In my last post on Tuesday I was looking at the bullish consolidation options on Bitcoin (BTCUSD), Solana (SOLUSD) & Ethereum (ETHUSD), and those have played out mostly as expected since.

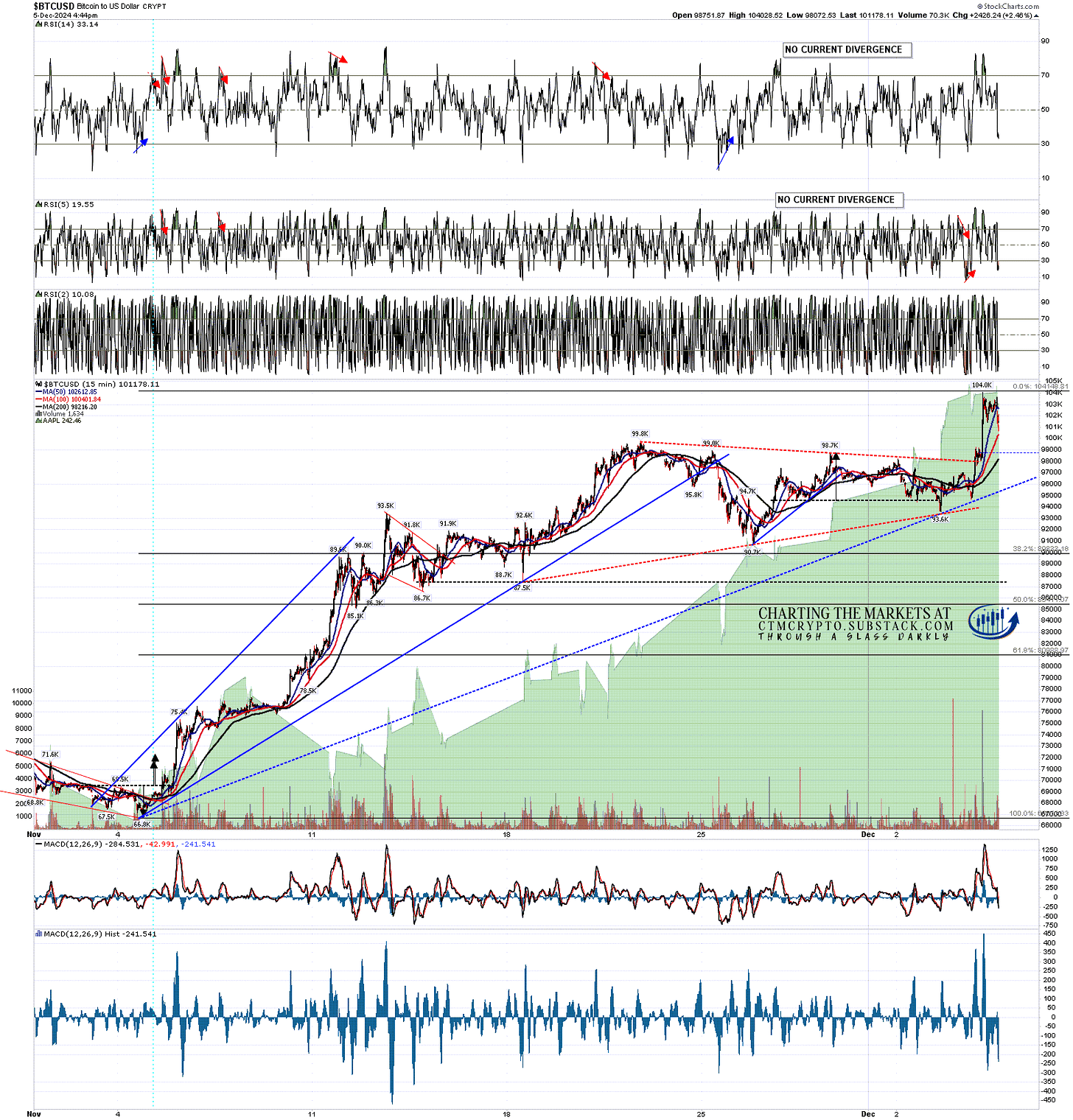

A small H&S had broken down on Bitcoin, and I was saying that might well fail into a retest of the prior high at 98.7k and then go higher and we saw that.

BTCUSD 15min chart:

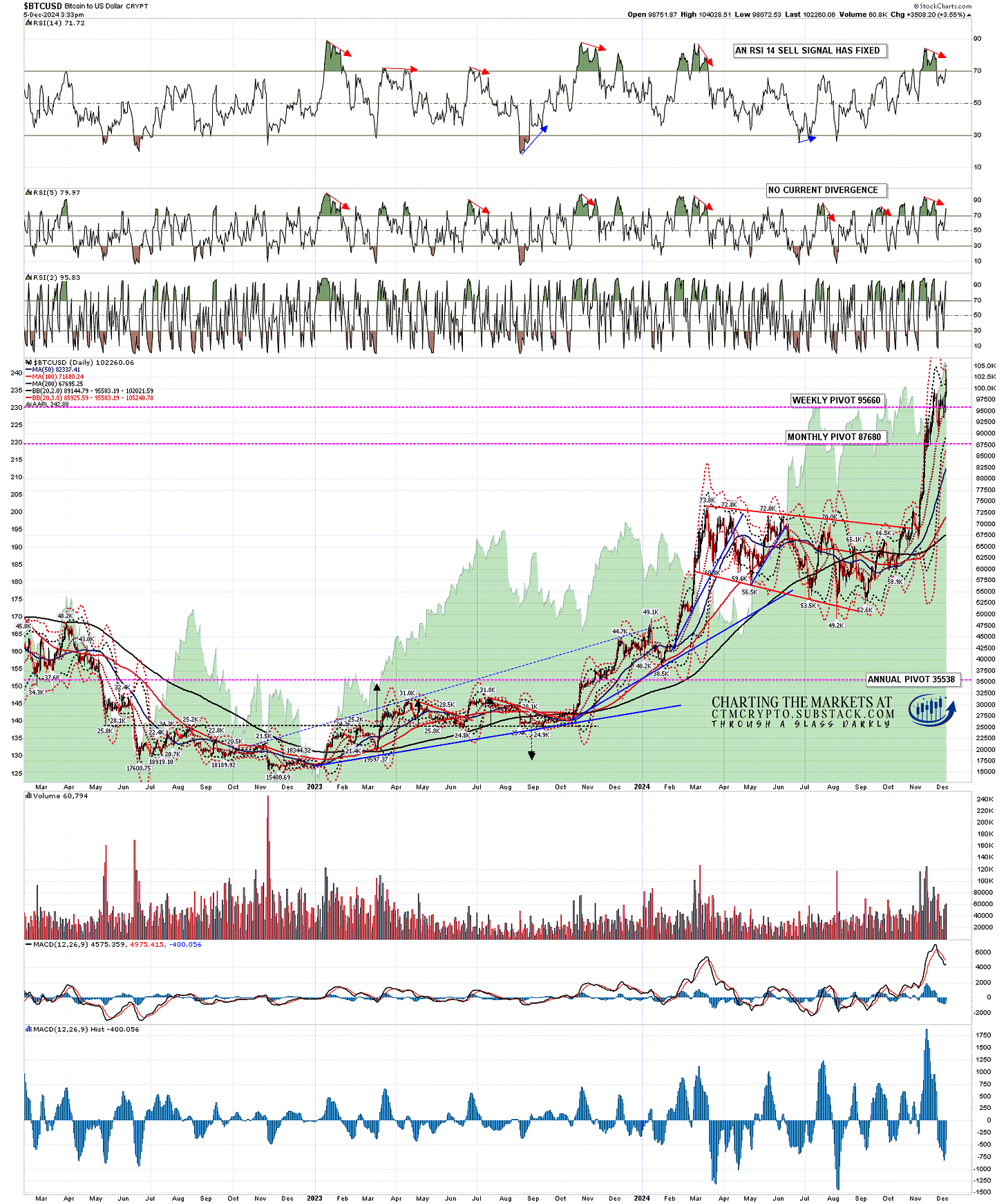

On the daily chart Bitcoin finally broke over $100k last night, but at the overnight high touched the daily 3sd upper band. That’s far from the big issue that such a hit would be on SPX, but we may well see a bit of consolidation here before going higher.

BTCUSD daily chart:

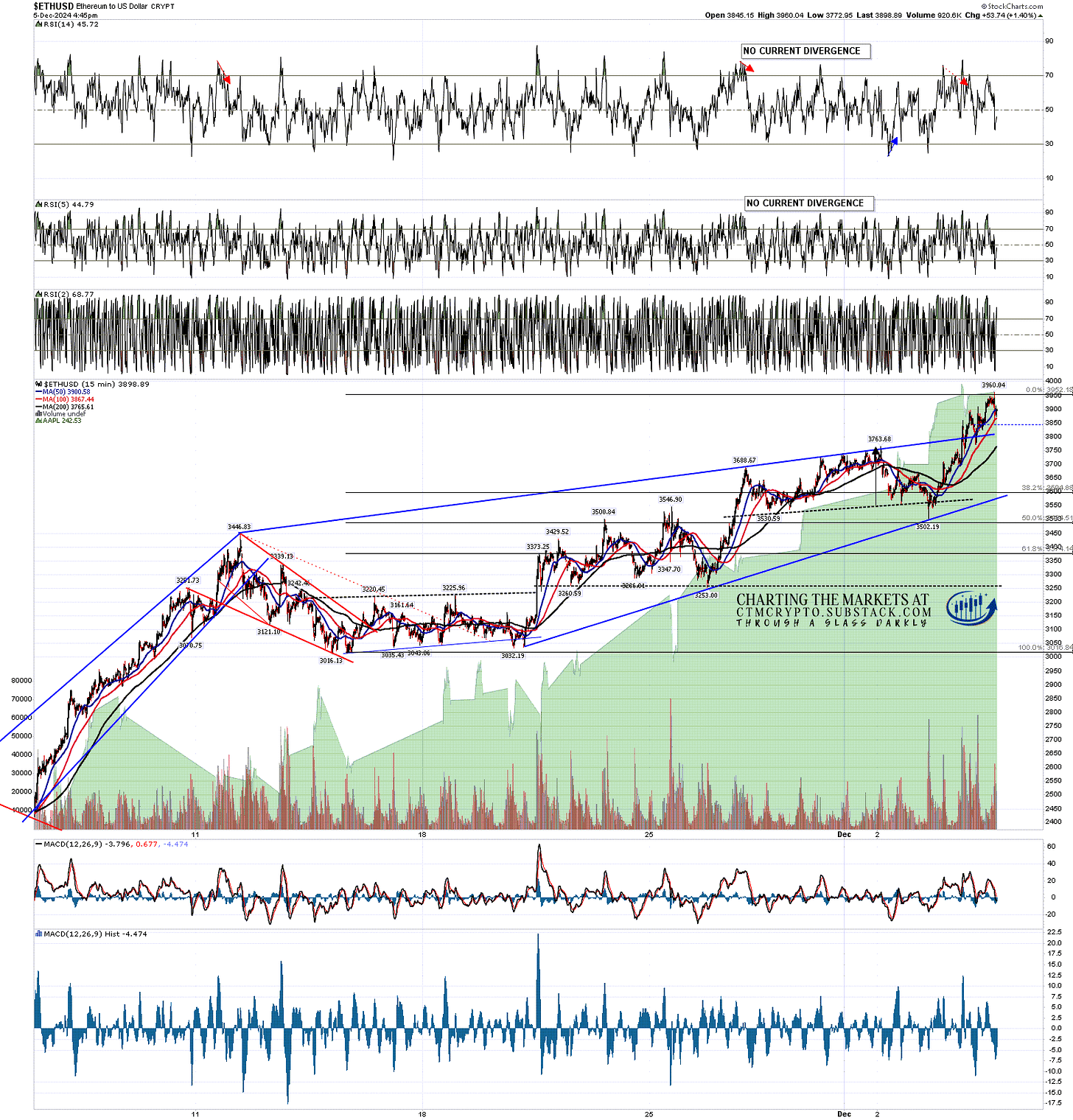

There was also a small H&S that had broken down on the Ethereum chart and again I was thinking that might well fail into a retest of the previous high at 3763.68, and then go higher. That’s gone well too and the decent quality wedge resistance trendline I was watching has broken convincingly, opening the upside.

ETHUSD 15min chart:

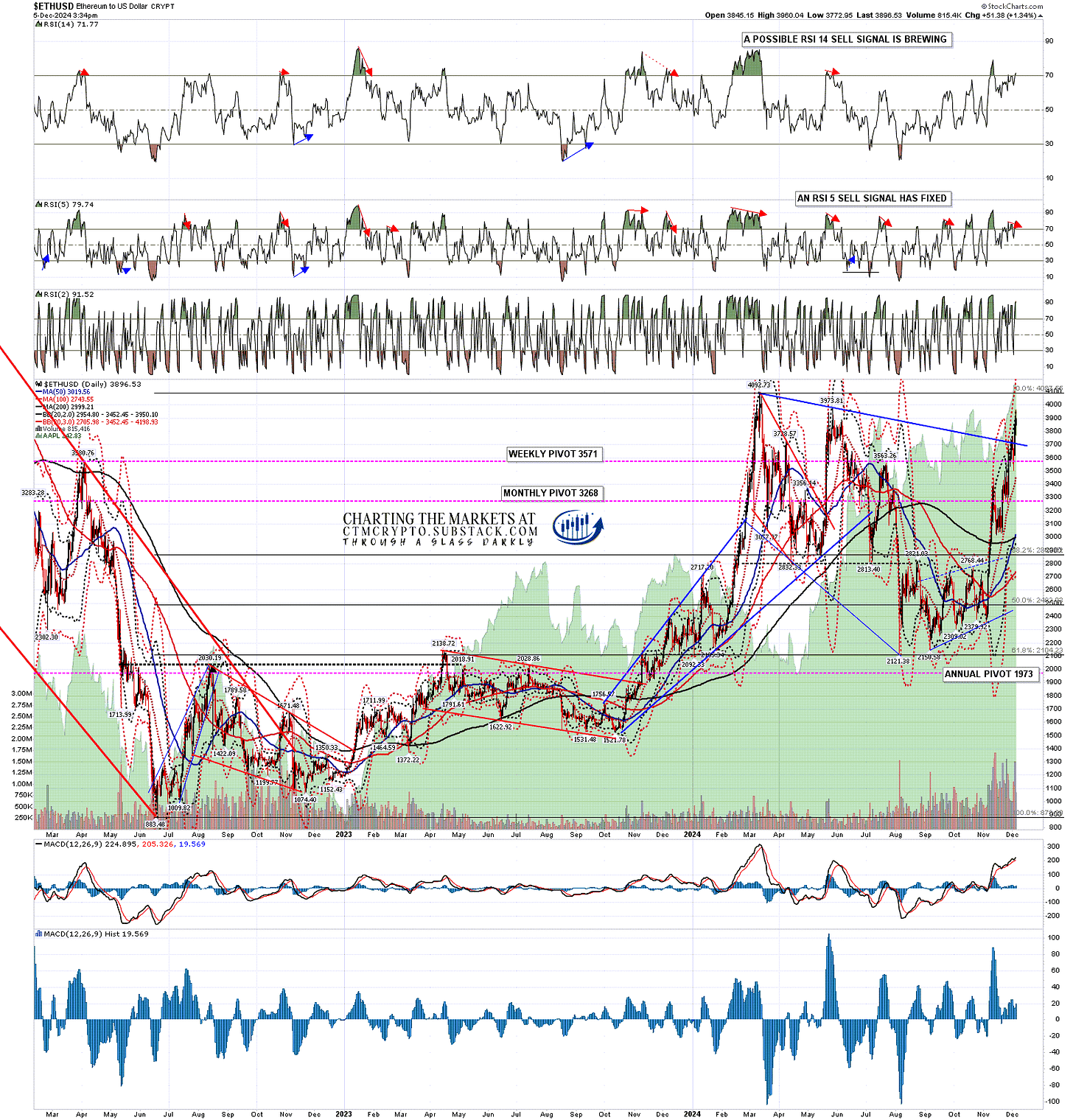

On the daily chart the very obvious next target is the retest of the 2024 high at 4092.73, and we will likely see that test within a few days.

ETHUSD daily chart:

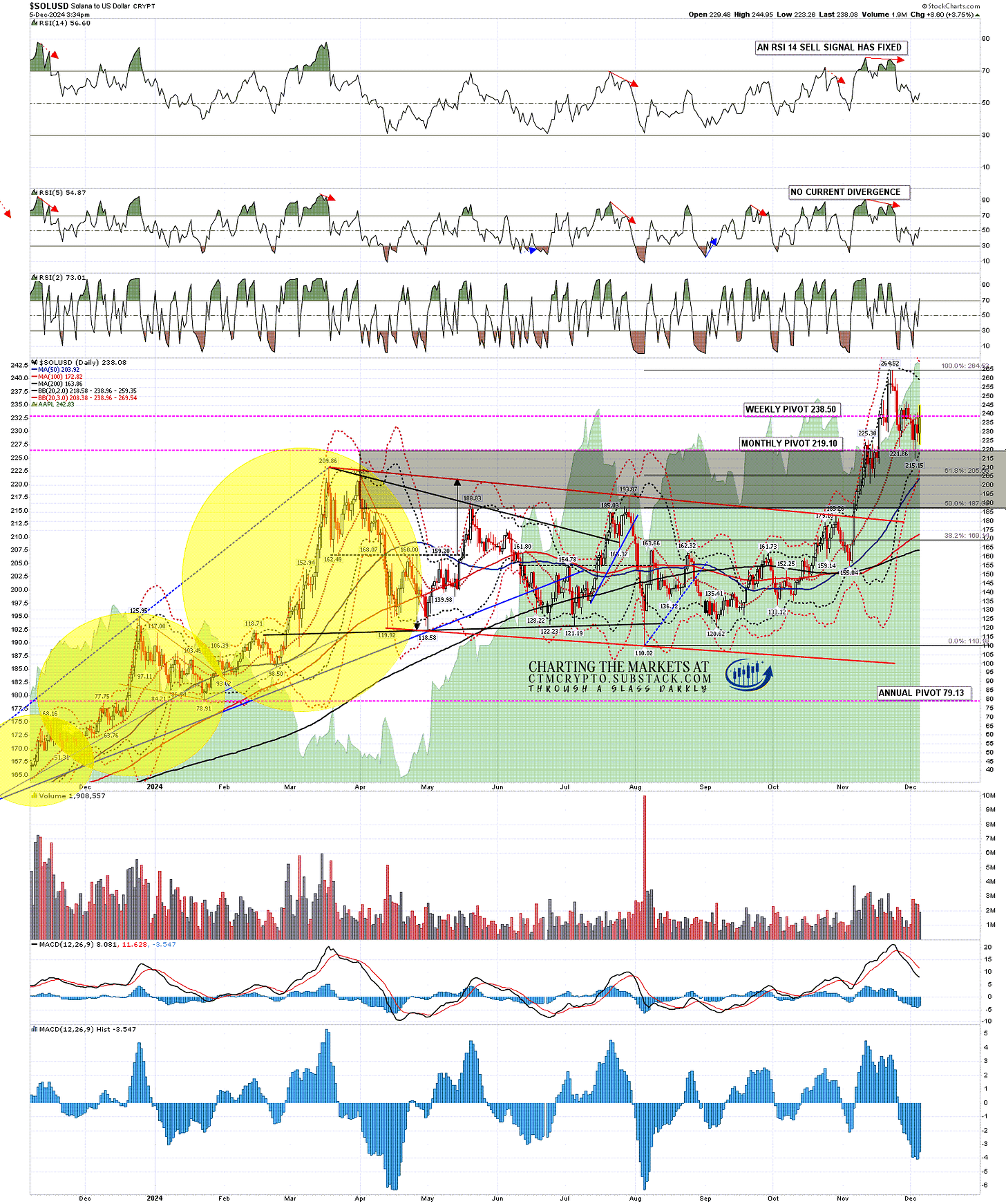

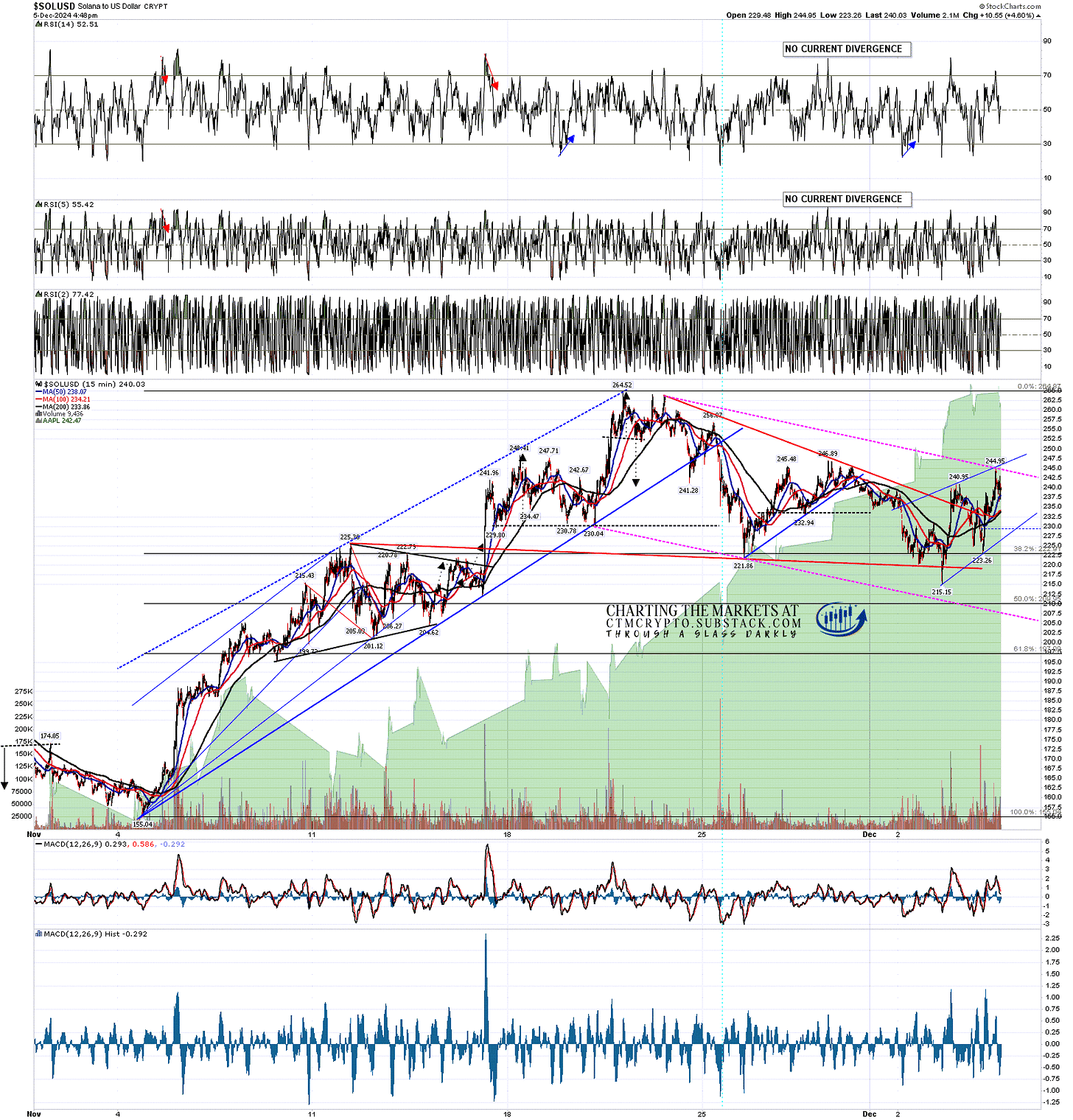

The question mark and minority report here is on Solana, which hasn’t yet broken back convincingly above the daily middle band, currently at 238.96, though it is trying. If that holds as resistance for now then it may well mean that Solana needs to retest the current retracement low at 215.15, and I have a decent looking setup for that.

SOLUSD daily chart:

The initial bull flag wedge has broken up, but the rising wedge formed from the low at 215.15 may be a decent looking smaller bear flag wedge or B wave setting up either a low retest or another leg down.

Sometimes when a bull flag breaks up it evolves into a larger bull flag, and that’s something I’m generally checking for. At yesterday’s rally high at 244.95 a larger bull flag channel has now been established (dotted purple lines) and, while that could break up directly, that raises the possibility that Solana may be reversing here towards that bull flag channel support, currently in the 207.5 area. We could see that move before Solana heads higher.

SOLUSD 15min chart:

On the bigger picture I’m leaning bullish across the board with the caveat that the fixed daily RSI 14 sell signals on Bitcoin and Solana (and possible one brewing on Ethereum) are warning that a longer and deeper consolidation may be coming within a few weeks.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment