In my post on Tuesday last week I was looking at the possibility that we might see a modest retracement (by Crypto standards) on Crypto over this week and into the end of September, during the last significantly bearish leaning period (on equities) this year.

In my premarket videos over the rest of last week I was looking at the possibility that daily RSI 5 sell signals might form on Bitcoin (BTCUSD) and Solana (SOLUSD), and that Bitcoin and Ethereum (ETHUSD) might get another leg down within larger bull flags that might be forming from their last all time highs.

We haven’t actually been seeing much bearish action on equities during this historically weak bearish window on equities, at least until the Fed comments yesterday casting doubt on further rate cuts this year, but the pullback on Crypto has been proceeding as expected.

In my post on Monday I was looking at Bitcoin’s return to backtest the strong support at the weekly middle band, currently at 111,726, and that is holding so far. This is a possible retracement low.

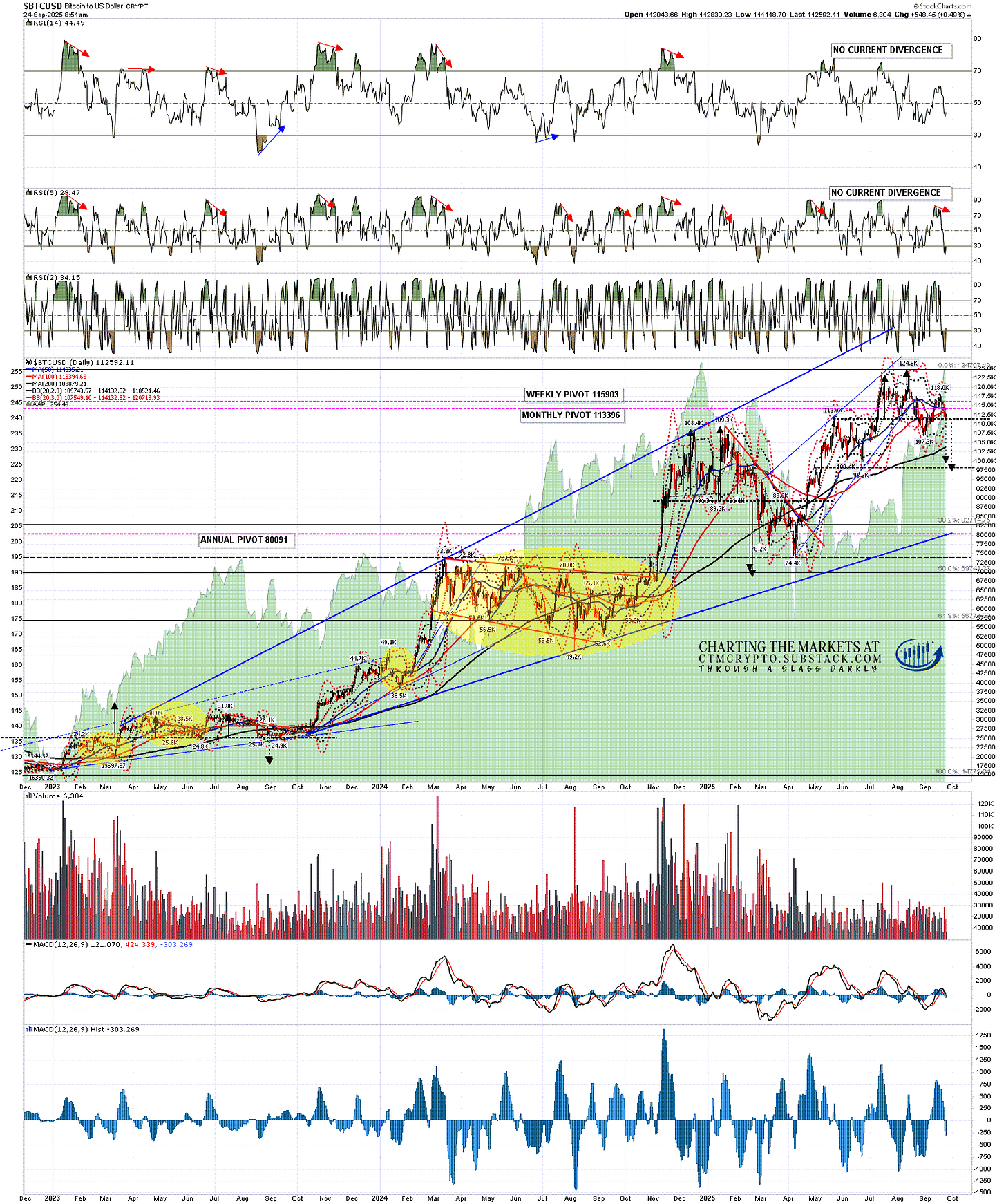

BTCUSD weekly chart:

On the daily chart an RSI 5 sell signal formed last week and made target at the close on Monday.

Could we still see Bitcoin go lower? Yes. I’m thinking that either this is likely either the retracement low on Bitcoin or the end of an A wave in an ABC retracement, with a rally here before another leg down.

BTCUSD daily chart:

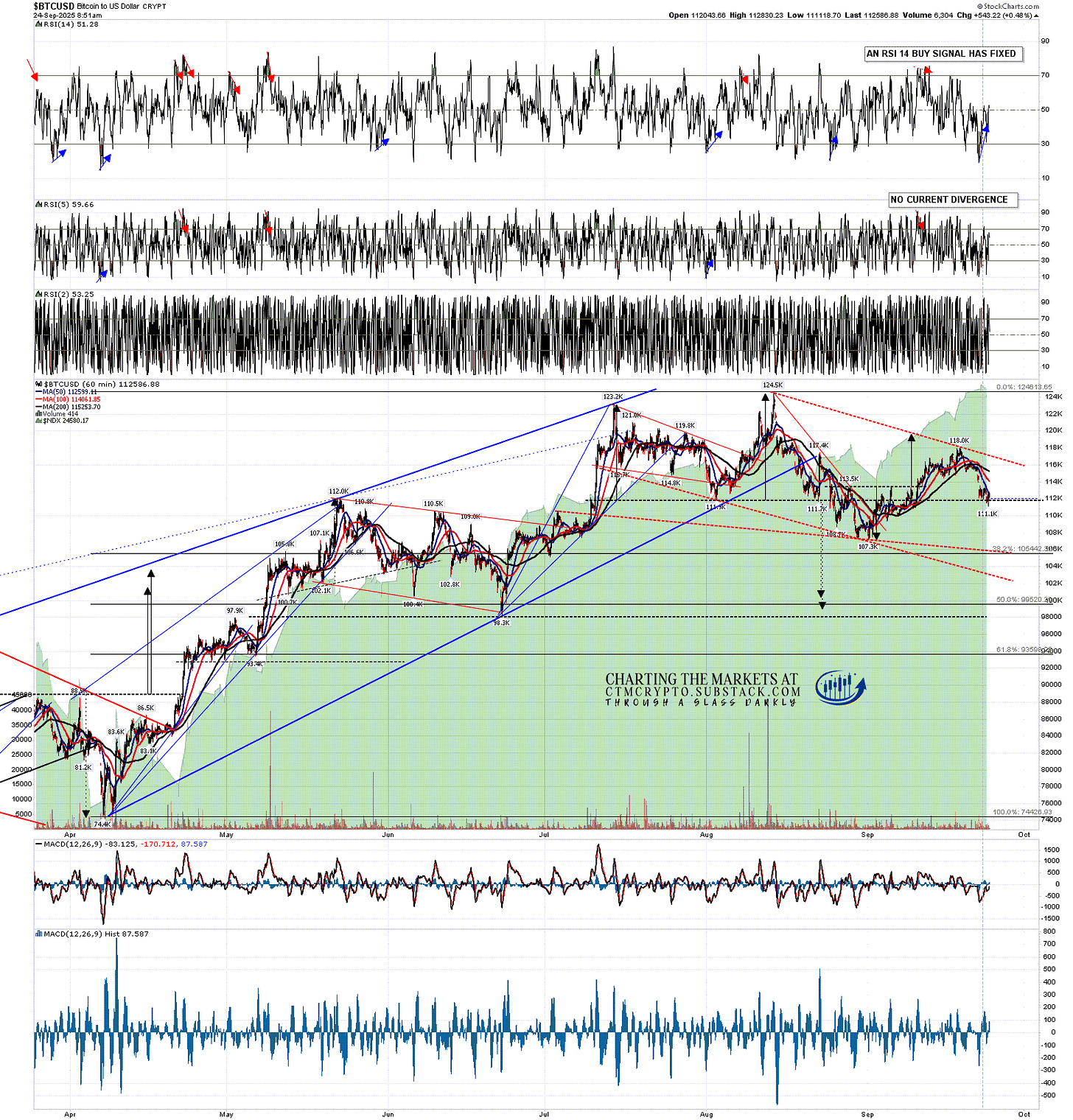

On the hourly chart an RSI 14 buy signal has fixed and a small double bottom has formed. If this is just a rally I’d be looking for that rally to go into the 114.5k area before turning back down again. At the time of writing the daily middle band is currently at 114,143.

If there is then another leg down then the obvious target would be the open double top target in the 99k to 100k area, supported by established support at 98.3k, or one of the two trendline options that I have shown above there currently in the 106k or 103k areas.

BTCUSD 60min chart:

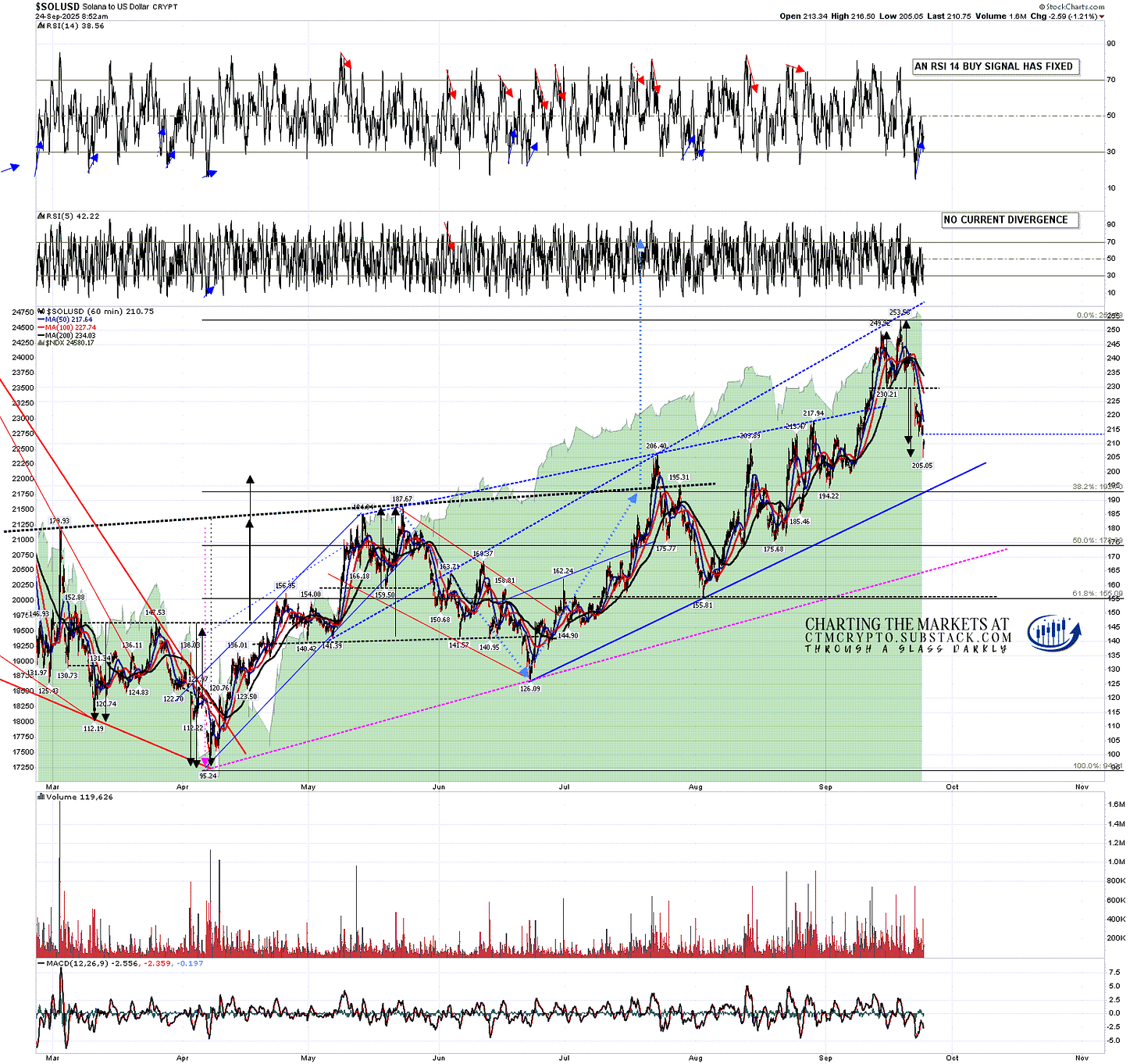

On the Solana daily chart an RSI 5 sell signal formed last week and also made target at the close on Monday.

At the end of my The Bigger Picture video on Sunday I was looking at the small double top setup on Solana, I showed that again my my post on Monday morning with a target in the 205-10 area, and the overnight low at the time of writing is 205.05. The big support level I mentioned was the 50dma, currently at 206.40, and is obviously being tested at the moment.

SOLUSD daily chart:

On the hourly chart an RSI 14 buy signal has also fixed, and I’m looking for a rally. If this is the bottom of an A wave and there is a C wave coming, then the rally would ideally take Solana back up into the 225-35 area, with the daily middle band currently at 227.12, before another leg down with an ideal target at the weekly middle band, currently at 180.84, supported by the 50 week MA, currently at 181.46.

SOLUSD 60min chart:

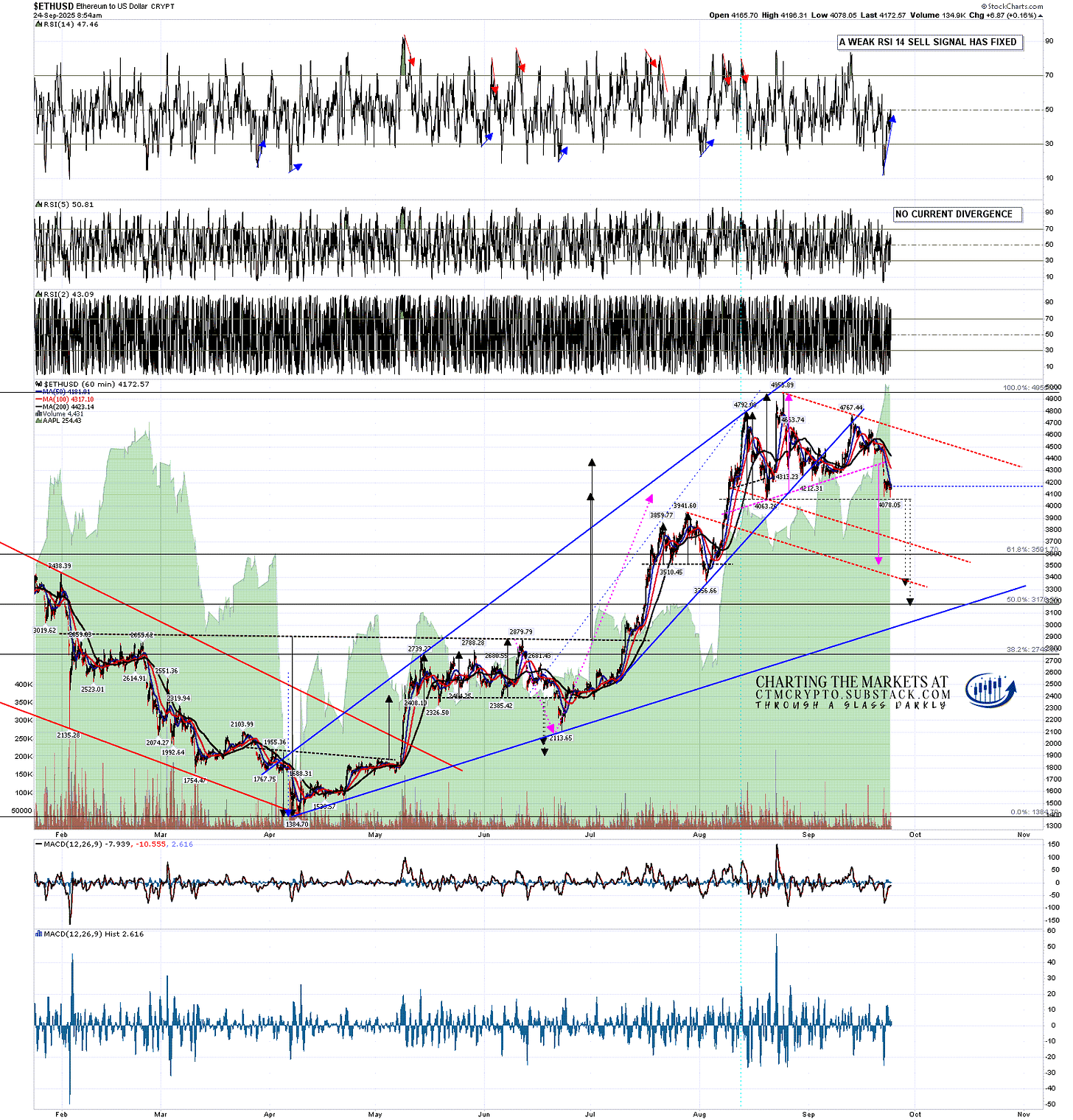

On the Ethereum hourly chart there is a third fixed RSI 14 buy signal that fixed overnight, and a possible small double bottom setup. As with the other two this could be the retracement low, but if this is is the bottom of an A wave and there is a C wave coming, then the rally would ideally take Ethereum back up into the 4400-50 area, with the daily middle band currently at 4423.53, before another leg down with an ideal target at the weekly middle band, currently at 3474.95, with the H&S target shown on Monday and the chart below in the 3500 area.

ETHUSD hourly chart:

All of these three have reached decent support and have hourly buy signals fixed. The obvious path is to rally back to their daily middle bands and then either break back over those on the way back to higher highs, or fail there into another leg down, ideally into my next target areas.

I’ve been hearing a lot this week about speculation that the bull market in Crypto has just ended. Anything is possible of course but I’m not seeing any sign that might be the case yet & there tends to be talk like this on every significant retracement. After this retracement I’m still looking higher into the possible bull market high in December 2025 that I’ve been looking for all year.

Since I started doing daily videos on Crypto early last year I’ve got Crypto direction right most of the time and more so than any other analyst anywhere that I’m aware of. I’m a very good analyst and all three of these instruments are very classical chartist friendly. I’m not much of a marketer though, and the free Crypto substack I set up last August still has less than 200 readers. I’d like to increase that readership and invite any suggestions on how I could do that.

I am thinking about setting up a second YouTube Crypto channel and recording videos giving likely market direction without requiring the viewers to have some knowledge of technical analysis to understand the videos. Comments on that and other suggestions very welcome. I’ll likely start publishing videos on that project before the end of the month.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment