This is my first public post on the US Dollar possibly since 2012, so it will be lengthier than normal as it will also act as a reference post that I can refer back to every time I do an update on USD here in the future.

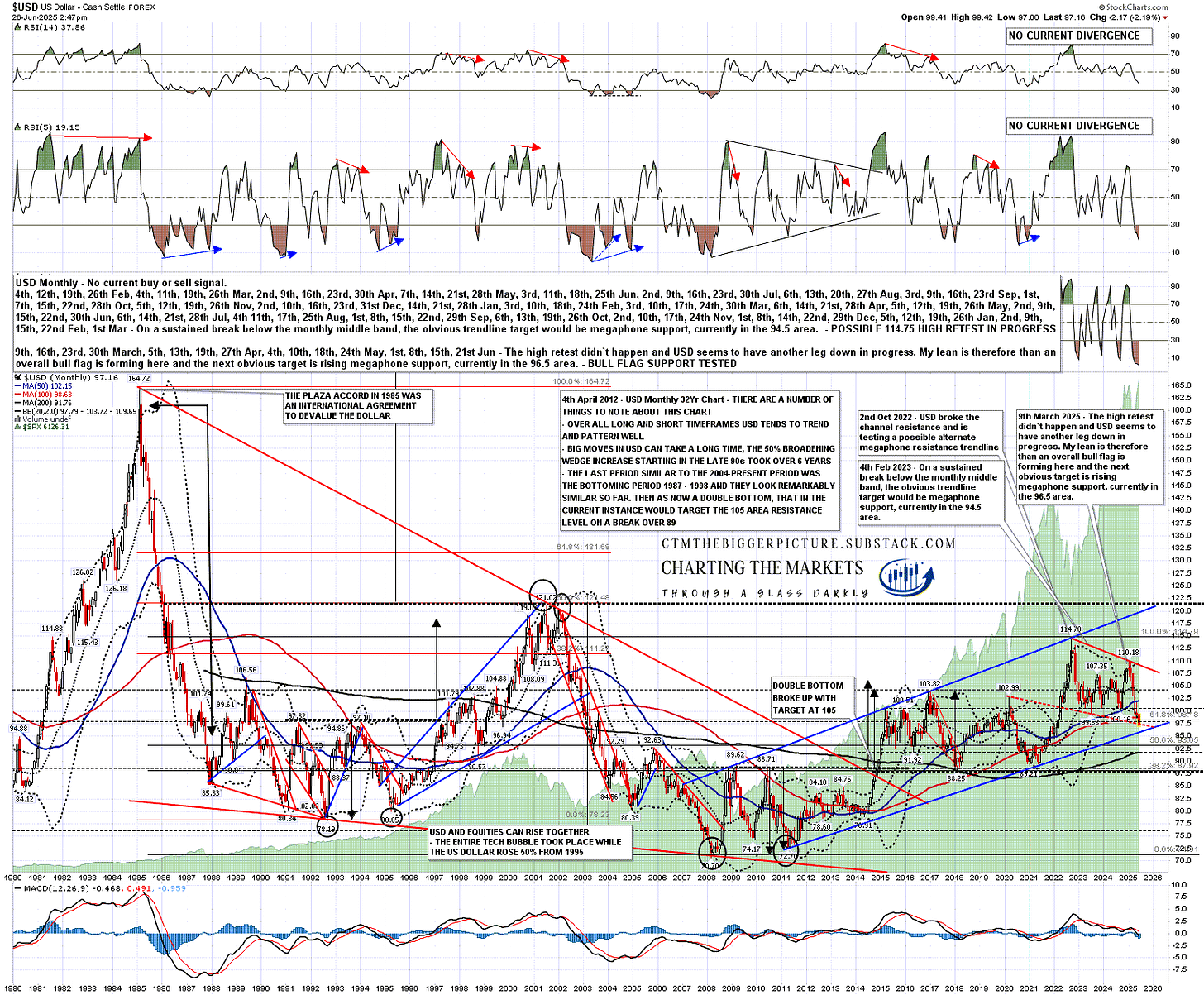

I’ve always really enjoyed doing the long term charts on the US Dollar. Longer term patterns can take decades to form, with the falling wedge that broke up in 2014 breaking a wedge resistance trendline coming from a high in 1985.

Even the shorter term patterns within these larger patterns can take many years to form. On the monthly chart below I was noting in April 2012 that the rising megaphone that formed in the 90’s took six years to form, and the current rising megaphone on USD has been forming since the big low in 2008, which was the lowest low going back as far as my data extends to the dying days of the gold standard in 1970.

What’s my point? Mainly that the larger trends on the US Dollar aren’t generally about short or even medium term news or policy, and on these timescales even individual presidential terms aren’t generally much more than a blip. I’ll be looking at the likely larger trend today, and the shorter term setup that will likely play out over the next few years, and the significant very short term inflection point that is being tested at the moment.

On the really big picture on the monthly chart below, the falling wedge starting in 1985 broke up in 2014, and then retraced slightly under 50% of that wedge decline into a high at 114.78 in 2022.

Was I thinking that USD might go higher? For sure, and I would note that I was particularly watching for a retest of the 2001 high at 121.02 as that was resistance on a possible double bottom that, on a sustained break over it, would have triggered a possible target at a retest of the 1985 high at 164.72. Given that the 1985 high was such an extreme outlier historically though, I was thinking that was a lower probability option.

As it happened the rally from the 2008 low started off as a likely rising channel which looked like a possible bear flag, and at the 2022 high at 114.78 USD broke rising channel resistance to establish an alternate rising megaphone resistance trendline that turned this pattern into a likely bear flag that, in due course, would likely break down towards a retest of the 2008 low at 70.70. I’ve put my contemporaneous comments on the chart below but at this point I started looking for a test of megaphone support, then at 94.5 and now in the 96.5 area.

Over the next two years USD traded above and below the monthly middle band and I was wondering about a possible retest of the high at 114.75 until the hard fail from the early 2025 high, after which I was looking once again at the test of rising megaphone support. I drew in a possible ideal shorter term bull flag falling wedge support trendline and was wondering whether both trendlines might be tested at the same level at the end of 2025.

USD monthly chart from 1980:

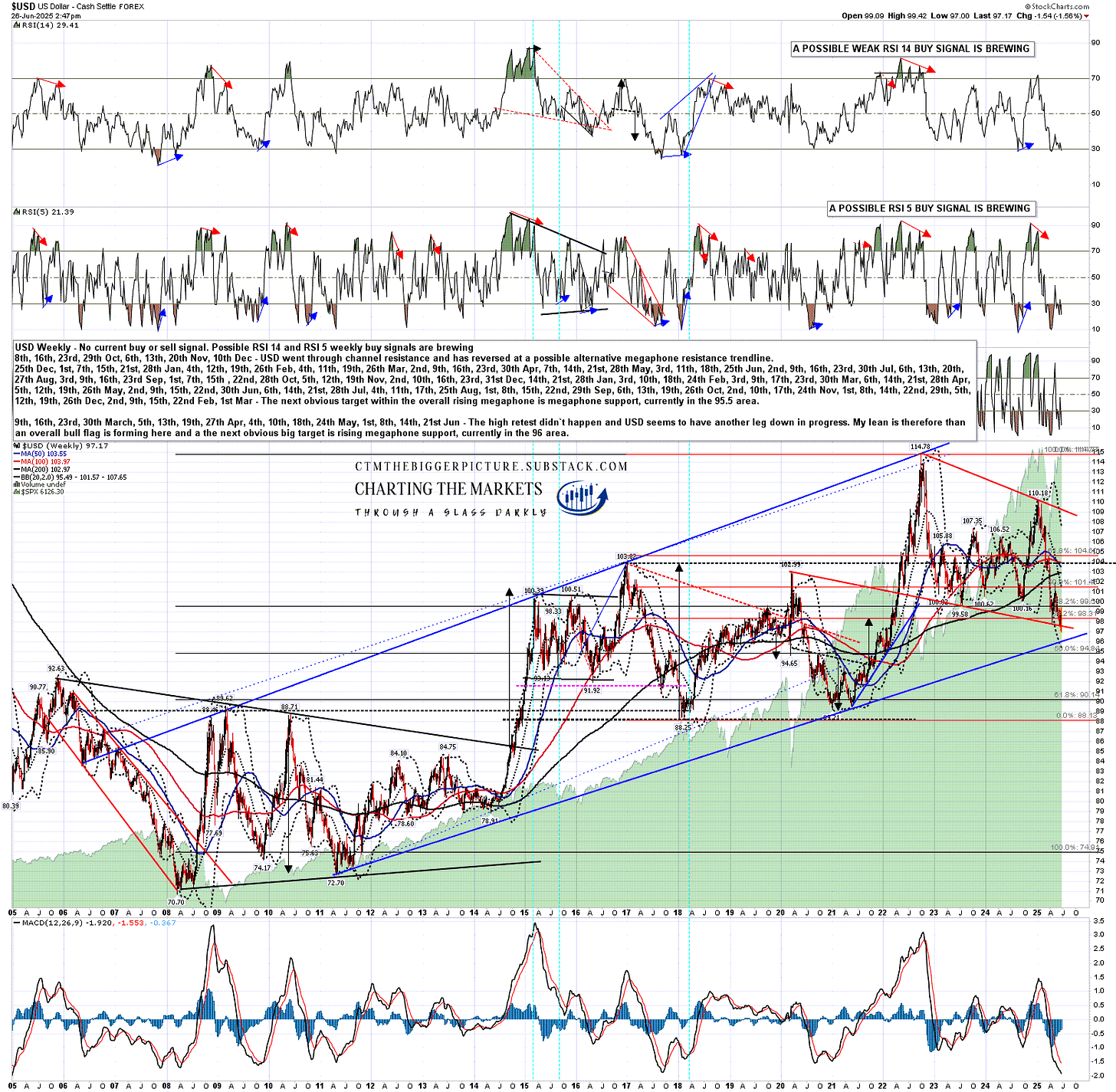

Not shown on the weekly chart below an H&S formed and broke down early March with a target with a target in the 102 area and, likely helped along by the tariff chaos, my ideal bull flag support was then perfectly tested at 97.92 in mid-April.

Now when a rising megaphone/wedge/channel tops out, a topping pattern will generally form, and the shorter term bull flag forming here would of course break up about 70% of the time with a target at a retest of the 2022 high at 114.78. That would likely then be the second high of a double top or break a little higher as a larger H&S formed.

There is another option for a topping pattern here though which is that the bull flag breaks down, as they do about 30% of the time, and on a sustained break down the bull flag itself then becomes the topping pattern, which in this case would have a target in about the 80 area.

Since flag support was tested I have been watching for signs that USD will reverse back up here, as my lean will always be that a bull flag will likely break up. USD rallied to 101.98 then retested the low ago early this month. This has set possible weekly RSI 14 and RSI 5 buy signals brewing that on a decent further move up would fix and support at least a substantial USD rally. The track record for these signals for the last twenty years on USD has been very good.

This low retest has also set up a possible double bottom, that on a sustained break back over 101.98 would look for a target in the 106-7 range and if that target was to be hit then the weekly buy signals should then have both fixed, and I’d be looking for a test of the bull flag resistance trendline, currently in the 109 area.

USD weekly chart:

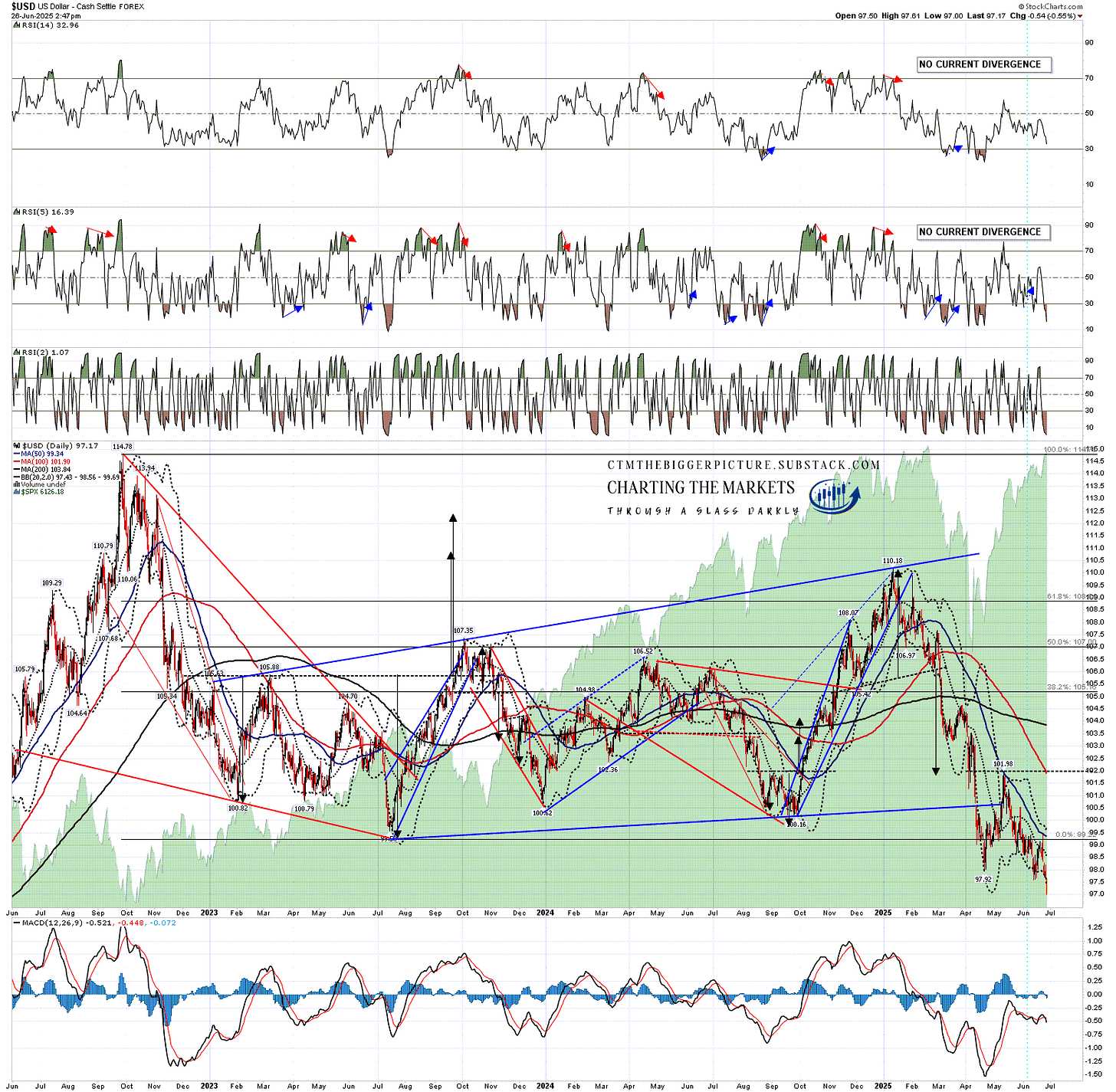

On the daily chart you can see that a high quality rising megaphone had been forming from the low in 2023 and this was always likely to break down in due course into lower lows so, while the Trump administration may have accelerated that sequence somewhat, it didn’t create it.

You can also see a smaller double bottom that may be forming at that on a sustained break over 99.42 would currently look for a target in the 101.2 to 101.8 area.

No current daily positive divergence, and in the last day USD has broken below bull flag support, so we are in the inflection point here and the next direction should be established soon. My lean would be higher, as this is an inherently bullish leaning setup, but it may break instead into continuation down. I think the odds of a break down are higher than normal in this instance due to US policies, but not enough for me to shift my overall lean towards a break down. Either way I’ll be looking for the next target areas either in the 115 area for the upside or 80 on the downside.

USD daily chart:

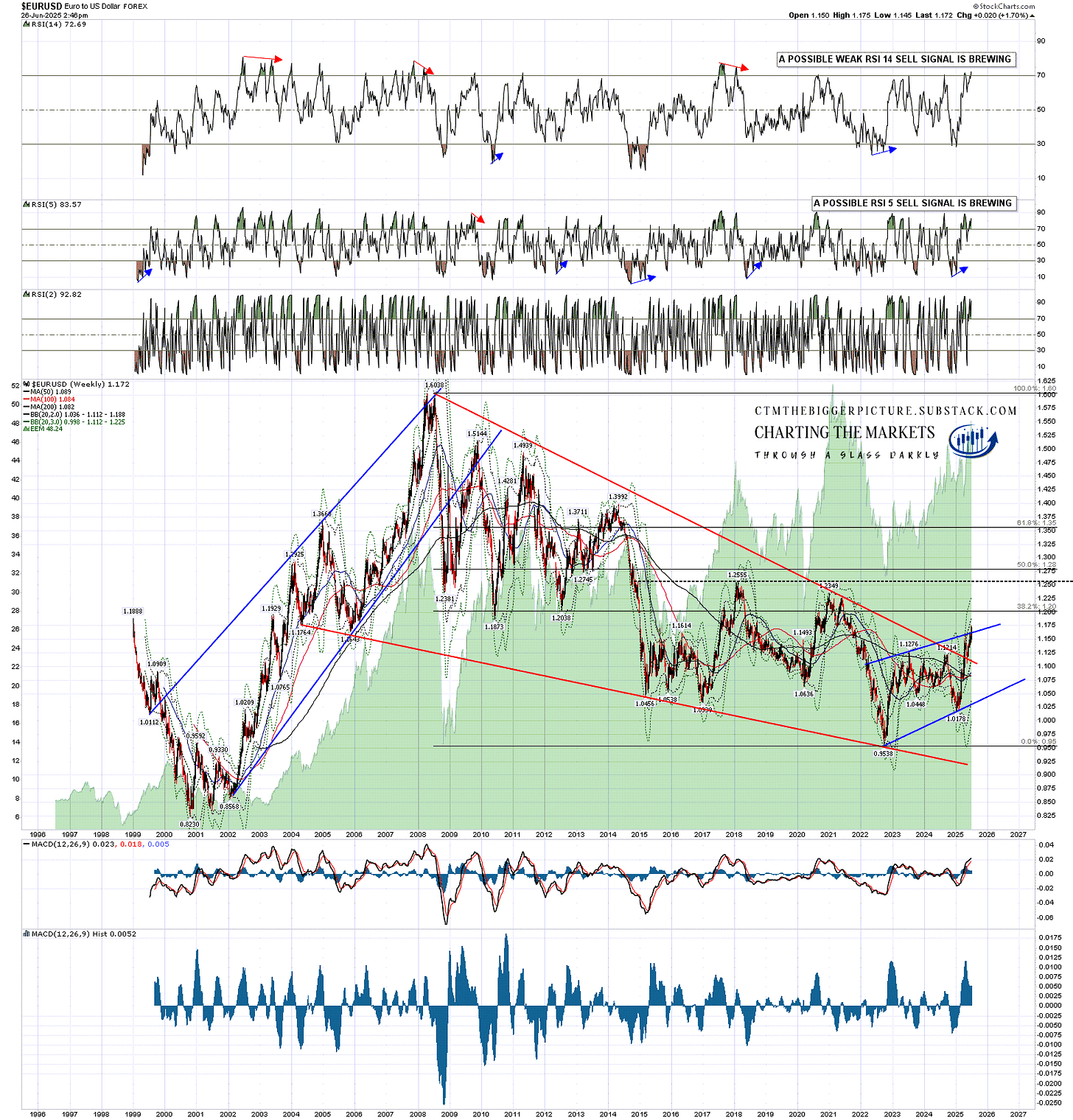

How well supported is this setup and inflection point on other currency pairs? Very well supported. The Euro is 57.6% of the US Dollar currency index and on the weekly chart below you can see the overall bullish setup (inverse to USD of course) with a falling wedge that has broken up and the bear flag wedge that has formed since the 2022 low.

The larger pattern is a falling wedge rather than the rising megaphone on USD, but otherwise this looks almost identical with EURUSD now breaking up over bear flag resistance in what is likely a bearish overthrow (~70% odds) or the start of a break up (~30% odds).

EURUSD weekly chart:

Pounds Sterling (GBP) is 11.9% of the USD index and with minor differences the setup on GBPUSD is almost identical to the setup on EURUSD.

GBPUSD weekly chart:

When I’m looking at USD direction I don’t usually pay much attention to US government policy, as apart from the obvious possible exception of the Plaza Accord in 1985 to devalue USD in the aftermath of the Latin American Debt Crisis in the early 1980s, I’ve never seen that make any real difference to the obvious longer term trends and targets, and I’m not seeing anything to suggest that current US government policies might change those either.

What I am wondering here though is whether US government policies might accelerate this process and send the US dollar down towards the obvious longer term target at a retest of the 2008 low at 70.70 earlier, and a lot faster, than would otherwise have been the case. We’ll see what happens at this current and very important inflection point.

If you like my analysis and would like to see more, please take a free subscription at my thebiggerpicture substack, where I publish these posts first and for members (from next week) also bi-weekly videos looking at equity indices, bonds, currencies and commodities. Those videos are posted on my Youtube channel after a four day delay. Links to all my posts from my charting substacks are also always posted on my twitter.

No comments:

Post a Comment