In my last post on Tuesday I was looking at possible rally options from the current 2025 lows, and was looking for a rally lasting at minimum a week or two to make right shoulders on the possible H&S patterns that may be forming on SPX, QQQ and DIA here.

Getting a rally that lasted that long was seeming somewhat doubtful on Wednesday morning but then the highest tariffs were delayed for 90 days and a window of opportunity opened to see that rally.

As a whole this reprieve is partial, temporary, and fragile, the US is still likely entering recession in my opinion, and is waging economic war on all trading partners at once at various levels, but this does give a window of opportunity for that rally. We’ll see how that goes.

So why are so many people so cheerful about this reprieve? Well that is recency bias for you. If you lose a $100 bill in the street it’s upsetting. If you lose three $100 bills in the street and then manage to recover two of them, then it feels like a win. Either way you still end up down a hundred bucks, the difference is purely psychological.

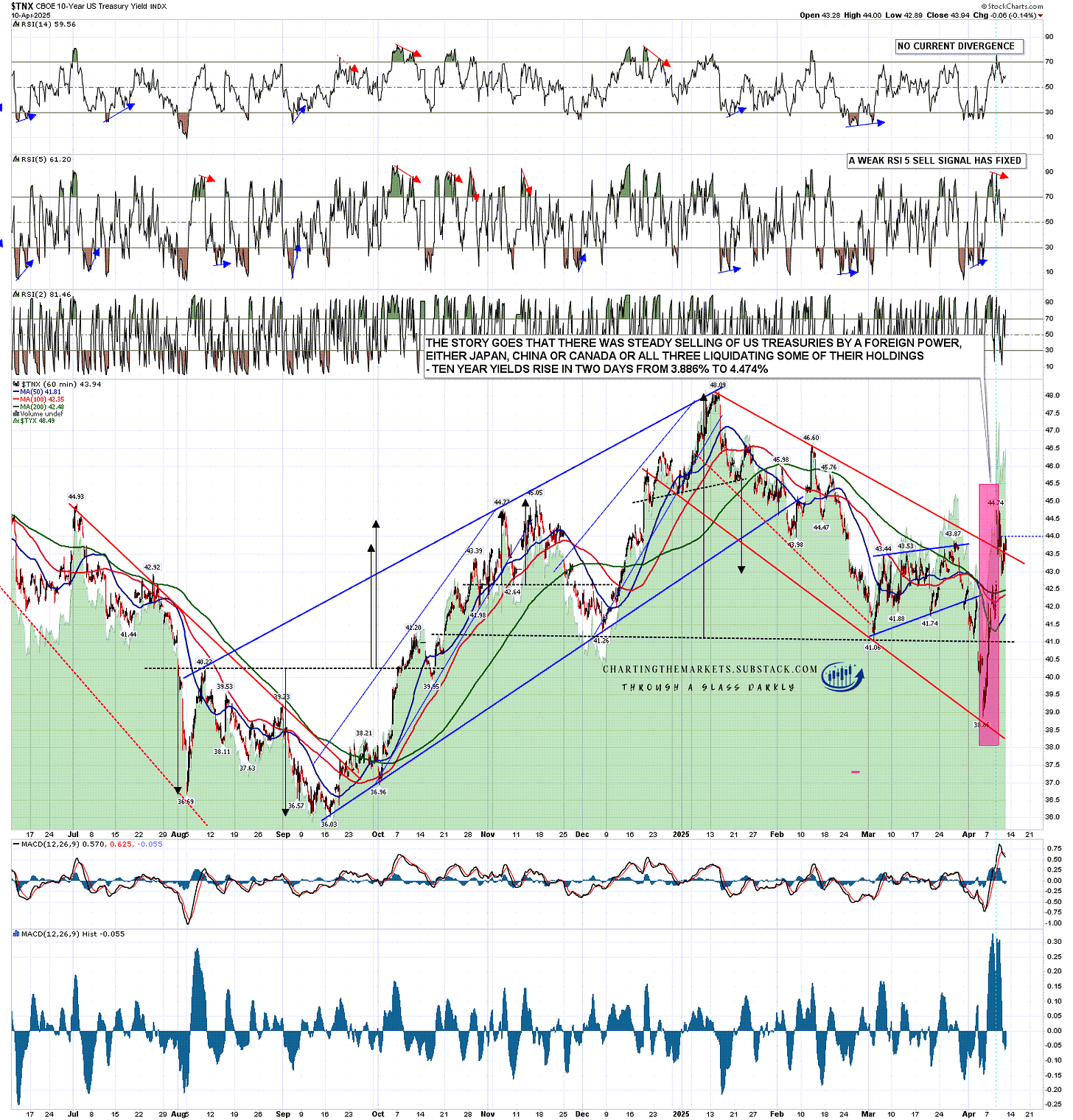

Why was there a reprieve at all? A number of reasons have been given but the most likely explanation seems to be that the White House was unnerved by the selloff on US treasuries that started on Monday and took ten year treasury yields from 3.886% at Monday’s low to 4.474% at Wednesday’s high. As the ten year treasury yield is the real interest rate for most of the US economy, that seems to have triggered the 90 day tariff delay.

I have a lot more to say about both US treasuries and the US dollar, but too much to say here. I’ll be publishing a post on each of these at the weekend on my The Bigger Picture substack so look out for those.

In the meantime this is what happened on US ten year treasuries from Monday’s low to Wednesday’s high, and since.

TNX 60min chart:

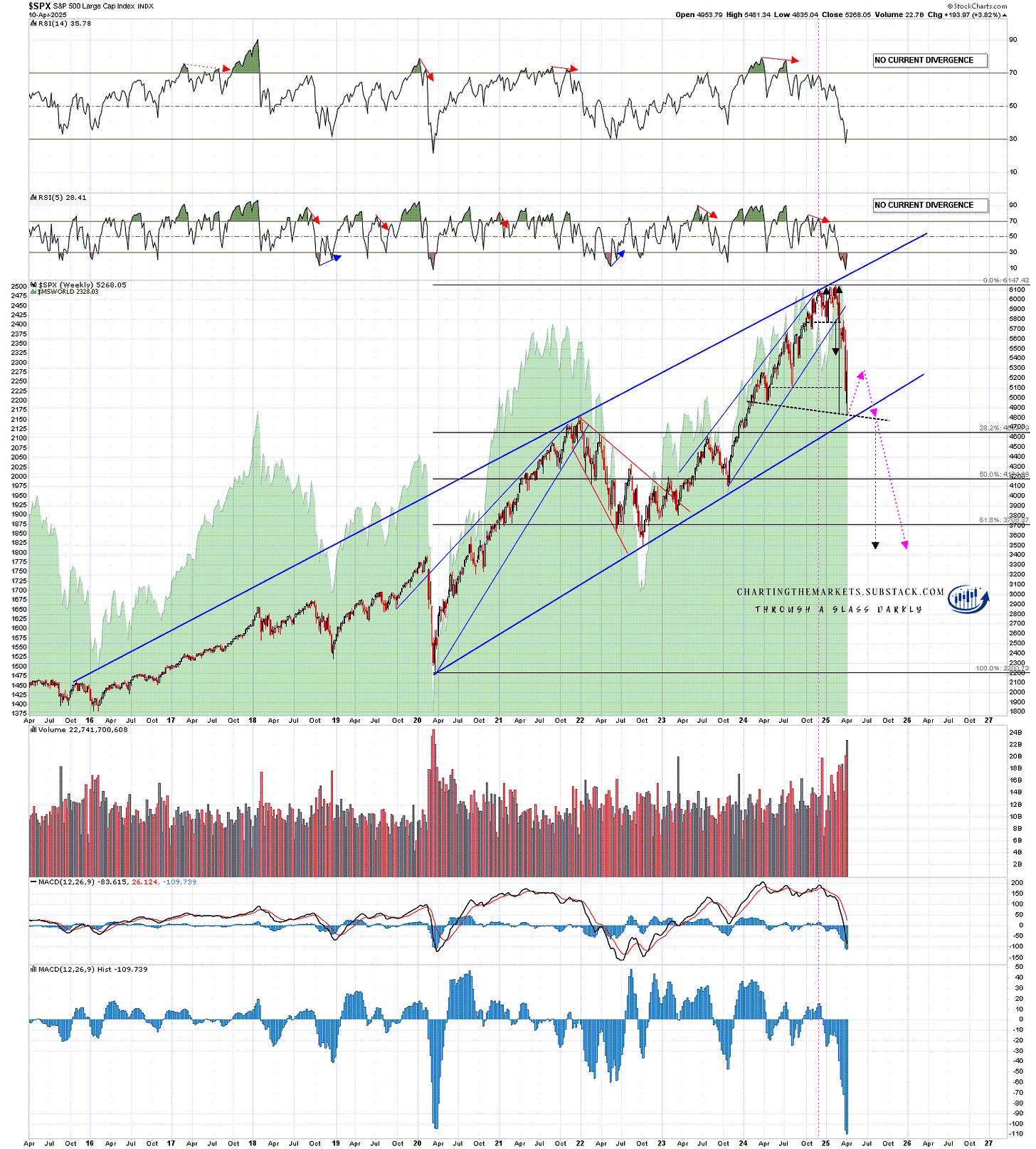

My main rally projection on SPX that I posted on Tuesday 1st April is still the main one I am looking at and if this rally should somehow manage to last two or three months then all the better, as the possible H&S left shoulder on the chart below took twelve weeks to form.

With Wednesday’s spike up SPX has already rallied over the ideal right shoulder high area, but that’s not uncommon and doesn’t weaken the setup much.

If markets react really positively to this delay there is also now a possibility that we might see retests of the all time highs on SPX, QQQ and DIA to form likely larger double tops, though that looks like more of a long shot, but is still something to bear in mind:

SPX weekly chart - bear market projection:

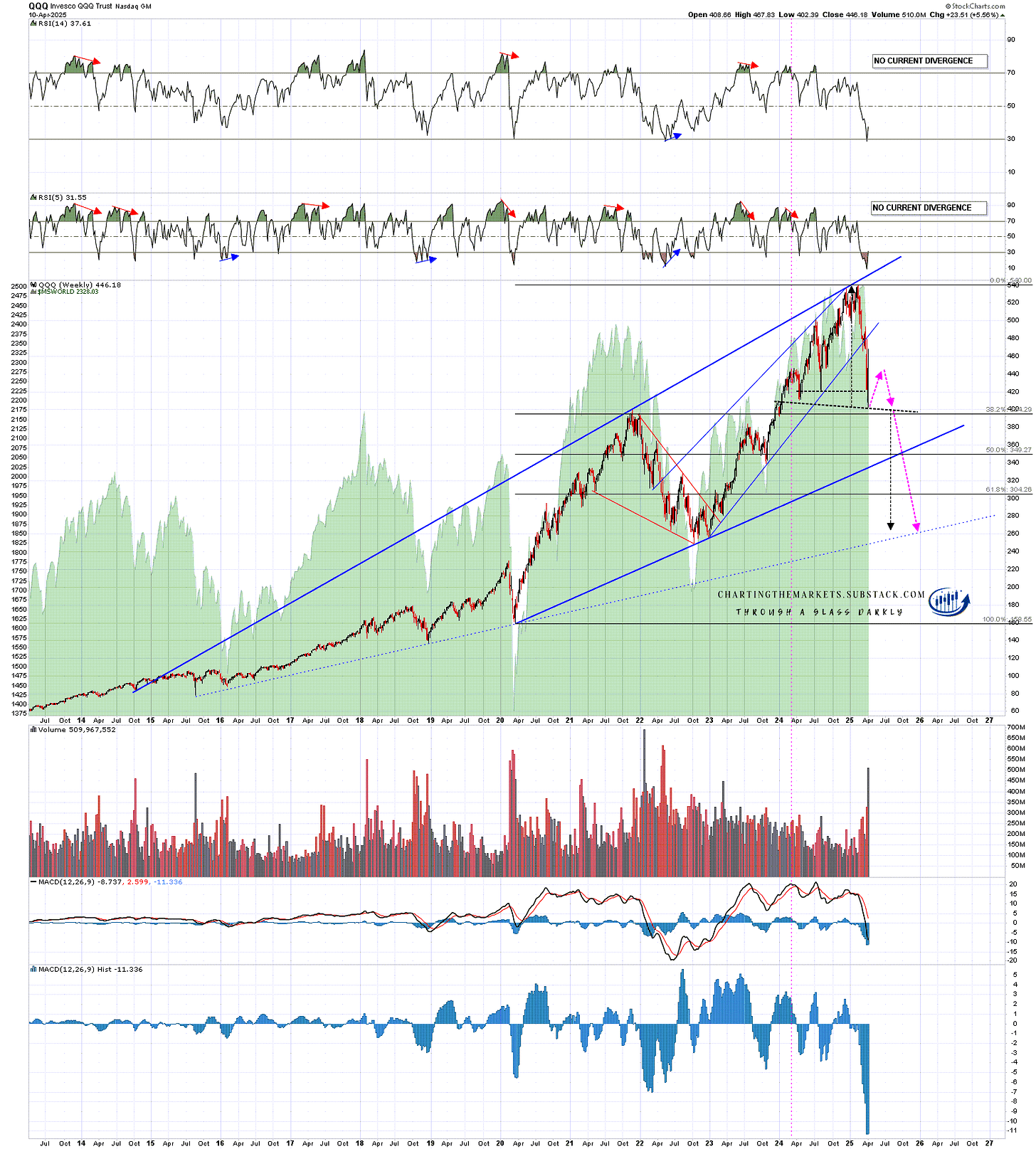

On QQQ the main scenario is still the scenario I posted on Wednesday 2nd April with again a possibility that we could still see a high retest.

QQQ weekly chart - bear market projection:

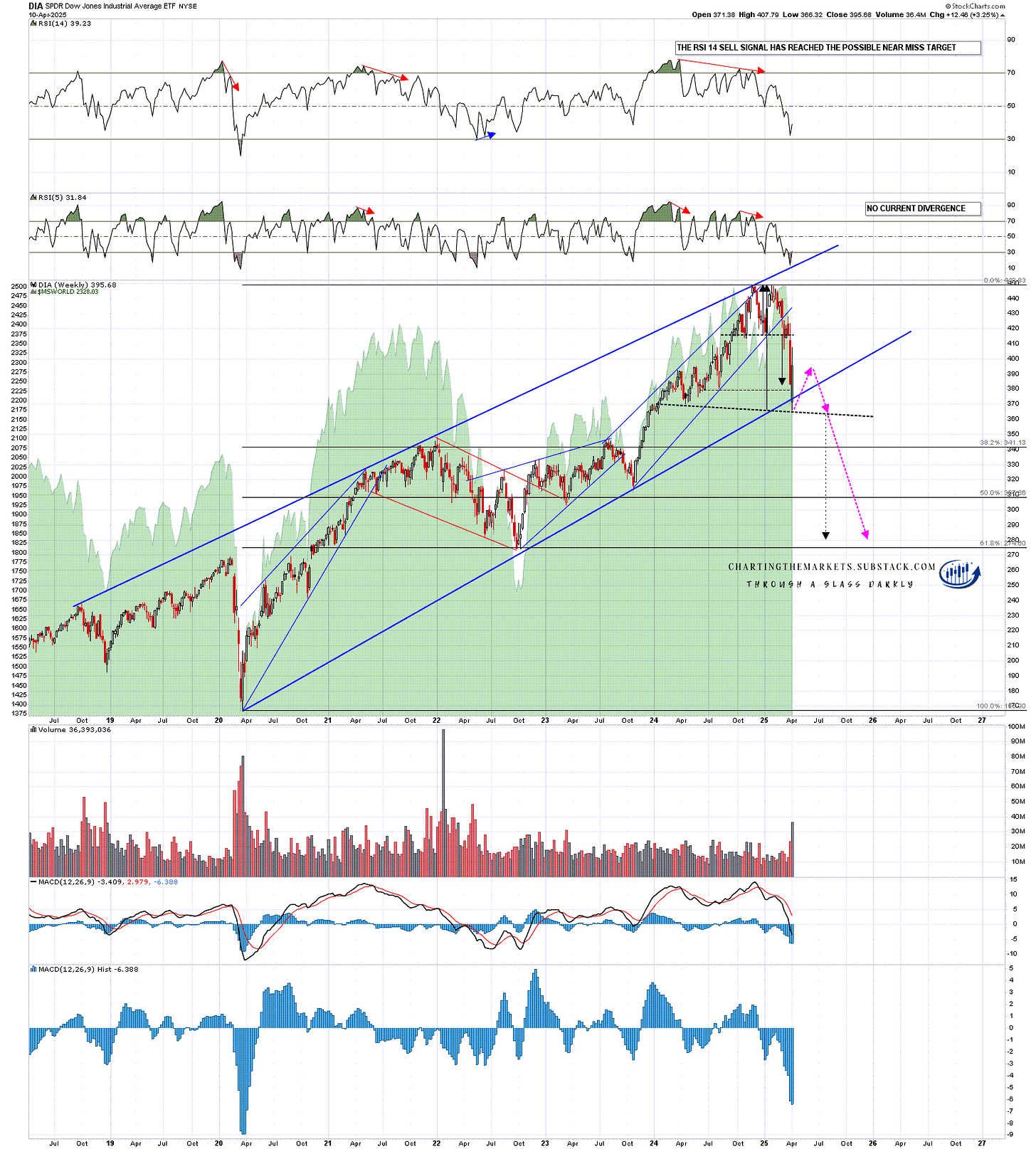

On DIA the main scenario is still the scenario I posted on Wednesday 2nd April with again a possibility that we could still see a high retest.

DIA weekly chart - bear market projection:

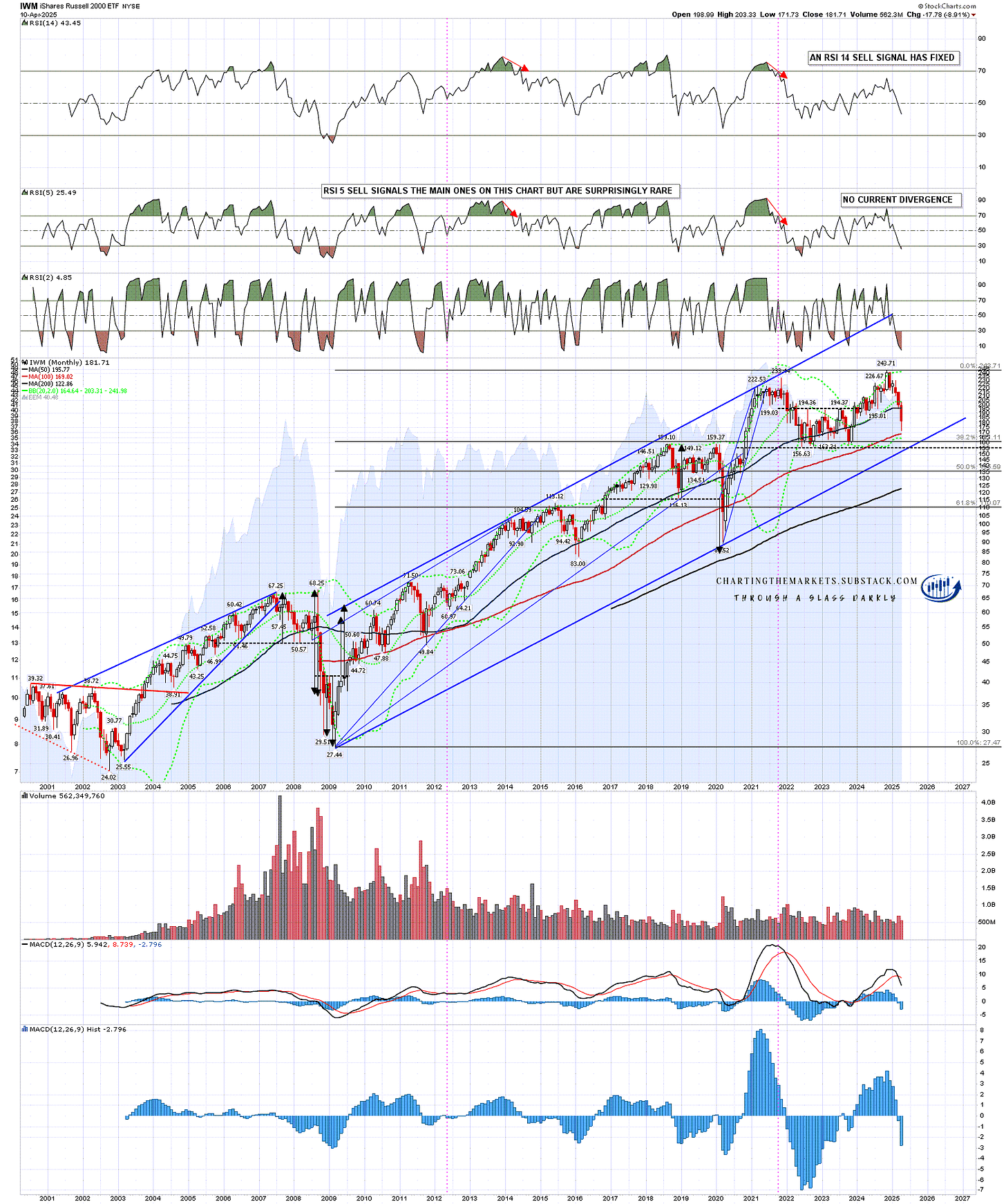

I have mentioned that IWM already had a topping pattern in place and that high quality possible double top setup is shown on the chart below.

IWM Monthly (LOG) Secular Patterns since 2009:

A lot of people seem to feel that the tariff delay on Wednesday was the end of the economic troubles this year. I think those troubles are just getting started and that the trade wars of various sizes being waged by the Trump administration are likely only part of that developing story. Watch out for my weekend posts on US treasuries and the US dollar and I’ll do my best to explain there why that is. Everyone have a great weekend :-)

As I have been since the start of 2025 I’m still leaning on the bigger picture towards a weak first half of 2025 and new all time highs later in the year, very possibly as a topping process for a much more significant high. One way or another I think we’ll be seeing lower soon and I’m not expecting this to be a good year for US equities, not least because both of the last two years have been banner years for US equities. A third straight year of these kinds of gains looks like a big stretch. I could of course however be mistaken. UPDATE 11th March 2025 - I am wondering if this may be a bear market that dominates the whole of 2025.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment