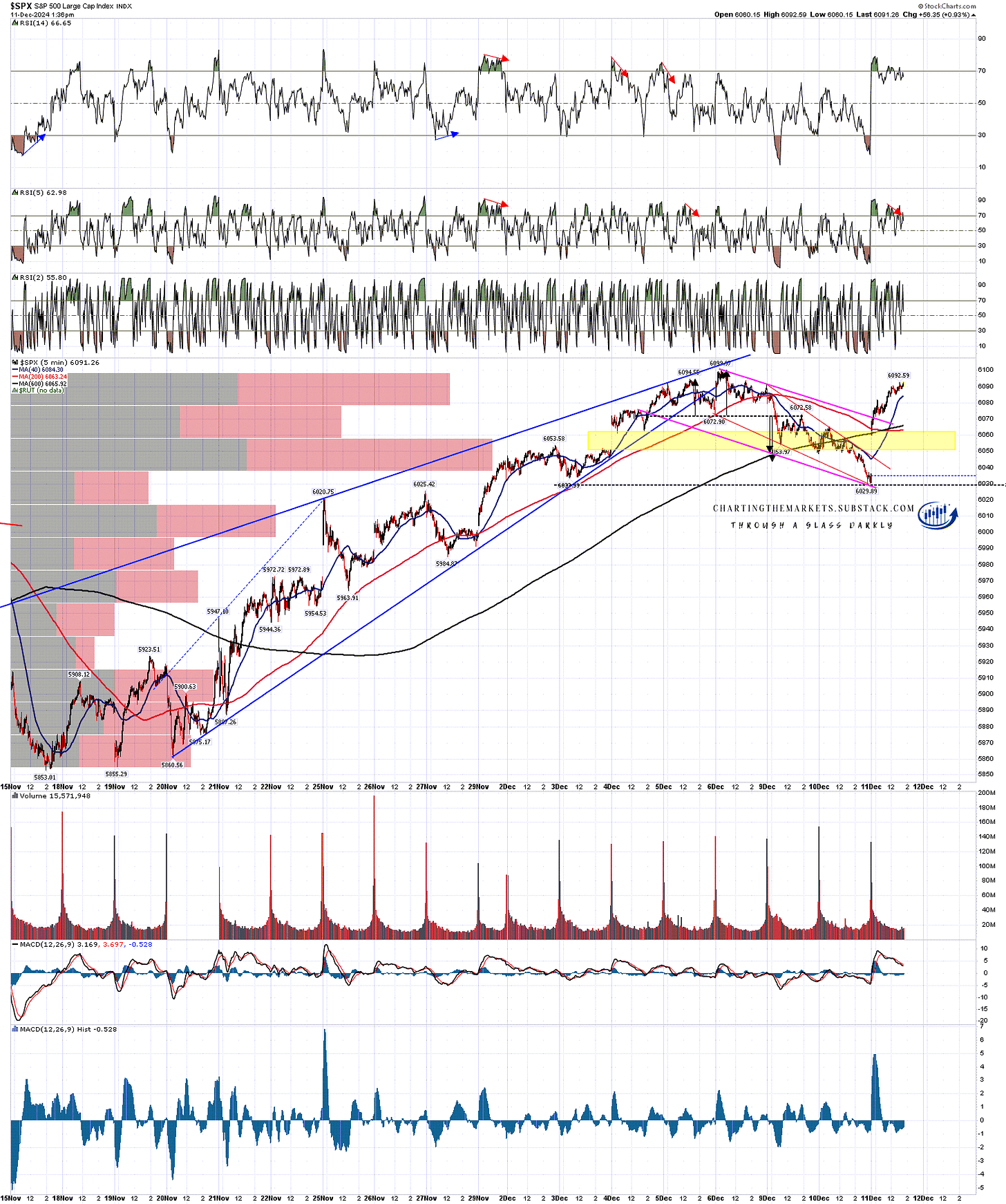

In my post yesterday I was saying that I was expecting SPX to make a low above the 6026 level and the low yesterday was at 6029.89. I was expecting this to be a bullish consolidation and the low established a perfect bull flag channel which broke up with a target at a retest of the all time high at 6099.97. SPX is most of the way to that target.

So far so good.

SPX 5min chart:

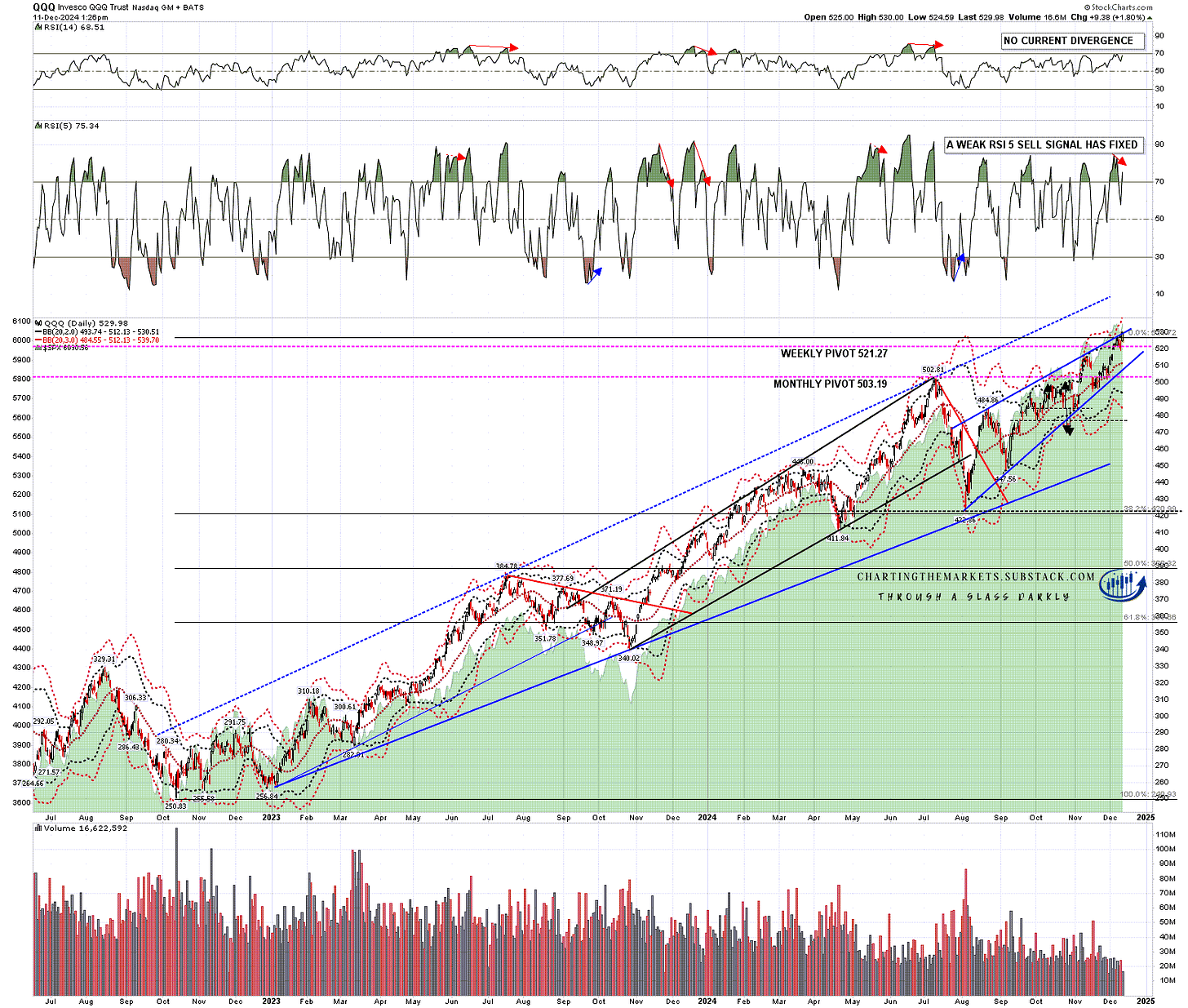

QQQ has led the charge to the upside today and has already made a new all time high.

QQQ daily chart:

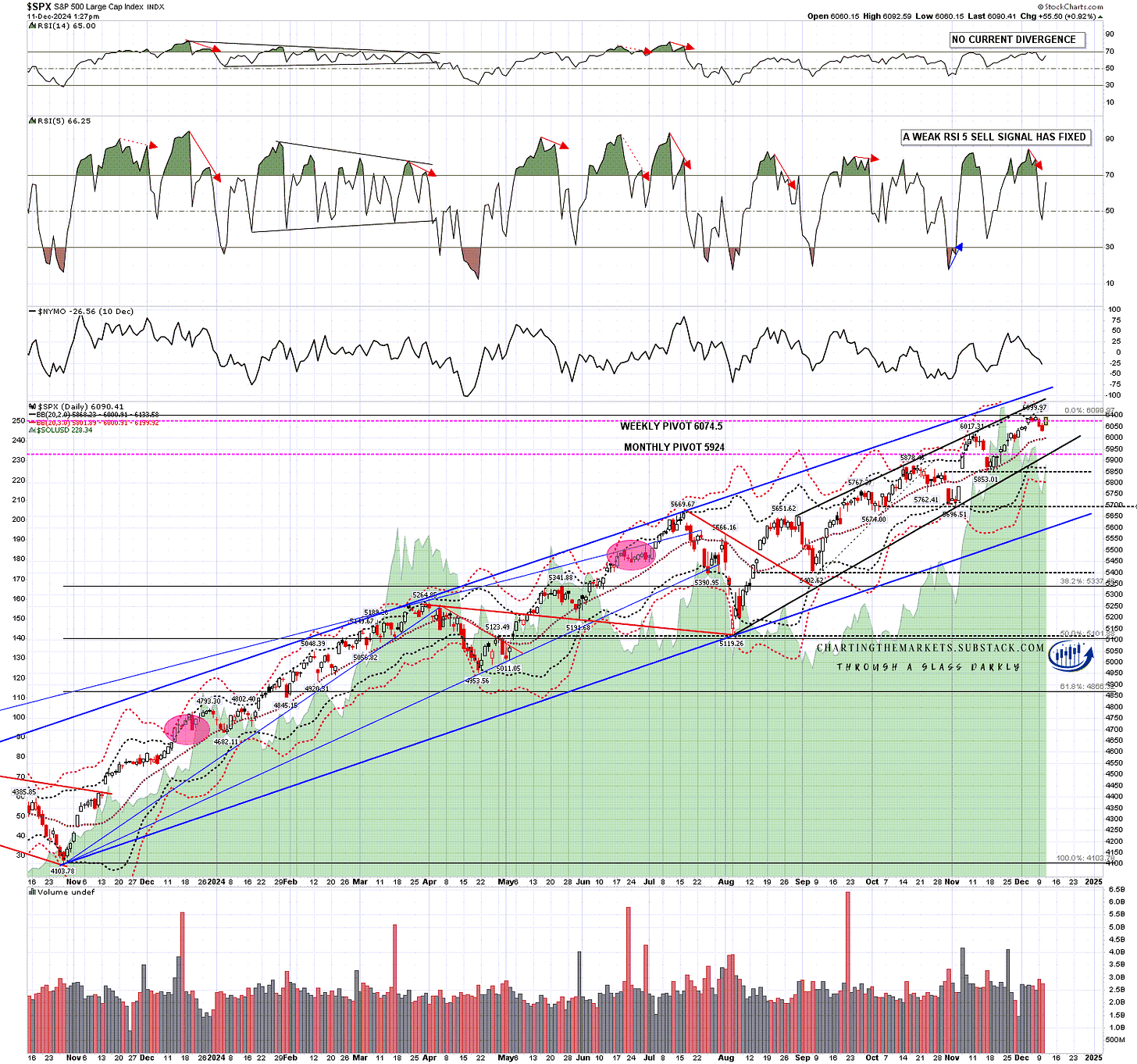

SPX has broken higher and is most of the way back to a new all time high at the time of writing.

SPX daily chart:

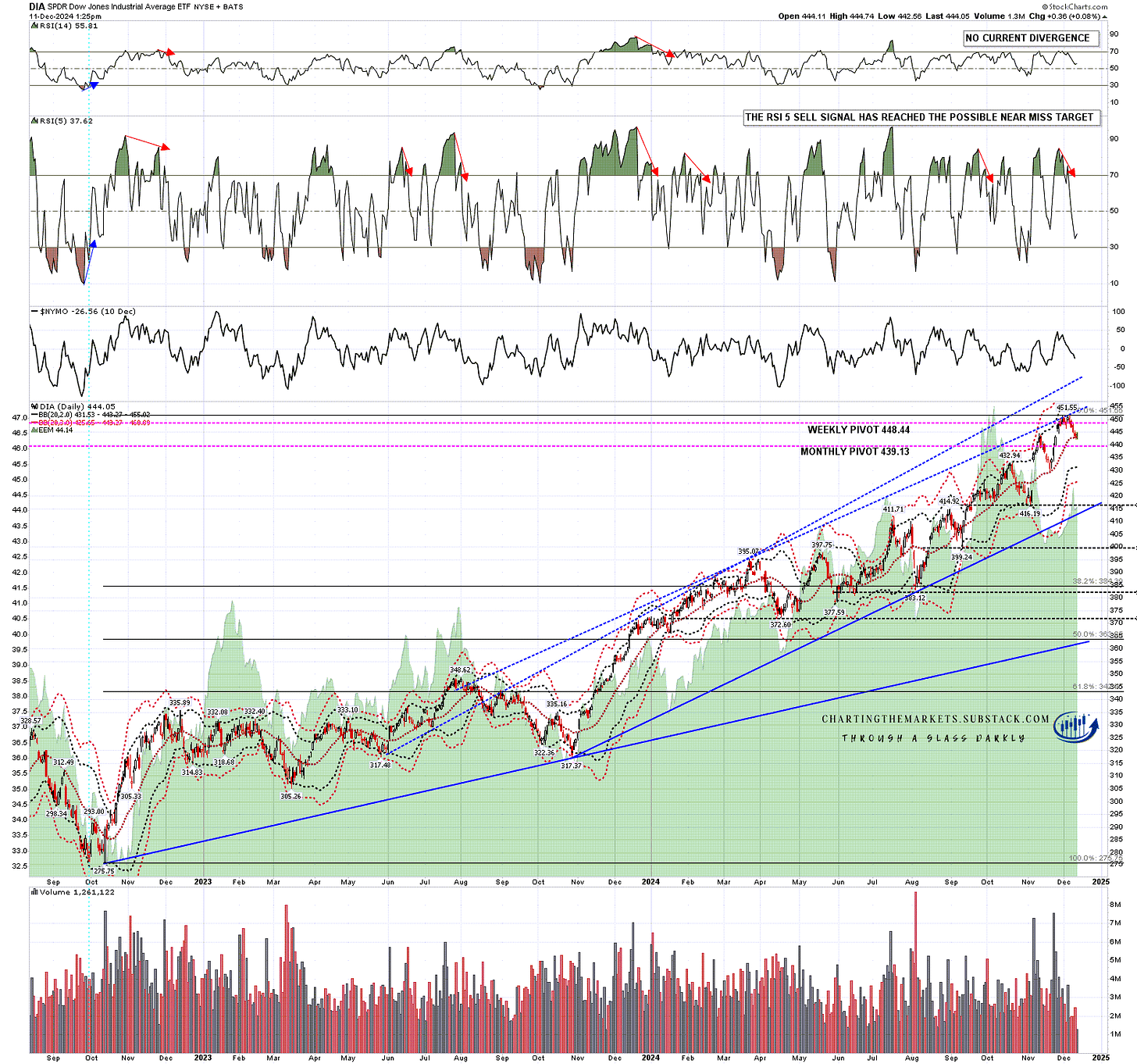

Elsewhere the picture is more cloudy however. The move down was led by DIA and IWM, both of which tested and have held support so far at the daily middle bands. The next obvious targets are retests of the highs on both but so far today both have barely moved off the low. They aren’t going down, but they’ve barely gone up.

The problem with DIA and IWM being on another planet today is that increases the possibility that they are trading sideways through this move, mainly confined to tech stocks, and that after that ends they will resume the downtrend and start doing some significant technical damage. That raises the possibility that the larger retracement that I have pencilled in for late Dec or early Jan could be in progress now, with SPX and NDX topping out here before following the others down.

DIA daily chart:

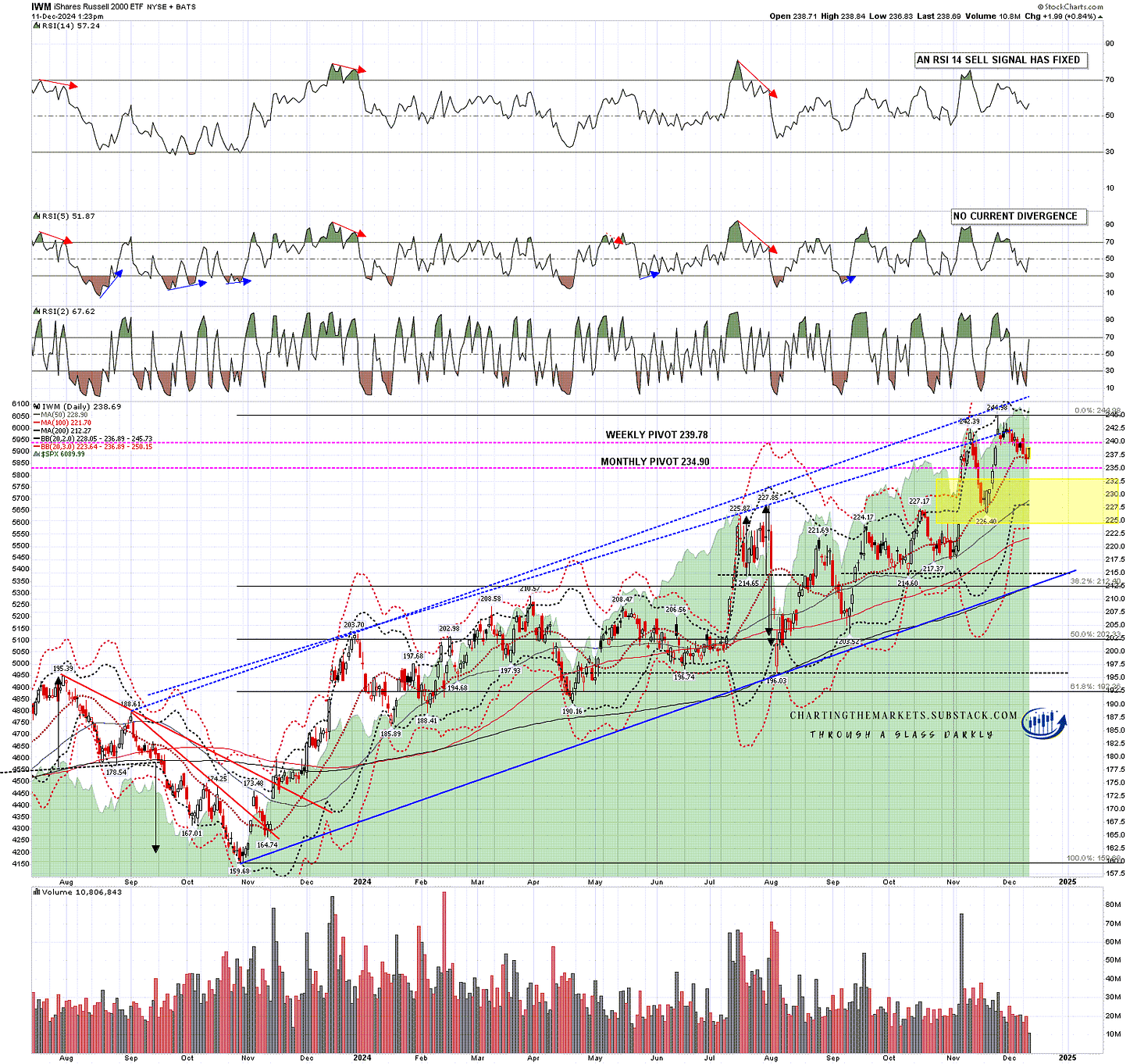

On IWM the picture is similar, though my eye is drawn to the very nice looking double top that may be about to try to play out if DIA and IWM can’t get off the mat soon.

What I would say here is that there is still a lovely bull flag setup on both RTY and IWM, and until that breaks there is still a very decent chance that will power a strong move into Xmas, but I am concerned about what I’m seeing today.

IWM daily chart:

The US equity indices have finally had a decent run from the 15th November low and in the absence of further evidence to the contrary, I’m expecting more upside into Xmas, and likely into January, though there should be a larger retracement in that period somewhere. I’m watching DIA and IWM very carefully here to see whether that roadmap might fail here.

The closer we come to inauguration the more I’m also going to be looking at the incoming administration and the policies that are being talked about for the first 100 days of the new administration. Tariffs, Ukraine and others may make this one of the most interesting years on the markets that anyone can remember.

I have to be out tomorrow and won’t be back until late in the day. My next premarket video will therefore be on Friday morning.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first.

I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

No comments:

Post a Comment