In my post on Monday September 15th and my post on Friday 19th September I was looking in detail at the historical stats suggesting that after Tuesday 16th September last week there was a short bearish window into the end of September, and looking at the limited pattern support for a modest retracement then.

In my last post on Friday 26th September I was looking at the backtests of the daily middle bands on SPX, DIA and IWM and saying that the minimum targets for a modest retracement had been met. The bearish window still runs into the close tomorrow, as the last day of September and the third quarter, but equity indices might well run directly back into new highs.

Today I would like to look at the possibility that we might still see another leg down into the end of the month as there are possible pattern setups and targets for that.

In terms of the historical stats this week tomorrow leans bearish, Wednesday is the first day of the month and, as these often do, leans bullish, and Friday leans strongly bullish.

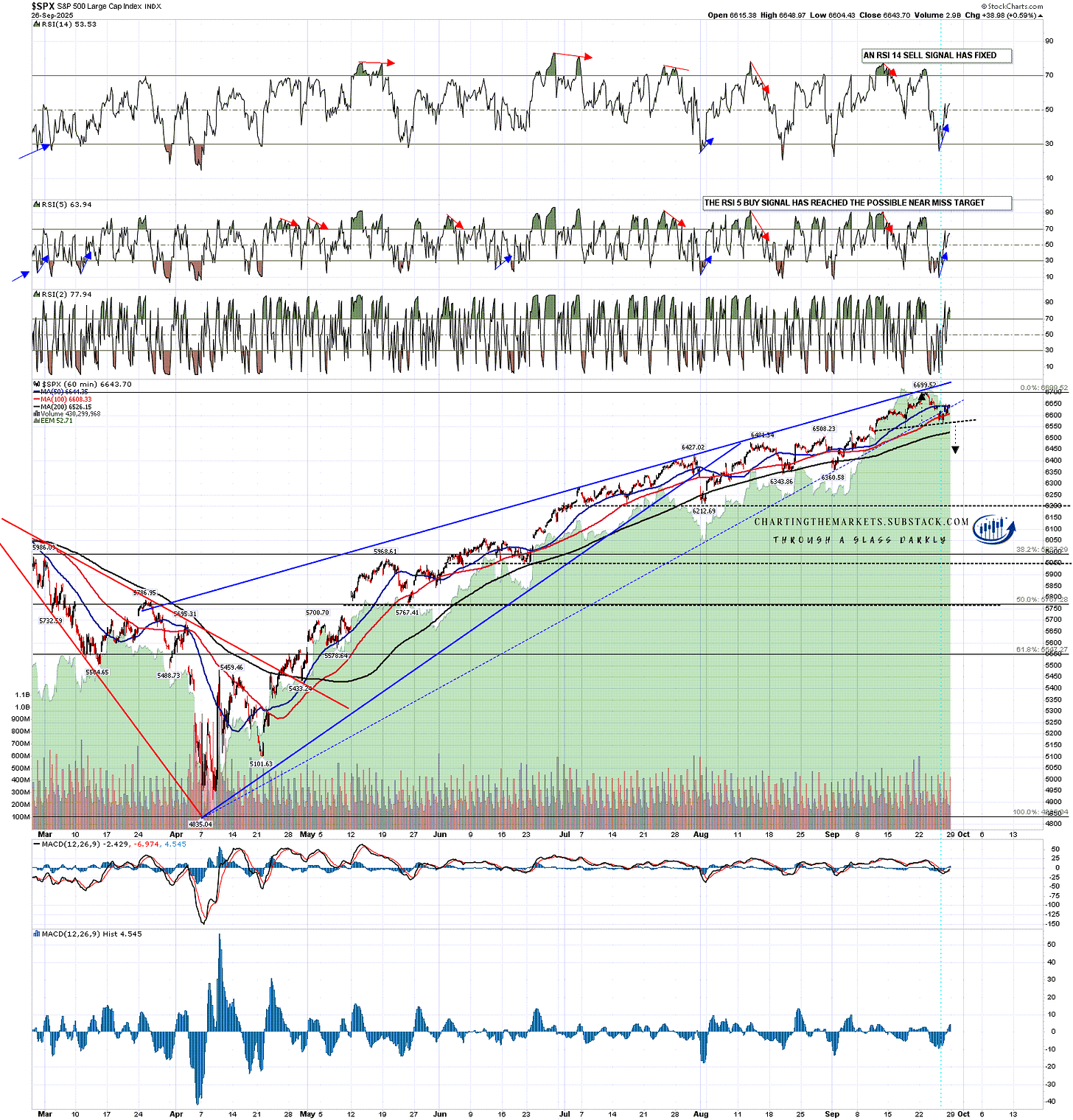

On SPX an H&S could be forming here, and on a sustained break below the H&S neckline, currently in the 6570 area, would have a target in the 6430 area. I would note that there is still a fixed hourly RSI 14 buy signal, but that is the only such hourly buy signal across these equity indices.

SPX 60min chart:

On the QQQ 15min chart there is also a possible H&S, though less high quality, and on a sustained break below the H&S neckline, currently in the 590-1 area, the target would be in the 574-5 area:

QQQ 15min chart:

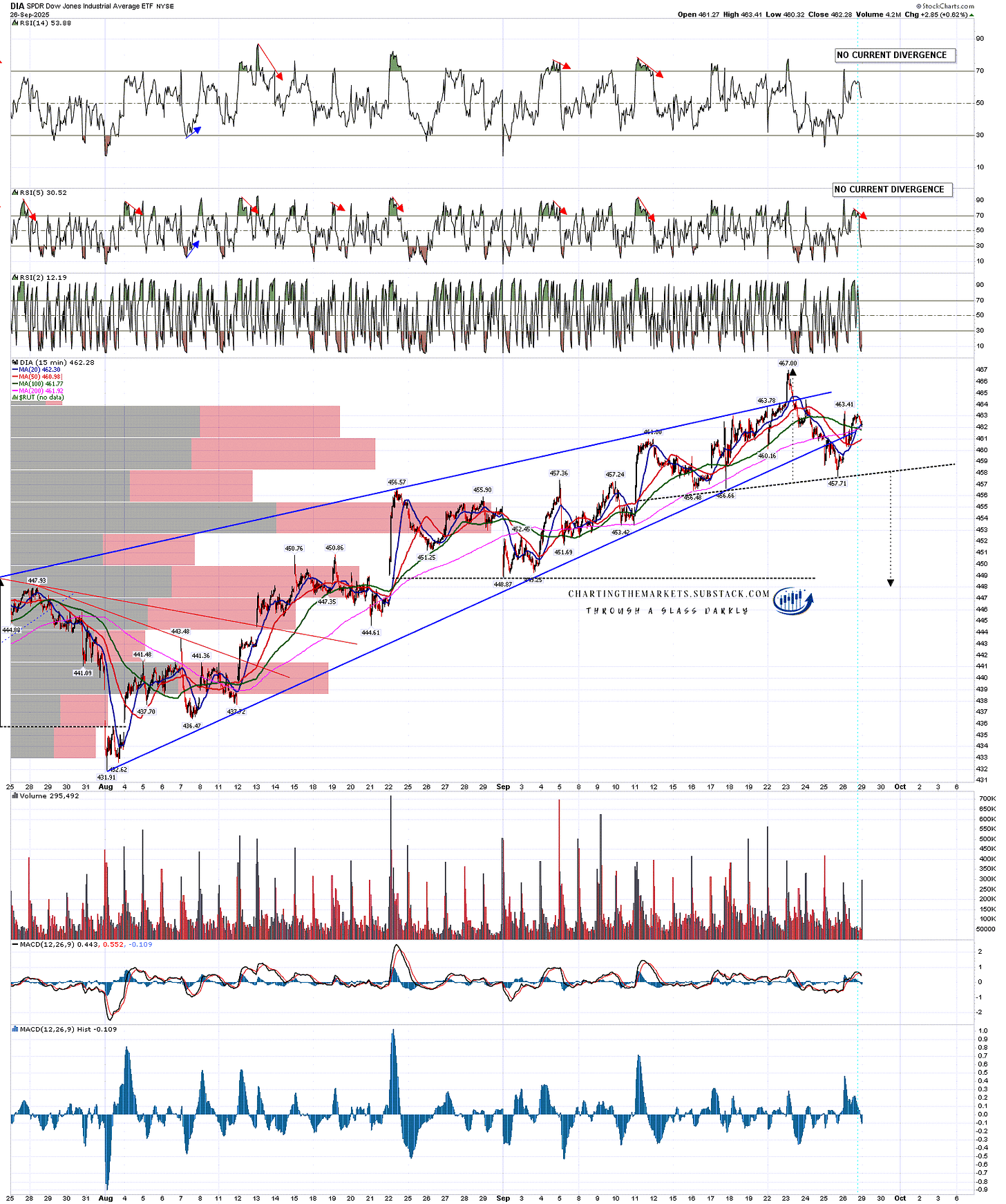

On the DIA 15min chart there is also a possible decent quality H&S setup, and on a sustained break below the H&S neckline, currently in the 458 area, the target would be in the 448 area:

DIA 15min chart:

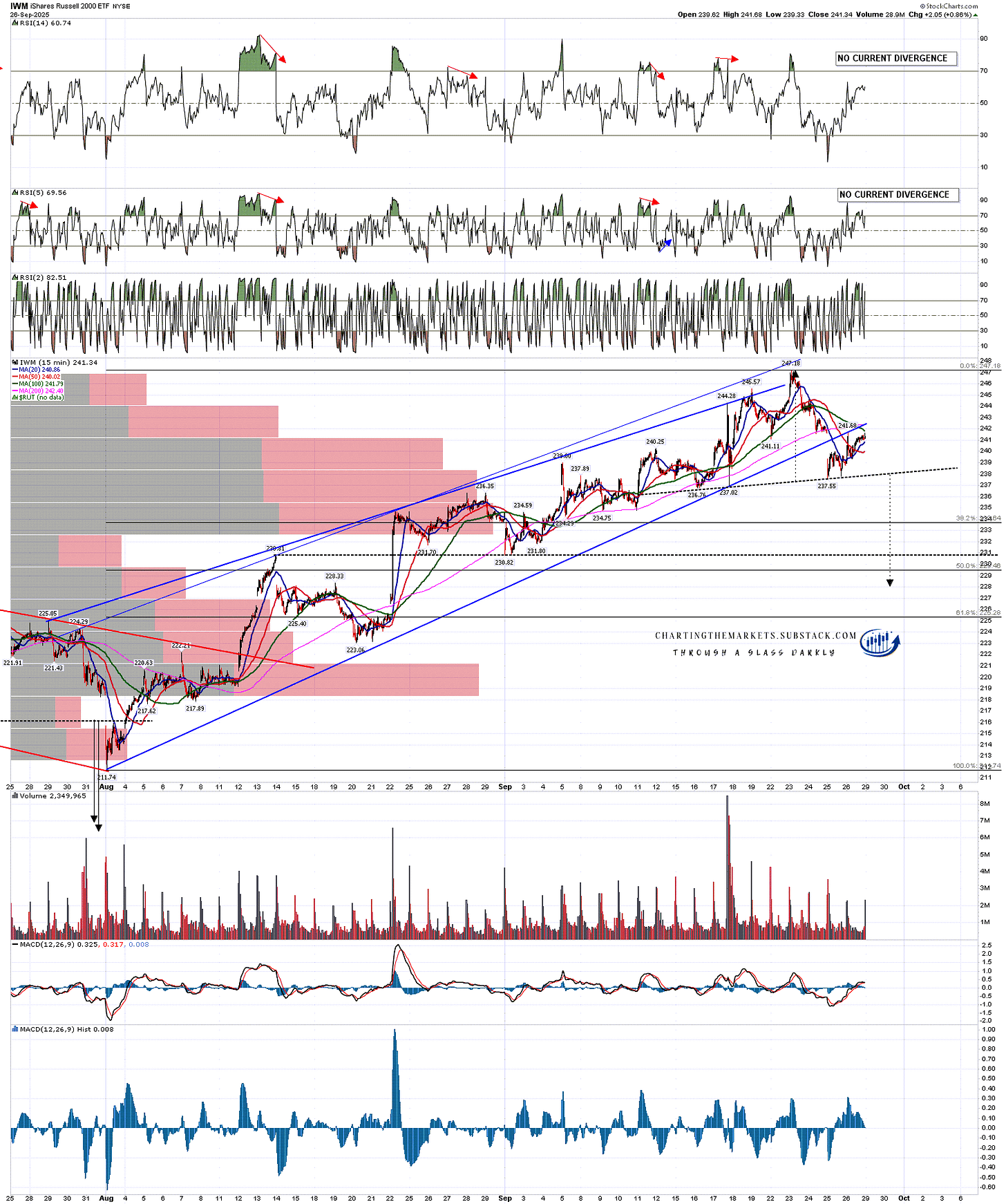

On the IWM 15min chart there is also a possible decent quality H&S setup, and on a sustained break below the H&S neckline, currently in the 238 area, the target would be in the 228 area:

IWM 15min chart:

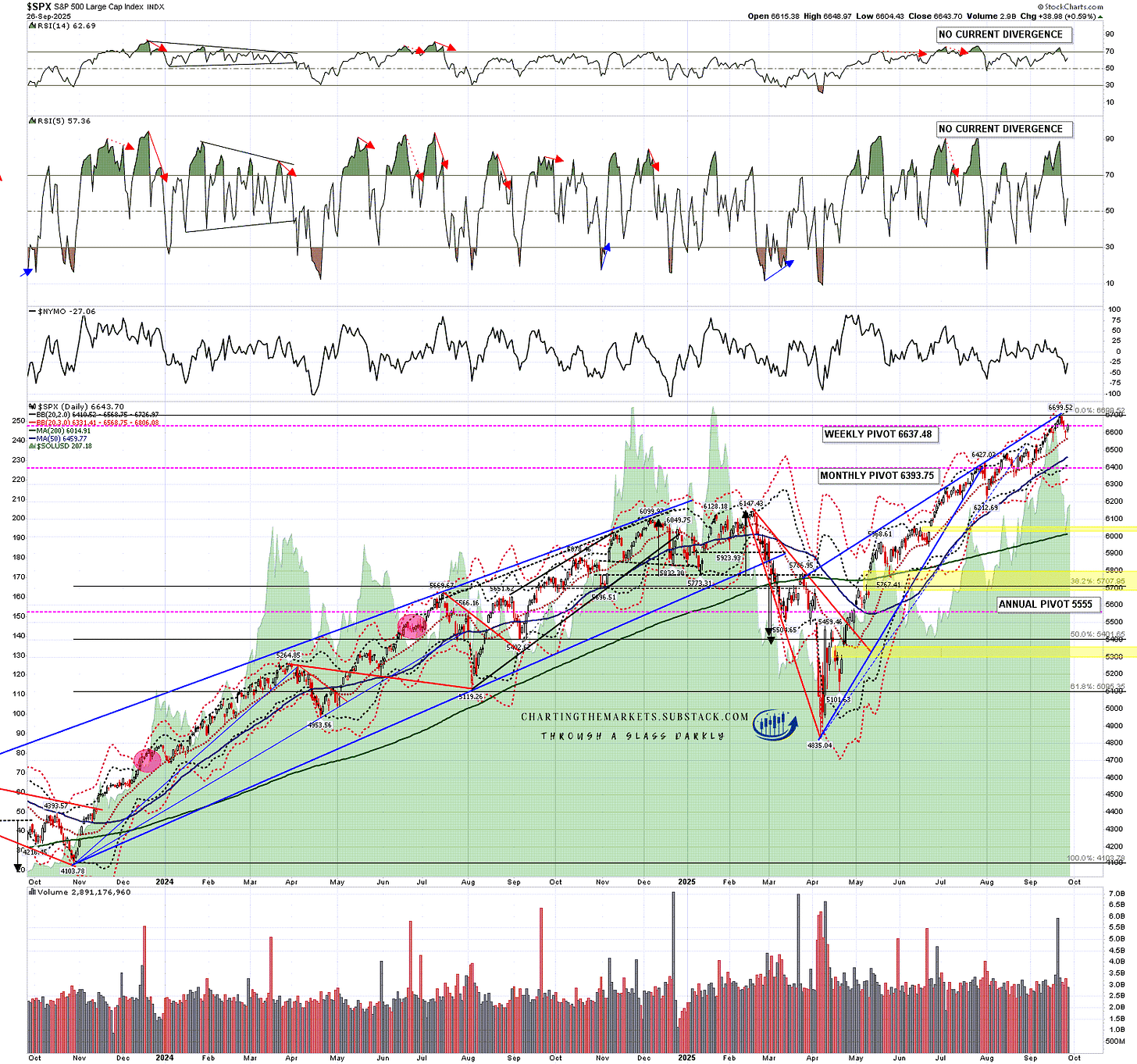

If instead SPX and QQQ head back directly into retests of their all time highs, then that would set possible daily sell signals brewing, with daily sell signals already fixed of course on DIA and IWM.

We could still see a larger retracement in October. There’s no clear bearish leaning window in October but that is the last of the historically weakest six months of the year and there have been a lot of bearish moves in October historically.

SPX daily chart:

What are the odds of seeing these H&S patterns play out today and tomorrow? Possible but not that likely IMO, maybe 25% to be generous. The setup for a larger retracement would look better if SPX and QQQ retest their all time highs and fail there, setting up high quality double tops with daily negative divergence. We’ll see.

Are equities looking extremely overvalued here? Definitely, but as John Maynard Keynes noted, ‘the markets can stay irrational longer than you can stay solvent’. I’m watching for a decent looking big topping setup to form, akin to the one I posted at the highs on 19th February, and I don’t see it yet. As I have been all year I’m still looking for a possible big high forming into December.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST, but only for paying subscribers. Other places to find me are my twitter, and my Youtube channel.

No comments:

Post a Comment