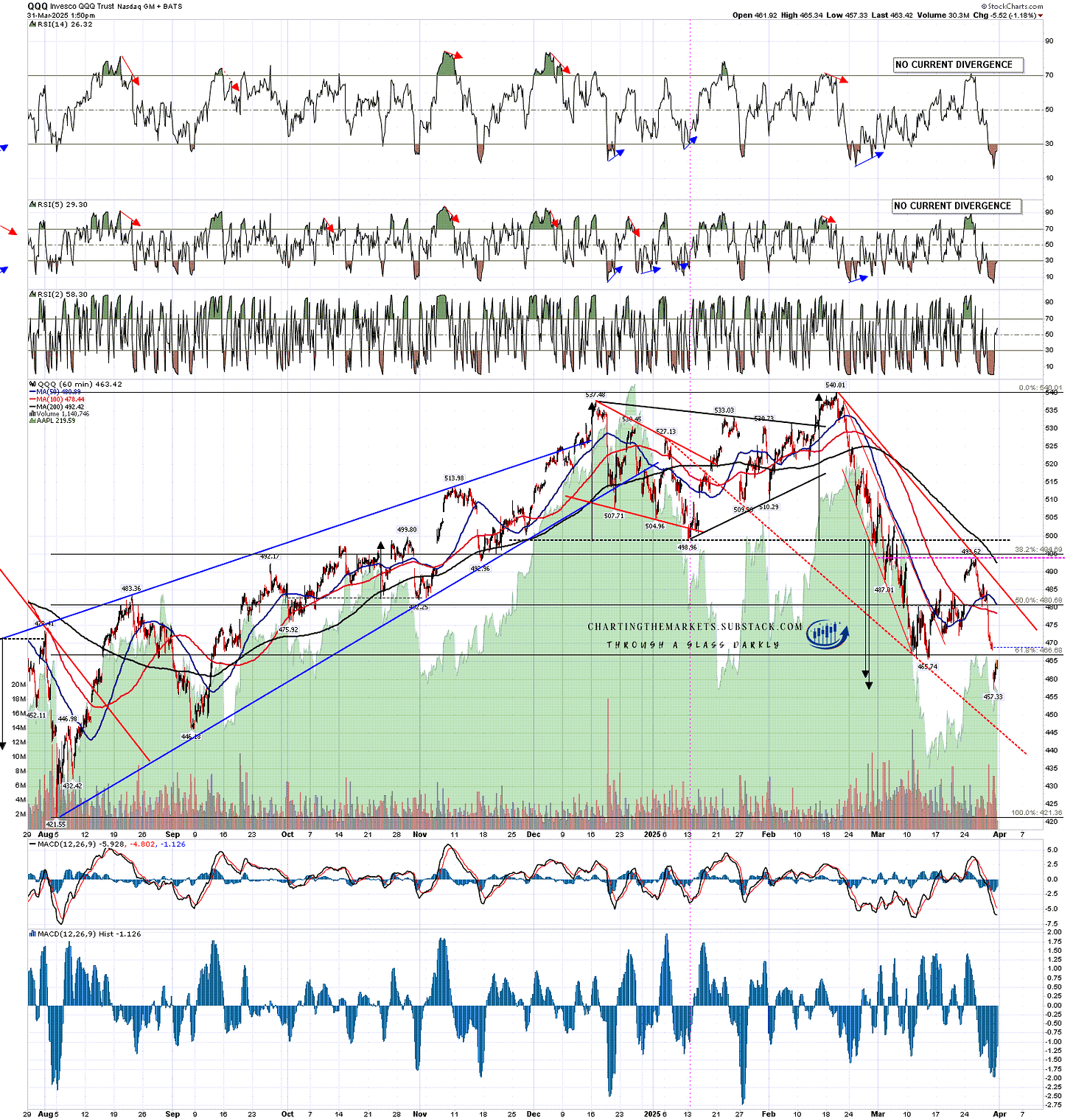

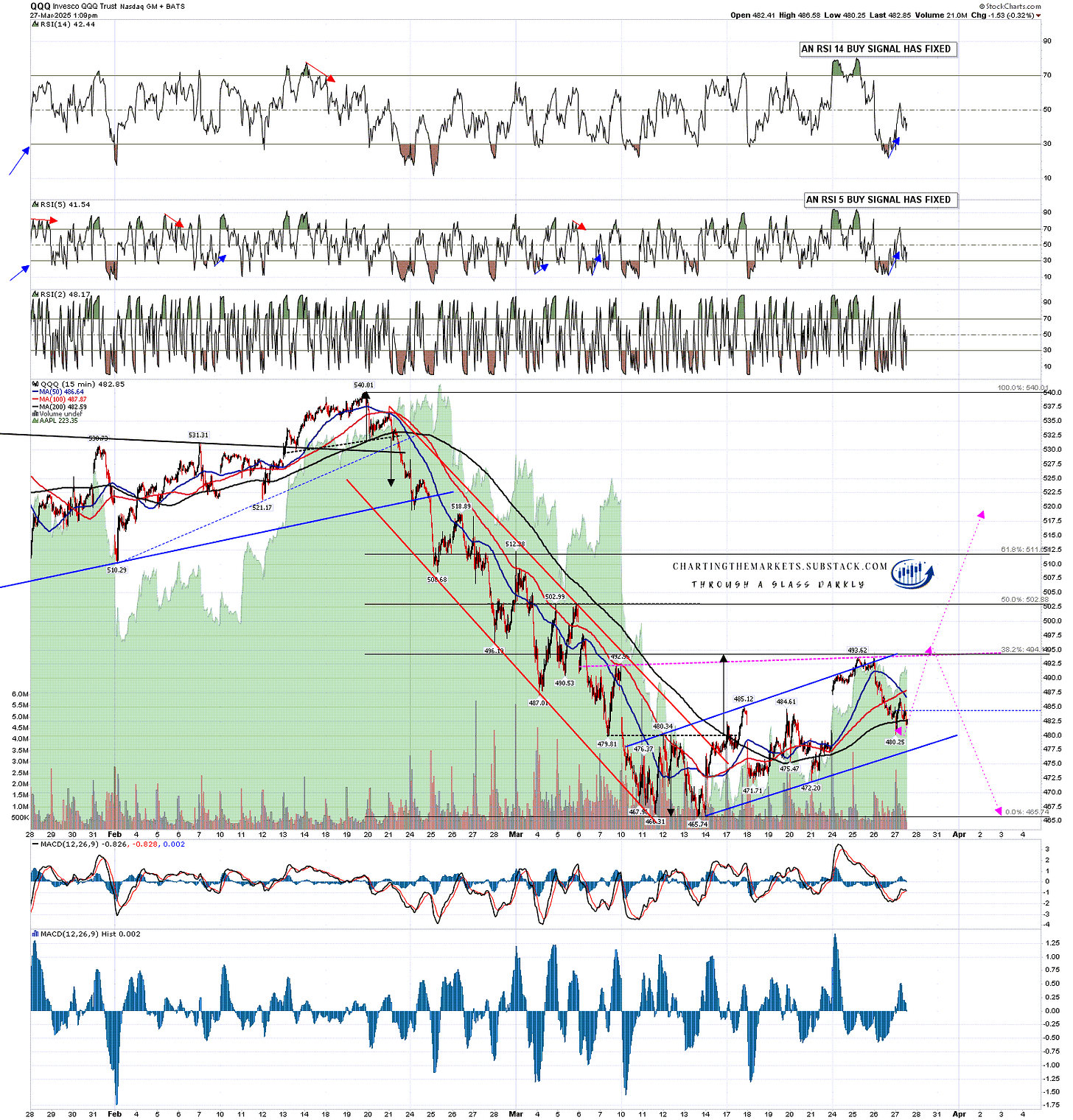

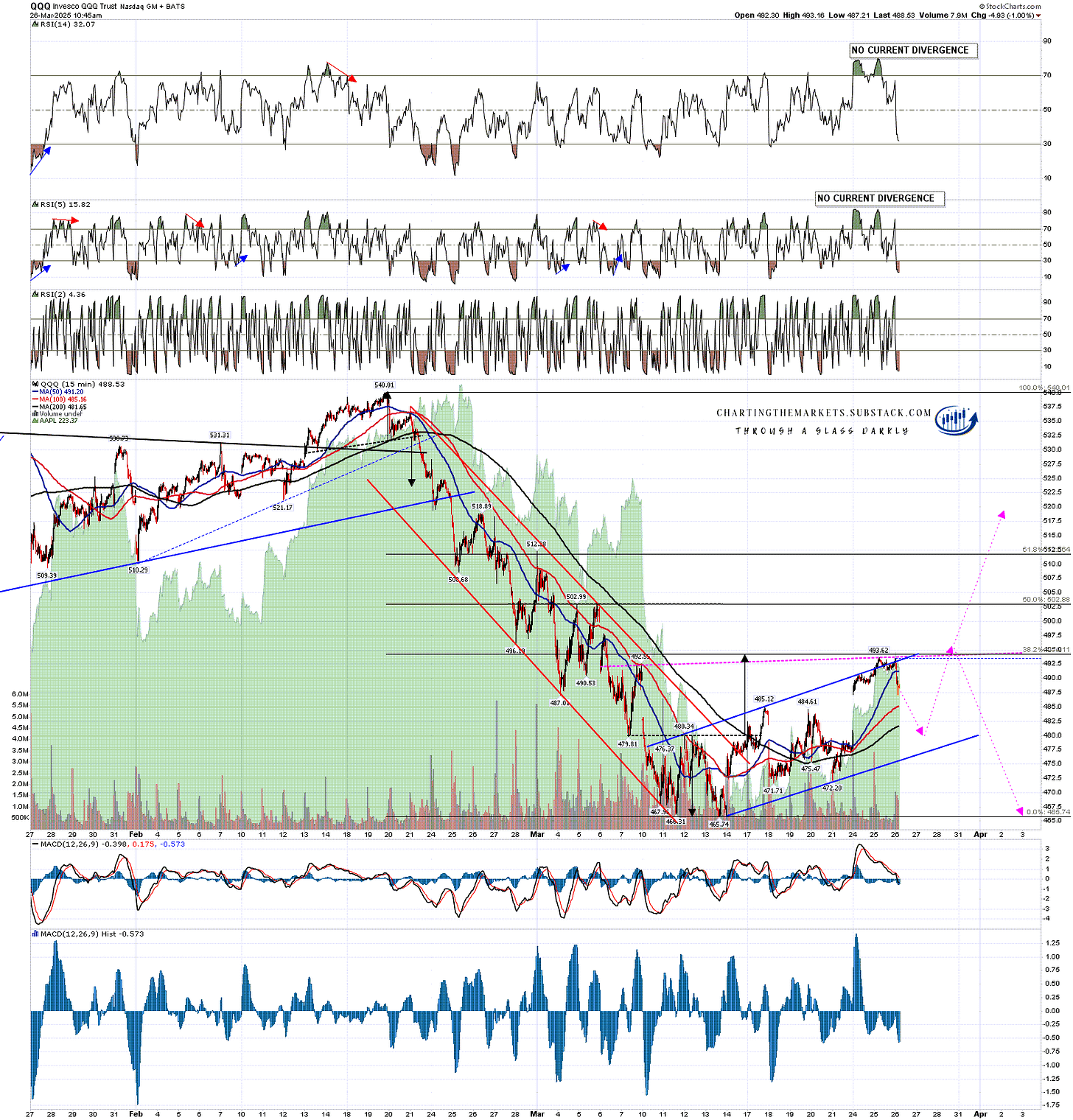

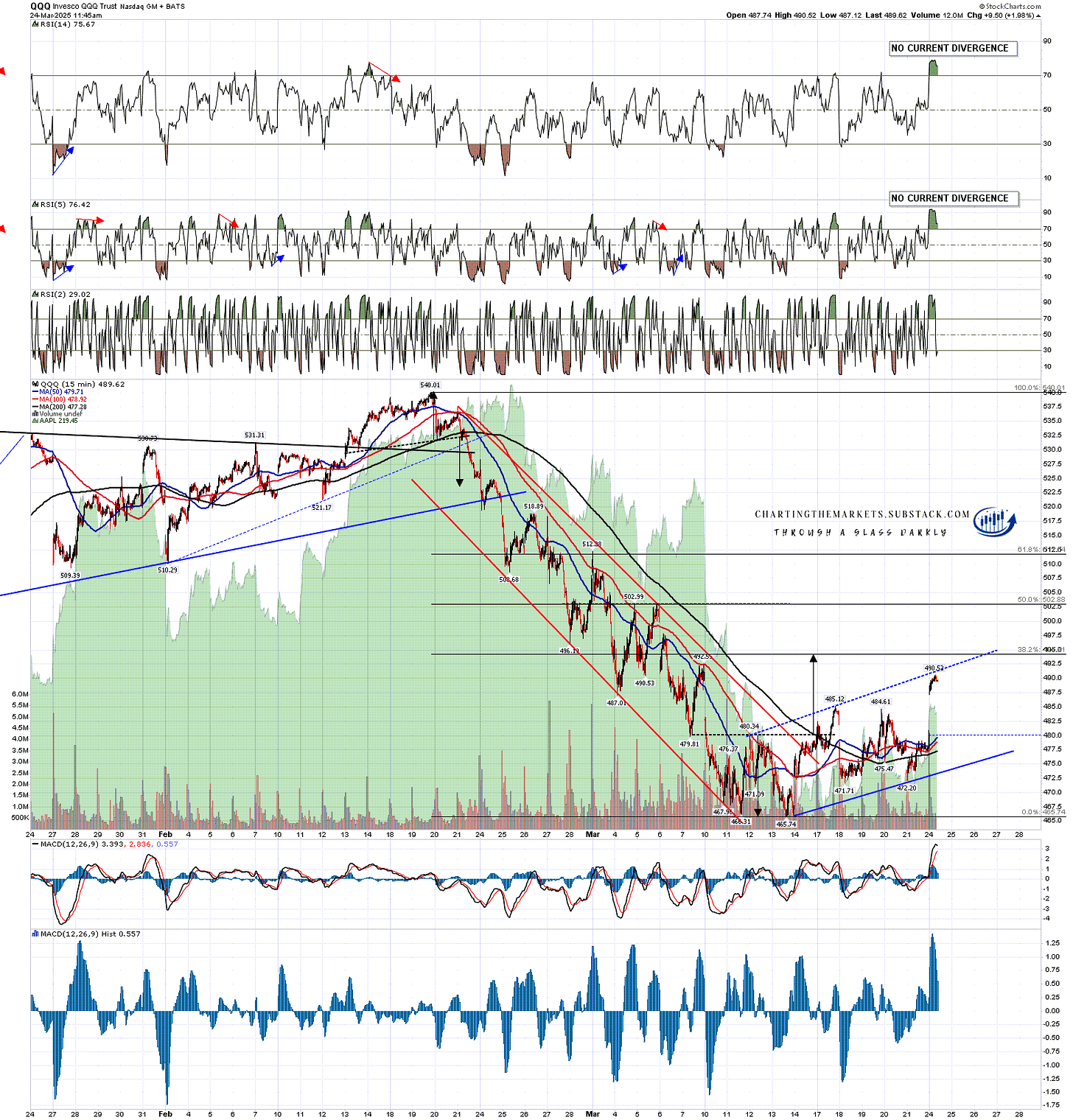

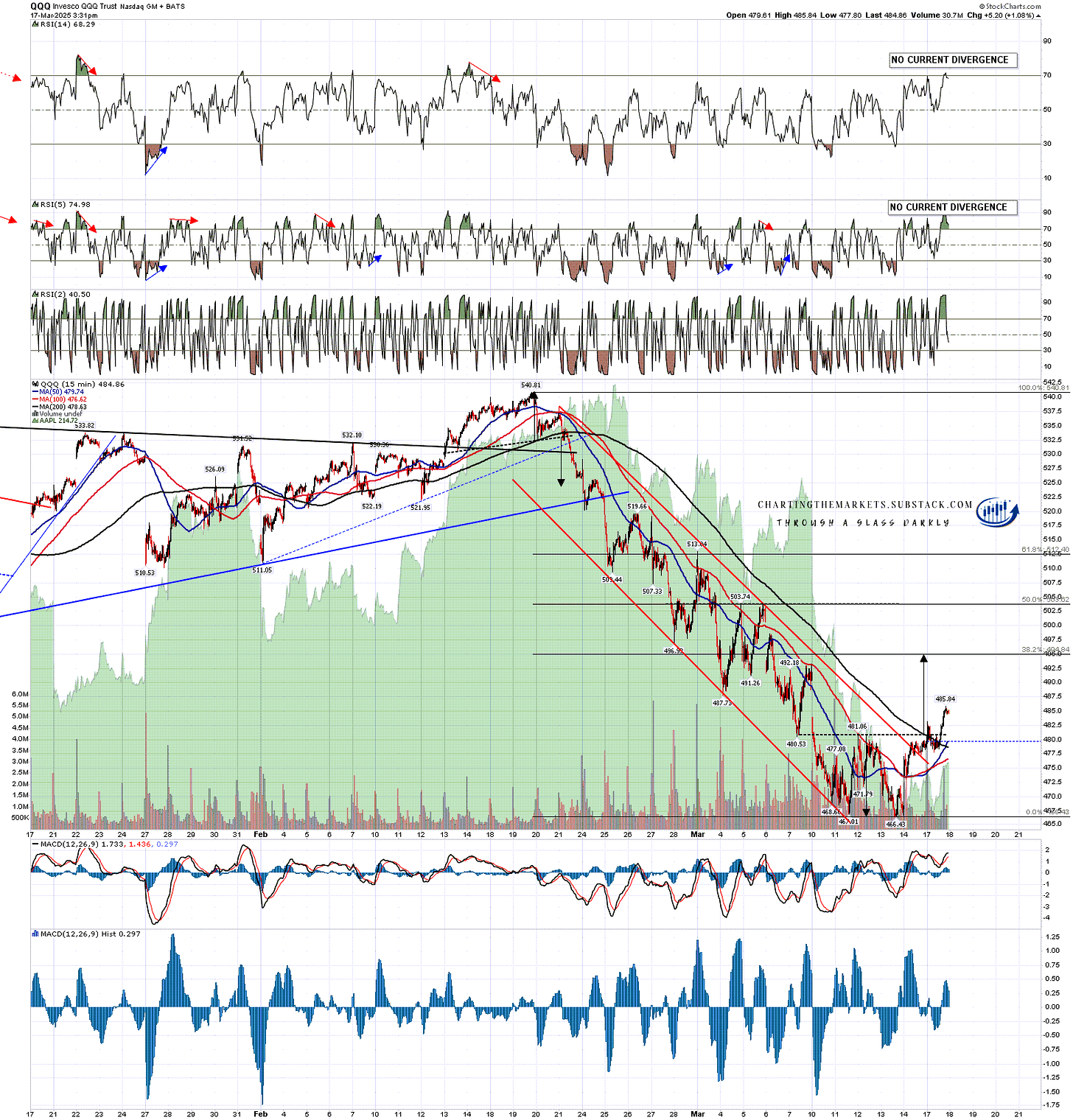

QQQ has retested the 2025 low and has set up a high quality double bottom that on a sustained break back over double bottom resistance at 493.62 would look for a target in the 521 to 529 area, within striking range of the all time high at 540.01.

The open double top target is not far below in the 461 to 457 range, and I am watching a high quality support trendline that is potential support and that I have marked on the chart below. That is currently in the 445 area and declining of course.

QQQ 60min chart:

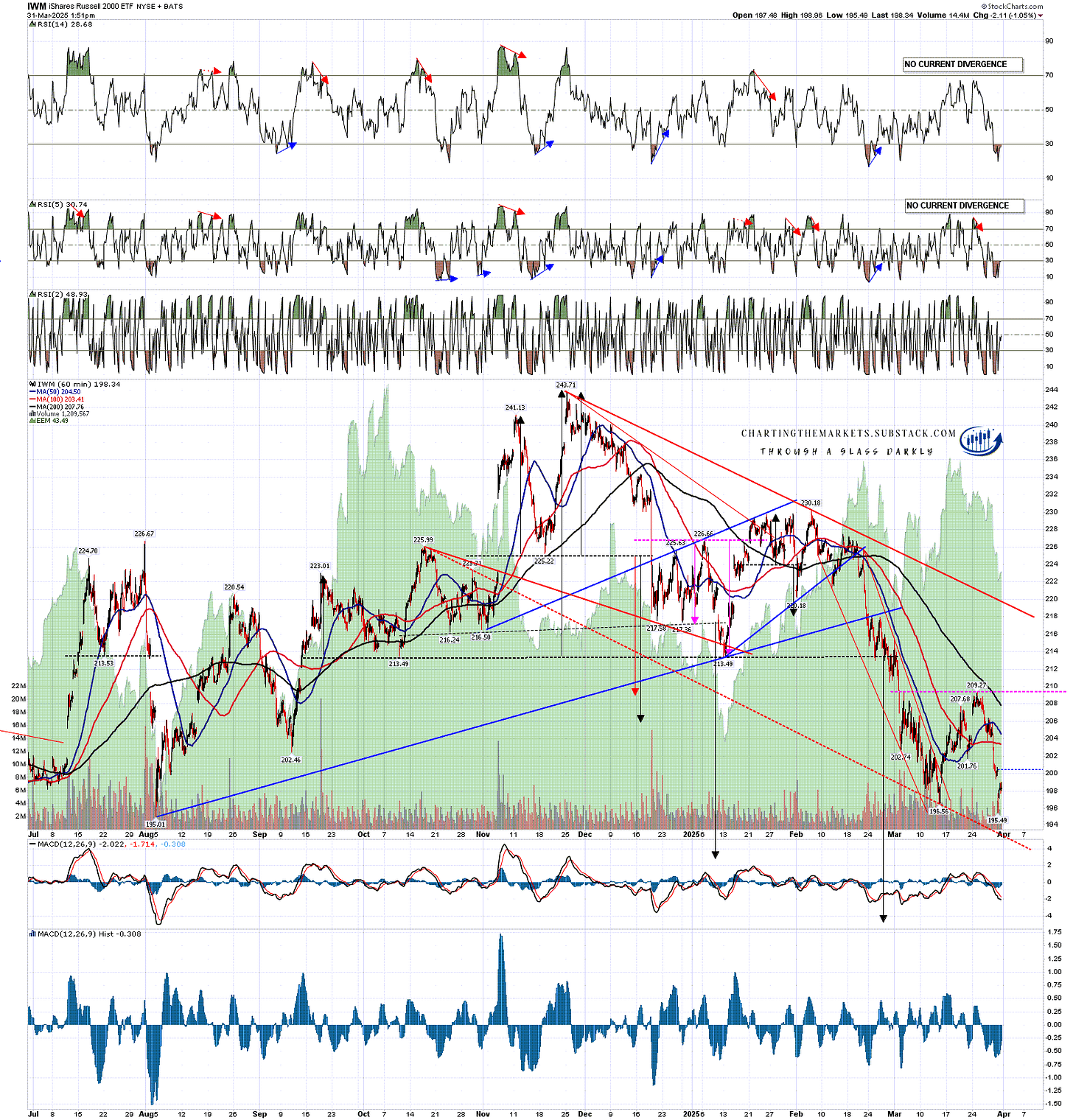

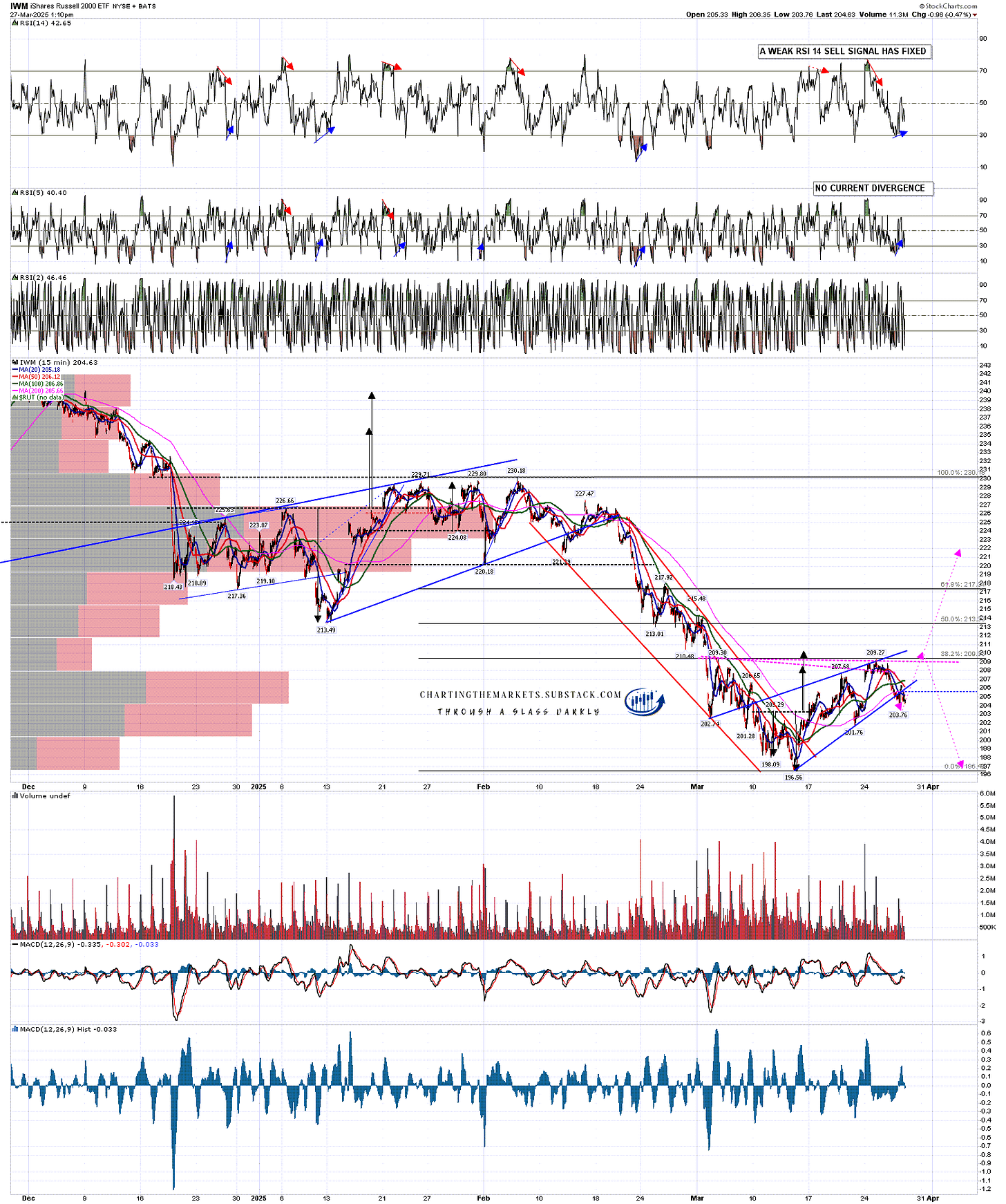

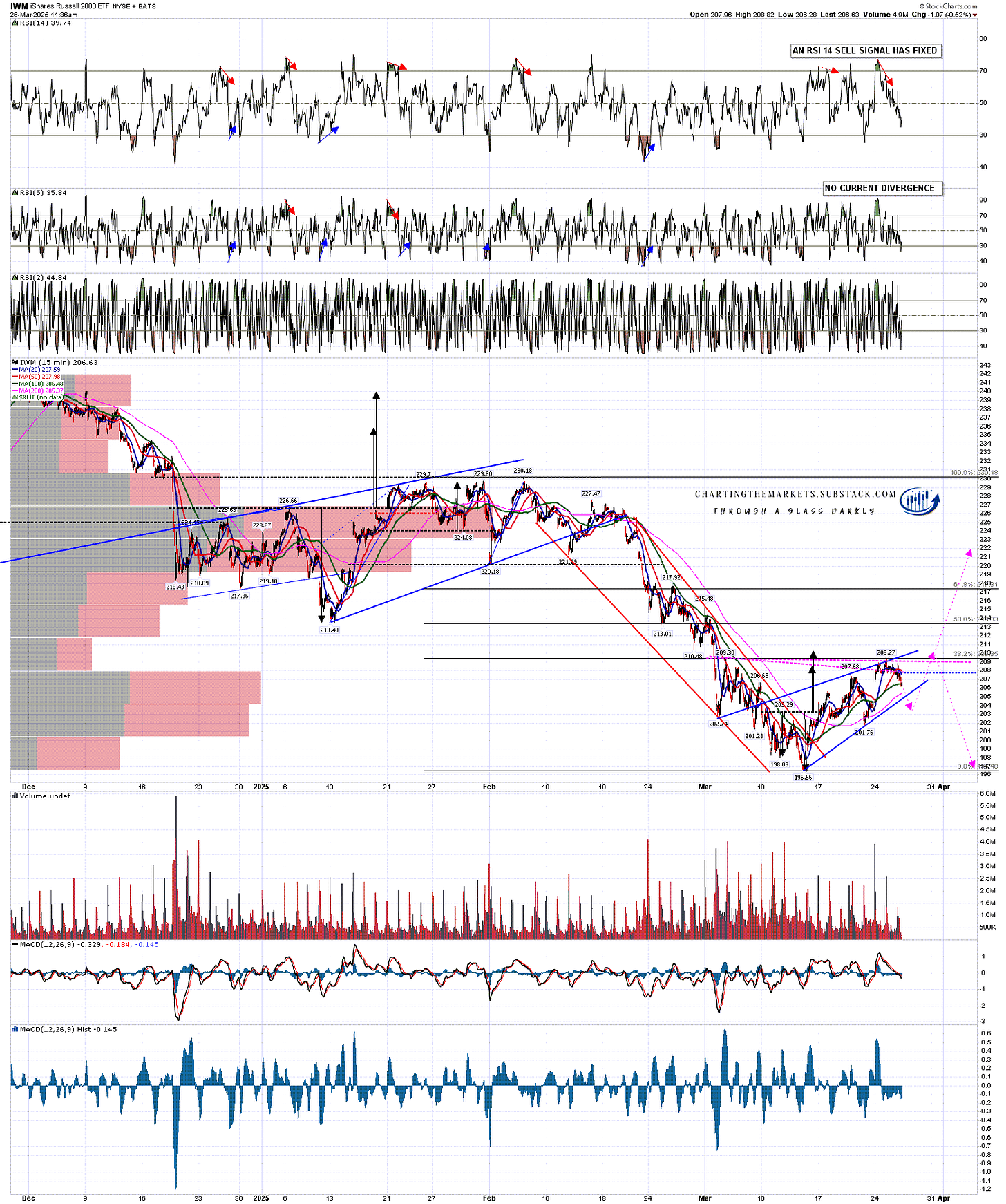

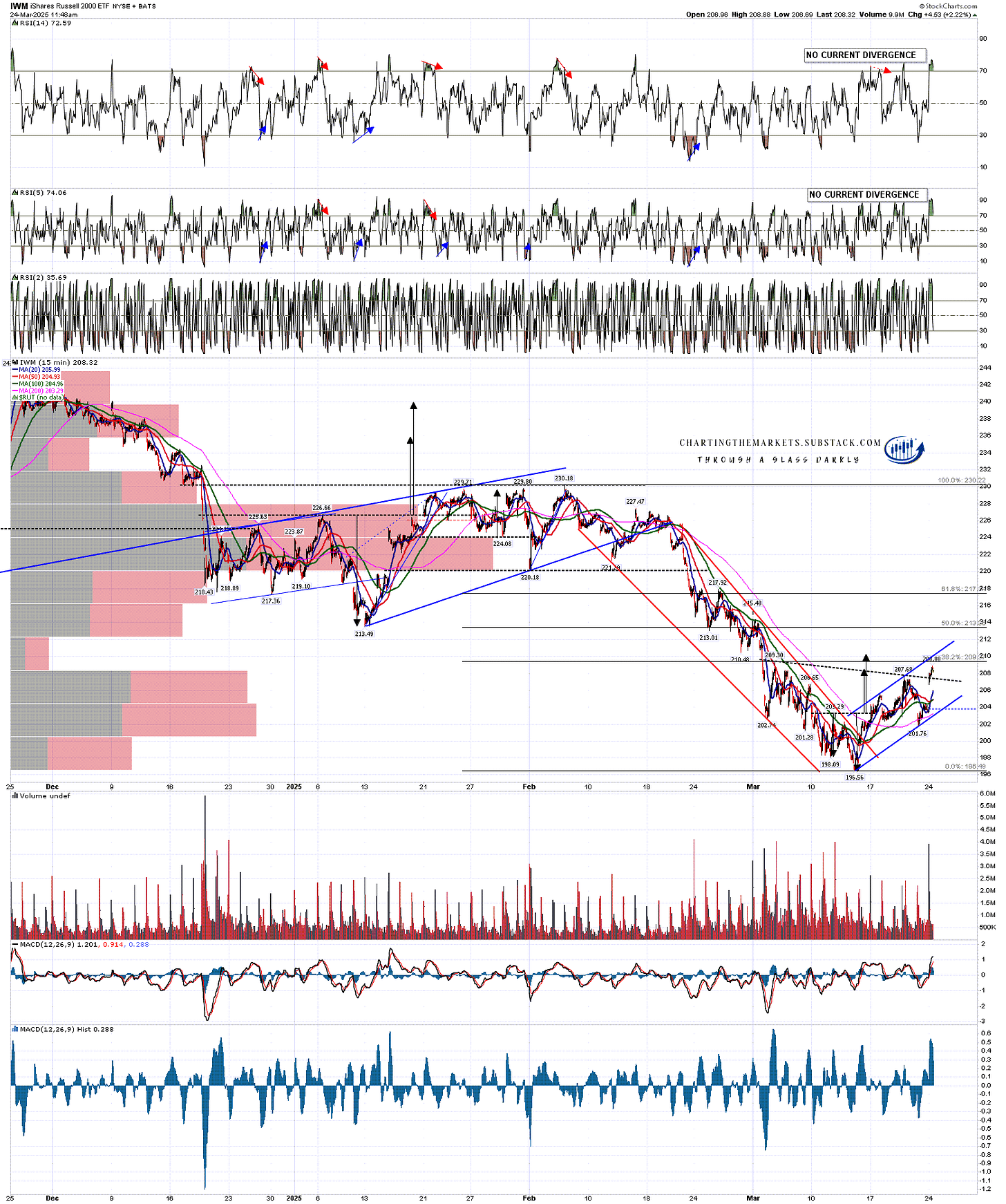

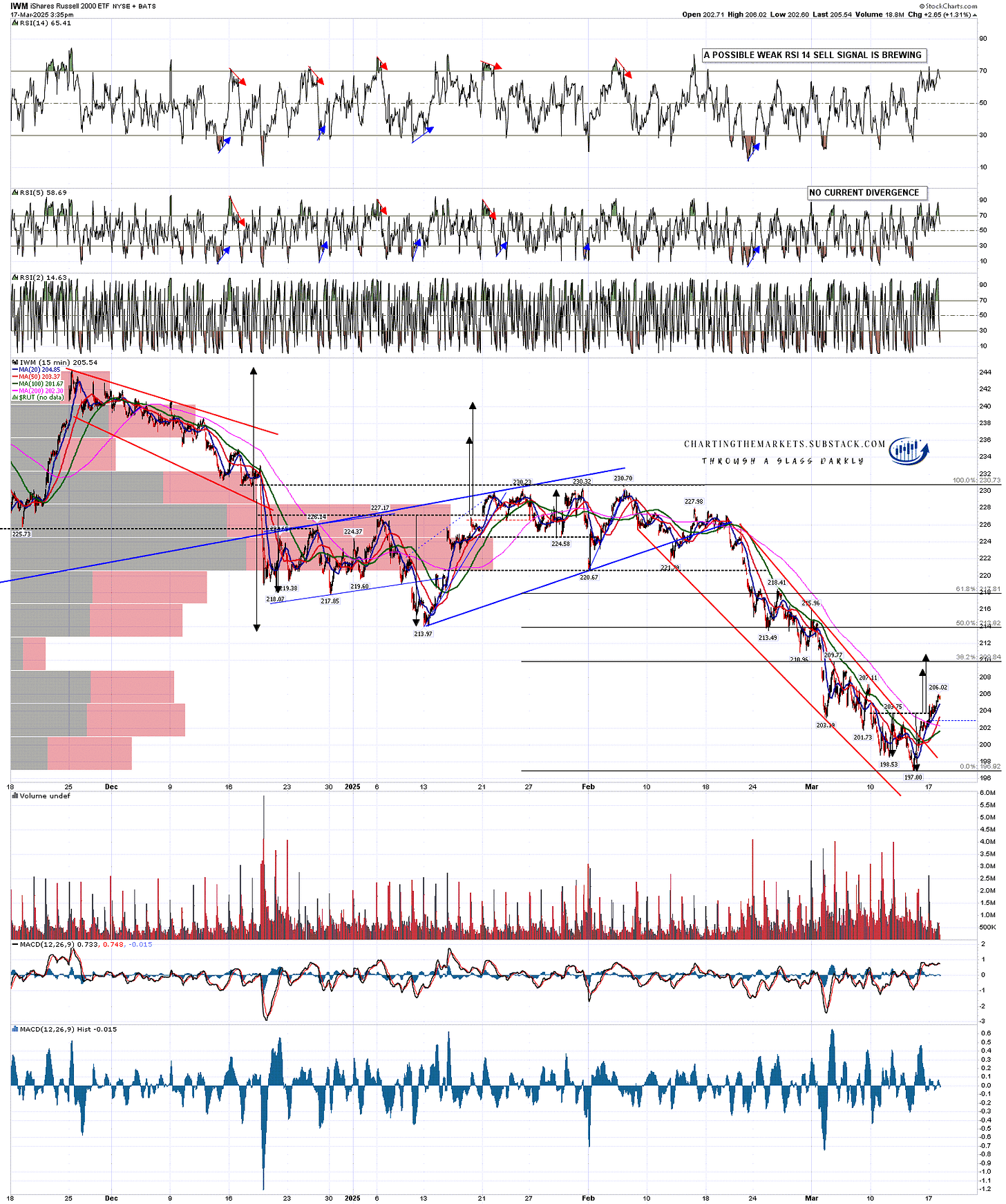

IWM has retested the 2025 low and has set up a high quality double bottom that on a sustained break back over double bottom resistance at 209.27 would look for a target in the 222-4 area, slightly over declining resistance from the all time high currently in the 220 area.

The open H&S target is still some distance below in the 183 area, and I am watching a good quality support trendline that is potential support and that I have marked on the chart below. That is currently in the 192.5 area, and declining of course. Unless this next leg down lasts into mid-May, this trendline would likely need to break in order for the H&S target to be reached.

IWM 60min chart:

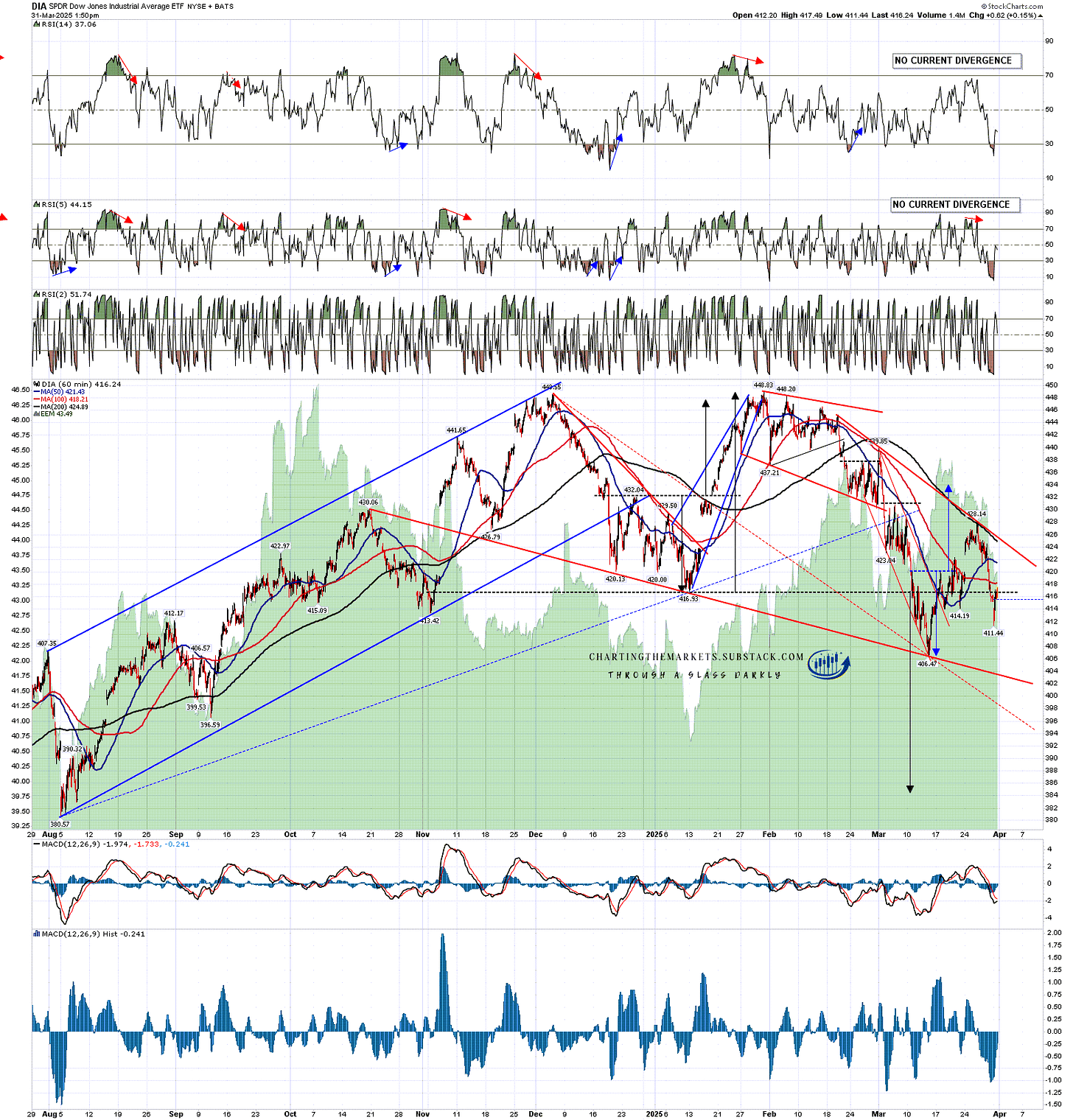

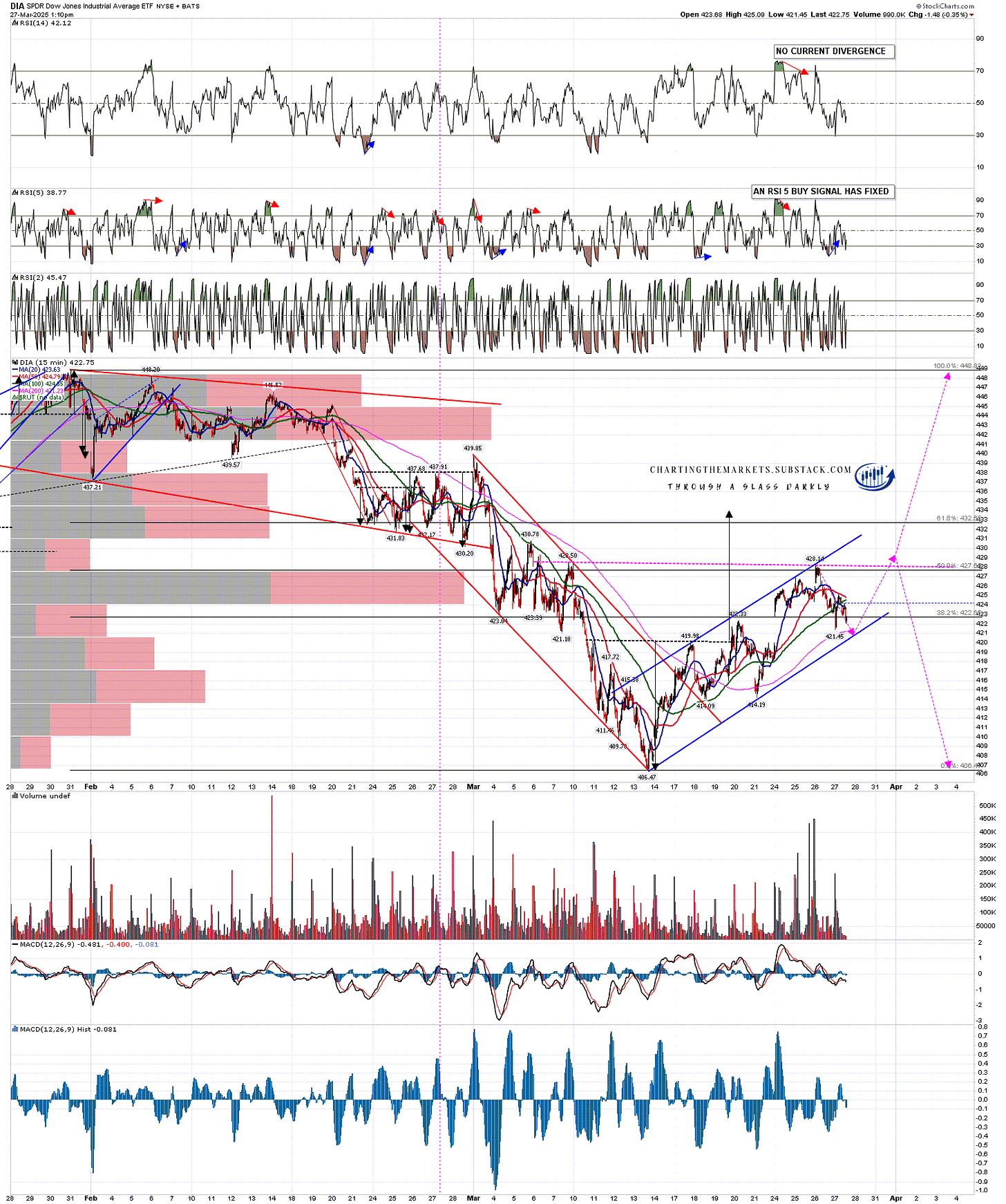

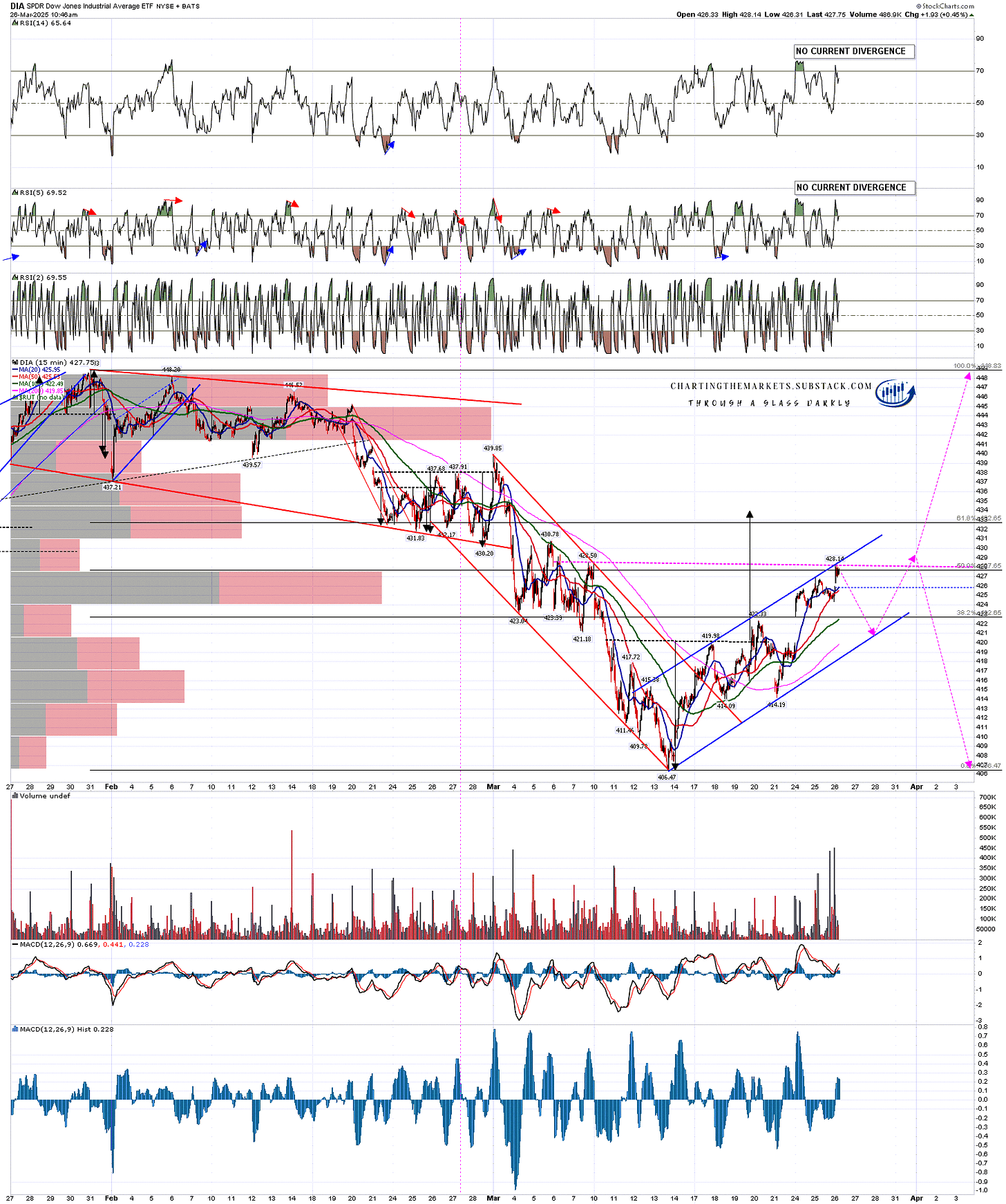

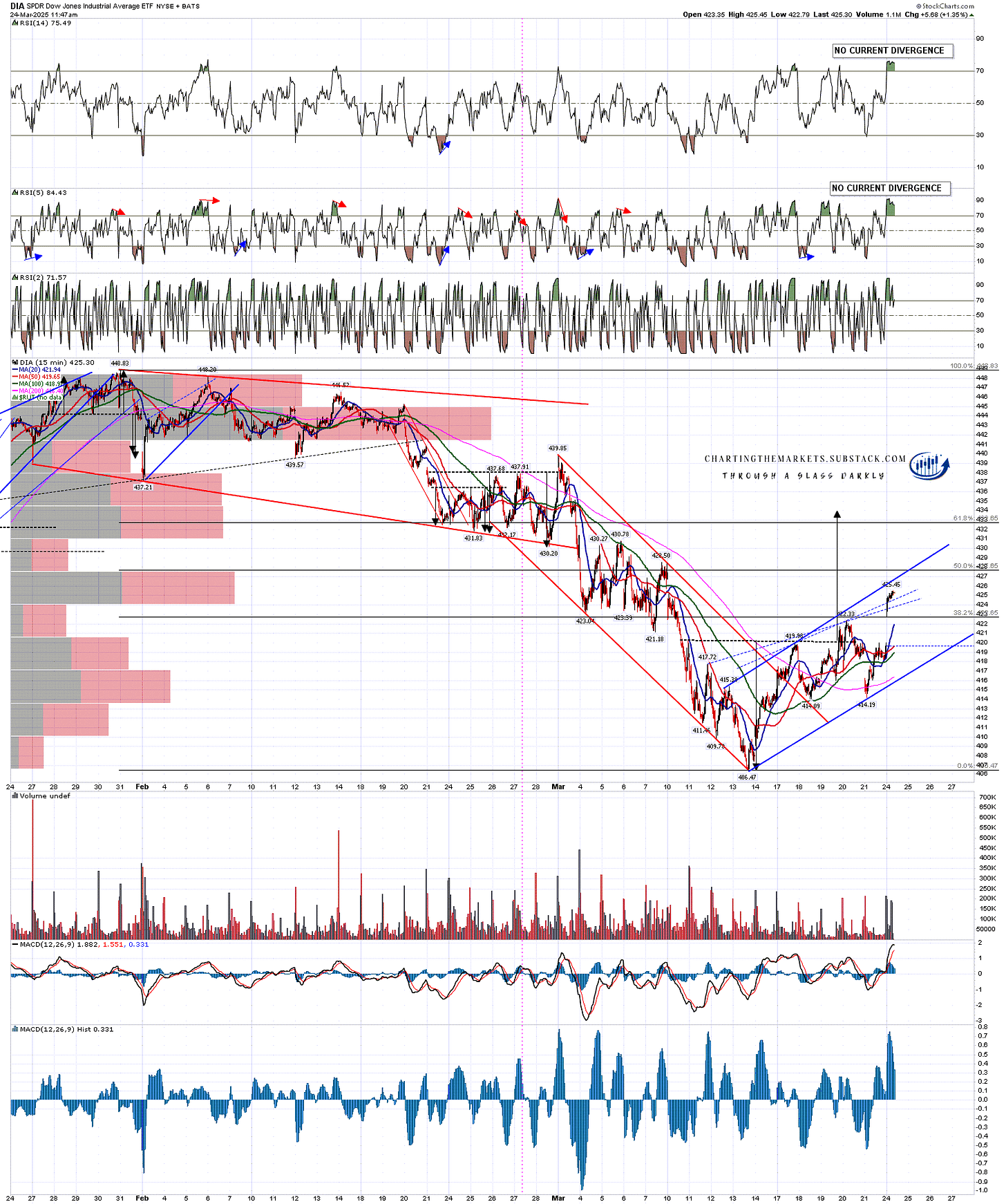

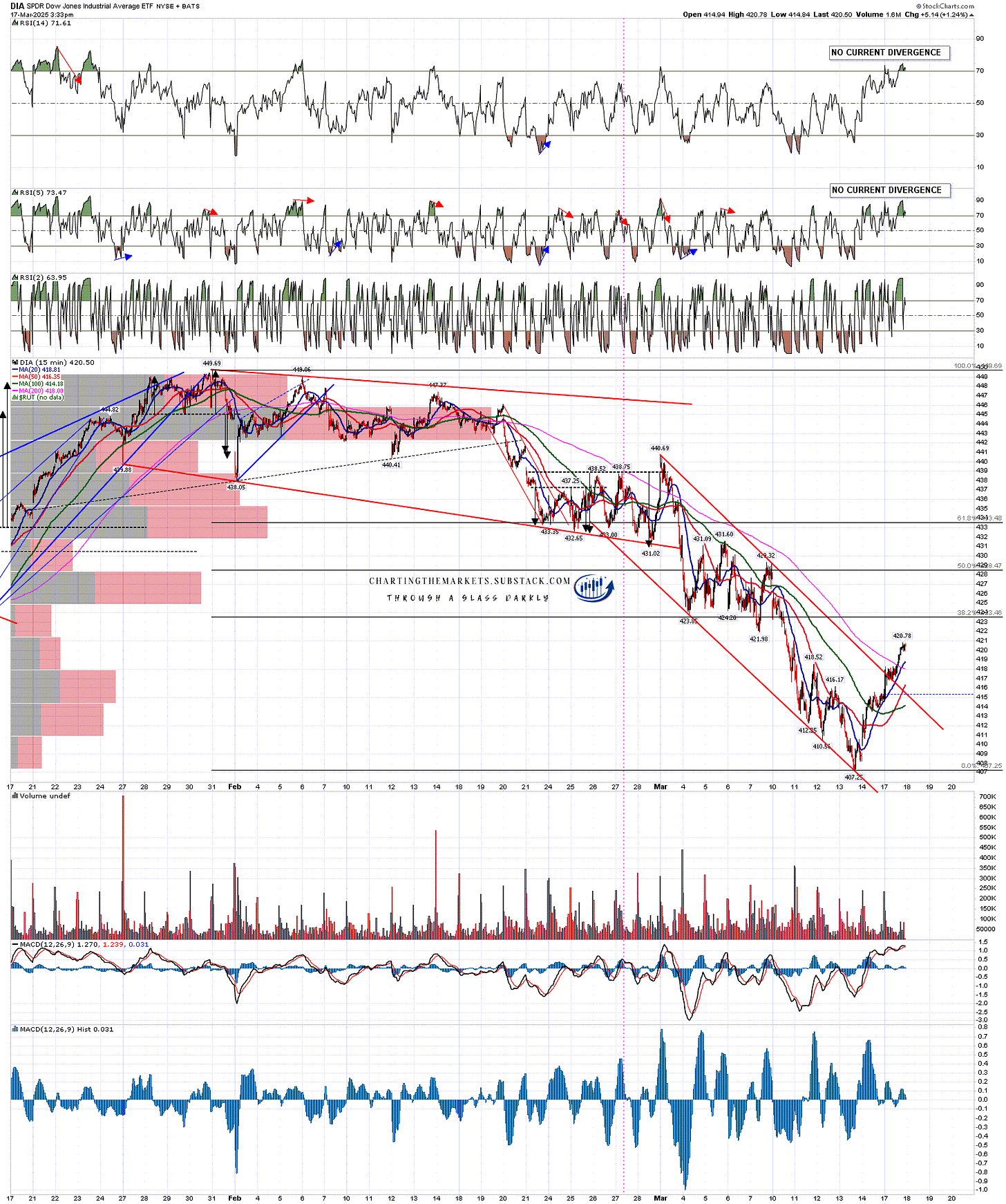

DIA has not yet retested the 2025 low, but likely will soon, ideally tomorrow. If seen, that would set up a possible double bottom that would have a target at a retest of the all time high at 448.83.

The open double top target is still a long way below at 384. I am watching two possible high quality support trendlines that are potential support and that I have marked on the chart below. Those are currently in the 404 and 399 areas, and declining of course. The higher trendline would likely need to be broken to reach this double top target, and unless this next leg down lasts into mid-May, the lower trendline would likely also need to break in order for the H&S target to be reached.

DIA 60min chart:

My working assumption here is that the April 2nd date for a major escalation of the trade war will go ahead as planned to a significant degree against most current US large trading partners, notably against the European Union, which so far appears to be particularly detested by the Trump administration. If so, I‘m expecting that will have a significant impact on economic growth and the equity markets. I’m working on another post to look at the tariffs issue and the big impact I think this may have on the US and other economies and on the US equity markets. I have done most of the research for that already and have split that into two posts. I’m aiming to publish both of those tomorrow morning.

As I have been since the start of 2025 I’m still leaning on the bigger picture towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities, not least because both of the last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch. I could of course however be mistaken. UPDATE 11th March 2025 - I am wondering if this may be a bear market that dominates the whole of 2025.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.