In the last couple of weeks of October I was writing about the likelihood of seeing a bullish November, and we saw that, but it wasn’t really what I had in mind. The bullish part came when Trump won the presidential election and, on SPX at least, the rest of the month was spent retesting that high, with both SPX and ES both now at new all time highs from there.

I was looking for more, and we might still get more, but more than half of the bullish window into Xmas is now behind us, and the news coming from the coming new administration is already starting to disturb the markets.

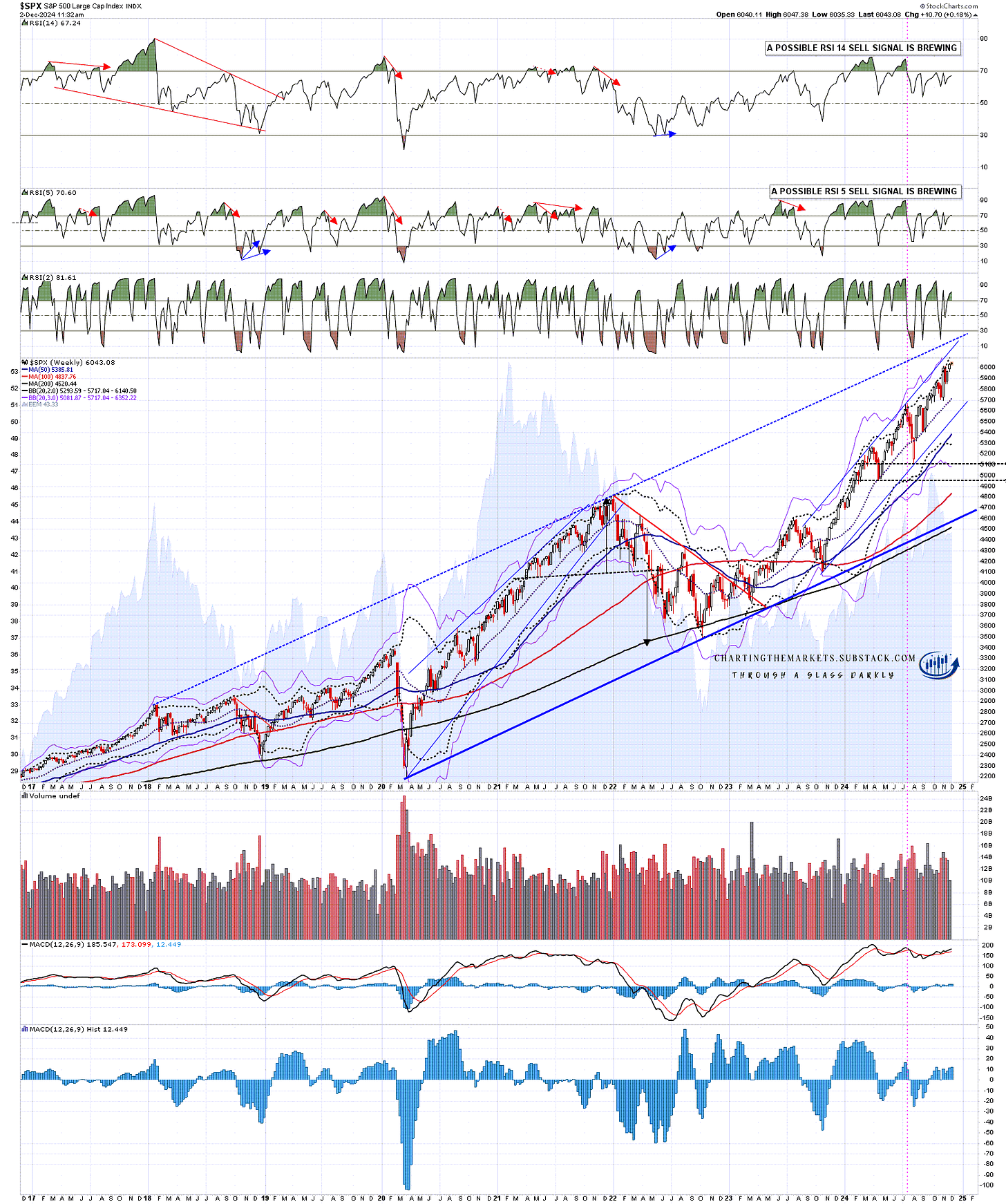

The target I was thinking might be reached on SPX in December, with a possibility of making a high there that might last through next year, is the larger resistance trendline shown on the chart below, and that is now in the 6200 area. That could still be seen if we see a decent bull run from here. There are other options though.

SPX weekly chart:

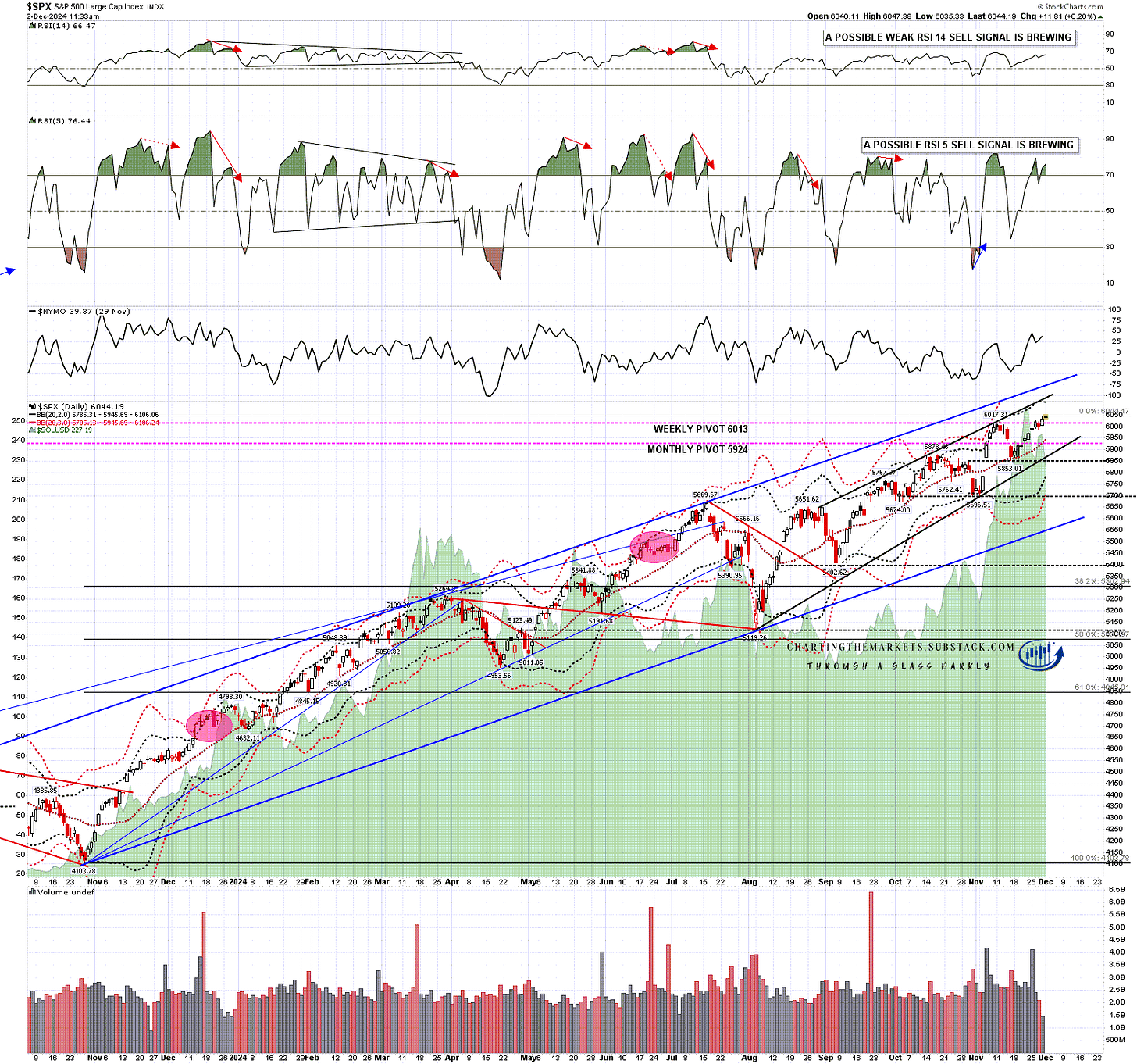

On the SPX daily chart the high on Friday has set a possible RSI 5 sell signal brewing. That’s just a potential for now and there’s nothing similar on QQQ, DIA or IWM yet.

SPX daily chart:

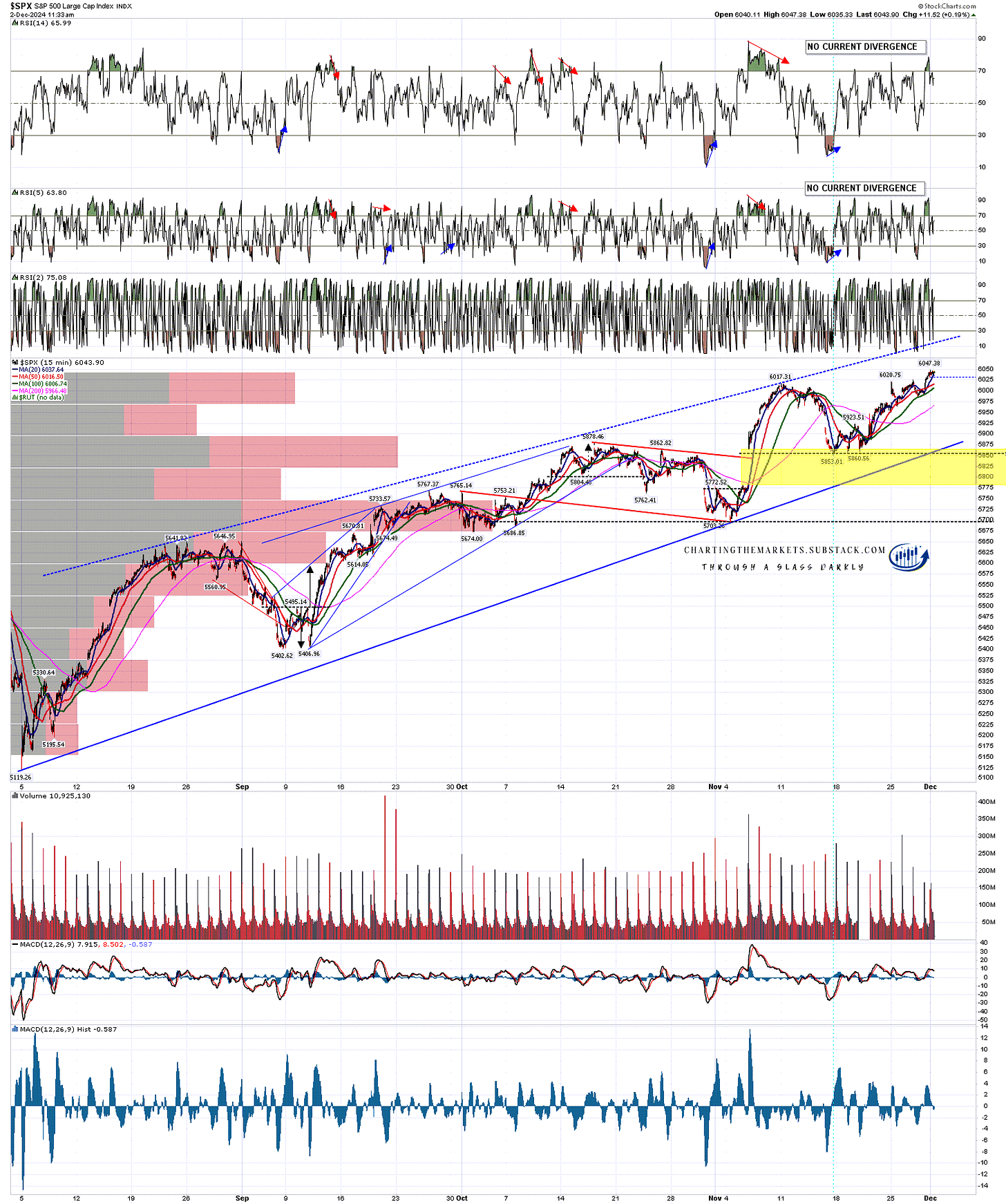

If SPX stalls in this area there is a very decent looking double top formed, and a sustained break below double top support at 5853 would look for a target in the 5650 area, though there is also a possible H&S neckline and strong support area in the 5700 area.

SPX 15min chart:

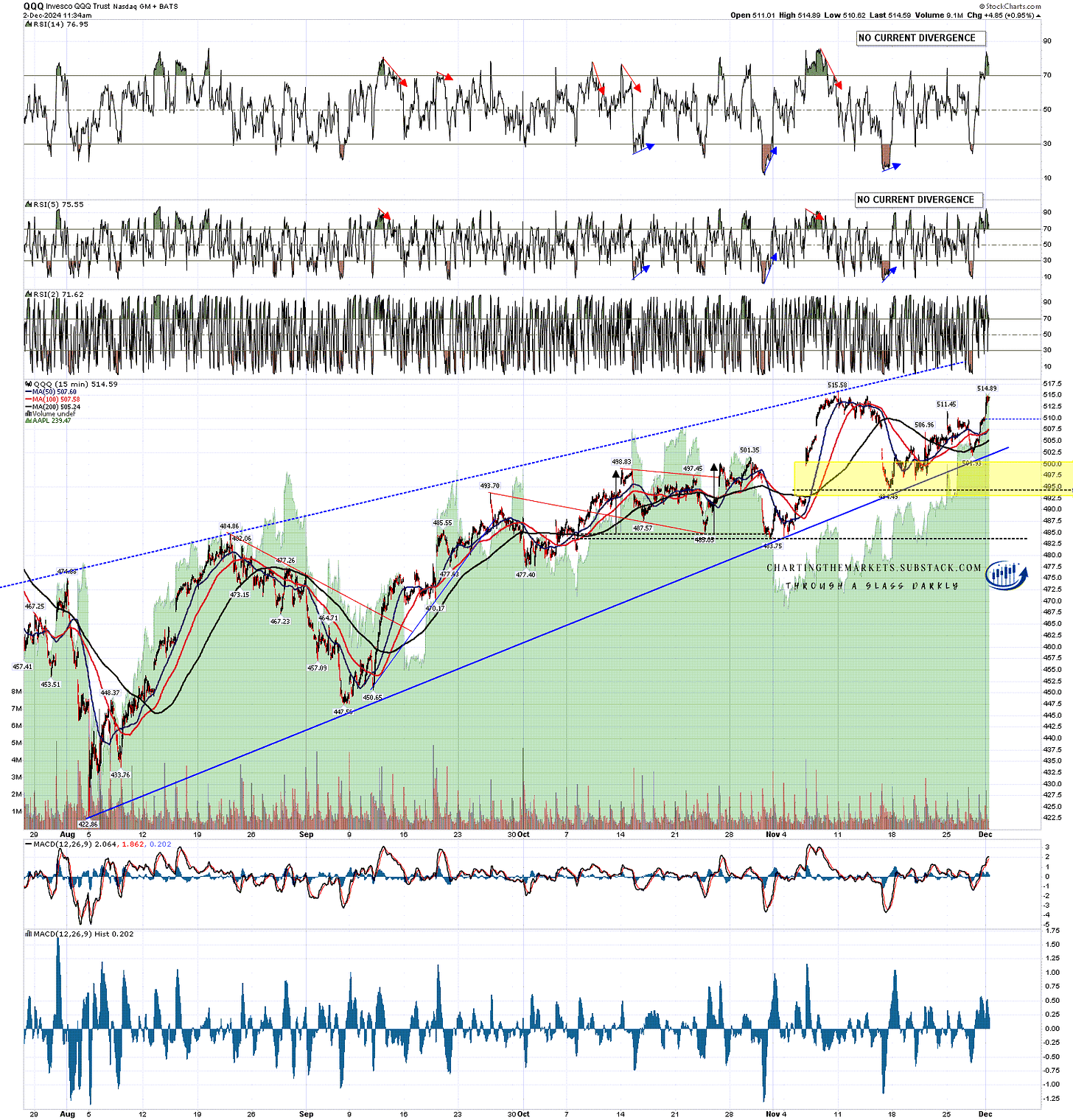

There’s also a very decent looking double top setup on QQQ, and a sustained break below double top support at 494.49 would look for a target in the 473 area.

QQQ 15min chart:

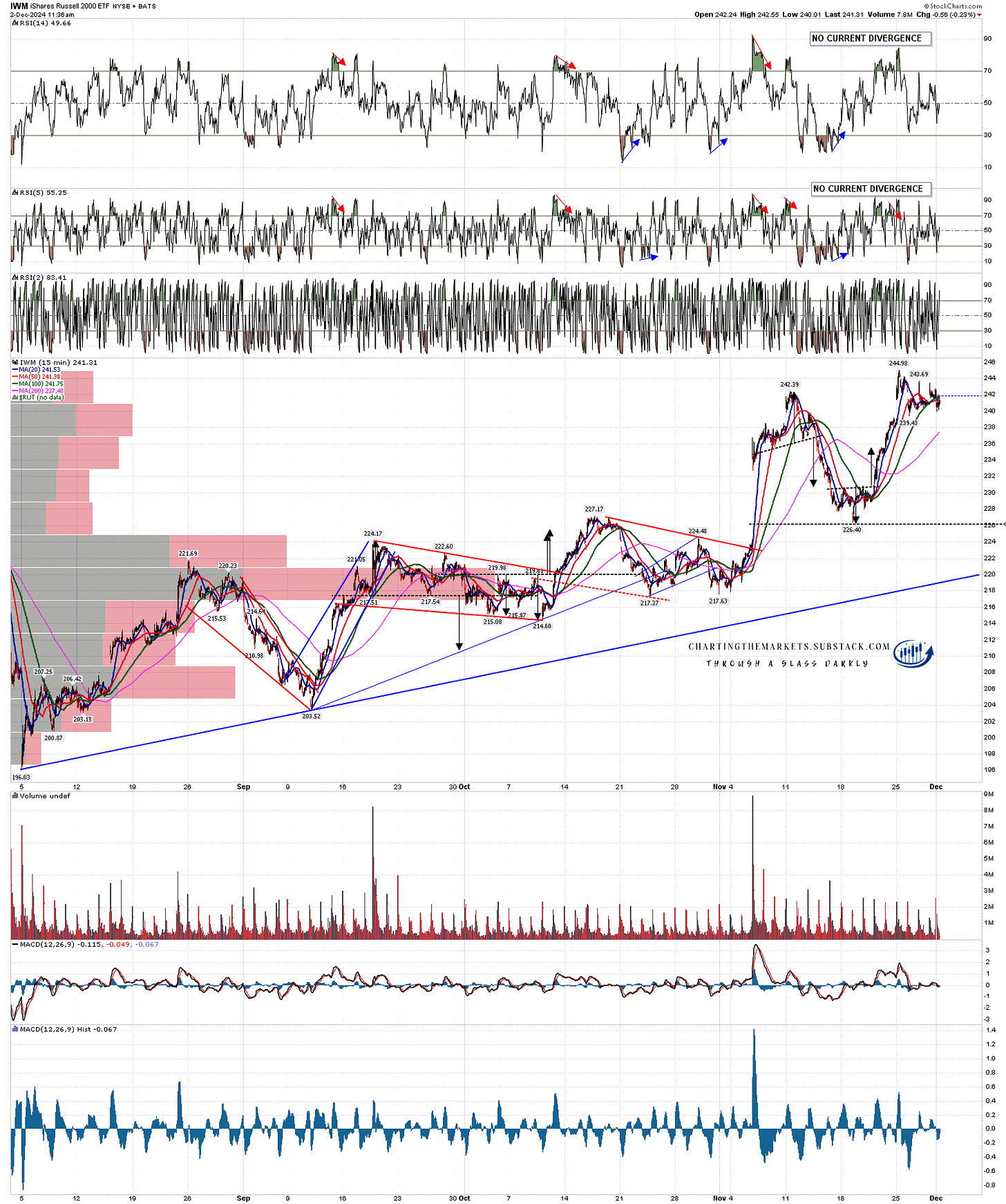

There is a decent looking double top on IWM as well. We’ll see.

IWM 15min chart:

The majority of the current bull window on equities is behind us now and I’m moderating my expectations of what we may see into Xmas accordingly. The closer we come to inauguration the more I’m also going to be looking at the incoming administration and the policies that are being talked about for the first 100 days of the new administration. Tariffs, Ukraine and others may make this one of the most interesting years on the markets that anyone can remember.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first and do a short premarket review every morning.

No comments:

Post a Comment