In my post on Tuesday 17th June I was looking at an inflection point on Crypto that might break down, and gave targets for that move. That setup started breaking down on Friday and two out of three of those downside target areas, on Bitcoin (BTCUSD) and Ethereum (ETHUSD) were reached over the weekend.

The target that has not been reached was on Solana (SOLUSD) but there is a decent case for all three making a significant low at the weekend lows.

Back in my post on Monday 12th May I was laying out a scenario where possible large large IHS patterns were forming on Solana and Ethereum and I gave the ideal right shoulder targets at 125.43 on Solana and 2135.28 on Ethereum. The weekend lows were at 126.09 and 2113.65 respectively.

Are these possible IHS patterns still in play? Well the IHS necklines have moved a bit, and making the right shoulders took longer than expected but yes, they are both still in play.

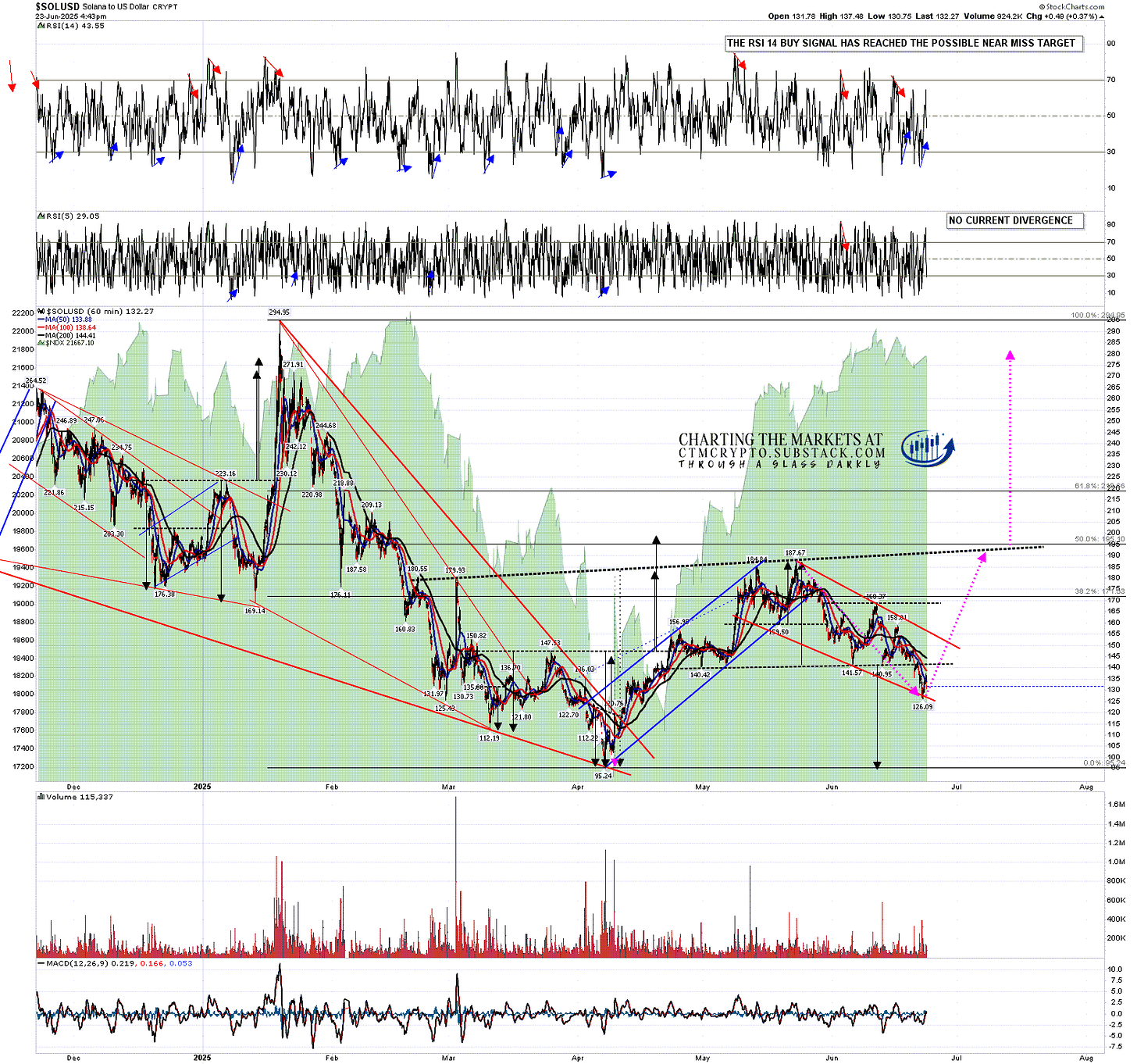

Looking at Solana first on the hourly chart the possible IHS is a bit long in the right shoulder, but the shoulder lows are at similar levels and this is still a decent quality IHS. On a sustained break above the neckline, currently in the 192 area, the target would be in the 282 area, and that would likely extend into a retest of the all time high at 294.95.

SOLUSD 60min chart:

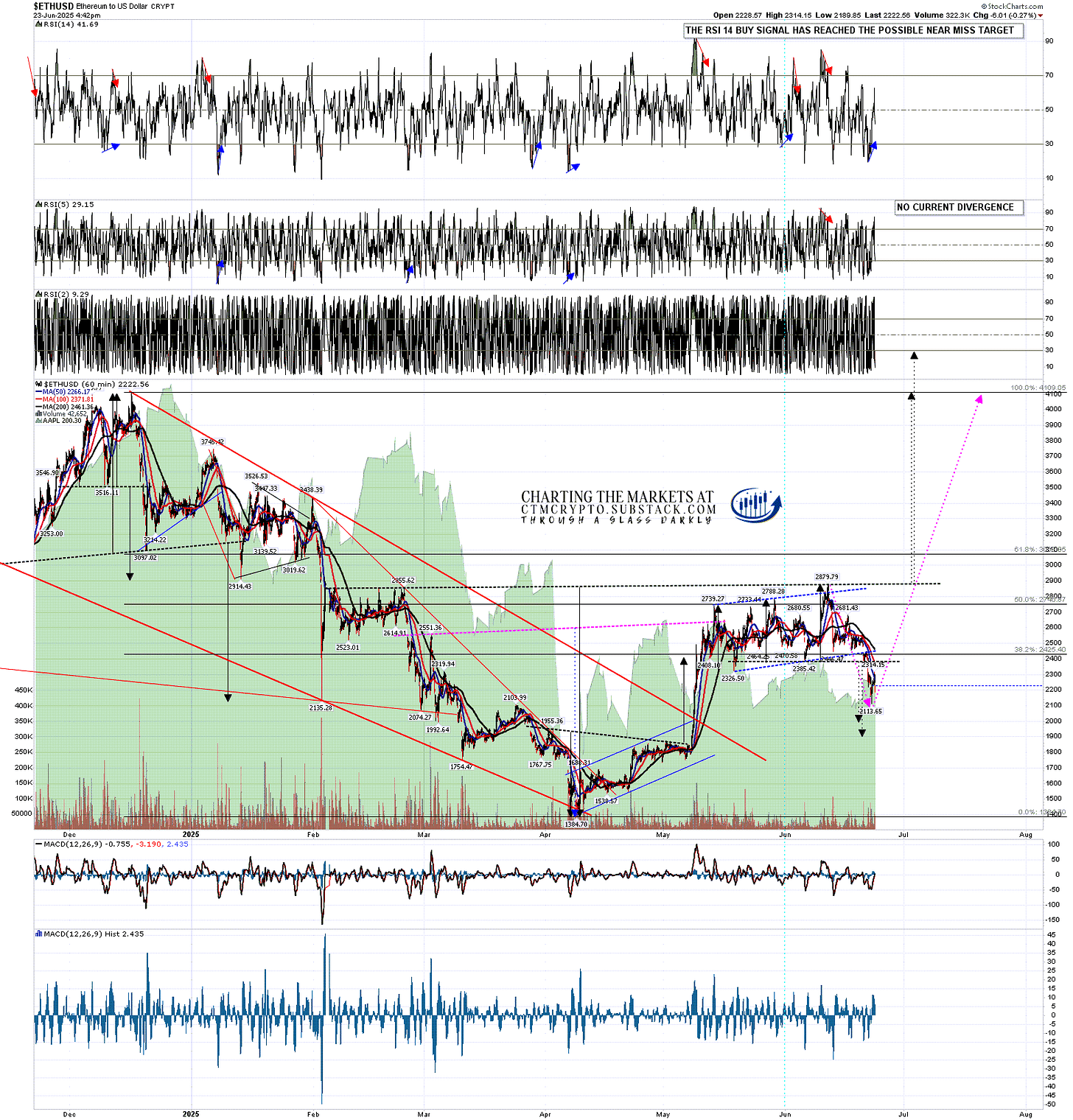

Looking at the Ethereum hourly chart the possible IHS is also a bit long in the right shoulder, but the shoulder lows are at similar levels and this is also a decent quality IHS. On a sustained break above the neckline, currently at 2880, the target would be at a retest of the 2024 high at 4109.05, with an extension target in the 4350 area. That might then continue into a test of the all time high at 4865.94.

In my last post I gave the target area for Ethereum in the 2000 to 2200 area, mainly with this IHS in mind, but I should note that a small asymmetric double top has broken down with a target in the 1900 to 2000 area, and if we do see more downside then that is still an open target area.

ETHUSD 60min chart:

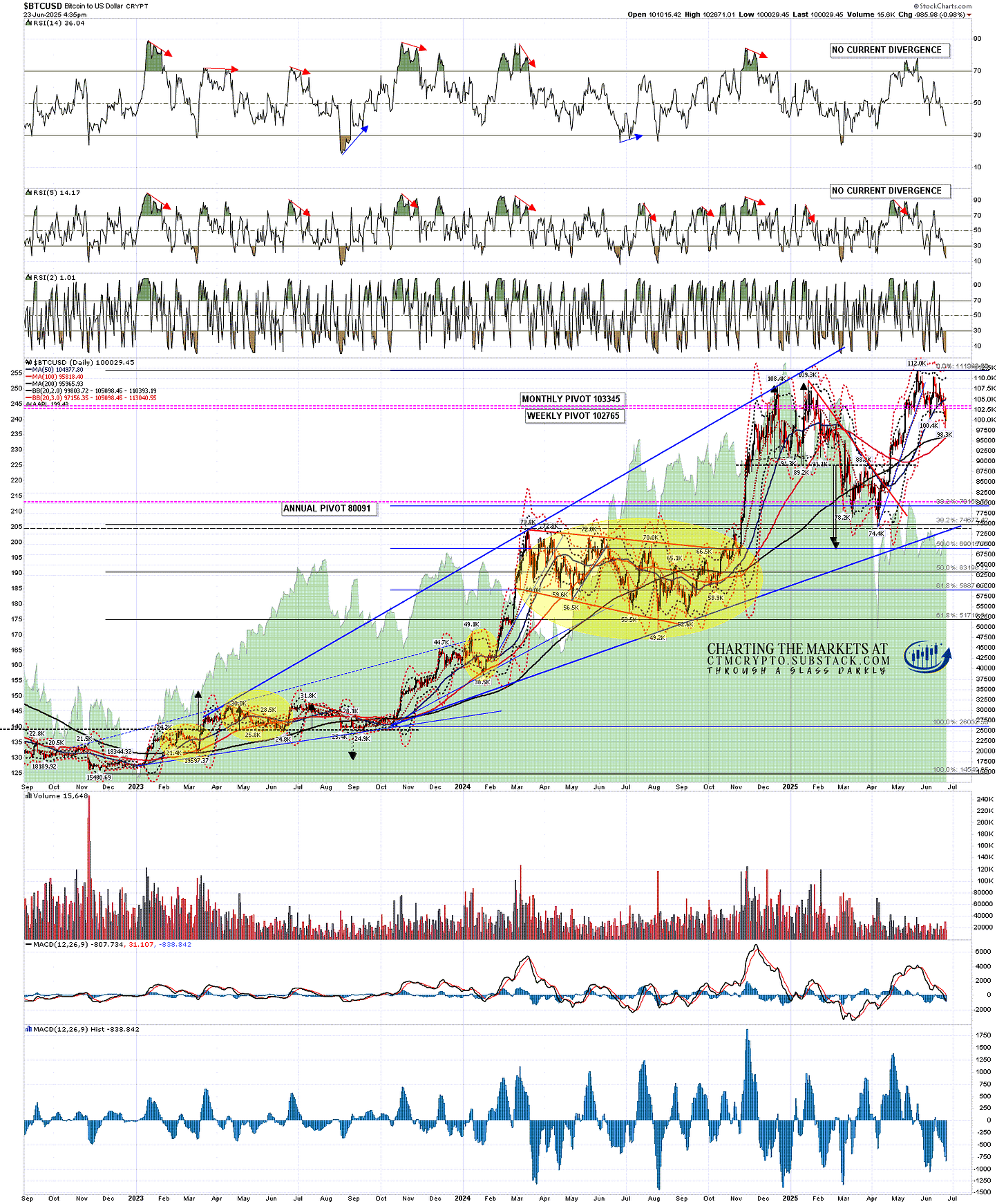

In my last post I was looking at a possible bull flag forming on BTCUSD and that reached the 100k target and overshot it slightly, in what currently looks like a bullish underthrow before the break up into the all time high retest.

BTCUSD 60min chart:

So what’s next? Well this is a nice looking low, and the touches of the 3sd daily lower bands on all three suggest at least a bounce here, but in order to deliver Bitcoin now needs to break back up over declining resistance at the monthly pivot, 50dma and daily middle band, all currently in the 103345, 104978 and 105098 areas respectively, and convert them to support.

BTCUSD daily chart:

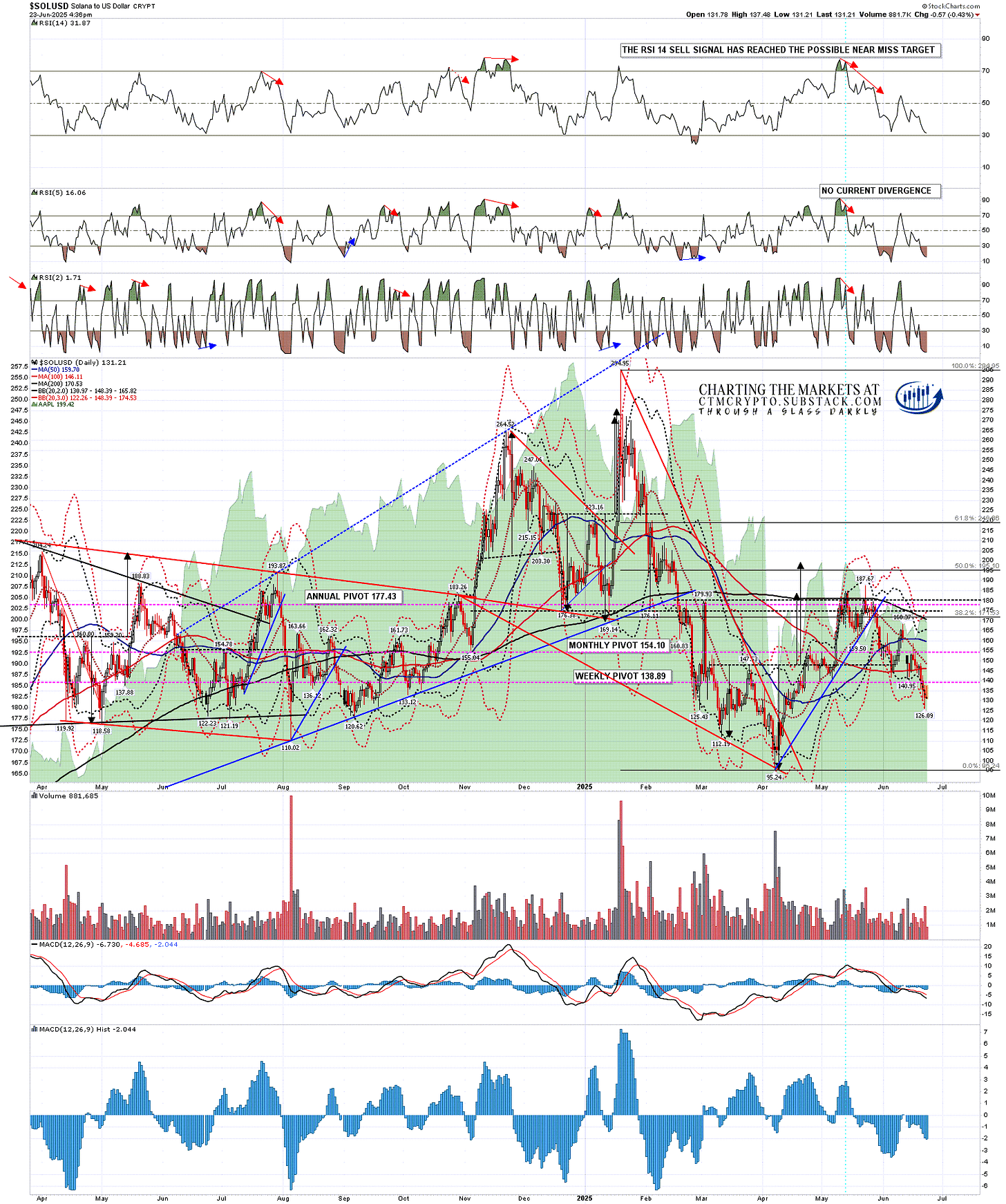

Solana has a larger mountain of resistance levels to climb, with the daily middle band, 50dma and then the 200dma, all currently in the 148, 160 and 170 areas respectively. The 200dma in particular has held as resistance since February and is the key resistance above that must be converted to support to open the upside.

SOLUSD daily chart:

Ethereum has a smaller but still significant mountain of resistance levels to climb, with the daily middle band, 50dma and then the 200dma, all currently in the 2517, 2490 and 2586 areas respectively. The 200dma in particular has held as resistance six times since February and is the key resistance above that must be converted to support to open the upside.

ETHUSD daily chart:

I like this scenario a lot but we really need some Crypto bulls to turn up and do some damage to the upside here and soon. If not then there are still open targets below at the retest of the 2025 low at 95.24 on Solana and in the 1900 to 2000 area on Ethereum. There is a parallel though much less bullish scenario on equities here to run alongside this, as long as Crypto and equities remain positively correlated, and in my view, if both need to play out together, that would be much best done in the next two or three months.

So far this year I have been and am still leaning towards seeing weakness in the first half of the year and renewed strength in the second half of 2025, with a very possible bull market high on Crypto pencilled in close to the end of the year. That scenario would be a good match with past Crypto bull markets. Is it possible that I am mistaken? Always, but we can only ever try to identify the higher probability paths in the future. Only time can show us the path that is actually taken. Still, I’m with Confucious who said ‘study the past, if you would divine the future’. - 22nd May 2025 - IDEALLY THE PATH FROM HERE TAKES CRYPTO INTO A BULL MARKET HIGH IN OR CLOSE TO DECEMBER 2025

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment