In my last post on Tuesday 14th October I was looking at the double top that had just broken down on Bitcoin. I was leaning towards this rejecting back up to the highs along with equities, but that high retest has been playing out on equities without any meaningful participation so far from Bitcoin (BTCUSD), Solana (SOLUSD), or Ethereum (ETHUSD). Last week Bitcoin actually broke and closed below the weekly middle band, in what was a significant support break.

This is bearish and the odds of that double top on Bitcoin playing out have risen considerably. If that double top plays out then there will likely also be serious further support breaks on Solana and Ethereum of a kind that would suggest that the bull market may have already ended on both, and possibly all three. This is what I wrote at the end of my last post:

‘If Bitcoin does reach the double top target would the bull market be over? No, but it would increase the chance that it might be. I would still be leaning towards at least a retest of the all time high from there but that might be forming a double top that could end this bull market cycle. There would also likely be some serious technical damage done on Ethereum and Solana while that played out.’

The problem is that Crypto is still closely directionally tied to equities and on equities I was only really looking for a retest of the all time highs on SPX and QQQ, which I’m thinking will likely happen by the close on Friday, before a fail into a larger retracement. If seen that might well then fail into a larger retracement matching the one forming on Bitcoin and the others here. If you’re interested I was looking at this in my equities post on Monday 20th October.

I’d still be then looking for a last leg up into December on Bitcoin, and likely equities too, but that might well just be to make the second high on a larger Bitcoin double top to finish the bull market there. I would note that the last two bull market highs on Bitcoin were in December 2017 and November 2021, close to the end of the year and four years apart, so the end of 2025 is the obvious period to be looking for an end to the current bull market.

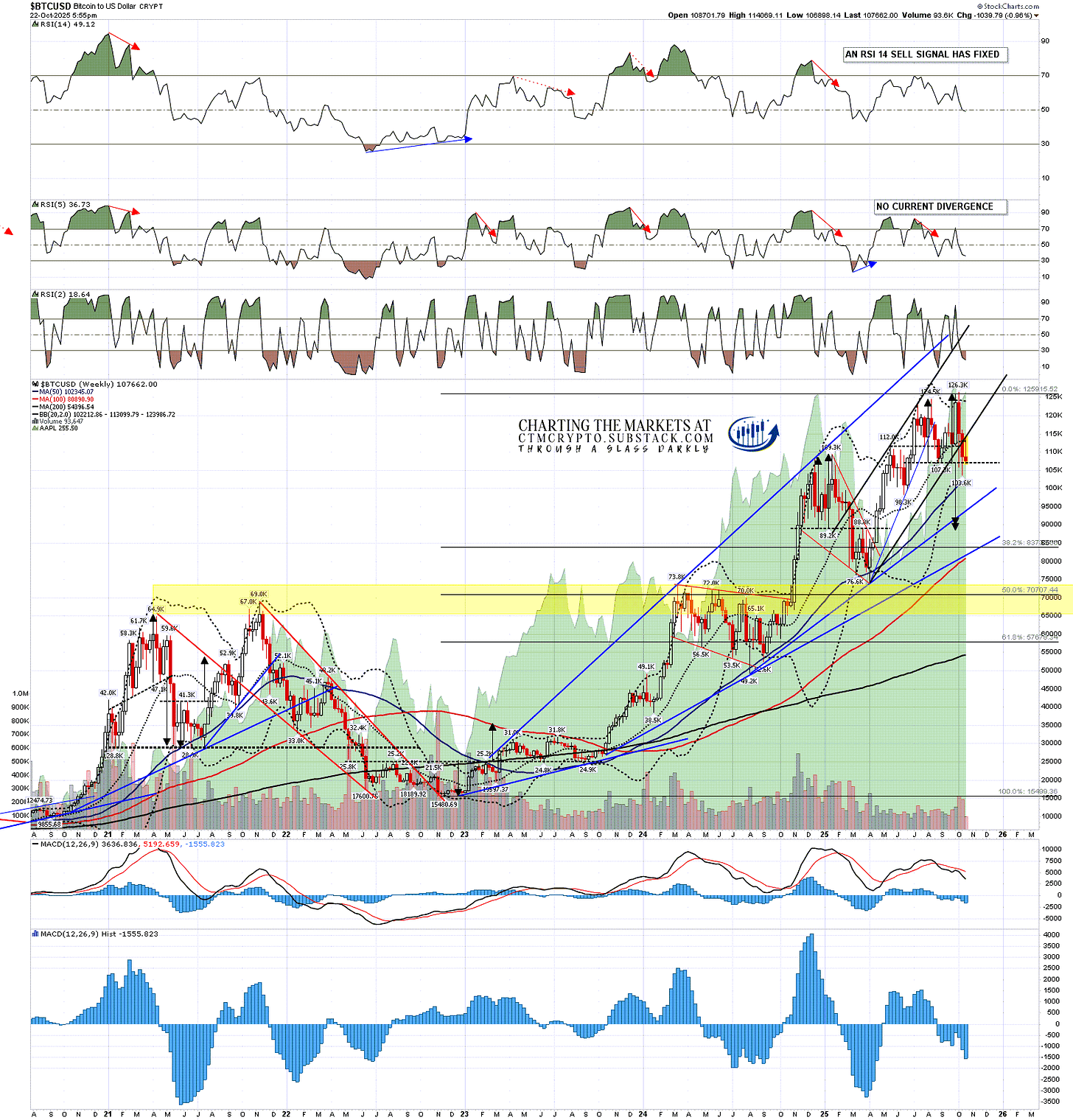

On the Bitcoin weekly chart, as I mentioned, support at the weekly middle band, currently at 113,125, was lost last week and that was backtested as resistance at the high this week. If this week closes below then that support break will be confirmed.

There is another big area on the weekly chart at the 50 week MA, currently at 102,354 and that is historically very good support during bull markets, such good support in fact that it was only broken after the highs of the last two bull markets had been made.

BTCUSD weekly chart:

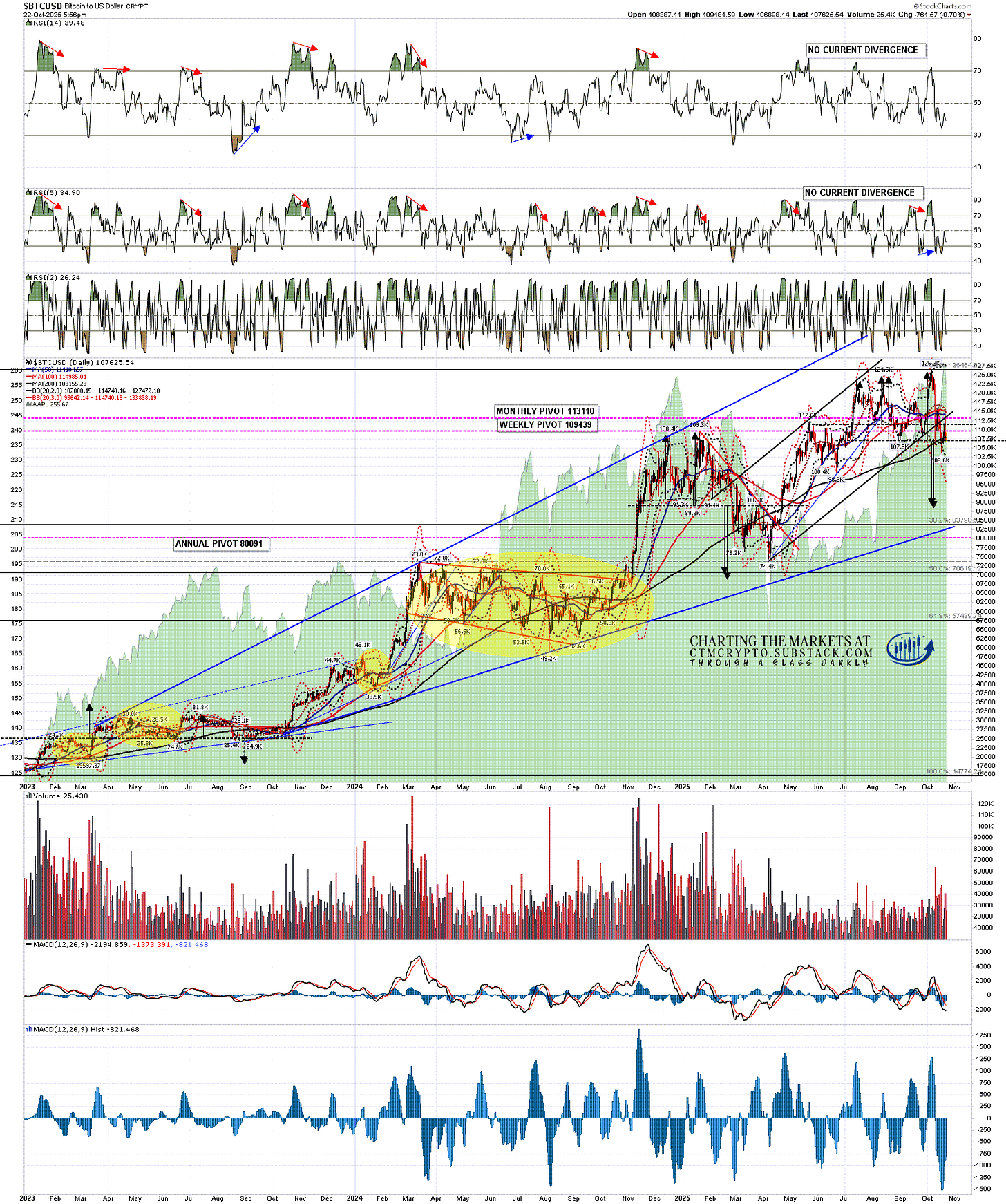

On the daily chart Bitcoin is testing the 200dma, currently at 108,158, as support. That has been broken three times since the start of 2024, for periods ranging from two weeks to two months. Still a big support level though, and strong breaks below this and the 50 week MA would clear the path for Bitcoin to reach the double top target in the 88.3k to 90k area.

BTCUSD daily chart:

On Solana the weekly middle band has still not been broken on a weekly close basis and that may still hold as support. That’s currently at 187.75, and just above the 50 week MA at 183.08. That 50 week MA was again only broken after the last bull market high in Q3 2021. These are the two big levels on the weekly chart and the only other big level on this chart is the 200 week MA, which was tested at the 2025 low, and is currently at 101.95.

SOLUSD weekly chart:

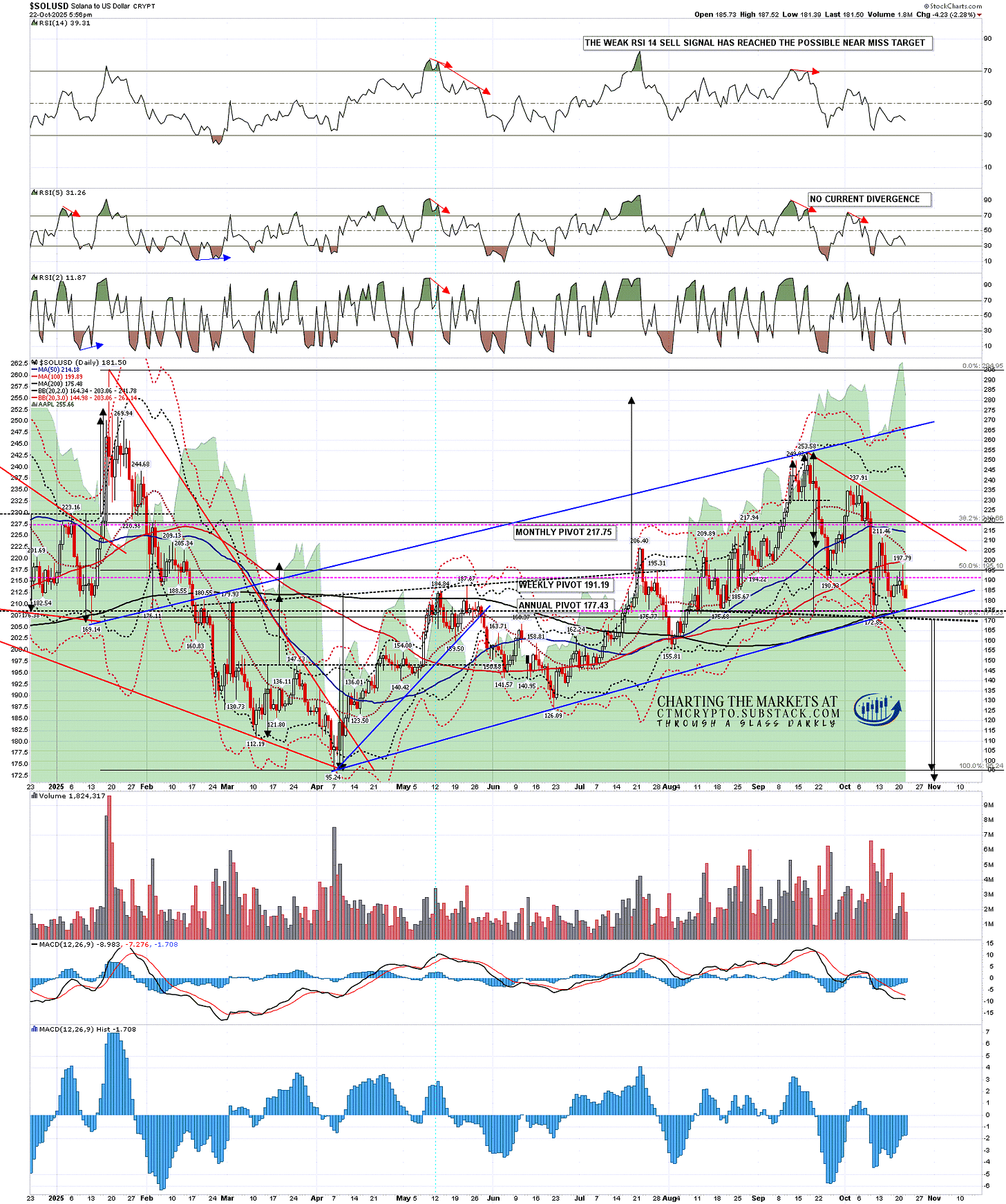

On the Solana daily chart the big support is at the 200dma, currently at 175.49. That is a strong support level that broke hard in February before Solana almost halved from that break into the low at 95.24. The only other big support on the daily chart is rising support from that 95.24 low, currently in the 176 area and currently unbroken. That is strong double support.

In terms of the pattern setup here that rising support trendline is the support trendline on a large and high quality rising wedge from that low, so a break below would also be a serious break for that reason.

On the bull side there is an IHS that broke up in July with a target in the 282/3 area, but there is also now a possible H&S forming here that on a break below the neckline in the 170 area would have a target at a retest of the March low at 95.24. A break below 126.09 would invalidate the bullish IHS, and a break below the March low at 95.24 would likely mean that this bull market high in Solana was likely made in January at 294.95.

One thing I would mention that I have said many times over the years is that when an H&S or IHS pattern fails, it is very often after a similar pattern has formed in the other direction. That would obviously be the case here.

SOLUSD daily chart:

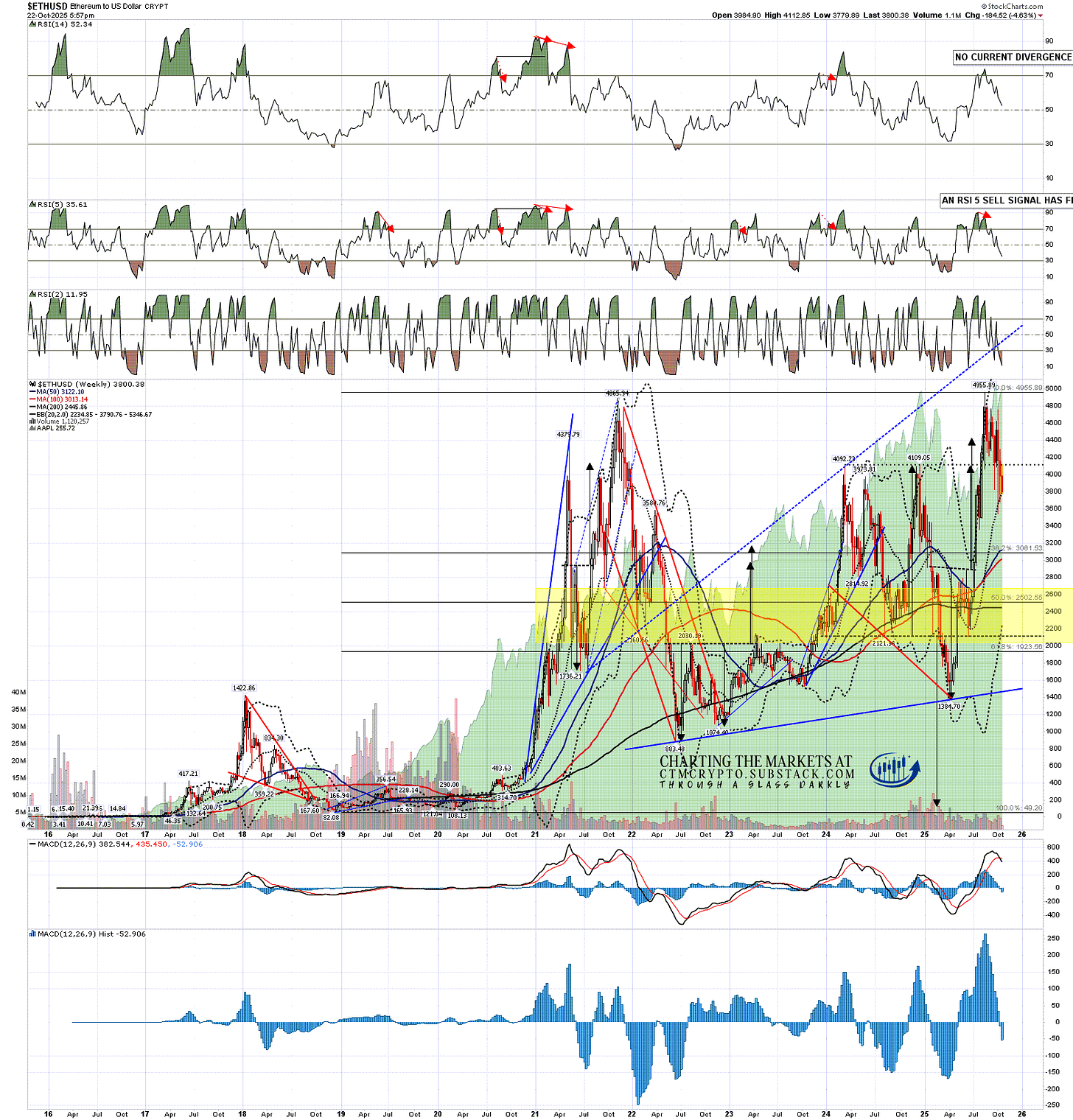

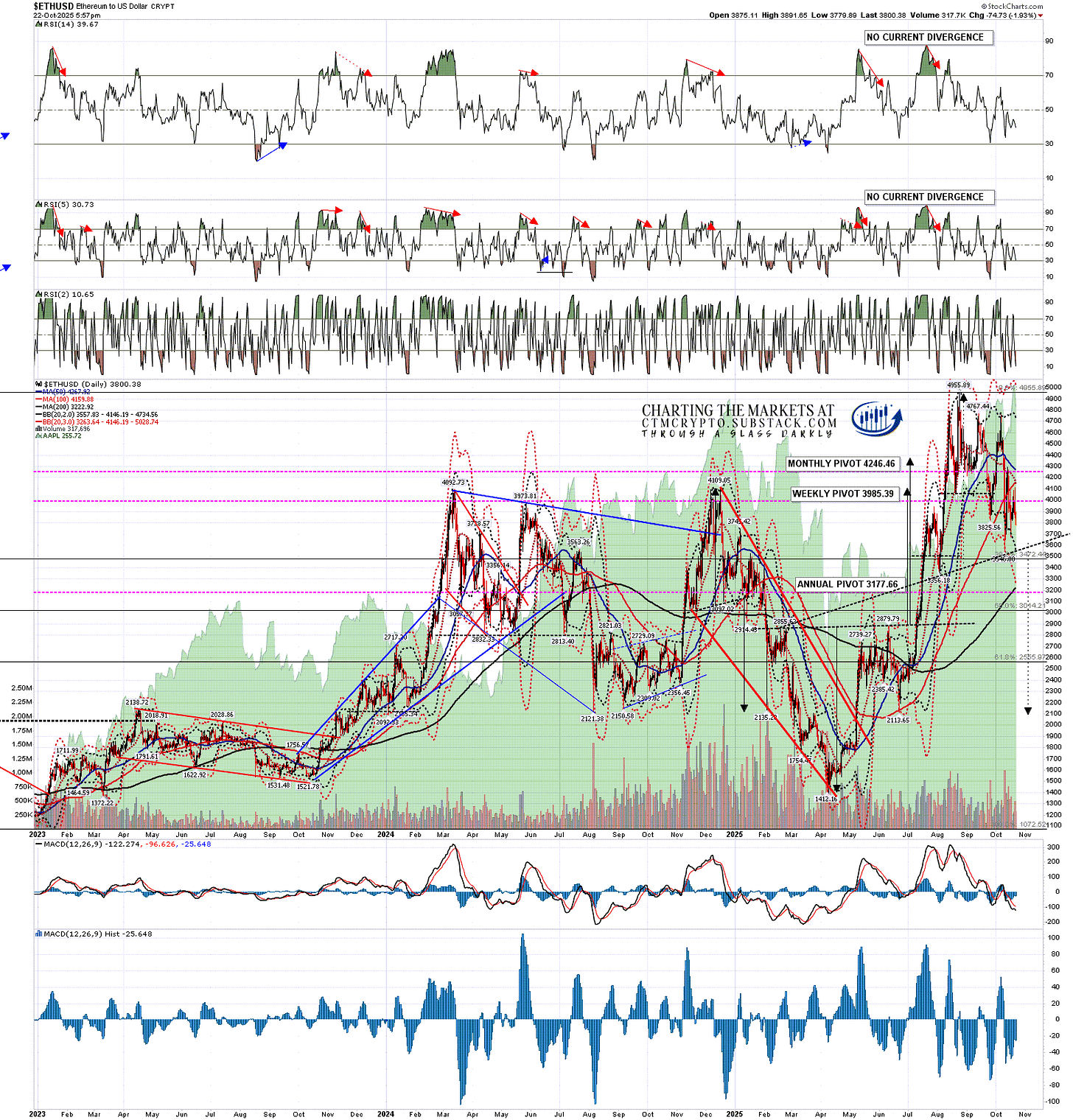

On Ethereum the weekly middle band has still not been broken on a weekly close basis and that may still hold as support. That’s currently at 3792.57. That is a big level on the weekly chart, with the other big level at the 50 week MA, currently at 3122.85. The 50 week MA was not broken until after the highs on the last two bull markets in early 2018 (on Ethereum, but in late 2017 on Bitcoin), and late 2021.

ETHUSD weekly chart:

On the Ethereum daily chart the next big support is at the 200dma, currently at 3223.06. That’s been good support and is a decent match with the 50 week MA, so there is a big double support level in the 3100-3250 area.

In term of the pattern setup there isn’t an obvious overall pattern but I’ll be watching rising support from the April low at 1384.70, and that trendline is currently in the 3250 area (but rising), so in effect there is overall a very strong triple support level in the 3100-3300 range.

The bullish IHS that was also on the Ethereum chart made target in August, so that is no longer an issue. As with Solana a possible H&S is forming and on a sustained break below the H&S neckline at 3600 the target would be in the 2100 area. If that target was to be hit then this bull market high in Ethereum was likely made in August at 4955.89.

ETHUSD daily chart:

What’s the bottom line here? The odds that bull market in Crypto is topping out on Bitcoin and already over on Solana and Ethereum have risen considerably over the last two weeks. All of them are testing big support levels at the moment and if those levels break then the odds will rise a lot more. We’ll see.

Since I started doing daily videos on Crypto early last year I’ve got Crypto direction right most of the time and more so than any other analyst anywhere that I’m aware of. I’m a very good analyst and all three of these instruments are very classical chartist friendly. I’m not much of a marketer though, and the free Crypto substack I set up last August still has less than 200 readers. I’d like to increase that readership and invite any suggestions on how I could do that.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment