This is my first post in a while looking at individual stocks, but I used to do a lot of these, and this is the first of regular posts on these in the future. Today I want to look at the two stocks in The Magnificent Seven which currently have the best and the worst looking prospects over coming months.

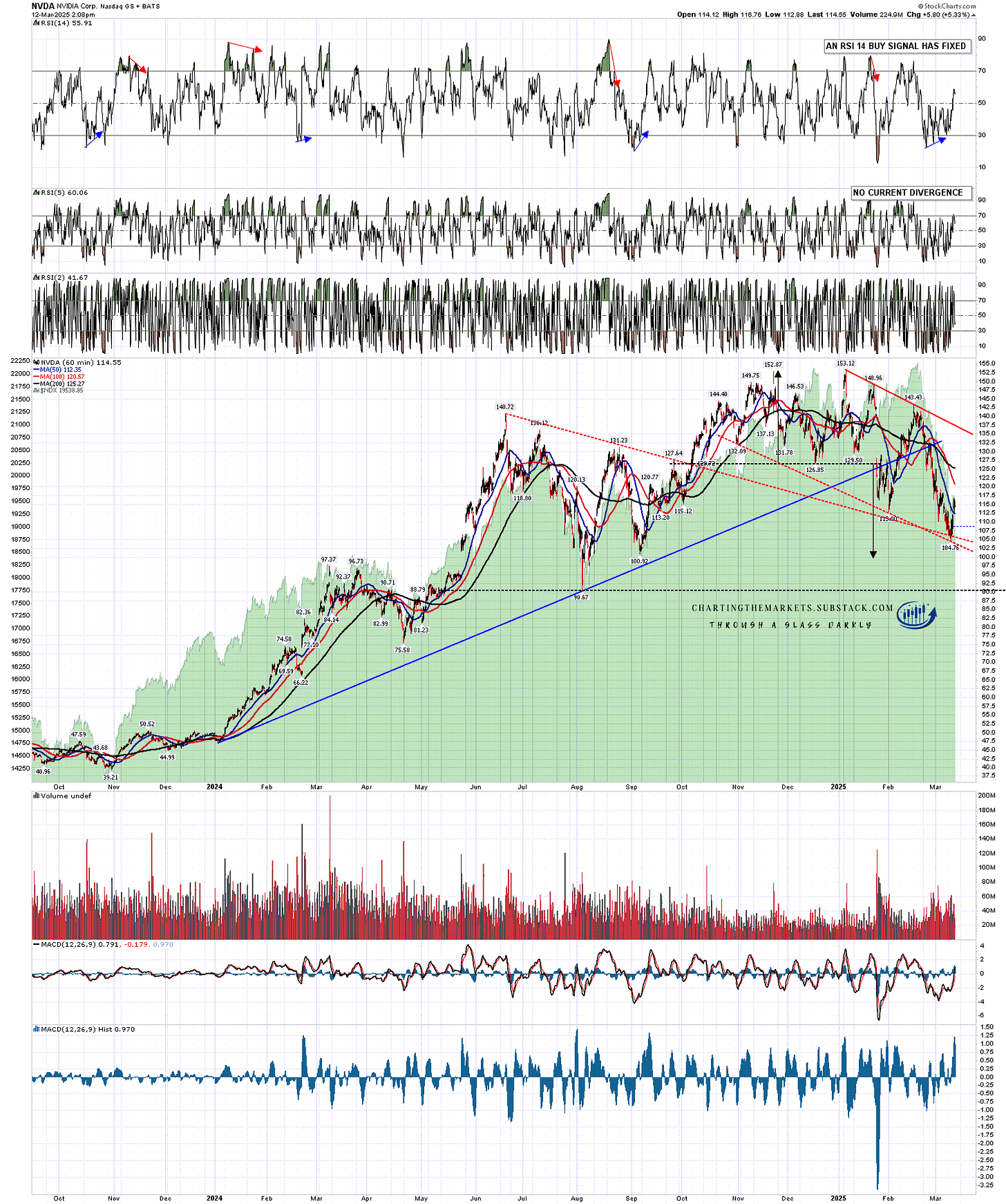

The one with the best looking chart is definitely NVDA. Looking at the hourly chart I have an H&S that has broken down with a target in the 100 area and a very possible bull flag falling wedge that has been forming as it declines. I’ve drawn in a couple of possible support trendlines on that and if the bull flag continues to form it would ideally now return to flag resistance, currently in the 136.5 area but declining rapidly, and then make a last leg down into the H&S target in the 100 area. We’ll see how that goes.

NVDA 60min chart:

Could the bull flag setup fail? Maybe, and the DeepSeek implications for future sales are of course still being digested. If so I’d still be looking for the H&S target in the 100 area and would be seeing the key support level at the August low at 90.67, and would be looking for likely support at one or the other.

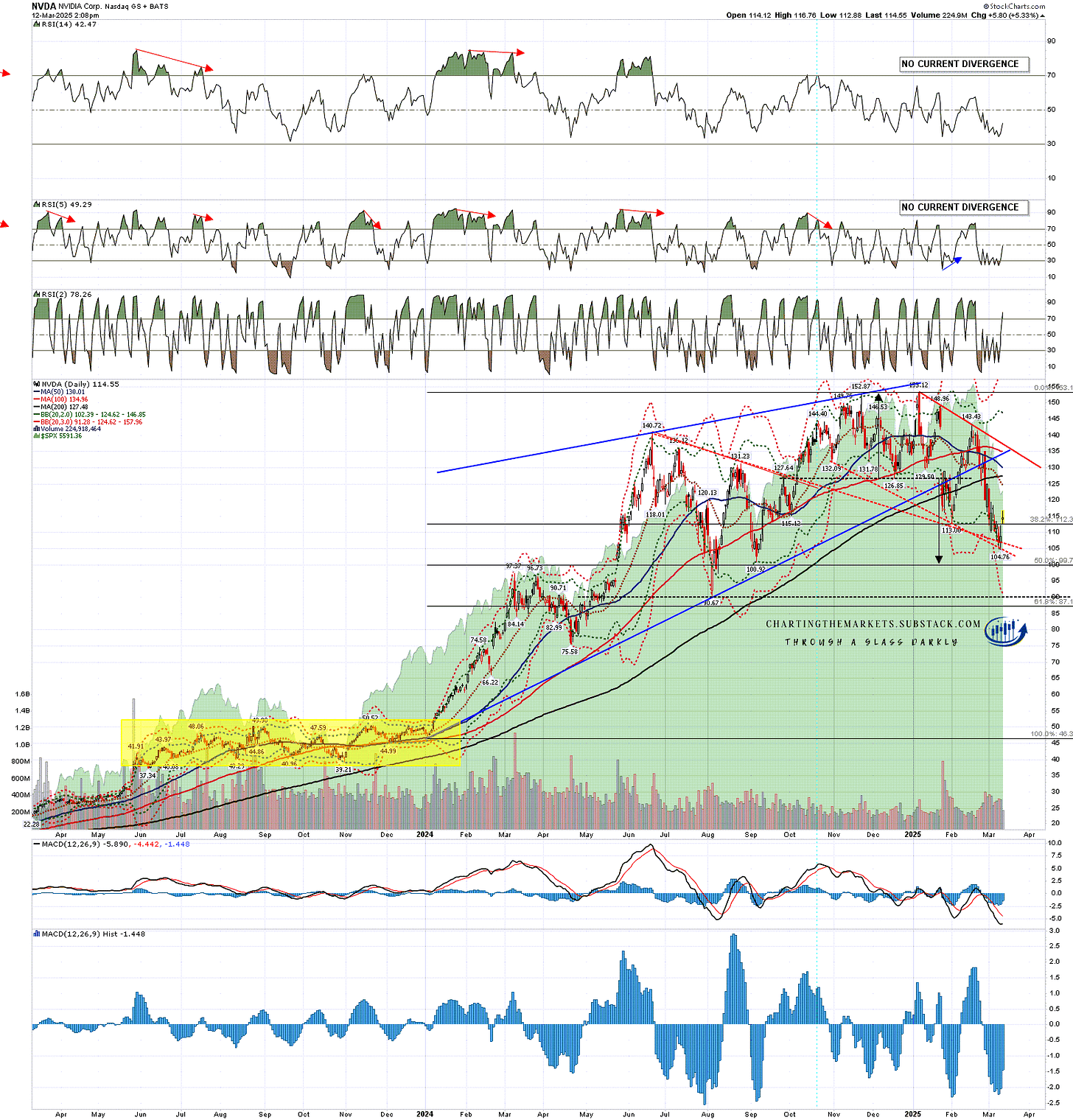

NVDA is a great company and I expect it to do well in the future. If it reaches the H&S target at 100 I’m thinking it looks like a buy there.

NVDA daily chart:

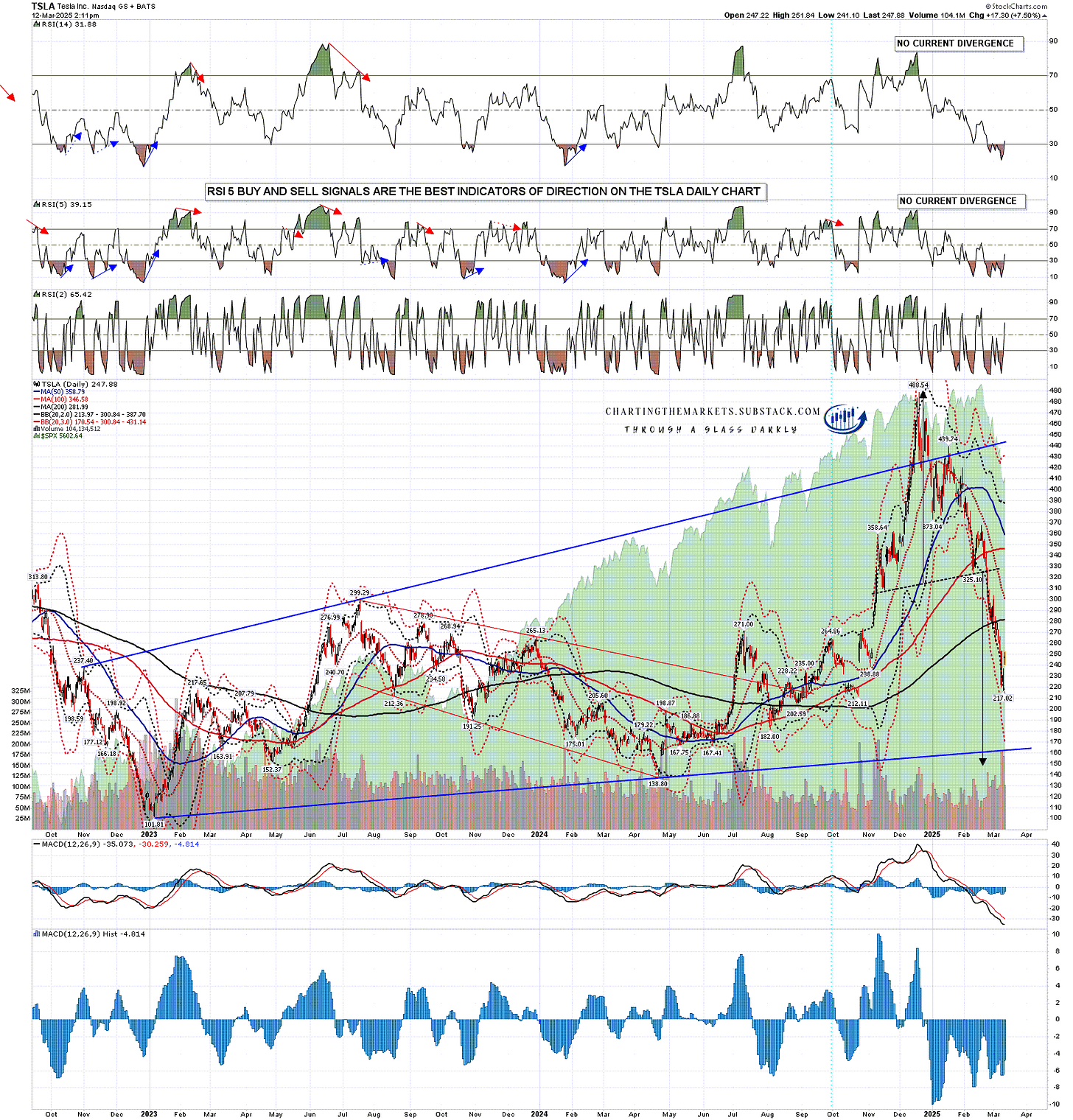

The one with the worst looking chart is definitely TSLA. A very high quality H&S has broken down with a target in the 150 area and, if seen, that would break rising support from the Jan ‘23 low and suggest a possible return to retest that low at 101.81.

This nasty looking setup is backed up by grim year on year data showing Tesla sales worldwide dropping hard, in significant part due to Elon Musk’s political activities, which have been alienating a large percentage of the existing customer base. It is always a chancy business when CEOs of major companies get involved with politics and that very much looks like the case so far here.

TSLA daily chart:

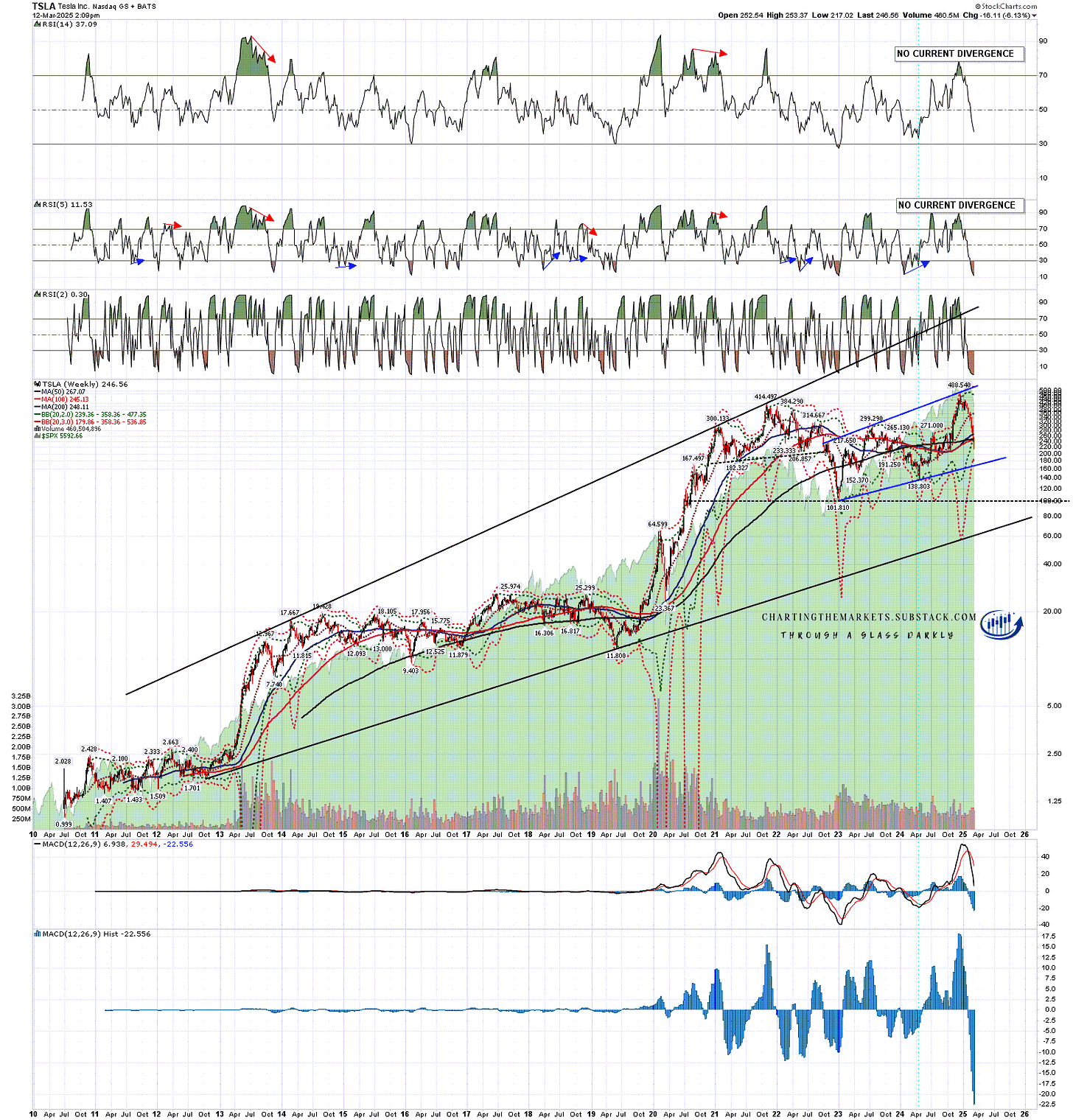

Is TSLA in really serious trouble here? Not with a decline to 100, which just wipes out two years of gains. This may just be eliminating some of the future growth expectations included in the very high P/E ratio it had reached, but I’ll be watching the long term rising support trendline on the weekly (LOG scale) chart below. I have that in the 60 area and a break below would be a very bad sign.

How badly is this affecting Elon Musk? Not hugely so far. He only owns 12% of TSLA, subject to further rulings about his disputed and currently disallowed $56bn bonus, and owns 40% of SpaceX, which has been doing very well with government contracts lately though the future export prospects for SpaceX and fully owned subsidiary Starlink are dimming somewhat as well. He’ll still be a very rich man if TSLA hits a hard wall at high speed here, but the same can’t be said of a lot of TSLA shareholders.

TSLA weekly (LOG) chart:

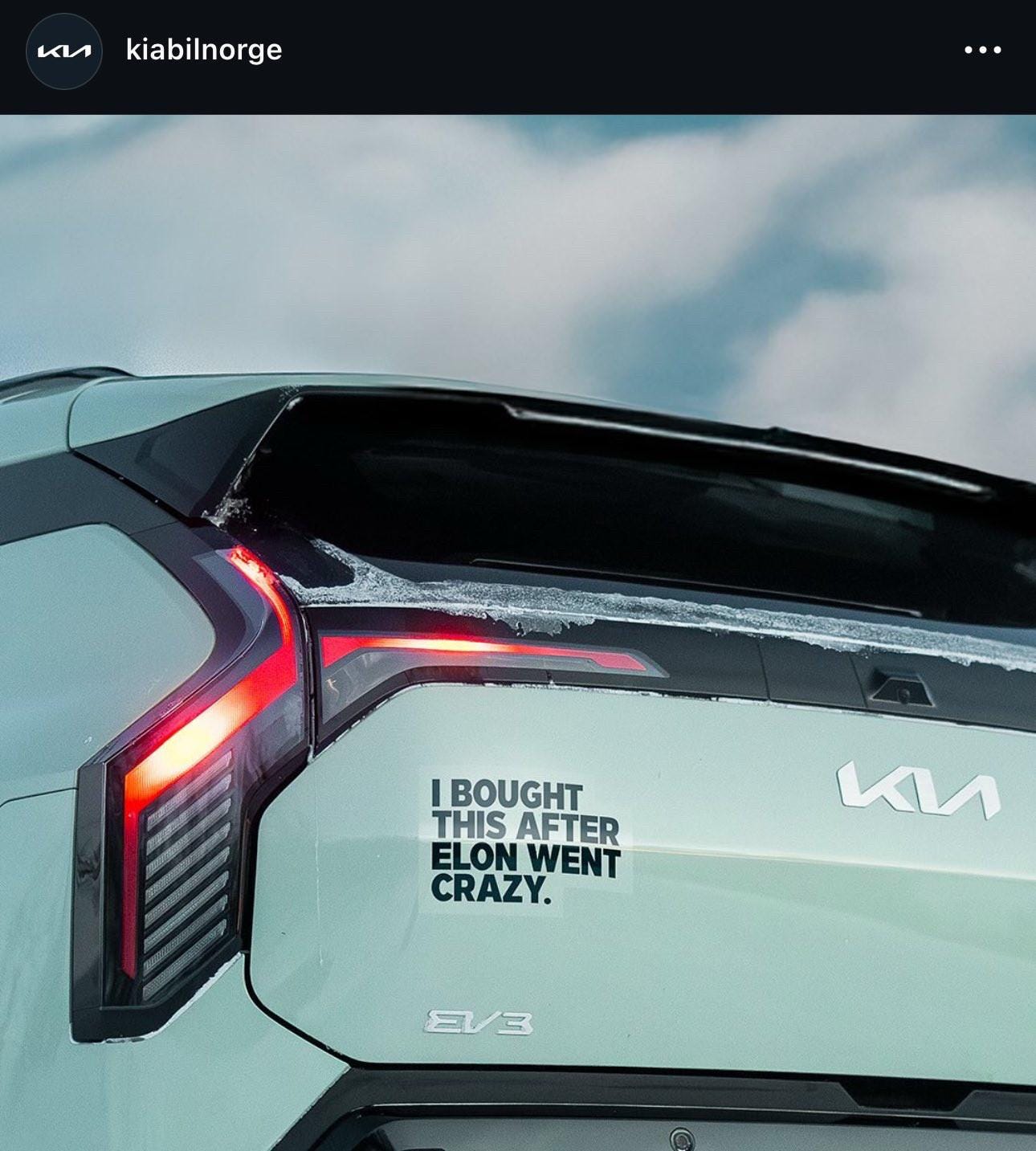

Two years ago there weren’t many alternatives to Tesla in the EV market but that is no longer the case and, just to illustrate TSLA’s sales problems in Europe, Canada and Australia particularly, I am reposting below one of the kindest responses that I have seen in Europe to Elon’s pivot from Green Jesus to pro-Russian MAGA prophet. This is an advertisement from Kia in Norway to wittily take advantage of a sticker that a lot of current Tesla owners have been putting on their cars in Europe to reduce the chances of them being vandalised by the many people that Elon has managed to alienate there in recent months. I’ll leave you to deduce what the original says.

TSLA is rallying here from the lows this week and I am thinking that TSLA is a sell on rallies until further notice.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment