Back in my post on 11th April I called the likely start of a strong rally which we then saw.

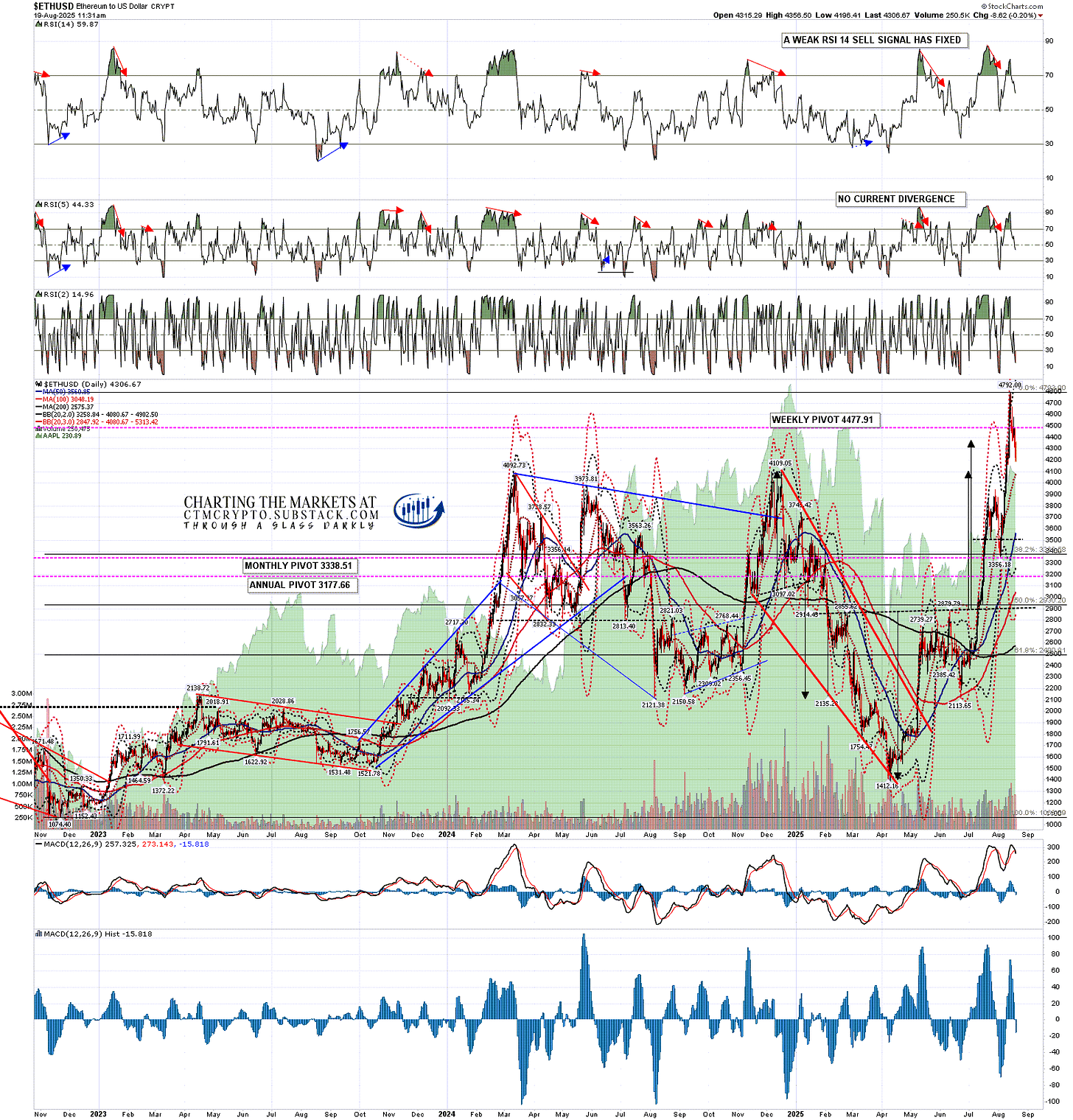

Back in my post on 12th May I called for new all time highs on Bitcoin (BTCUSD) and laid out possible IHS scenarios on both Solana (SOLUSD) and Ethereum (ETHUSD), looking for ideal right shoulder lows on Solana in the 125.43 area and on Ethereum in the 2074.27 area. That hasn’t gone quite as I drew then but essentially both are still running that scenario.

Back in my post on 23rd June I called the likely lows on those right shoulders made on Solana at 126.09 and on Ethereum at 2113.65, and was looking for that IHS scenario on both to start to play out.

Back in my post on 18th July I was looking at the IHS that had since broken up on Ethereum and the progress made towards the IHS neckline on Solana.

In my post on 22nd July I was looking for some retracement after the IHS on Solana had broken up, and looking also at the possibility that a setup for a hard fail might form in that retracement.

In my last post on 4th Aug I was looking at that retracement on Solana and looking for higher highs soon which we saw. I was expecting Ethereum to reach the IHS target at 4109.05 which we saw.

So what now? At some point I expect that equities and Crypto will stop being so strongly positively correlated but there’s little evidence of that having happened yet, so there is an inflection point here where both equities and Crypto could well see a significant retracement. Equities look like they are topping out for that retracement here but on Crypto there is some evidence that may have already started.

Looking at the Bitcoin daily chart the key short term support levels for the uptrend are the daily middle band, currently at 116,752, and the 50dma, currently at 115,920. At the time of writing both of those have been broken, opening up a possible test of the next big level which is the 200dma, currently at 100,421.

BTCUSD daily chart:

Looking at the hourly chart Bitcoin has broken rising wedge support from the April low and a double top has formed but has not yet broken down. A sustained break below double top support at 111.9k would look for a target in the 99k to 100k area.

The 98k to 100k level on Bitcoin is important, just under the 200dma and with the June low and a possible H&S neckline at 98.3k. This would be a very attractive target area.

BTCUSD 60min chart:

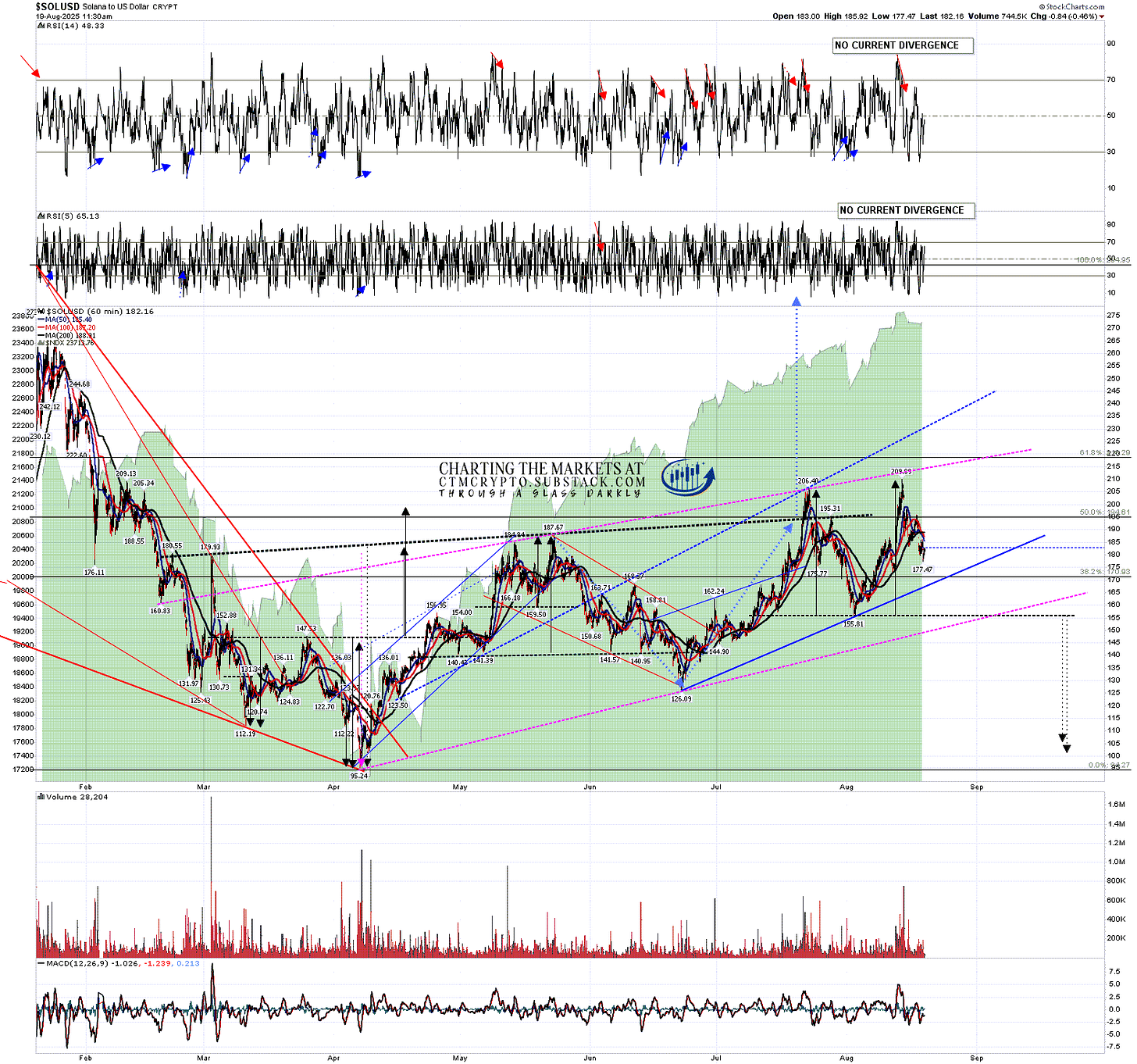

Looking at the Solana daily chart the key short term uptrend support is at the daily middle band, currently at 178.26 and that has been tested in the last day and has held so far.

There is no small possible topping pattern on Solana here and on a break below the daily middle band I’d be watching the 50dma and 200dma, currently at 173.20 and 157.86 respectively, and the rising support trendlines from the April and June lows, currently in the 167 and 149 areas respectively.

SOLUSD daily chart:

I would mention though that there is a possible larger topping pattern on Solana here but it isn’t one I would expect to deliver unless this bull market on Crypto is ending unexpectedly early. On a sustained break below the July low at 155.81 the double top range would be 101-4. I’m really not expecting this to be an issue but I’ll be keeping an eye on it.

SOLUSD 60min chart:

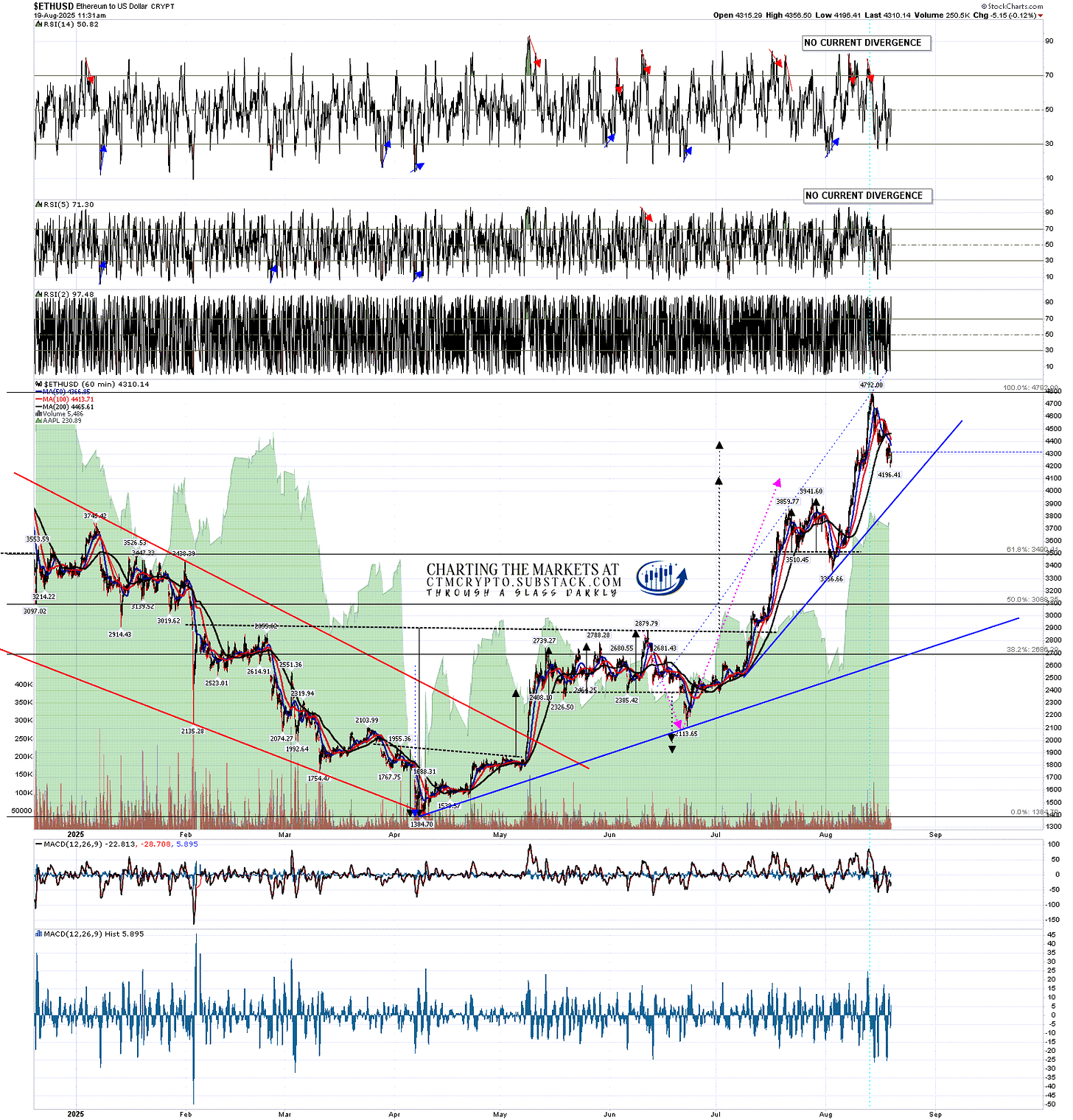

Ethereum reached the IHS target at 4109.05, then the extended target at 4290, and came close to retesting the 2021 all time high at 4865.94. That looks like unfinished business above, and after the current retracement I’m expecting to see a new all time high.

Ethereum has led this latest move up on Crypto and the key support level is at the daily middle band, currently at 4081, supported by the two big 2024 highs at 4092.73 and 4109.05. The 4100 area is the very obvious target for a backtest here and should have a decent chance of holding. On a break below I’d be watching the 50dma, currently at 3561.

ETHUSD daily chart:

There’s no obvious topping pattern on Ethereum here though there is a possible H&S setup forming that might then look for the 3600 area. There is also a rising support trendline in the 3900 area but not of high quality so I wouldn’t be surprised to see that broken.

ETHUSD 60min chart:

I posted the following note at the end of my post on 13th Jan:

My preferred scenario here is that we see a bullish consolidation either now or soon on Crypto that takes a few months and sets up the next big leg up on Crypto into a possible bull market high in late 2025.

I still like this scenario for a possible overall bull market high on Crypto on or around the end of this year but, as I mentioned at the start, we have currently seen little evidence that Crypto can sustain a bullish move while equities are in a strong downtrend. I’m not seeing any strong evidence yet that the current inflection point on equity indices is the start of a strong downtrend but, if it should evolve into that, Crypto would likely be dragged down with it.

Since I started doing daily videos on Crypto early last year I’ve got Crypto direction right most of the time and more so than any other analyst anywhere that I’m aware of. I’m a very good analyst and all three of these instruments are very classical chartist friendly. I’m not much of a marketer though, and the free Crypto substack I set up last August still has less than 200 readers. I’d like to increase that readership and invite any suggestions on how I could do that.

I am thinking about setting up a second YouTube Crypto channel and recording videos giving likely market direction without requiring the viewers to have some knowlege of technical analysis to understand the videos. Comments on that and other suggestions very welcome.

If you’d like to see more of these posts and the other Crypto videos and information I post, please subscribe for free to my Crypto substack. I also do a premarket video every day on Crypto at 9.05am EST. If you’d like to see those I post the links every morning on my twitter, and the videos are posted shortly afterwards on my Youtube channel.

I'm also to be found at Arion Partners, though as a student rather than as a teacher. I've been charting Crypto for some years now, but am learning to trade and invest in them directly, and Arion Partners are my guide around a space that might reasonably be compared to the Wild West in one of their rougher years.

No comments:

Post a Comment