In my post on Tuesday 5th August I was looking at the modest breaks back over the daily middle bands on SPX and QQQ on the previous day and noting that conversion of those to support would open possible all time high retests, and hard fails there would strongly support the H&S patterns forming on both.

In my post on Thursday 7th August I was saying the same about the second breaks on SPX and QQQ above those daily middle bands on Wednesday and looking at the three strong resistance trendlines on SPX, QQQ and DIA in the event that SPX and QQQ delivered those all time high retests.

In my post on Wednesday 13th August I added a fourth target trendline on IWM and noted a short term inflection point as we waited to see whether DIA would confirm the break back over the daily middle band on Tuesday. That resolved into a strong break higher on DIA.

In my last post on Monday 18th August I was noting that two of those target trendlines on QQQ and DIA had been perfectly hit and held, that there were high quality rising wedges on SPX and IWM that had already broken down, and said that a period of consolidation or retracement should be starting that might well deliver a strong retracement of the move up from the April low. I also reviewed the possible topping patterns that might deliver that retracement.

On Monday I mentioned possible small bull flag setups forming on NQ and RTY that suggested a high retest early this week and that didn’t happen. What we have seen instead is tech-led weakness that has delivered some tests of the daily middle bands. If we are to see a larger retracement then it is the breaks and conversions of these bands to resistance that opens up further downside.

On QQQ there was a close on the daily middle band, currently at 569.50, on Tuesday and a full day yesterday trading and closing below it. The updated rising wedge from the April low has also broken down. This is a promising start but all four of the daily middle bands on QQQ, SPX, IWM and DIA will need to be broken and converted to resistance to open the path to an overdue strong retracement of the move up from the April low.

QQQ daily chart:

SPX delivered a full test of the daily middle band yesterday, currently at 6381, and spent much of the day below it, recovering back over it late in the day. A promising start but holding so far.

SPX daily chart:

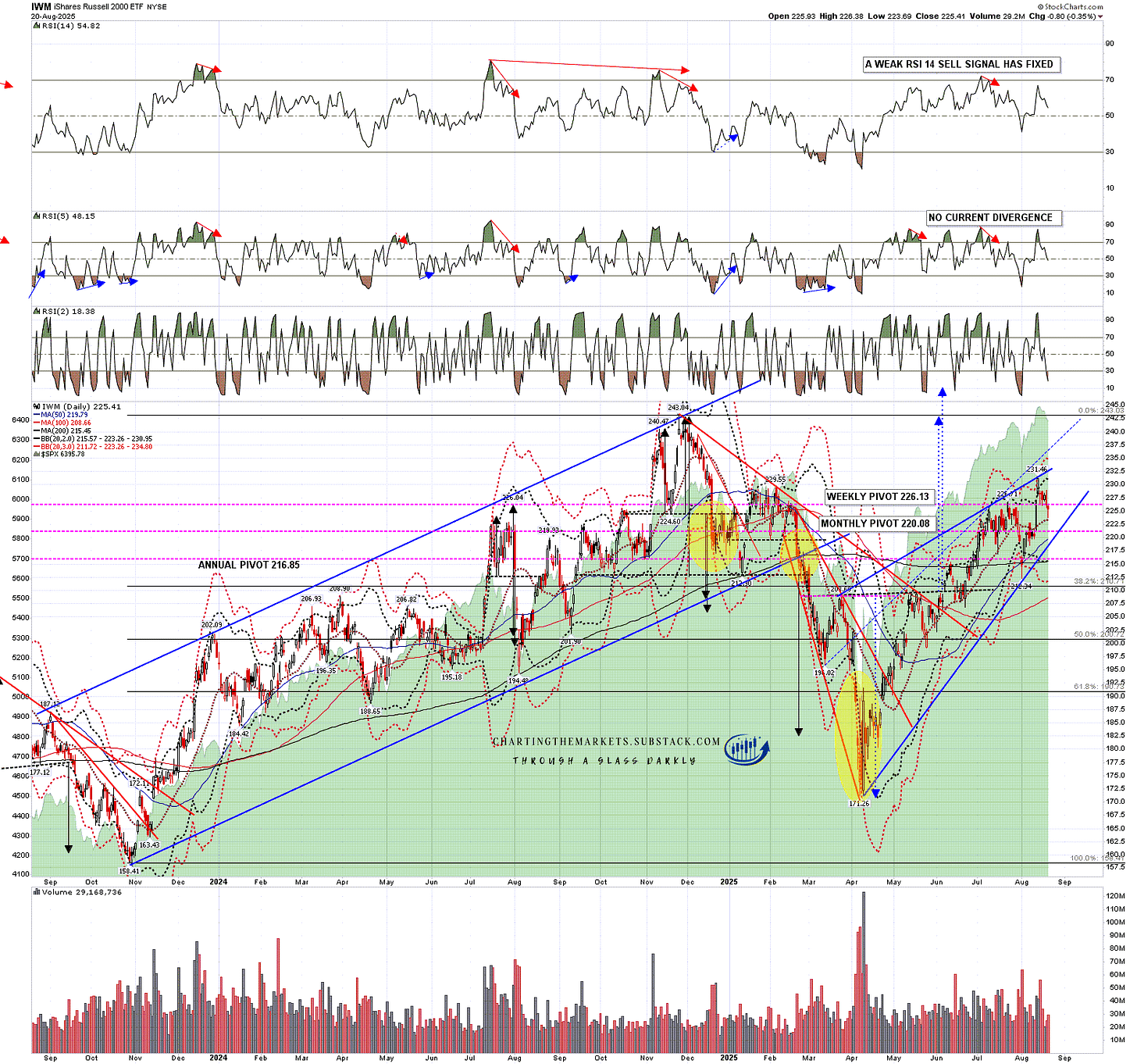

IWM came very close to a test of the daily middle band yesterday, currently at 22.36, and that too is a promising start.

IWM daily chart:

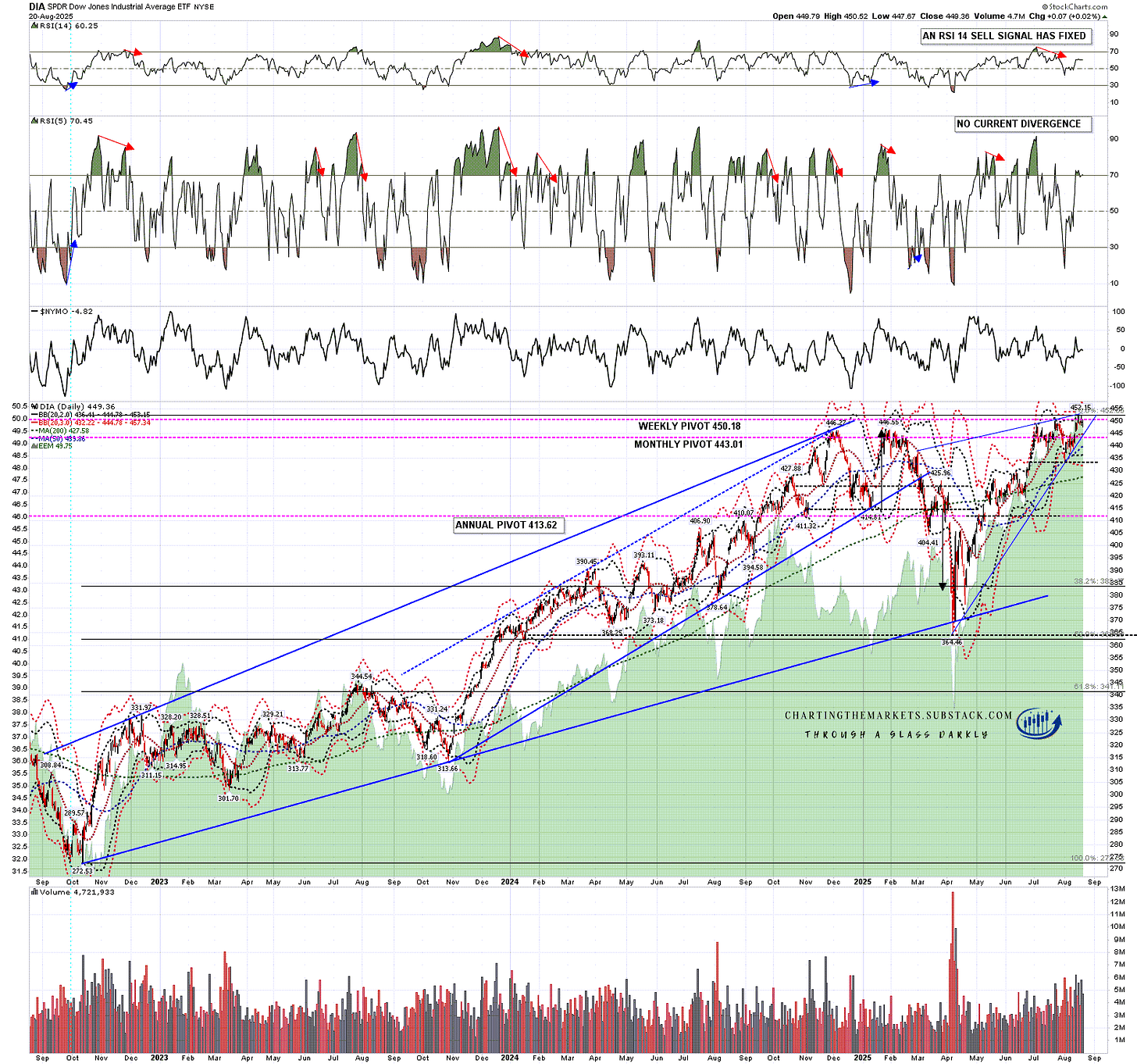

DIA has held up the best of these US indices from the highs so far, and has not yet declined enough to threaten a test of the daily middle band, currently at 444.78.

DIA daily chart:

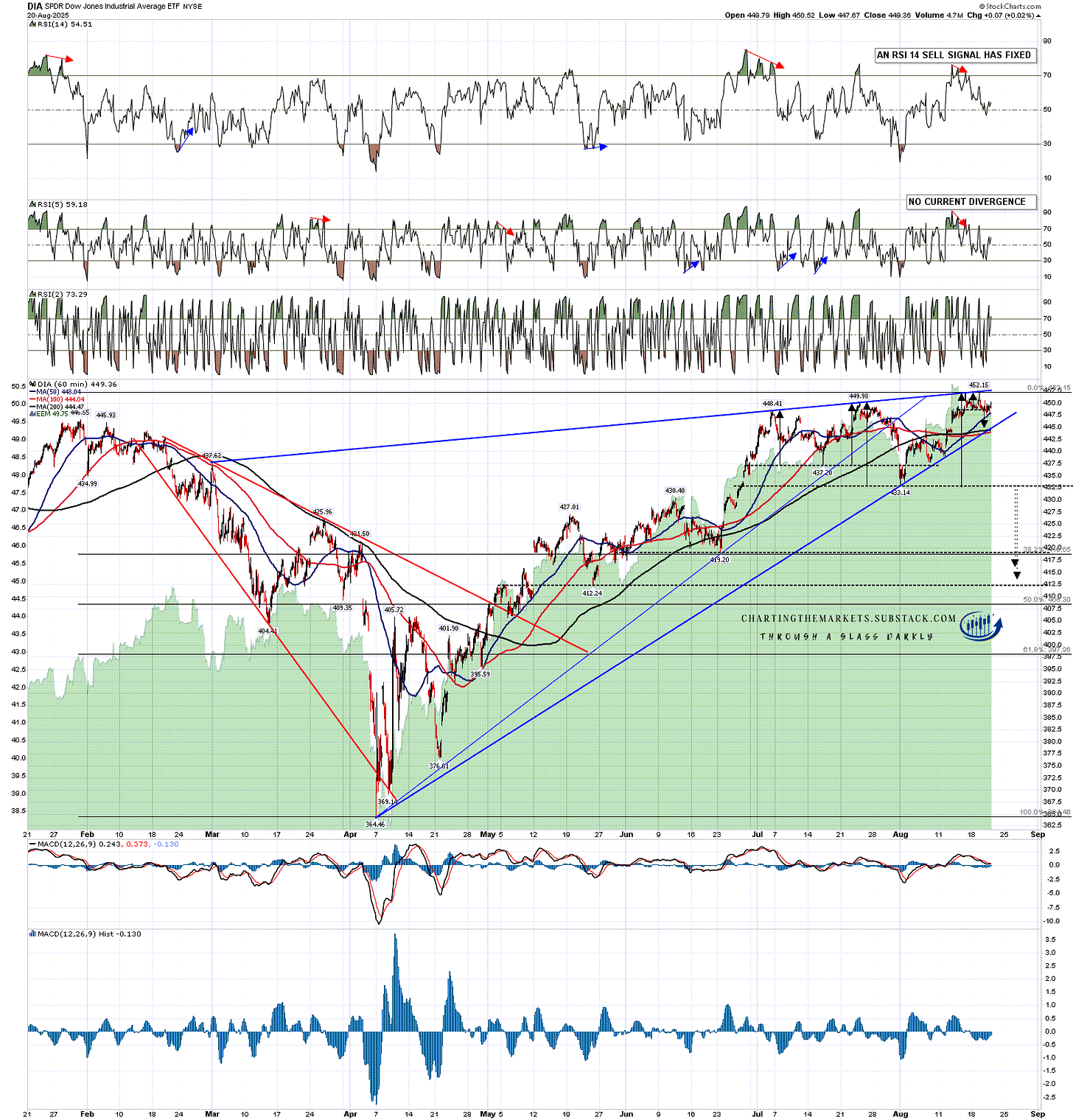

There is however some reason to think though that a test of the daily middle band on DIA may be coming next. On the hourly chart an RSI 14 sell signal has fixed and a small double top has broken down with a target in the 445 area. If this double top makes target that would deliver the test of the daily middle band on DIA.

DIA 60min chart:

In my last post I said:

What are the odds that all four of these indices are topping out for that overdue decent retracement here? Pretty good in my view, and at minimum a period of consolidation is likely here to create some space between price and these rising resistance trendlines.

I’m very much liking the setup for a decent retracement here and this is a promising start. If this does happen I’m thinking this would likely last four to eight weeks and resolve into another leg up on equities into the end of the year. If we do see that retracement here I’ll be watching to see whether bullish patterns form to support that.

I’m also watching for patterns and divergence suggesting an imminent reversal back up. So far I’m not seeing anything significant.

If you like my analysis and would like to see more, please take a free subscription at my chartingthemarkets substack, where I publish these posts first. I also do a premarket video every day on equity indices, bonds, currencies, energies, precious commodities and other commodities at 8.45am EST, but only for paying subscribers. Other places to find me are my twitter, and my Youtube channel.

No comments:

Post a Comment