In my post on Tuesday last week I was looking at possibility that we might see a modest retracement on Crypto over the next few days into the end of September, during the last significantly bearish leaning period this year.

In my premarket videos over the rest of the week I was looking at the possibility that daily RSI 5 sell signals might form on Bitcoin (BTCUSD) and Solana (SOLUSD), and that Bitcoin and Ethereum (ETHUSD) might get another leg down within larger bull flags that might be forming from their last all time highs.

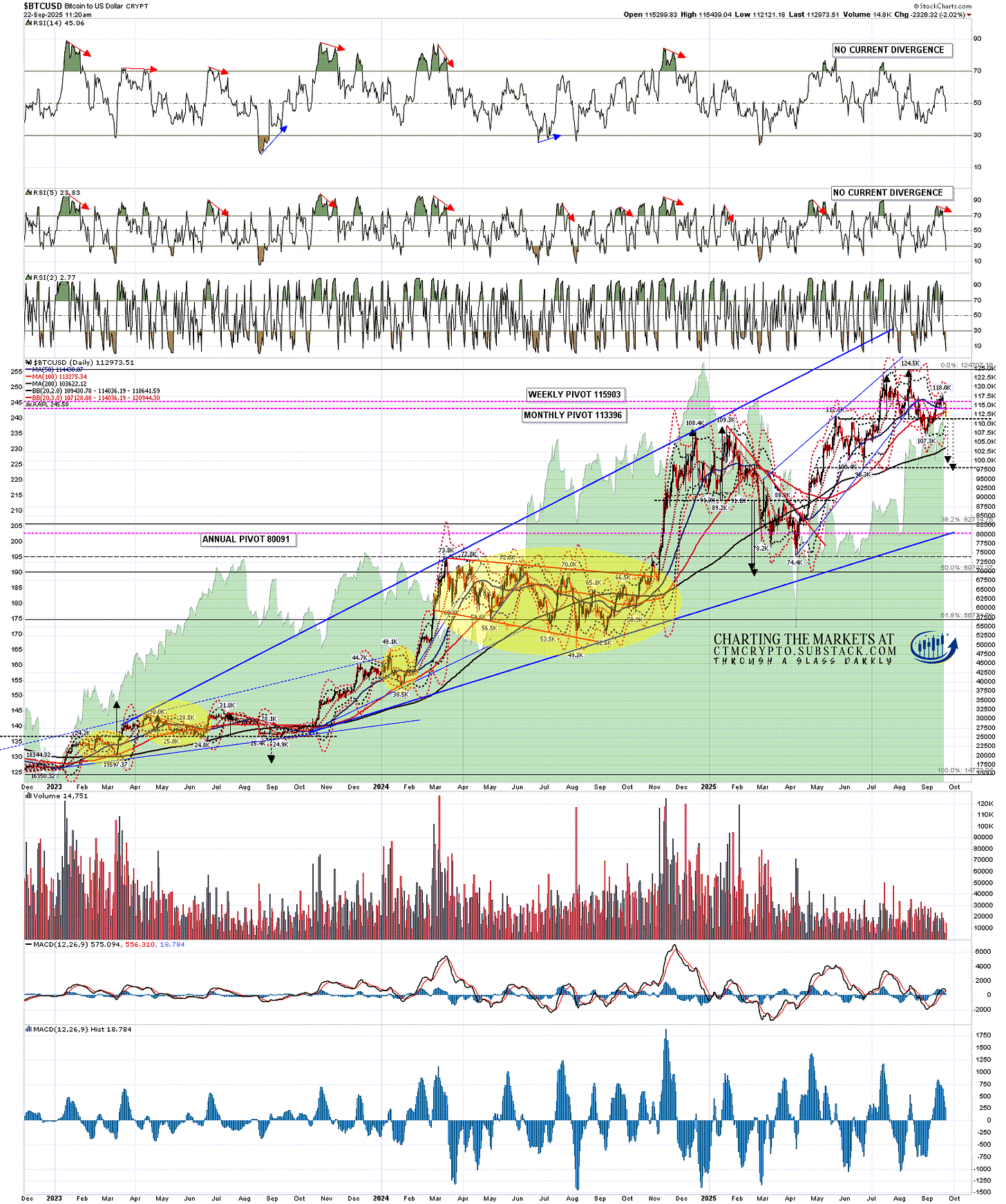

Looking at Bitcoin, that next leg down may now have started, and it has retraced to test the first big support level on the way at the backtest of the May (then) all time high at 112k, and the weekly middle band just below that currently at 111,738. The overnight low at the time of writing is at 112,121.

For Bitcoin to break lower this is the key level that needs to be broken and converted to resistance so I am watching this level carefully.

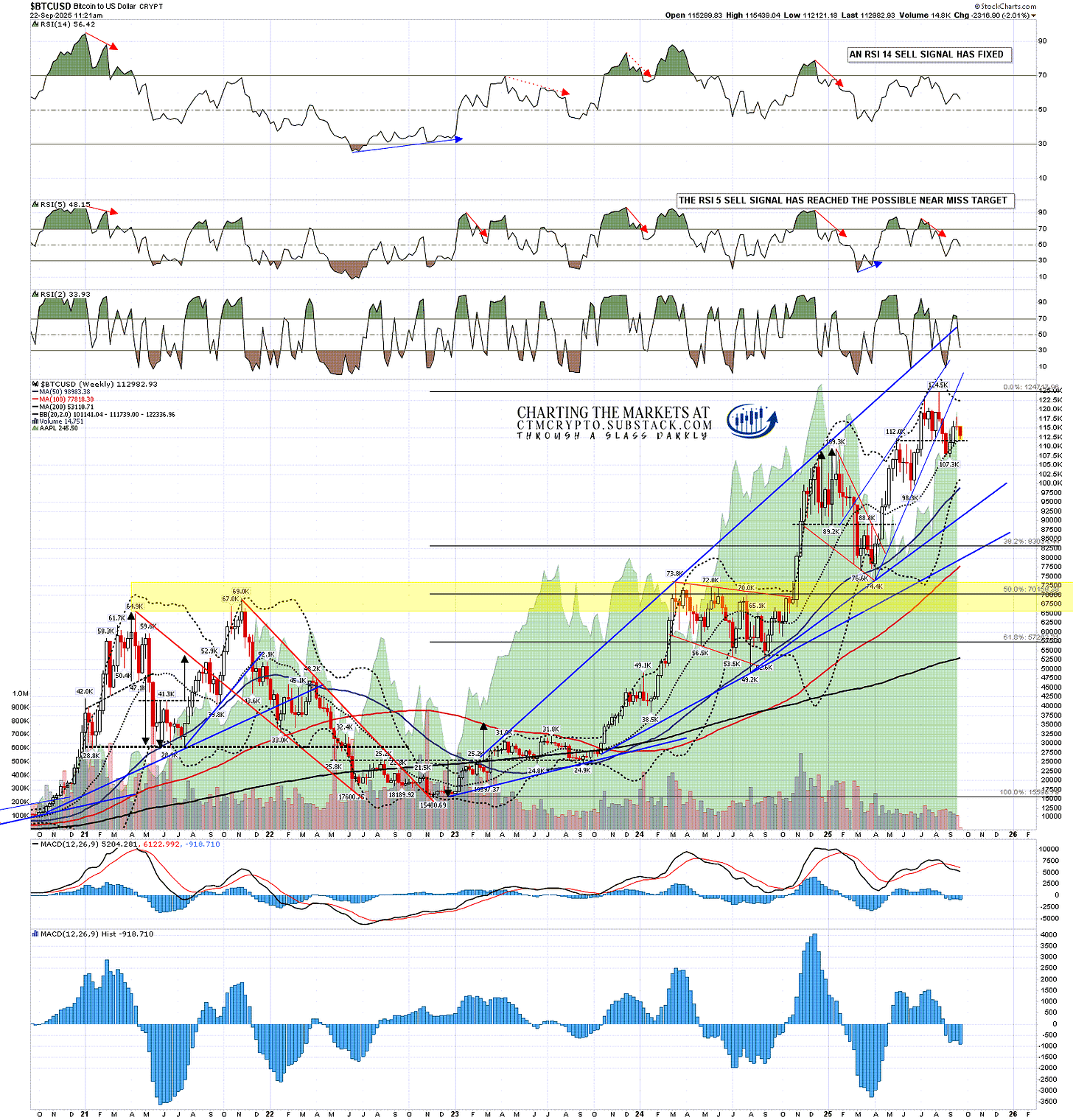

BTCUSD weekly chart:

In terms of that daily RSI 5 sell signal it did form as I hoped and broke down on Friday, but won’t be much further assistance as it is already reaching the target at the 30 level on the daily RSI 5.

Bitcoin has broken back below the 50dma, currently at 114,030, and the daily middle band, currently at 114,028. If the daily middle band can also be converted to resistance then that opens the downside.

BTCUSD daily chart:

In terms of the hourly chart the only topping pattern was very small and has already reached target, but there is still an open target from a double top that broke down in August in the 99k to 100k area, and established strong support at the June low in the 98.3k area. If we see more weakness then that area just under 100k would be the obvious target area.

If a bull flag is forming I have drawn in the two most likely support trendlines, currently in the 103k and 106k areas.

BTCUSD 60min chart:

On Solana that daily RSI 5 sell signal also formed as I hoped and broke down over the weekend, but also won’t be much further assistance as it is already reaching the target at the 30 level on the daily RSI 5.

At the end of my The Bigger Picture video yesterday I was looking at the small double top setup on Solana and that broke down overnight with a target in the 205-10 area. Overnight Solana has broken below the daily middle band, currently at 226.58, and I’m liking the odds of that making target, particularly with the attractive support level at the 50dma currently at 204.60.

SOLUSD daily chart:

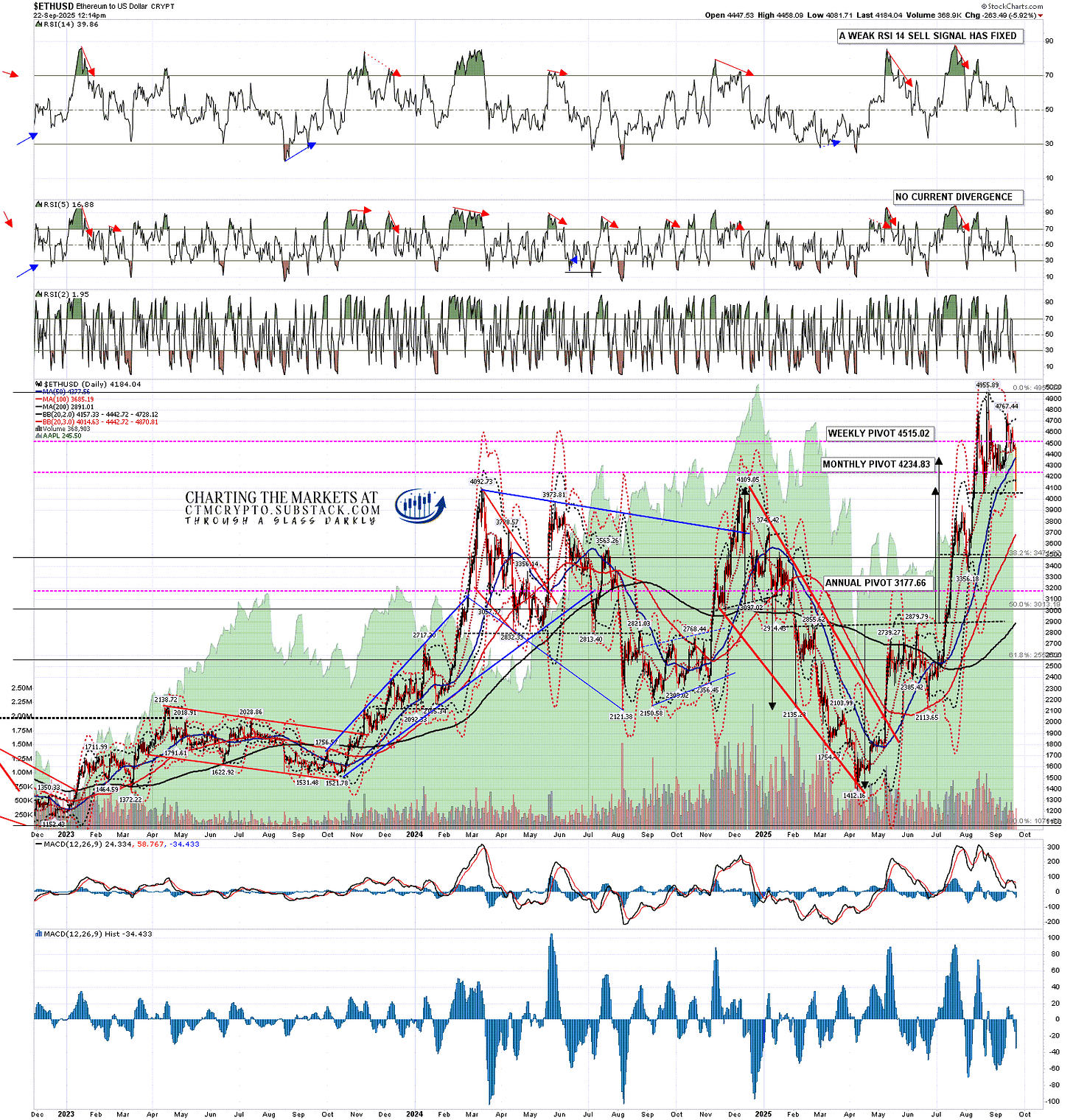

Ethereum still has a fixed daily RSI 14 sell signal that fixed in August and I am thinking that may well reach target in this retracement. Ethereum broke the daily middle band hard overnight and is testing the first important support area at the mid-August low at 4063.26.

ETHUSD daily chart:

A small upsloping H&S on Ethereum broke down overnight with a target in the 3500 area and, on a move below 3500 I have possible alternate double top targets in the 3150-3330 range.

I have drawn in possible larger bull flag support trendlines currently in the 3770 and 3430 areas and there is also a rising support trendline currently in the 2950 area that could be a target.

ETHEUSD 60min chart:

These levels hit overnight may be support, the daily RSI 5 sell signals on Bitcoin and Solana are already in their target areas, and it may be that support here will hold. If these do break lower I’m looking for a fairly modest retracement (in Crypto terms) over the next few days setting up the next legs up on all three of these.

On a break lower we could see daily buy signals set up on any or all three of these and if so I’ll be calling those as they form.

Since I started doing daily videos on Crypto early last year I’ve got Crypto direction right most of the time and more so than any other analyst anywhere that I’m aware of. I’m a very good analyst and all three of these instruments are very classical chartist friendly. I’m not much of a marketer though, and the free Crypto substack I set up last August still has less than 200 readers. I’d like to increase that readership and invite any suggestions on how I could do that.

I am thinking about setting up a second YouTube Crypto channel and recording videos giving likely market direction without requiring the viewers to have some knowledge of technical analysis to understand the videos. Comments on that and other suggestions very welcome. I’ll likely start publishing videos on that project before the end of the month.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment