In my post yesterday I was looking at the possible bull flag setups on SPX, DIA and IWM, and today of course we have FOMC.

Those flags all ended yesterday on an encouraging note but overall this very much looks like an inflection point as we are coming into FOMC and it may well be that FOMC today determines the direction of the break from this.

The Fed is expected to cut rates 0.25% today and everyone seems very certain that will happen. I am assuming that is because the Fed have indicated that will be the case informally as to be honest, given the recent inflation and job numbers, and the uncertainty over tariffs next month, they might logically be expected to leave rates unchanged or raise them.

Nonetheless the Fed has a long history of supporting equity bulls and while in theory the Fed Chairs have spines, the historical evidence in recent decades for the existence of those spines isn’t compelling. I’m assigning an 80% probability that they cut rates today and that the equity indices react positively to that.

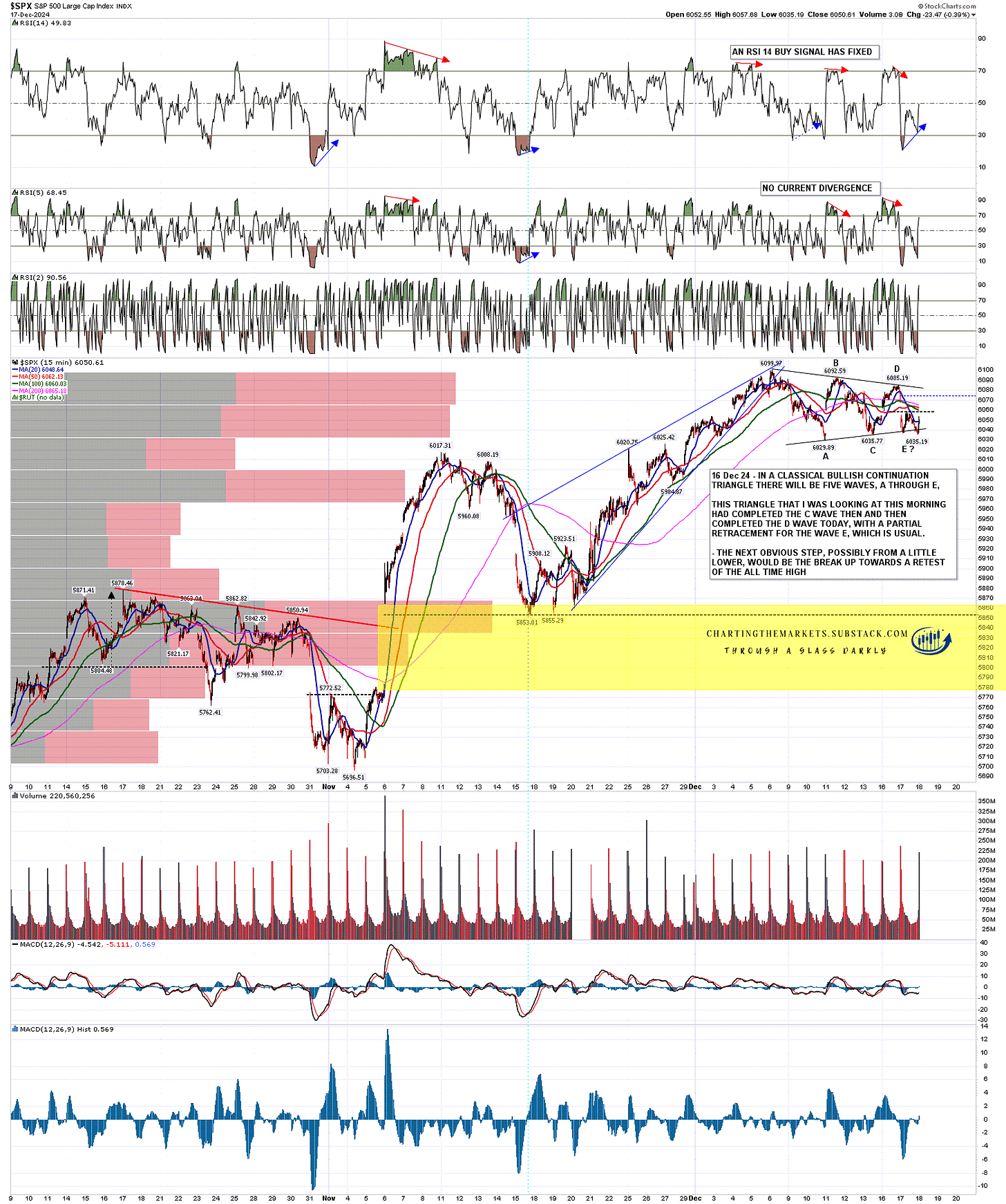

On SPX my triangle support was broken briefly twice yesterday but that formed a small double bottom looking for the triangle resistance area and a 15min RSI 14 buy signal was fixed at the close.

SPX 15min chart:

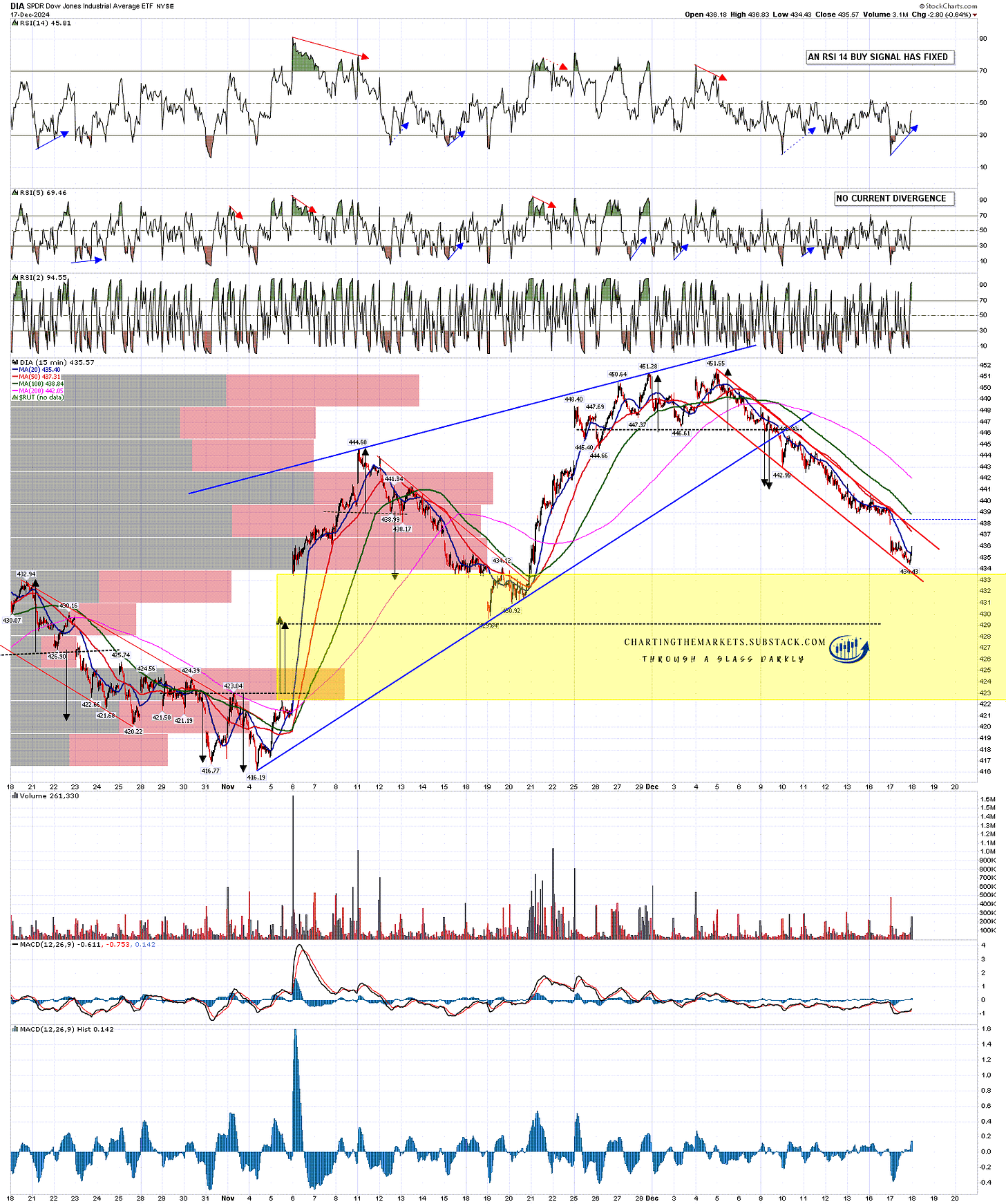

On Dow the possible bull flag falling channel still looks good and there was another 15min RSI 14 buy signal fixed at the close.

DIA 15min chart:

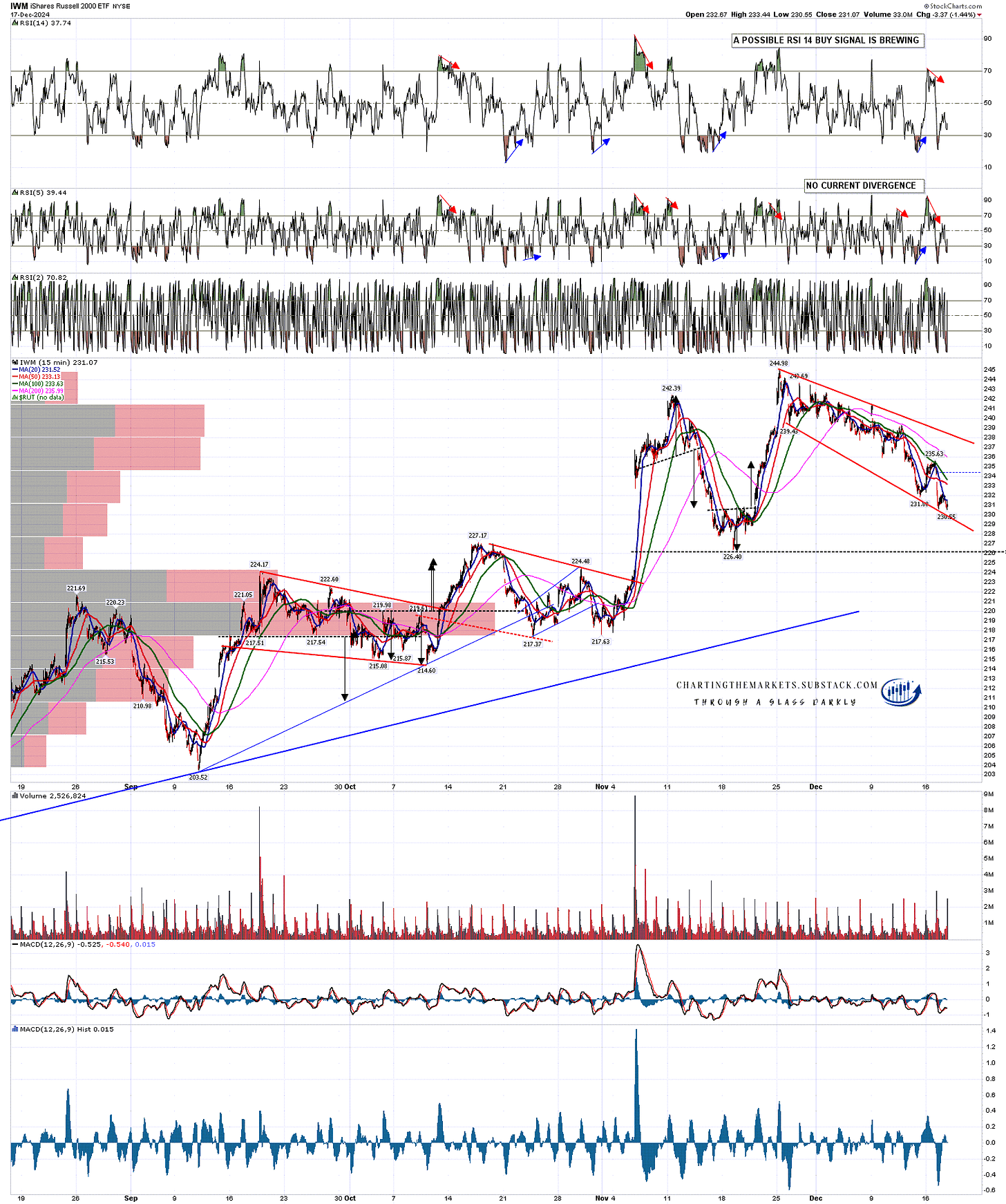

On IWM the possible bull flag falling megaphone again was looking good at the close.

IWM 15min chart:

Looking at the overnight action on ES and the setup there the small double bottom formed that mirrors the one on SPX has broken up overnight so, at the moment, a test of triangle resistance on both today looks likely.

ES Mar 60min chart::

I’m hoping to see more upside on US indices, maybe into Xmas and, if not, then likely into January, though there should be a larger retracement in that period somewhere and that could be starting here.

The closer we come to inauguration the more I’m also going to be looking at the incoming administration and the policies that are being talked about for the first 100 days of the new administration. Tariffs, Ukraine and others may make this one of the most interesting years on the markets that anyone can remember.

Presidential election years tend to be bullish historically, the years after not so much, and equity indices are up a lot over the last two years. I am doubtful about equity markets seeing much upside next year as valuations look very stretched going into a year where the news stream is likely to be turbulent, and interest rates may be on an upward track all year. We'll see.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first.

I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment