In my post on Tuesday 16th September I was looking at the possibility that we might see a modest retracement (by Crypto standards) on Crypto over the rest of the week and into the end of September, during the last significantly bearish leaning period (on equities) this year.

In my post on Wednesday 24th September I was looking at the possibility that the low on that retracement had been made and giving the obvious targets below in the event that Bitcoin (BTCUSD), Solana (SOLUSD), and Ethereum (ETHUSD) went lower.

As it turned out the short retracement low was in, all three recovered back over their daily middle bands and Bitcoin then made a new all time high.

What I was delighted to find then on Bitcoin was a perfect rising channel from the April low. Why was the channel important? It was important because as long as that channel lasted it gave us clear resistance and support trendlines and target areas for moves up.

Unfortunately there was then a very sharp decline on Friday last week and my Bitcoin rising channel broke, and all three of these cryptocurrencies are now testing big support.

I have been seeing a lot of speculation in recent weeks that the bull market on Crypto might be over and that’s possible, but I’m still favoring another leg up into December. There is however a real risk here of seeing another leg down here that could do some real technical damage, so I’m going to look at that today.

Ethereum and Solana never retested their highs so in effect we are still looking at the same retracement that I was speculating about starting on Tuesday 16th September. There was of course an H&S on Ethereum that broke down soon after with a target in the 3500 area, and the low on Friday was at 3546.88, close to that target.

For now I’m seeing this as a likely bull flag forming and watching main support at the weekly middle band, currently at 3726, which held as support at the close last week. Ethereum rallied to backtest the daily middle band as resistance yesterday, so Friday’s low may be retested, possibly to make the second low of a double bottom.

ETHUSD 60min chart:

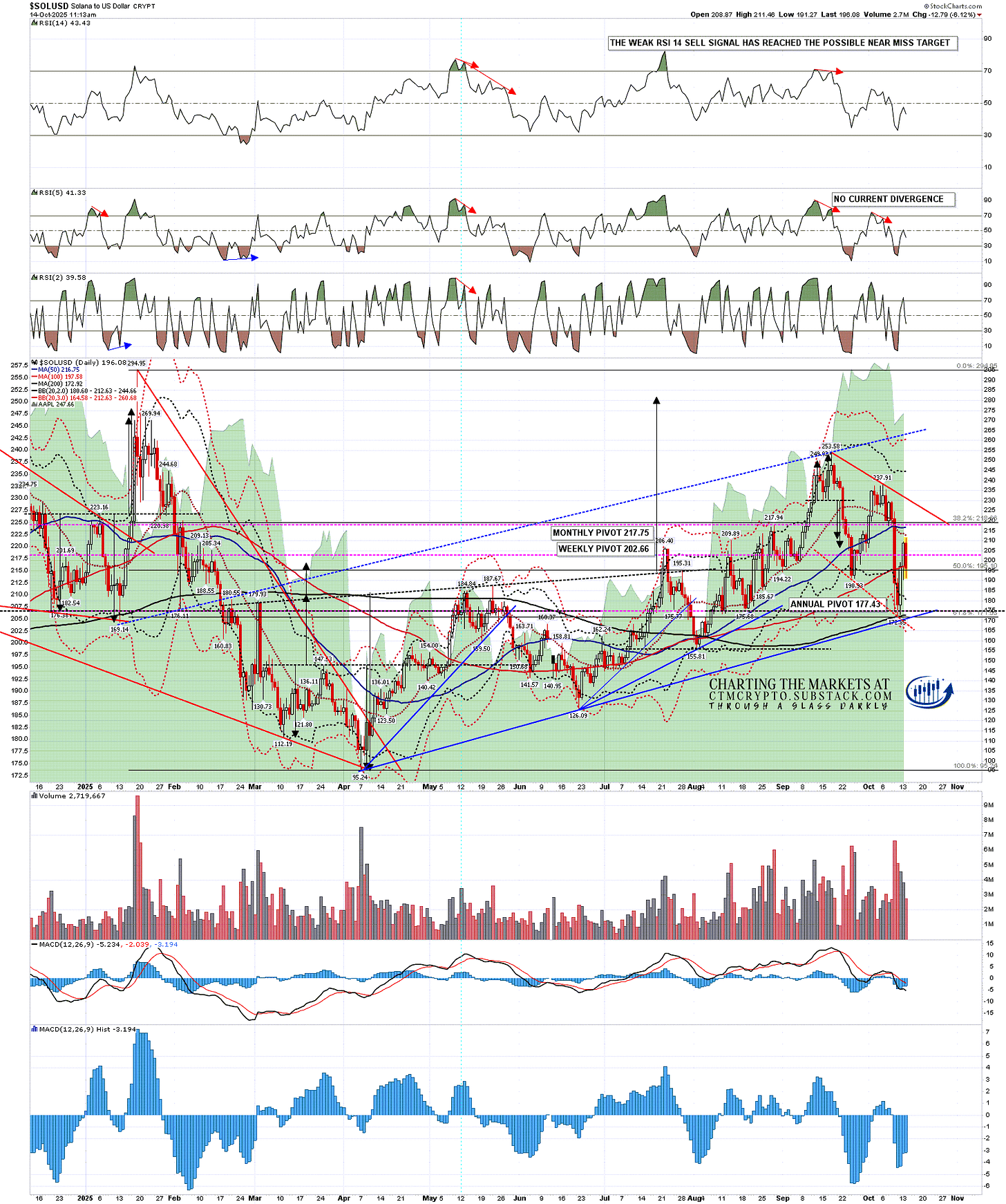

Solana also tested the weekly middle band on Friday, currently at 186.59, and that also held as support at the weekly close. On the daily chart Solana backtested the 200dma, currently at 1172.92, as support for the first time since August and that too has held as support so far. For now I’m also seeing this as a likely bull flag forming.

Solana rallied to backtest the daily middle band as resistance yesterday, so Friday’s low may be retested, possibly to make the second low of a double bottom.

SOLUSD daily chart:

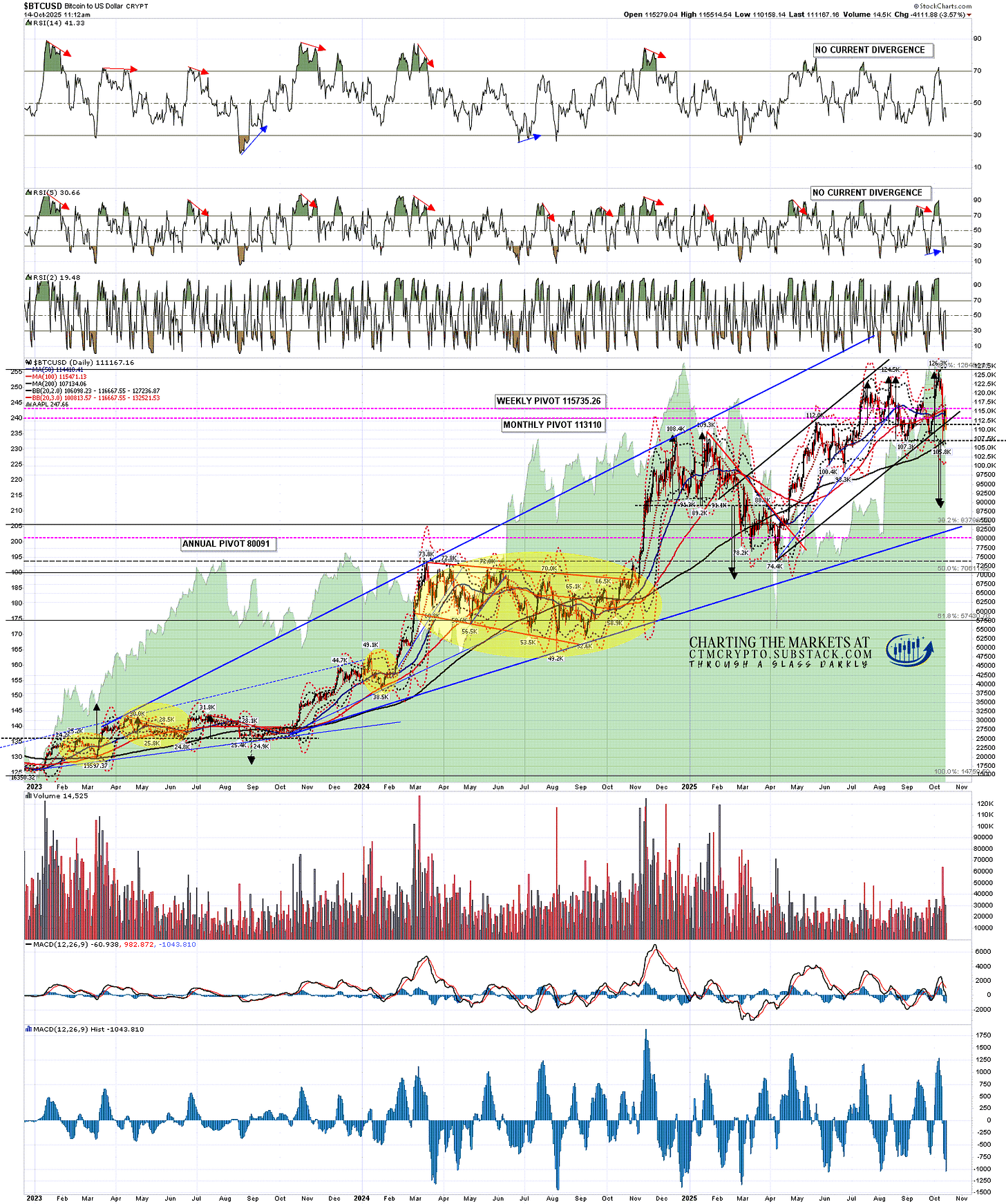

The big issue here though is Bitcoin, as the latest all time high may have been the second high of a double top, and that double top broke down on Friday with a target in the 88.2k to 90k area. At this point I am looking for either a move down to that target area or a rejection back up into the all time high at 126.3k.

There was an aggressive test of weekly middle band support on Friday, currently at 113,147, with a close above at the end of the week, so that support is holding so far.

BTCUSD weekly chart:

Bitcoin rallied to backtest the daily middle band as resistance yesterday, so Friday’s low may be retested, possibly to make the second low of a double bottom, and if seen that would set a possible daily RSI 5 buy signal brewing.

BTCUSD daily chart:

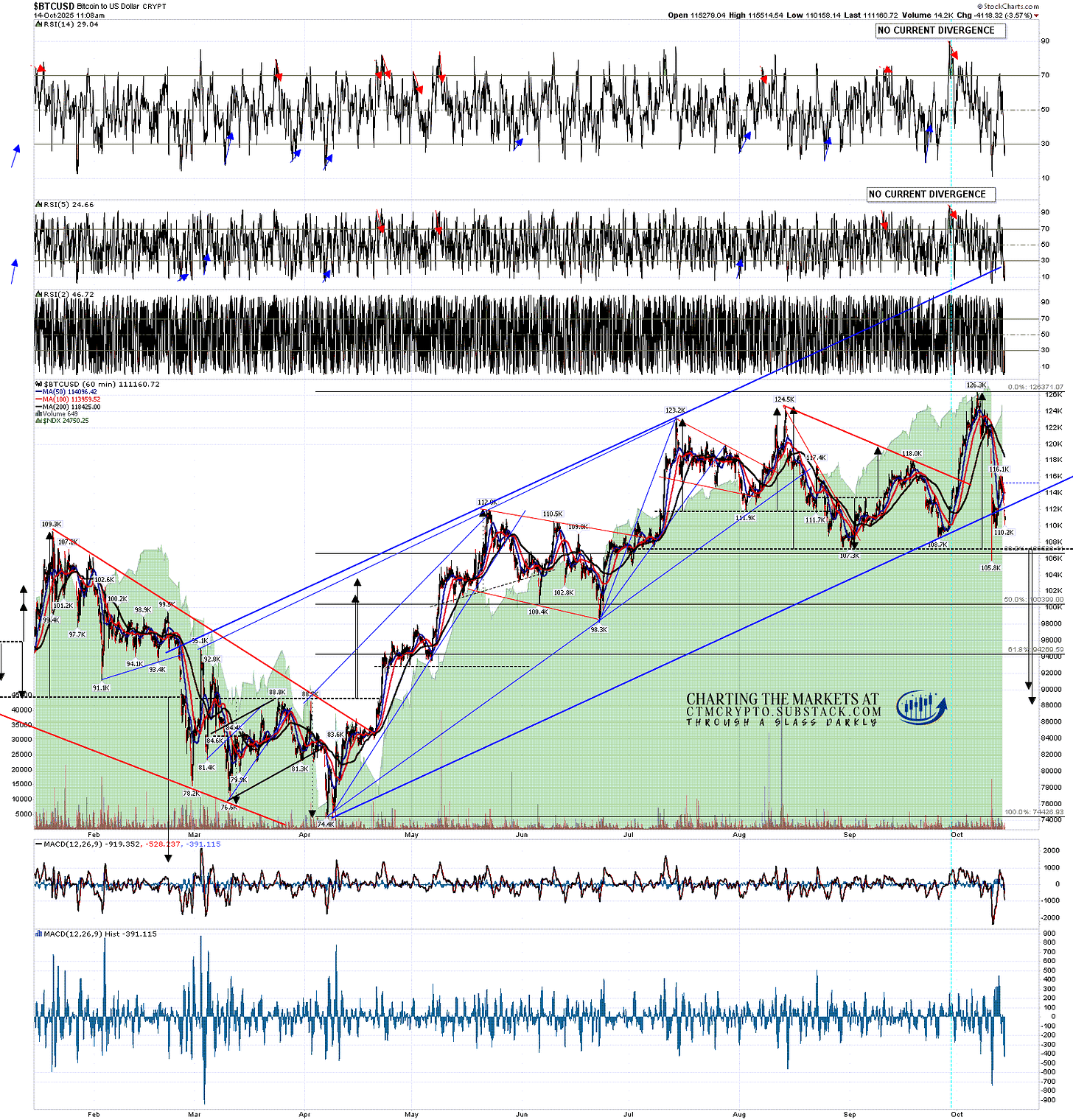

On the Bitcoin hourly chart below you can see the rising channel that was established and then broke, and the double top that has now broken down.

At this point, as I mentioned, we should either see that double top target reached, or a rejection back to the high. If Friday’s low is retested and that area holds then this would set up a very nice double bottom to retest the all time high.

BTCUSD 60min chart:

If Bitcoin does reach the double top target would the bull market be over? No, but it would increase the chance that it might be. I would still be leaning towards at least a retest of the all time high from there but that might be forming a double top that could end this bull market cycle. There would also likely be some serious technical damage done on Ethereum and Solana while that played out.

Since I started doing daily videos on Crypto early last year I’ve got Crypto direction right most of the time and more so than any other analyst anywhere that I’m aware of. I’m a very good analyst and all three of these instruments are very classical chartist friendly. I’m not much of a marketer though, and the free Crypto substack I set up last August still has less than 200 readers. I’d like to increase that readership and invite any suggestions on how I could do that.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment