I was saying on my last post that there were daily sell signals fixed on BTCUSD (Bitcoin) and SOLUSD (Solana), that a bullish consolidation period looked very possible and we’ve been seeing that. So how’s that going?

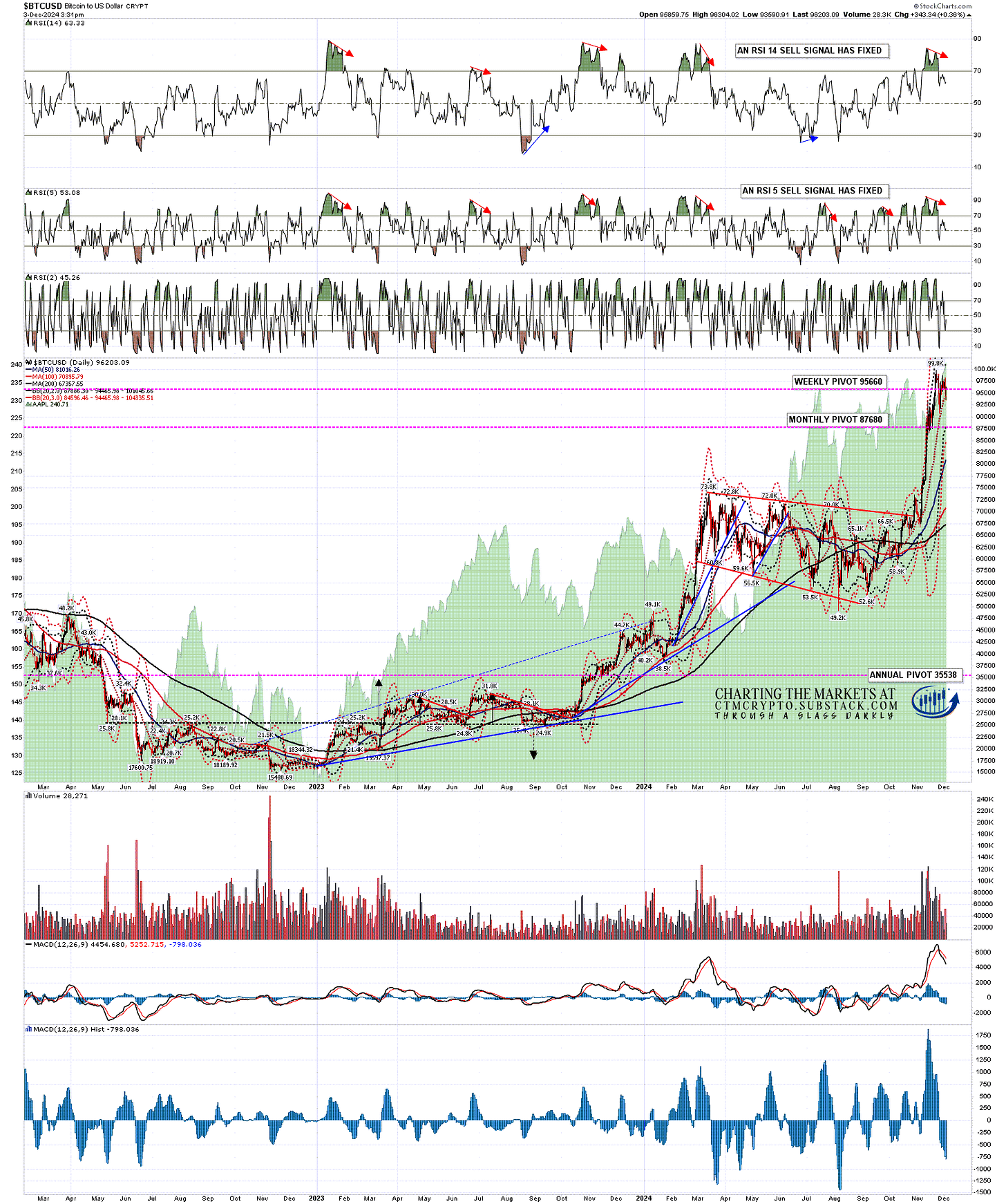

On the Bitcoin daily chart below the daily RSI 5 sell signal has almost reached the possible near miss target at 31 to 37 on the RSI 5 and that might be enough. The RSI 14 sell signal has fixed but is a longer term signal and we may well see significantly higher highs before that makes target. It is an early warning to watch out for a longer multi-week or month consolidation that may be coming in the first months of next year.

BTCUSD daily chart:

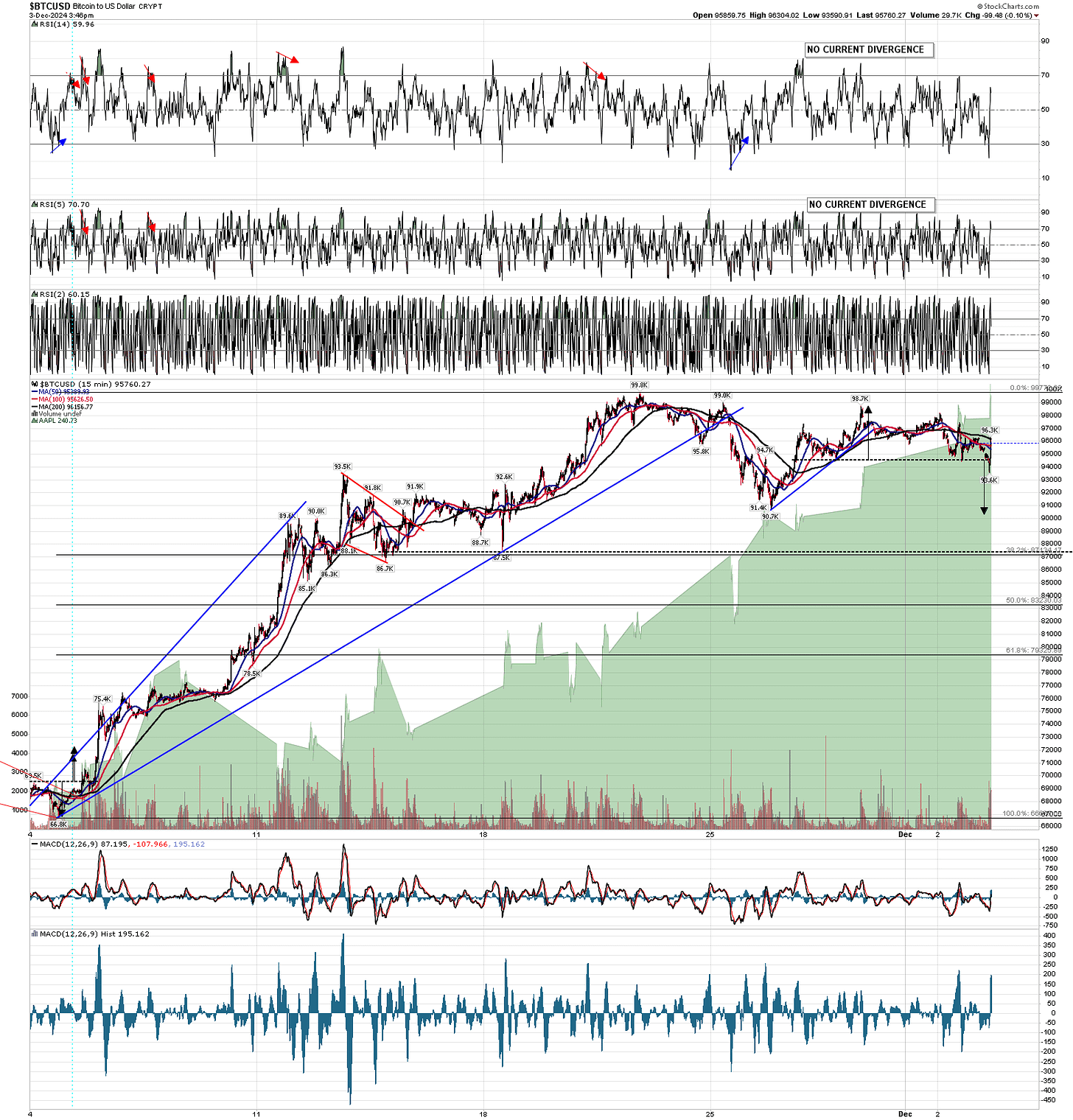

On my premarket video this morning I was looking at a possible small H&S on Bitcoin, that broke down shortly after I recorded the video, with a target in the 90.3k area. That was followed quickly by a sharp rally, but the usual principle applies here after an H&S breaks down, in that I’d expect either that Bitcoin reaches the 90.3k target, or rejects back up to the top of the H&S at 98.7k.

Is there a case for rejecting back up here? Yes there is, a bullish triangle may be forming, and this morning’s low may be at that triangle support. If so I’d be looking for the 98k area next, a pullback into the 95k to 96k area after that, and then a break up into a retest of the all time high.

BTCUSD 15min chart:

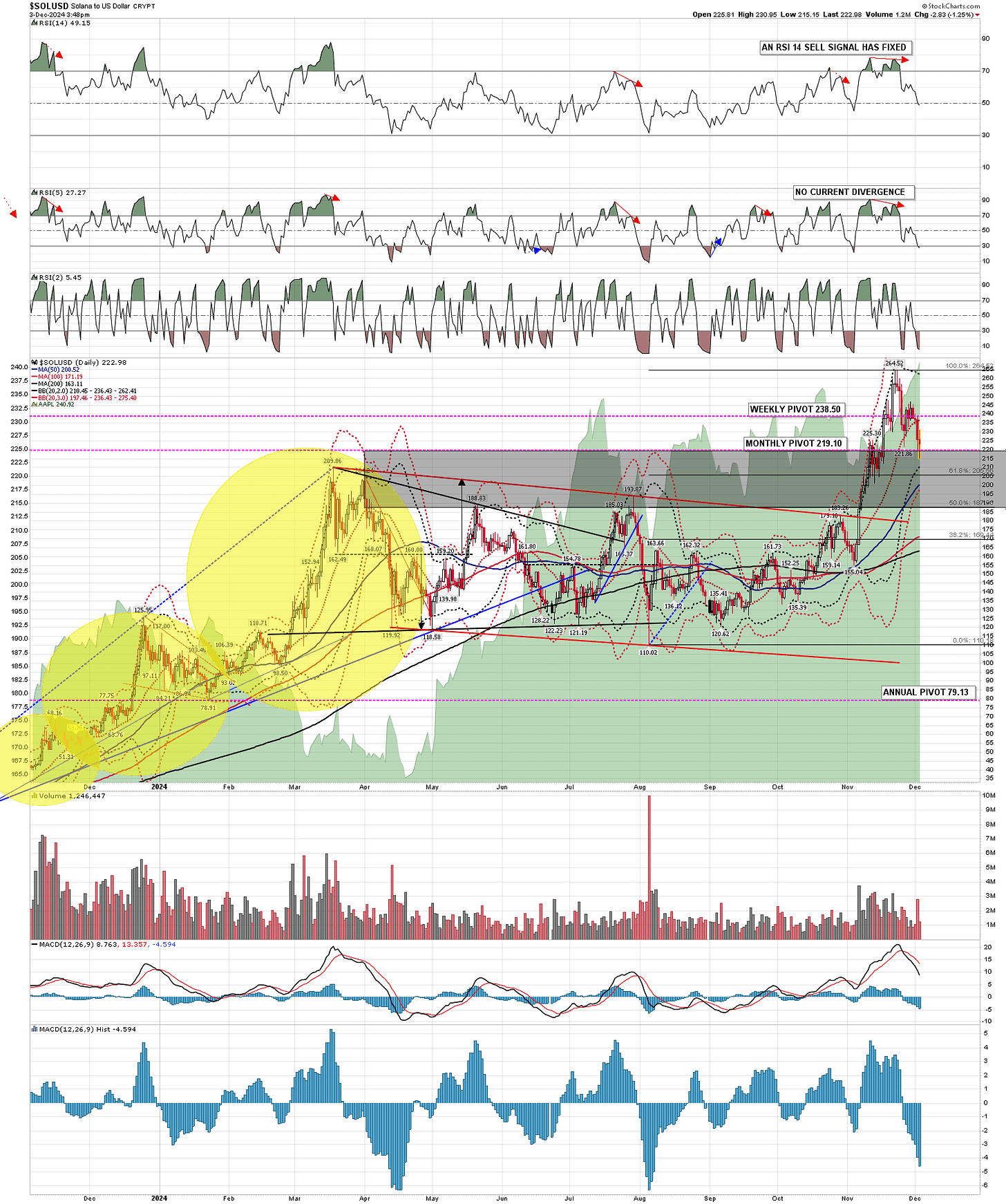

On Solana the daily RSI 5 sell signal has already reached target, and the daily middle band held as support on the first test and broke on the second.

In my premarket videos I’ve been looking at an obvious backtest zone in the 185 to 220 area, and that was reached after I recorded this morning’s video with a low at 215.15. On the daily charts the key levels I am watching at the monthly pivot at 219.10 and the 50dma at 200.52.

SOLUSD daily chart:

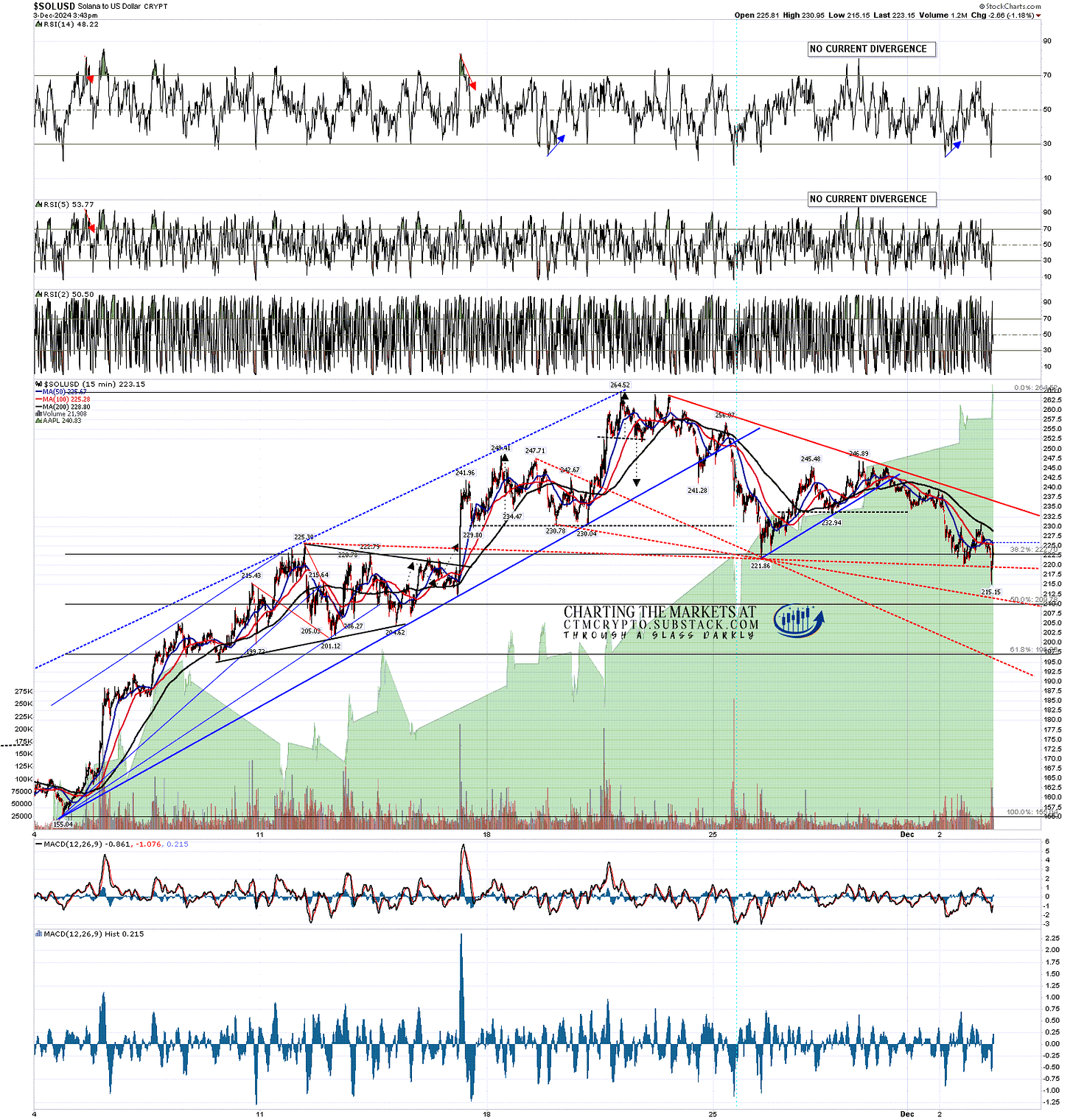

In the short term it seems very likely that a bull flag is forming on Solana. The flag resistance is established, and I have drawn in the three most likely options for the flag support trendline. The first of those was reached yesterday and this morning’s brief spike down could be a bullish underthrow signalling a low. That would be confirmed by a break over flag resistance, currently in the 236.5 area.

If Solana needs to go lower, the first high quality trendline options is currently at 212, and a good match to a backtest of the broken April 2024 high at 209.86. The second high quality trendline option is currently in the 196 area, currently a strong match with the 3sd daily lower band, and a backtest of the July 2024 high at 193.87.

SOLUSD 15min chart:

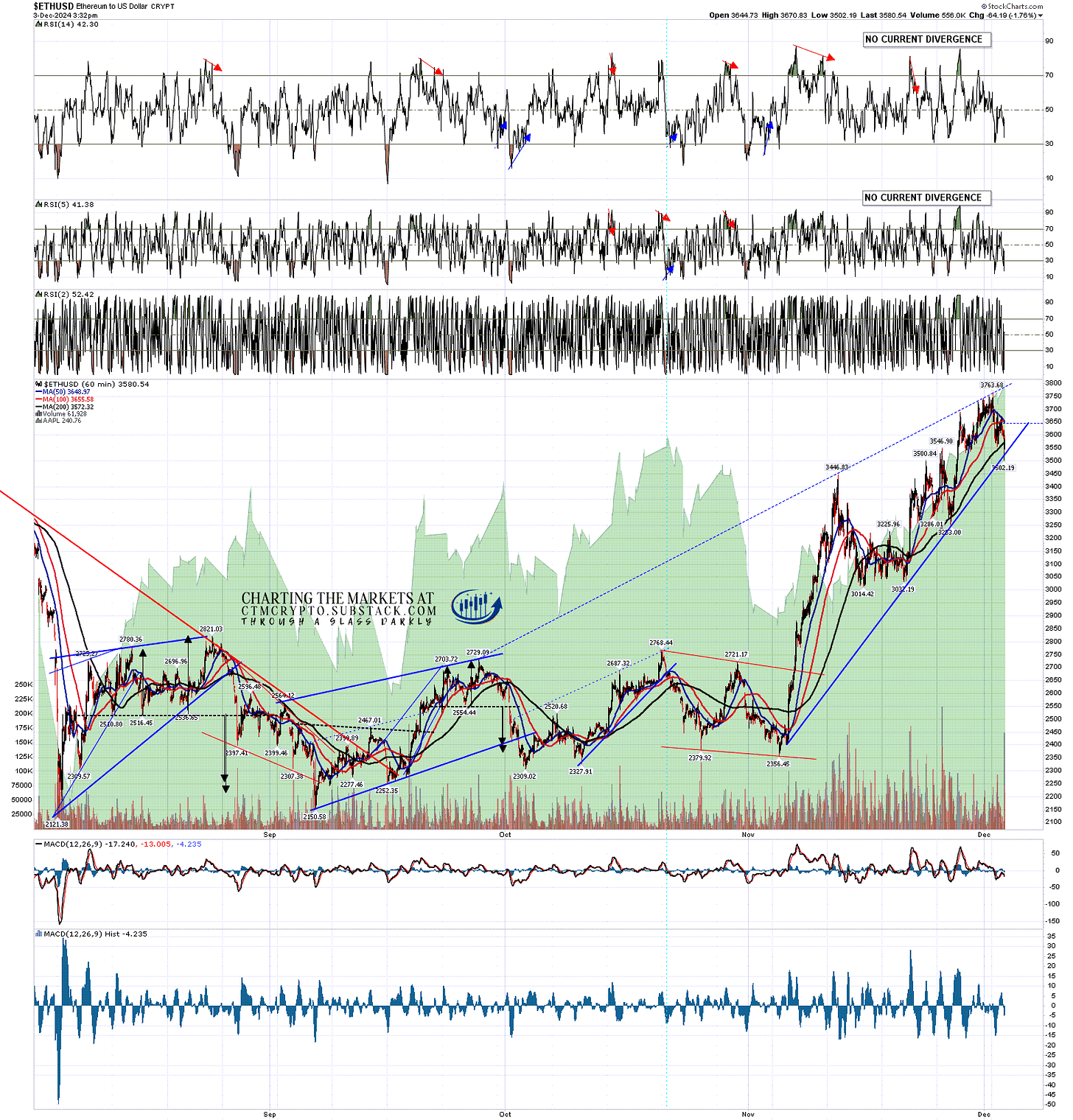

Bitcoin and Solana have not been strongly correlated during this consolidation, and the same is also true of ETHUSD (Ethereum).

There were no daily sell signals fixed or forming at the time the sell signals fixed on Bitcoin and Solana, and it continued higher, and has now broken over the declining resistance trendline from the 2024 high at 4092.73, making a retest of that high likely on the next upswing.

At the same time there is now a possible daily RSI 14 sell signal brewing and yesterday a daily RSI 5 sell signal fixed.

ETHUSD daily chart:

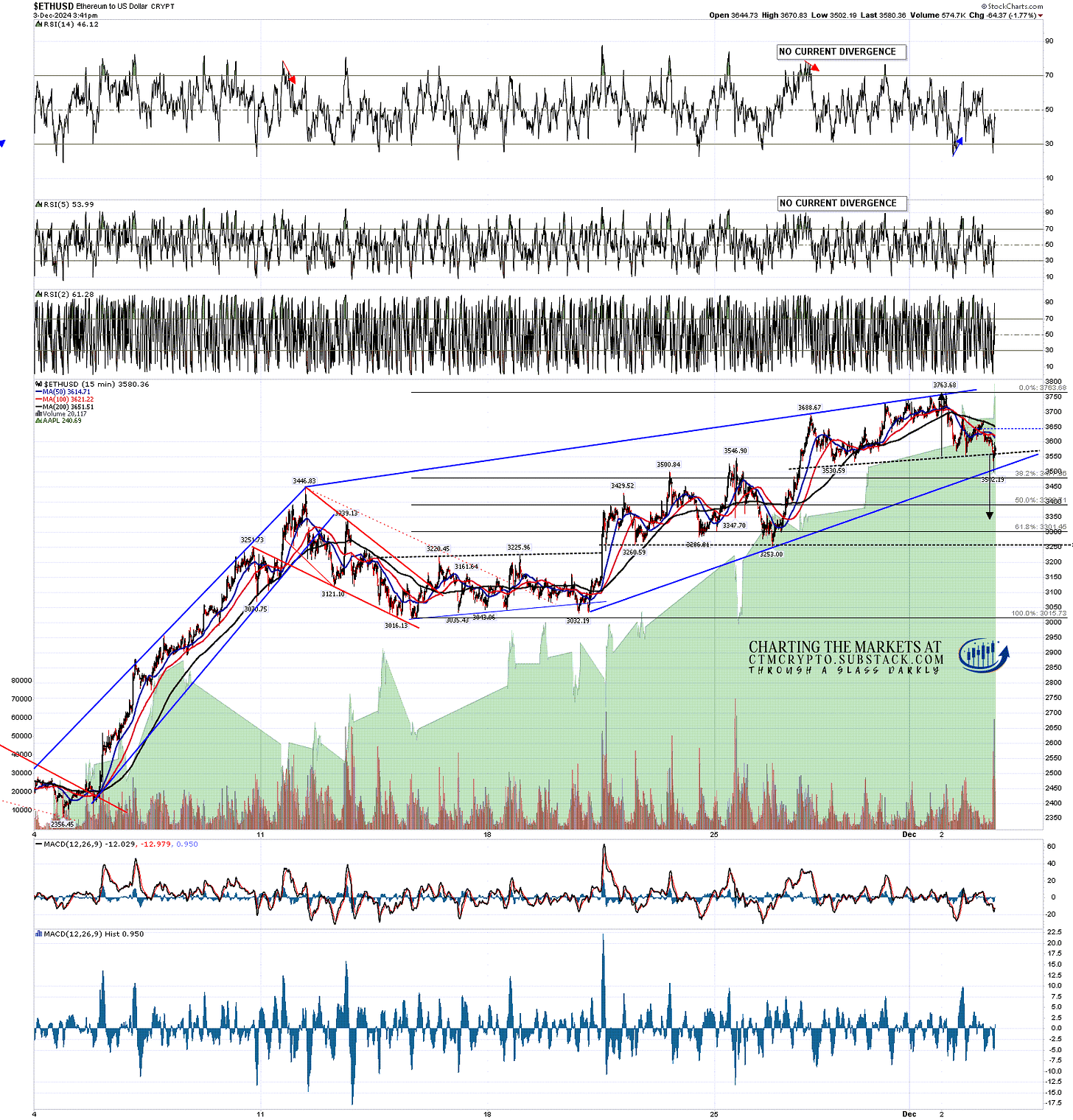

A small H&S has also formed and broken down on Ethereum with a target in the 3345 area. As with the Bitcoin H&S, I’d expect that to either make target, or to reject back to the H&S top at 3763.68.

ETHUSD 15min chart:

What’s the takeaway here? Well overall this is a likely short term bullish consolidation and I’d expect all of these three to go higher soon, though we may see some more downside first in the short term.

On the bigger picture, the daily RSI 14 sell signals are warning that a longer and deeper consolidation may be coming within a few months.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment