In my post on Friday I was talking about the possible rally setup on Crypto and, while Crypto has gone down over the weekend, the rally setup has improved. It looks fragile though, and would rapidly fall in quality with a significant decline from here.

In the meantime Trump was interviewed yesterday and was talking about further tariffs he was looking at against overseas trade partners. He was asked whether these policies might trigger a recession and said it was possible while seeming very relaxed about that prospect. This was not encouraging for equities and is fuelling further speculation that the current bull markets in Crypto and equities may now be over. I’m wondering more about that too but we’ll see how this develops.

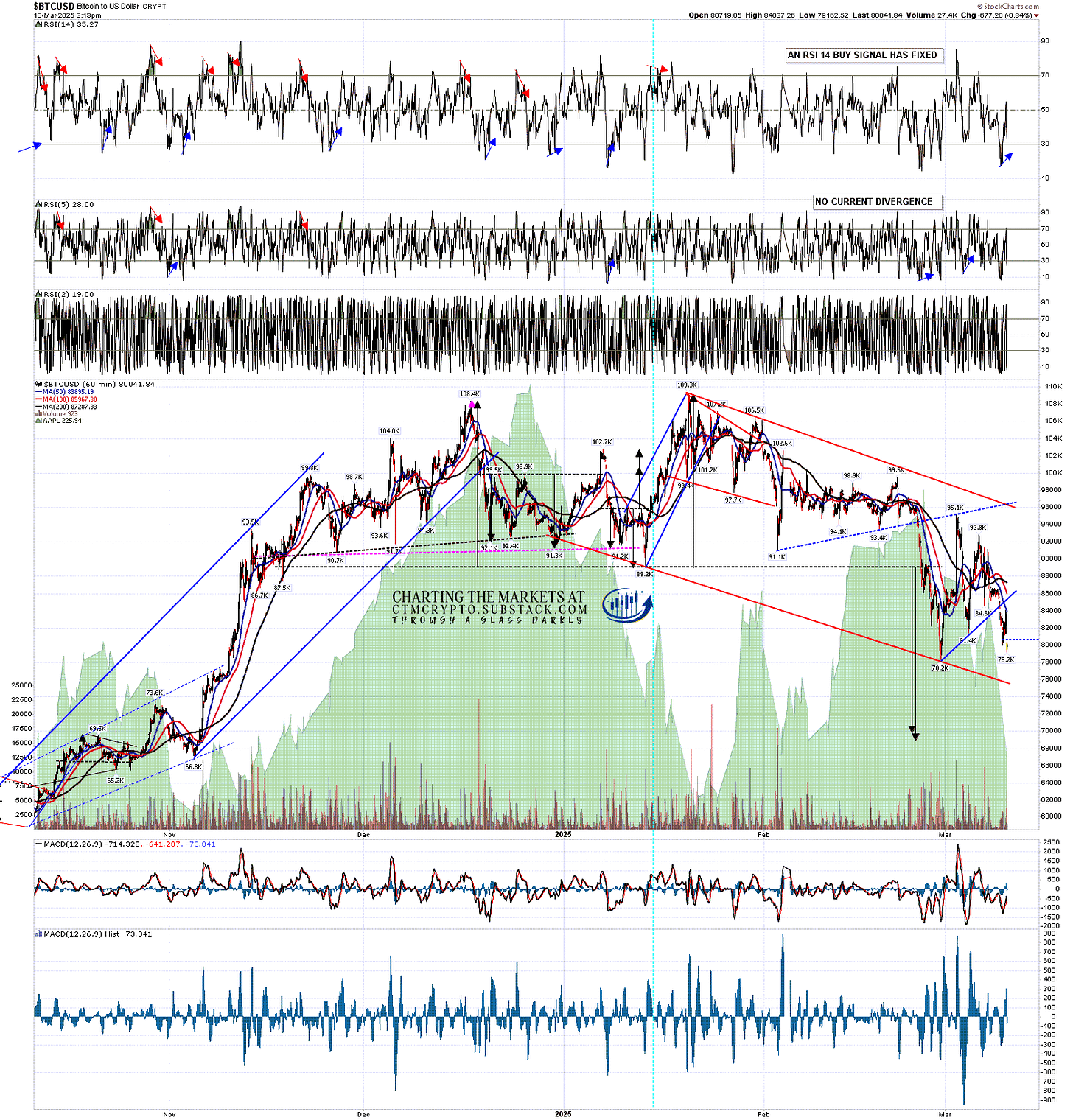

In the short term Bitcoin (BTCUSD) is close to a retest of the February low at 78.2k, and a full retest would set up a possible large double bottom there. There is already a smaller double bottom setup formed that on a sustained break over 84k would look for a target in the 88k to 89.6k range. That is a decent looking setup.

BTCUSD 60min chart:

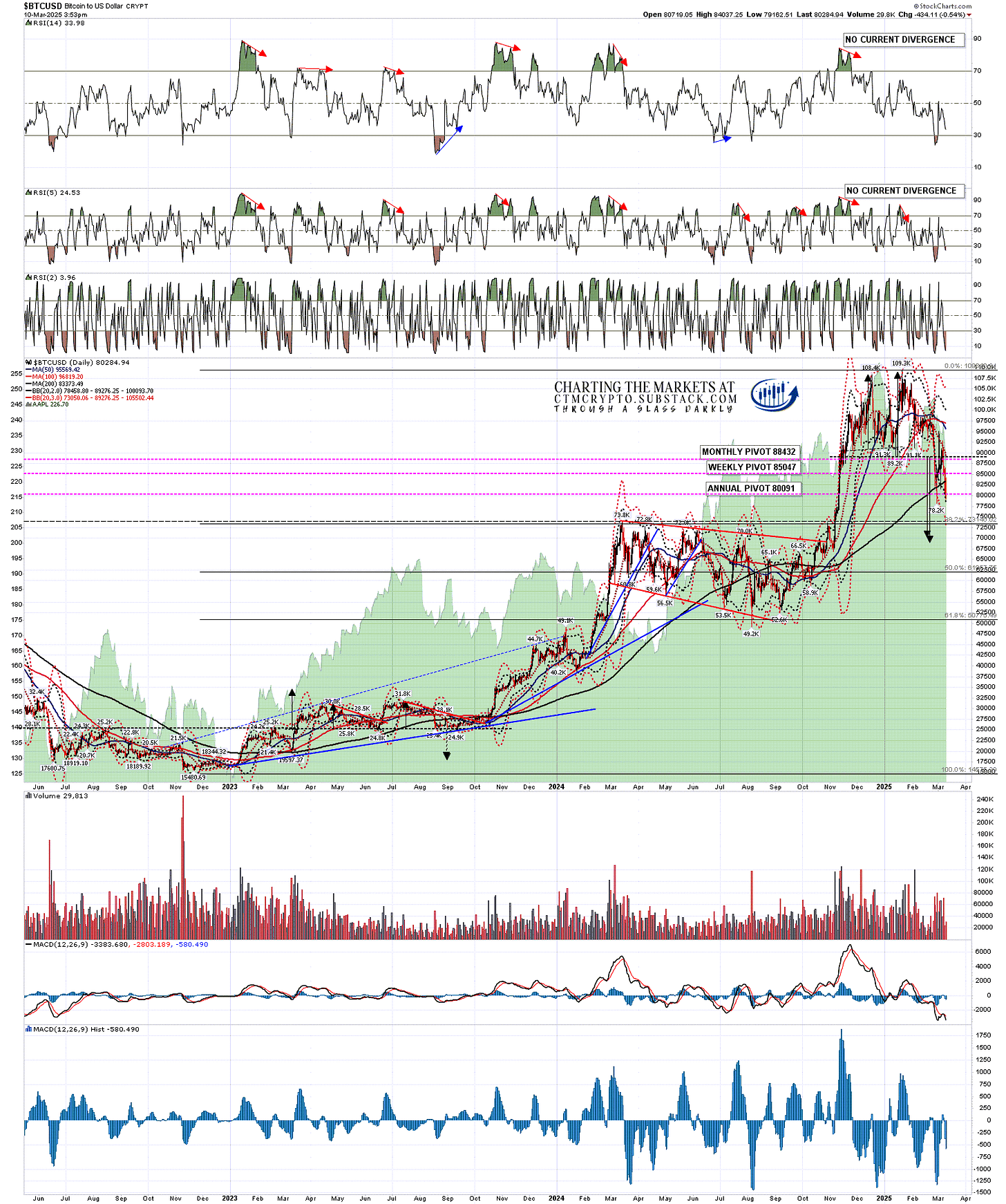

I would note of course that there is still a double top on the Bitcoin daily chart that has an open target in the 69k to 70k range, and I’m still expecting that target to be reached after any rally here.

BTCUSD daily chart:

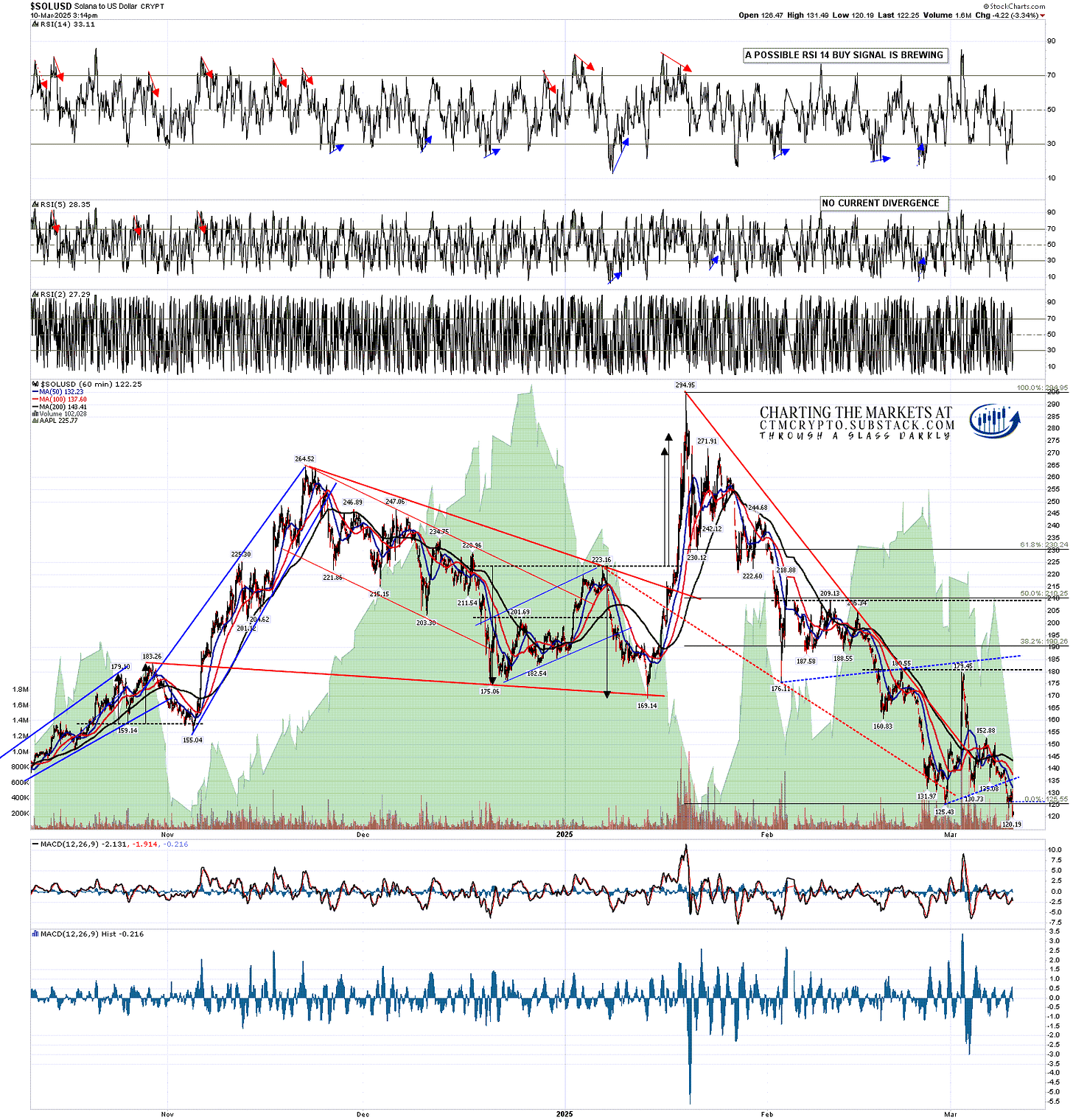

Solana (SOLUSD) has retested the low and a possible double bottom setup has formed that on a sustained break above 179.93 would look for a target in the 234 to 239 area. This is currently a decent looking setup and a possible hourly RSI 14 buy signal is brewing.

SOLUSD 60min chart:

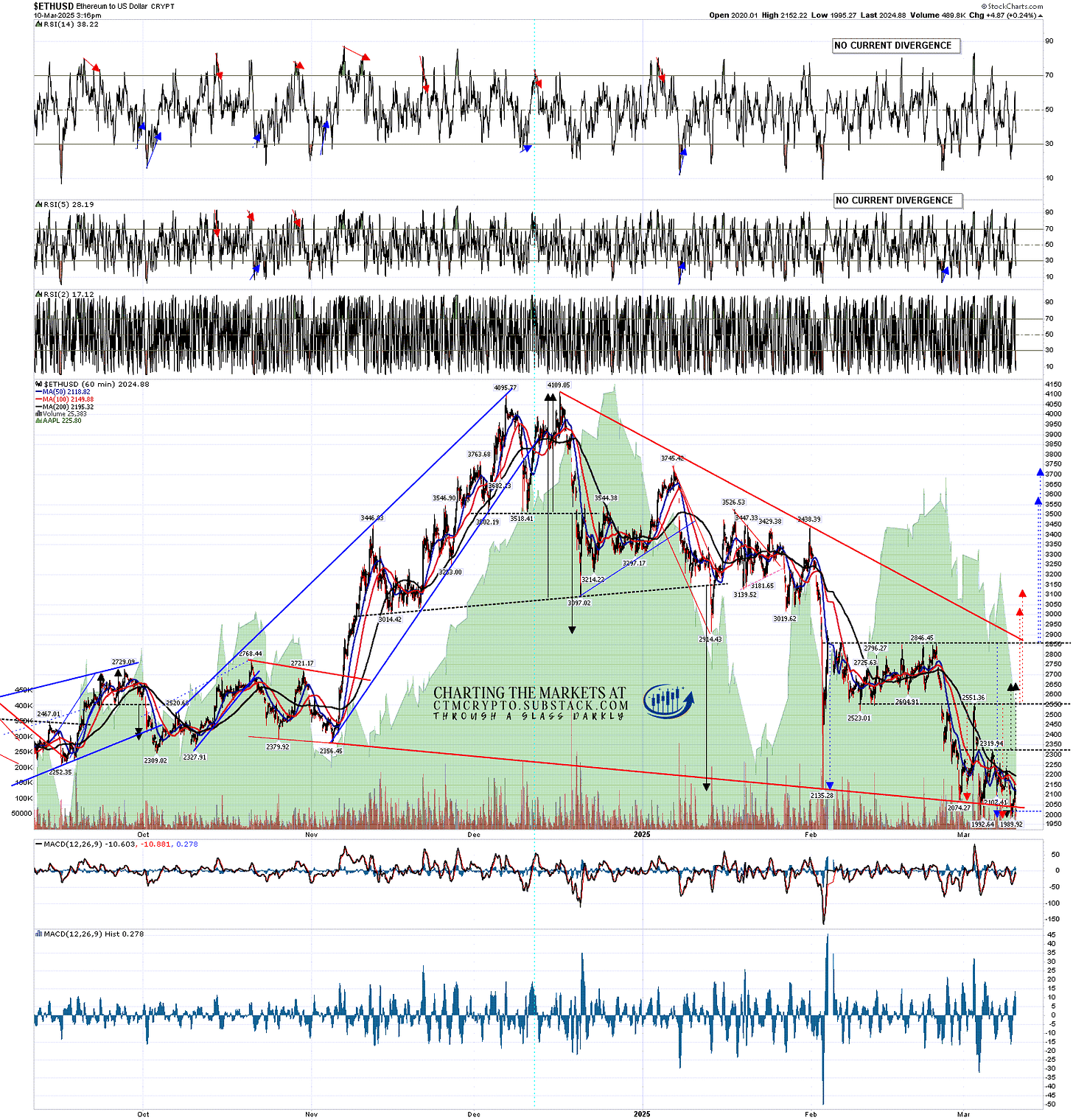

The fairest of them all in terms of the rally setups here though is Ethereum (ETHUSD), where the current rally setup is just a picture of technical beauty. There is a lovely triple nested double bottom setup here just waiting for a wisp of optimism to set it in motion.

On a sustained break over 2319.94 the first and smallest double bottom would look for a target in the 2655 area.

On a sustained break over 2551.36 the second double bottom would look for a target in the 3040 to 3130 area.

On a sustained break over 2846.45 the third and largest double bottom would look for a target in the 3590 to 3730 area.

There is arguably a fourth and even smaller double bottom forming here that on a sustained break over 2152.22 would look for a target in the 2315 area.

This is a textbook setup of a rare bottoming formation, but a break much lower would damage this considerably. We’ll see.

ETHUSD 60min chart:

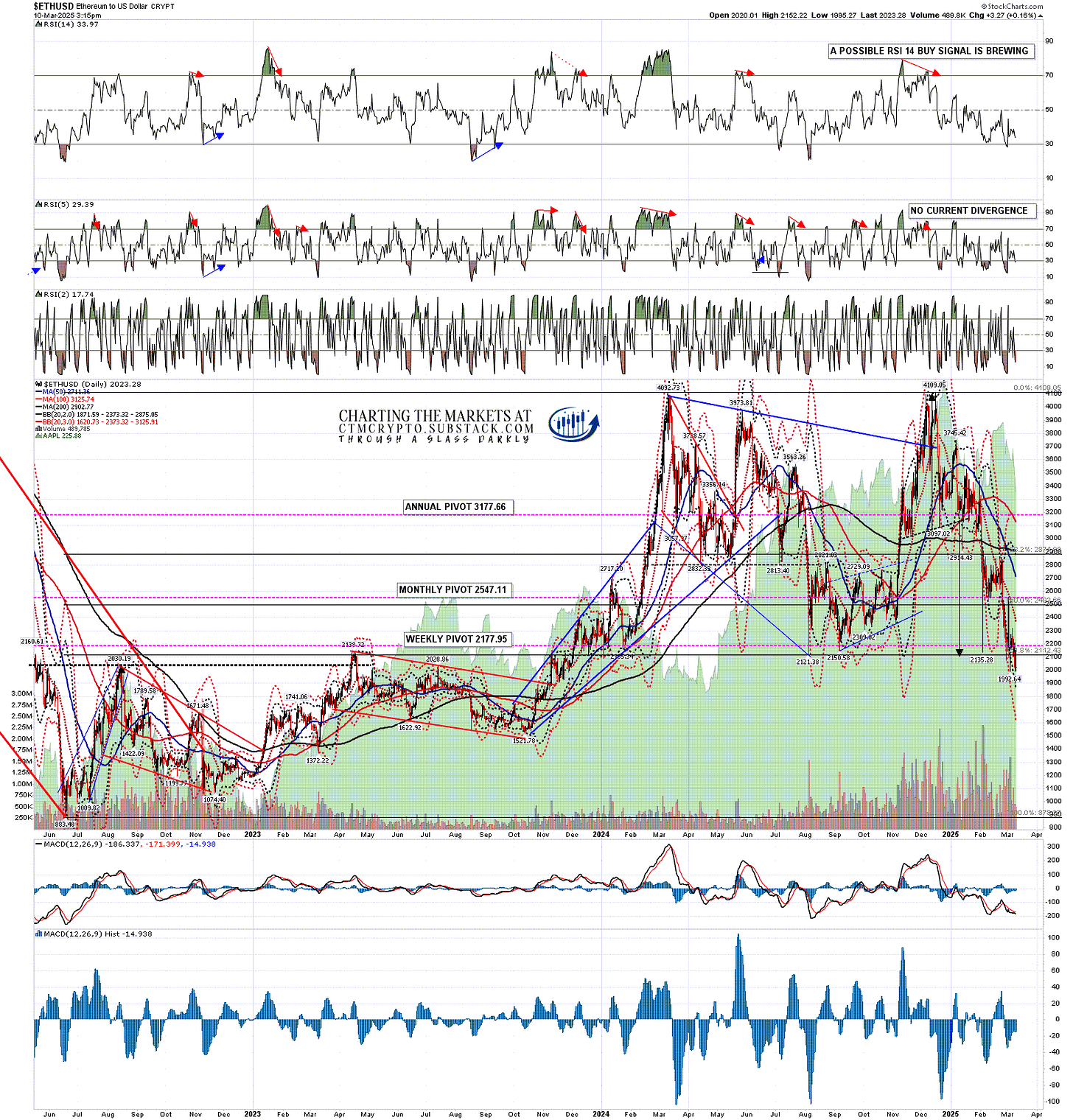

On the daily chart I would also add that Ethereum has a possible weak RSI 14 buy signal brewing, though not of the highest quality.

ETHUSD daily chart:

What would really be helpful in terms of seeing this rally happen would be a strong rally here on equity indices. In terms of seeing that happen it might be very helpful there if President Trump was unable to speak to anyone for a few days, ideally for two or three weeks, as he currently seems to be depressing markets almost every time that he does speak.

So far this year I have been and am still leaning towards seeing weakness in the first half of the year and renewed strength in the second half of 2025, with a very possible bull market high on Crypto pencilled in close to the end of the year. That scenario would be a good match with past Crypto bull markets. Is it possible that I am mistaken? Always, but we can only ever try to identify the higher probability paths in the future. Only time can show us the path that is actually taken. Still, I’m with Confucious who said ‘study the past, if you would divine the future’.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

CTM Crypto Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

No comments:

Post a Comment