In my last post on Monday I was looking at the rally setup on Crypto which was decent but looked fragile, and that setup didn’t deliver, with Bitcoin (BTCUSD), Solana (SOLUSD) and Ethereum (ETHUSD) making lower lows and those bottoming setups disintegrating.

I want to have a look at the bigger picture on Crypto today as there are some reasons to think that a larger low may be forming, though with Crypto tied as closely as it is to equity prices, there is an obvious large risk that further equity declines may drag Crypto down into a larger decline.

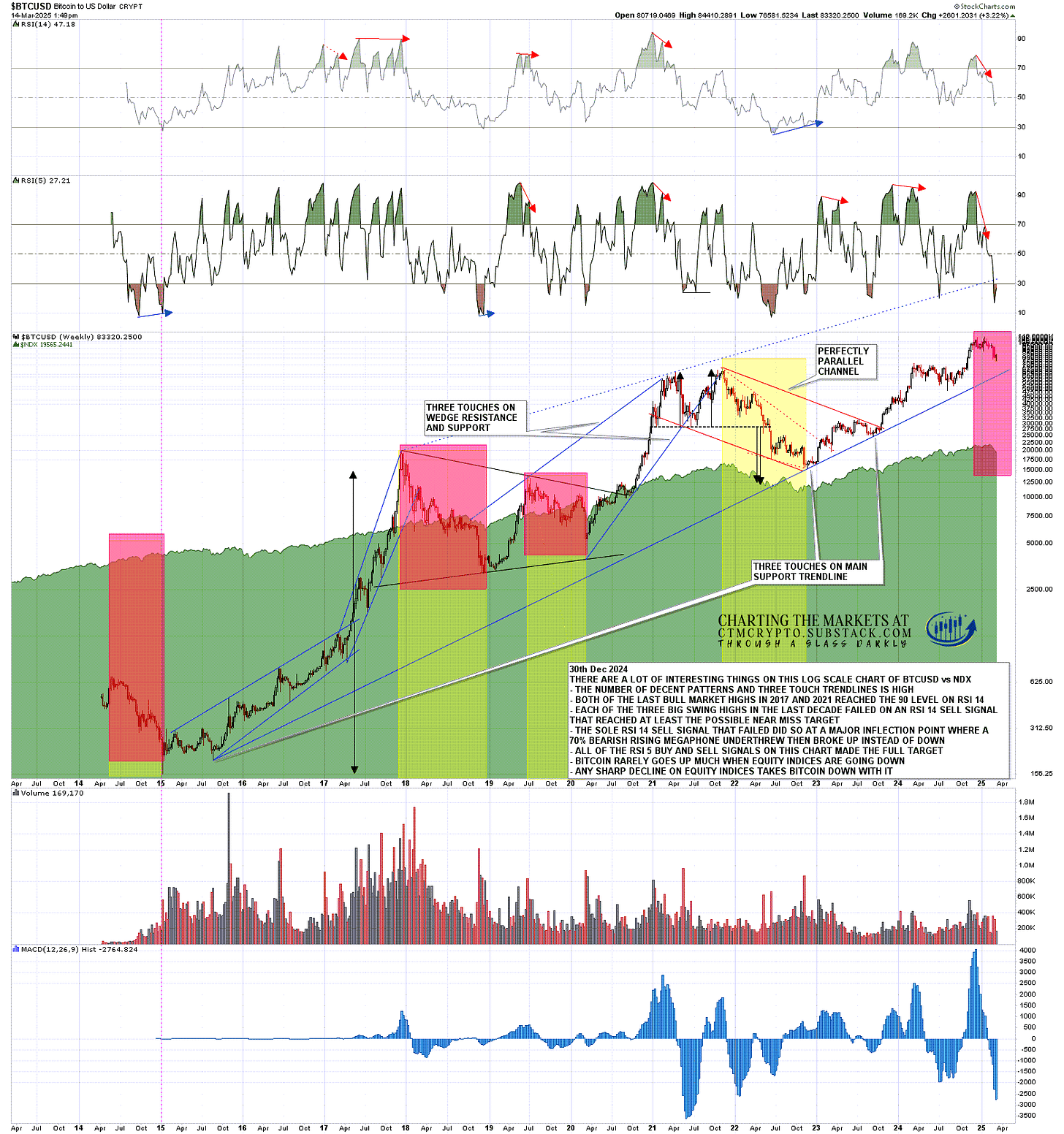

That risk is very clear on the chart below, where you can see that historically Bitcoin regularly makes a high before equities, but tends strongly to make significant lows with equities.

BTCUSD weekly (LOG) vs SPX:

There are three things to note on the Bitcoin chart. The first is, as I’ve mentioned before, that there is not currently much reason to think that Bitcoin is now in a bear market. Bitcoin is off more than 20% from the high, but but that is a measure for technical bear markets on equities. Using that measure for Bitcoin would make this the fifth ‘bear market’ on Bitcoin since the actual bear market low in November 2023. Given that only one of those previous three ‘bear markets’ lasted more than three months or dropped much more than 20%, if this was to be described as a bear market, we would now be looking for a low here in any case.

The second thing to note is that there is a fixed double top target in the 69k - 70K area, and a very attractive rising megaphone support trendline target currently in the 66k area and rising. That target area would be a good backtest of a big broken resistance level and also a solid bullish retracement in the 38.2% to 50% area of both the rise from the bear market low in November 2023 and the start of that support trendline. If that rising support trendline should be be tested and break, I would start to think that Crypto generally might be in a bear market. Until then the obvious read here is that this is a bullish retracement.

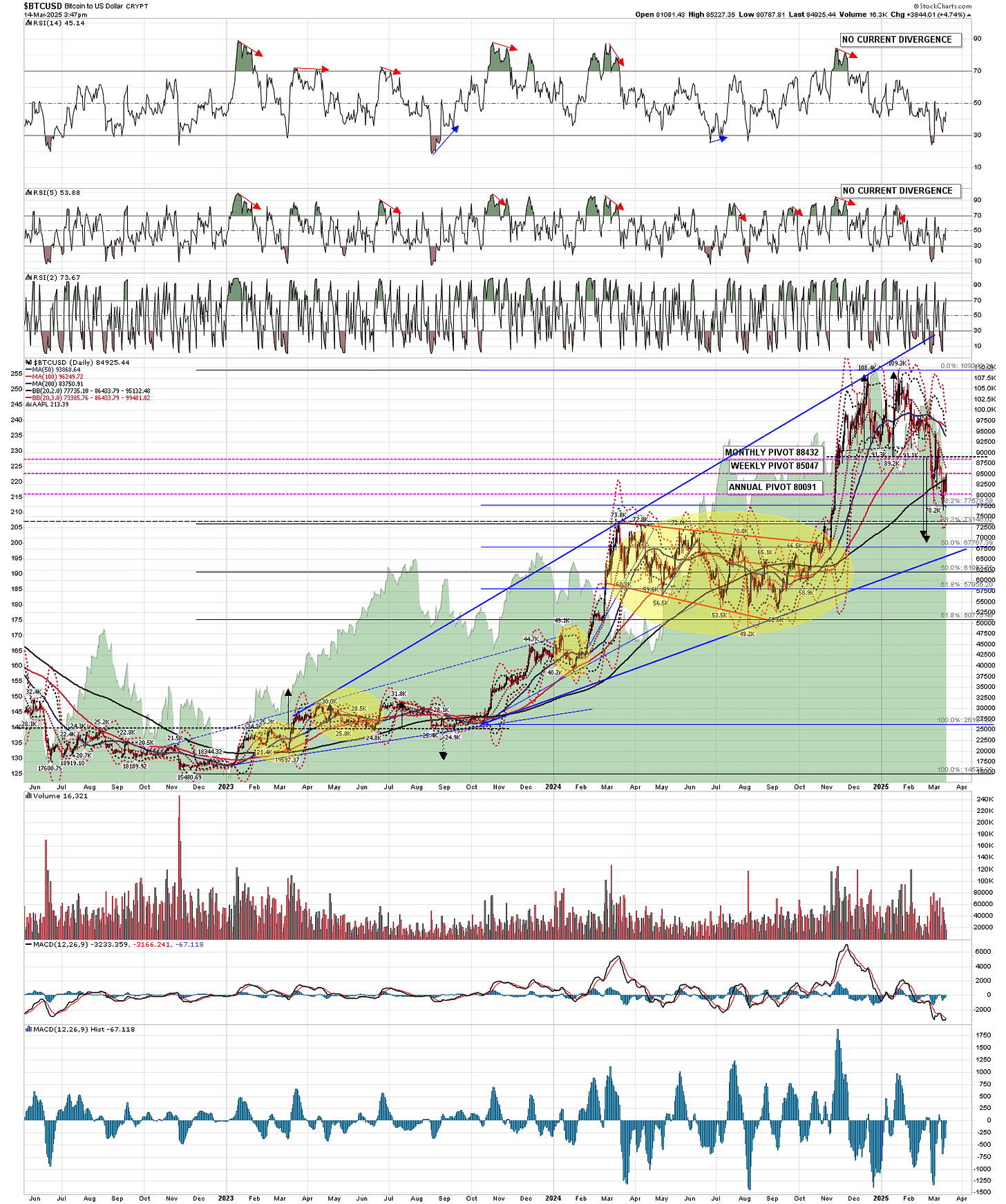

The third thing to note, in the short term, is that the very obvious resistance on Bitcoin over the last few days has been at the 200dma. We’re seeing an attempted break over that this morning which is encouraging for seeing a shorter term rally here.

BTCUSD daily chart:

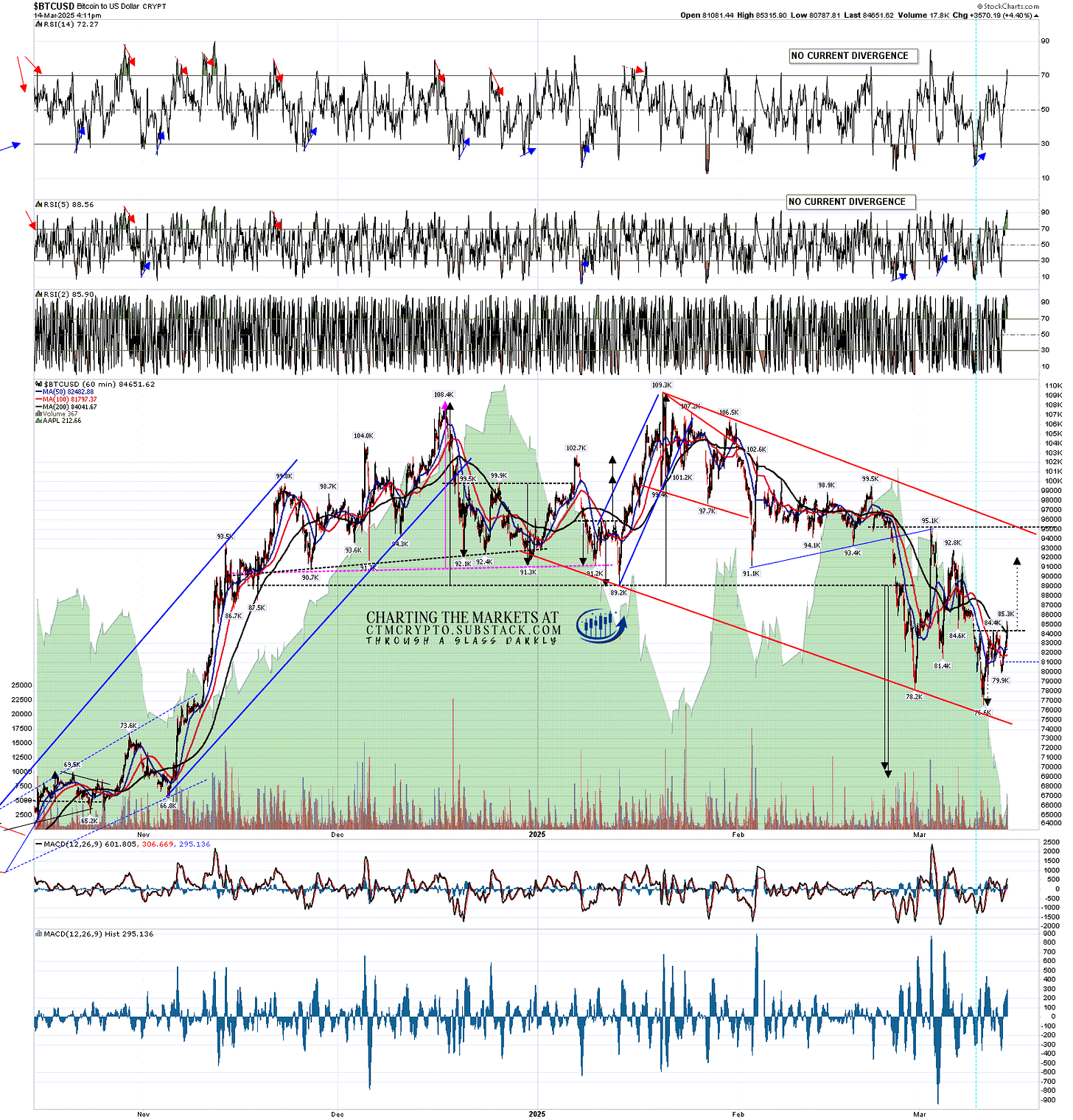

Looking at the Bitcoin hourly chart I have drawn in a pretty decent quality falling megaphone bull flag from the all time high and I really like it. I think this pattern will likely hold. If so, the next obvious target would be wedge resistance, currently in the 95k area.

A short term IHS is breaking up with a target in the 92k and that would be a good fit with this possible overall bull flag pattern, which would ideally head up soon to test that wedge resistance, and then ideally return to hit the double top target in the 69-70k area, and then the rising megaphone support trendline currently in the 66k area, before breaking up from the bull flag and retesting the all time high.

BTCUSD 60min chart:

Solana and Ethereum have both declined far more than Bitcoin since the January high, so I’m doubtful about describing patterns from the highs on either as bull flags, but there is also a high quality falling wedge setup on the Solana chart, with a bullish underthrow marking a possible low, so I am thinking that both Solana and Ethereum may be making a significant low here ahead of Bitcoin.

The next obvious target within this falling wedge would be in the 146 area and an IHS is currently breaking up with a target in the 152 area.

SOLUSD hourly chart:

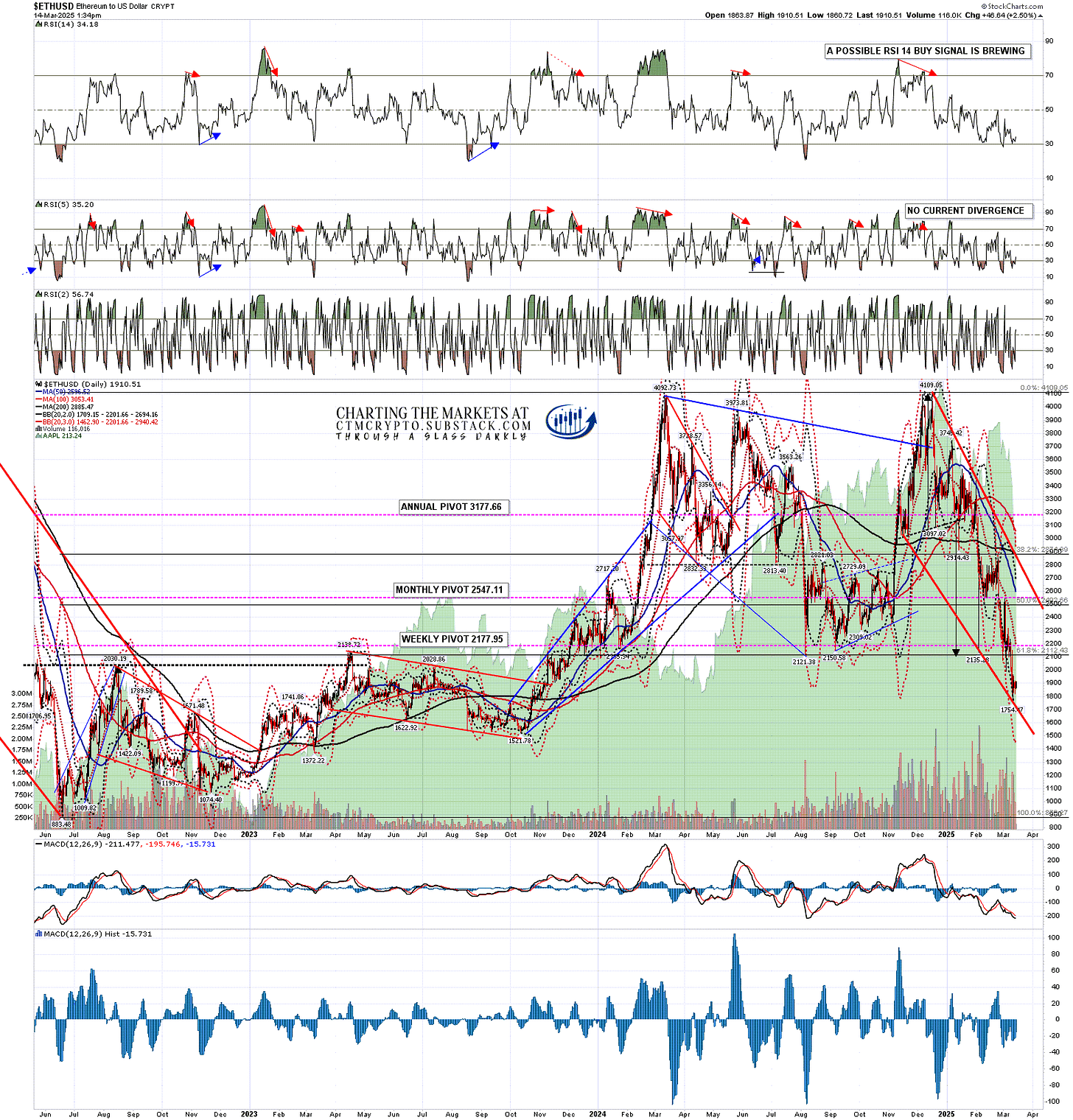

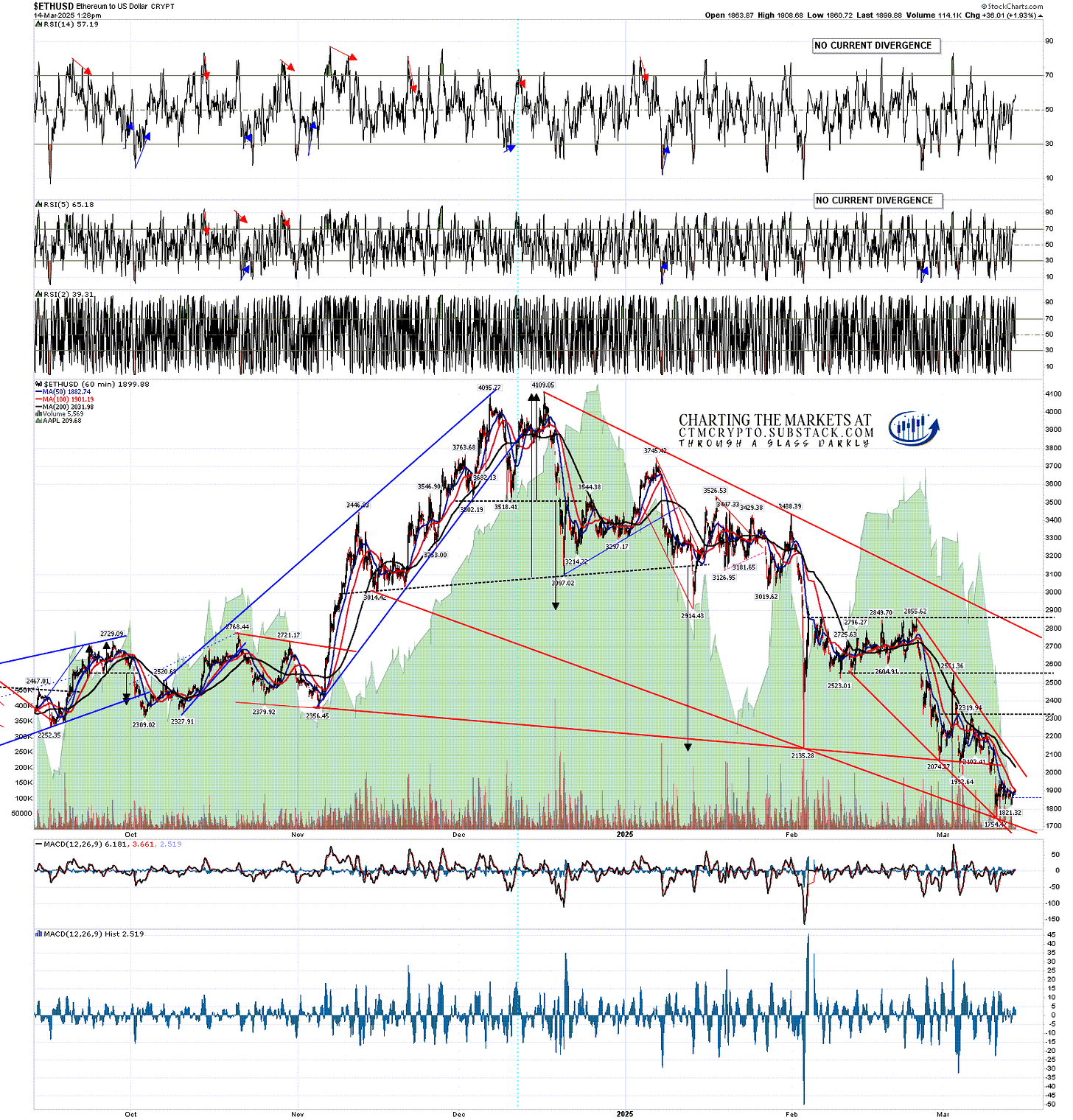

There is also a high quality falling wedge setup on Ethereum, without any bullish underthrow. This has gone lower than I hoped but the pattern is a good one with a smaller and equally high quality falling wedge developed in the latest decline.

I like a rally on Ethereum here with the smaller wedge target now in the 2050 area and the larger wedge resistance currently in the 2840 area.

ETHUSD 60min chart:

On the bigger picture I think that talk of the next bear market on Crypto having already started is very premature. It’s possible but there’s no compelling evidence for that so far. I think Bitcoin likely has some more downside coming but I think Solana and Ethereum may already be starting to make their lows for this move. Everyone have a great weekend :-)

So far this year I have been and am still leaning towards seeing weakness in the first half of the year and renewed strength in the second half of 2025, with a very possible bull market high on Crypto pencilled in close to the end of the year. That scenario would be a good match with past Crypto bull markets. Is it possible that I am mistaken? Always, but we can only ever try to identify the higher probability paths in the future. Only time can show us the path that is actually taken. Still, I’m with Confucious who said ‘study the past, if you would divine the future’.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment